Tax Deductions Templates

Documents:

1801

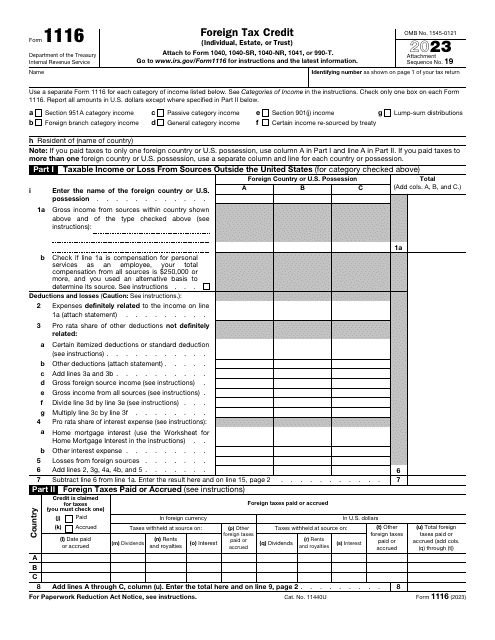

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

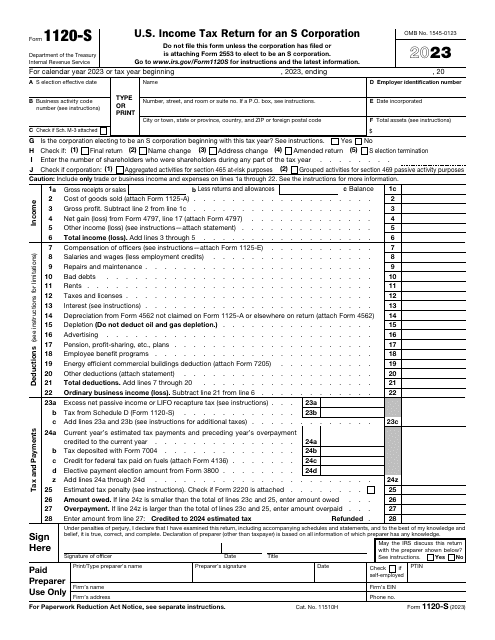

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

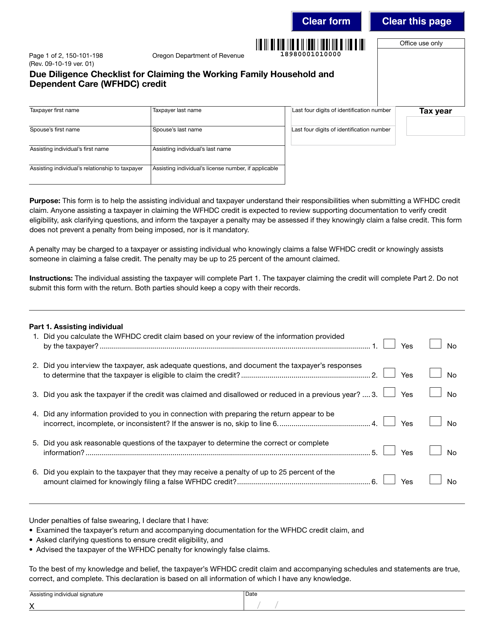

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

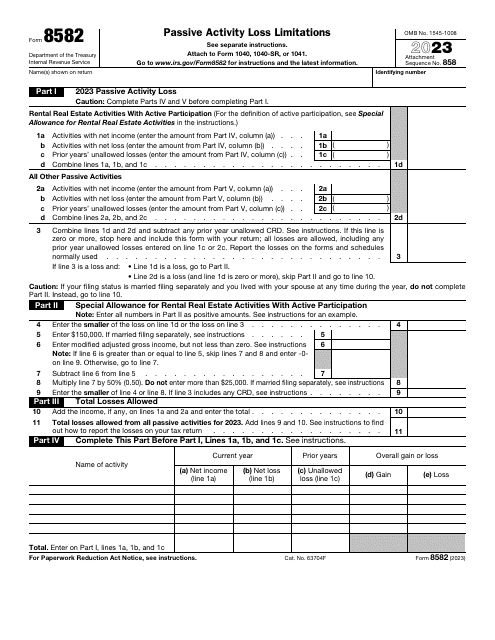

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

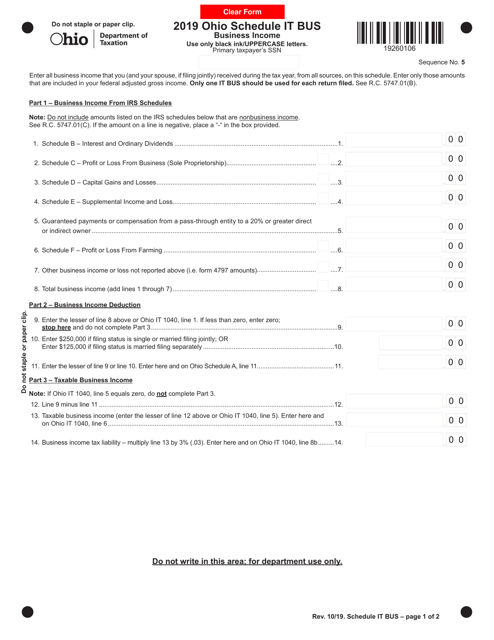

This document is used for reporting the business income of an IT company in the state of Ohio. It is necessary for tax purposes and helps the company accurately calculate their taxable income.

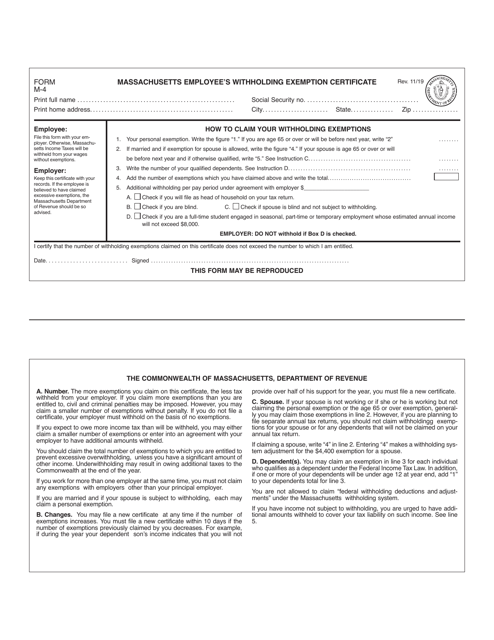

This Form is used for employees in Massachusetts to declare their withholding exemptions for income tax purposes.