Tax Report Templates

Documents:

943

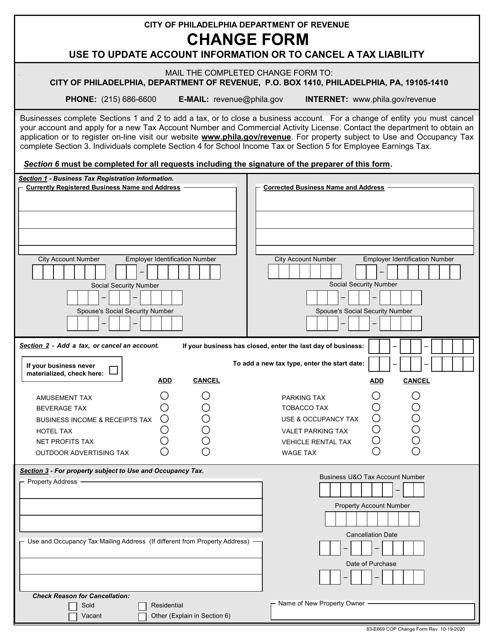

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

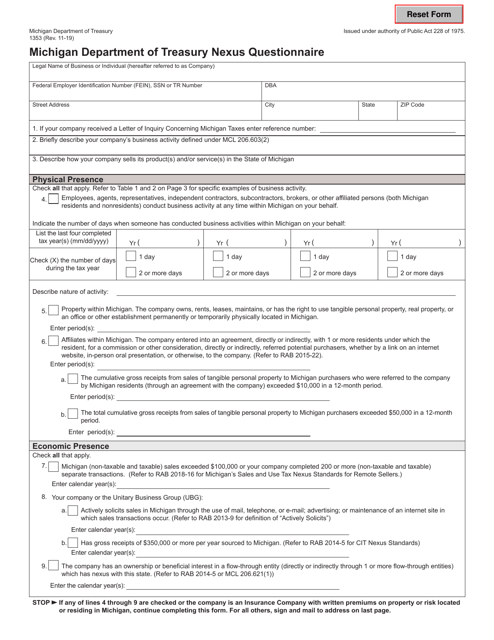

This form is used for the Nexus Questionnaire required by the Michigan Department of Treasury to determine if a business has sufficient presence in Michigan to be subject to state taxes.

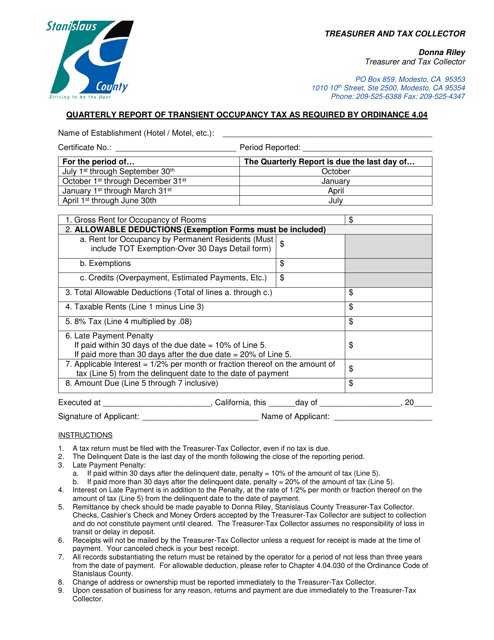

This document is used for reporting the Transient Occupancy Tax in Stanislaus County, California, as required by Ordinance 4.04. It is a quarterly report that provides information on the tax collected from temporary accommodations.

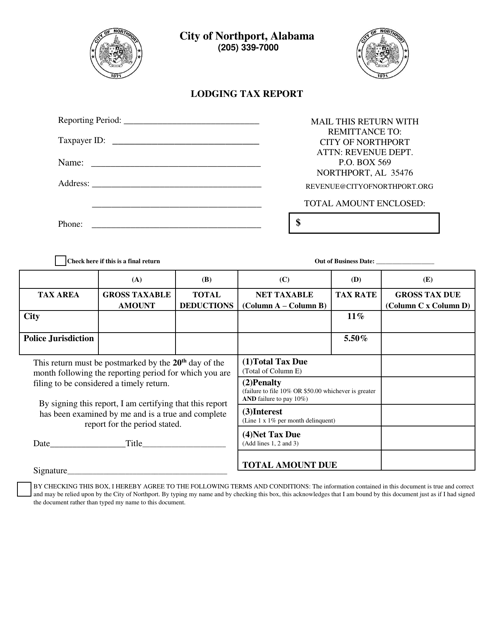

This Form is used for reporting lodging taxes in the City of Northport, Alabama.

