Tax Obligation Templates

Documents:

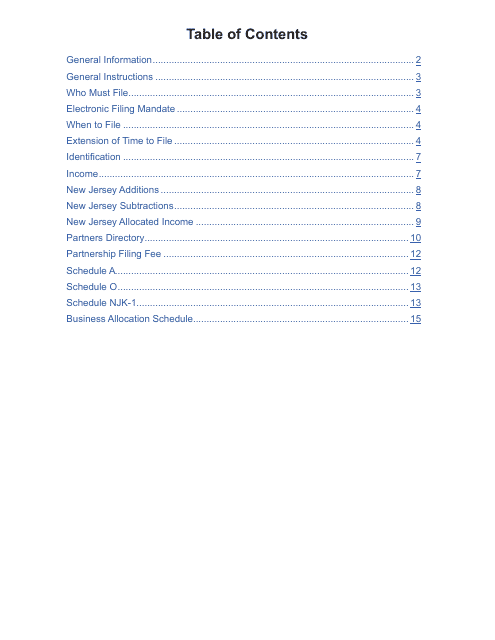

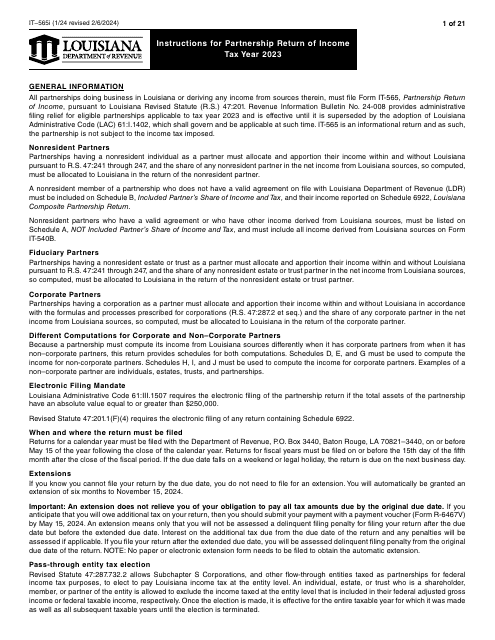

442

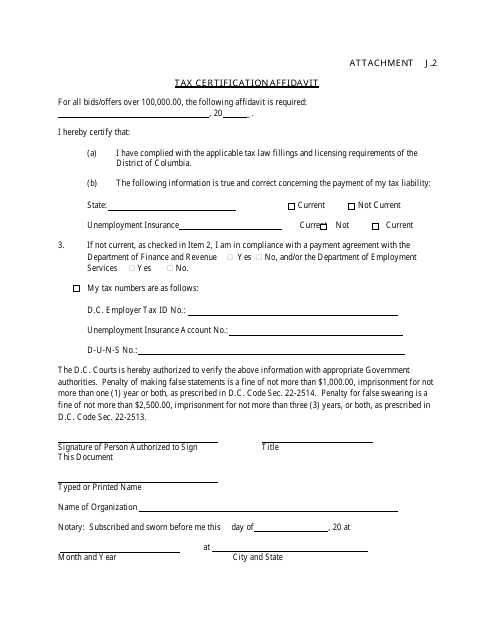

This document is for certifying tax information in Washington, D.C. It is used to confirm details related to tax obligations.

This is a formal document filed with the IRS by a domestic corporation to inform the government about their taxable income and taxes they compute annually.

