Tax Report Templates

Documents:

943

This Form is used for reporting payments from qualified education programs for tax purposes.

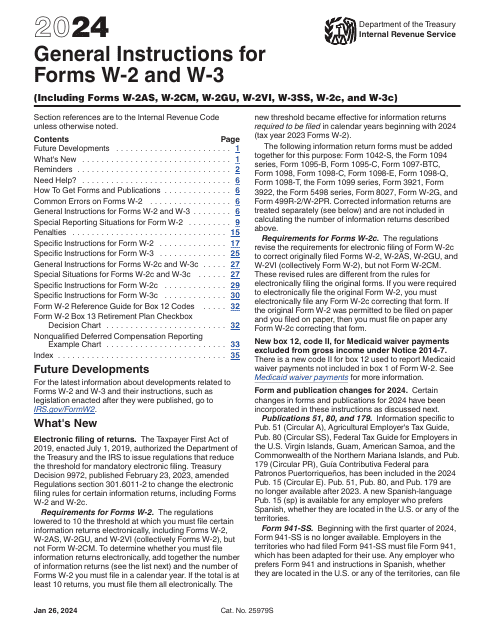

This document provides instructions for various IRS forms including 1096, 1097, 1098, 1099, 3821, 3822, 5498, and W-2G. The instructions guide individuals or organizations on how to fill out these specific information returns required by the IRS.

This form is used for reporting the compensation of corporate officers for tax purposes. It provides instructions on how to fill out IRS Form 1125-E.

This Form is used for reporting the agreement between a Certified Professional Employer Organization (CPEO) and their customer to the Internal Revenue Service (IRS).

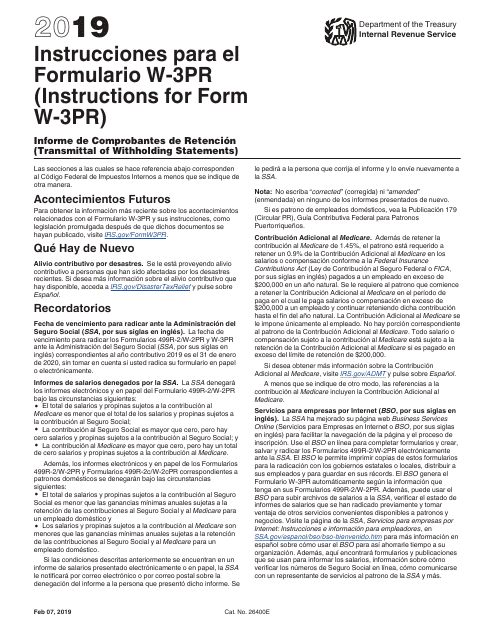

This document provides instructions for completing the IRS Form W-3PR, which is used to transmit withholding statements. The instructions are available in both English and Spanish.

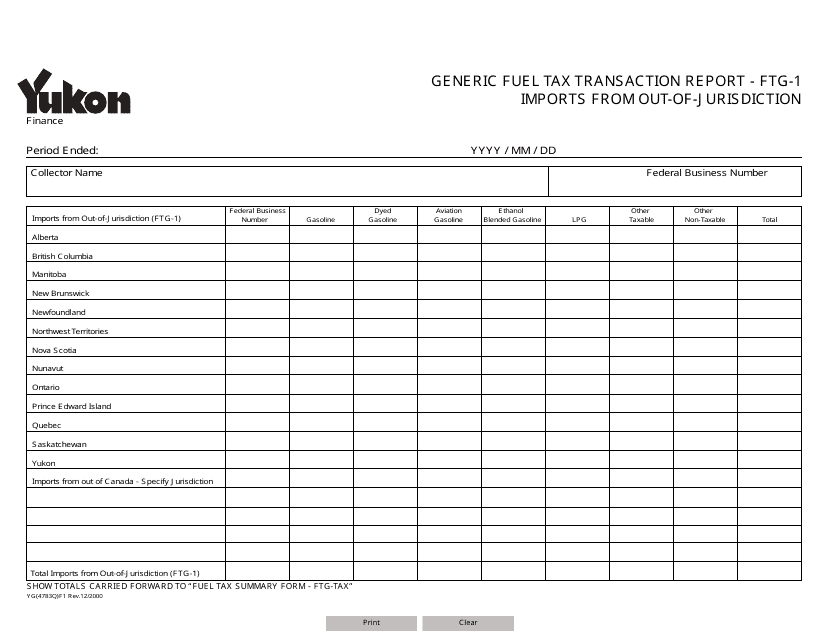

This form is used for reporting fuel tax transactions related to imports from out-of-jurisdiction in Yukon, Canada.