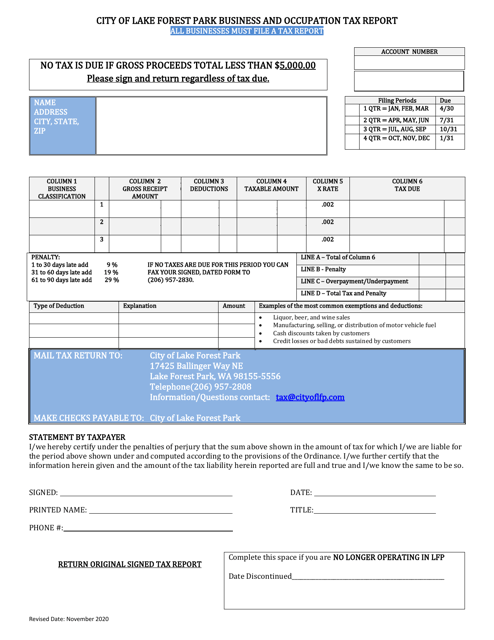

This document is used for reporting business and occupation taxes in the City of Lake Forest Park, Washington. It is a form that businesses must complete to comply with local tax regulations.

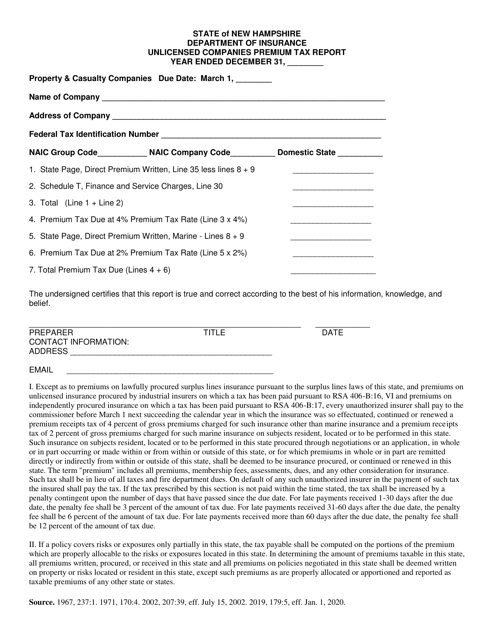

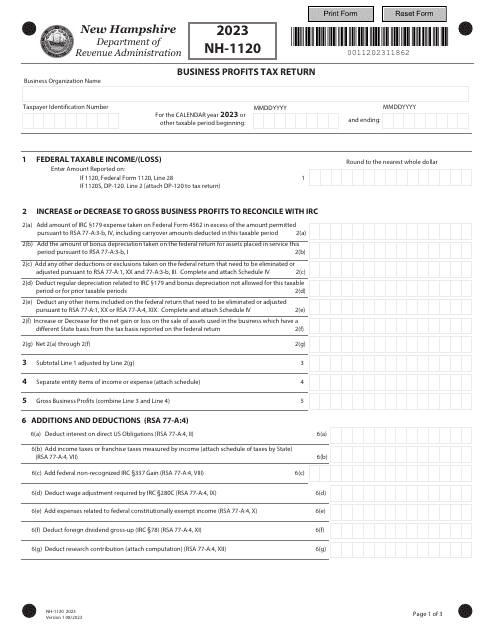

This document is used for reporting unlicensed premium taxes for property and casualty insurance companies in New Hampshire.

