Tax Deductions Templates

Documents:

1801

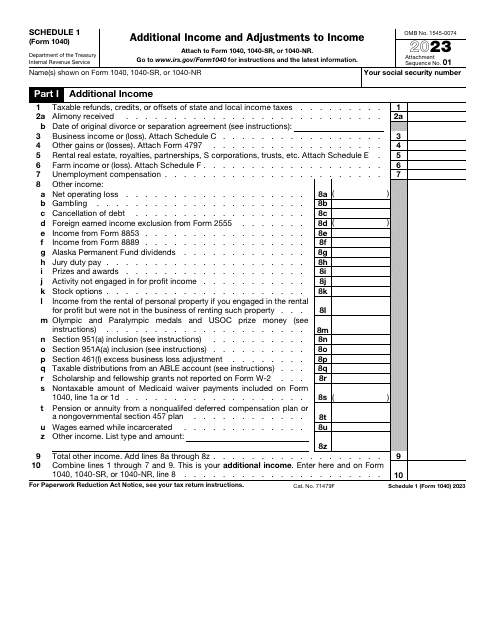

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

This form is used for applying for a determination from the IRS for an employee benefit plan.

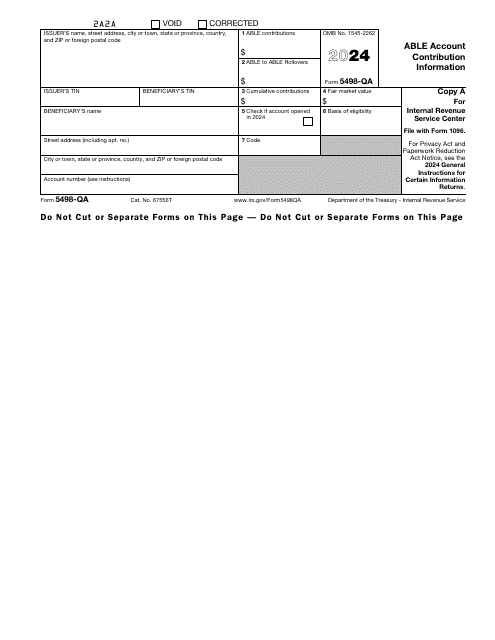

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

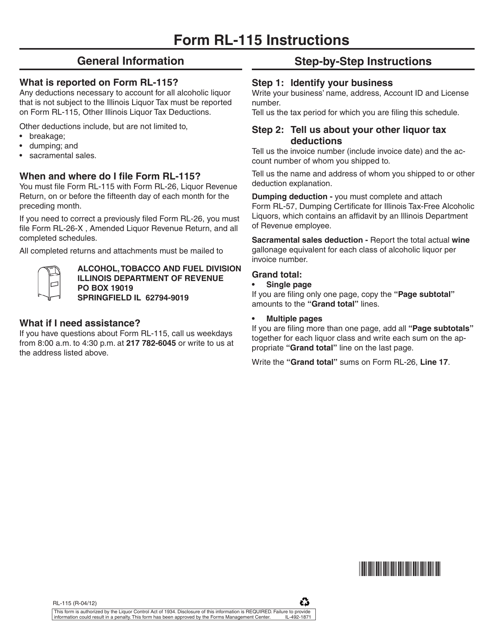

This form is used for claiming other liquor tax deductions in the state of Illinois.

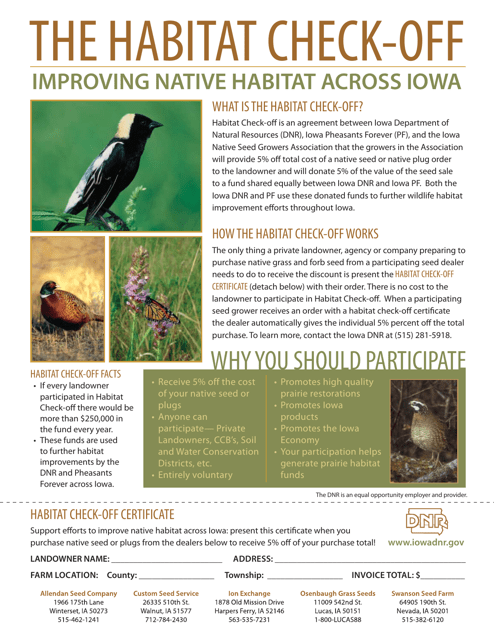

This document certifies that a habitat check-off contribution has been made in the state of Iowa. It helps support conservation efforts and protect wildlife habitats in Iowa.

