Tax Report Templates

Documents:

943

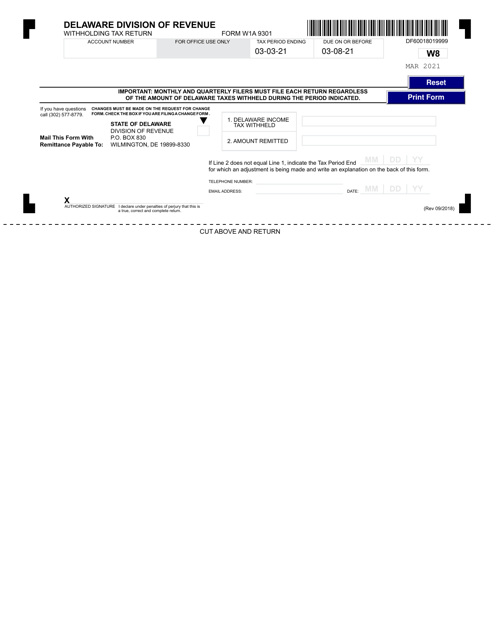

This document is used for reporting monthly withholding taxes in the state of Delaware for the month of March.

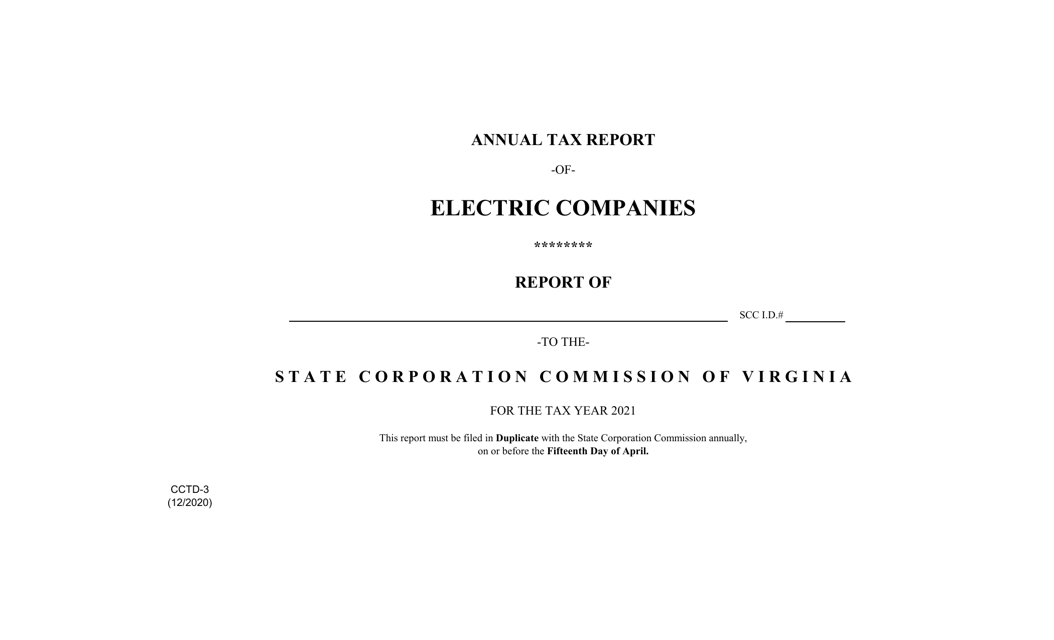

This form is used for the annual tax reporting of electric companies operating in the state of Virginia.

