Tax Report Templates

Documents:

943

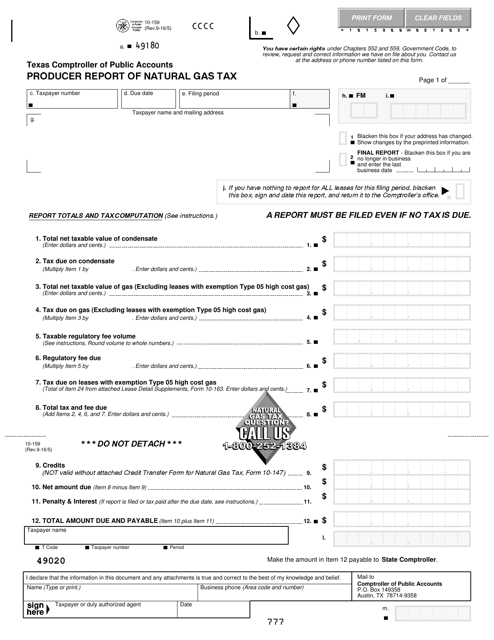

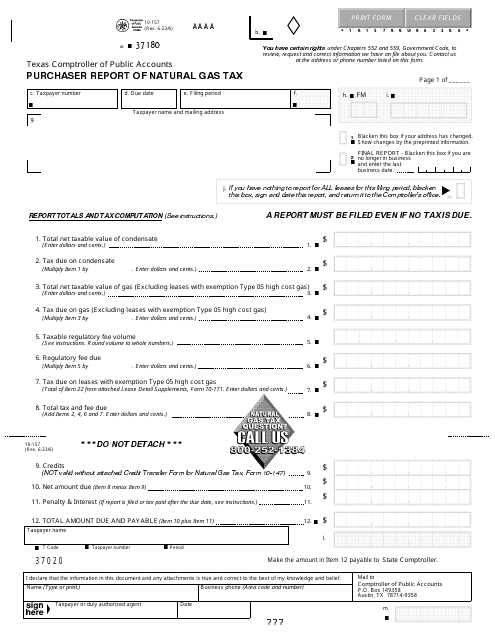

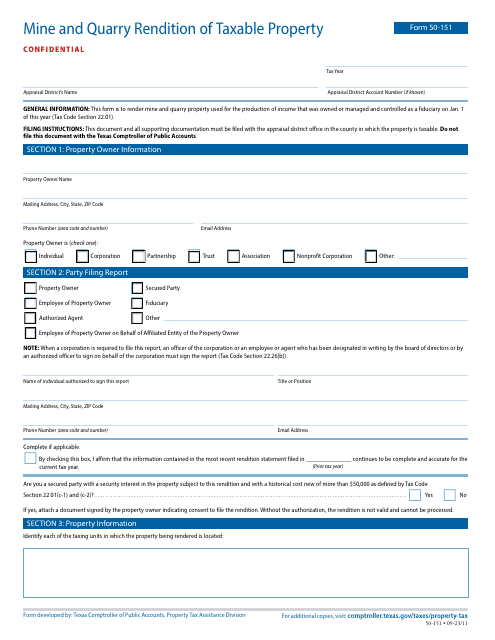

This Form is used for reporting natural gas tax by producers in the state of Texas.

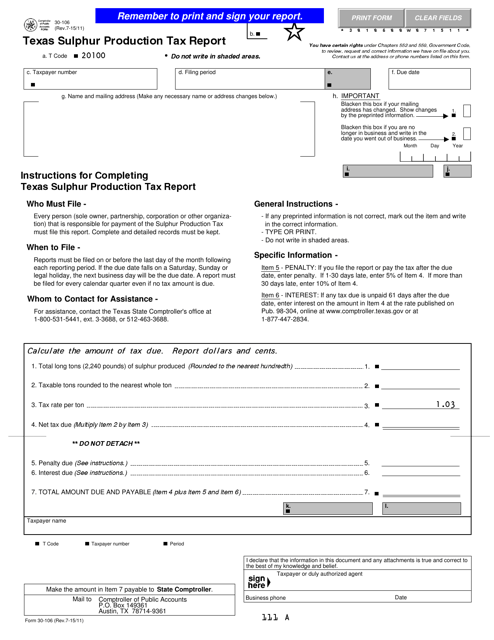

This form is used for reporting sulphur production tax in Texas.

