Tax Report Templates

Documents:

943

This form is used for reporting long-term care and accelerated death benefits received during the tax year. It is used by individuals and insurance companies to report these benefits to the IRS.

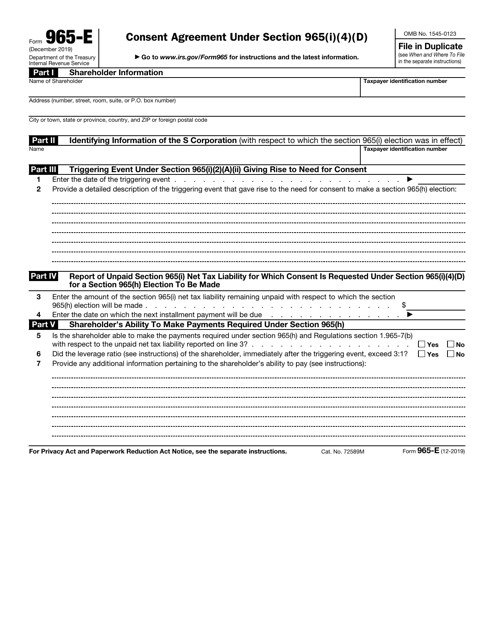

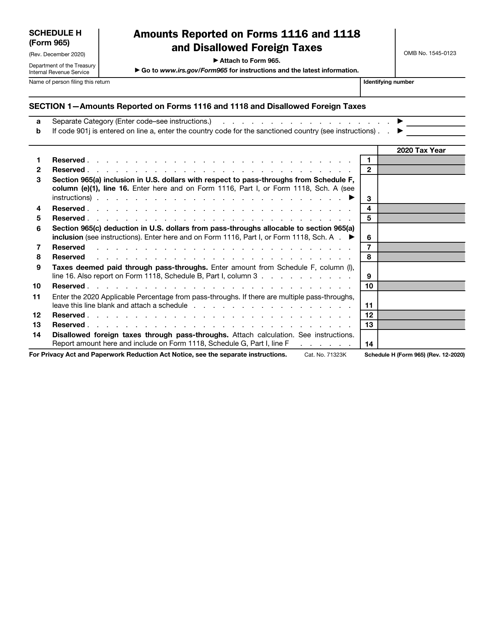

This form is used for entering into a consent agreement under Section 965(I)(4)(D) of the Internal Revenue Code.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

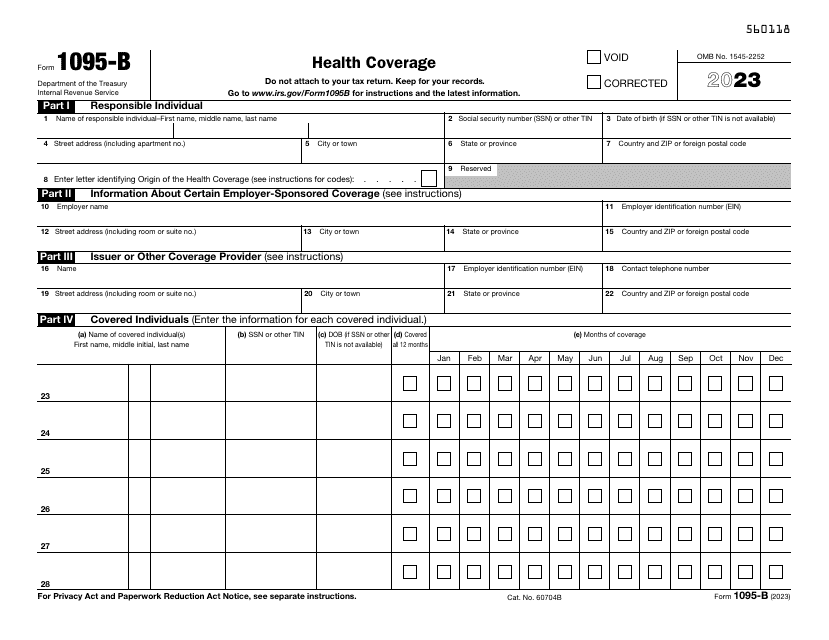

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

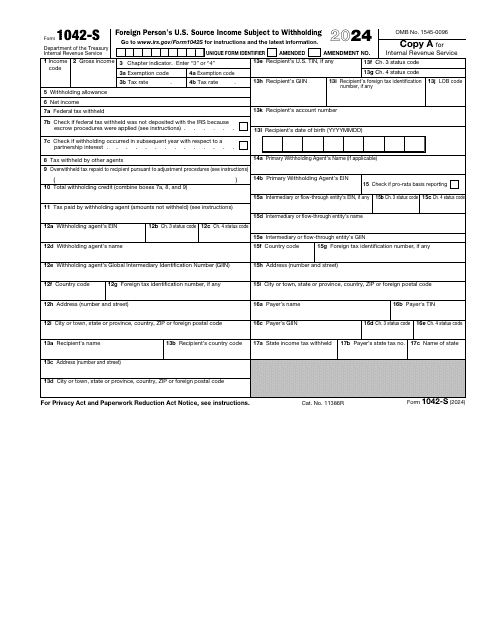

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

This is a formal IRS document that outlines the details of a property foreclosure.

