Tax Report Templates

Documents:

943

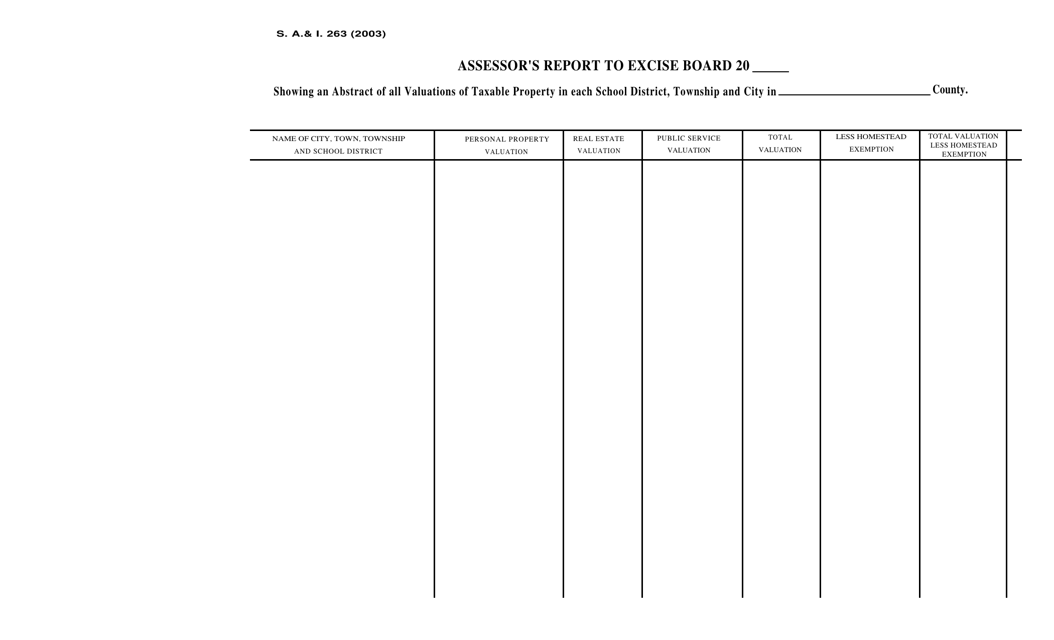

This type of document is used for submitting an Assessor's Report to the Excise Board in Oklahoma.

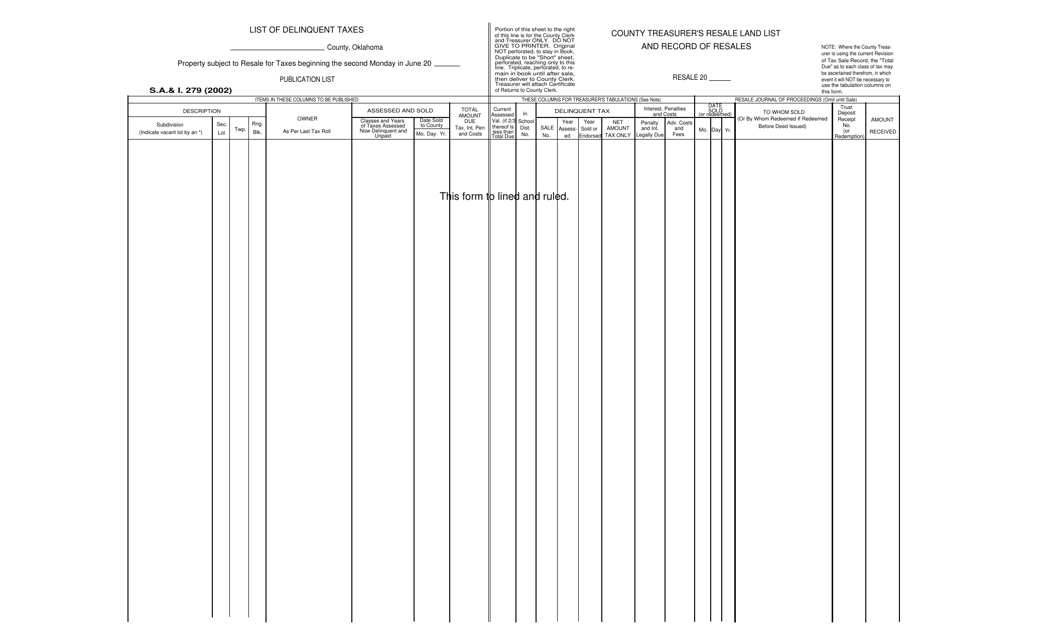

This form is used to list delinquent taxes in the state of Oklahoma. It provides information on individuals or businesses who haven't paid their taxes on time.

