Tax Deductions Templates

Documents:

1801

This document provides instructions on how to calculate interest using the look-back method for property depreciated under the income forecast method. It is used for IRS Form 8866.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

This Form is used for claiming the Credit for Oil and Gas Production From Marginal Wells. It provides instructions on how to fill out and submit the form to the Internal Revenue Service (IRS).

This document provides information on the tax incentives available for businesses that provide accessibility accommodations for individuals with disabilities. It outlines the potential tax benefits and requirements for businesses to qualify for these incentives.

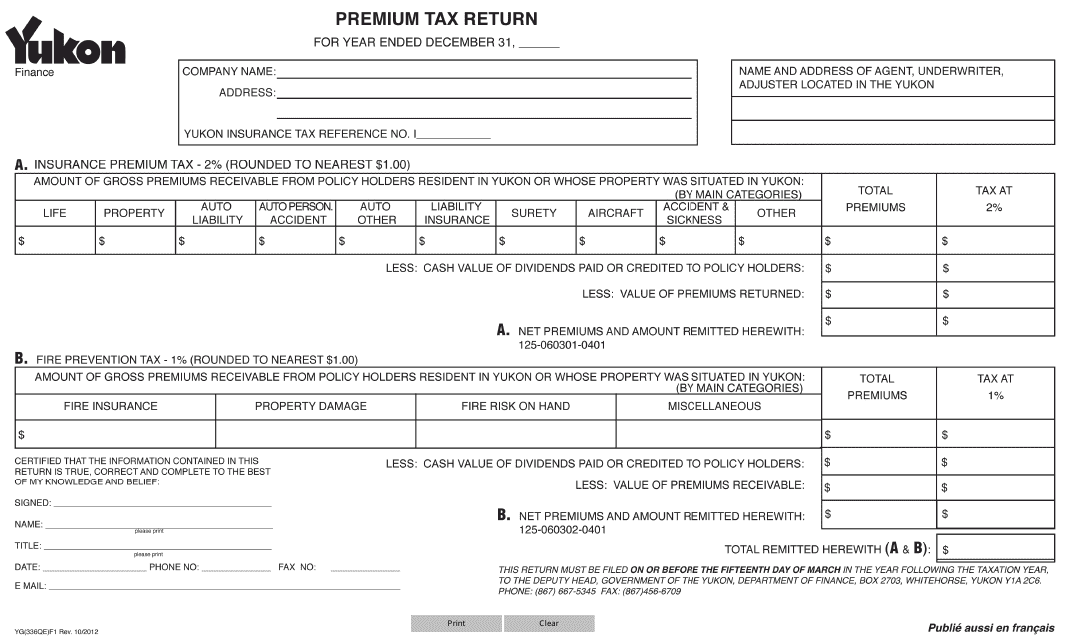

This form is used for filing premium tax returns in Yukon, Canada.

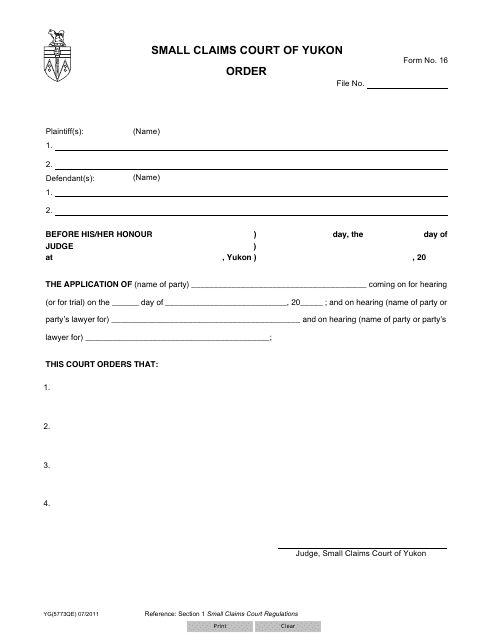

This Form is used for ordering a Form 16 (YG5773) in Yukon, Canada.

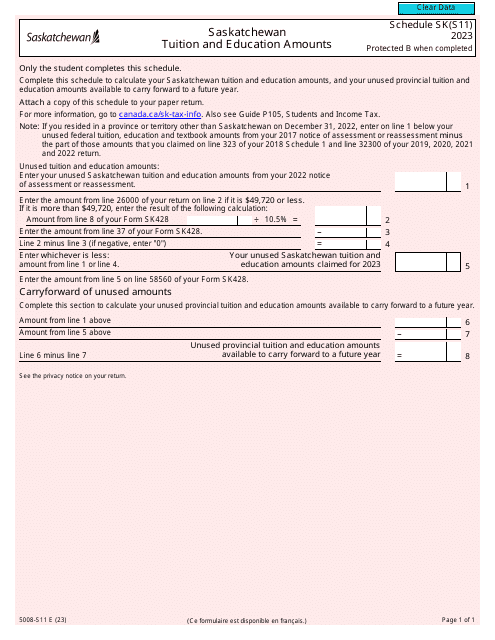

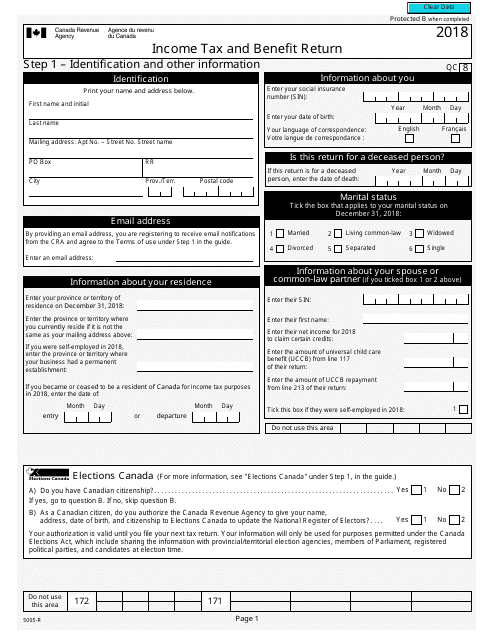

This Form is used for filing your annual income tax and benefit return in Canada. It helps you report your income, claim deductions and credits, and calculate your tax payable or refund.