Tax Deductions Templates

Documents:

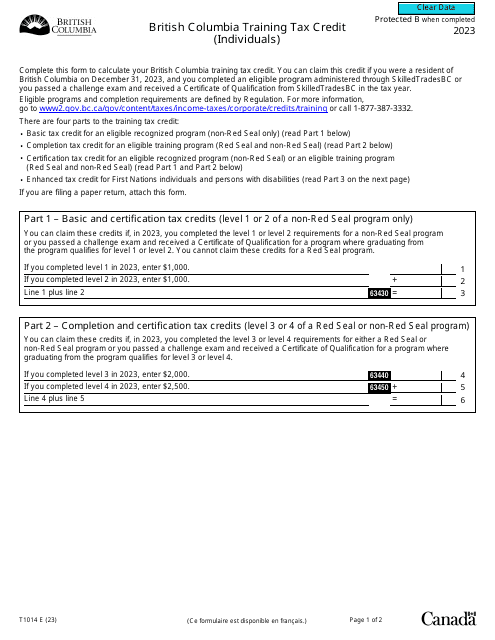

1801

This type of document is the Minnesota Income Tax Withholding form, which is used to determine the amount of state income tax that employers should withhold from employees' paychecks in Minnesota.

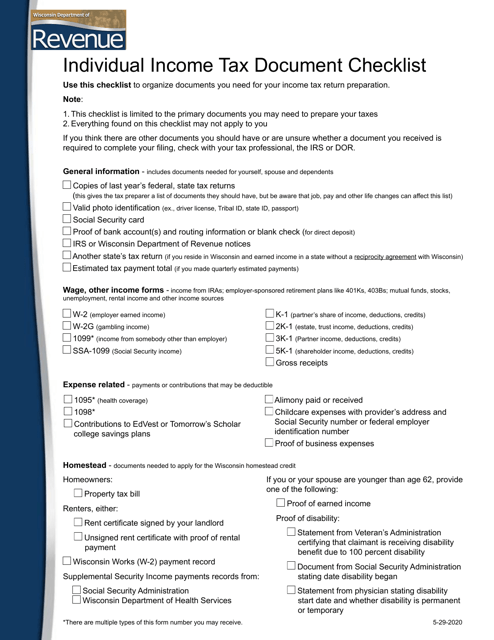

This document is a checklist for individuals filing their income tax in Wisconsin. It helps ensure that all necessary documents and information are gathered for accurate tax reporting.

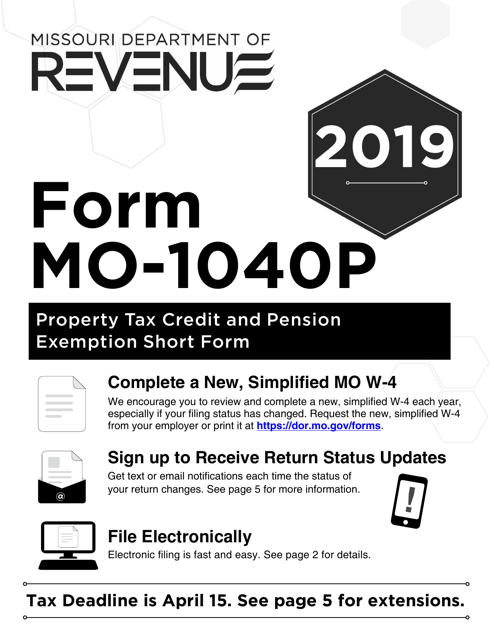

This Form is used for filing the individual income tax return and claiming property tax credit or pension exemption in Missouri.

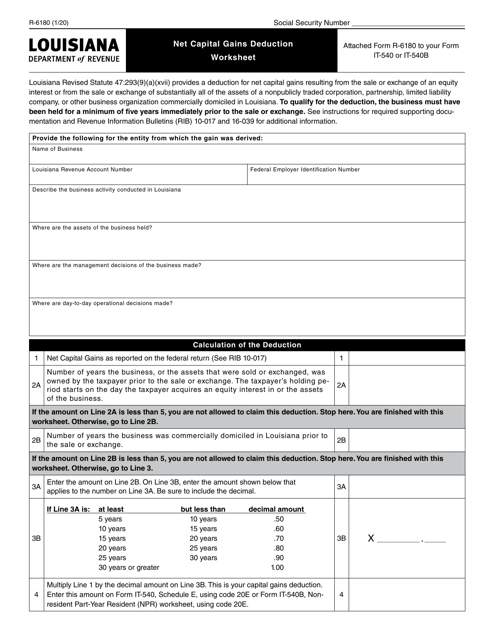

This form is used for calculating and claiming the net capital gains deduction in the state of Louisiana.

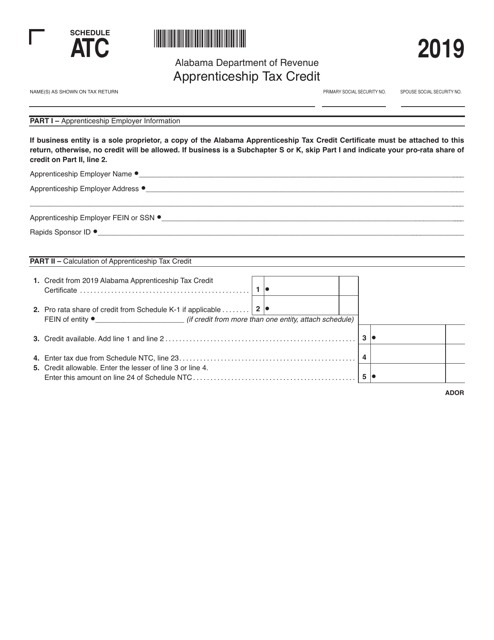

This document is a schedule for claiming the ATC Apprenticeship Tax Credit specific to the state of Alabama. It provides information on how to calculate and claim tax credits related to apprenticeship programs.

