Tax Deductions Templates

Documents:

1801

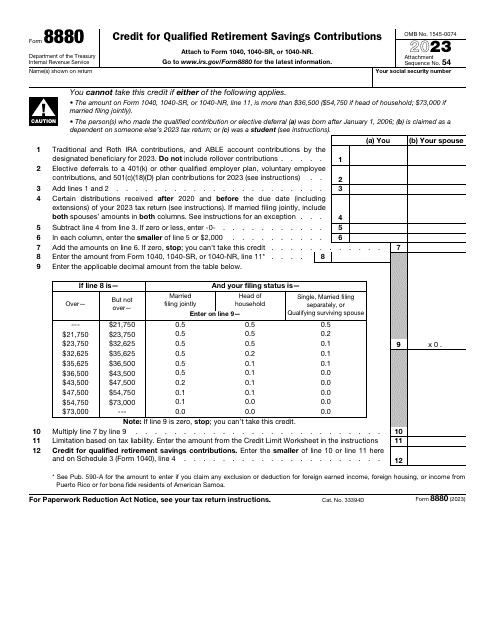

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

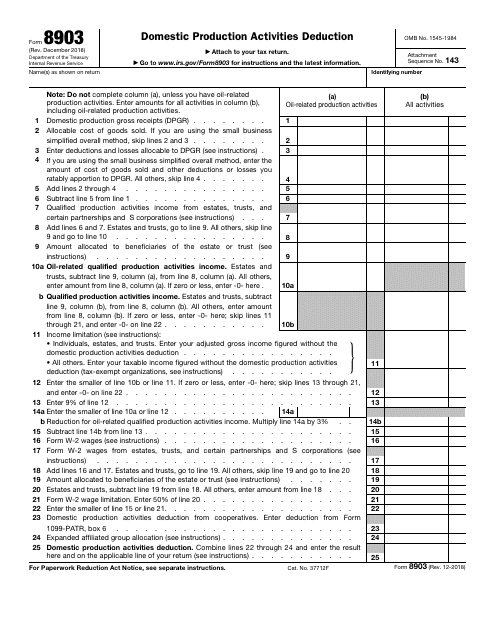

This Form is used for claiming the Domestic Production Activities Deduction on your federal tax return. It is for businesses that engage in certain qualified production activities within the United States.

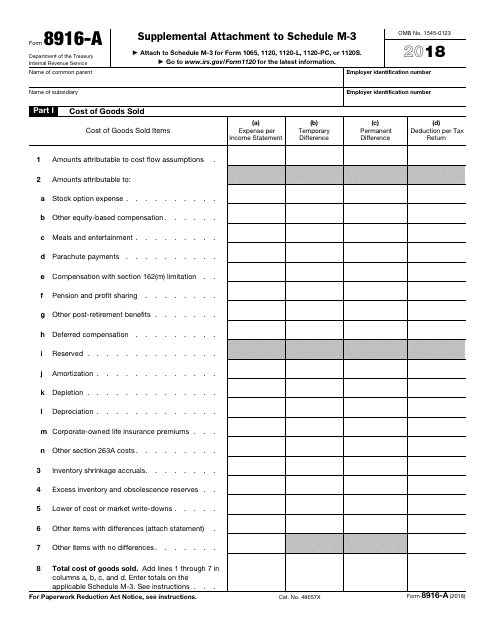

This form is used for providing additional information and attachments to the Schedule M-3 when filing taxes with the IRS.

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

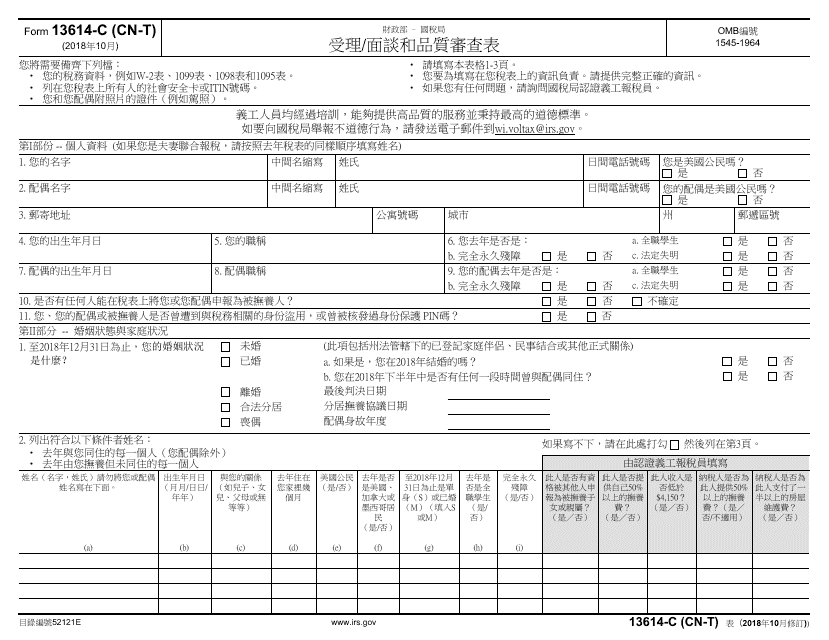

This form is used for the intake, interview, and quality review process conducted by the IRS. It is specifically designed for Chinese individuals or those who prefer to use Chinese language.

