Tax Report Templates

Documents:

943

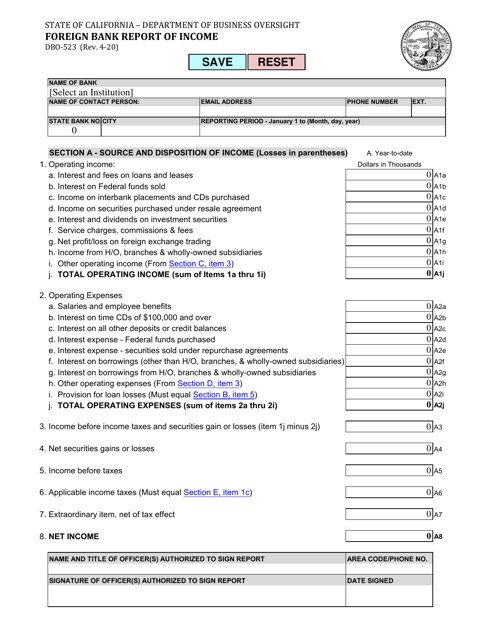

This form is used for reporting foreign bank income to the state of California.

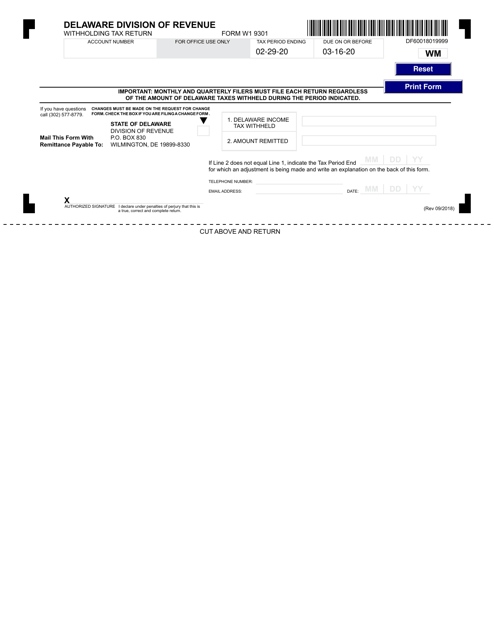

This Form is used for reporting monthly withholding taxes in the state of Delaware.

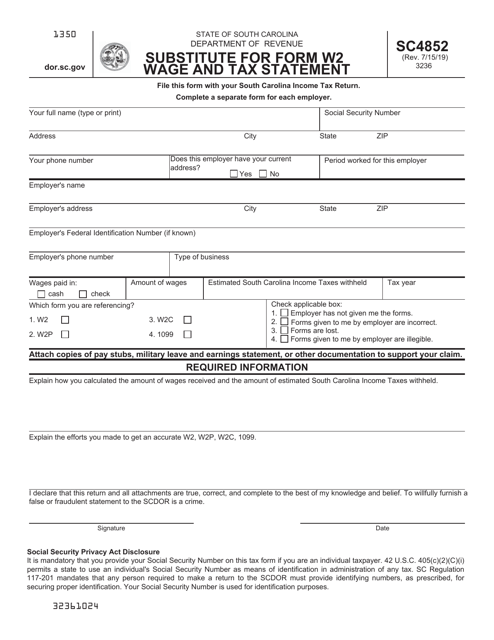

This form is used as a substitute for Form W2 Wage and Tax Statement in the state of South Carolina. It provides information on wages and taxes withheld by employers.

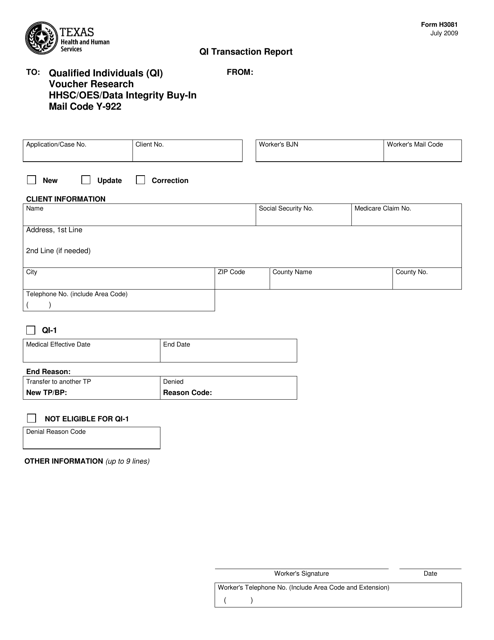

This form is used for reporting Qi transactions in the state of Texas. It provides information on the transactions made by a Qualified Intermediary (Qi) in real estate exchanges.