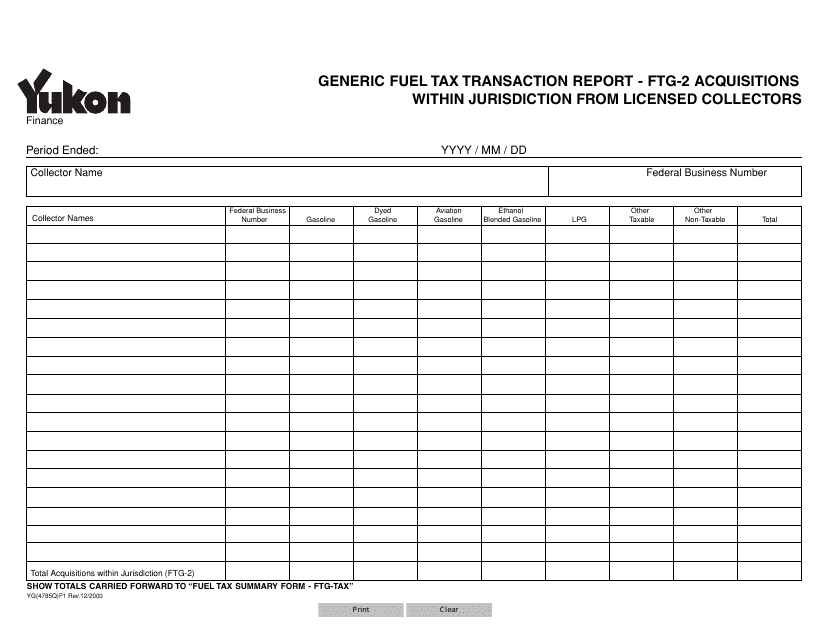

This form is used for reporting fuel tax transactions related to acquisitions within Yukon, Canada jurisdiction from licensed collectors.

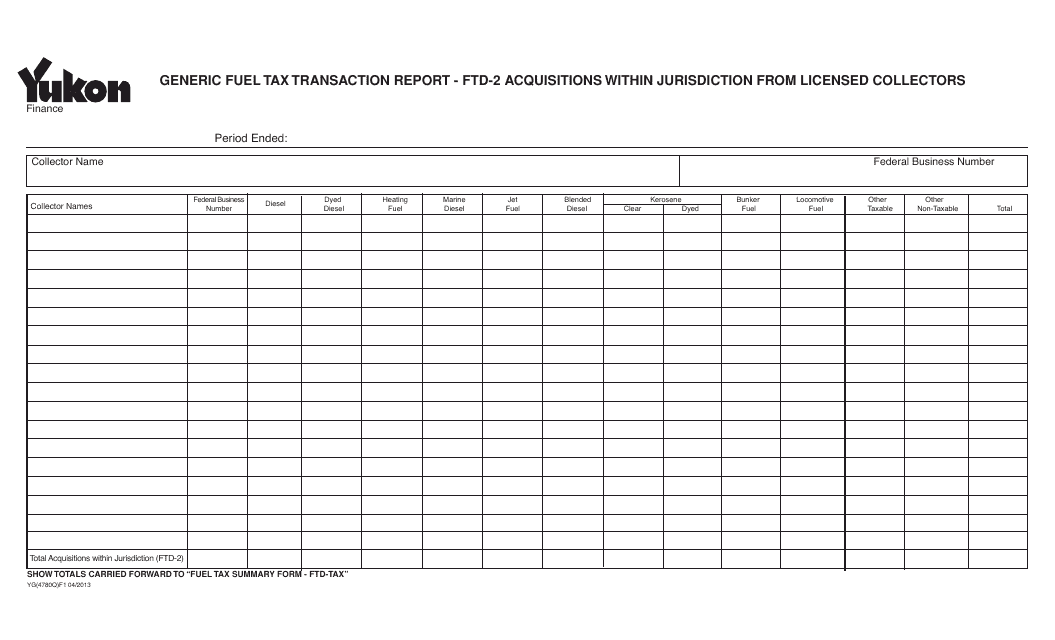

This form is used for reporting fuel tax transactions in the Yukon, Canada. It specifically covers acquisitions made within the jurisdiction from licensed collectors.

