Tax Report Templates

Documents:

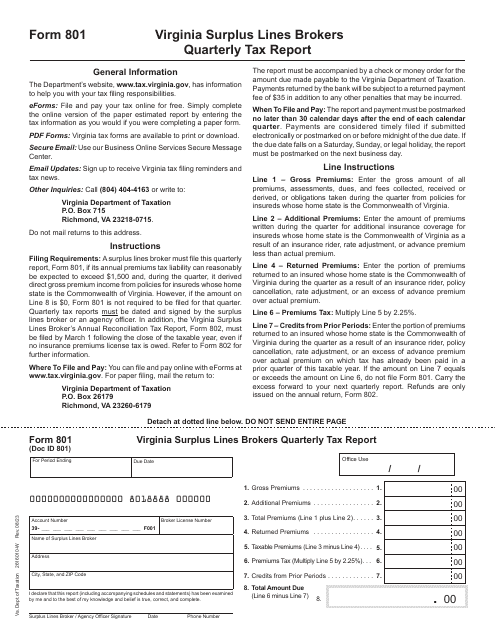

943

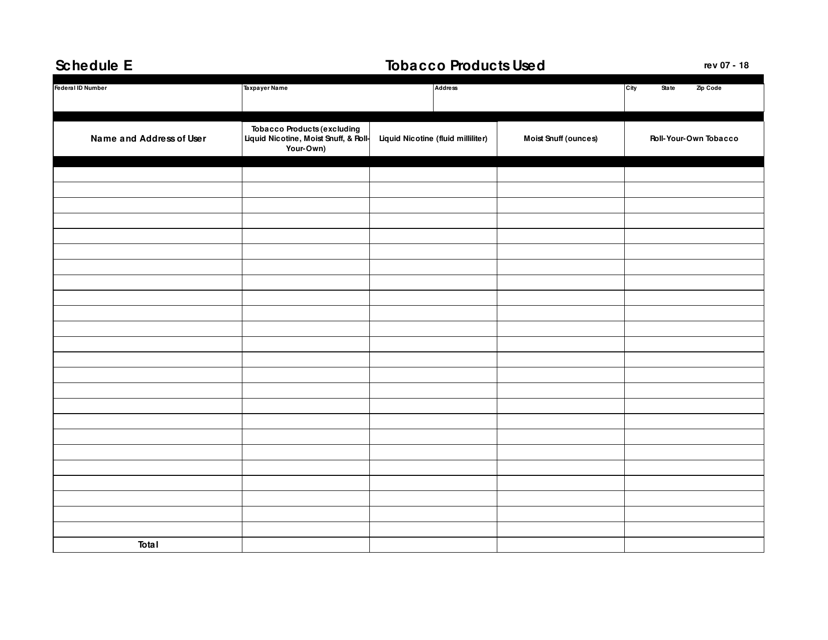

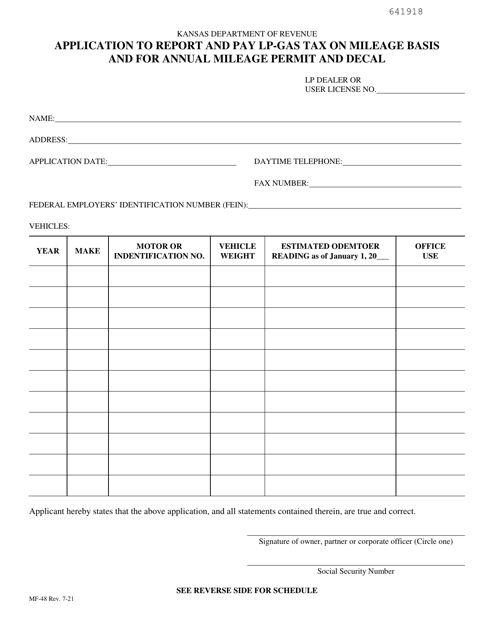

This document is used for reporting the usage of tobacco products in the state of New Jersey. It is a form that must be filled out by individuals or businesses who use tobacco products and is used for tax purposes.

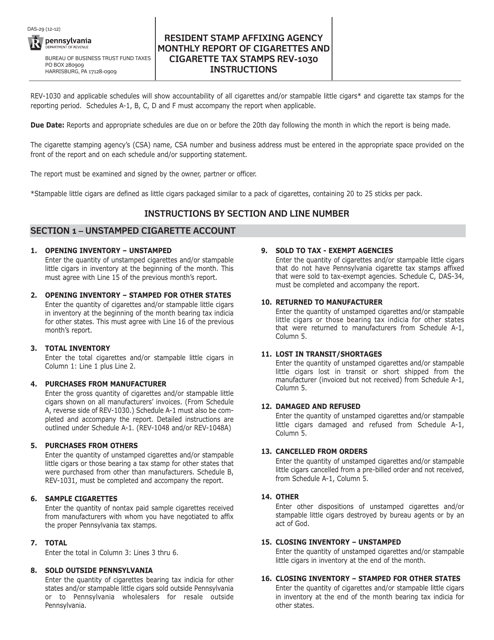

This form is used for the monthly reporting of cigarettes and cigarette tax stamps by resident stamp affixing agencies in Pennsylvania. Residents and agencies can submit this form to report their activities related to the sale and distribution of cigarettes and tax stamps.

