Tax Report Templates

Documents:

943

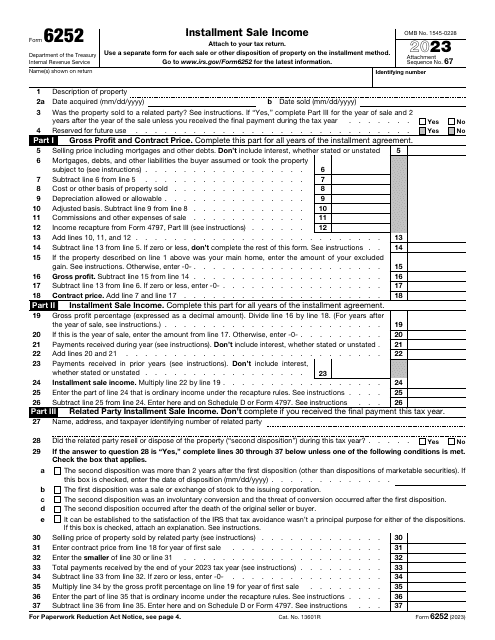

This is an IRS form that includes the details of an installment sale.

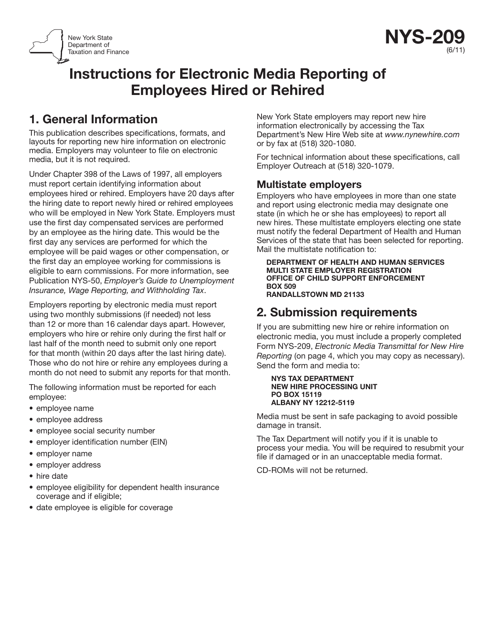

This form is used for electronically transmitting new hire information to the New York State Department of Taxation and Finance. It is required by employers to report the hiring of new employees.

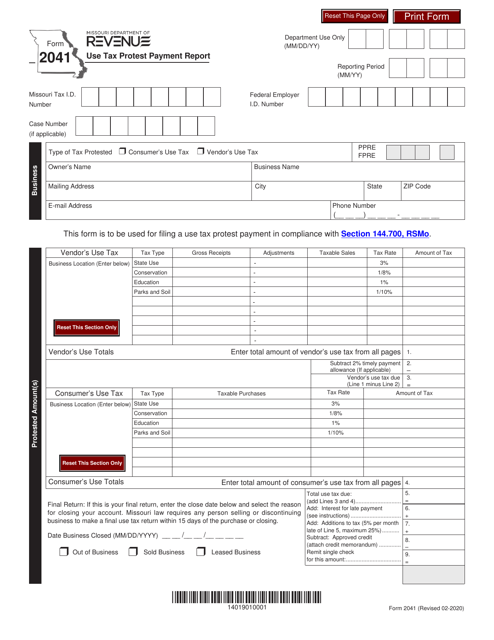

This form is used for reporting and protesting use tax payments in the state of Missouri. It allows individuals and businesses to dispute any taxes they believe were incorrectly imposed on their purchases.

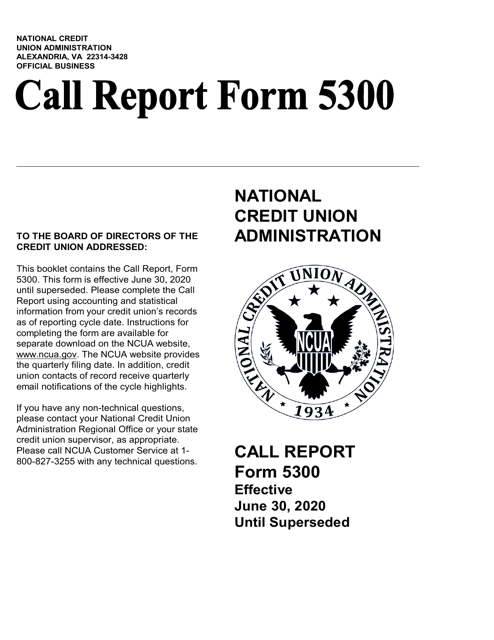

This Form is used for reporting financial information and activities of credit unions to regulatory authorities. It helps monitor the financial health and compliance of credit unions.