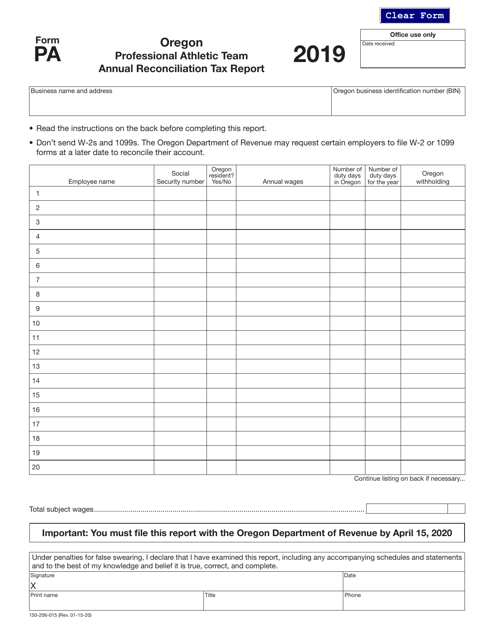

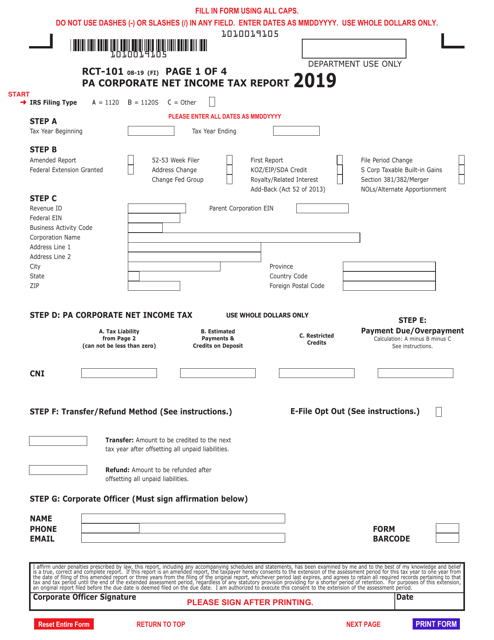

This form is used for reporting corporate net income tax in the state of Pennsylvania.

