Tax Deductions Templates

Documents:

1801

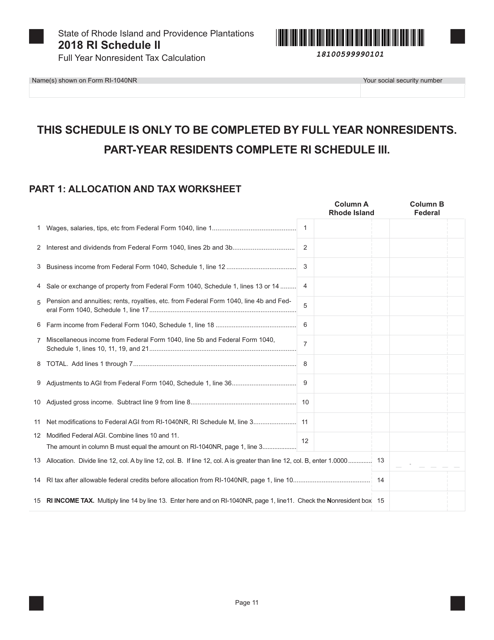

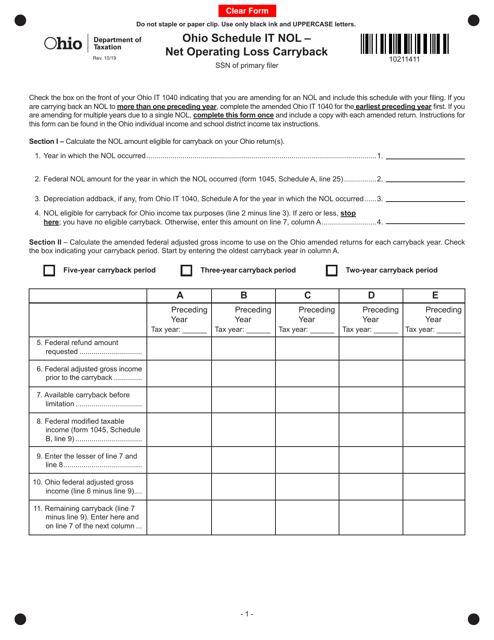

This document is used for calculating the full-year nonresident tax for Schedule II in Rhode Island.

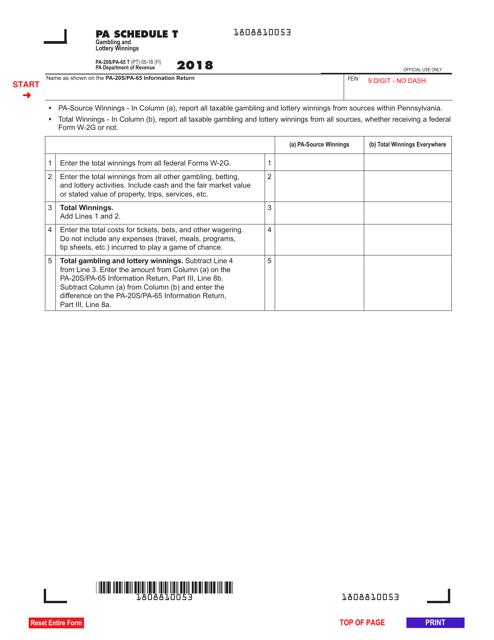

This form is used for reporting gambling and lottery winnings in the state of Pennsylvania.