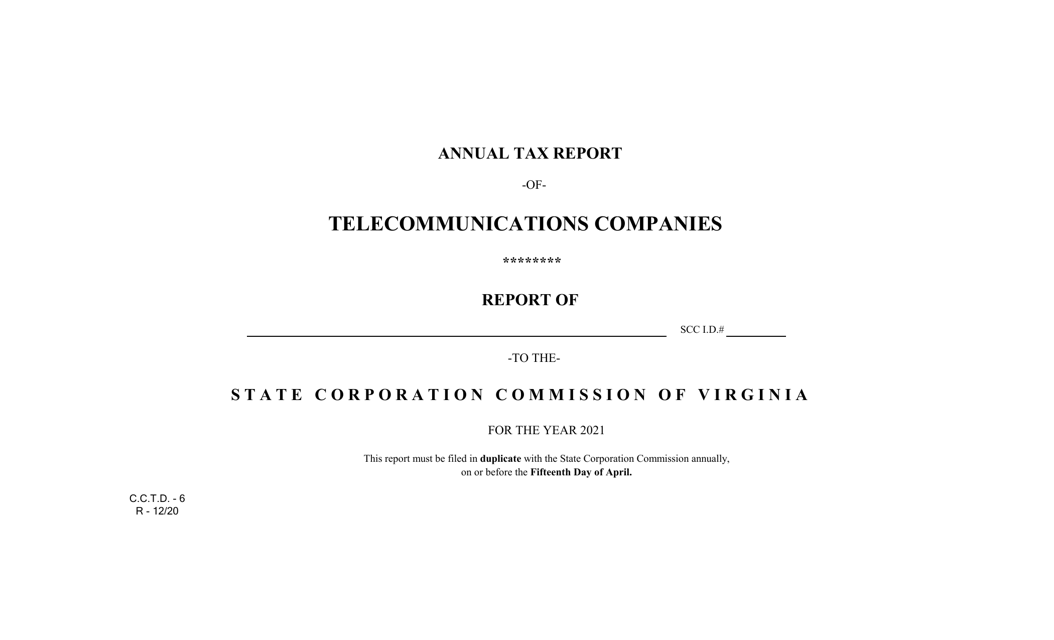

This form is used for filing the annual tax report of telecommunications companies in the state of Virginia.

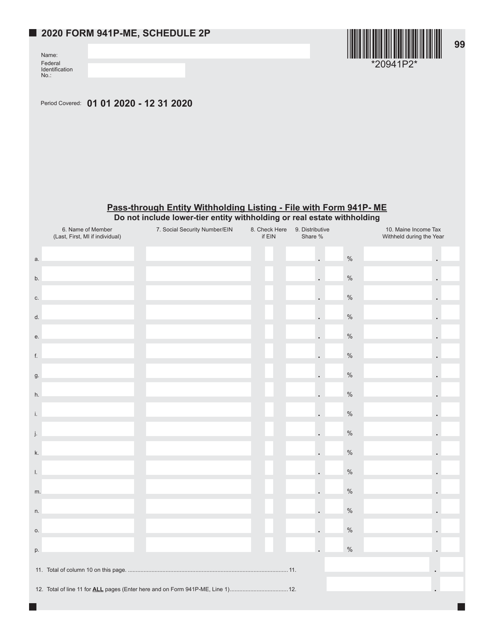

This type of document is used for listing withholding information for Maine state taxes on Form 941P-ME Schedule 2P.

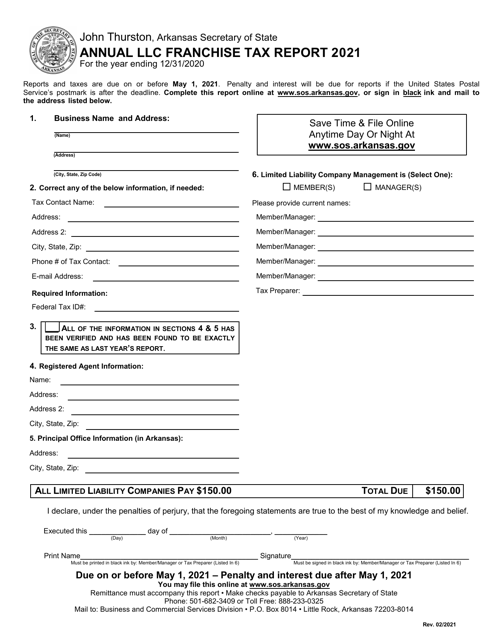

This document is the Final Franchise Tax Report for businesses in the state of Arkansas. It is used to report and pay the final franchise tax for the year.

