Tax Deductions Templates

Documents:

1801

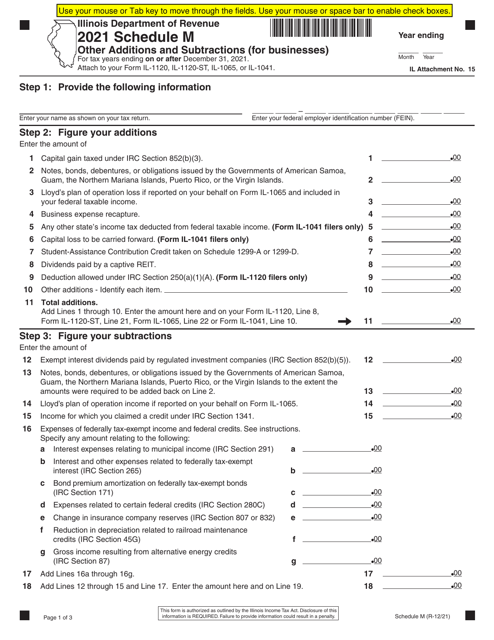

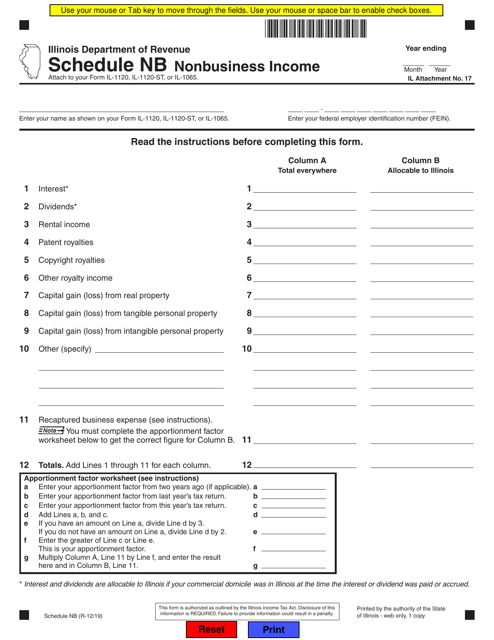

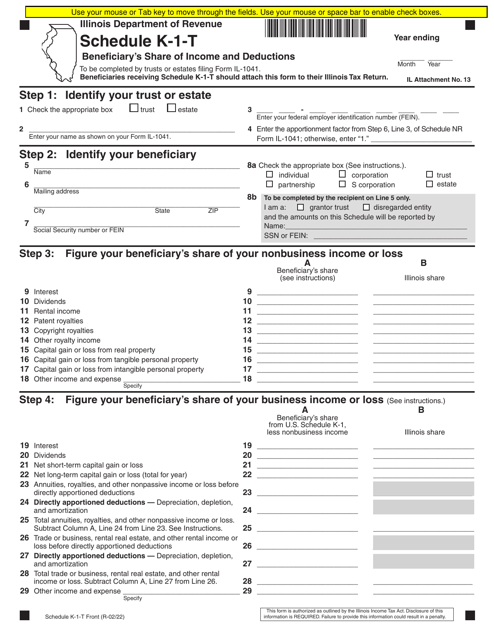

This document is for reporting nonbusiness income in the state of Illinois for individual taxpayers. It is used to schedule the income that is not derived from business activities.

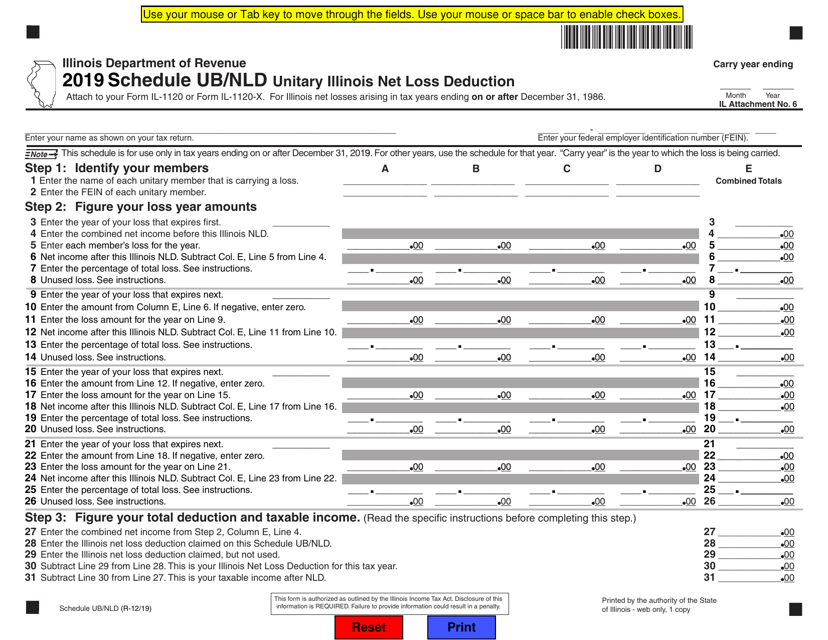

This document is for claiming the Unitary Illinois Net Loss Deduction in the state of Illinois. This deduction allows businesses to offset their net losses against their income.

