Tax Obligation Templates

Documents:

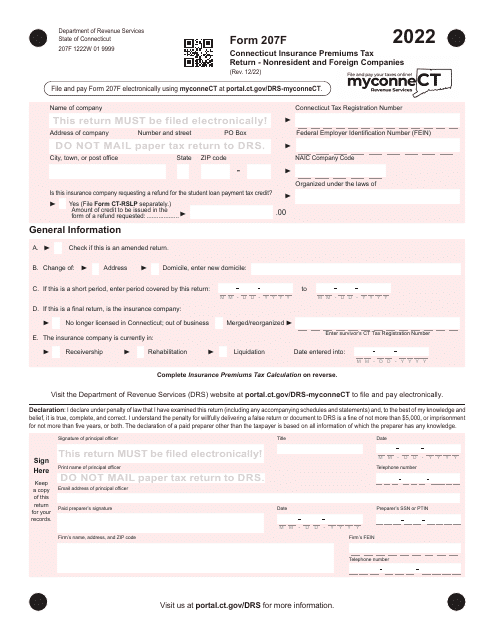

442

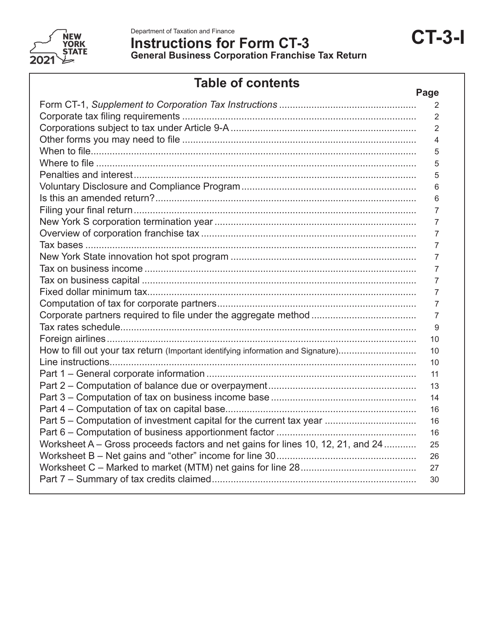

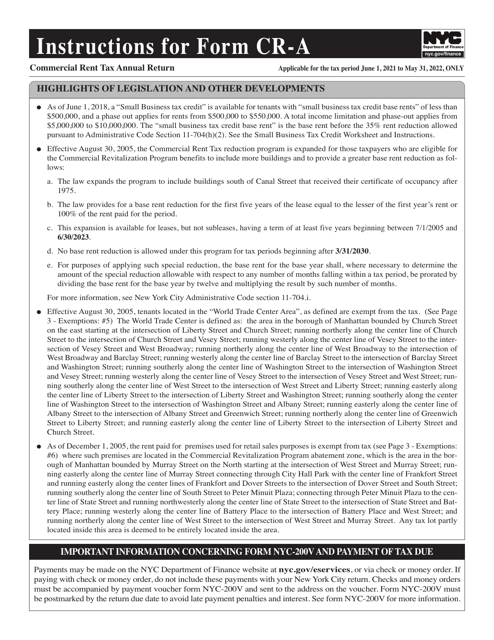

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

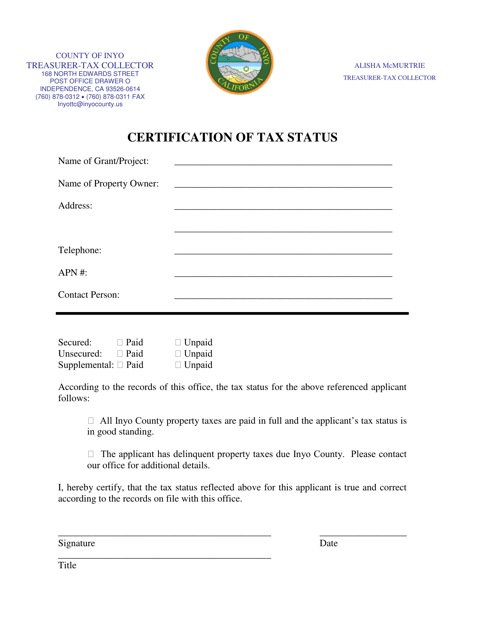

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

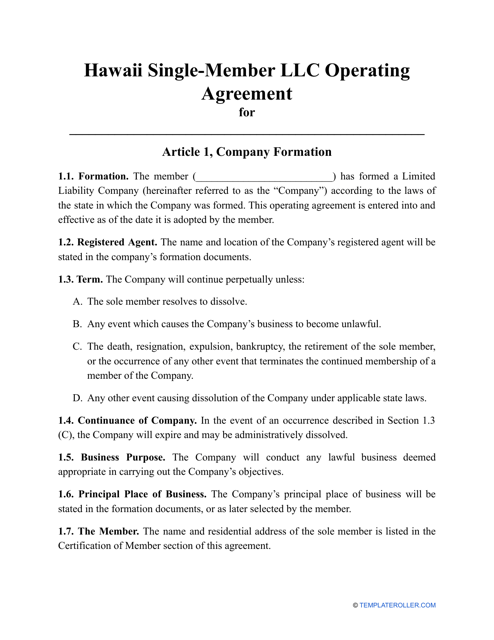

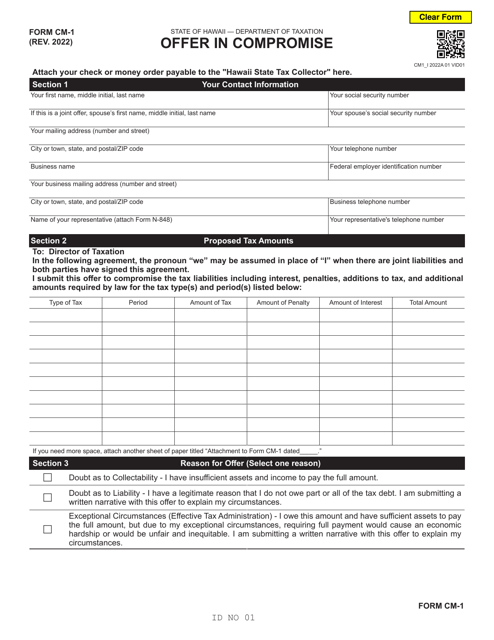

