Tax Report Templates

Documents:

943

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

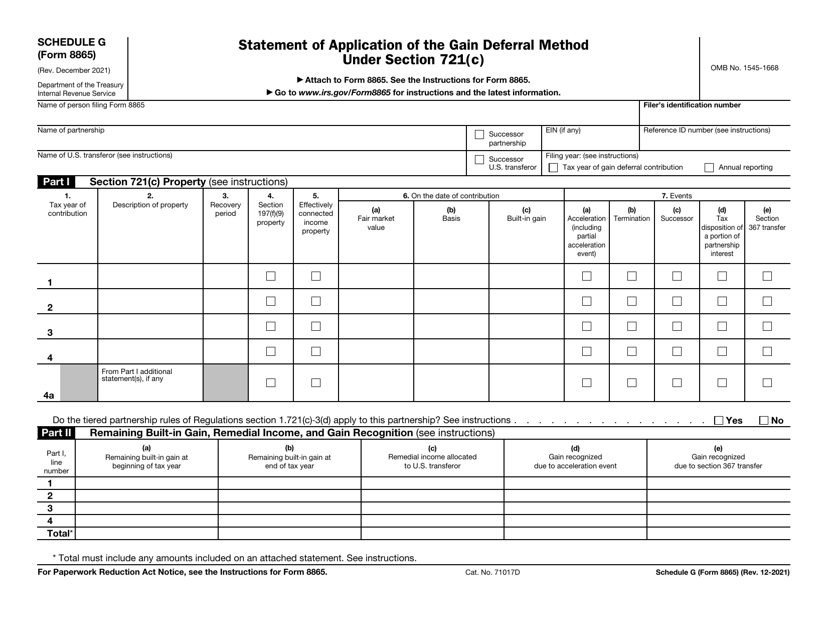

This form is used for reporting the application of the gain deferral method under Section 721(c) for certain contributions of property to a partnership.

Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as a W-2 and is one of the crucial annual tax documents.

Form 150-211-155 Oregon Combined Payroll Tax Report Instructions for Oregon Employers - Oregon, 2022

This document provides instructions for Oregon employers on how to complete Form 150-211-155, which is the Oregon Combined Payroll Tax Report. It guides employers on how to report their payroll taxes to the state of Oregon.

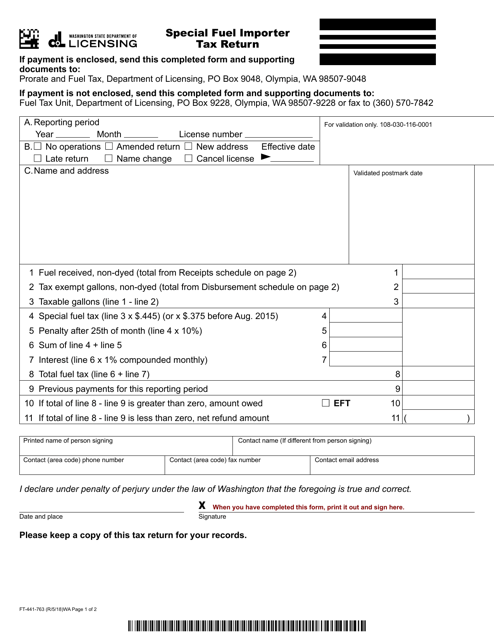

This form is used for filing the Special Fuel Importer Tax Return in the state of Washington.