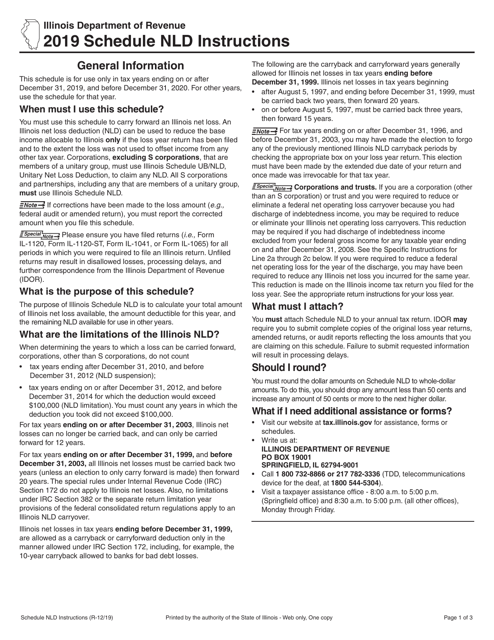

This type of document provides instructions for claiming a net loss deduction in Illinois when filing taxes.

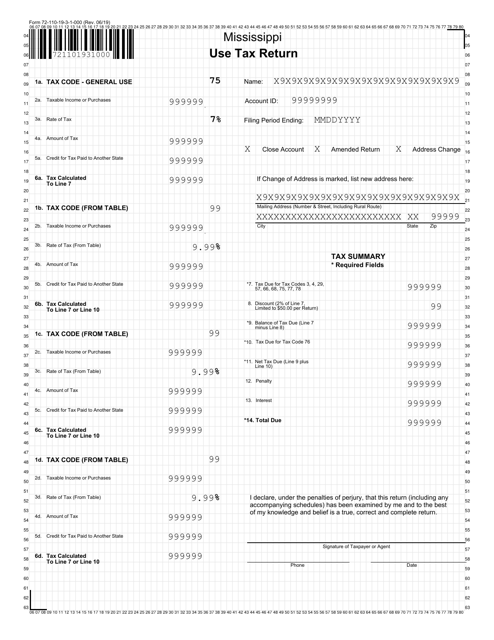

This form is used for reporting and paying use tax in the state of Mississippi. Use tax is a tax on goods and services purchased outside of the state but used within Mississippi.

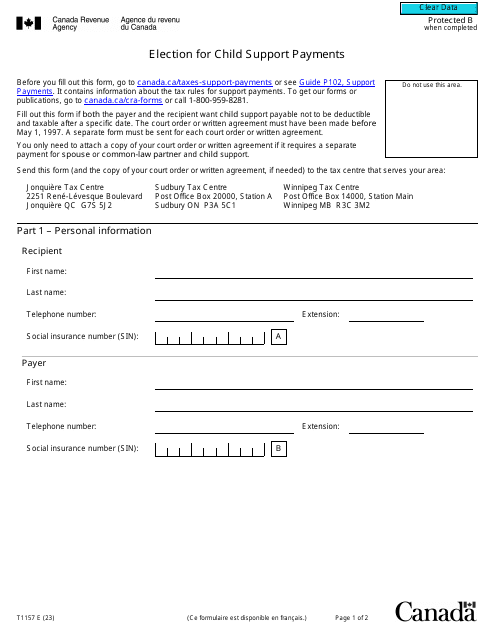

This is a legal document that needs to be completed to register an election for child support payments in Canada.

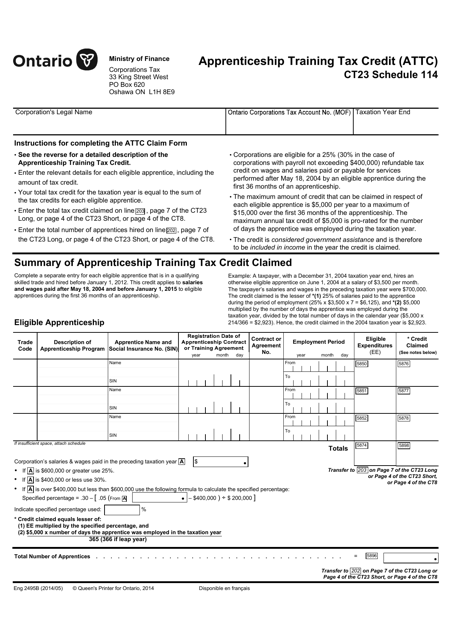

This form is used for claiming the Apprenticeship Training Tax Credit in Ontario, Canada. It is a schedule that needs to be filed along with Form CT23 (2495B).

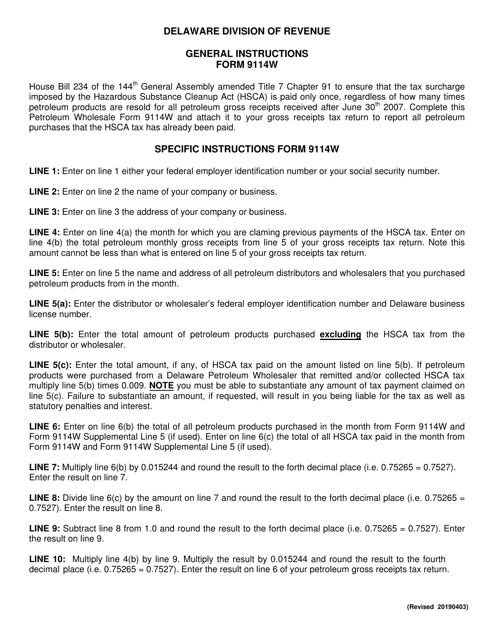

This Form is used for petroleum wholesalers in Delaware to report payments made for HSCA taxed purchases. It provides instructions for filling out the form accurately.