This agreement is used in Hawaii to outline details about standard day-to-day business operations as well as to establish ownership and management within a company.

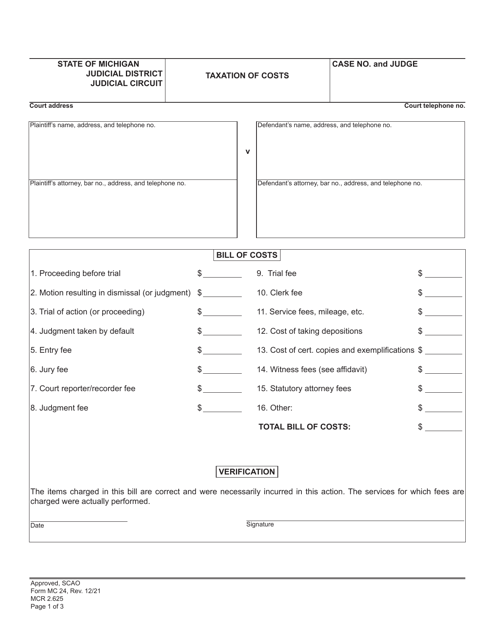

This form is used for determining the taxation of costs in Michigan. It provides a detailed breakdown of the costs that can be taxed in a legal case.

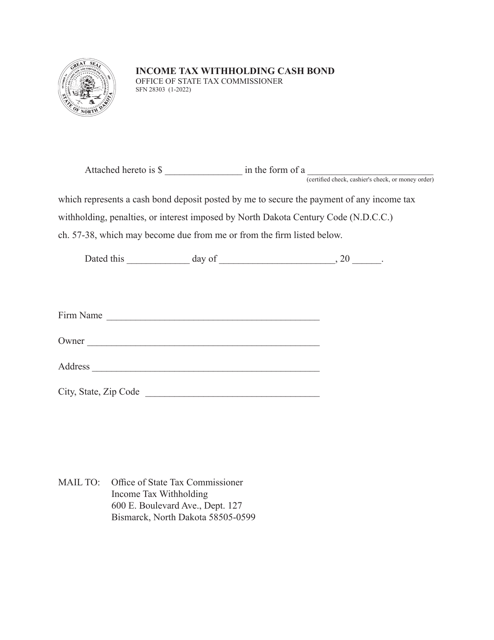

This form is used for individuals or businesses in North Dakota to provide a cash bond as a guarantee for their income tax withholding.

