Tax Deductions Templates

Documents:

1801

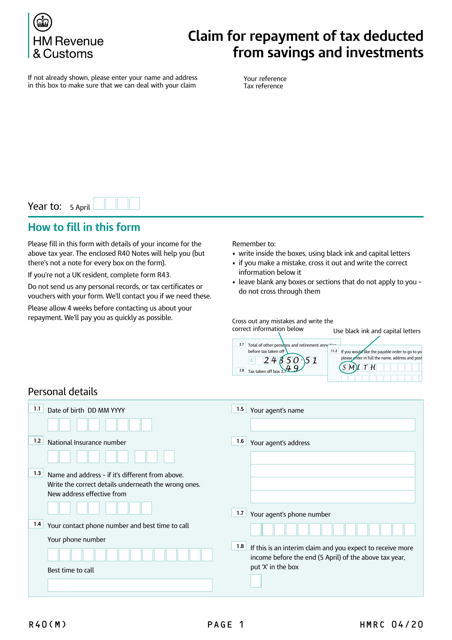

This is a document that may be used when an individual wants to claim a repayment of tax on their savings interest.

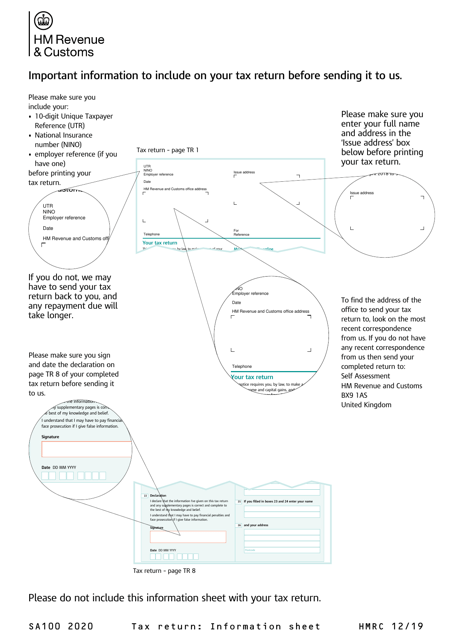

This form is used for reporting income, loan repayments, pensions, annuities, charitable contributions, and tax allowances.

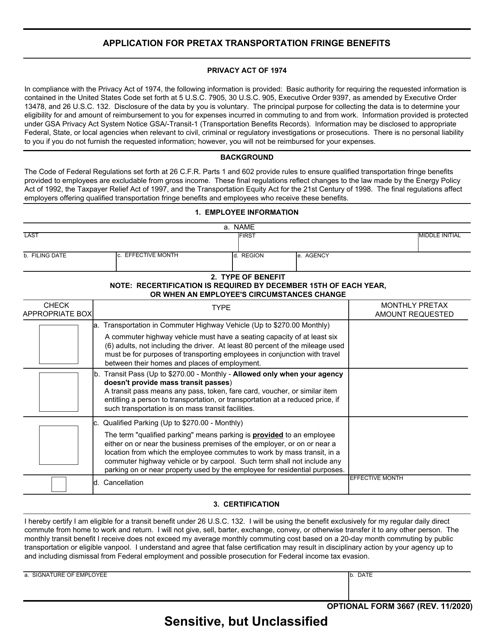

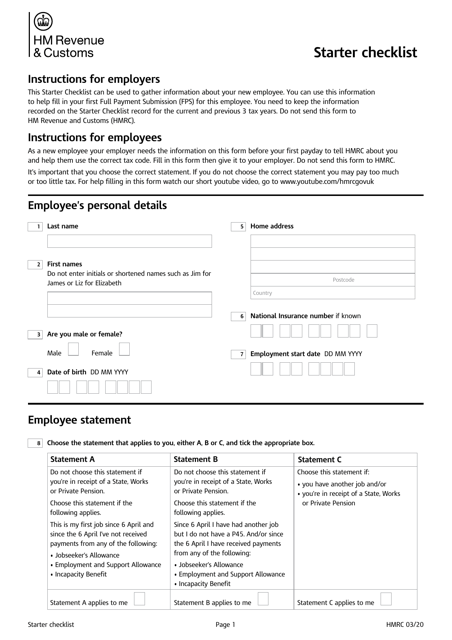

Employers may use this form to collect information about their employees, their previous employment, and the pension and benefits they are entitled to.