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

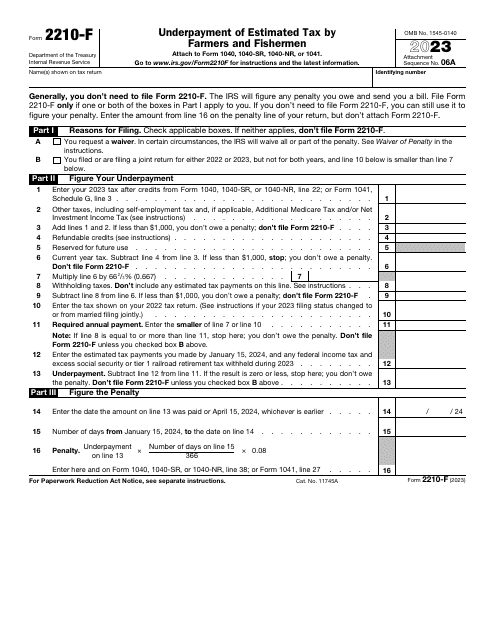

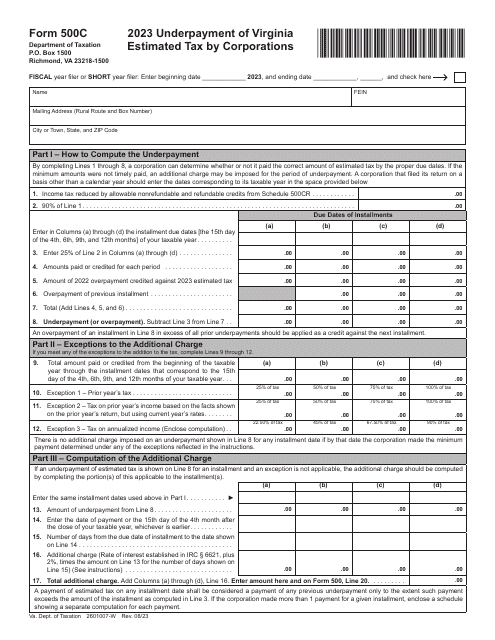

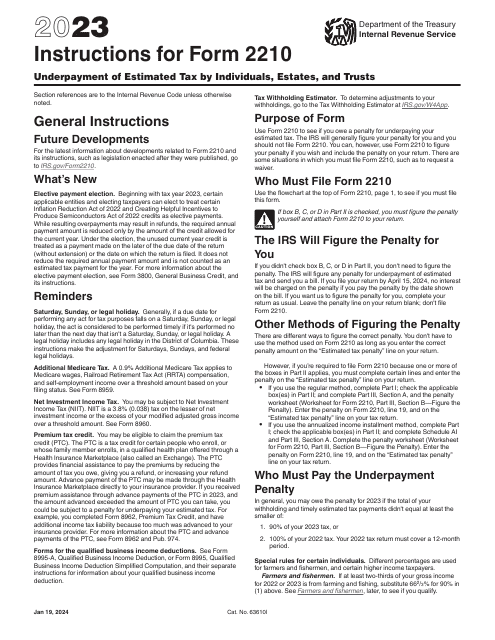

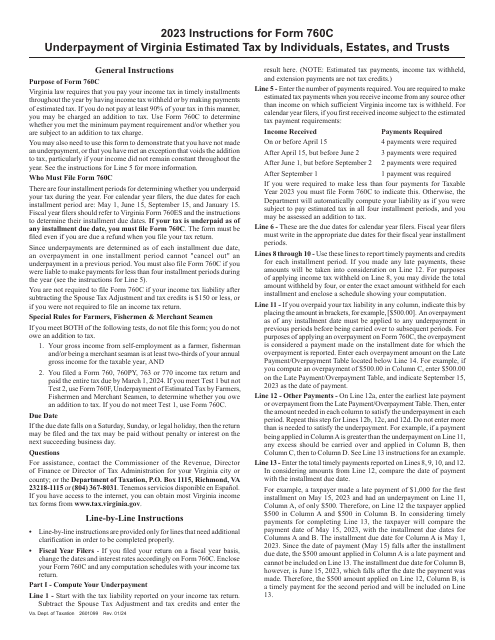

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

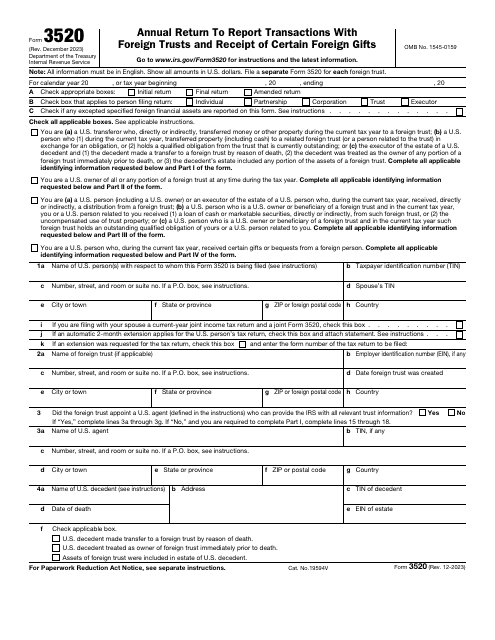

This form is a formal statement used by people and entities obliged to tell the fiscal authorities about the transactions they have had with foreign trusts throughout the year.