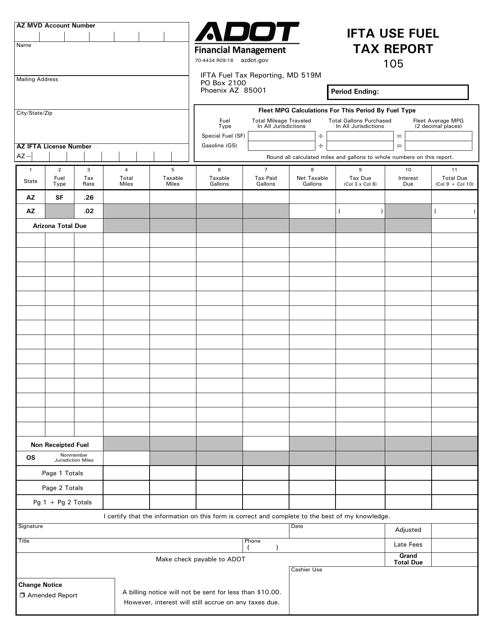

This Form is used for reporting and paying the International Fuel Tax Agreement (IFTA) use fuel tax in the state of Arizona.

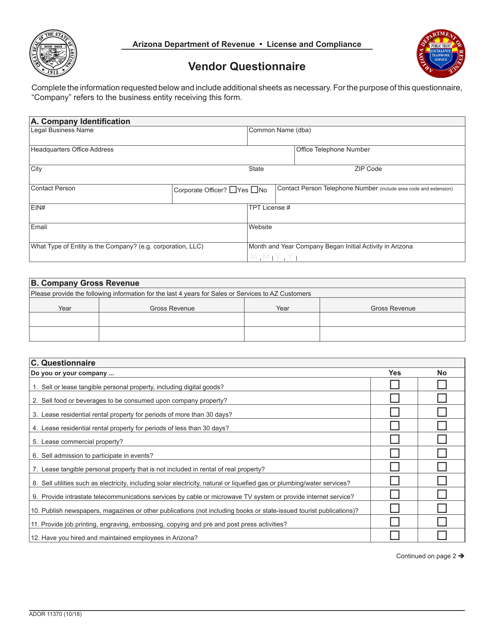

This form is used for vendors to complete a questionnaire in Arizona.

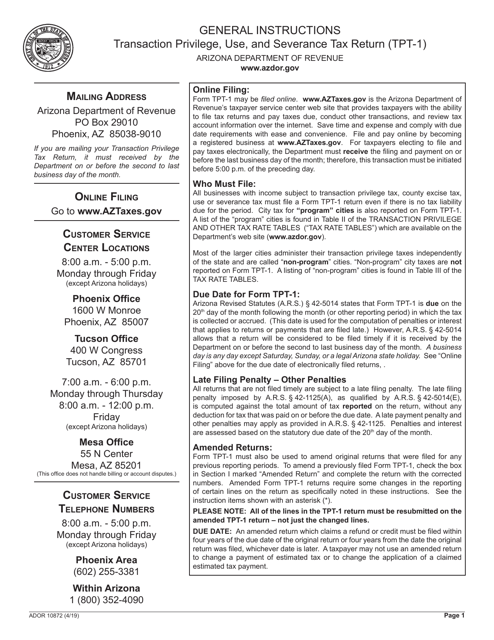

This Form is used for filing the Transaction Privilege, Use, and Severance Tax Return in the state of Arizona. It provides instructions on how to accurately fill out and submit the form to the Arizona Department of Revenue (ADOR).

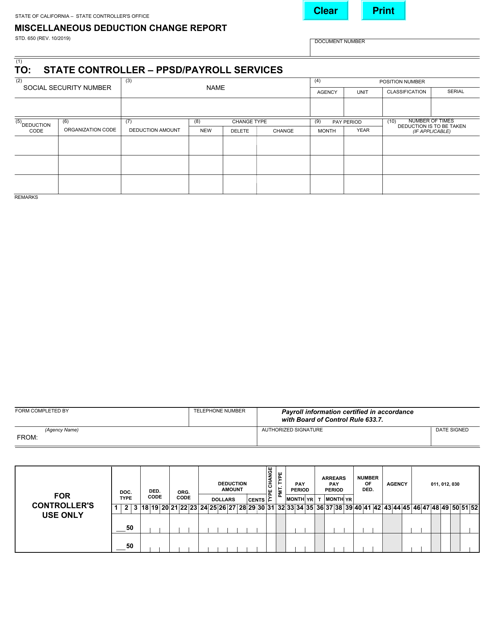

This form is used for reporting changes in miscellaneous deductions in the state of California.