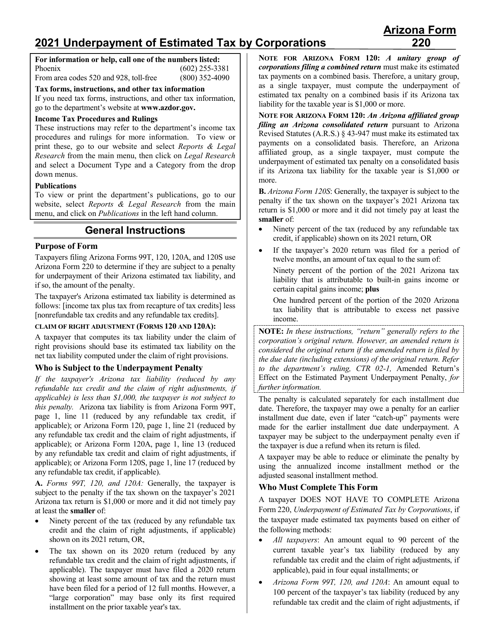

This form is used for addressing underpayment of estimated tax by corporations in Arizona. It provides instructions for filing Form 220, ADOR10342.

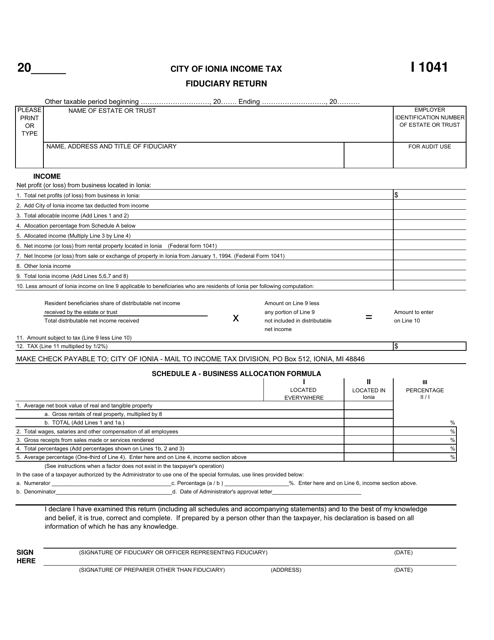

This form is used for filing the Fiduciary Return for the City of Ionia, Michigan. It is specifically for individuals who are acting as fiduciaries for an estate or trust in the city of Ionia, Michigan.

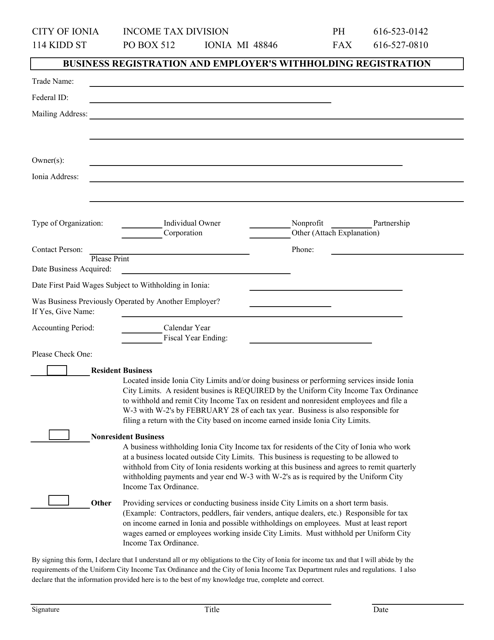

This document is used for registering a business and obtaining an employer's withholding registration in the city of Ionia, Michigan.