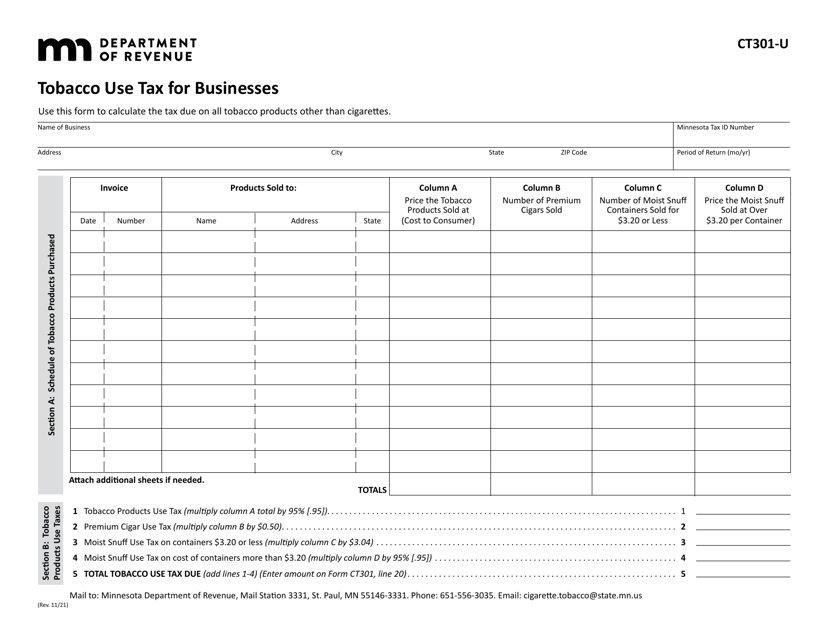

This form is used for businesses in Minnesota to report and pay tobacco use tax.

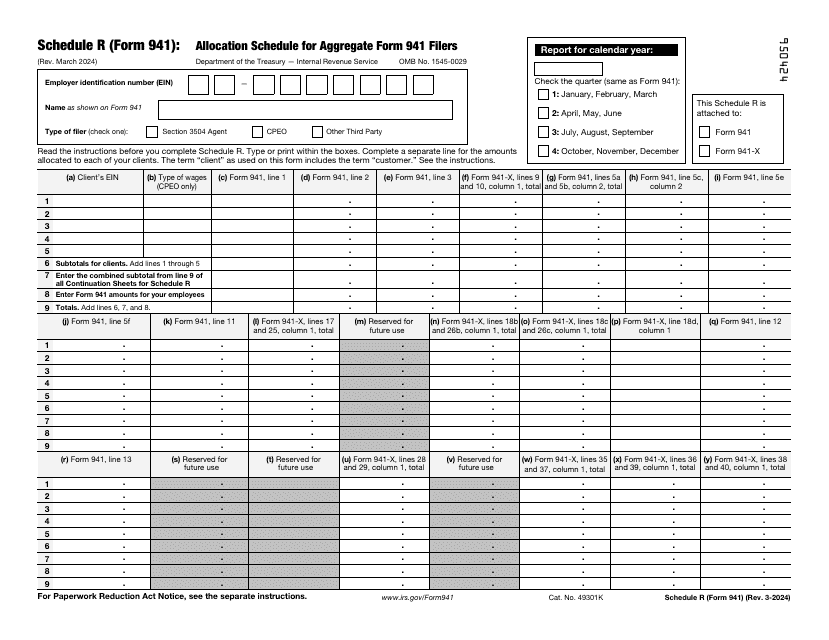

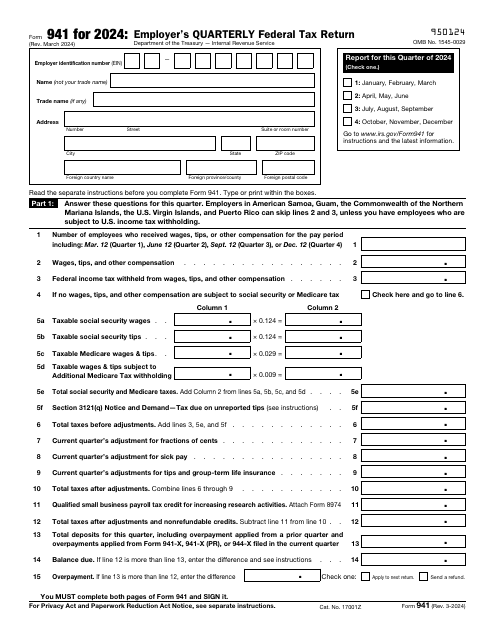

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

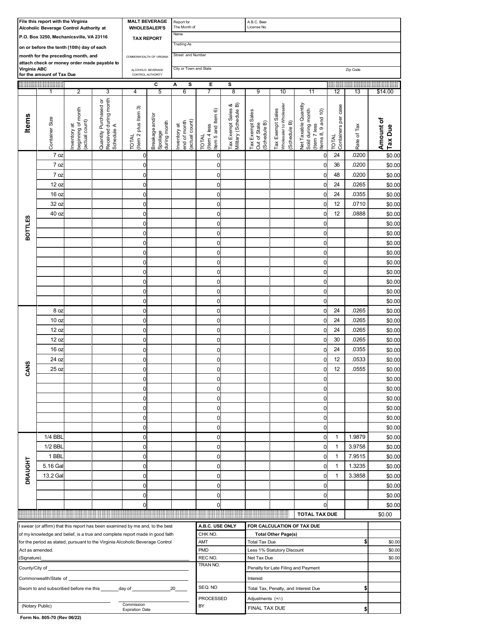

This form is used for reporting and paying the wholesale tax on malt beverages by wholesalers in Virginia.