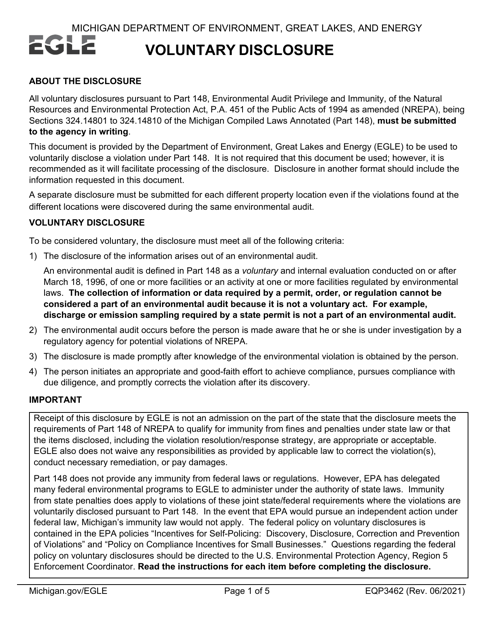

This form is used for voluntary disclosure in the state of Michigan.

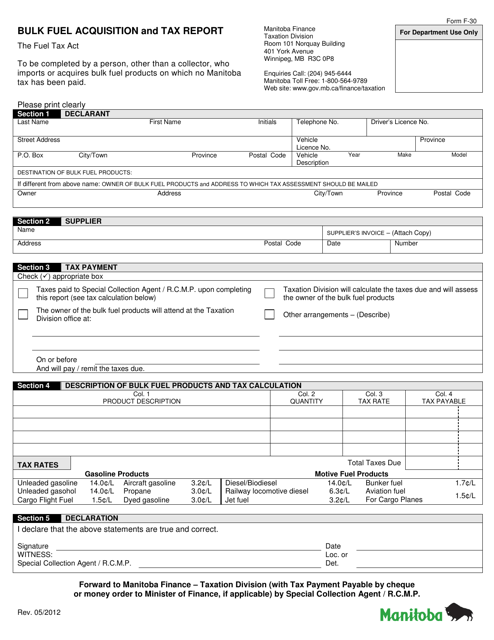

This form is used for reporting bulk fuel acquisition and taxes in Manitoba, Canada.

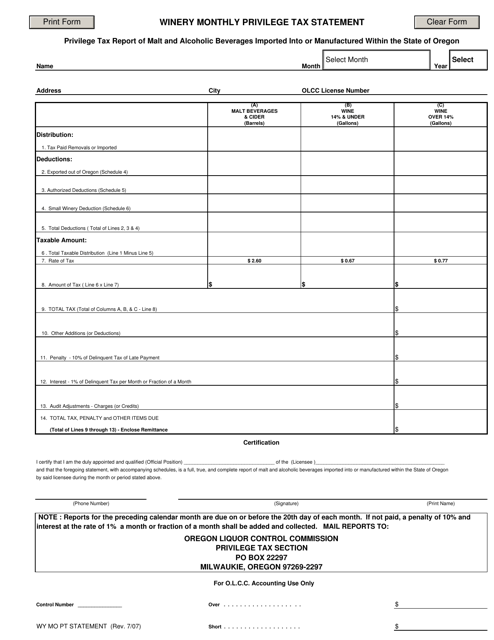

This document is used for reporting and paying monthly privilege tax for wineries in Oregon.

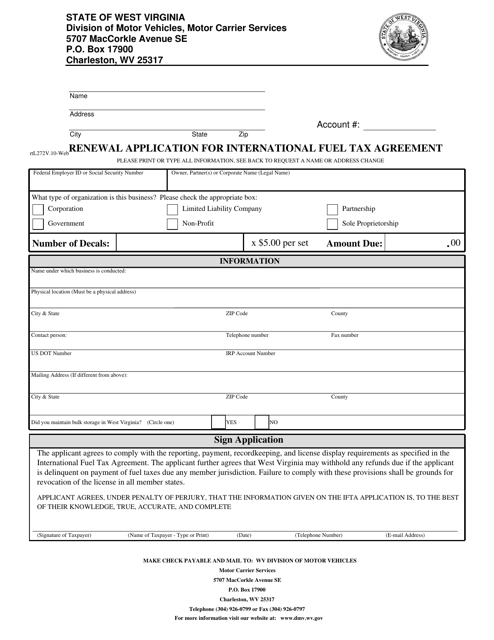

This form is used for renewing the International Fuel Tax Agreement in the state of West Virginia.