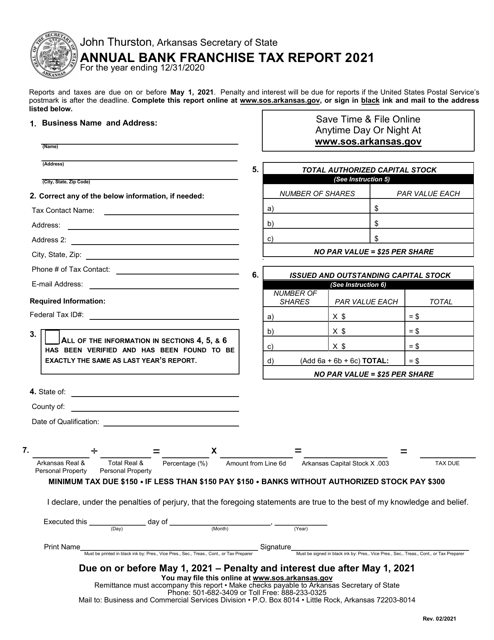

This document is used for reporting the annual franchise tax for banks operating in Arkansas.

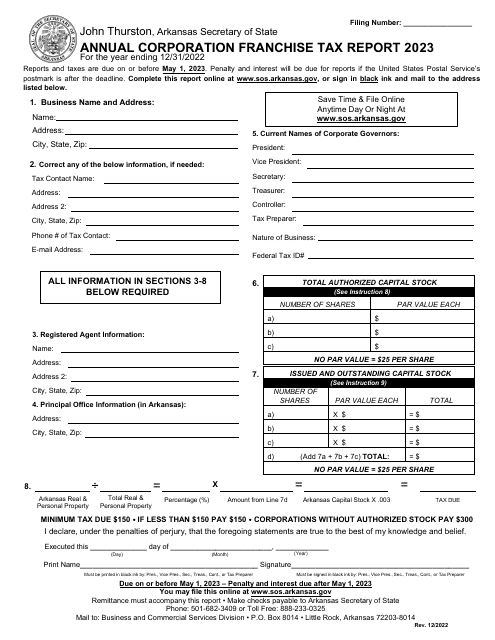

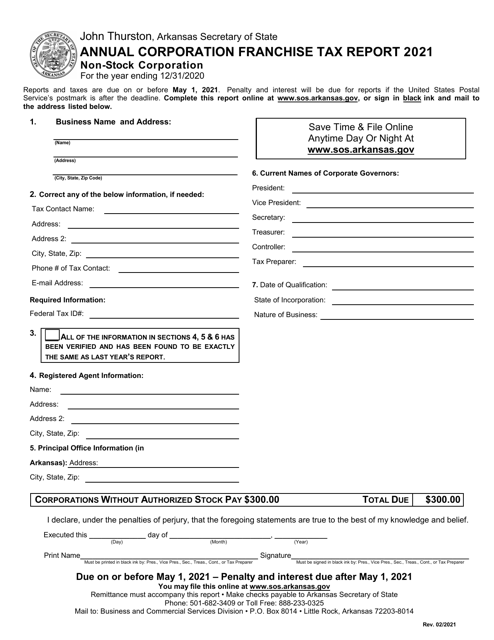

This document is for non-stock corporations in Arkansas to report their annual franchise taxes. Non-stock corporations are typically nonprofit organizations or professional associations.

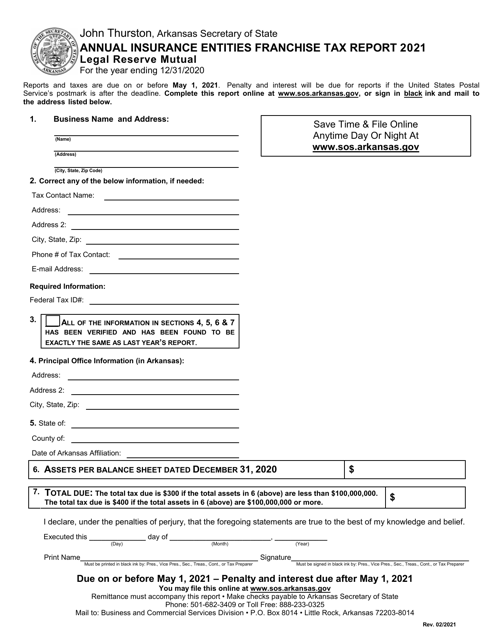

This Form is used for filing the Annual Insurance Entities Franchise Tax Report for Legal Reserve Mutual insurance companies in the state of Arkansas.