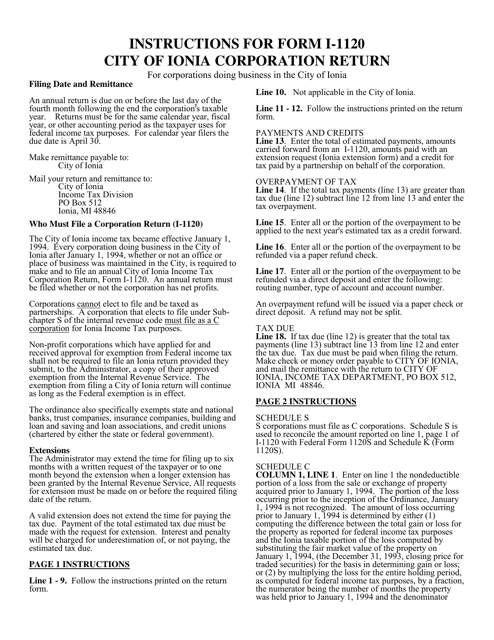

This Form is used for filing the Corporation Income Tax Return for businesses in the City of Ionia, Michigan. It includes instructions on how to accurately report income, deductions, and credits for the tax year.

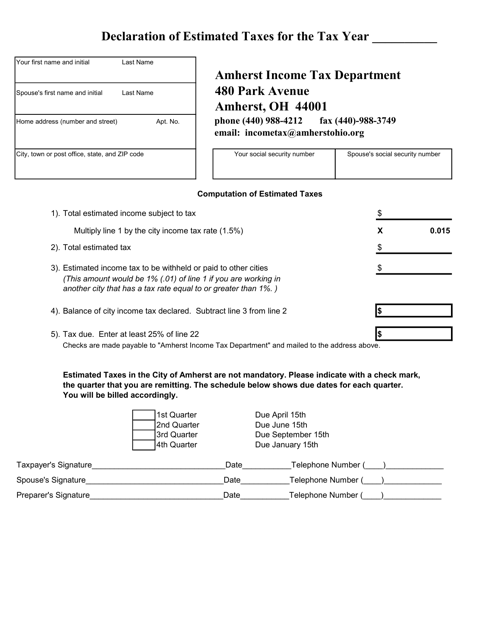

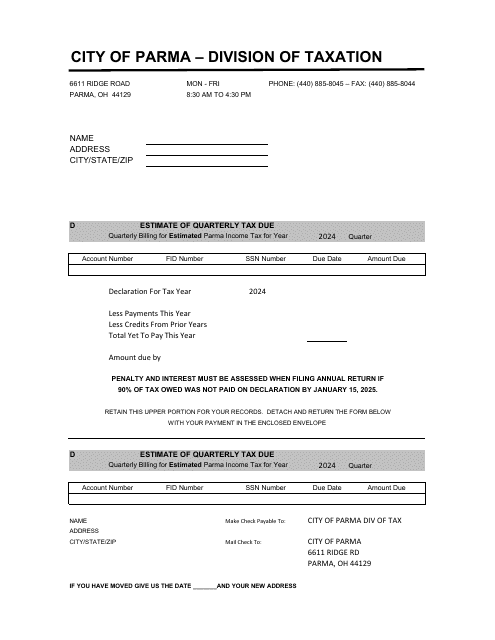

This document is used for declaring estimated taxes in Amherst, Ohio.

