Tax Report Templates

Documents:

943

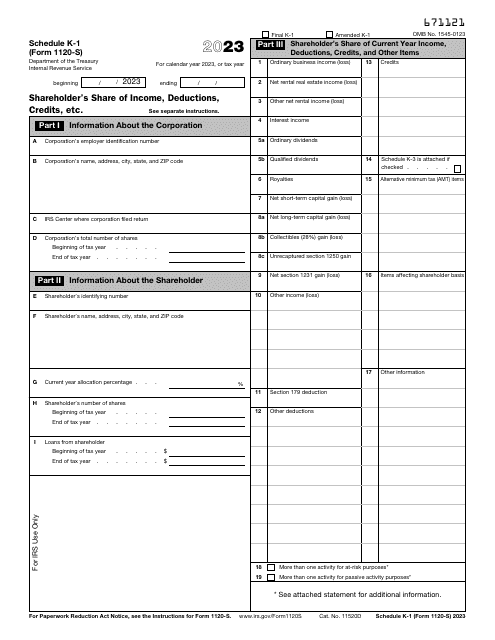

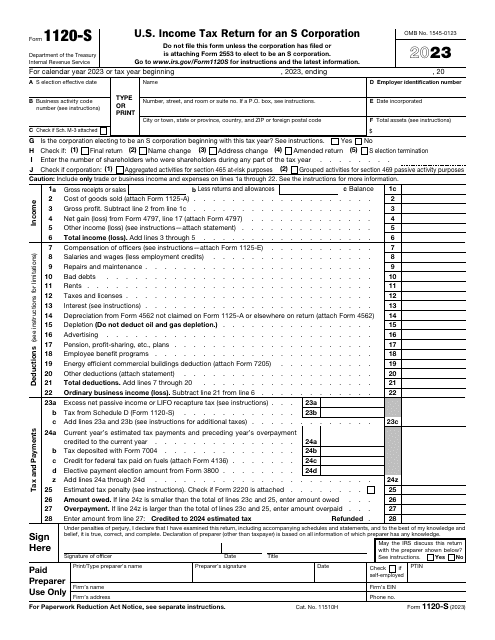

This form is used for reporting income, deductions, and credits of a domestic corporation or any other entity for any tax year covered by an election to be an S corporation. The information is sent to the Internal Revenue Service (IRS).

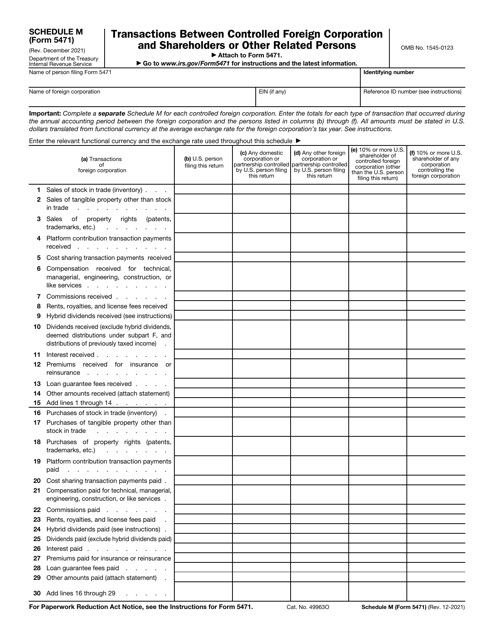

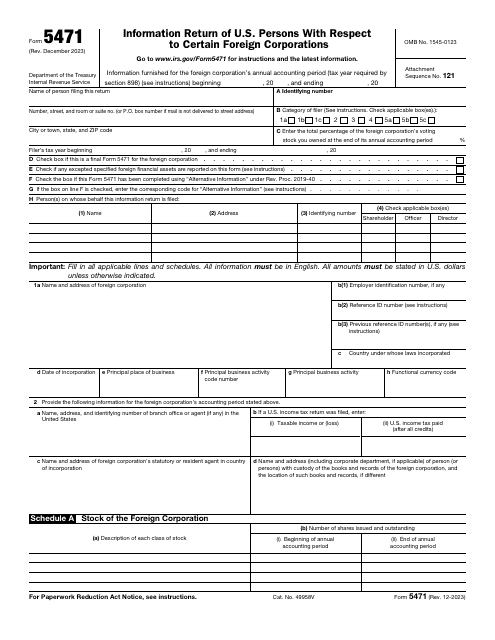

Fill in this document if you are a U.S. citizen that had control of a foreign corporation during the yearly accounting period of a foreign corporation