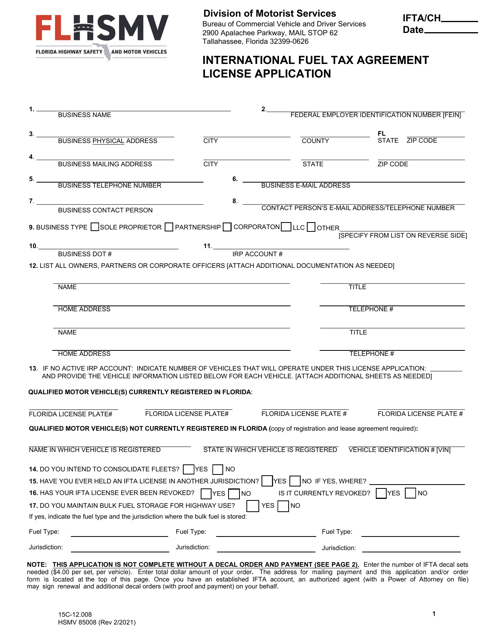

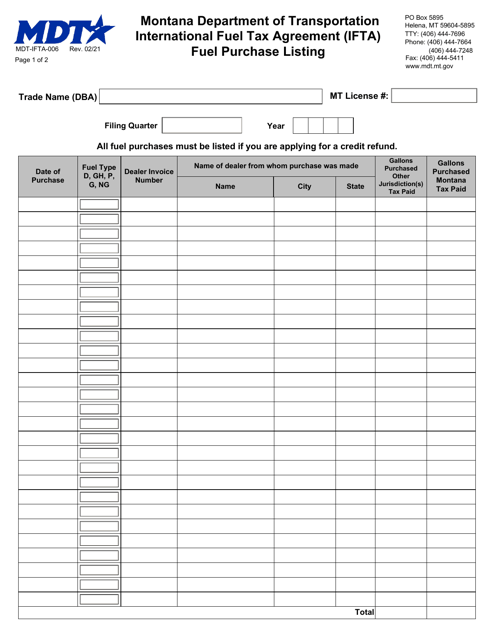

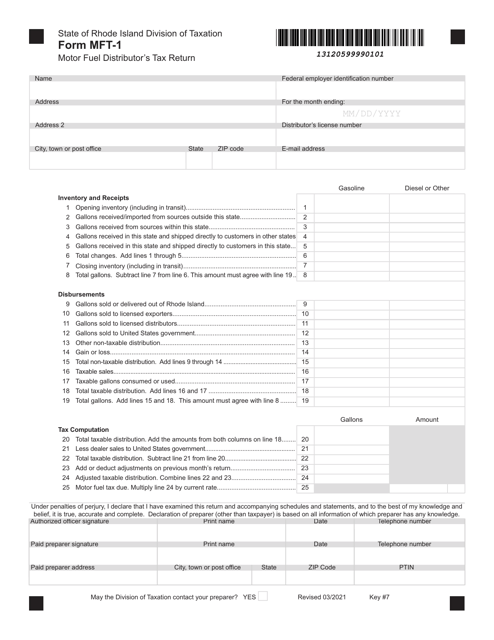

This Form is used for reporting fuel purchases made under the International Fuel Tax Agreement (IFTA) in the state of Montana.

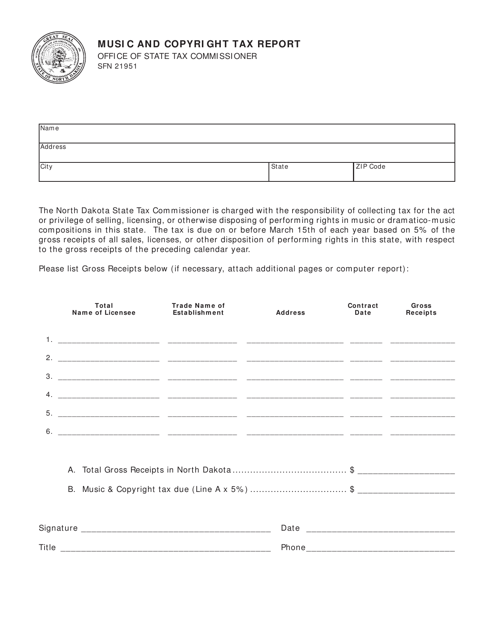

This form is used for reporting music and copyright taxes in North Dakota.