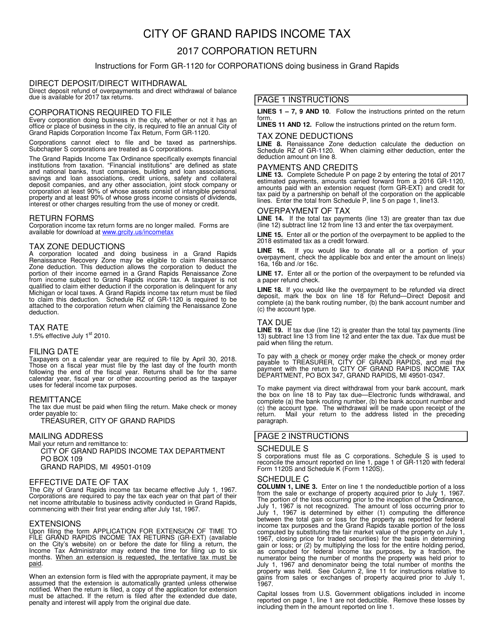

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

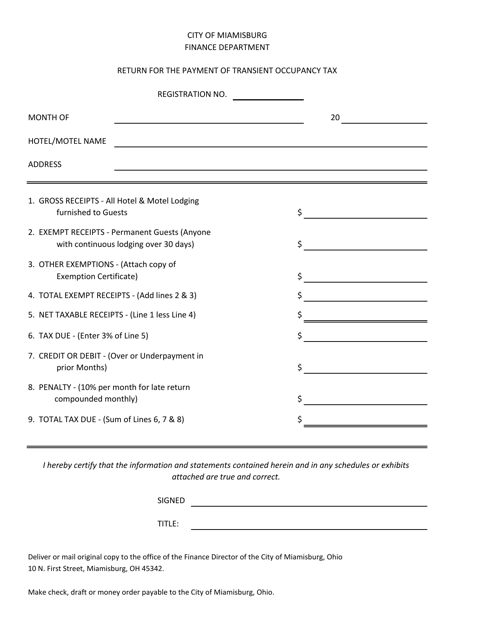

This form is used for reporting and submitting payment for the transient occupancy tax in the City of Miamisburg, Ohio.

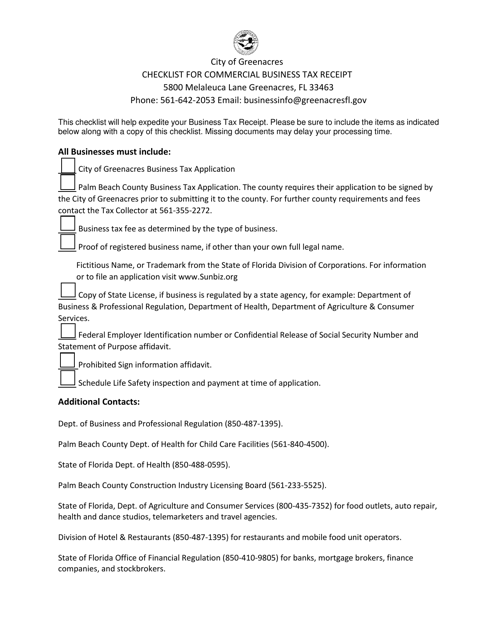

This document is a checklist for applying for a Commercial Business Tax Receipt in the City of Greenacres, Florida. It outlines the steps and requirements for obtaining a tax receipt for commercial businesses in the city.

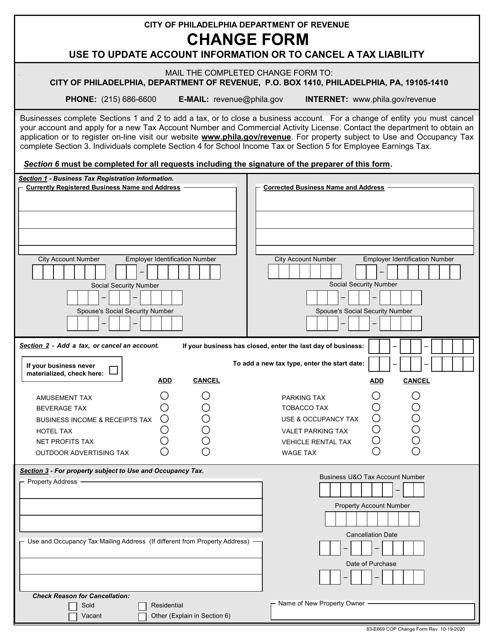

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

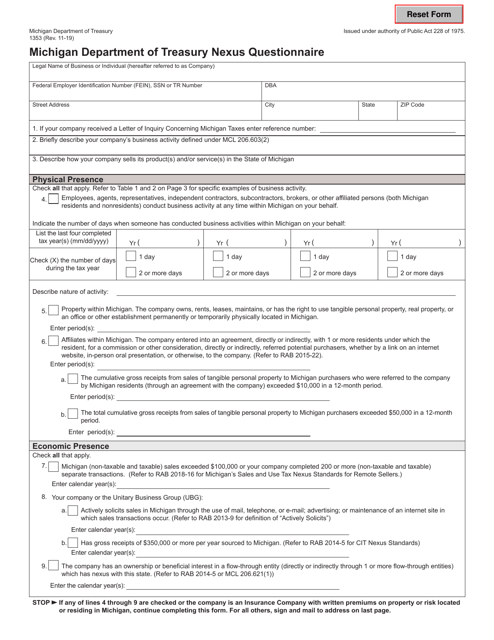

This form is used for the Nexus Questionnaire required by the Michigan Department of Treasury to determine if a business has sufficient presence in Michigan to be subject to state taxes.