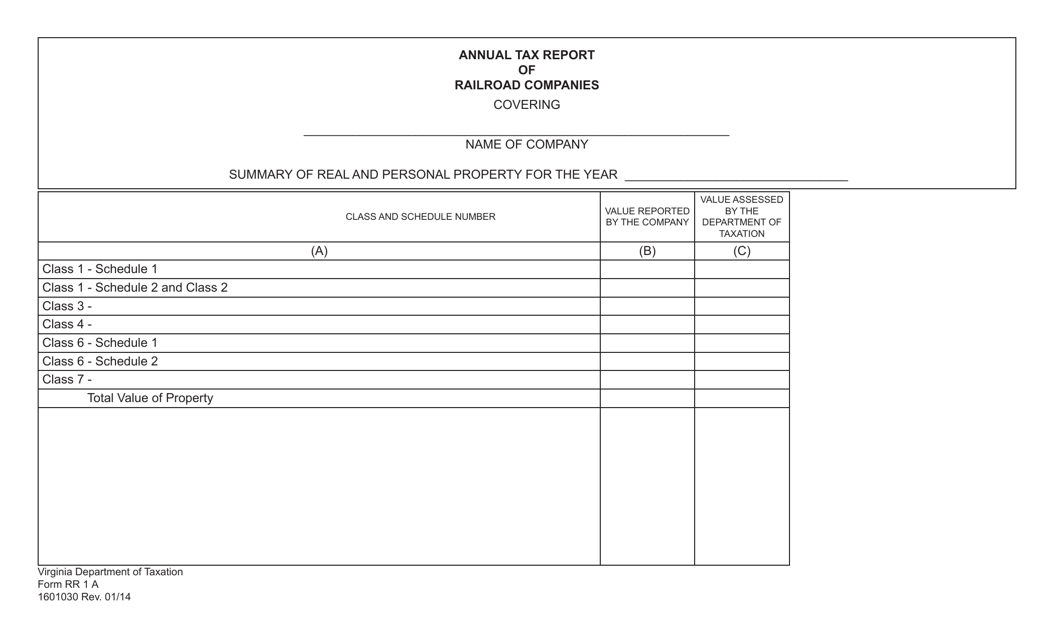

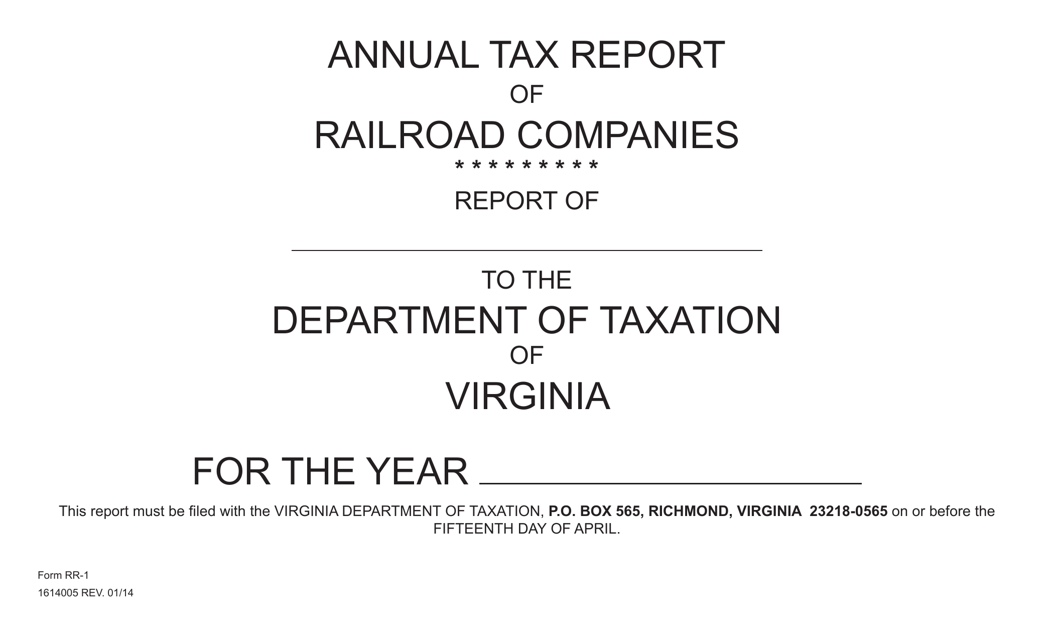

This form is used for railroad companies in Virginia to report a summary of their real and personal property for the annual tax report.