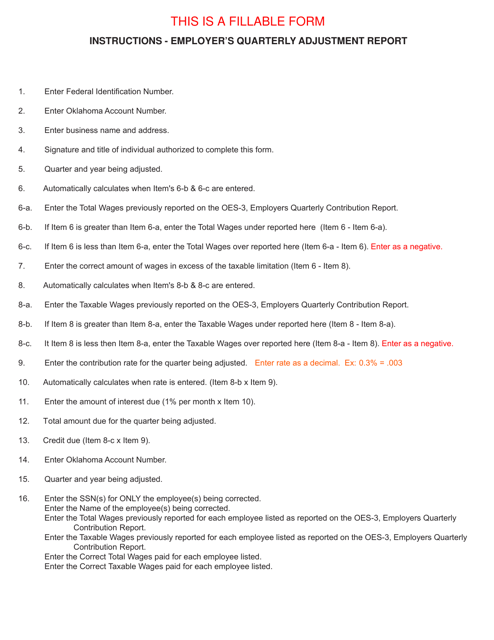

This form is used for Oklahoma employers to report quarterly adjustments in their employee's wages and taxes.

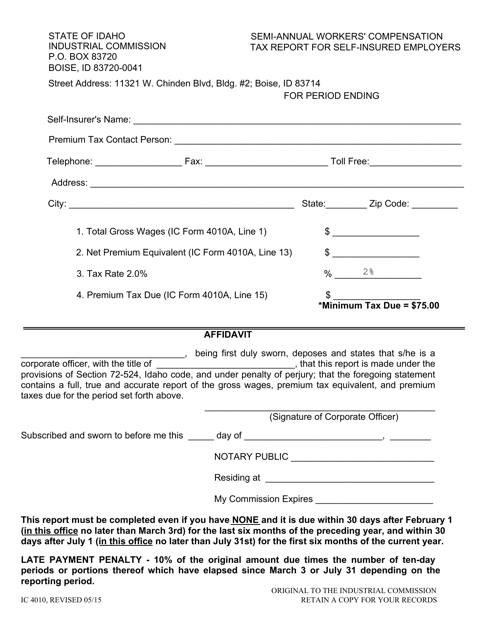

This form is used for self-insured employers in Idaho to report their semi-annual workers' compensation tax.

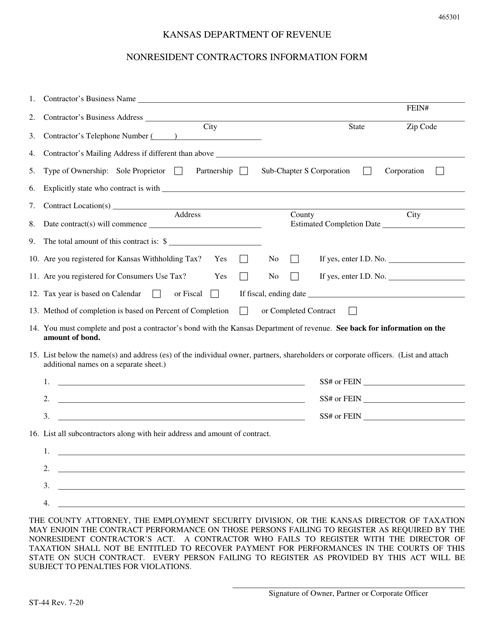

This document is used for reporting employer earnings in the state of North Carolina. It is a form that employers fill out to provide information about their earnings for tax and regulatory purposes.