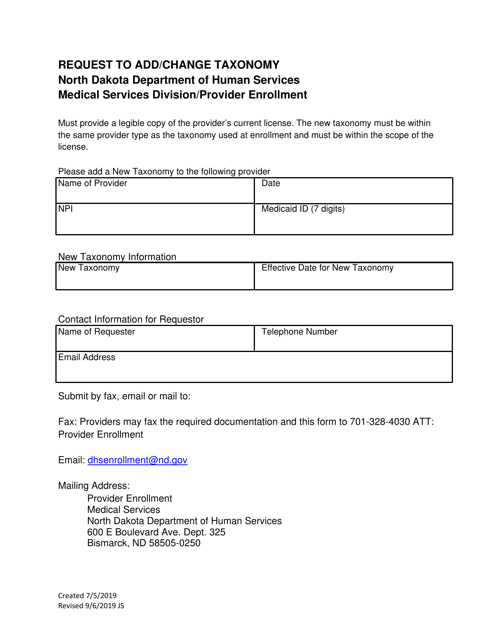

This document is a request form used in North Dakota to add or change a taxonomy.

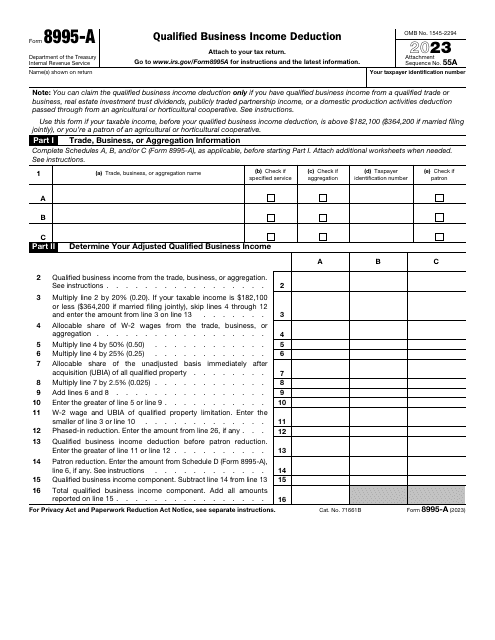

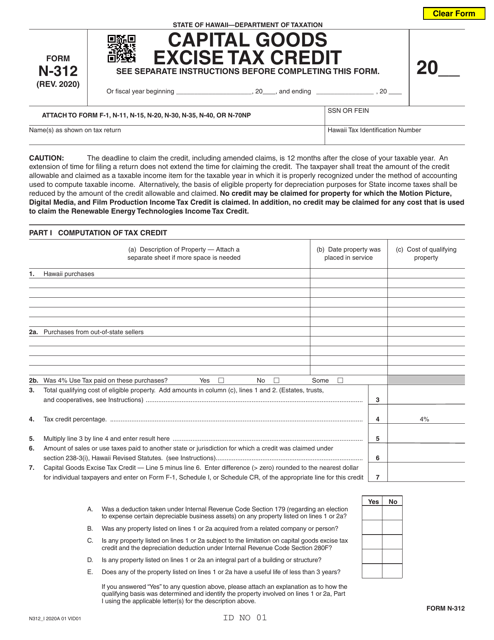

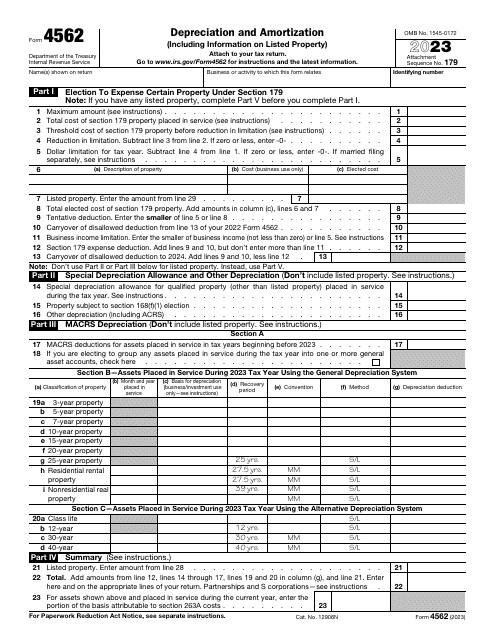

This is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

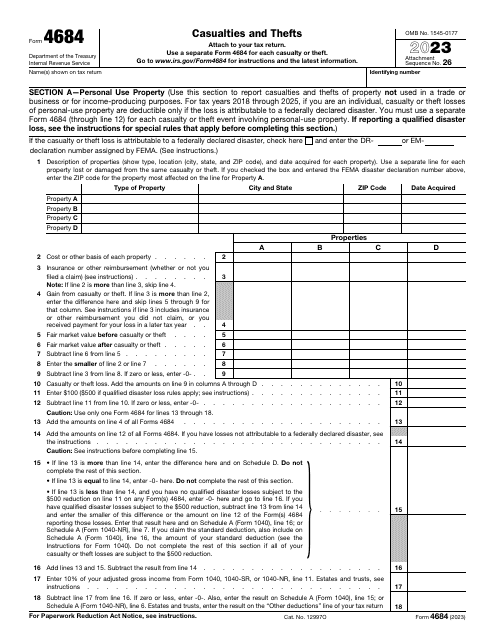

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