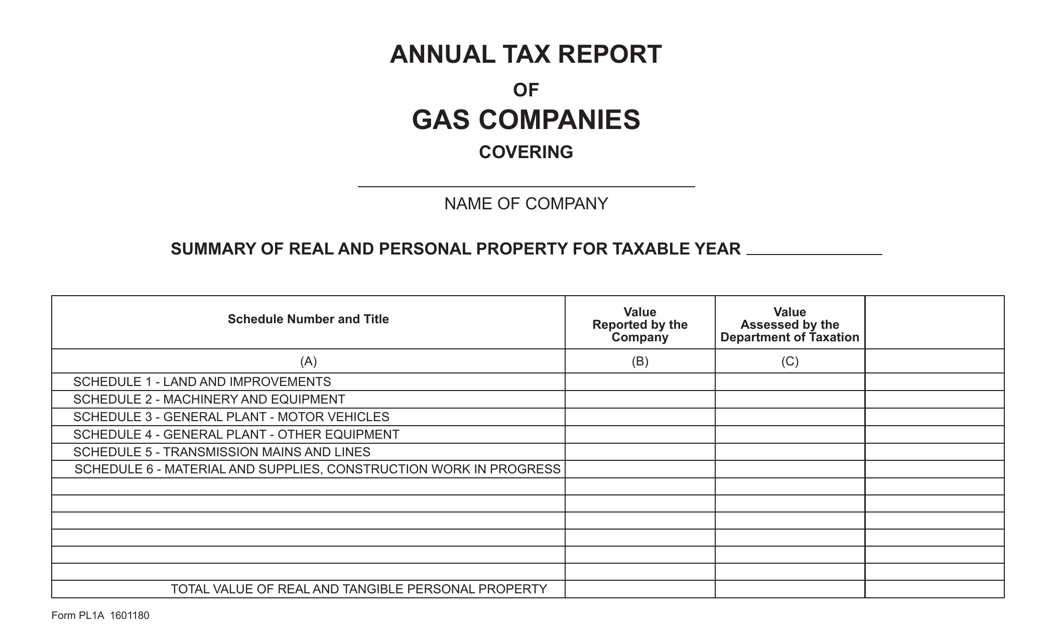

This Form is used for gas companies in Virginia to report their annual tax information. It is necessary for gas companies to submit this report to comply with tax regulations in Virginia.

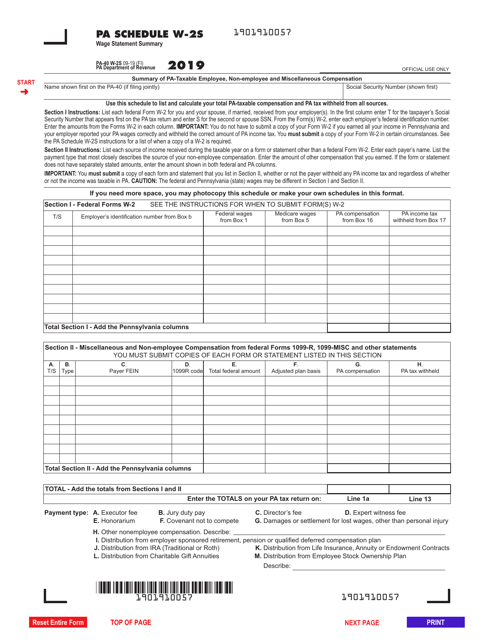

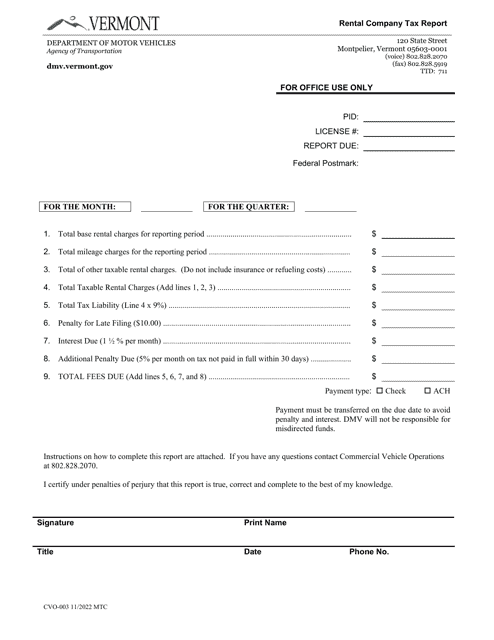

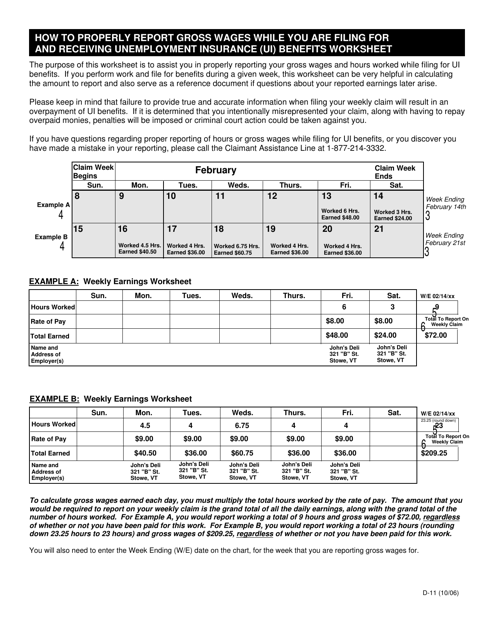

This form is used for properly reporting gross wages in the state of Vermont.