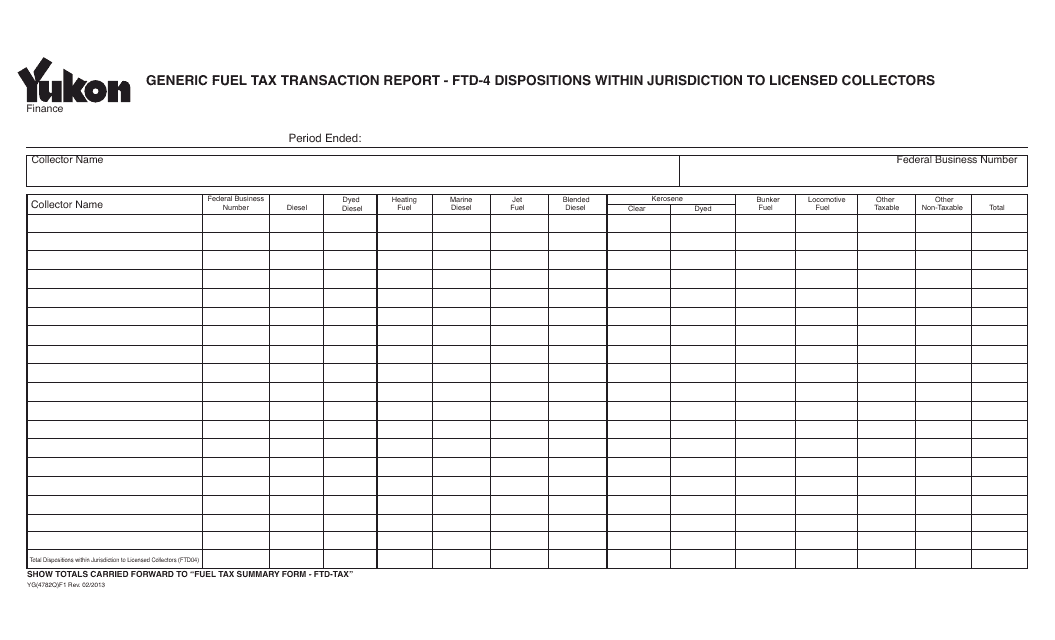

This Form is used for reporting fuel tax transactions and dispositions within the jurisdiction of Yukon, Canada. It is specifically intended for licensed collectors.

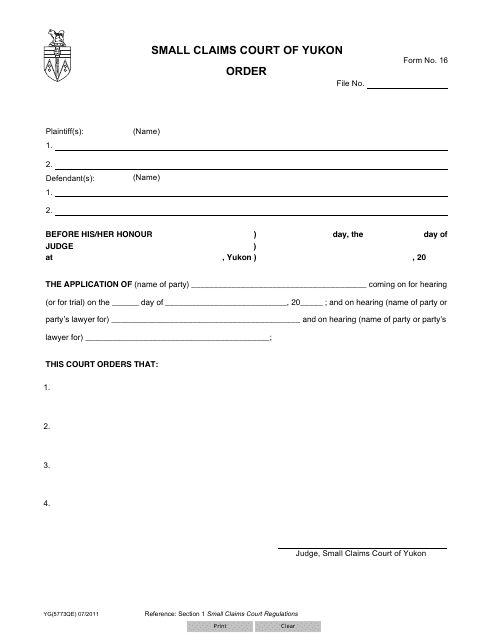

This Form is used for ordering a Form 16 (YG5773) in Yukon, Canada.

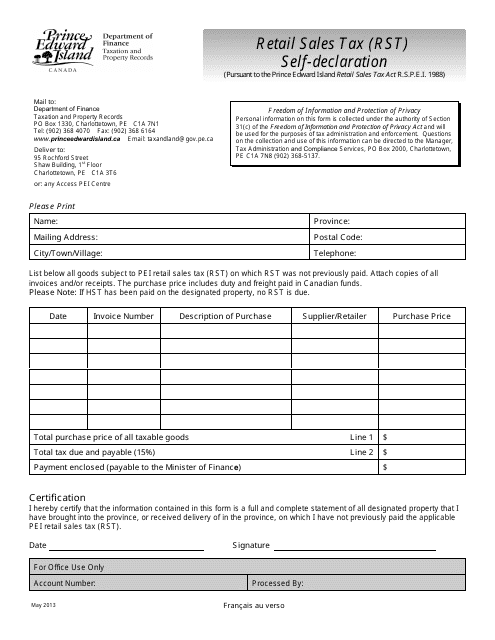

This document is used for self-declaration of Retail Sales Tax (RST) in Prince Edward Island, Canada. It pertains to businesses reporting and paying their retail sales tax obligations to the provincial government.