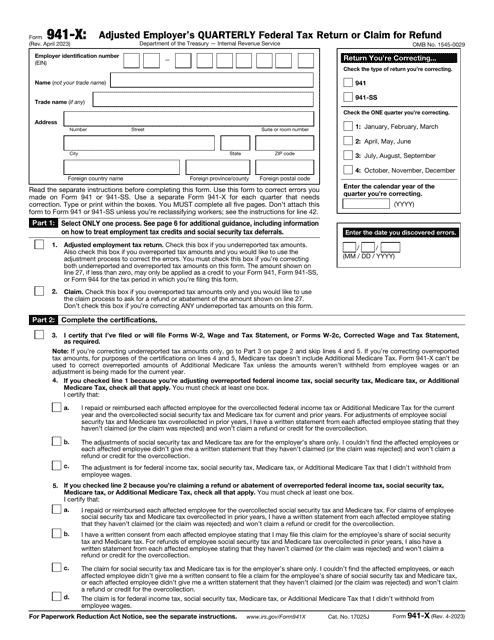

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

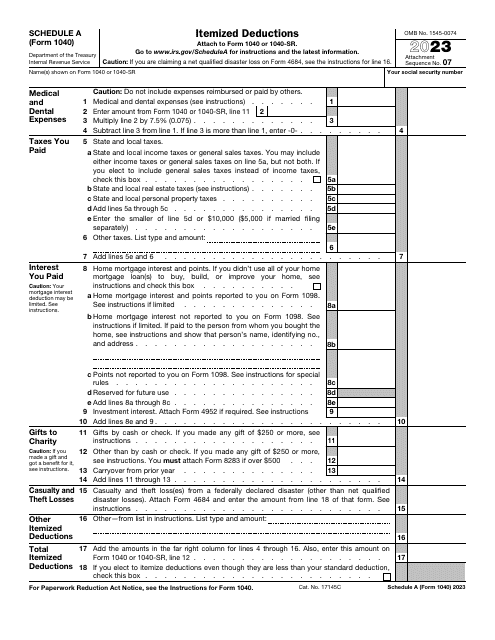

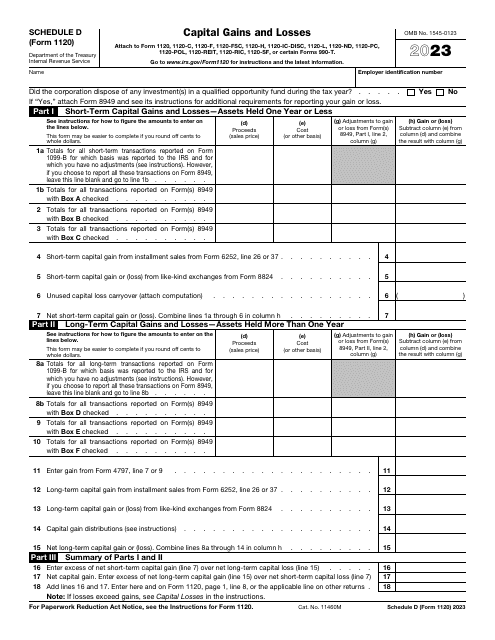

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

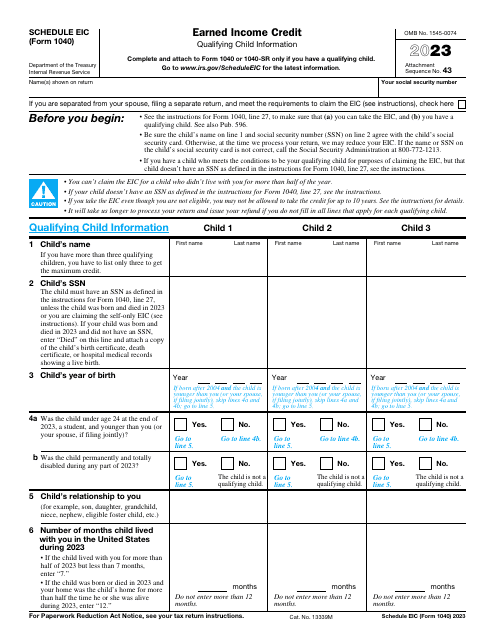

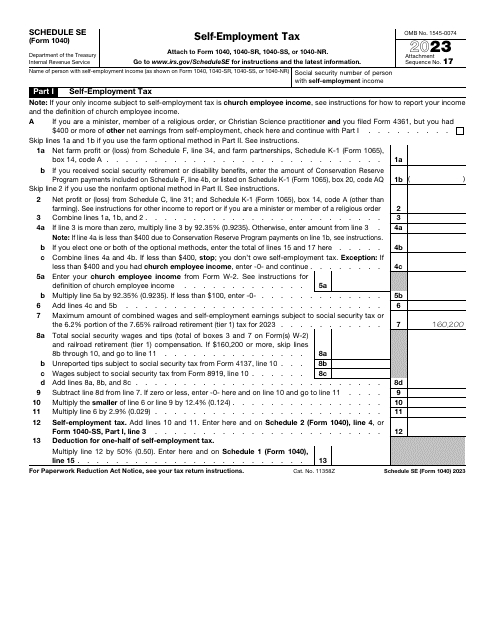

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

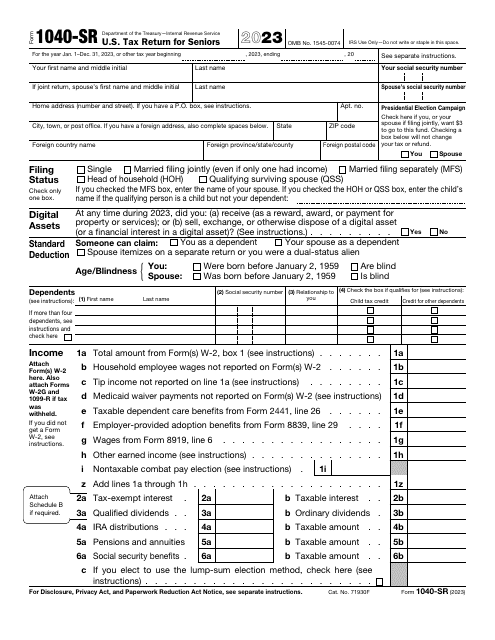

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

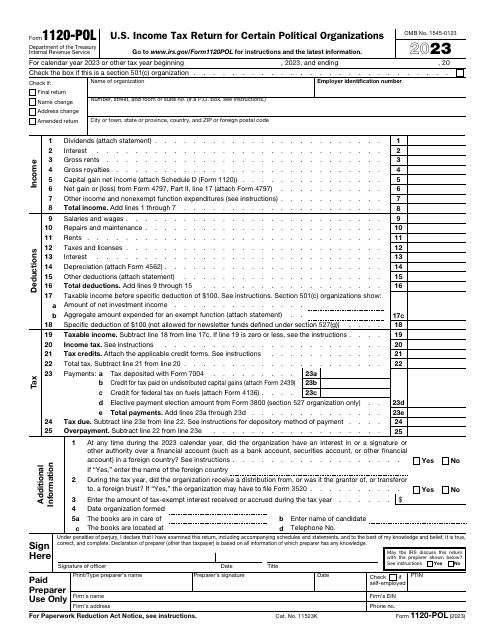