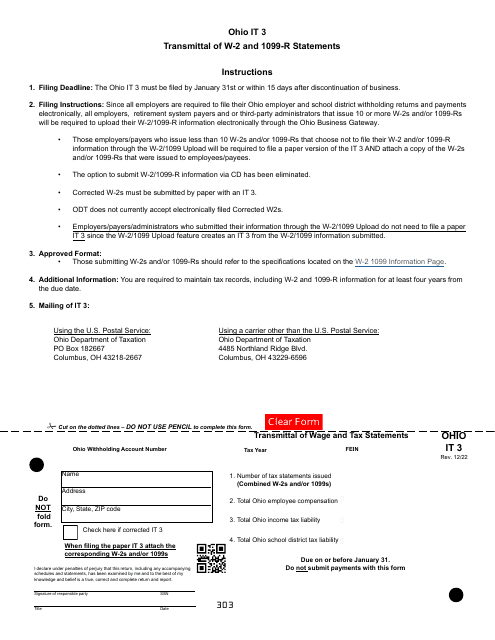

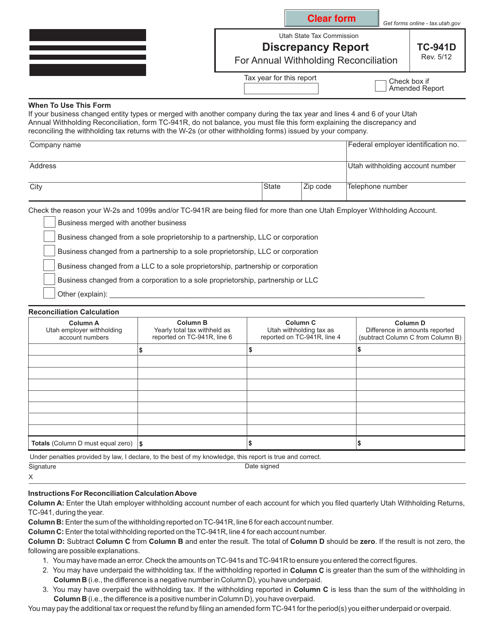

This form is used for reporting discrepancies in annual withholding reconciliation in the state of Utah.

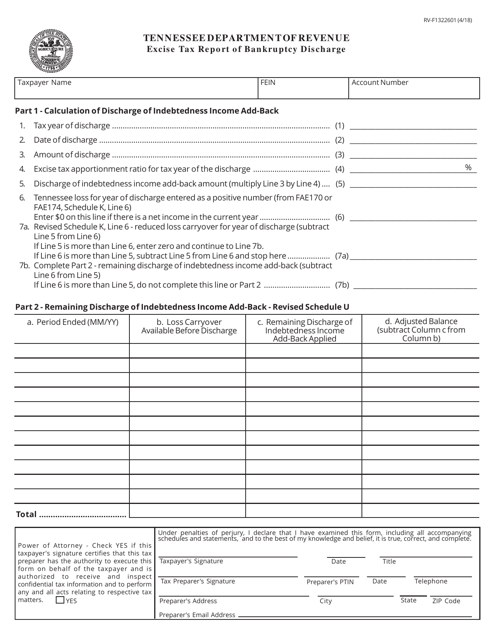

This form is used for reporting excise tax information related to a bankruptcy discharge in Tennessee.

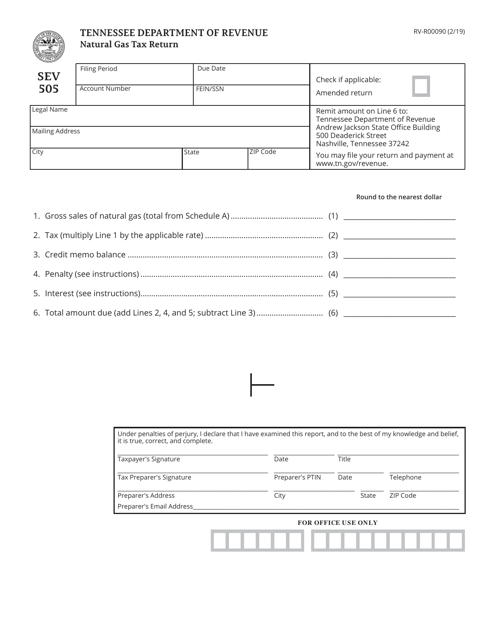

This form is used for filing the Natural Gas Tax Return in Tennessee.

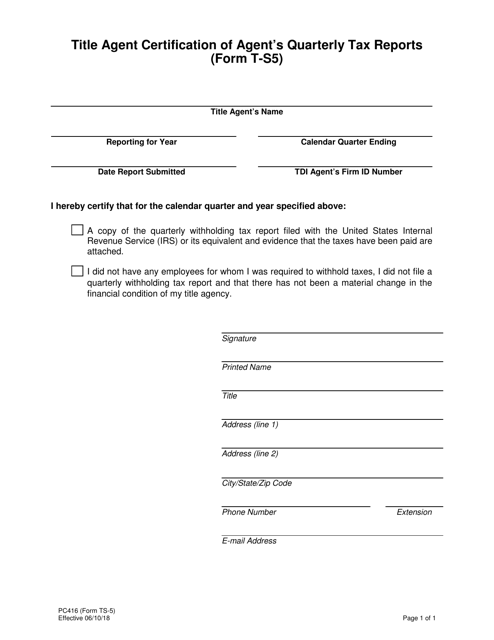

This form is used for title agents in Texas to certify their quarterly tax reports.

This Form is used for filing the Annual Tax Report of Railroad Companies in the state of Virginia.