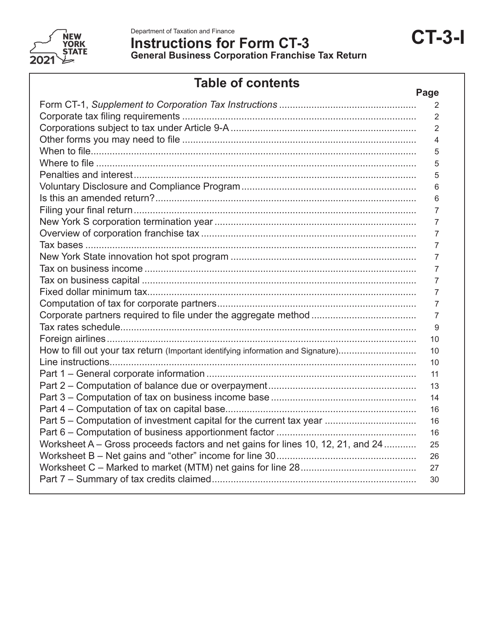

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

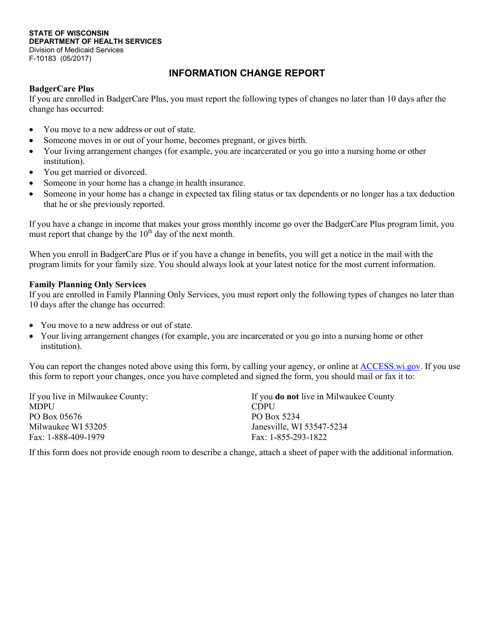

This document is used for reporting changes to personal information in the state of Wisconsin.

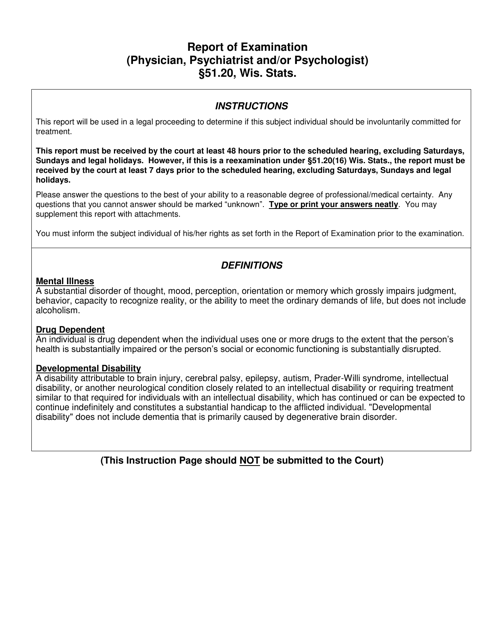

This form is used for reporting the results of an examination conducted under Section 51.20 of the Wisconsin Statutes in Wisconsin.

