Tax Deductions Templates

Documents:

1801

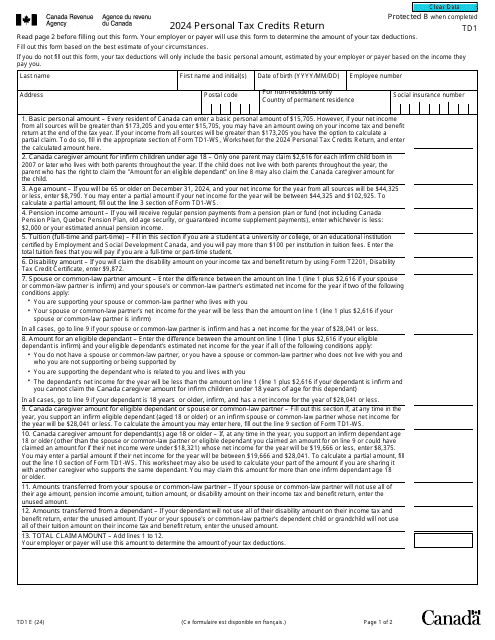

The purpose of this document is to provide a taxpayer's employer with all of the necessary information so that they will be able to determine the number of tax deductions for the Canadian taxpayer.

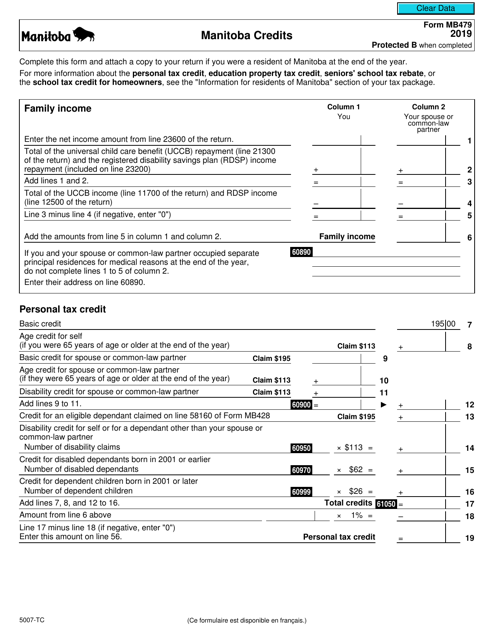

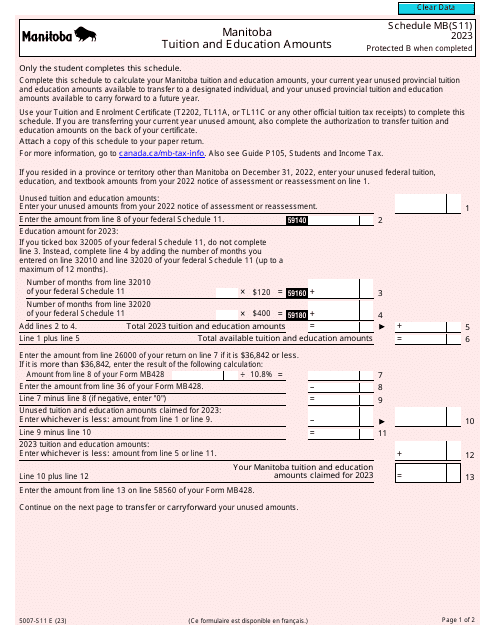

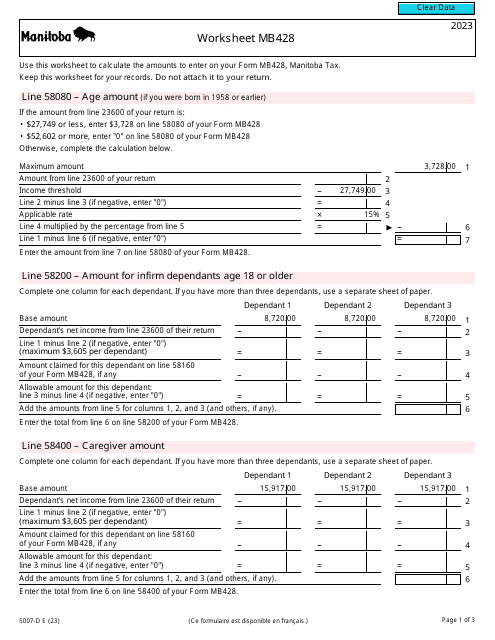

This form is used for claiming Manitoba credits in Canada.

