Tax Deductions Templates

Documents:

1801

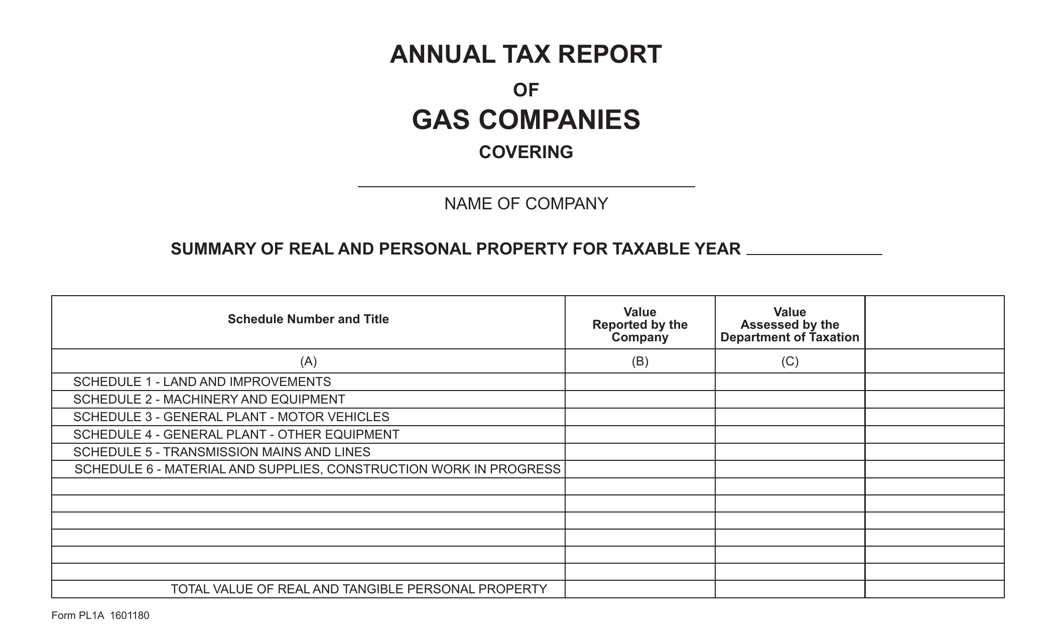

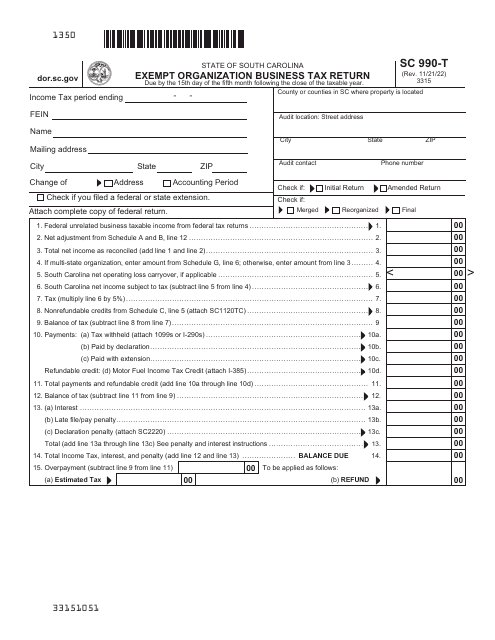

This Form is used for gas companies in Virginia to report their annual tax information. It is necessary for gas companies to submit this report to comply with tax regulations in Virginia.

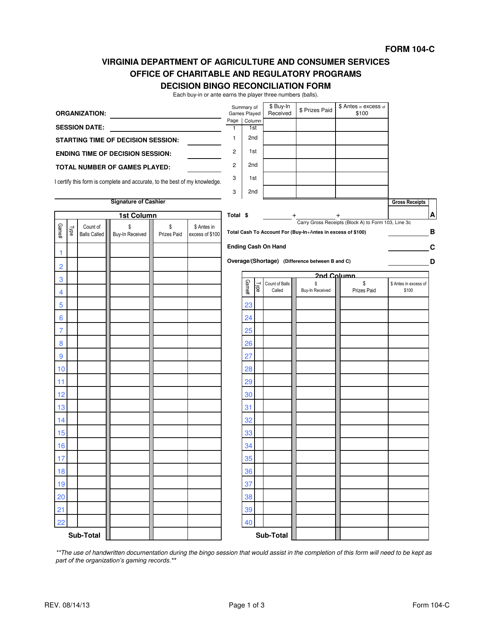

This Form is used for reconciling decisions made during a game of bingo in the state of Virginia.