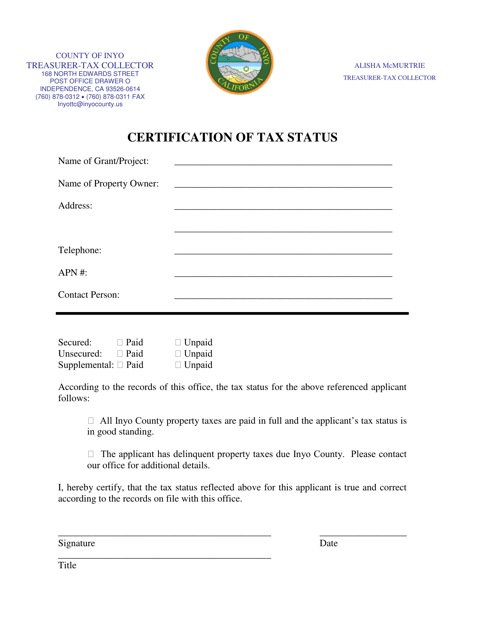

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

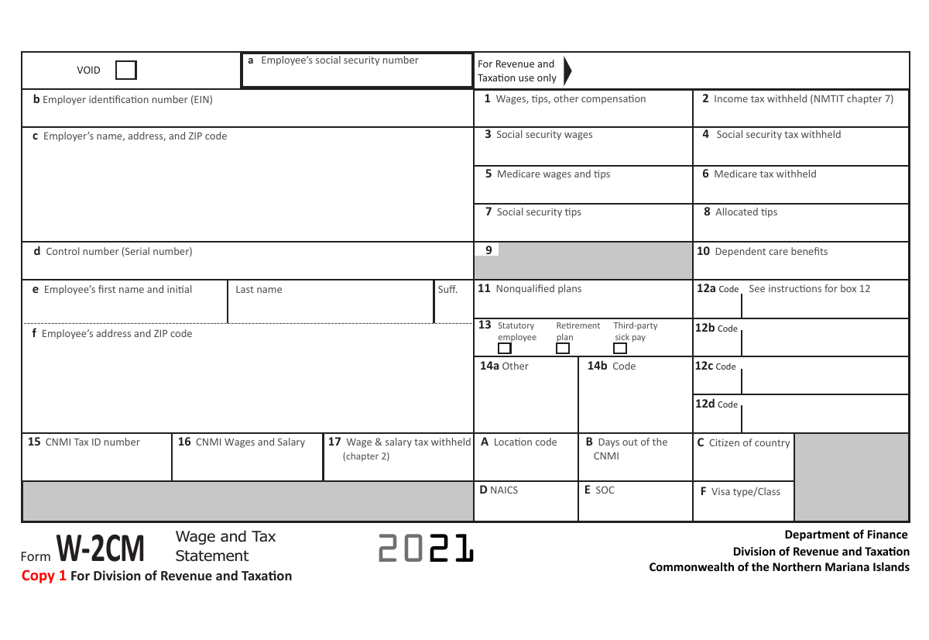

This Form is used for reporting wages and taxes in the Northern Mariana Islands.

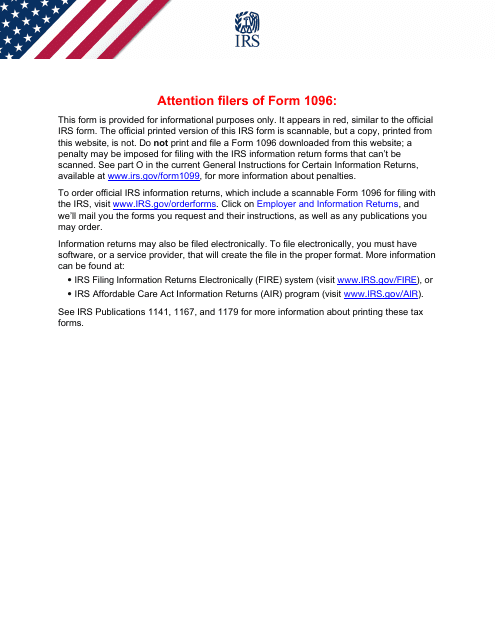

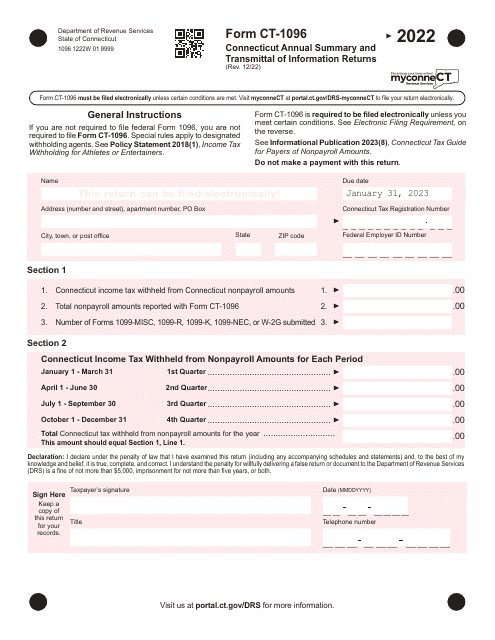

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.