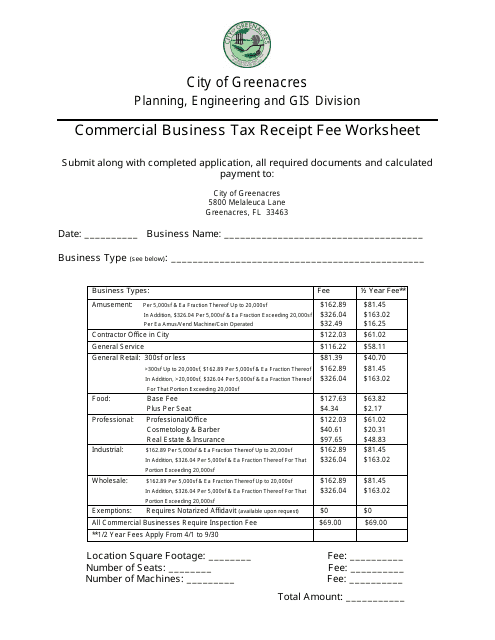

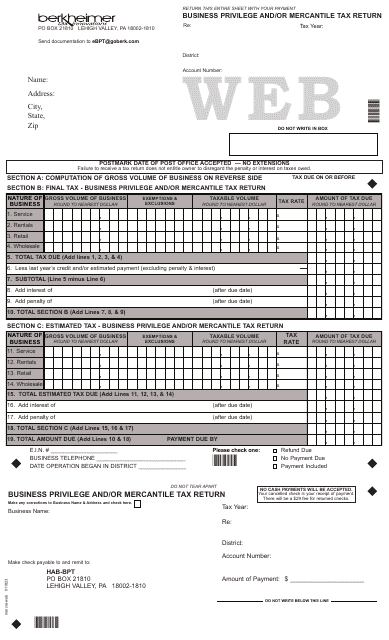

This document is used for calculating the fee for a commercial business tax receipt in the City of Greenacres, Florida.

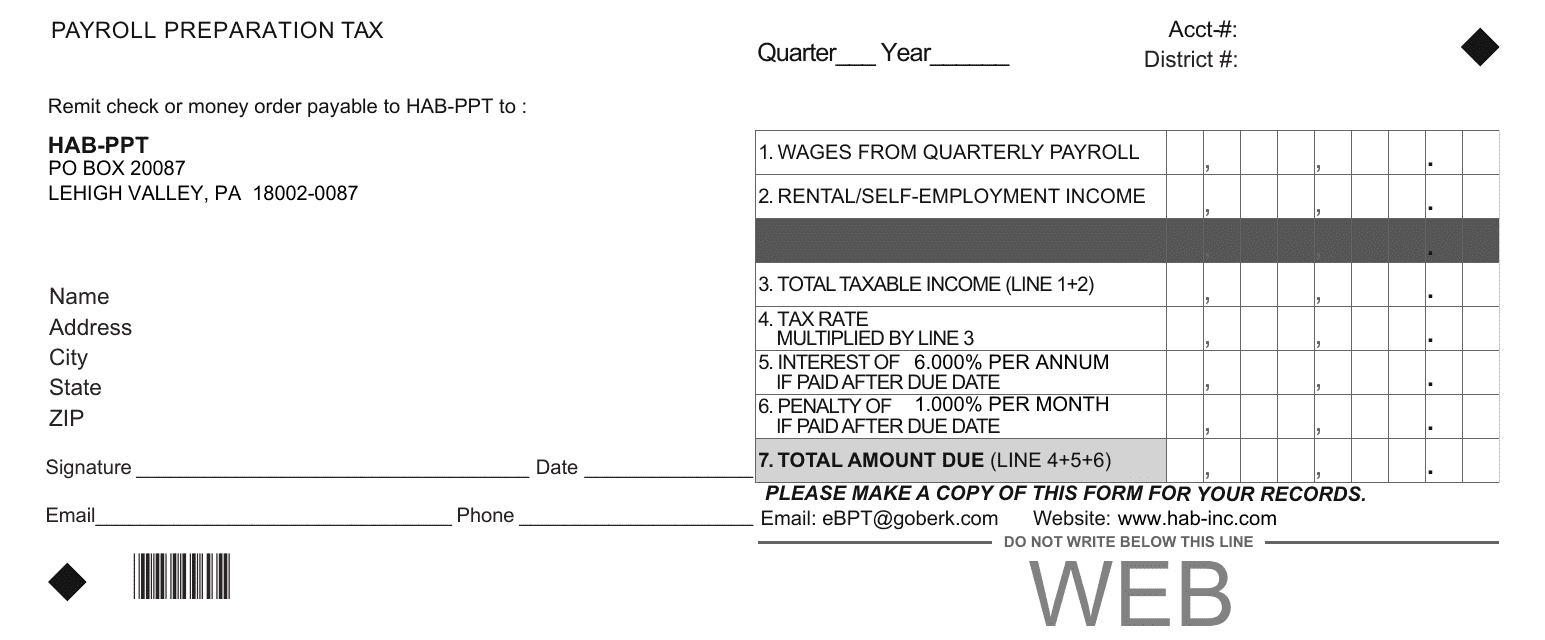

This document is for the preparation of payroll taxes in the state of Pennsylvania. It provides guidelines and instructions for calculating and filing payroll taxes for businesses operating in Pennsylvania.