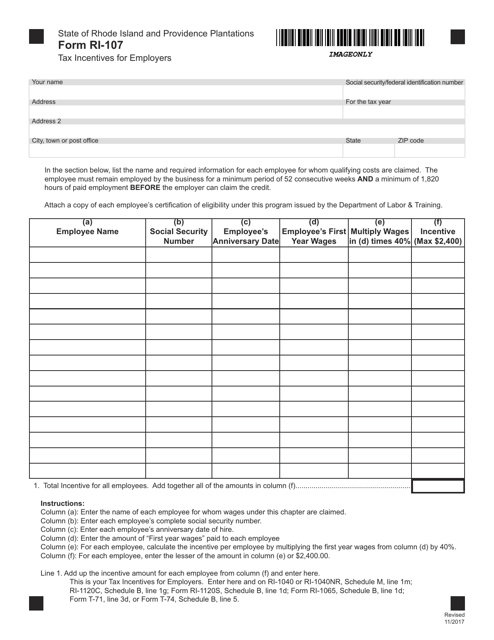

This Form is used for employers in Rhode Island to claim tax incentives and benefits.

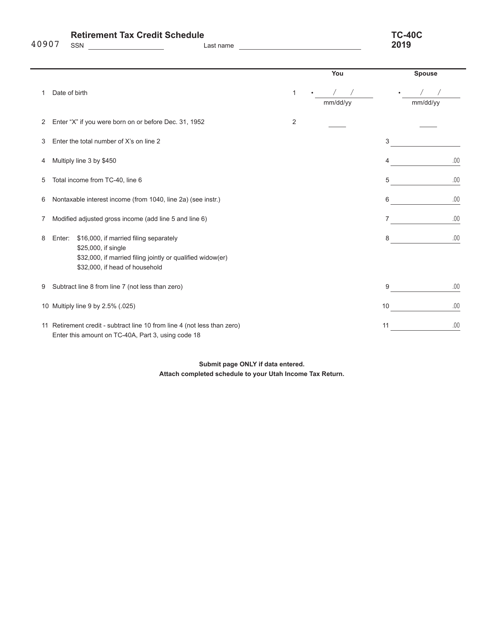

This Form is used for reporting retirement tax credits in the state of Utah.

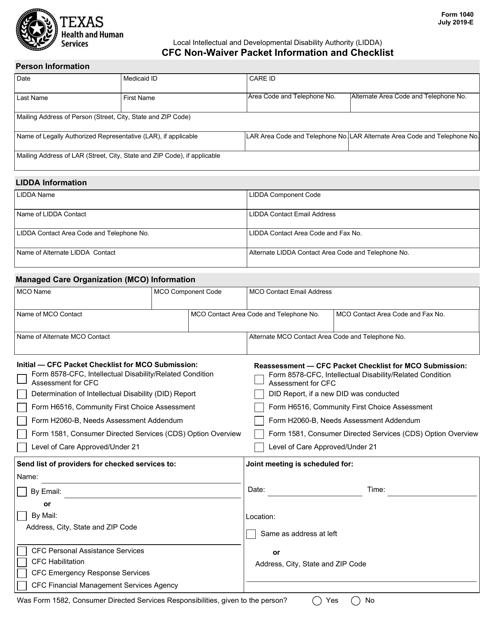

This Form is used for providing information and checklist for filing Form 1040 CFC Non-waiver Packet in Texas.

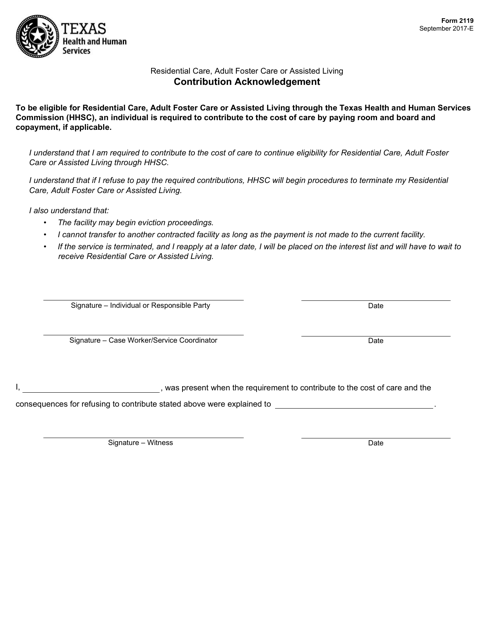

This form is used for acknowledging contributions made in Texas.