Use this form to inform the Internal Revenue Service (IRS) about the taxable income of your political organization, as well as about your tax liability according to Section 527.

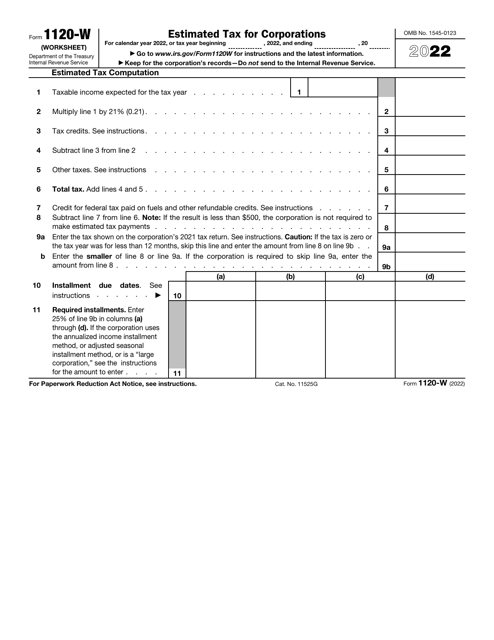

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

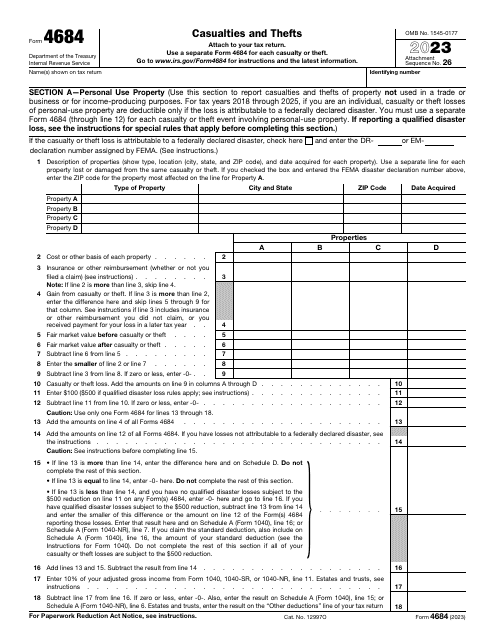

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

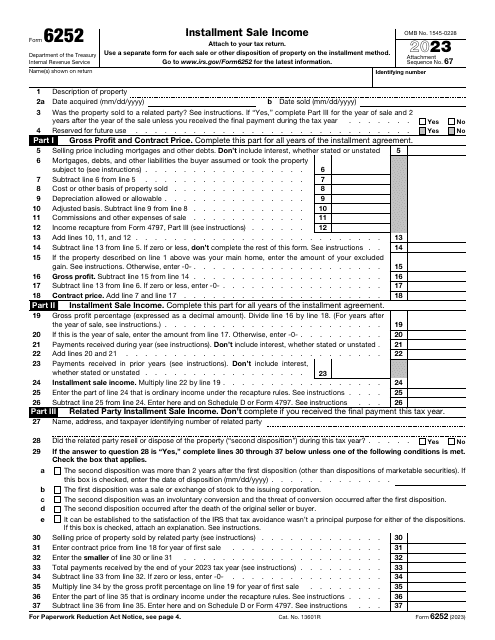

This is an IRS form that includes the details of an installment sale.