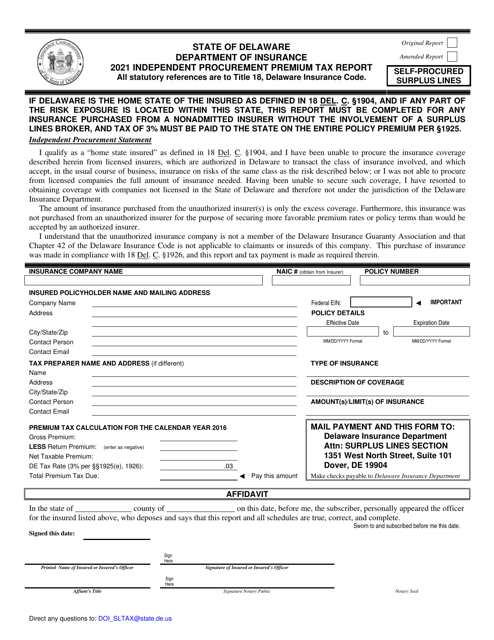

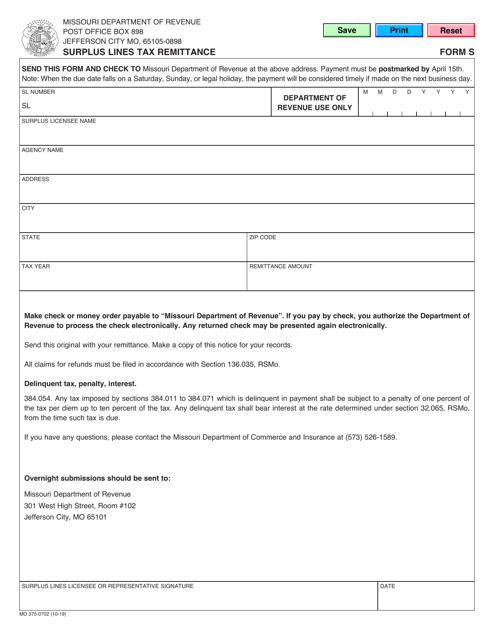

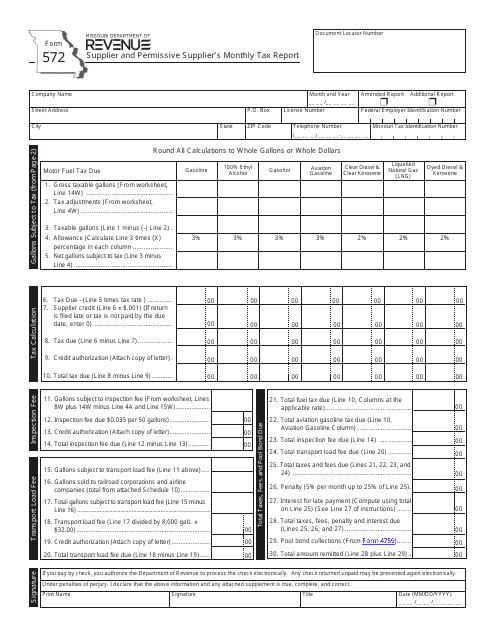

This form is used for remitting surplus lines tax in the state of Missouri.

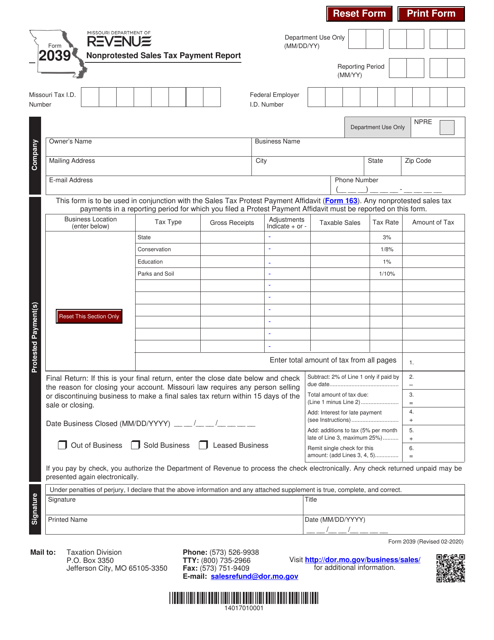

This form is used for reporting nonprotested sales tax payments in Missouri. It helps businesses accurately report and pay their sales tax obligations.

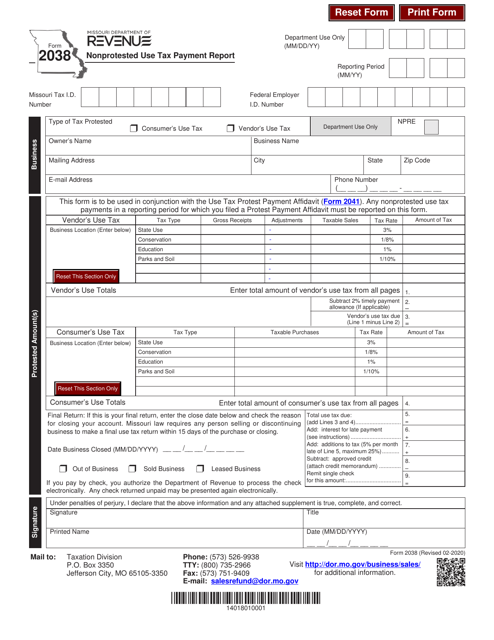

This Form is used for reporting and paying nonprotested use tax in the state of Missouri.

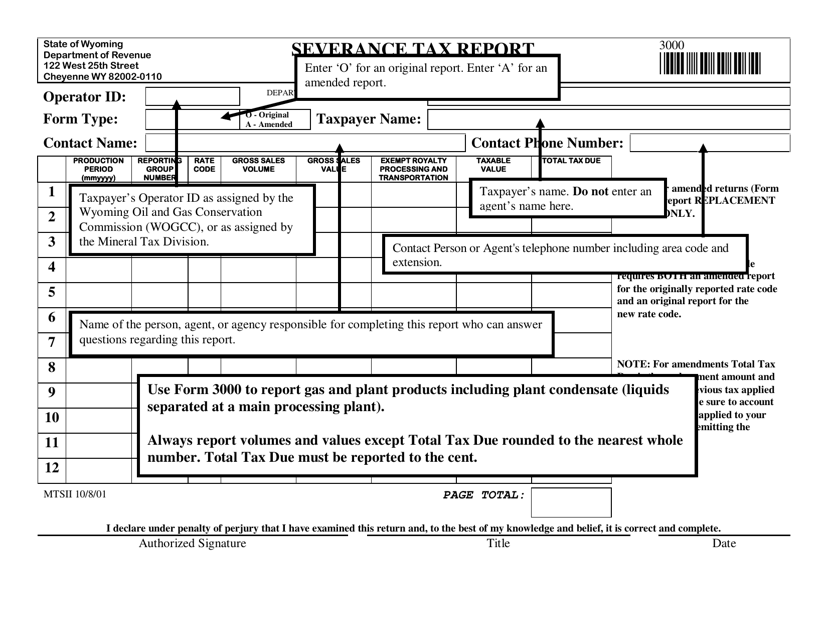

This Form is used for reporting the severance tax in the state of Wyoming. It is used by companies or individuals who are engaged in the extraction of natural resources such as oil, gas, coal, or minerals in Wyoming. The report helps the state government track and collect the appropriate severance tax revenue.

