Tax Deductions Templates

Documents:

1801

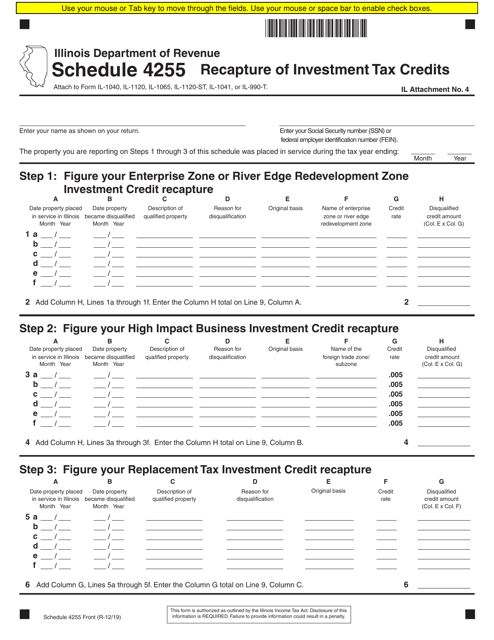

This Form is used for the recapture of investment tax credits in the state of Illinois.

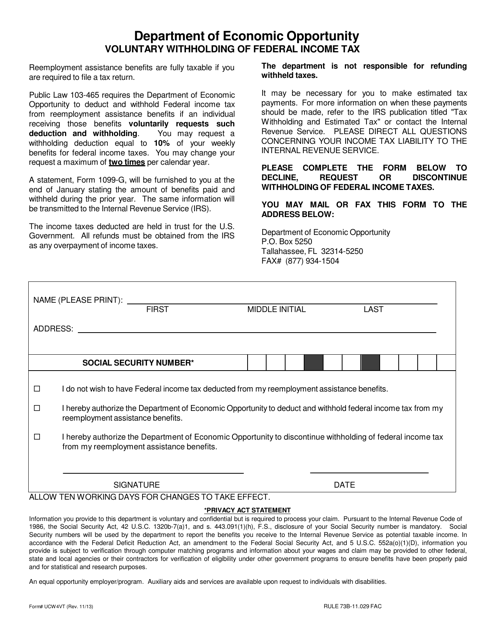

This form is used for voluntary withholding of federal income tax in the state of Florida.

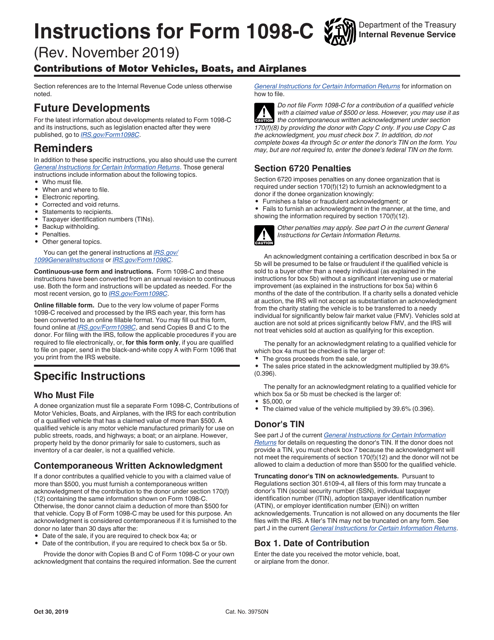

This Form is used for reporting contributions of motor vehicles, boats, and airplanes to the IRS. It provides instructions on how to properly report the donation for tax purposes.

