Tax Deductions Templates

Documents:

1801

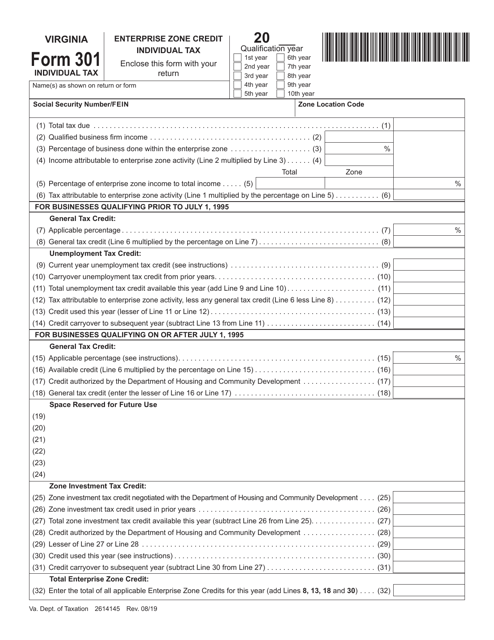

This Form is used for claiming the Enterprise Zone Credit on individual income tax returns in Virginia.

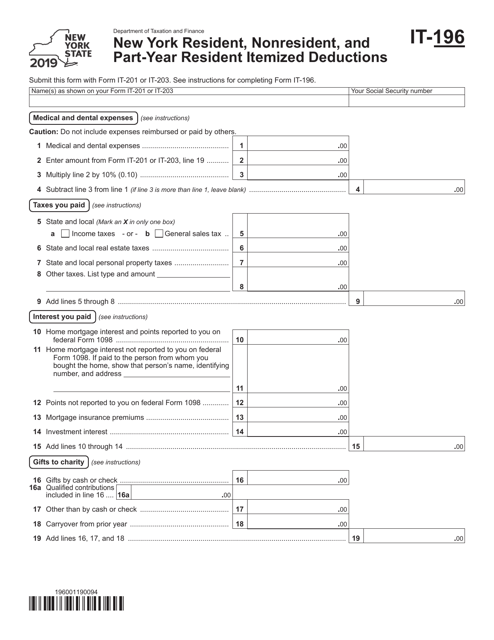

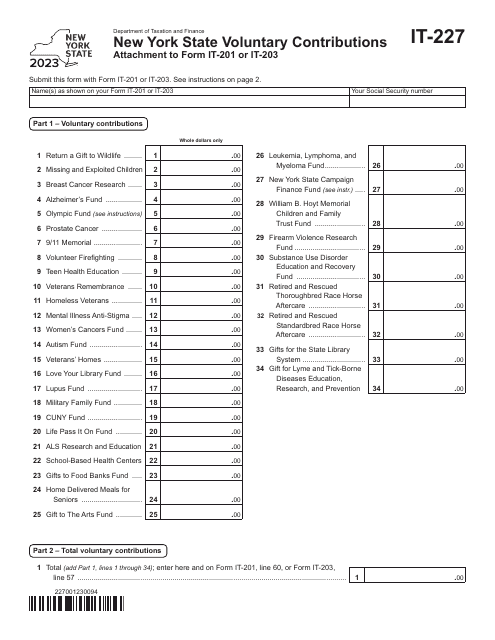

This Form is used for reporting itemized deductions for New York state residents, nonresidents, and part-year residents on their tax return.

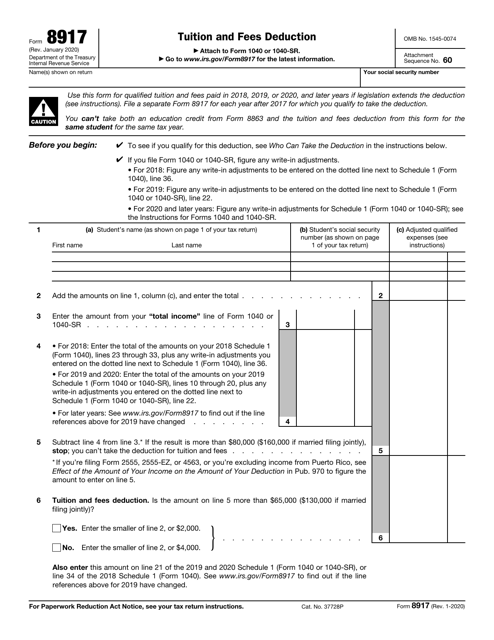

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

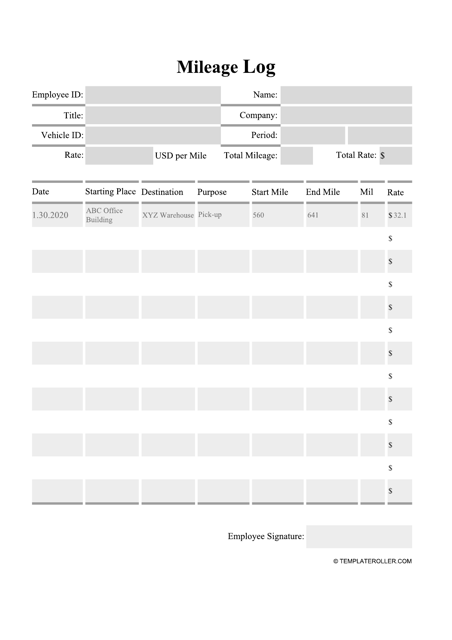

Individuals or businesses may use this document to record vehicle miles traveled for business.

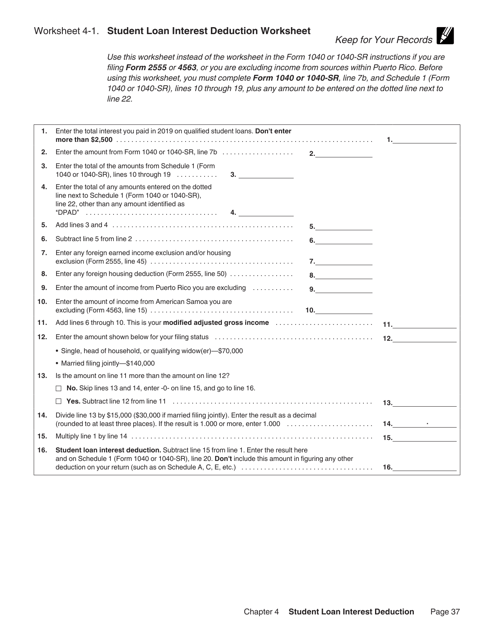

This document is a worksheet that helps you calculate the amount of student loan interest you can deduct from your taxes. It is explained in Publication 970, which provides information on tax benefits for education expenses.

This form is used for claiming the Additional Child Tax Credit on your federal tax return. It provides instructions on how to fill out Form 1040 or Form 1040-SR if you qualify for this tax credit.

This form provides instructions for filling out the IRS Form 1040, 1040-SR Schedule A, which is used for reporting itemized deductions on your federal income tax return. It guides you on how to properly calculate and report your deductible expenses such as medical expenses, state and local taxes, mortgage interest, and charitable contributions.

This document provides instructions for individuals who operate a sole proprietorship to report their business profit or loss on their IRS Form 1040 or 1040-SR. It guides taxpayers through the process of filling out the Schedule C section of the form and provides explanations of the various sections and line items related to business income and expenses.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.