Tax Deductions Templates

Documents:

1801

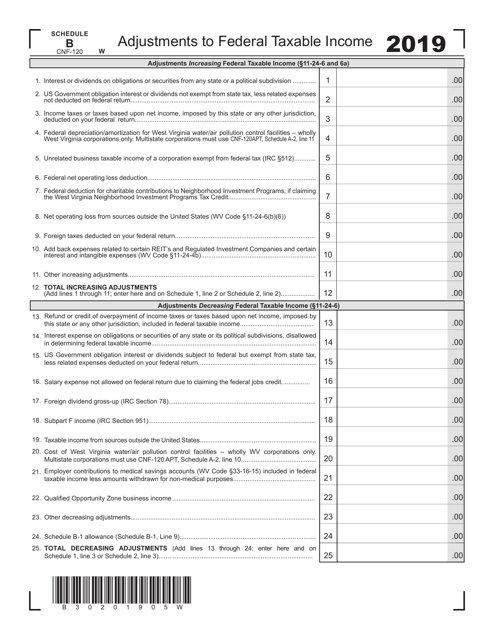

This form is used for reporting adjustments to federal taxable income for residents or businesses in West Virginia. It is required to calculate the correct state tax liability.

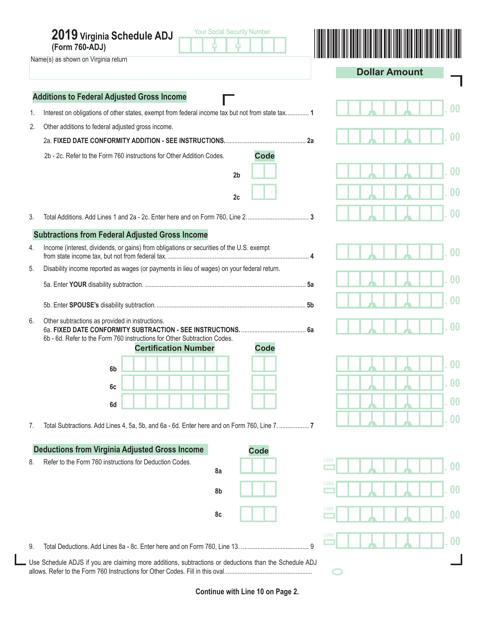

This form is used for reporting adjustments made to your Virginia state tax return. It is specific to Virginia residents.

This Form is used for filing nonresident individual income tax return in the state of Virginia.