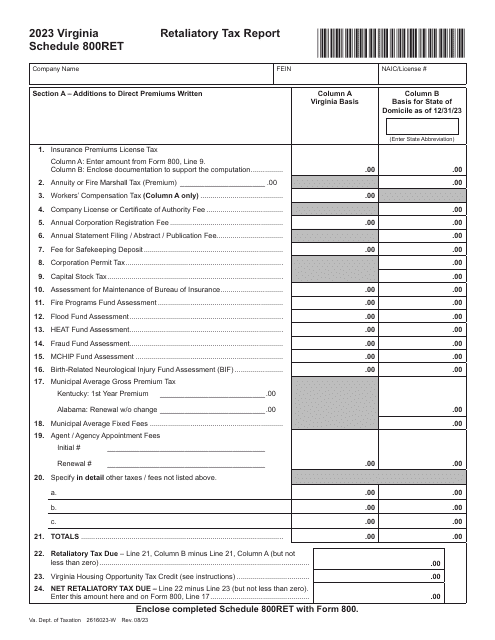

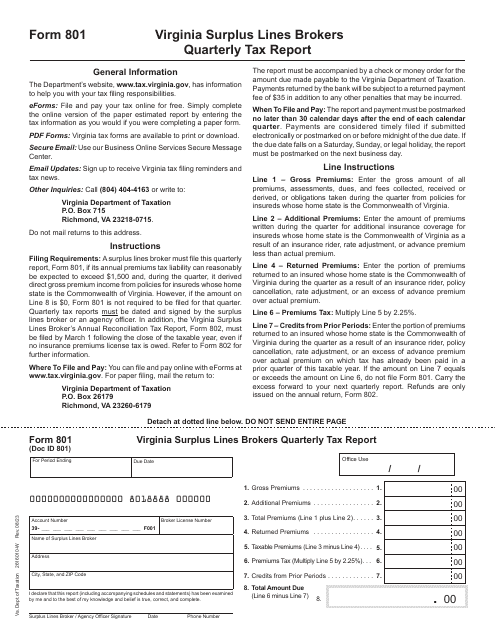

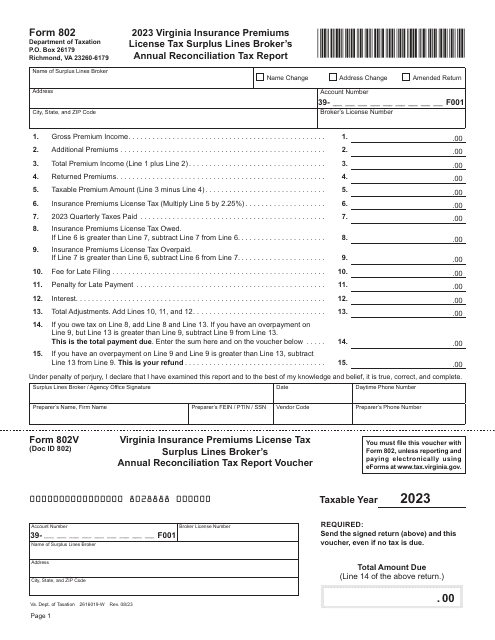

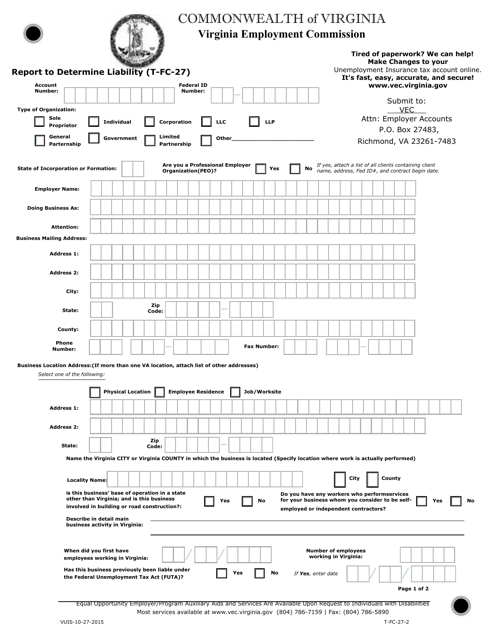

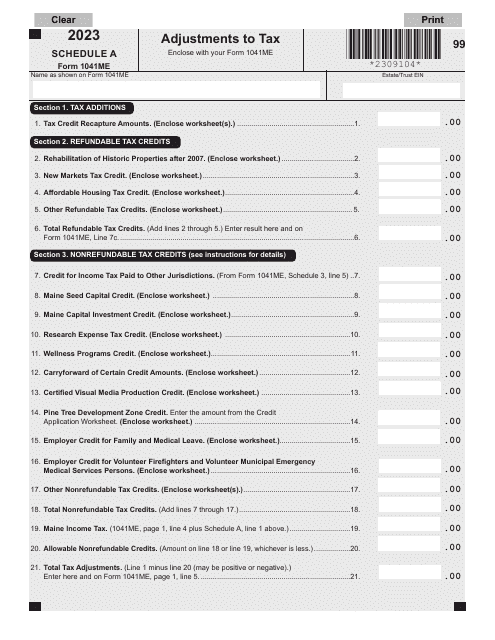

This form is used for reporting and determining liability in the state of Virginia. It is specifically for tax purposes and helps individuals or businesses report their financial obligations accurately.

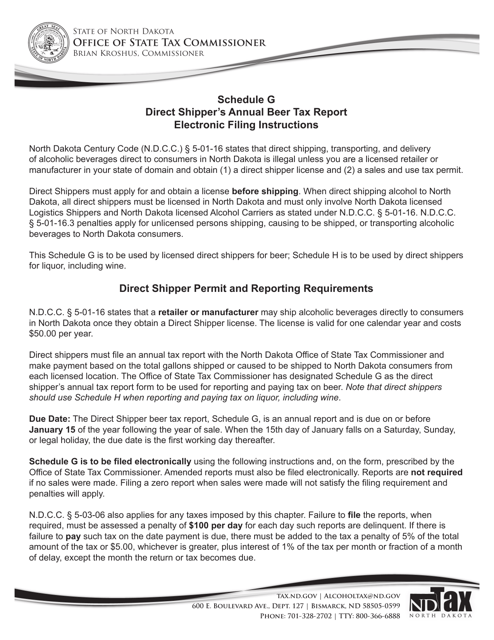

This document is used to provide instructions for filling out the Schedule G Direct Shipper's Annual Beer Tax Report in the state of North Dakota.