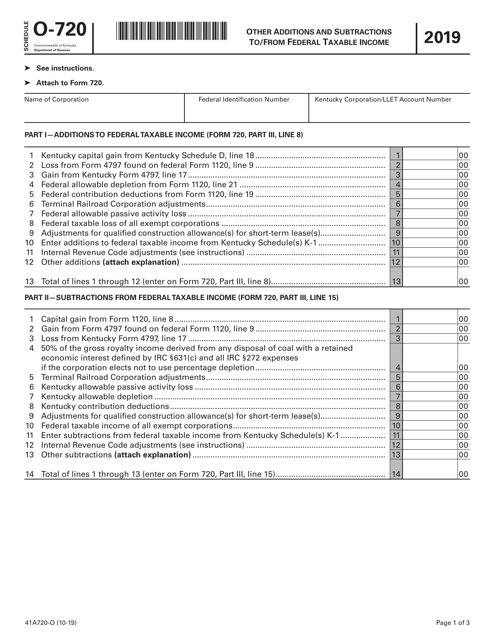

This form is used for reporting other additions and subtractions to or from federal taxable income for residents of Kentucky on their state tax return.

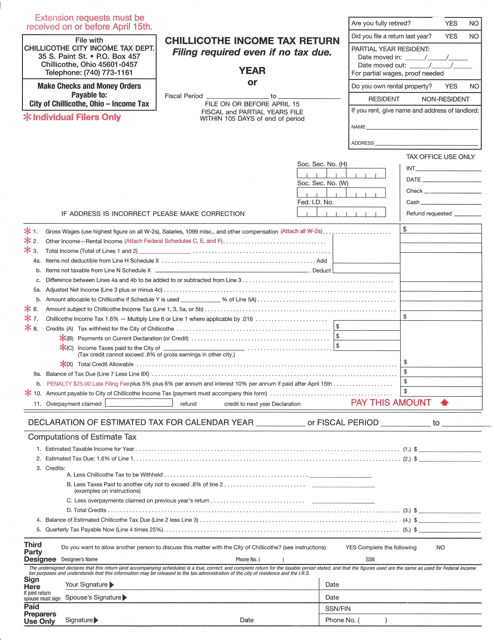

This document is used for filing your income tax return with the City of Chillicothe, Ohio.

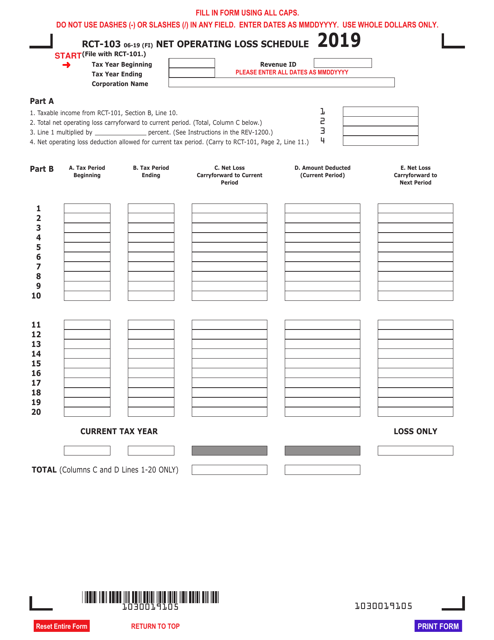

This form is used for reporting net operating losses in the state of Pennsylvania.