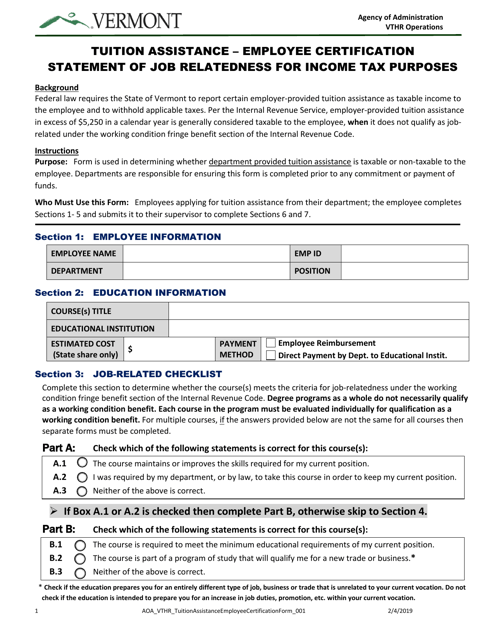

This document is used to determine the relevance of a job for income tax purposes in the state of Vermont. It helps determine if a specific job qualifies for certain tax deductions or credits.

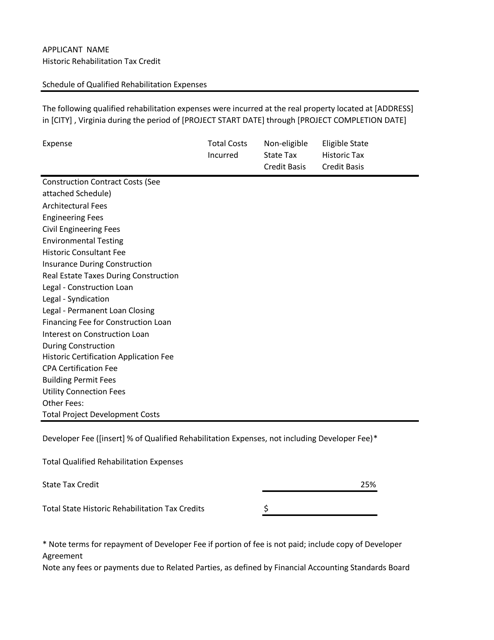

This document provides information about the schedule of qualified rehabilitation expenses in the state of Virginia. It outlines the expenses that qualify for rehabilitation tax credits in the state.

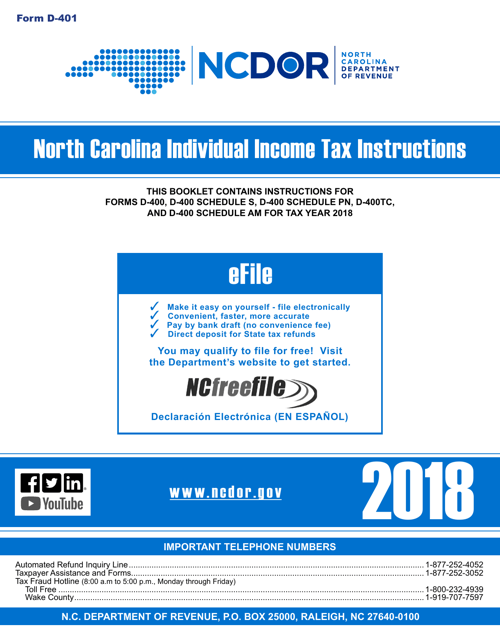

This Form is used for filing individual income taxes in the state of North Carolina. It provides instructions on how to accurately complete and submit the D-400 tax return form.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