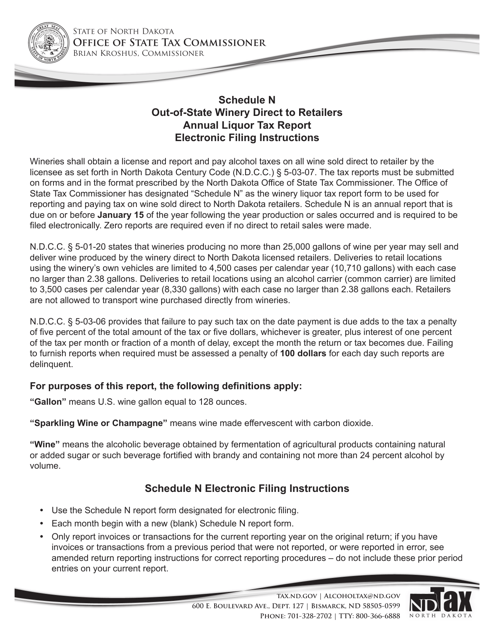

This Form is used for submitting an annual liquor tax report by out-of-state wineries selling directly to retailers in North Dakota.

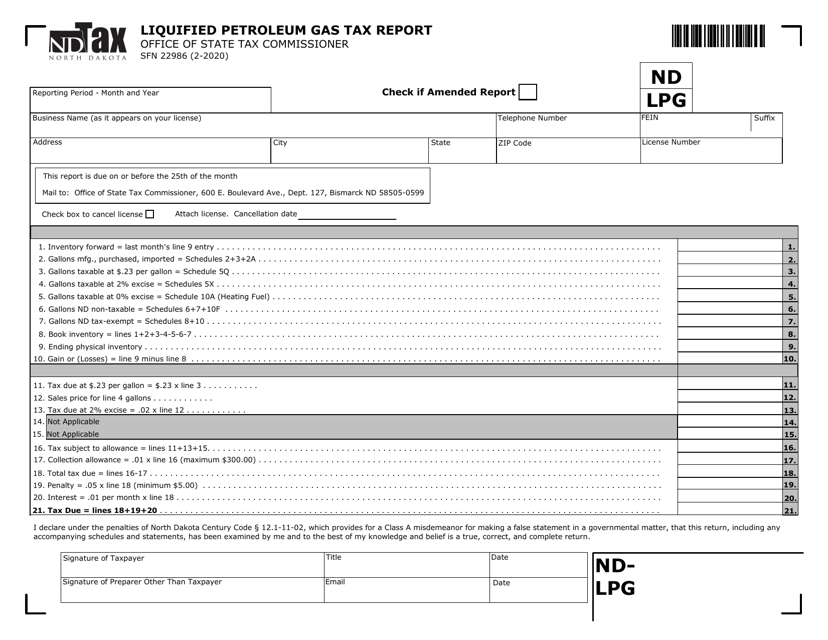

This form is used for reporting and paying taxes on the sale of liquified petroleum gas in the state of North Dakota.

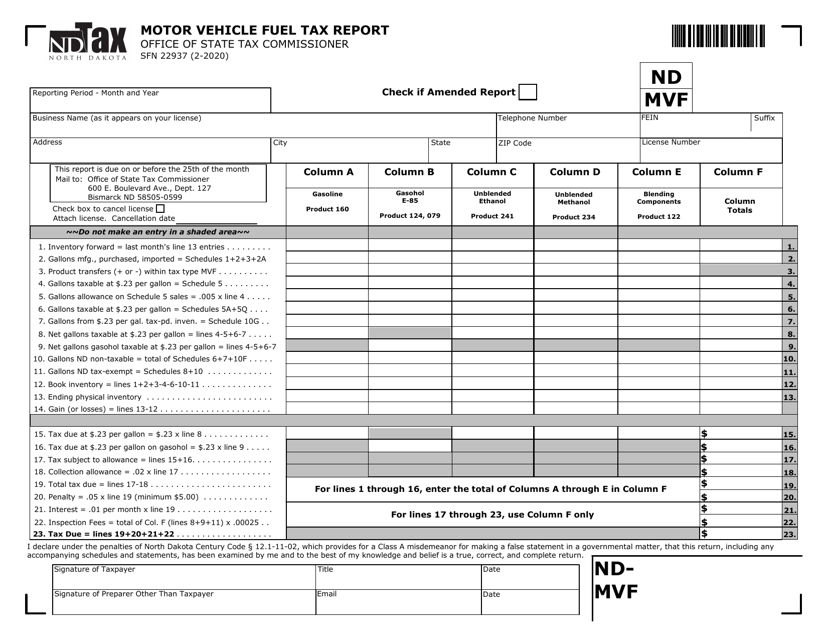

This Form is used for reporting motor vehicle fuel tax in North Dakota.