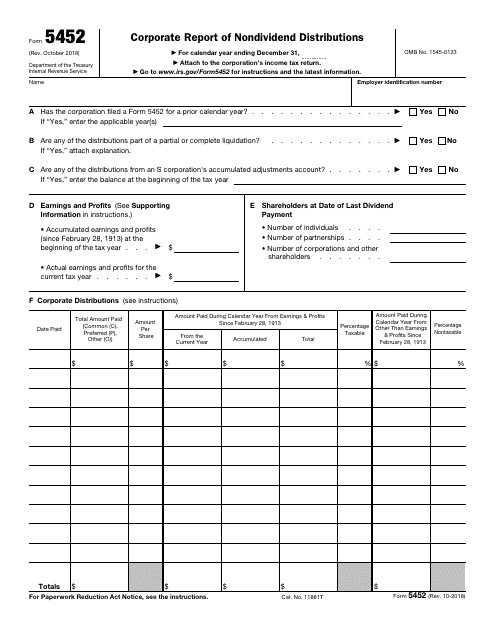

This type of document is used by corporations to report nondividend distributions to the IRS.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

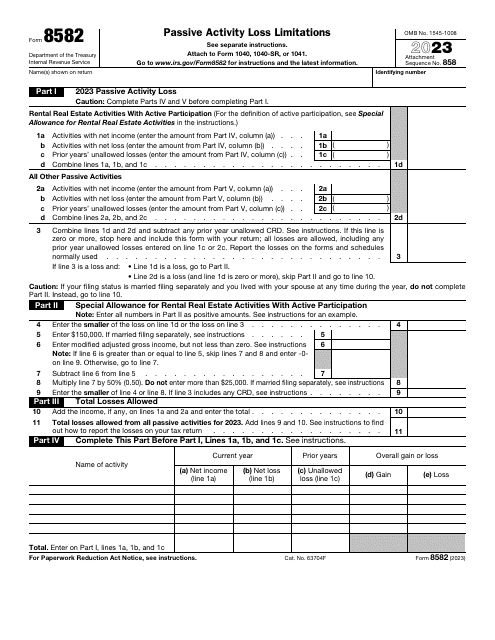

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

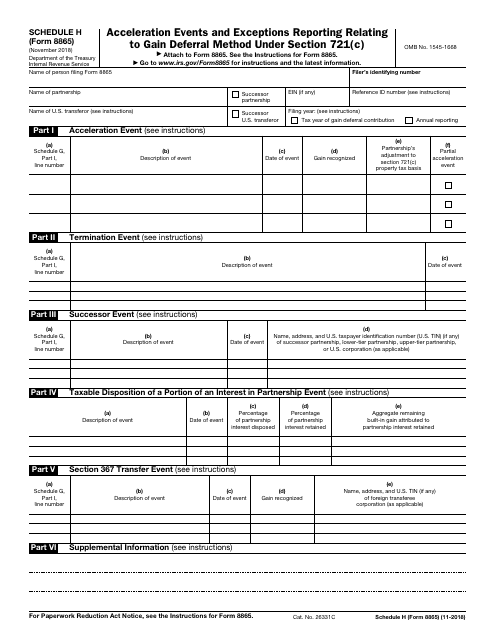

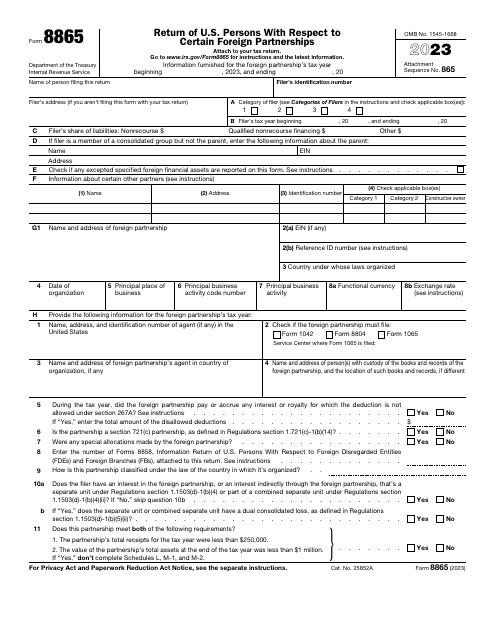

This document is used for reporting acceleration events and exceptions related to the gain deferral method under Section 721(c) on IRS Form 8865 Schedule H.

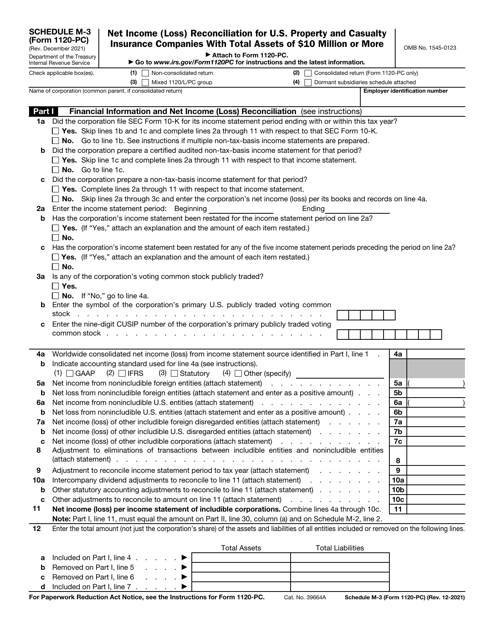

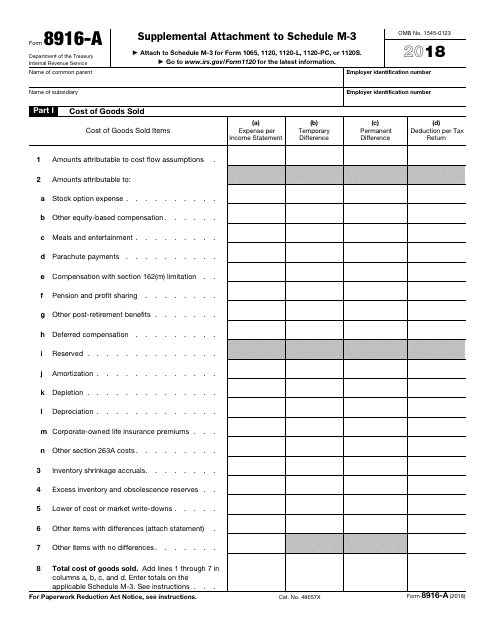