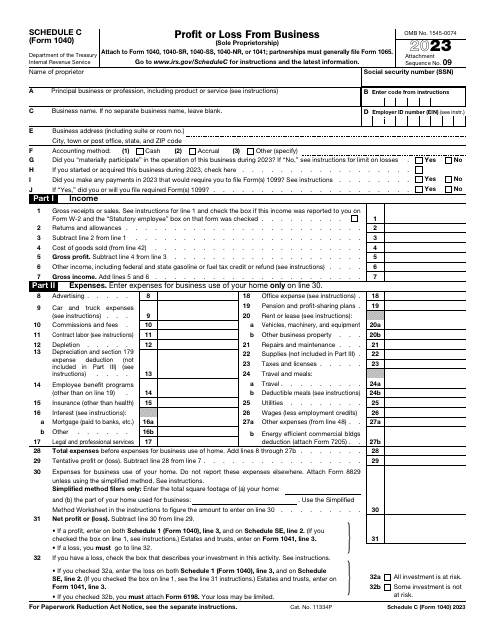

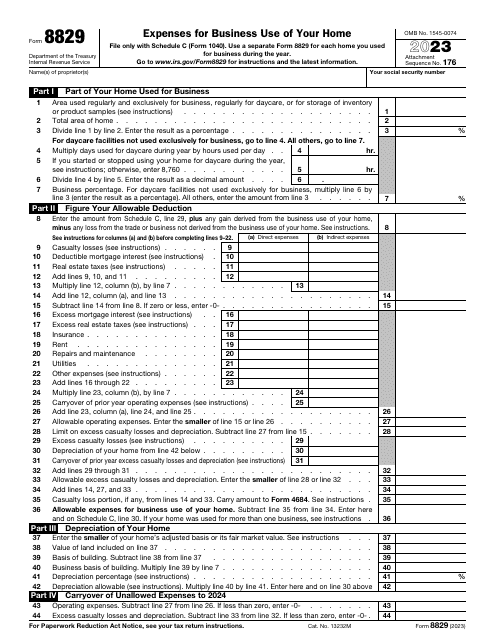

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

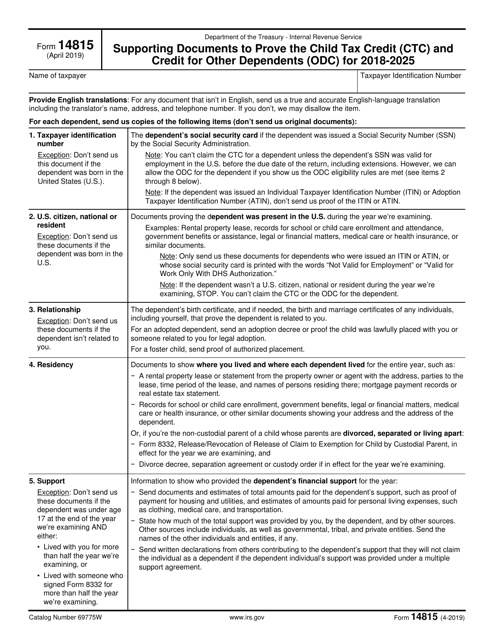

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

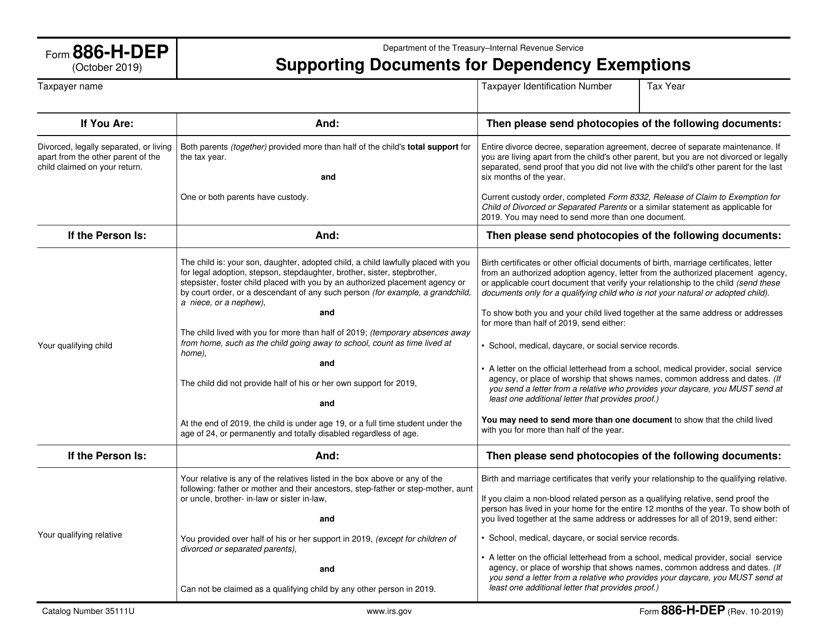

This type of document is used to provide supporting documents for dependency exemptions on Form 886-H-DEP.