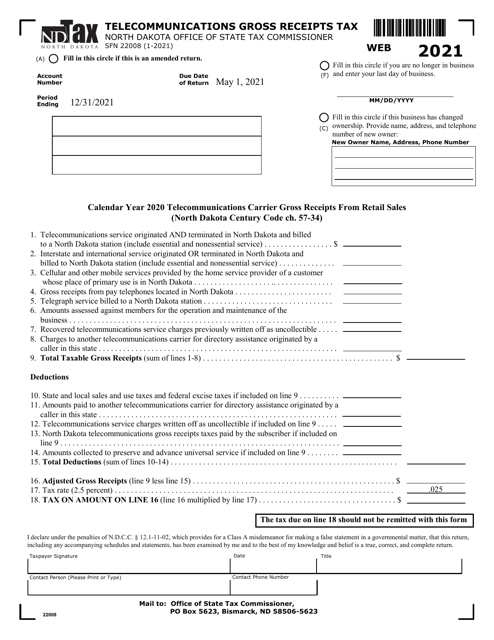

This form is used for calculating and reporting the telecommunications gross receipts tax in North Dakota.

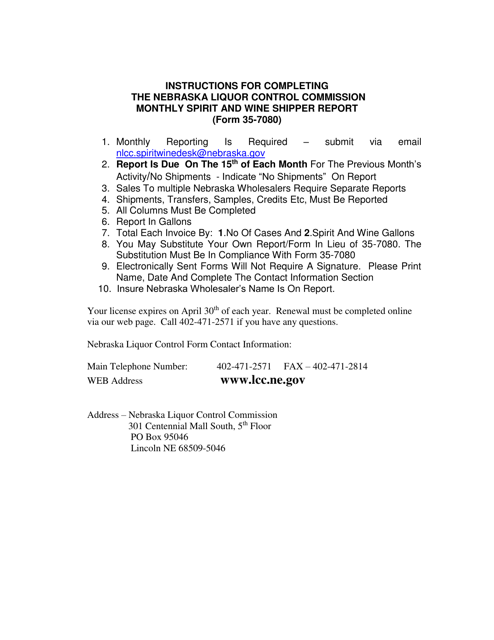

This document is used for reporting monthly sales and inventory of spirits and wine in Nebraska. It provides instructions on how to fill out Form 35-7080.