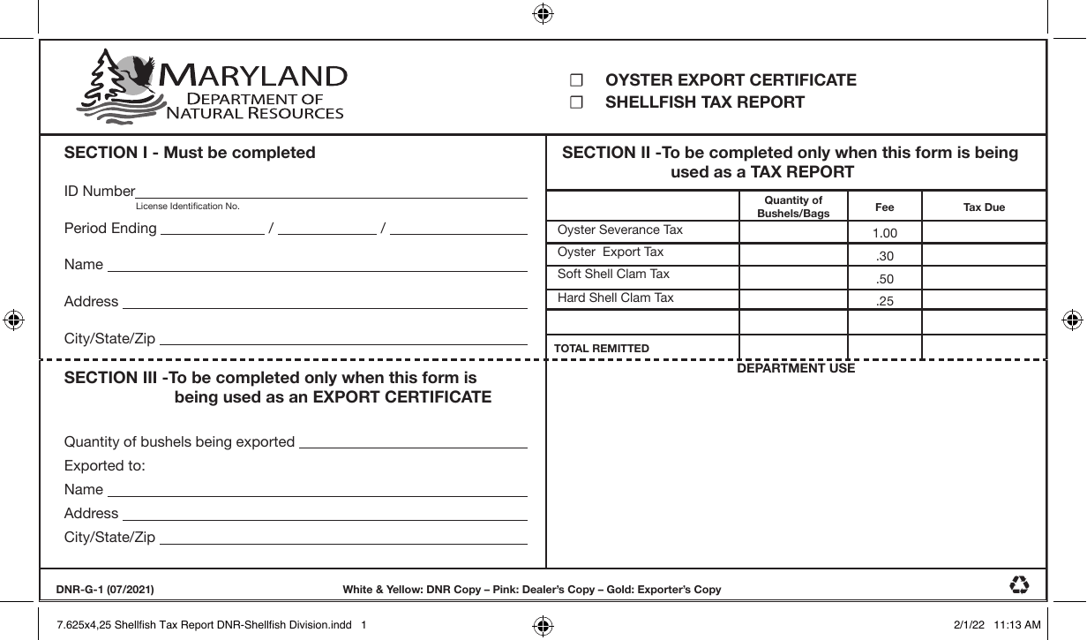

This form is used for shellfish dealers in Maryland to report their taxes.

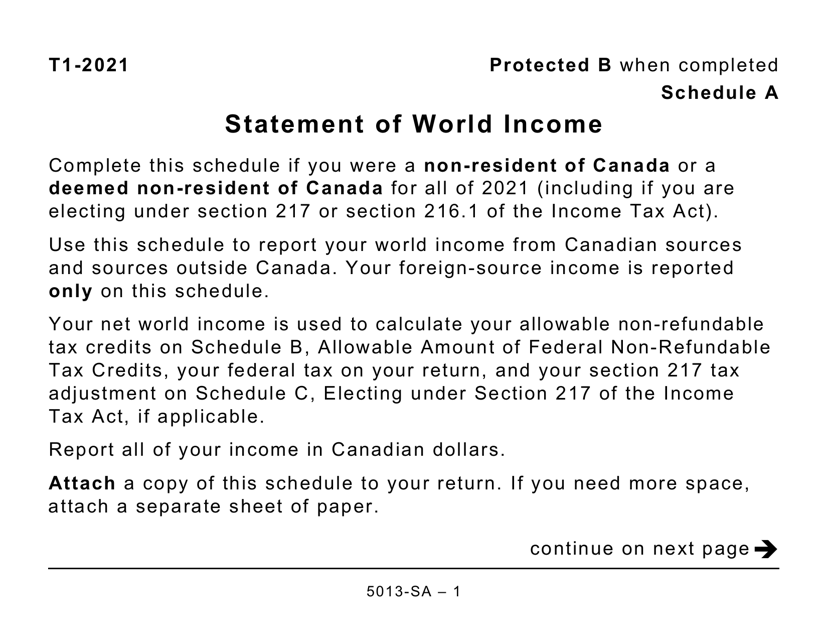

This form is used for reporting world income for Canadian taxpayers who are visually impaired and require a large print format. It is specifically for Schedule A of Form 5013-SA.