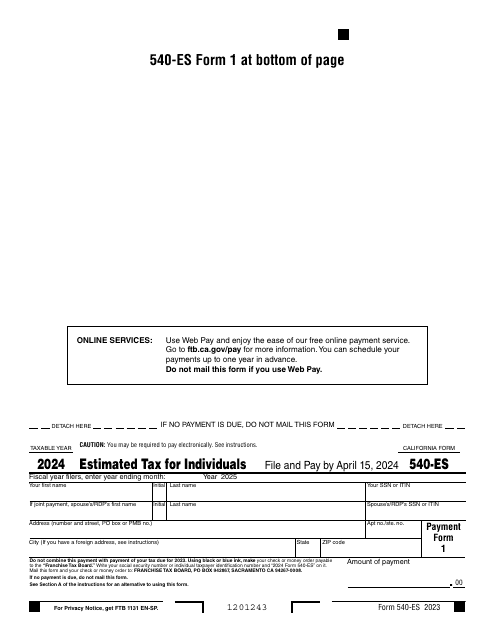

Fill out this form over the course of a year to pay your taxes in the state of California.

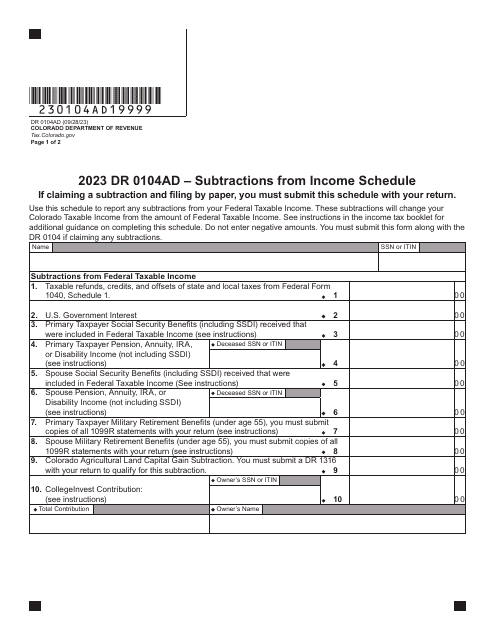

This is an application developed by the Colorado Department of Revenue. The form is used to report subtractions from Federal Taxable Income.

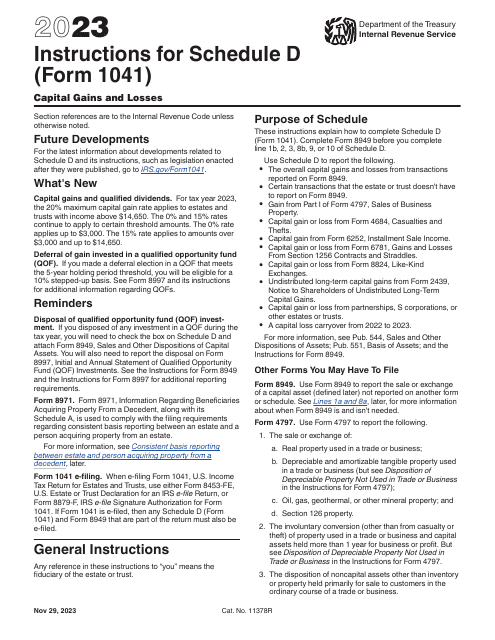

This document provides instructions for filling out and filing IRS Form 1040 and 1040-SR Schedule SE, which are used to calculate and report self-employment taxes. It includes step-by-step guidance on how to report income, deductions, and calculate the amount of self-employment tax owed.

This is a document you may use to figure out how to properly complete IRS Form 6765