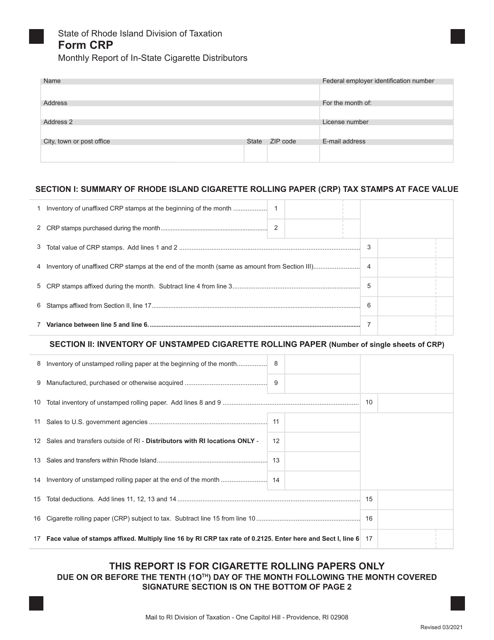

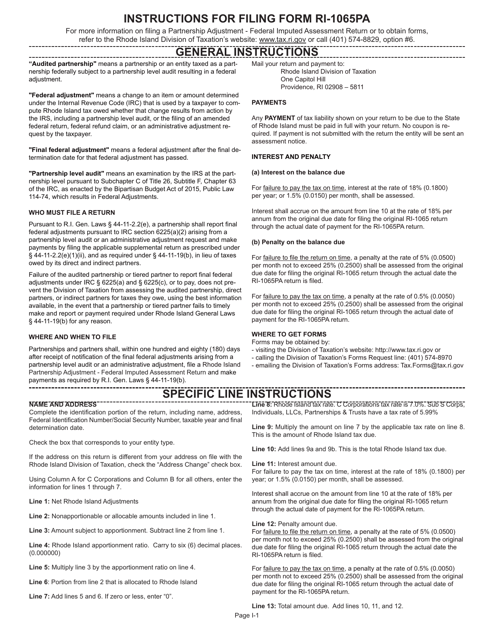

This document provides instructions for completing Form RI-1065PA Partnership Adjustment for Federal Imputed Assessment in Rhode Island.