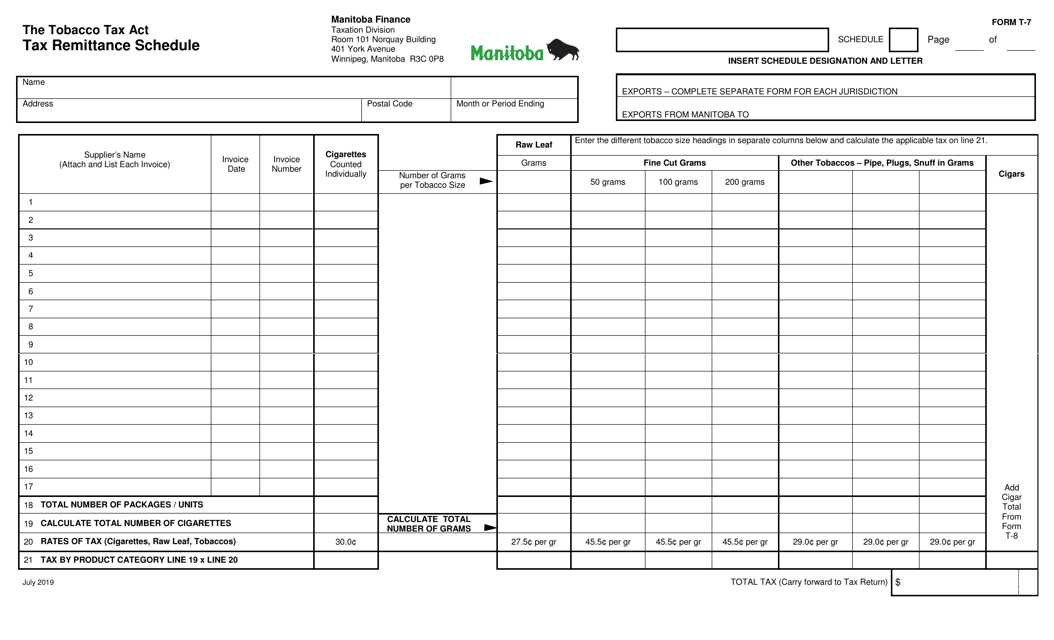

This form is used for reporting and remitting taxes in the province of Manitoba, Canada. It is necessary for businesses to accurately declare and remit taxes owed to the government on a regular schedule. Failure to do so can result in penalties and fines.

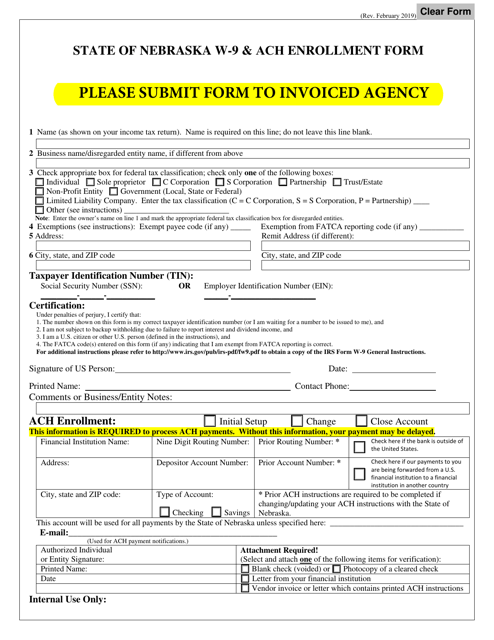

This form is used for the state of Nebraska to receive W-9 information and enroll in ACH (Automated Clearing House) payment.

This document sets the standard for the automatic exchange of financial account information among countries, as established by the Organisation for Economic Co-operation and Development (OECD). It aims to promote transparency and combat tax evasion.