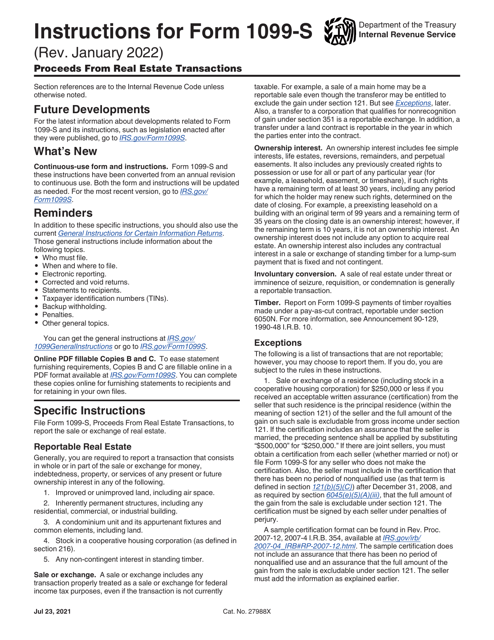

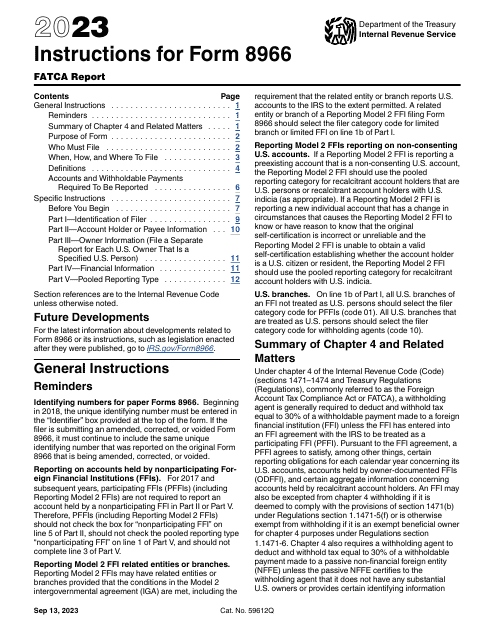

This type of document provides instructions for filling out various IRS forms including 1096, 1097, 1098, 1099, 3921, 3922, 5948, W-2G. It outlines the reporting requirements and guidelines for different types of income and transactions.

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This is a formal IRS document completed to outline the discount received on particular debt instruments.

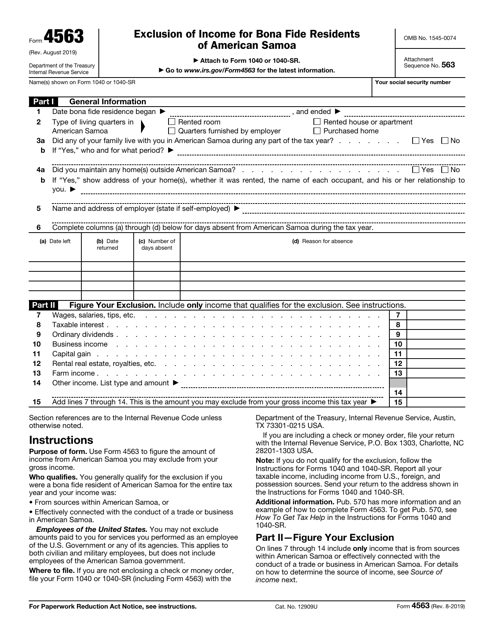

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

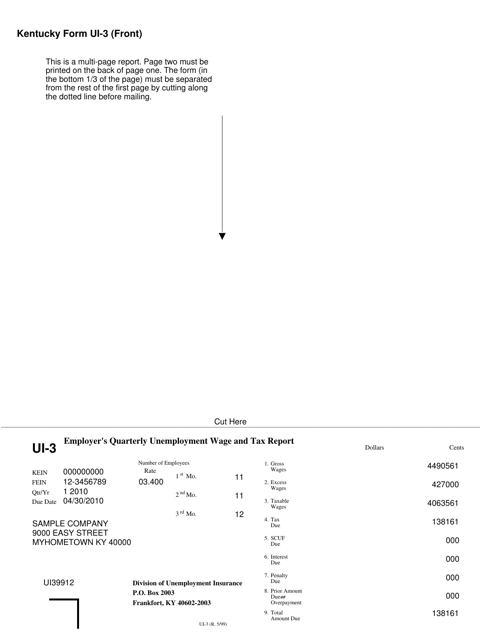

This form is used for employers in Kentucky to report tax and wage details on a quarterly basis.