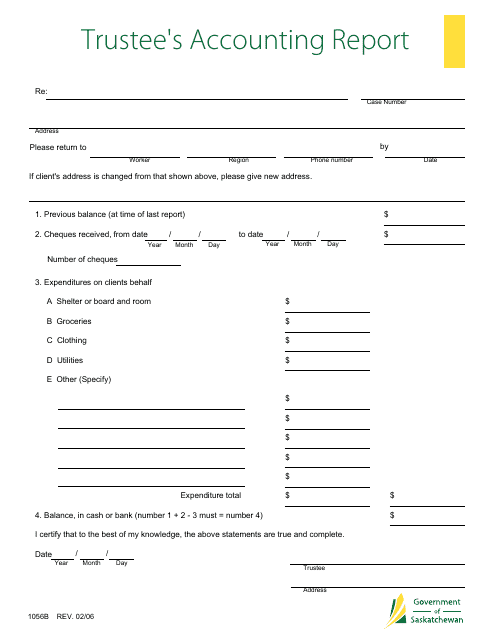

This form is used for reporting the financial activities of a trust as per the regulations in Saskatchewan, Canada. It helps trustees to provide an accounting report for the trust.

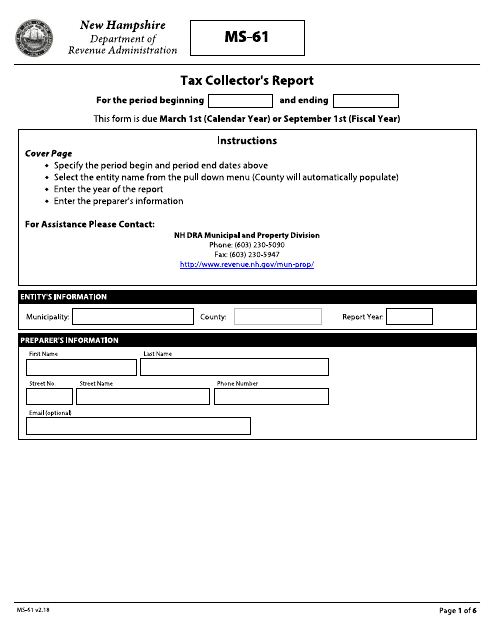

This Form is used for reporting taxes collected by the tax collector in the state of New Hampshire.

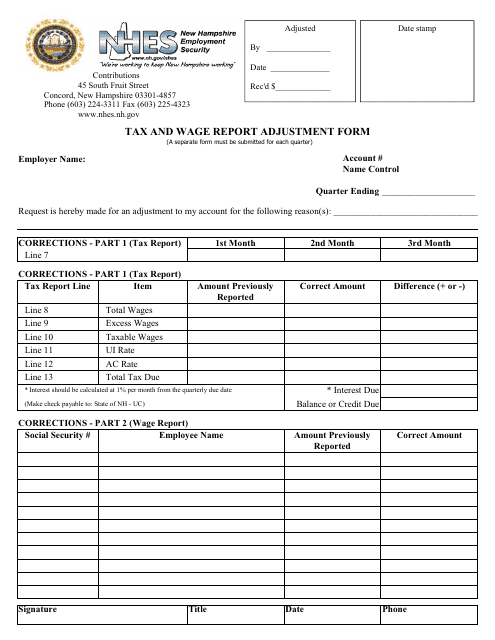

This Form is used for adjusting tax and wage reports in the state of New Hampshire.