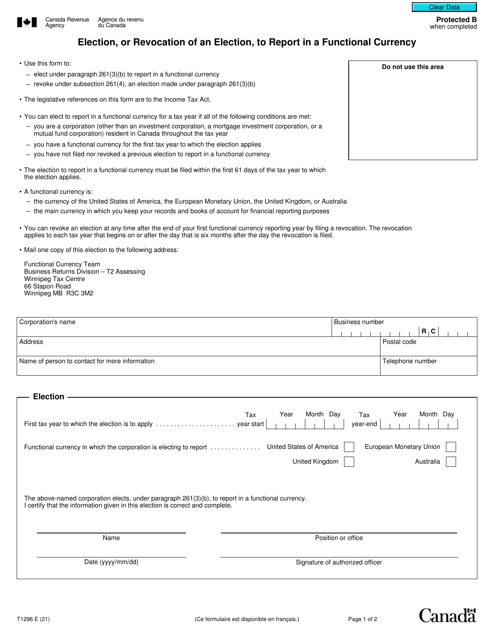

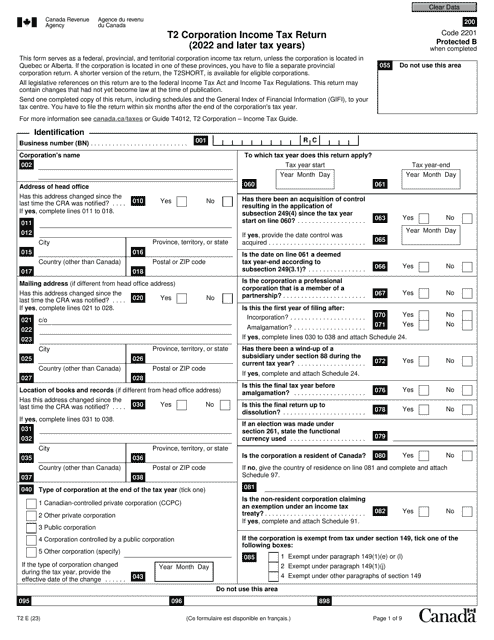

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

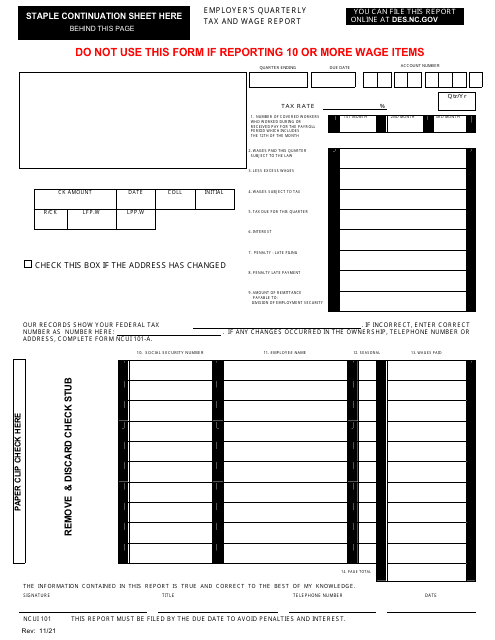

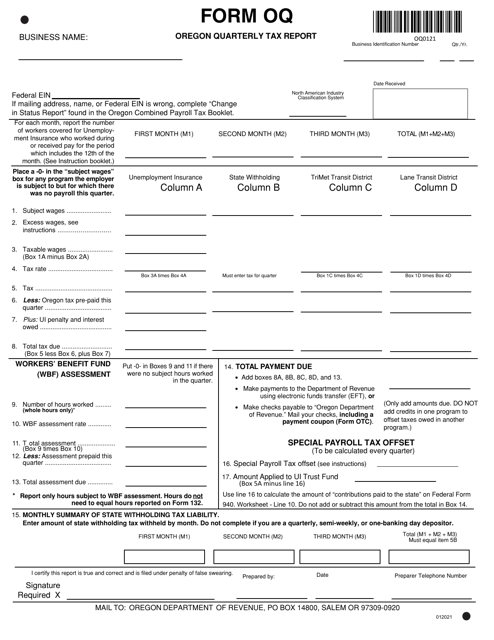

This Form is used for reporting quarterly taxes in the state of Oregon.

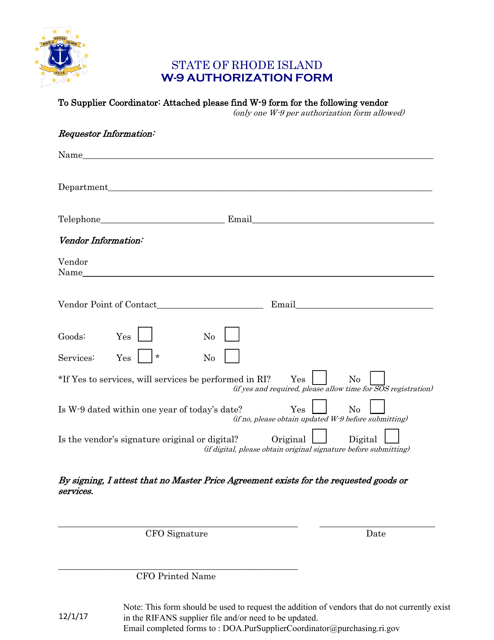

This document authorizes the withholding of taxes in Rhode Island.

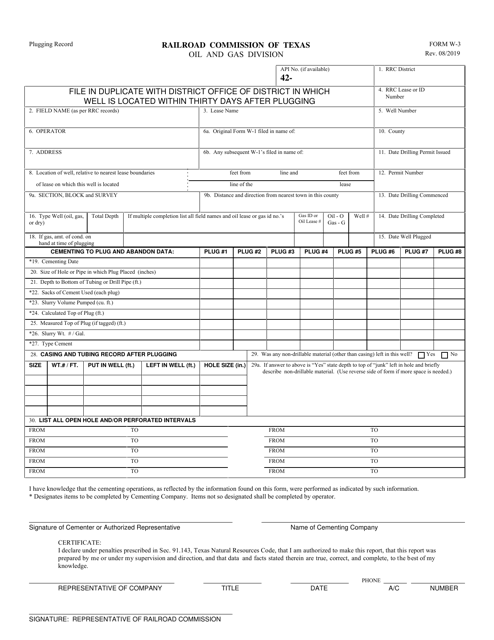

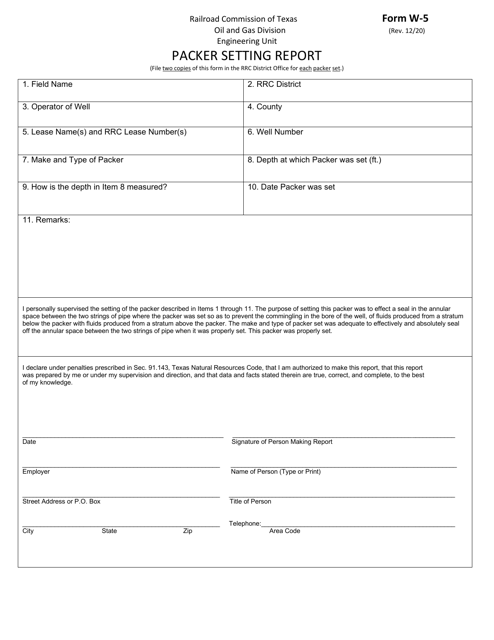

This form is used for record keeping purposes in the state of Texas. It is specifically used for plugging records related to oil and gas wells.