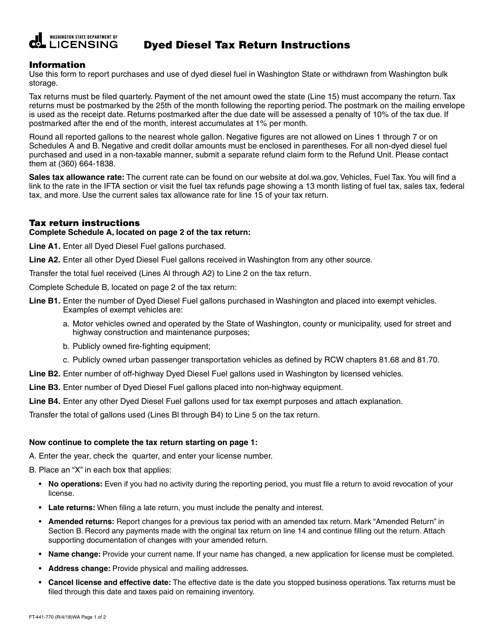

This form is used for reporting and paying taxes on dyed diesel fuel in the state of Washington.

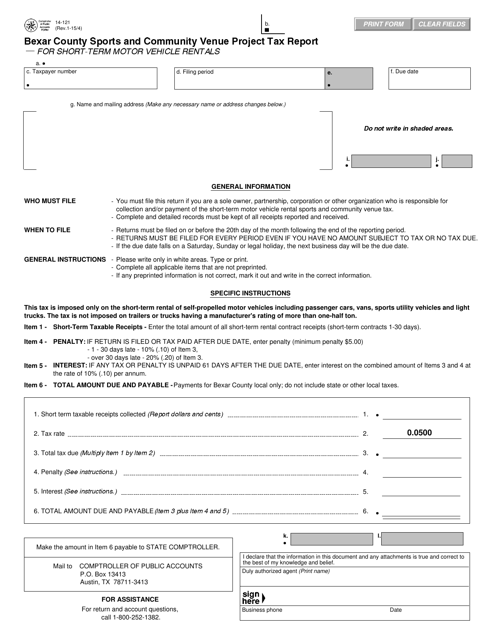

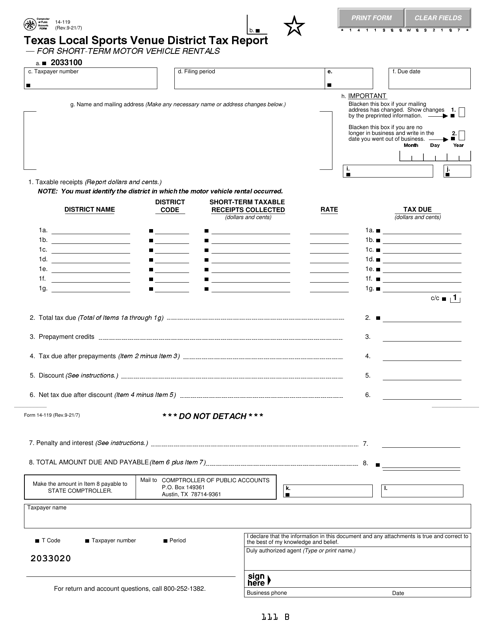

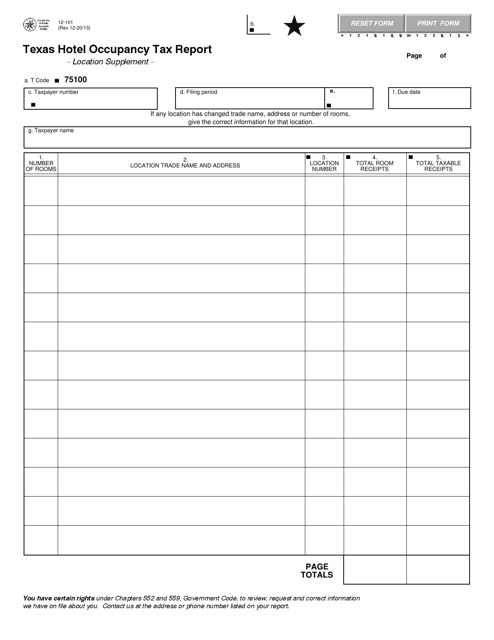

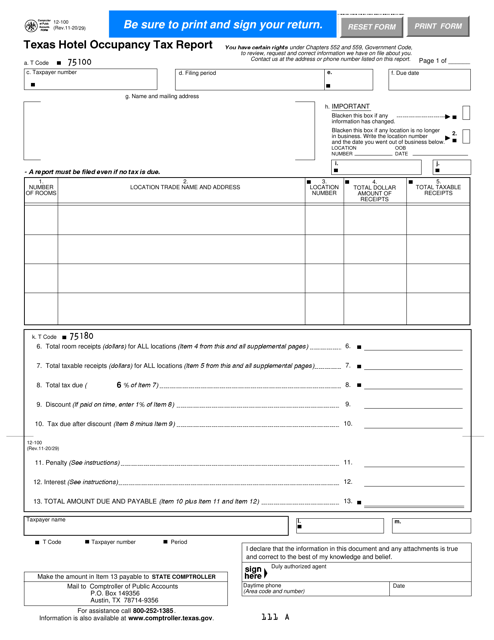

This form is used for reporting taxes on short-term motor vehicle rentals in Bexar County, Texas, specifically for sports and community venue projects.