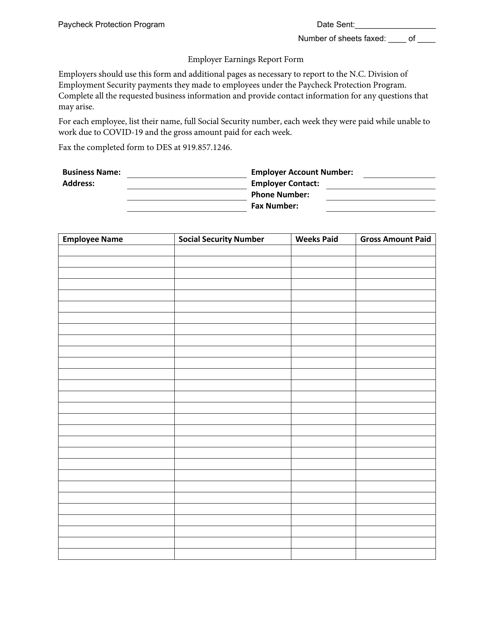

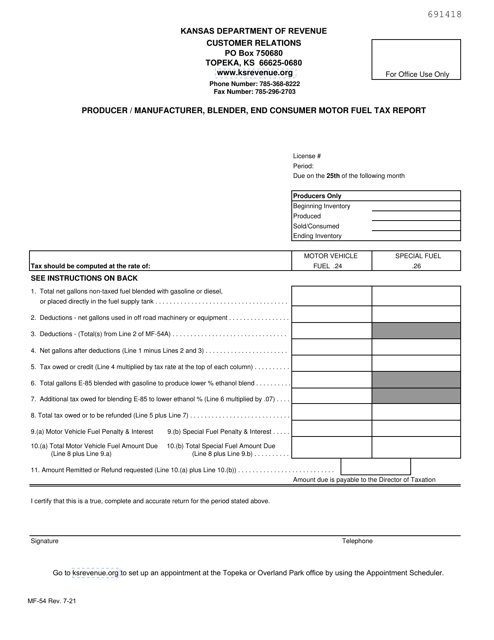

This document is used for reporting the monthly consumption of taxable materials in Kansas. It helps businesses comply with tax regulations and accurately track their material usage.

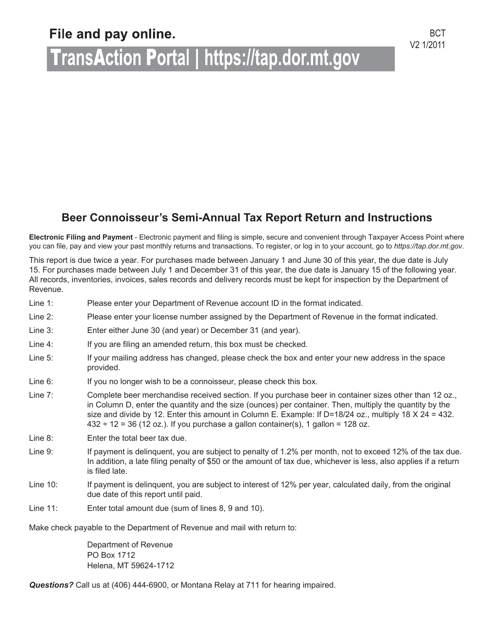

This Form is used for reporting and paying taxes related to the Beer Connoisseur's semi-annual tax in the state of Montana.

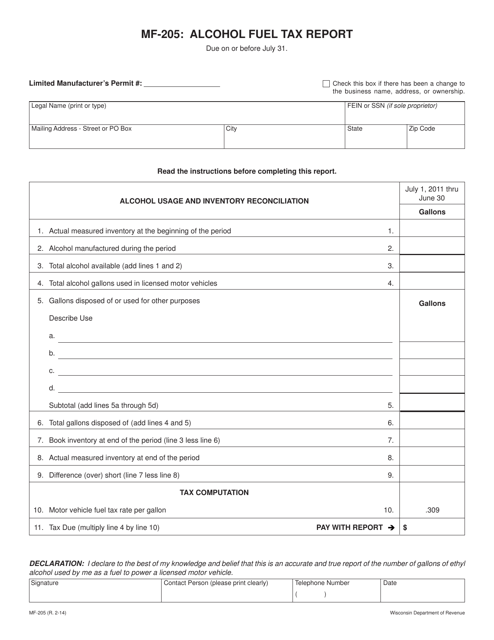

This Form is used for reporting alcohol fuel tax in Wisconsin.