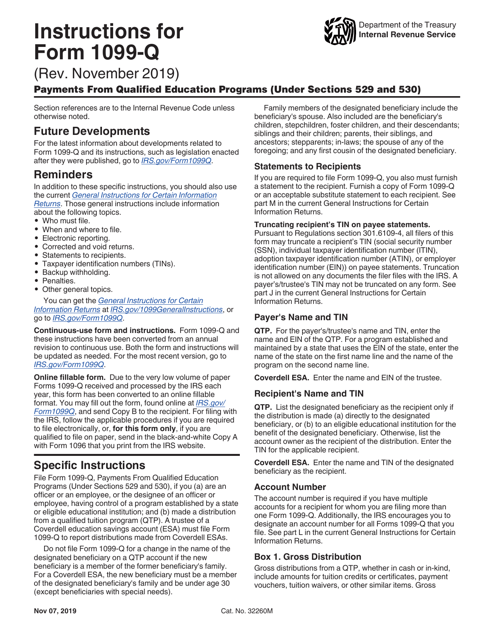

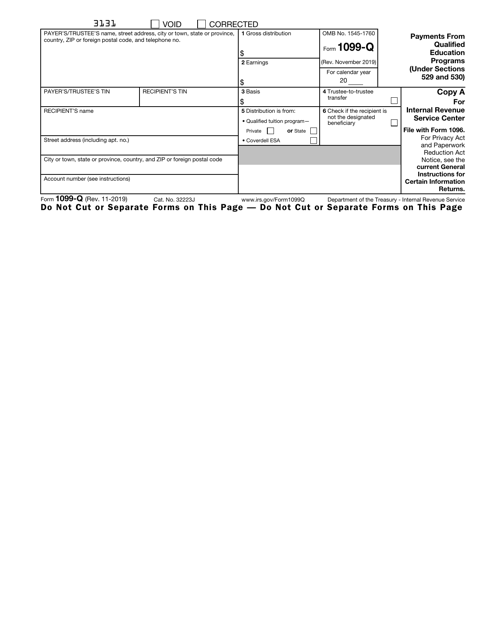

This Form is used for reporting payments from qualified education programs under Sections 529 and 530 of the IRS code.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

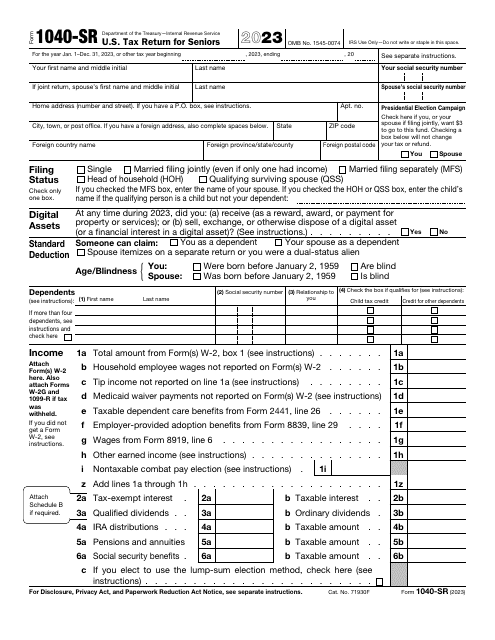

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

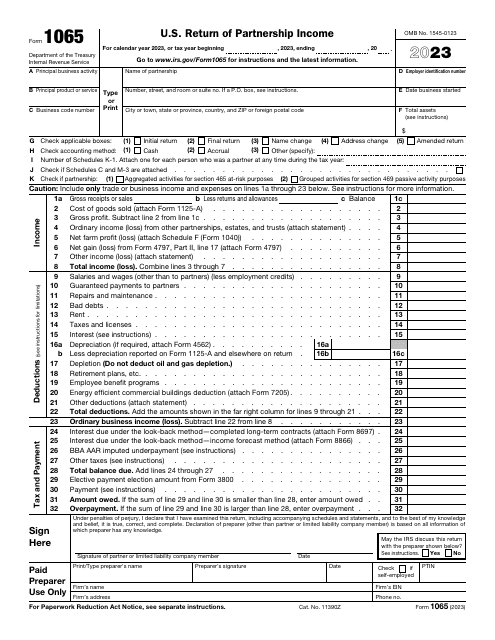

Use this form to report information on deductions, credits, and income relevant to the operation of a partnership to the Internal Revenue Service (IRS).

This is an IRS form governmental entities prepare and file in order to inform the government about deductible payments like fines and penalties they have made during a particular calendar year.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.