Tax Report Templates

Documents:

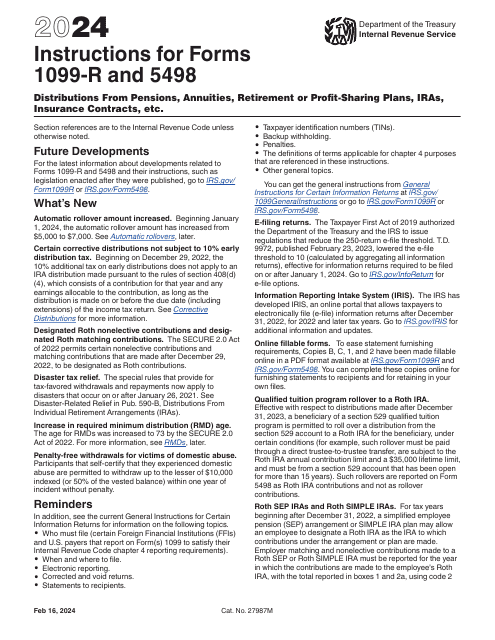

943

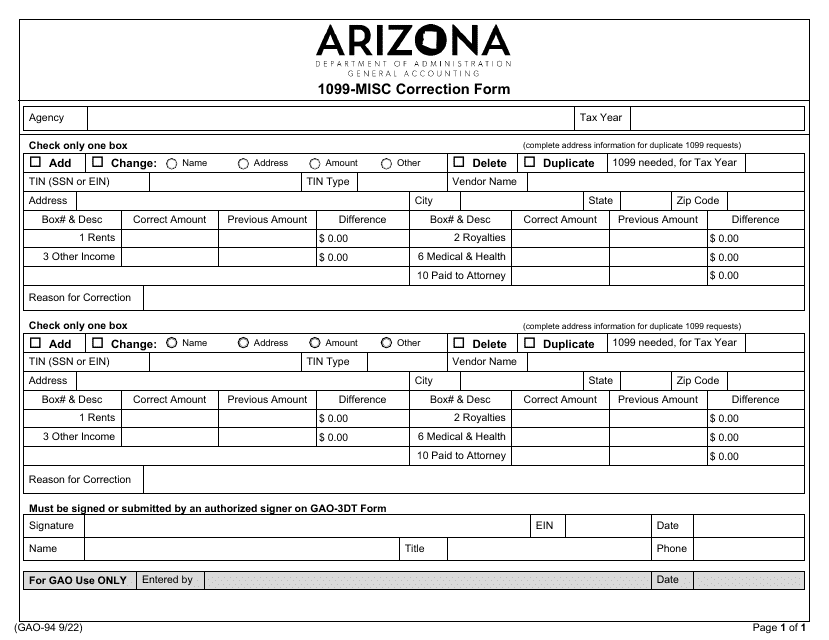

This is an IRS form governmental entities prepare and file in order to inform the government about deductible payments like fines and penalties they have made during a particular calendar year.

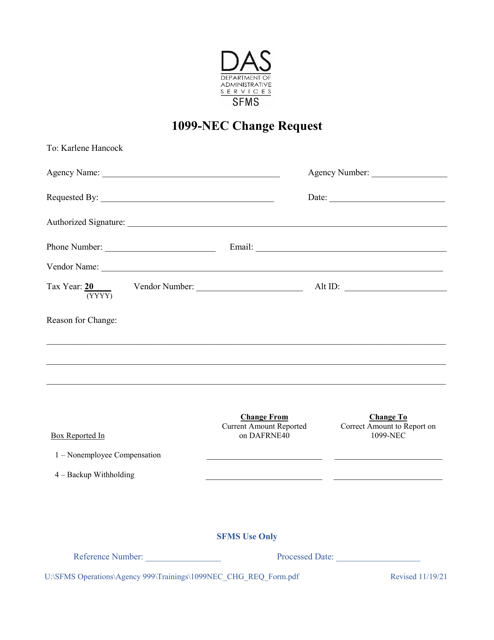

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

This is a fiscal form used by taxpayers that need to inform the tax organs about the financial profit they generated through transactions with real estate.

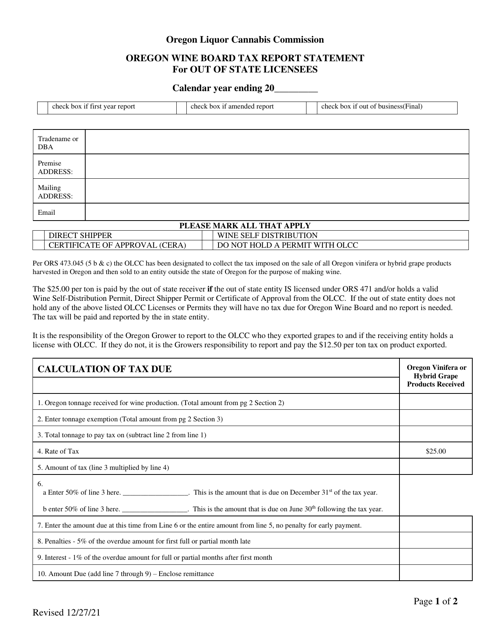

This document is for out-of-state licensees who need to report their taxes to the Oregon Wine Board. It provides a statement for tax reporting purposes.