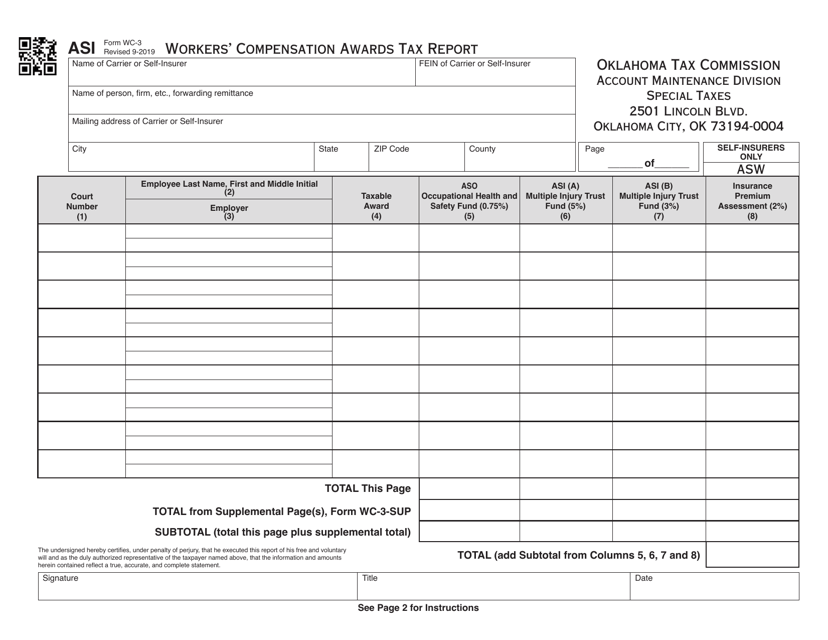

This Form is used for reporting Workers' Compensation Awards for tax purposes in the state of Oklahoma.

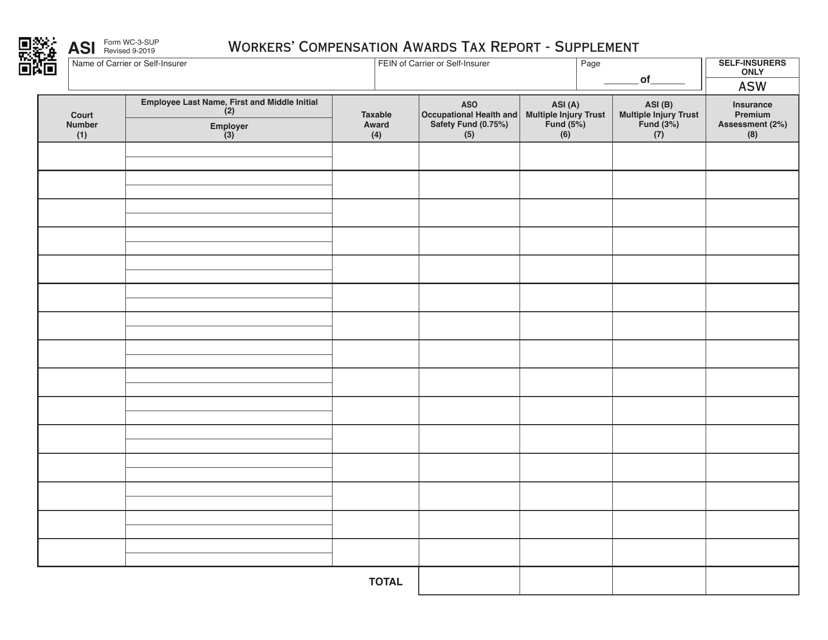

This document is a supplemental tax report used in Oklahoma for reporting workers' compensation awards.

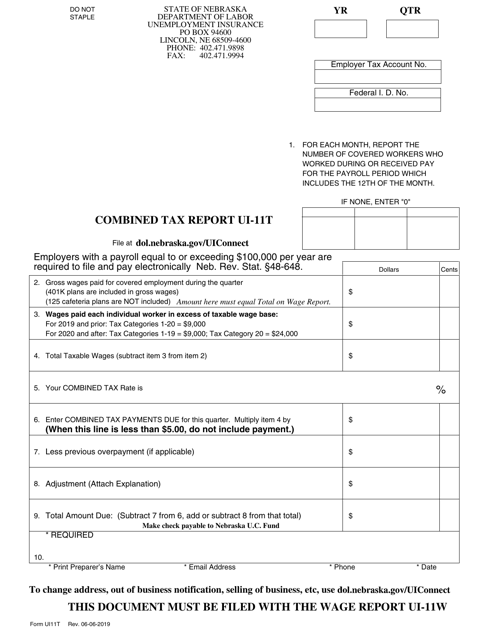

This document is used for filing a combined tax report in Nebraska. It is known as Form UI-11T.