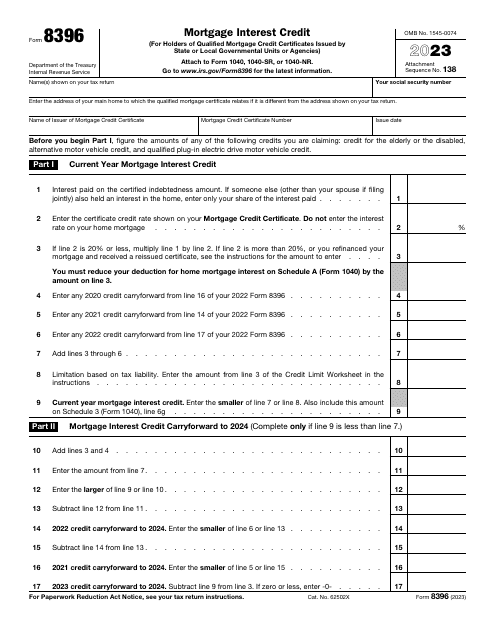

This is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.

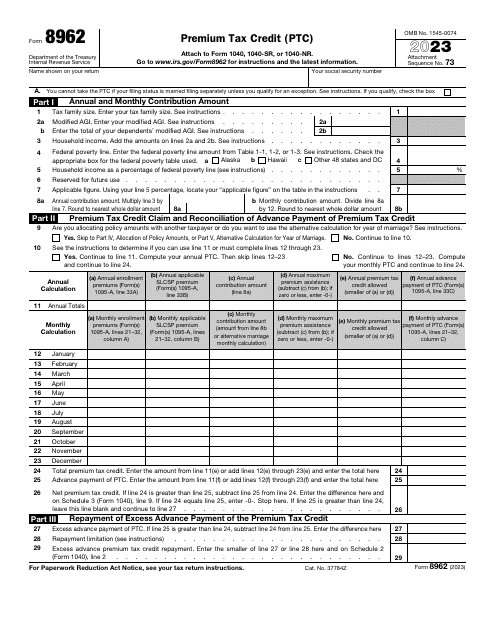

This is an IRS legal document completed by individuals who need to figure out the amount of their Premium Tax Credit and reconcile it with the Advanced Premium Tax Credit (APTC) payments made throughout the reporting year.