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

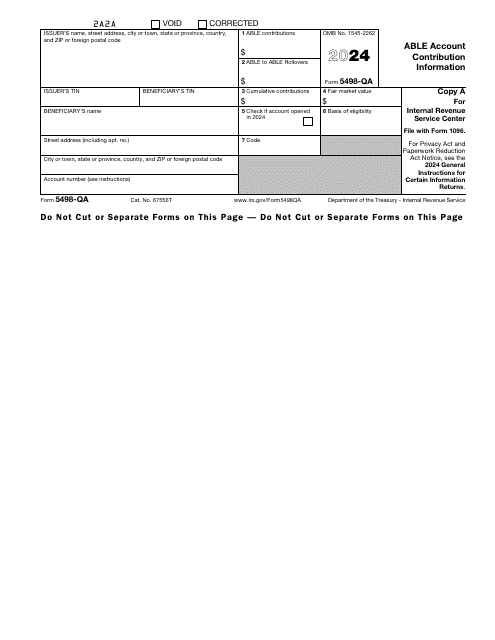

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

This is a fiscal document used by issuers and trustees to report the amount of individual retirement arrangement contributions formalized during the calendar year covered in the paperwork.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

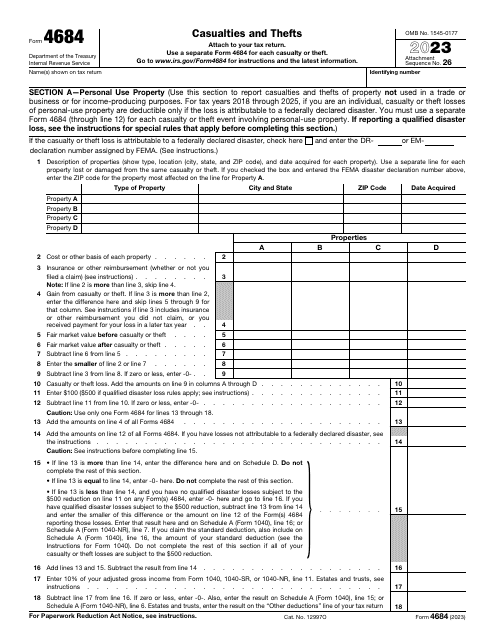

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

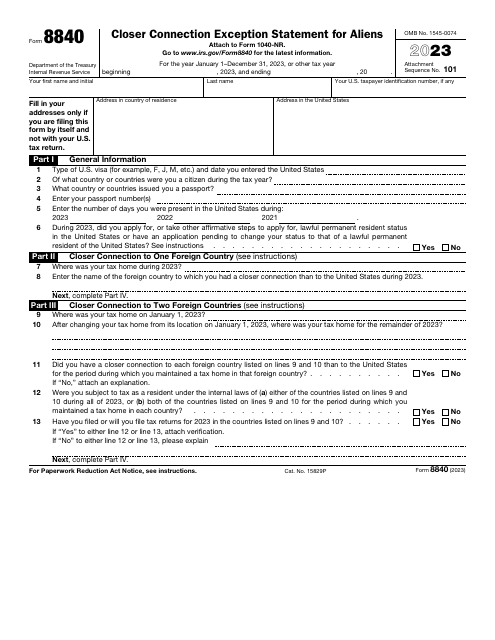

This is an application issued by the Internal Revenue Service (IRS) especially for alien individuals who use it to claim the closer connection to a foreign country exception to the substantial presence test.

