Tax Report Templates

Documents:

943

This is a fiscal document completed by financial entities to specify the amount of supplementary income investors have generated during the year.

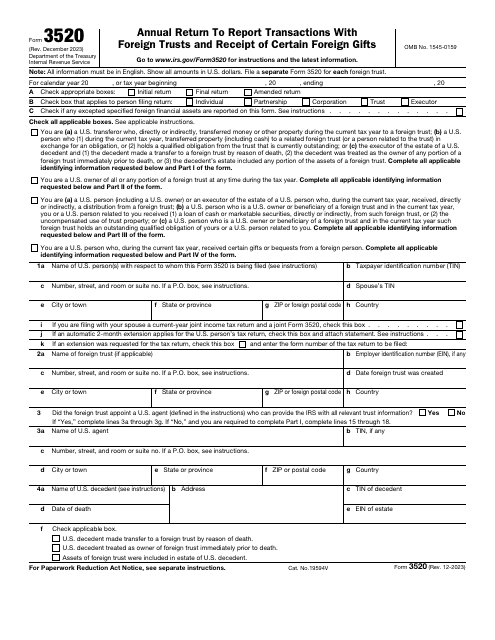

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

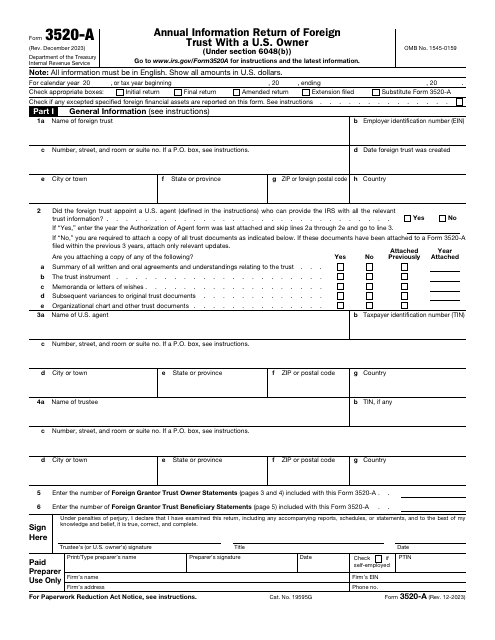

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

This is an IRS form that includes the details of an installment sale.

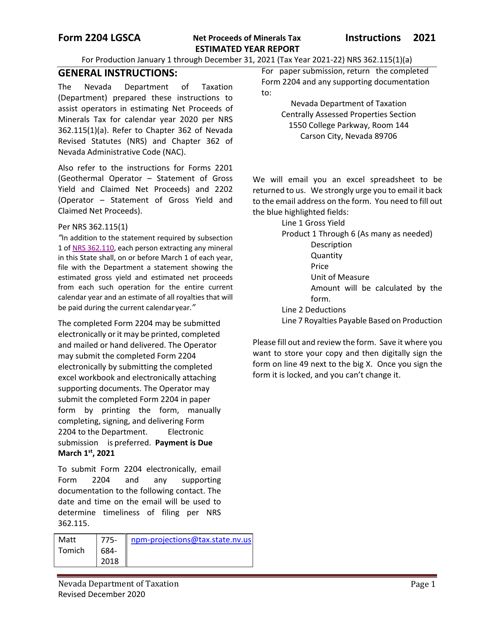

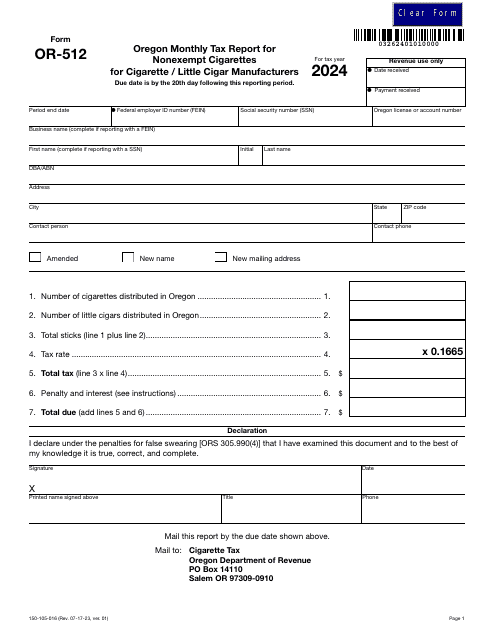

This Form is used for reporting estimated yearly net proceeds of minerals tax in Nevada.