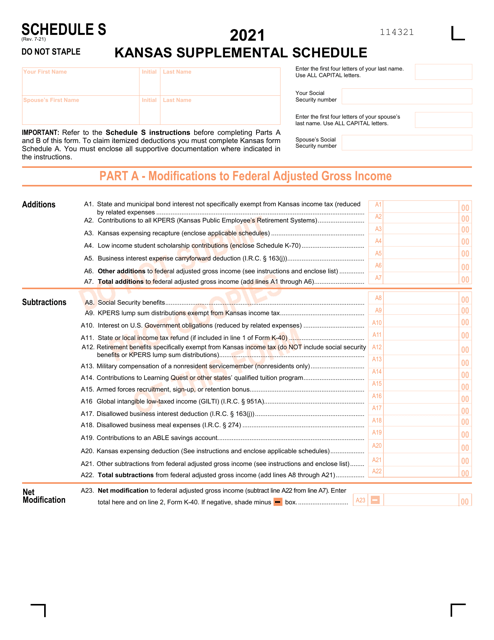

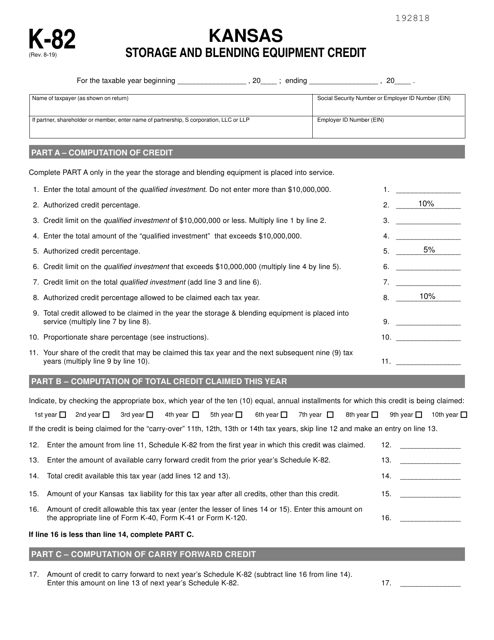

This Form is used to claim the Storage and Blending Equipment Credit in the state of Kansas.

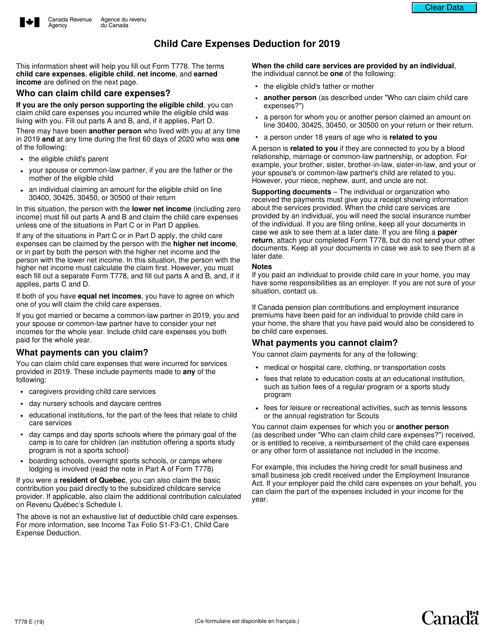

Canadian parents or guardians may use this form to claim expenses incurred from child care on their taxes.

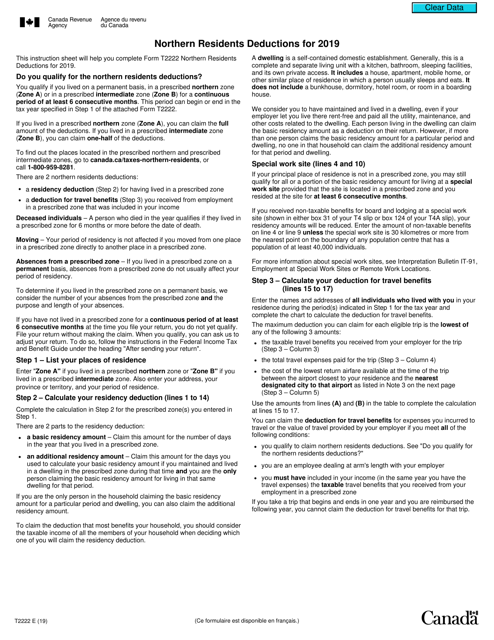

This form is used for claiming northern residents deductions in Canada. It helps residents of certain northern regions to reduce their taxable income by claiming expenses related to living in these regions.