Tax Report Templates

Documents:

943

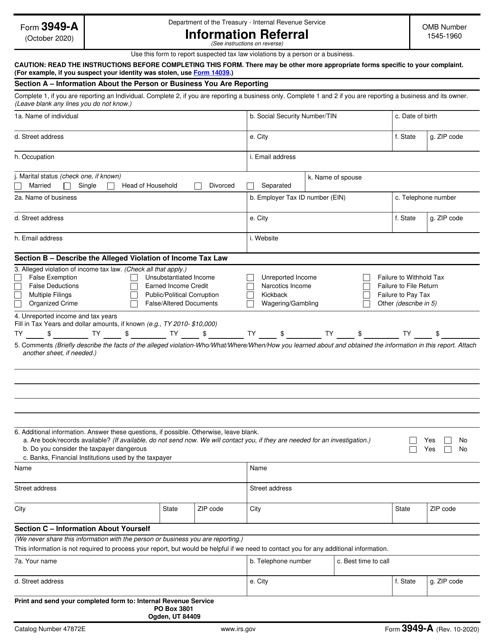

This is a fiscal IRS form any individual is free to use to report an alleged tax violation.

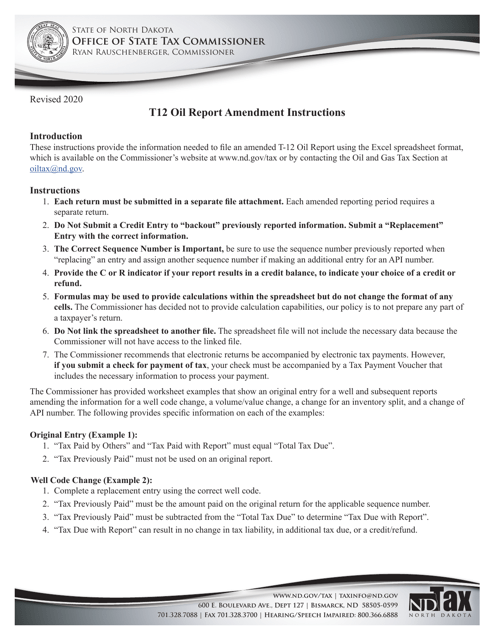

This Form is used for reporting oil gross production and oil extraction tax in North Dakota. It provides instructions on how to complete the T-12 Oil Gross Production and Oil Extraction Tax Report.

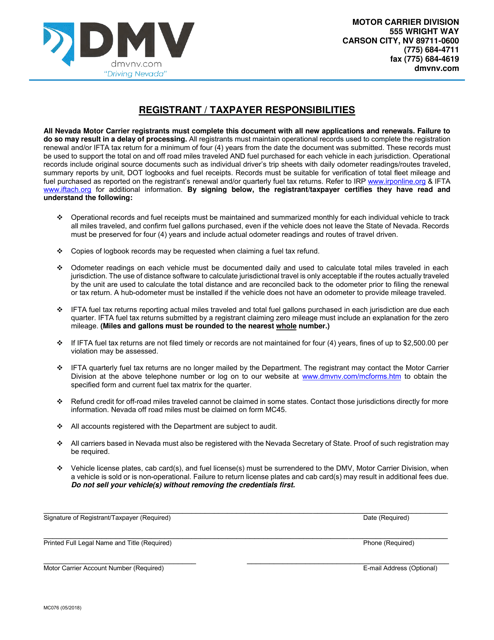

This form is used for registrants or taxpayers in Nevada to understand and fulfill their responsibilities.

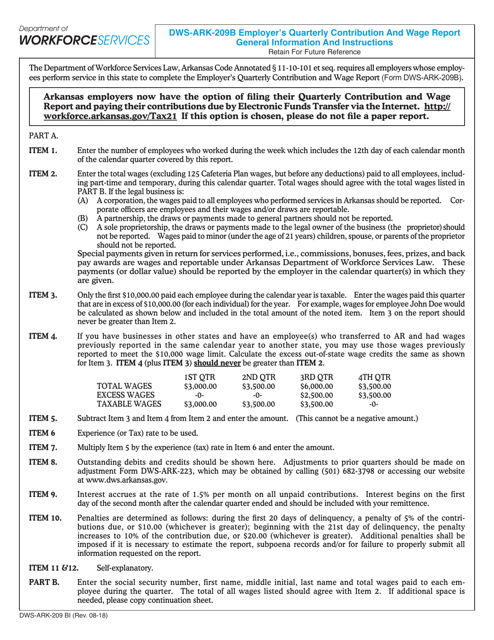

This document is used by employers in Arkansas to report their quarterly contributions and wages. It provides detailed instructions on how to fill out Form DWS-ARK-209B.

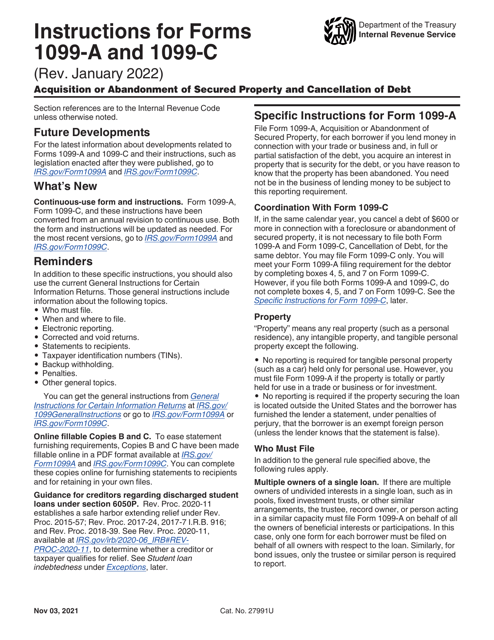

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This document is used for reporting income from foreign banks in California. It provides instructions on how to fill out Form DFPI-523.

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

This is a formal instrument used by taxpayers that need to fix the mistakes they have discovered upon filing IRS Form 941, Employer's Quarterly Federal Tax Return.

This is a formal IRS document used by entities that charge their customers a commission or fee for handling buy and sell orders to report how much capital gain or loss every client has got.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.