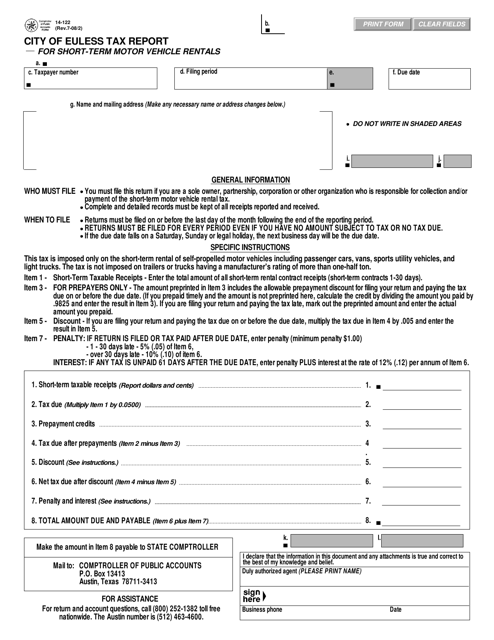

This document is used for reporting taxes on short-term motor vehicle rentals in the City of Euless, Texas.

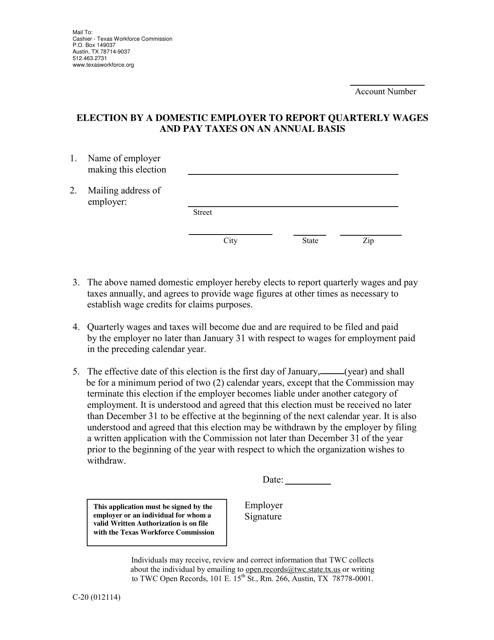

This form is used by domestic employers in Texas to elect to report their quarterly wages and pay taxes on an annual basis.

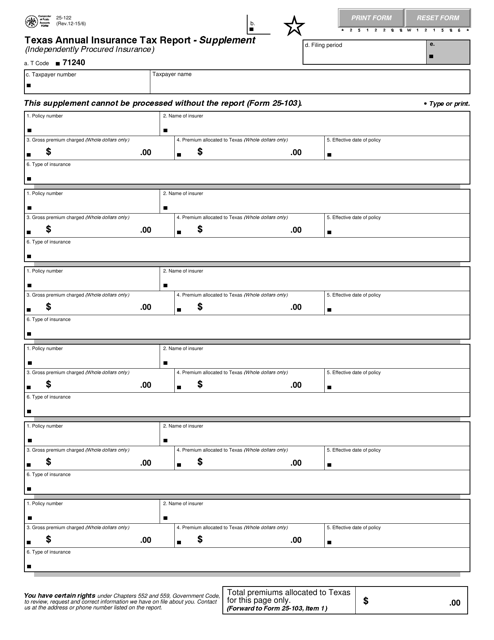

This document is used for filing the annual insurance tax report in the state of Texas. It serves as a supplement to the main tax report form.

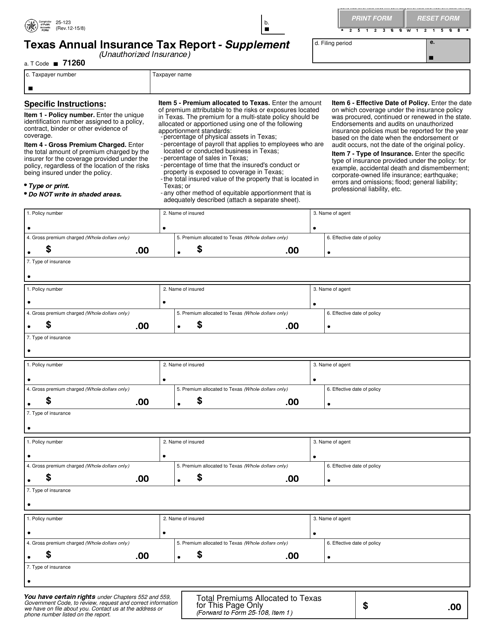

This form is used for reporting annual insurance tax for unauthorized insurance in Texas.

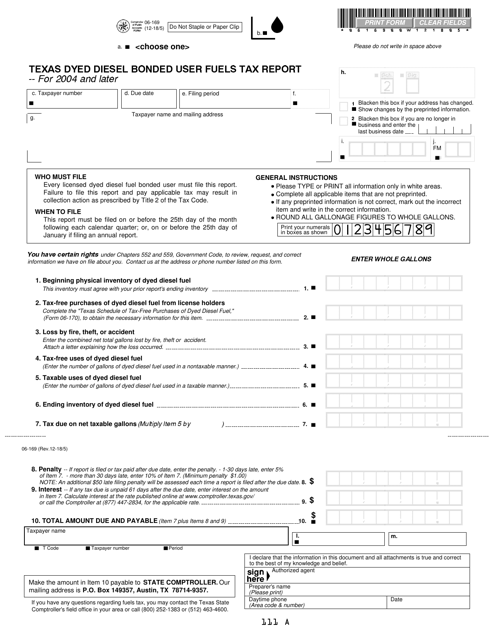

This document is used for reporting dyed diesel fuel sales in Texas. It applies to bonded users of the fuel tax system and covers reporting for the year 2004 and later.