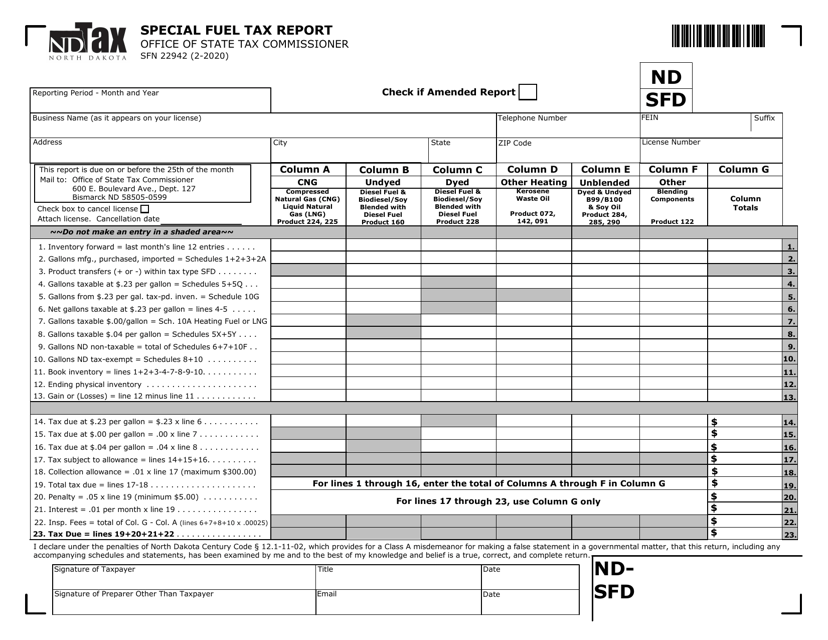

This form is used for reporting special fuel tax in North Dakota.

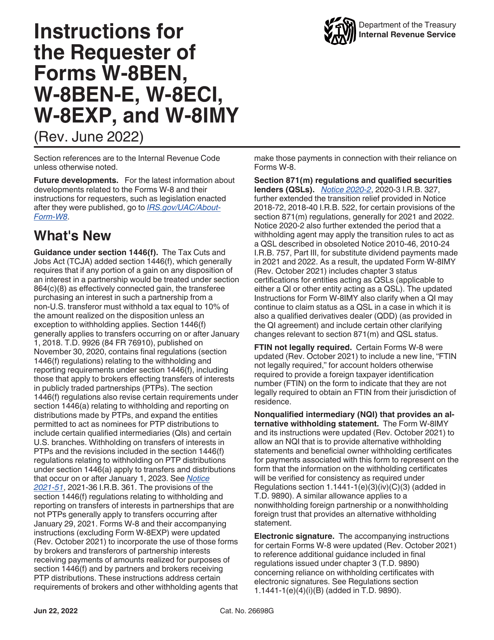

This document provides instructions for individuals or entities requesting Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. It explains how to complete these forms necessary for tax purposes.

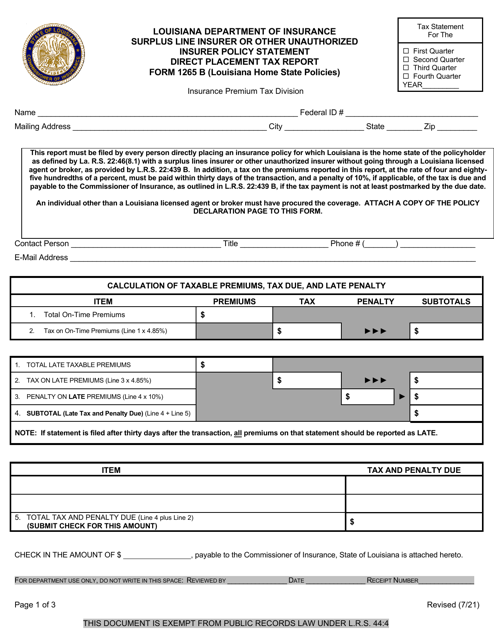

This Form is used for reporting tax information related to direct placements with surplus line insurers or other unauthorized insurers in Louisiana.