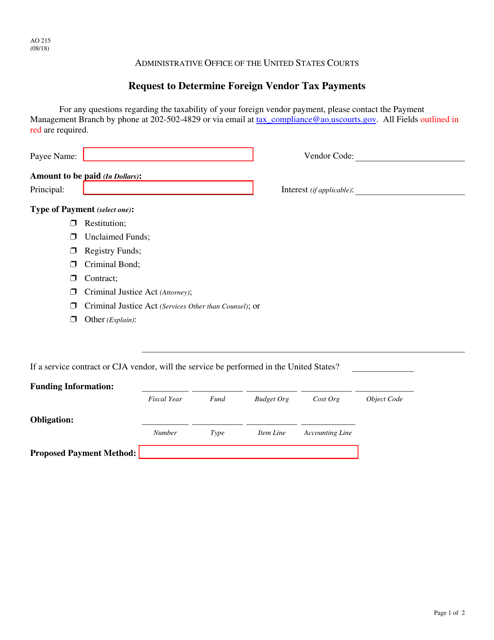

This form is used for requesting the determination of tax payments made by a foreign vendor.

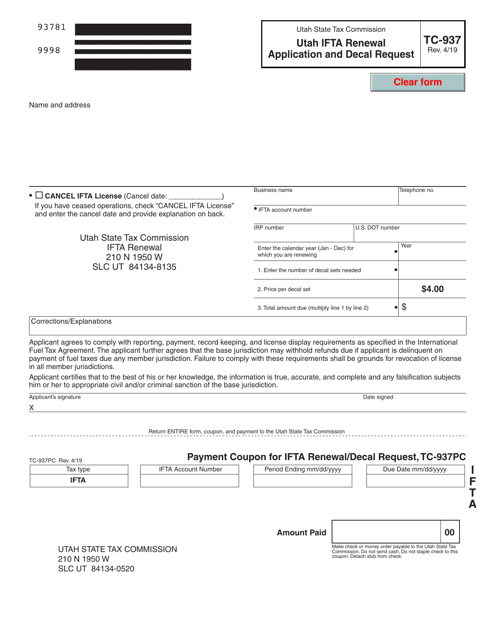

This Form is used for the renewal of an IFTA (International Fuel Tax Agreement) license in Utah and to request decals for commercial vehicles.

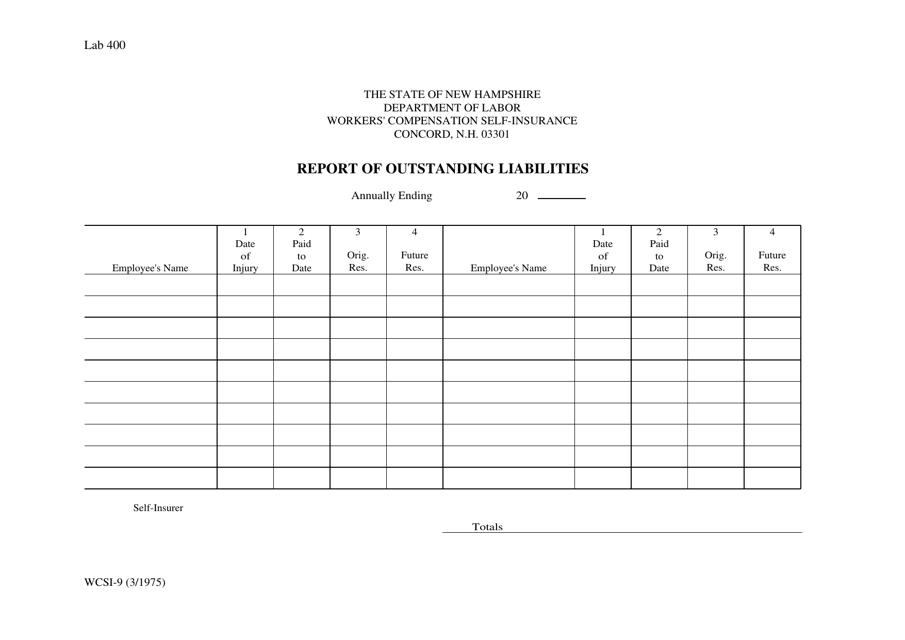

This Form is used for reporting outstanding liabilities in the state of New Hampshire. It is used to provide information about any debts or obligations that are still owed by an individual or business.