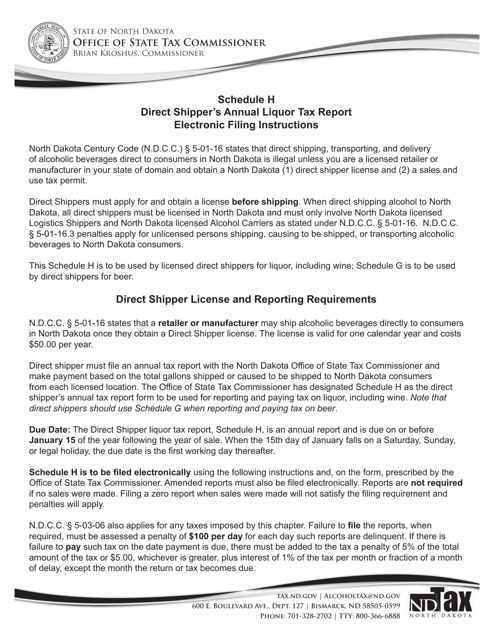

This document provides instructions for completing the Schedule H Direct Shipper's Annual Beer Tax Report in North Dakota. It guides individuals and businesses on reporting and paying their annual beer taxes when shipping beer directly to consumers in the state.

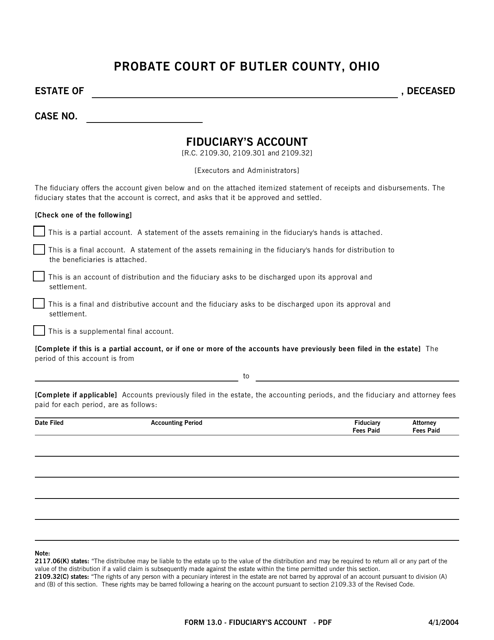

This form is used for filing a fiduciary's account in Butler County, Ohio. It is used to report the financial transactions and assets of an individual acting as a fiduciary, such as an executor, trustee, or guardian.

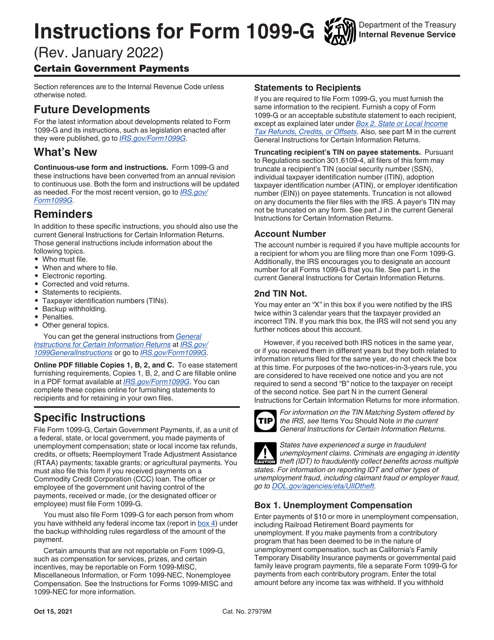

This Form is used for reporting miscellaneous income, such as freelance earnings or rental income, to the IRS.

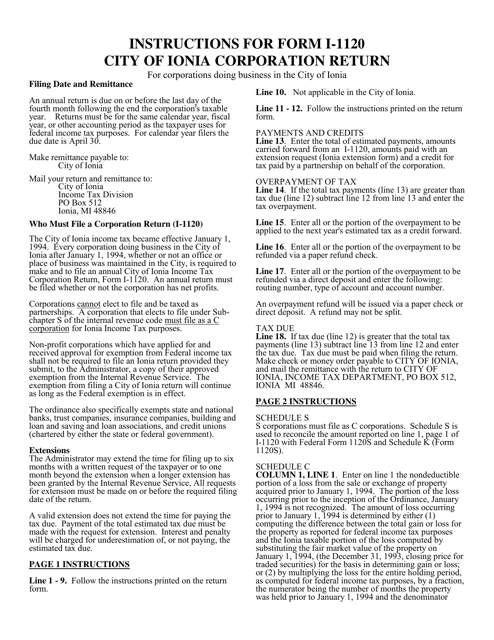

This Form is used for filing the Corporation Income Tax Return for businesses in the City of Ionia, Michigan. It includes instructions on how to accurately report income, deductions, and credits for the tax year.