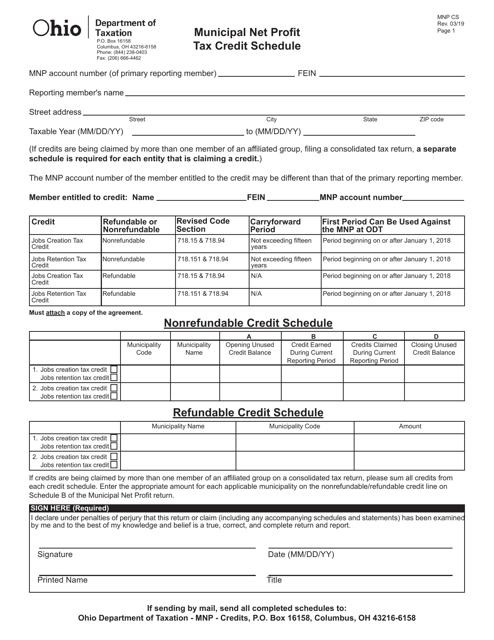

This form is used for claiming the Municipal Net Profit Tax Credit in Ohio for those who have incurred municipal net profit tax in another city or state. The credit is applicable to individuals, estates, and trusts.

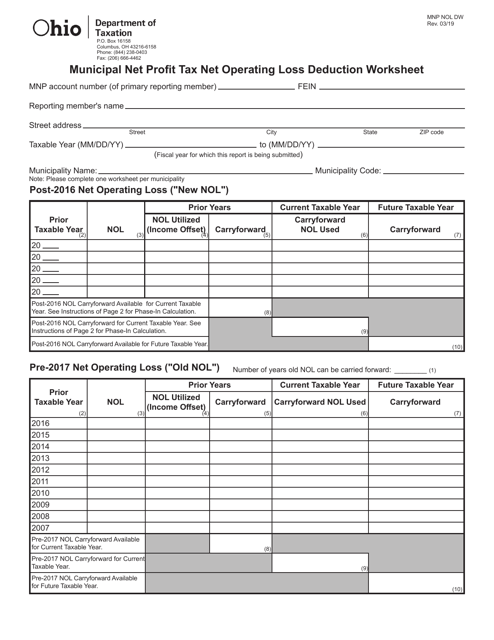

This form is used for calculating the Net Operating Loss (NOL) deduction for the Municipal Net Profit Tax in Ohio. It is specifically designed for businesses and helps determine the allowable deduction for any net operating losses incurred during the tax year.

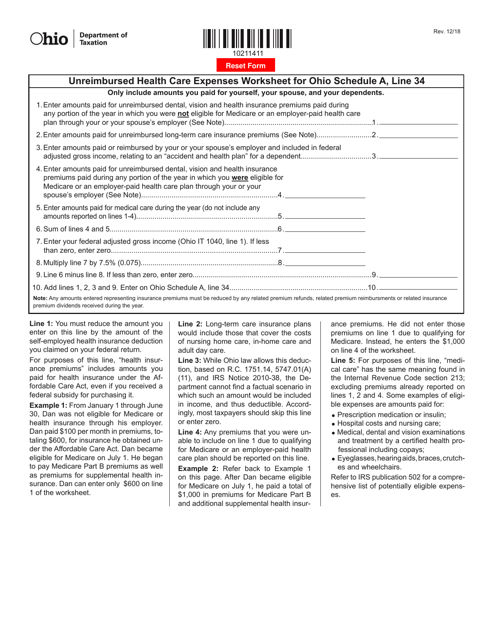

This Form is used for calculating unreimbursed health care expenses in Ohio for Schedule A. It is used to determine the amount that can be deducted on Line 34 of the Ohio state tax return.