This form is used for providing additional information and attachments to the Schedule M-3 when filing taxes with the IRS.

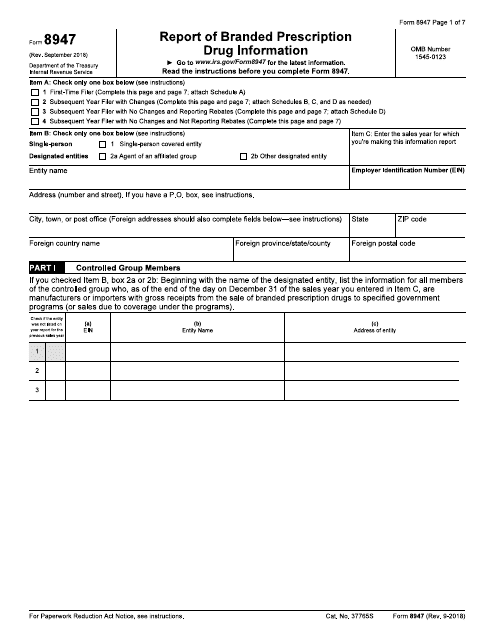

This Form is used for reporting information on branded prescription drugs to the IRS. It helps the IRS track and analyze data related to the Affordable Care Act's health insurance coverage provisions.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

This type of document provides instructions for filling out IRS Form 1099-CAP, which is used to report changes in corporate control and capital structure.