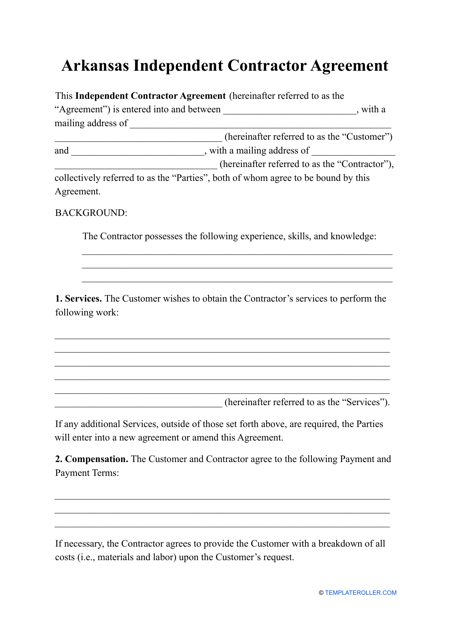

When signing this type of agreement in Arkansas, the main function of the document ensures a guarantee that the contractor will complete a specific job and will stick to the terms stipulated in the agreement.

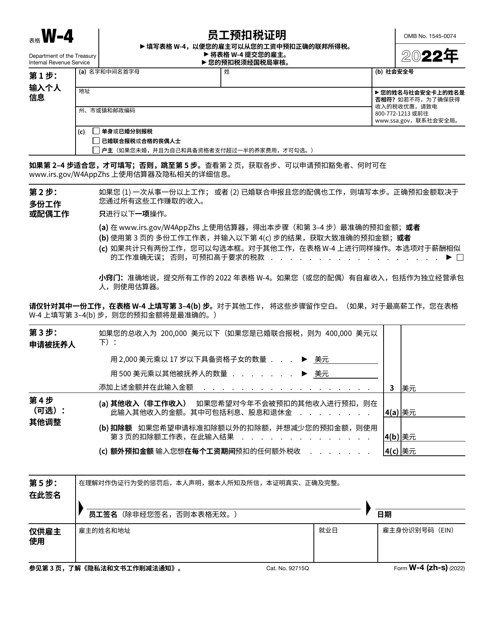

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.