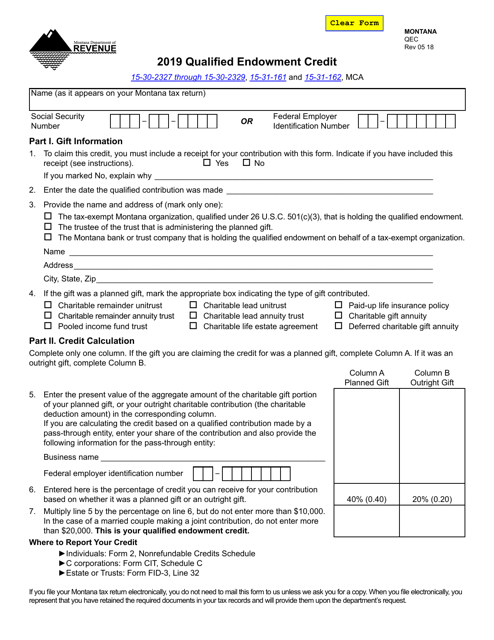

This Form is used for claiming the Qualified Endowment Credit in Montana. The credit is available to individuals and businesses contributing to qualified endowment funds.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

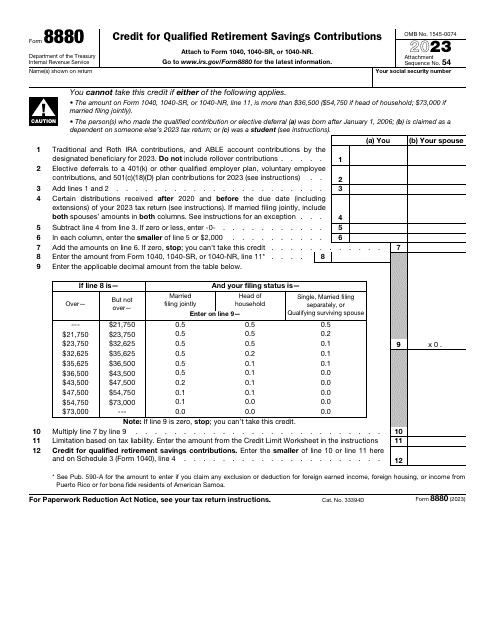

This is a formal instrument that allows individuals to express their intention to receive a saver's credit after contributing money to their retirement savings plans.

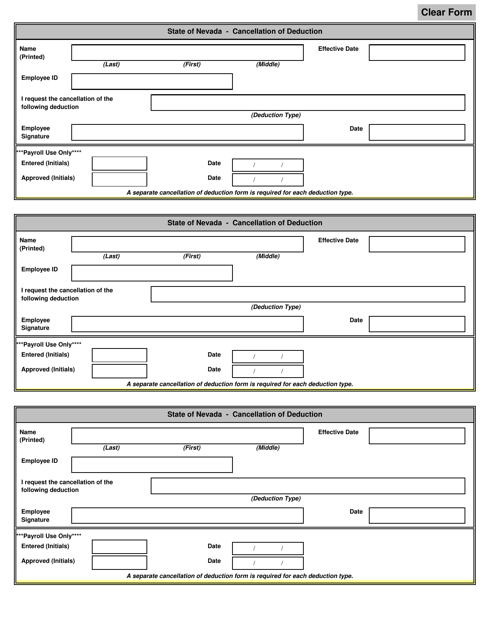

This document is for canceling a deduction in the state of Nevada.

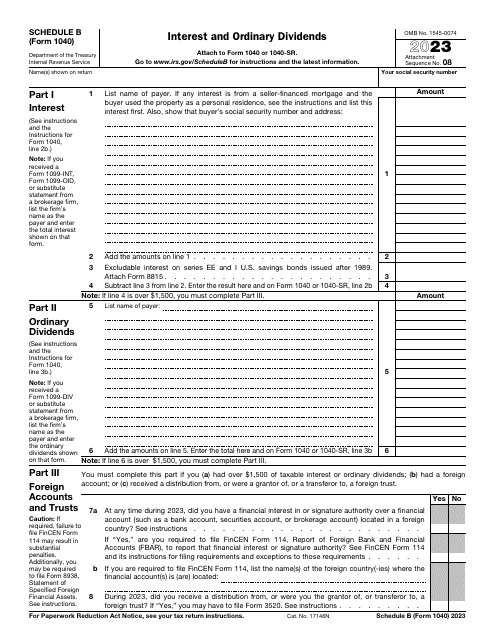

This is a supplementary form individuals are supposed to use to calculate income tax they owe after receiving interest from bonds and earning dividends.

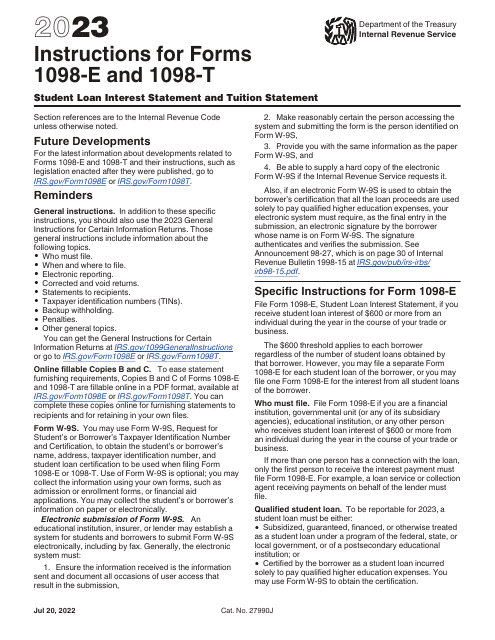

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.