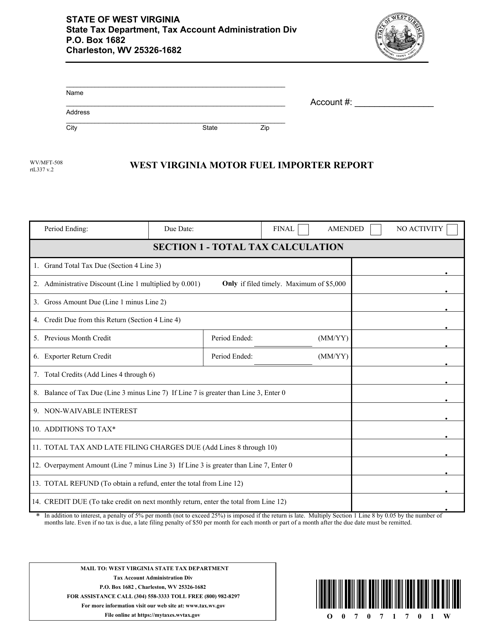

This form is used for reporting motor fuel imports in West Virginia.

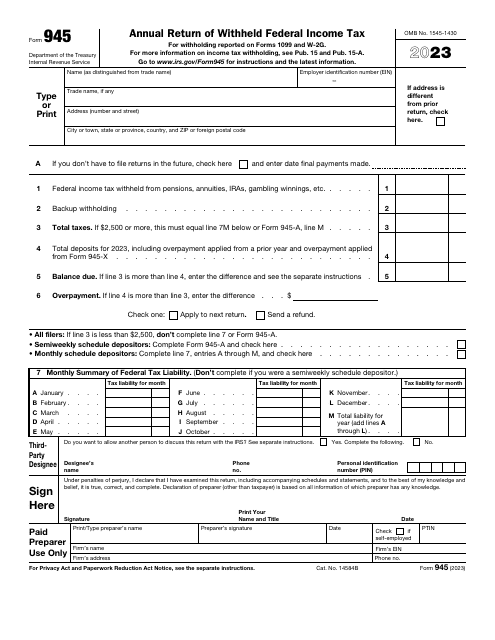

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.

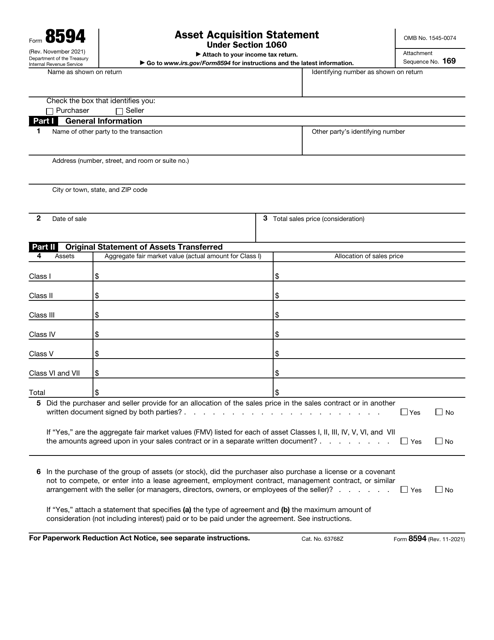

This is a fiscal form designed for taxpayers that carried out a sale of assets used for a business or trade.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

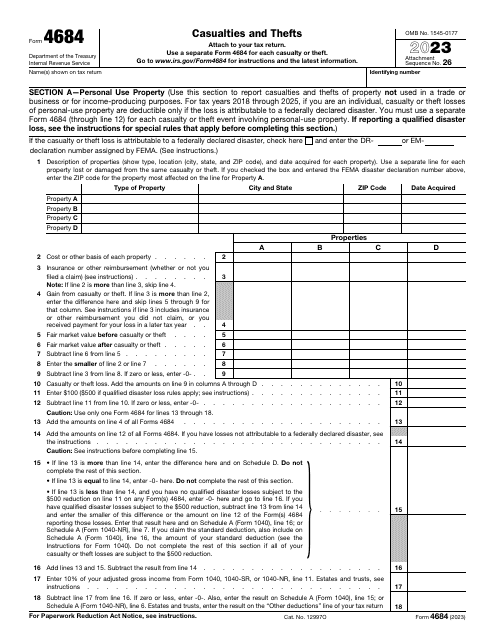

This is a formal statement prepared by a taxpayer who wants to confirm their right to receive a tax deduction upon property damage or loss they sustained if the reason for it was a casualty or theft.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.