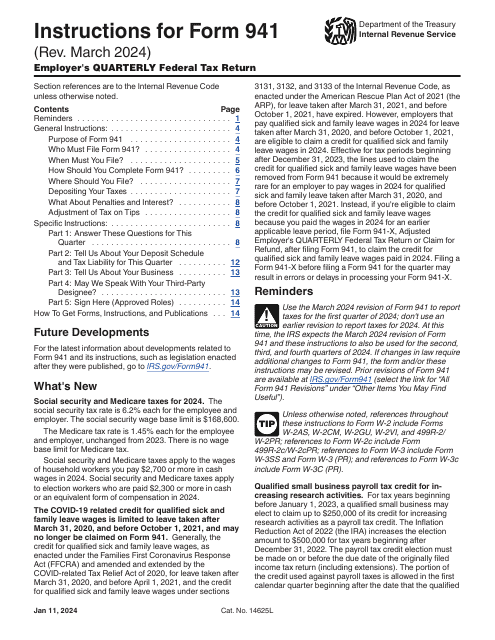

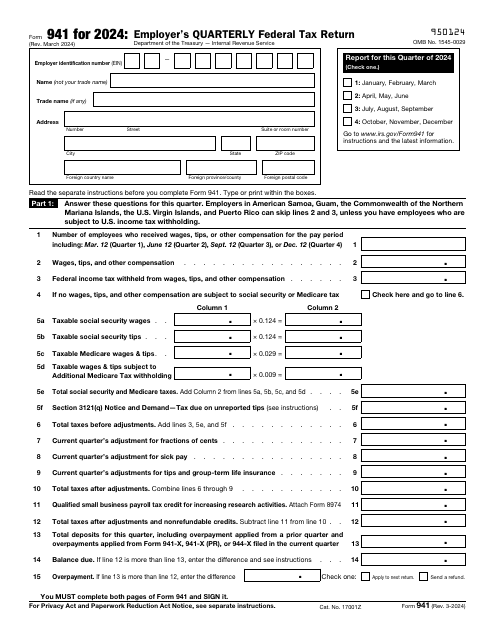

This is a formal statement used by companies to tell tax organizations about the salaries and tips their employees have received over the course of the previous quarter and the tax already subtracted from the workers' salaries.

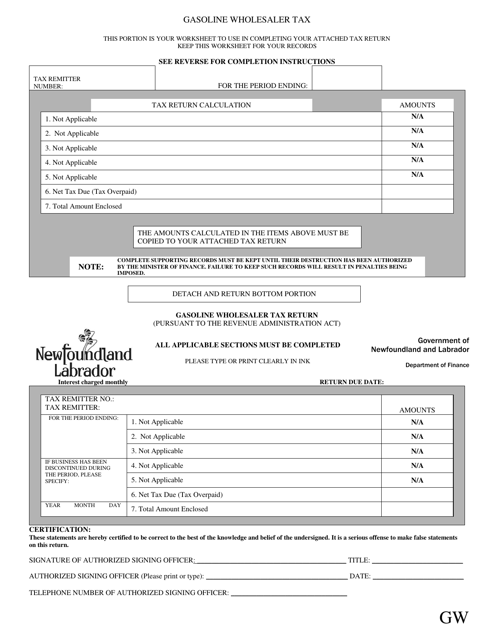

This document is for the Gasoline Wholesaler Tax in Newfoundland and Labrador, Canada. It explains the tax regulations for wholesalers who sell gasoline in the province.

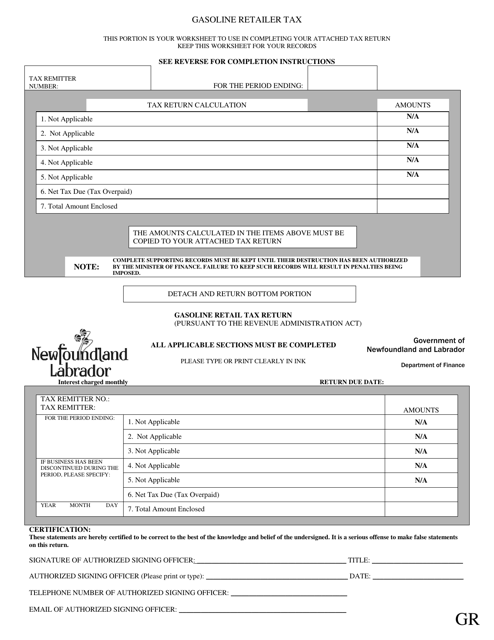

This document is used to schedule and pay the gasoline retailer tax in Newfoundland and Labrador, Canada.

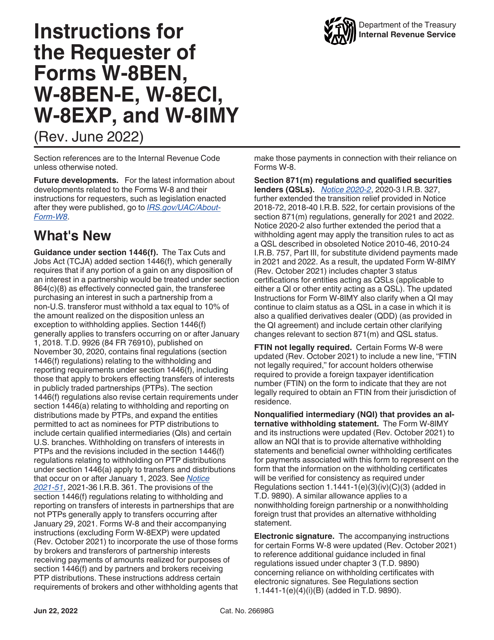

This document provides instructions for individuals or entities requesting Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. It explains how to complete these forms necessary for tax purposes.