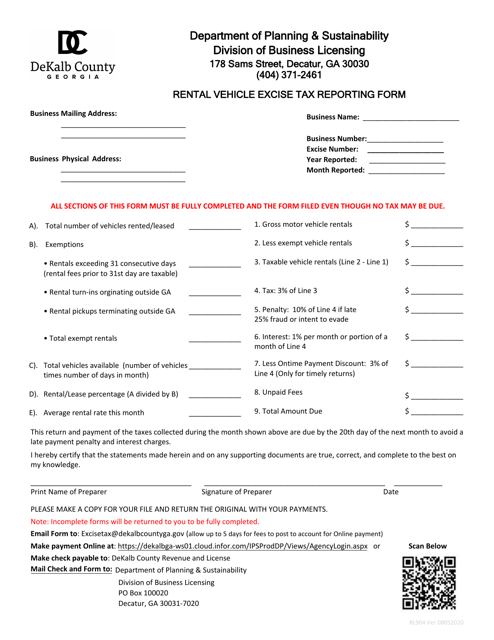

This form is used for reporting rental vehicle excise tax in DeKalb County, Georgia.

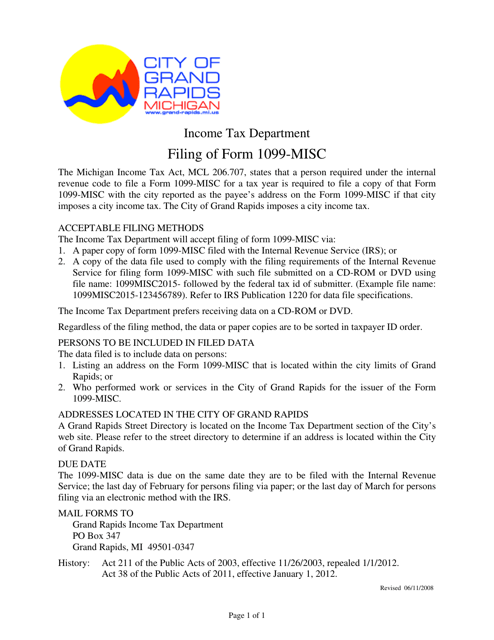

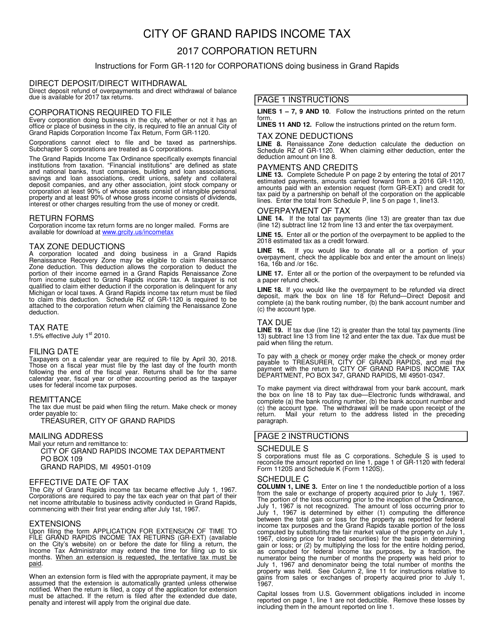

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

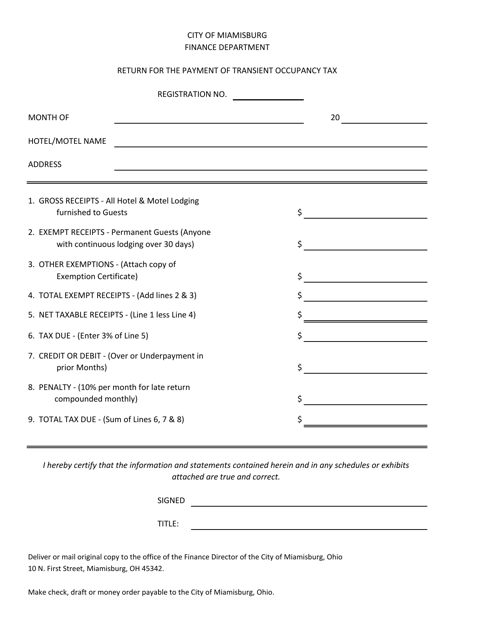

This form is used for reporting and submitting payment for the transient occupancy tax in the City of Miamisburg, Ohio.