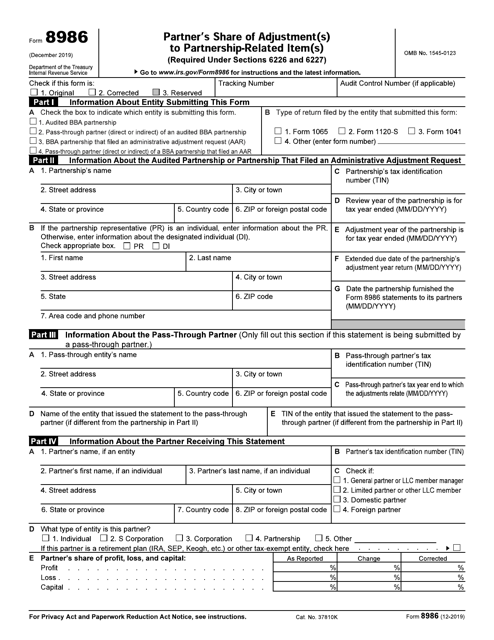

This Form is used for reporting transmittal and partnership adjustment tracking information required under Sections 6226 and 6227 of the IRS code.

This Form is used for reporting a partner's share of adjustments or items related to a partnership. It is required by sections 6226 and 6227 of the Internal Revenue Code.

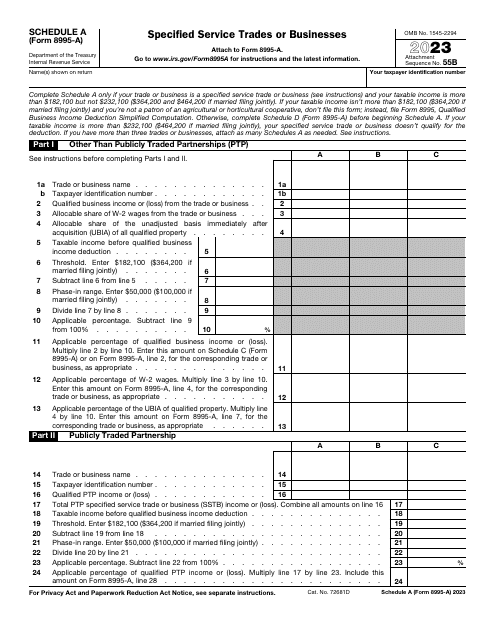

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

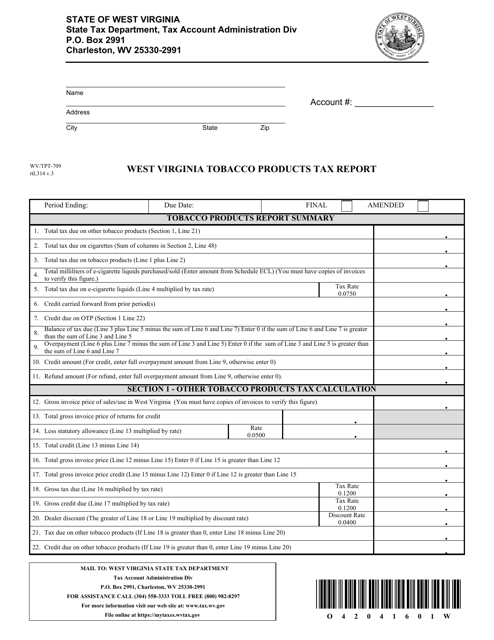

This Form is used for reporting and paying tobacco products taxes in the state of West Virginia.

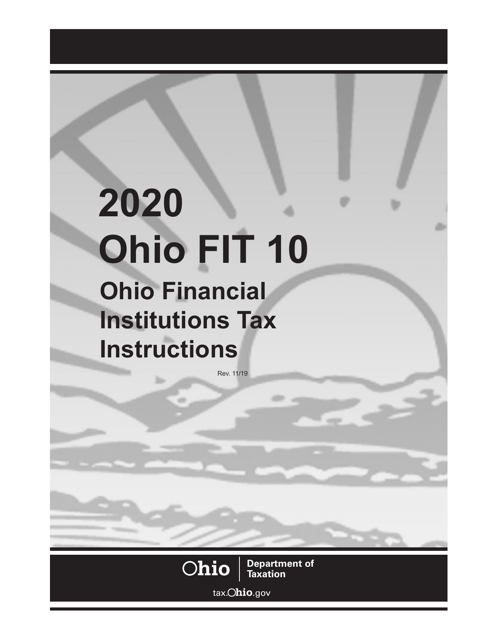

This form is used for reporting financial institution taxes in the state of Ohio. It provides instructions on how to accurately complete the form FIT10.

