Tax Report Templates

Documents:

943

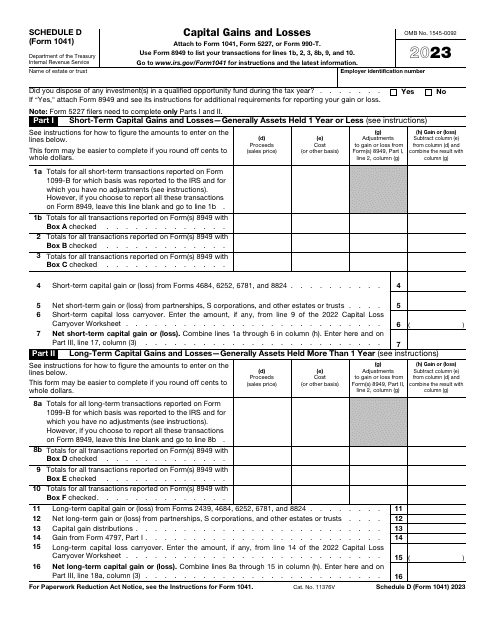

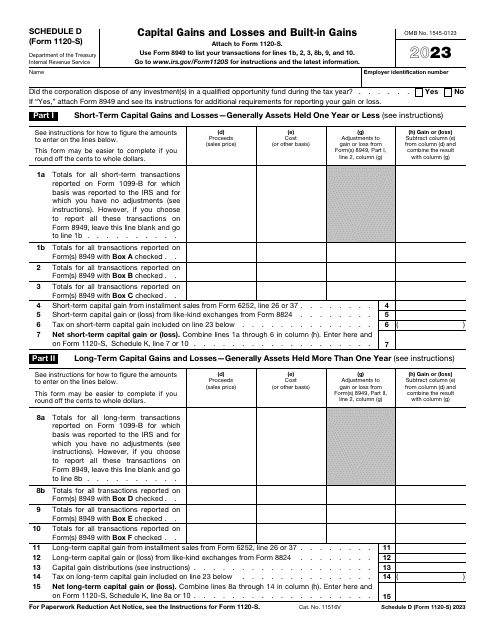

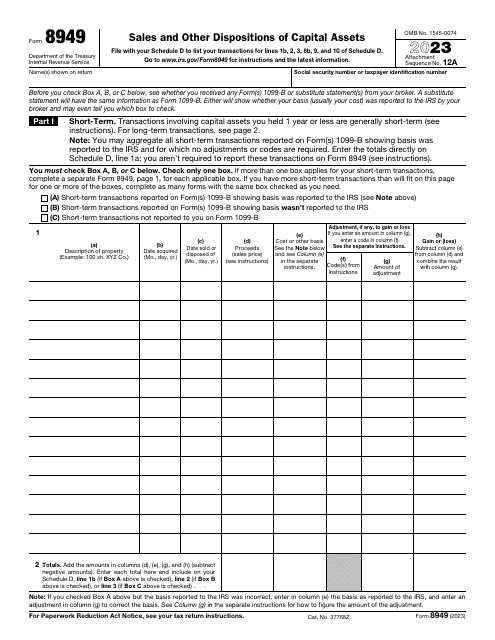

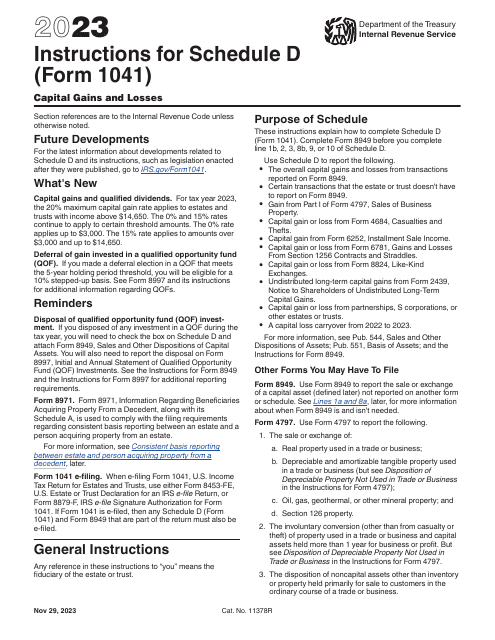

This is a legal document used to report exchanges and sales of capital assets, both long- and short-term capital gains and losses, to the IRS.