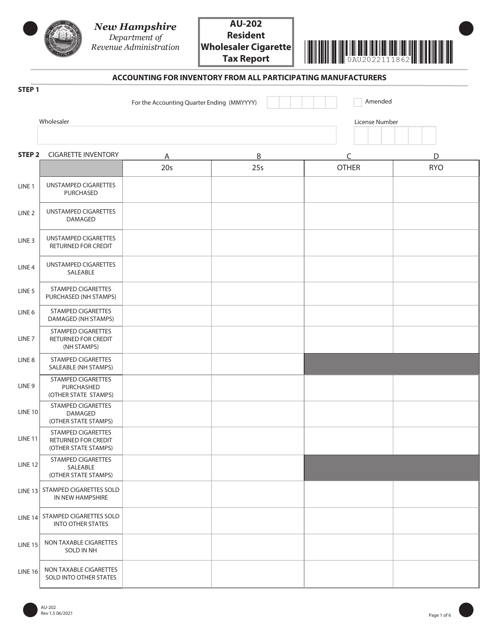

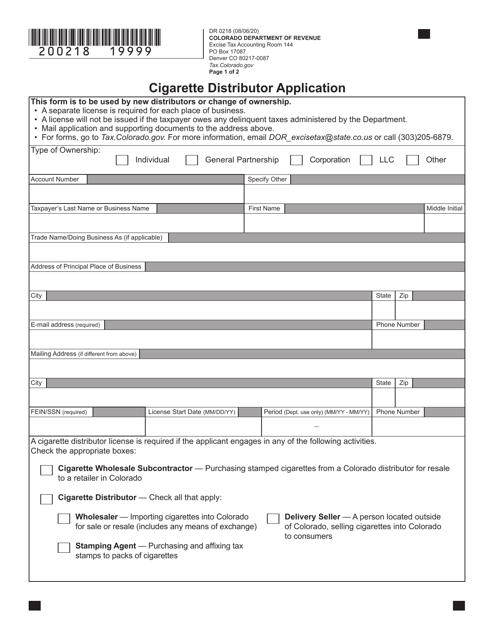

This Form is used for applying to become a cigarette distributor in Colorado.

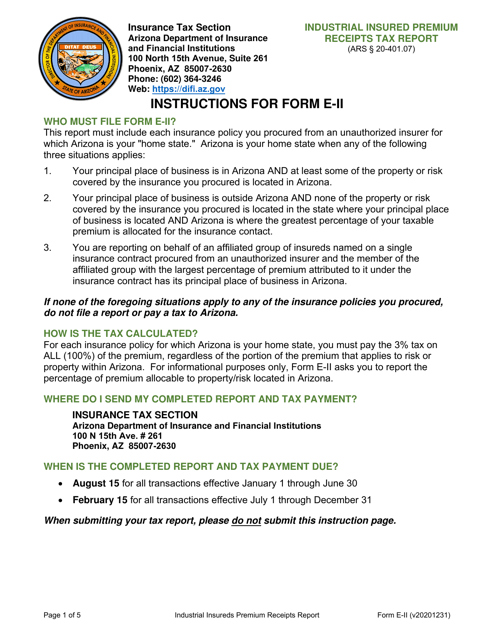

This Form is used for reporting premium receipts taxes for industrial insureds in Arizona.