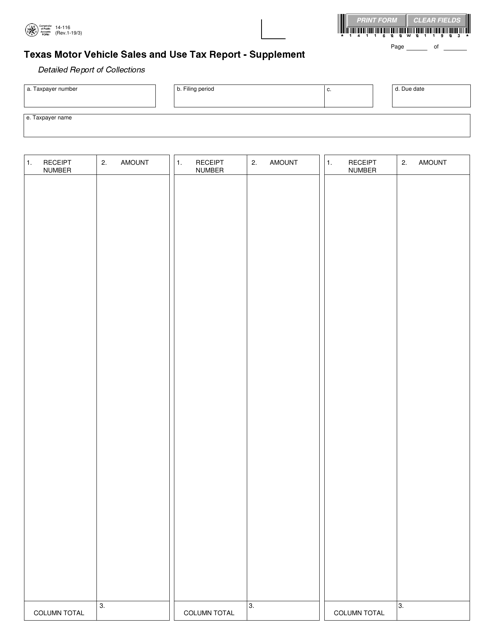

This Form is used for reporting sales and use tax related to motor vehicle transactions in the state of Texas.

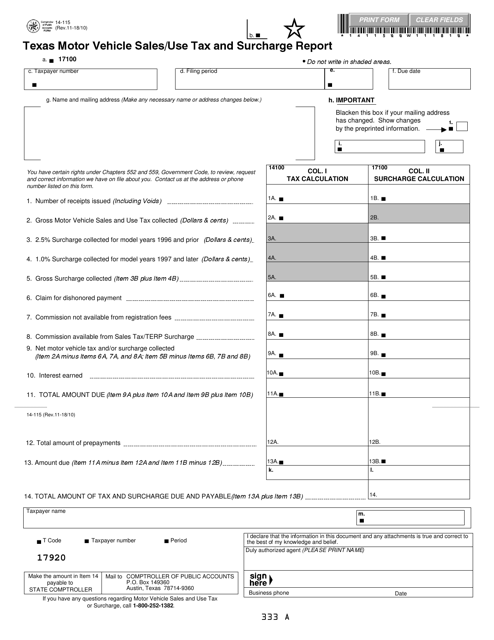

This Form is used for reporting sales and use tax on motor vehicles in Texas. It includes a surcharge report as well.

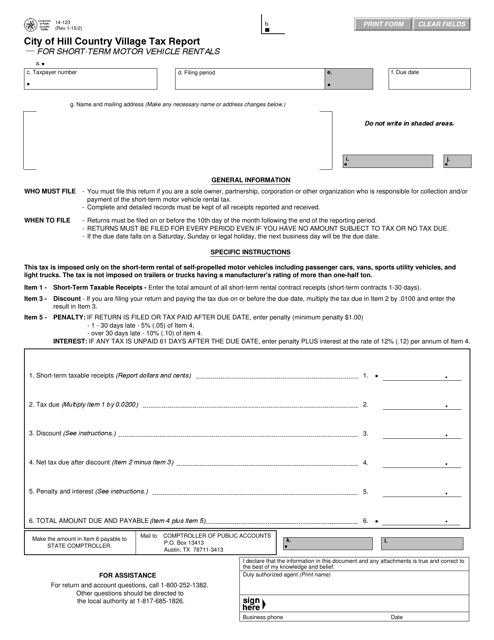

This Form is used for reporting taxes for short-term motor vehicle rentals in Hill Country Village, Texas.

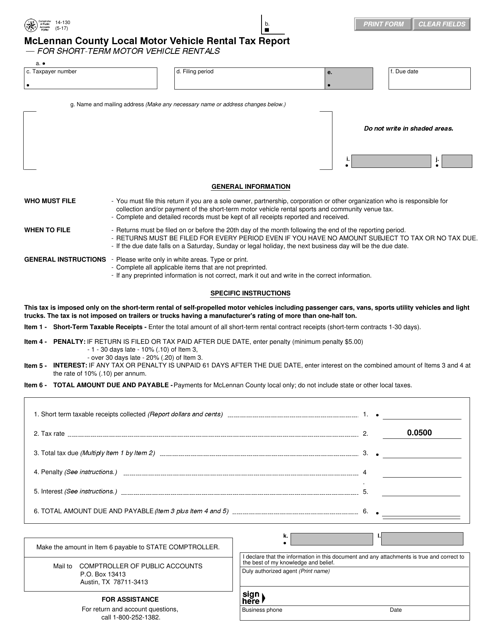

This form is used for reporting local motor vehicle rental tax for short-term vehicle rentals in McLennan County, Texas.