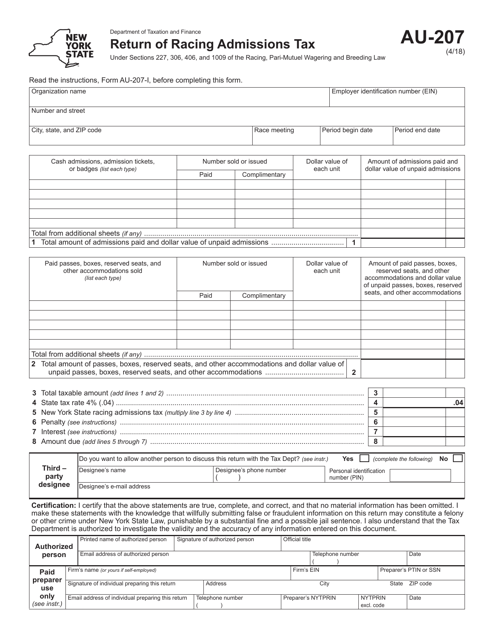

This form is used for reporting and paying the Racing Admissions Tax in New York.

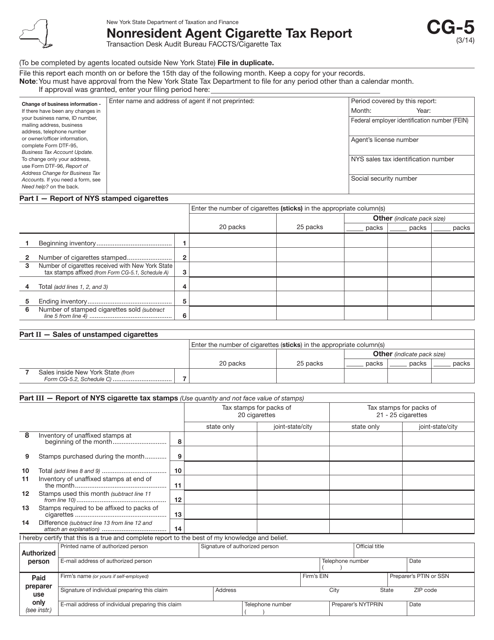

This Form is used for reporting cigarette taxes by nonresident agents in New York.

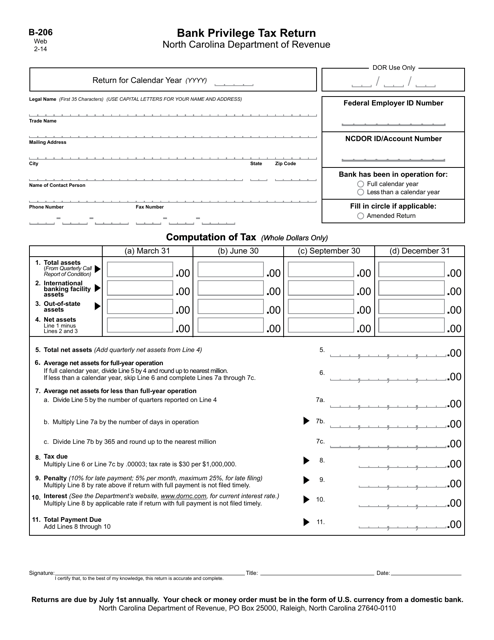

This Form is used for filing the Bank Privilege Tax Return in the state of North Carolina. The Bank Privilege Tax is a tax imposed on banks for the privilege of doing business in the state.

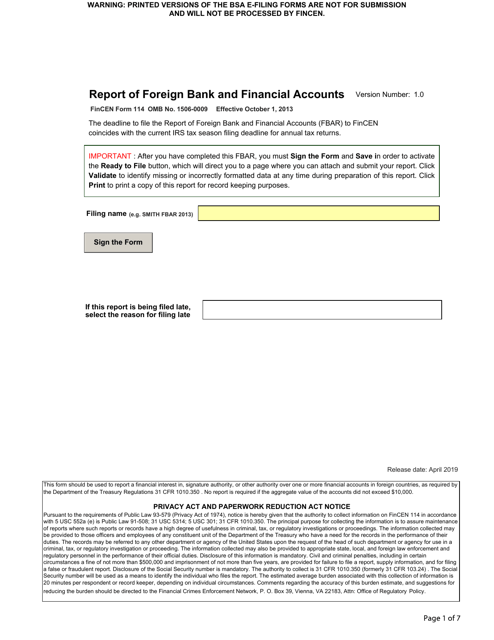

Use this document if you have a financial interest in any foreign financial account or signature authority over it. The term "financial account" includes a brokerage account, bank account, trust, mutual fund, or any other foreign financial account.