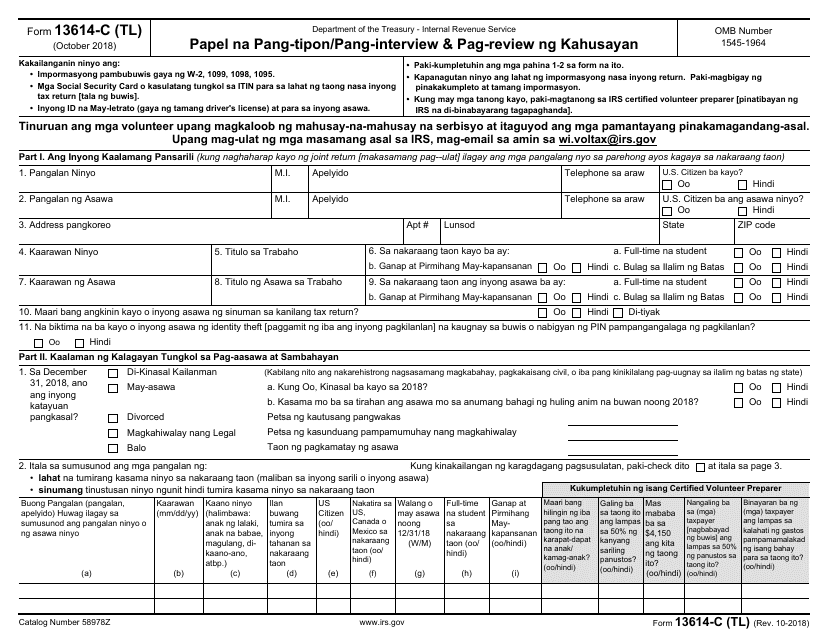

This document is for individuals who speak Tagalog and need assistance with their tax intake process. It is used to gather information about the taxpayer's financial situation for the IRS.

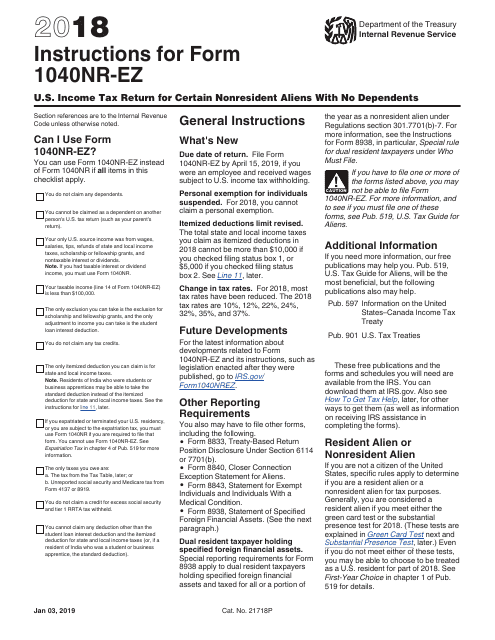

This document is for nonresident aliens with no dependents who need to file their U.S. income tax return. It provides instructions on how to complete IRS Form 1040NR-EZ.

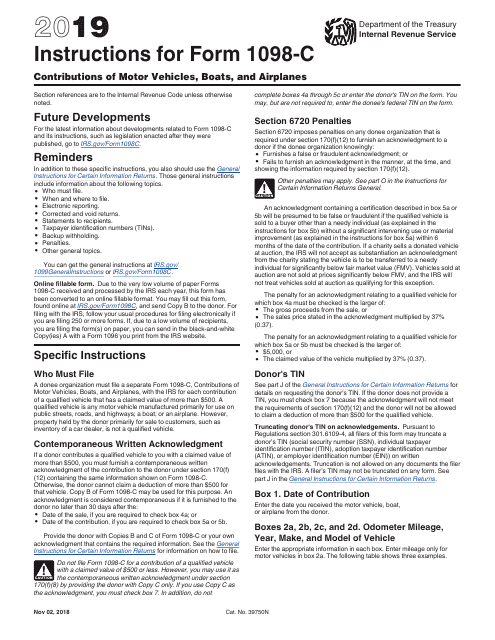

This document is used for reporting contributions of motor vehicles, boats, and airplanes to qualifying organizations.

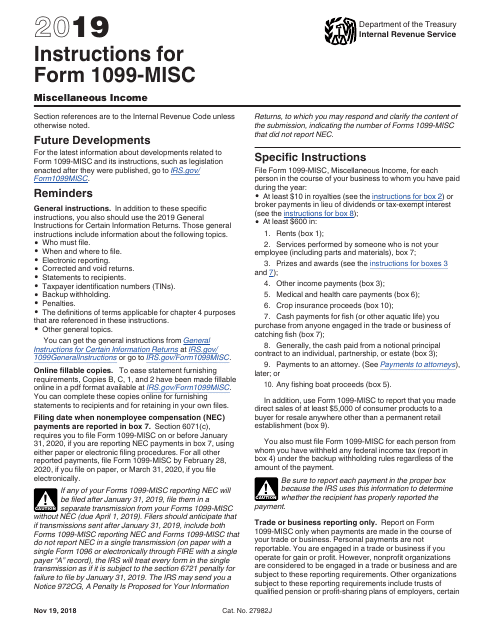

This form is used for reporting miscellaneous income received, such as freelance work or rental income. It provides instructions on how to fill out Form 1099-MISC accurately.

This form is used for reporting the compensation of corporate officers for tax purposes. It provides instructions on how to fill out IRS Form 1125-E.