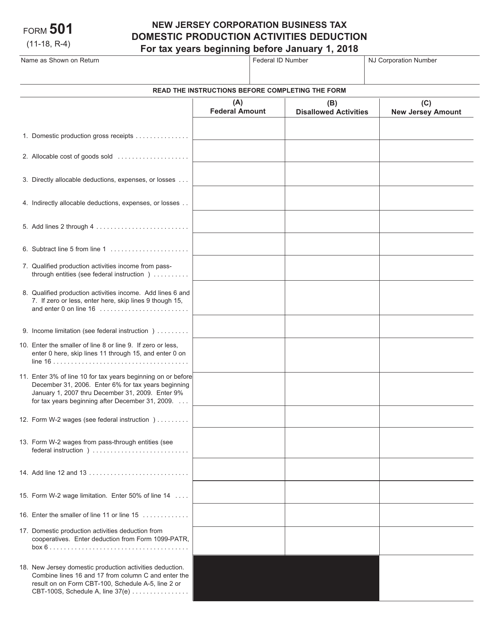

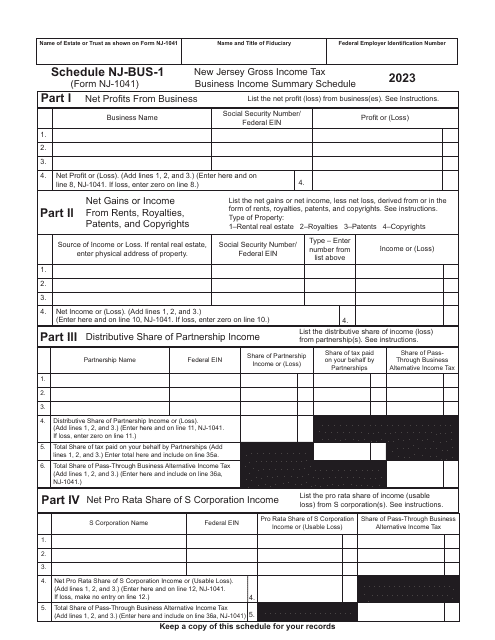

This form is used for claiming the Domestic Production Activities Deduction in the state of New Jersey. The deduction allows businesses to reduce their taxable income based on certain production activities that take place within the state.

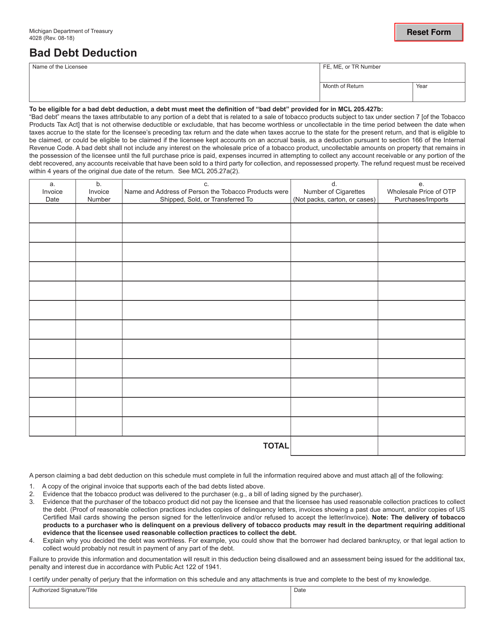

This form is used for claiming a bad debt deduction on your Michigan state taxes. It allows you to deduct the amount of a debt that is considered uncollectible.

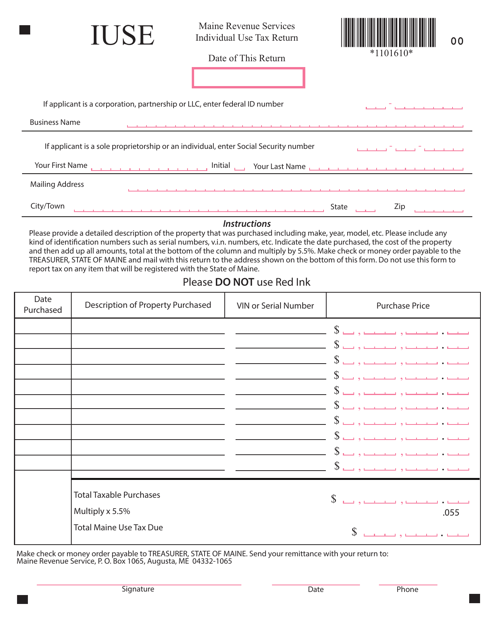

This form is used for reporting and paying individual use tax in the state of Maine. Individual use tax is owed on items purchased outside of Maine that would have been subject to sales tax if purchased in the state.