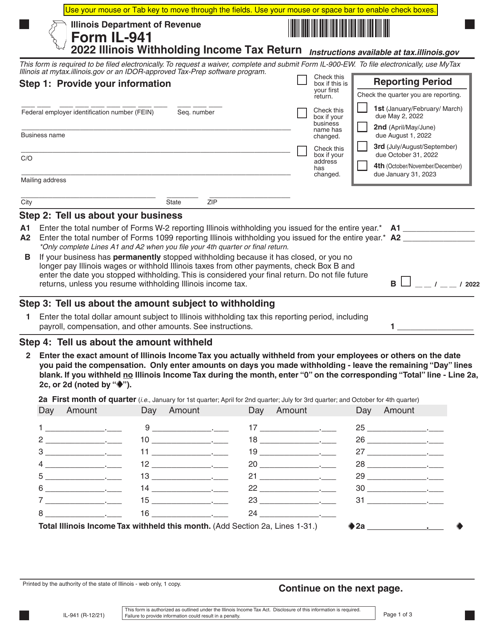

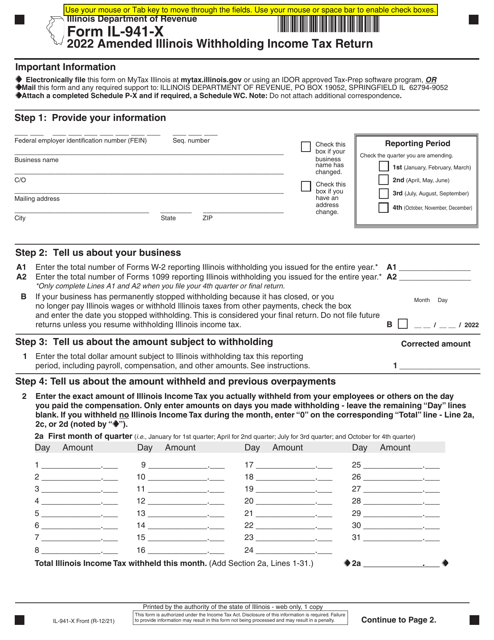

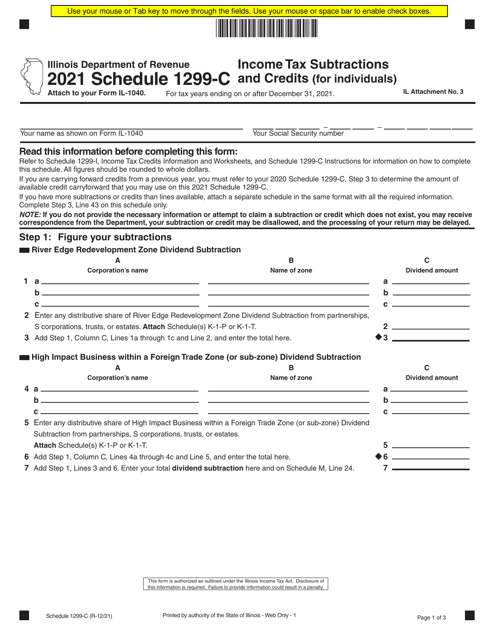

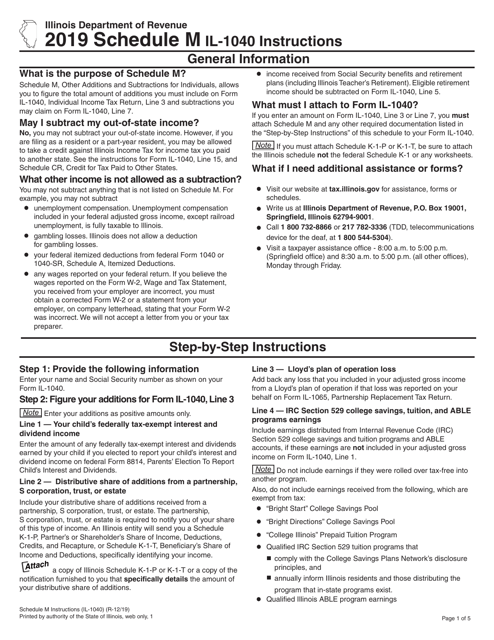

This Form is used for reporting other additions and subtractions on your Illinois Individual Income Tax Return (Form IL-1040). It helps calculate your total income or deductions for tax purposes in Illinois.

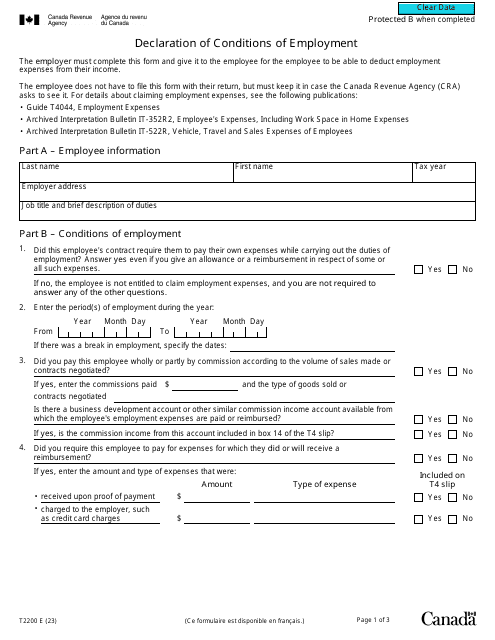

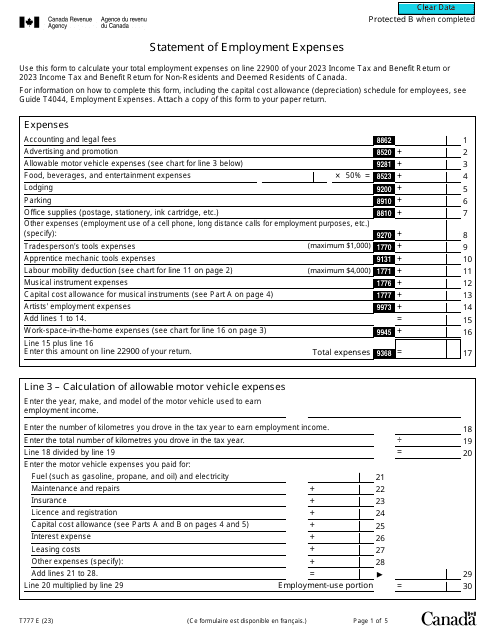

The purpose of the document is to provide an employee with information about employment expenses that can be deducted from their income in Canada.

Canadian employees may use this form when they often need to supply themselves with materials necessary to complete their work, but are not reimbursed through their place of work for these expenses.