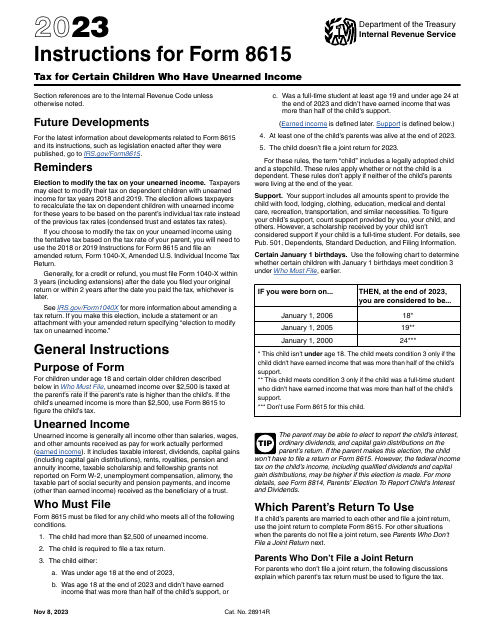

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

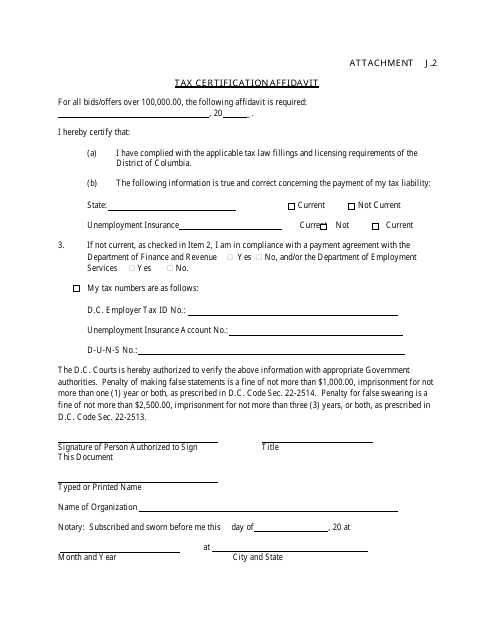

This document is for certifying tax information in Washington, D.C. It is used to confirm details related to tax obligations.

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

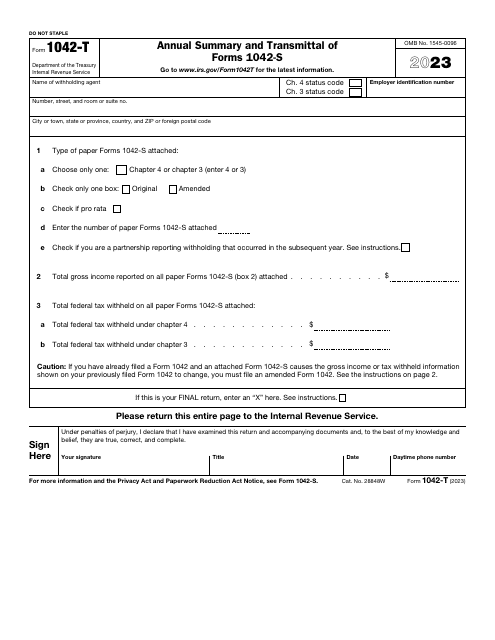

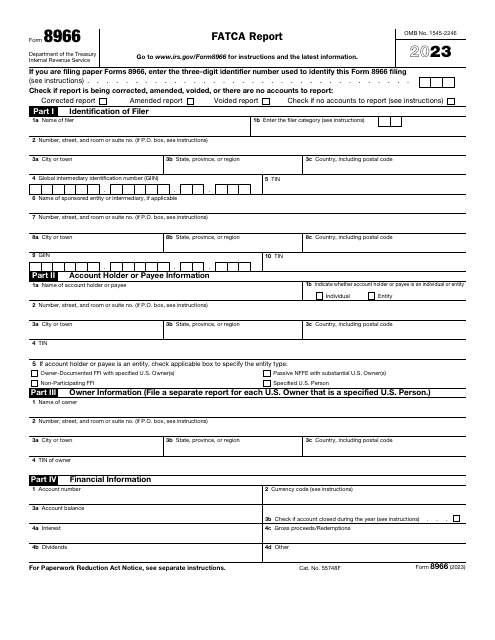

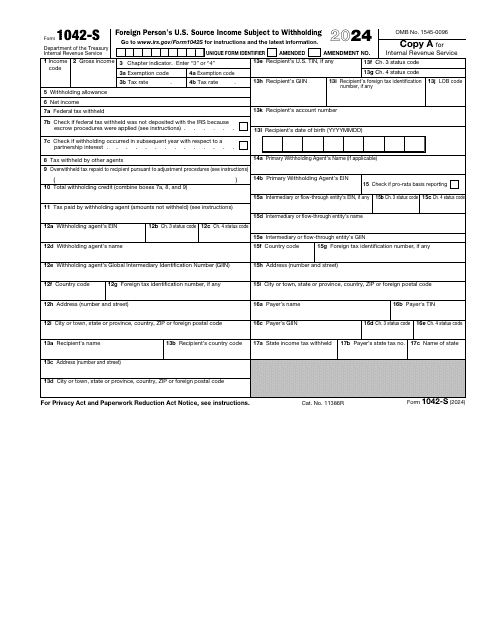

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.