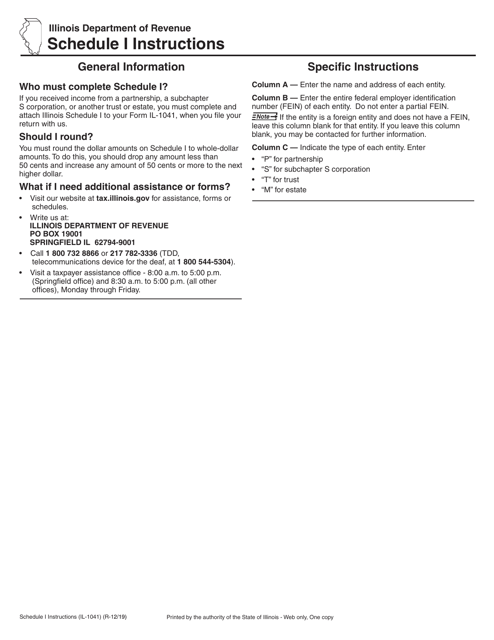

This Form is used for reporting income received in the state of Illinois when filing Form IL-1041. It provides instructions for filling out Schedule I, which is used to report various types of income.

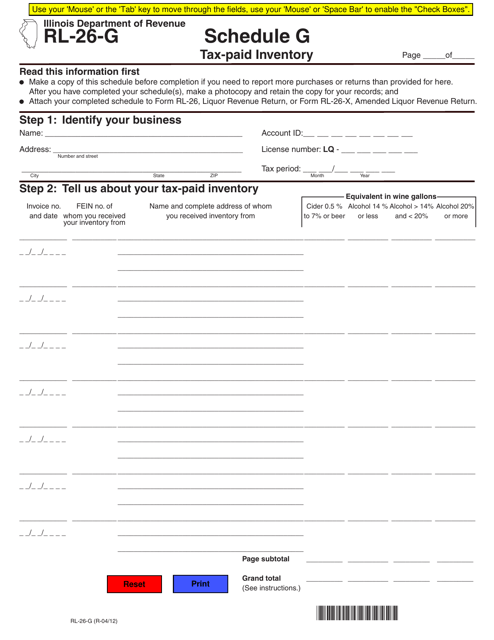

This form is used for reporting tax-paid inventory in Illinois.

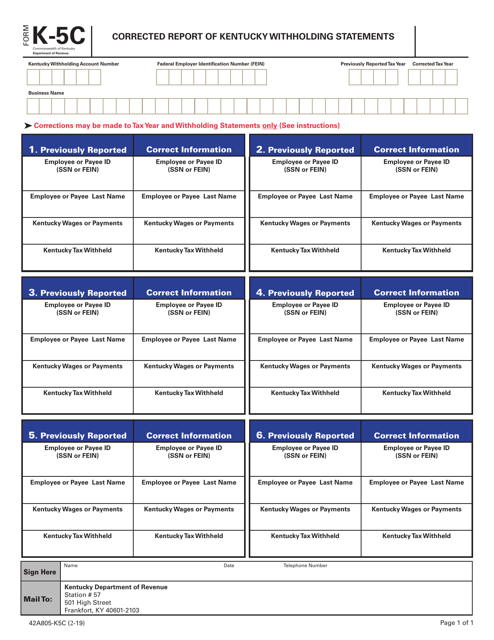

This form is used for submitting corrected withholding statements for Kentucky state taxes.

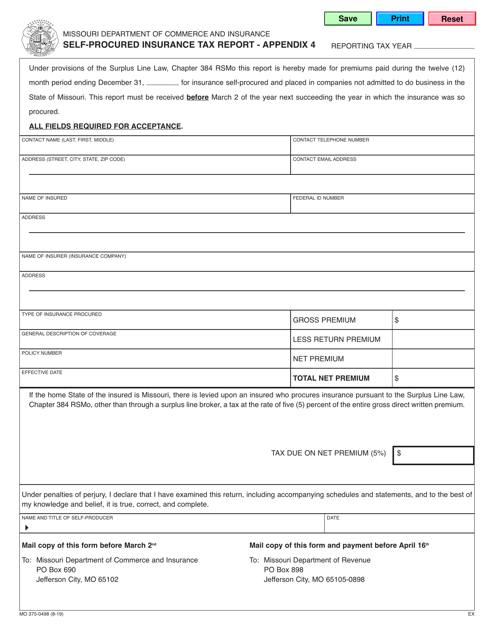

This form is used for reporting self-procured insurance taxes in the state of Missouri.

This type of document provides instructions for reporting the workers' compensation tax and assessment for group self-insurance in Missouri.