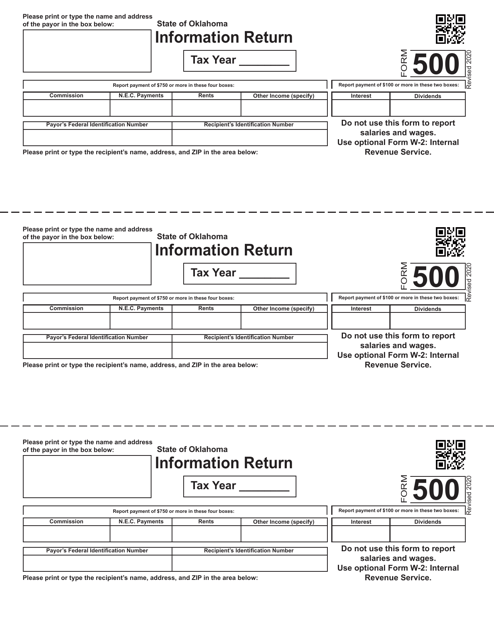

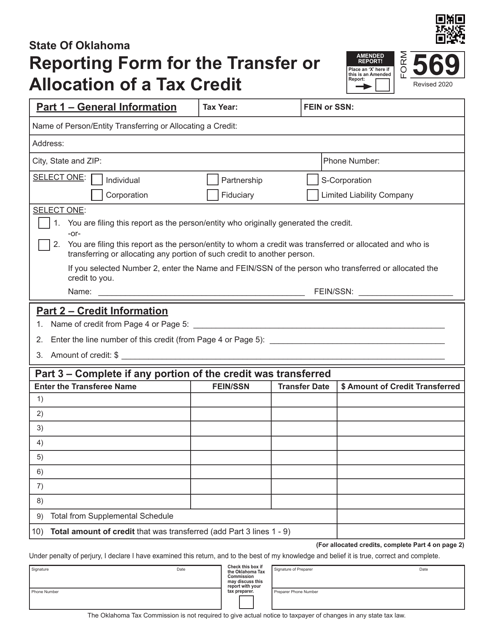

This document is used for filing an information return in the state of Oklahoma. It includes detailed information about various income sources and expenses.

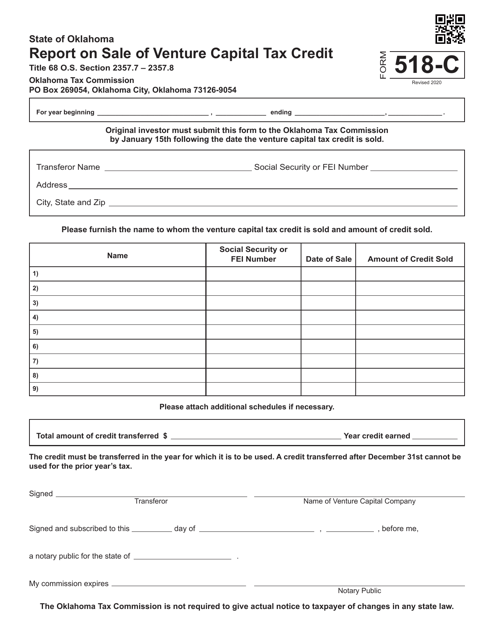

This form is used for reporting the sale of venture capital tax credit in the state of Oklahoma.

If you are an employer and have to file Form W-2, Wage and Tax Statement, you need to fill out this form. This form is needed for transmitting a paper Copy A of Form W-2, to the SSA. Make sure you supply your employees with a copy of Form W-2.

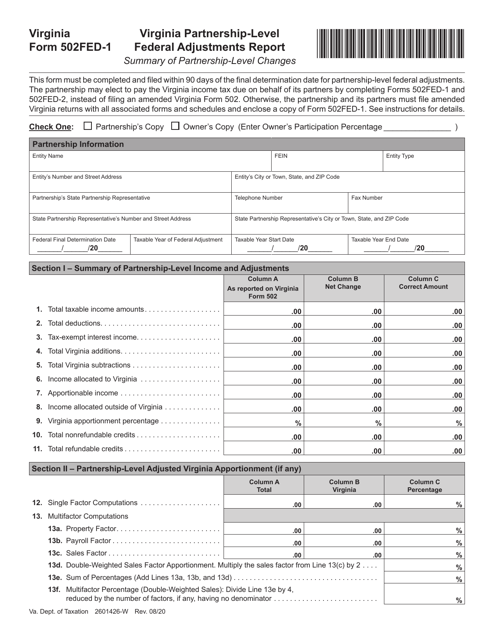

This form is used for reporting federal adjustments for partnerships in Virginia. It is specific to the state of Virginia and is used to report partnership-level federal adjustments.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.