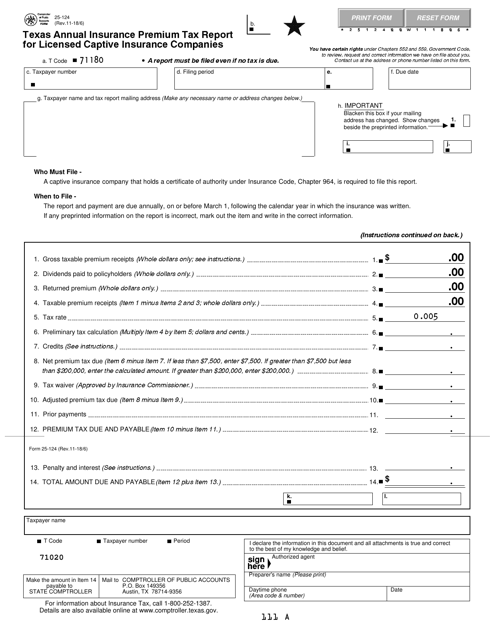

This Form is used for filing the annual insurance premium tax report for licensed captive insurance companies in Texas.

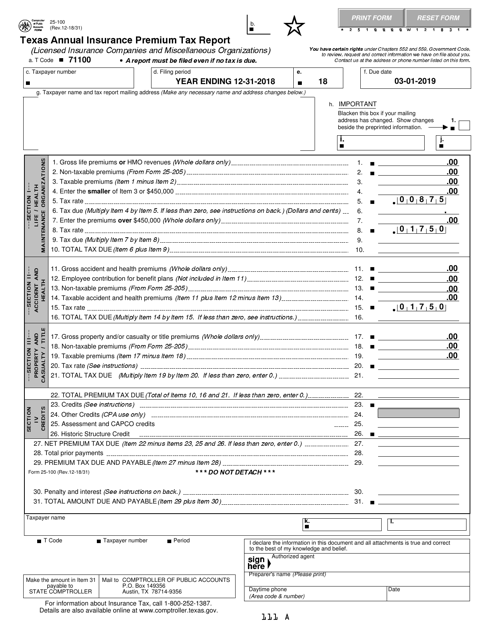

This form is used for reporting the annual insurance premium tax for licensed insurance companies and miscellaneous organizations in Texas.

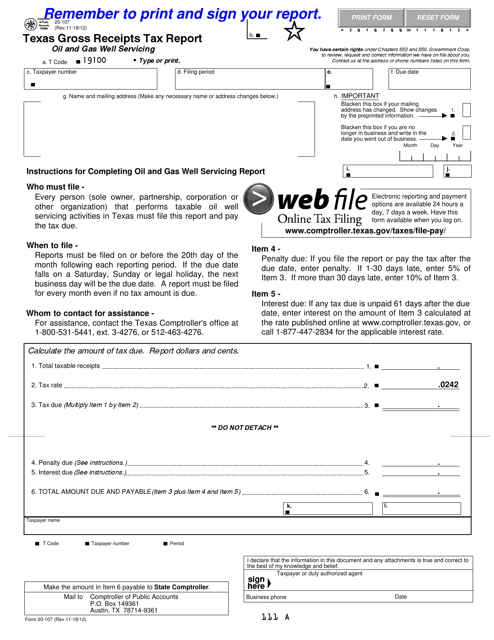

This form is used for reporting the gross receipts tax specifically for oil and gas well servicing businesses in the state of Texas. It helps businesses accurately calculate and report their tax liability to the Texas Comptroller's Office.

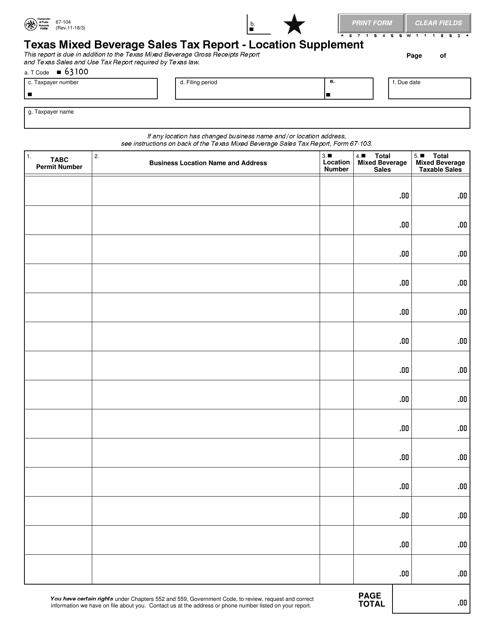

This Form is used for reporting mixed beverage sales tax in Texas and includes supplemental information about the location.

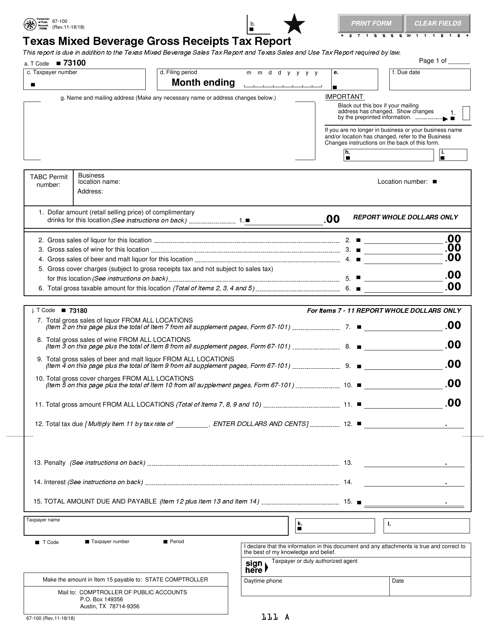

This form is used for reporting the gross receipts tax on mixed beverages in the state of Texas. It is required for businesses that sell mixed drinks.