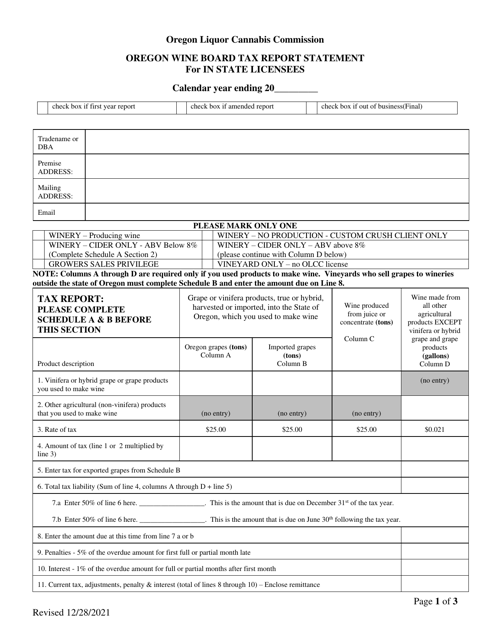

This document is used for in-state licensees of the Oregon Wine Board to report and submit tax statements related to wine sales in Oregon.

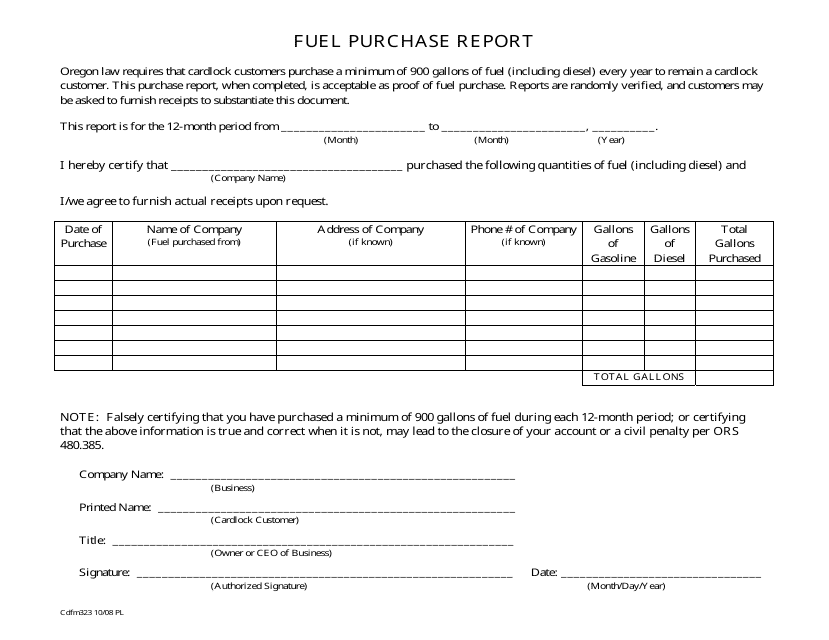

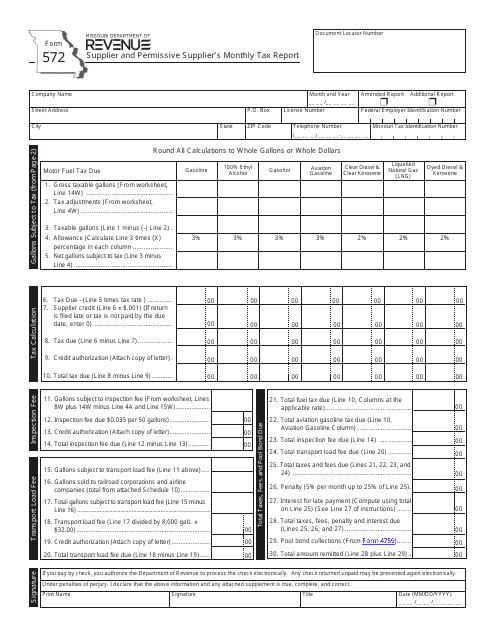

This form is used for reporting fuel purchases in the state of Oregon.