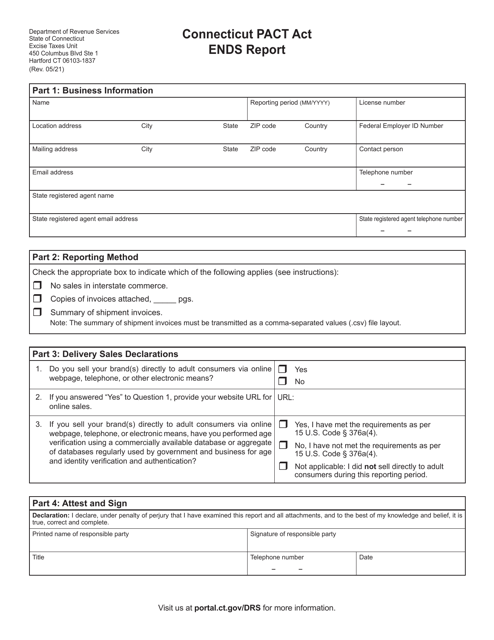

This document is for the State of Connecticut. It announces the end of the Connecticut Pact Act report.

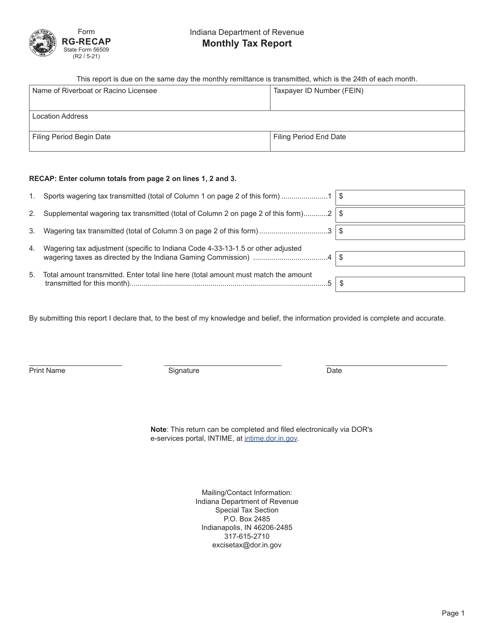

This form is used for reporting monthly taxes on wagering and providing a detailed daily summary in Indiana.

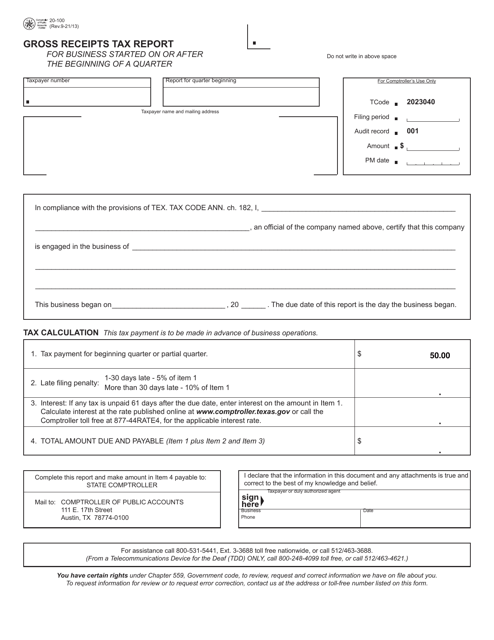

This Form is used for reporting the gross receipts tax for businesses that started operating in Texas during a quarter.

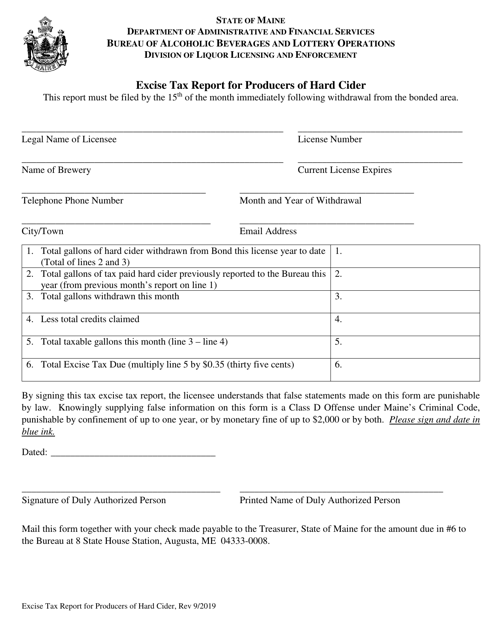

This form is used for reporting excise taxes by producers of hard cider in the state of Maine.