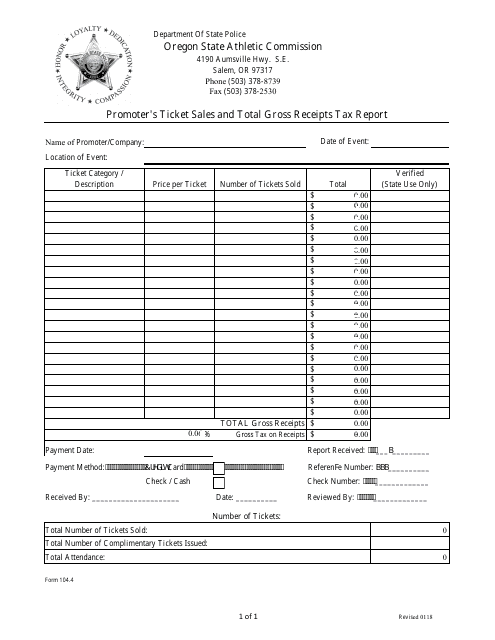

This document is used for reporting the promoter's ticket sales and total gross receipts tax in the state of Oregon.

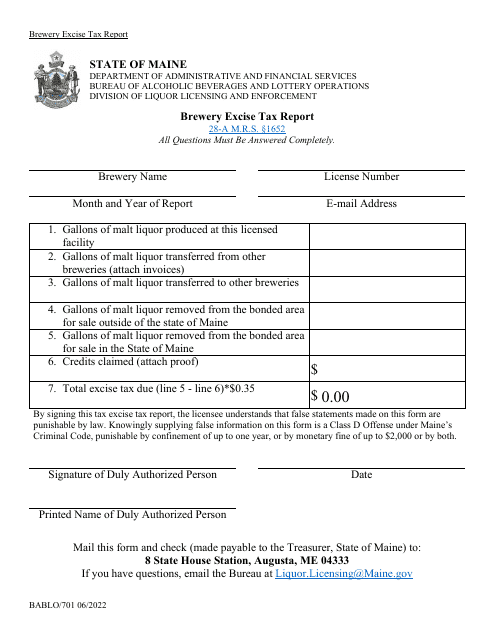

This Form is used for reporting brewery excise taxes in the state of Maine. It is required for breweries to accurately report and pay their excise tax obligations.

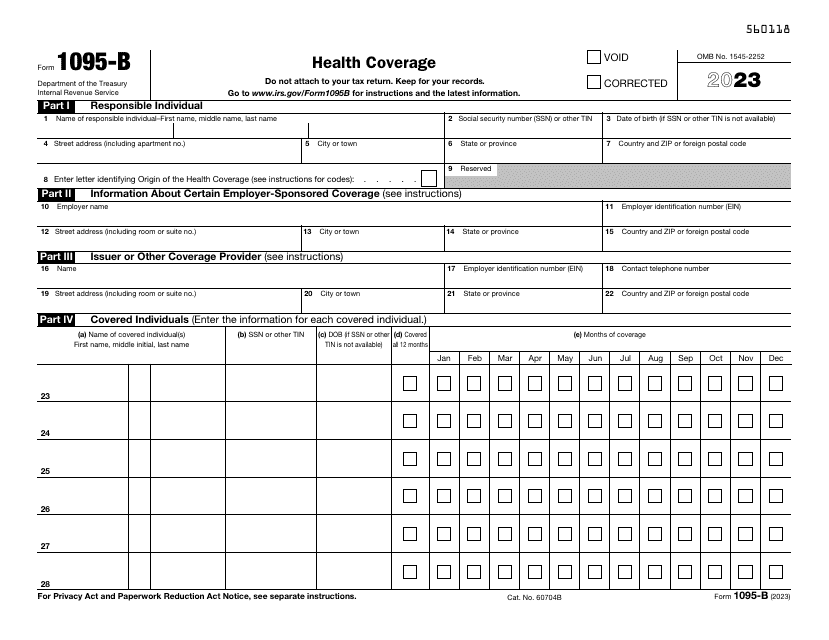

Use this document, otherwise known as the IRS Health Coverage Form, for submitting a report to the Internal Revenue Service (IRS) and to taxpayers about individuals with minimum essential coverage who are not liable for the individual shared responsibility payment.

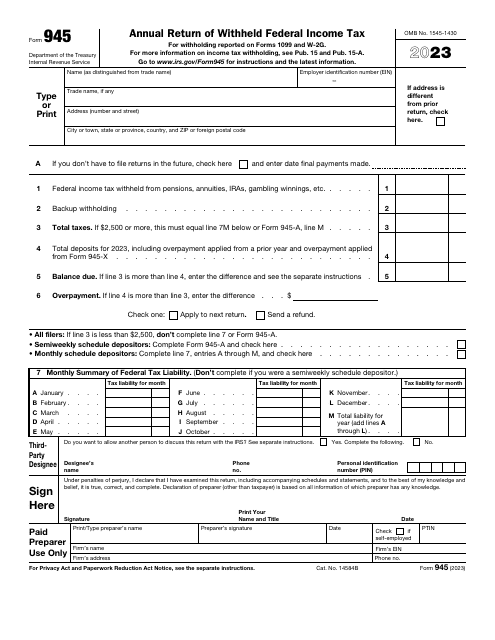

This is a fiscal form taxpayers are obliged to prepare and submit to provide information about nonpayroll payments subject to tax and confirm they are paying an accurate amount of tax for the last year.