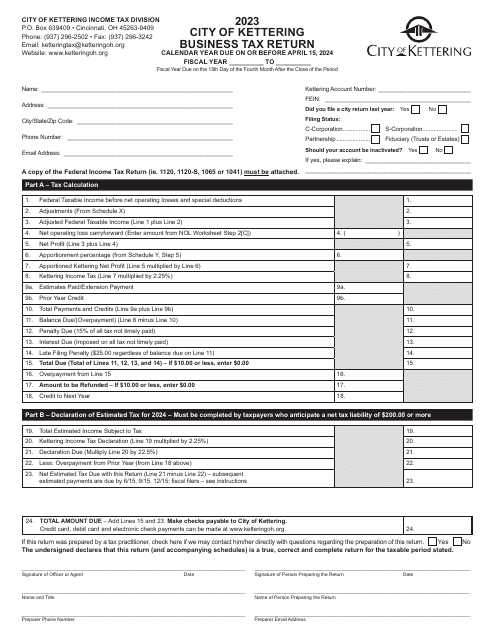

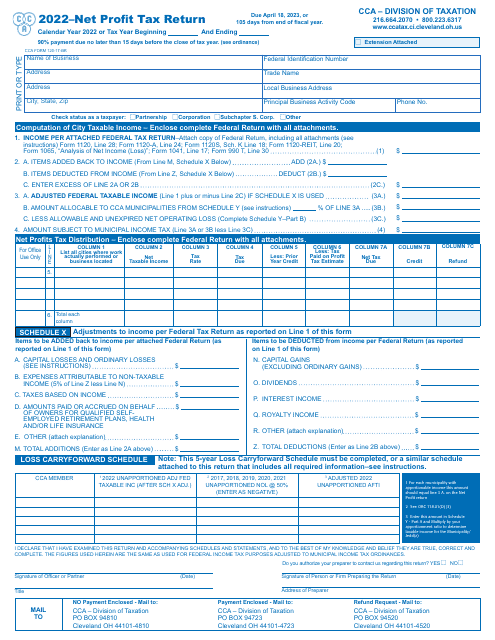

This form is used for filing the net profit tax return with the City of Cleveland, Ohio.

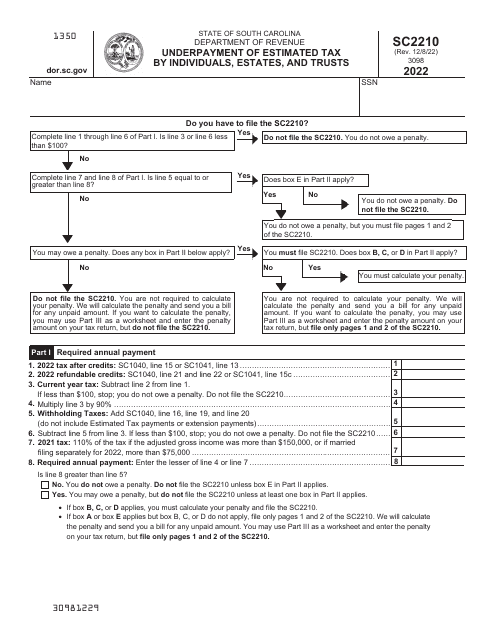

Form SC2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - South Carolina, 2022

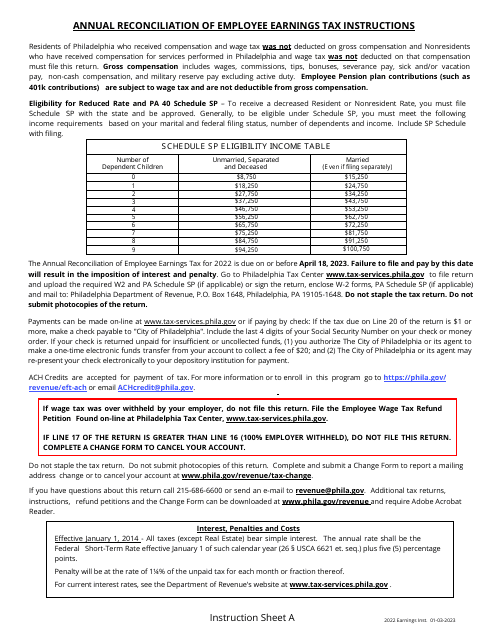

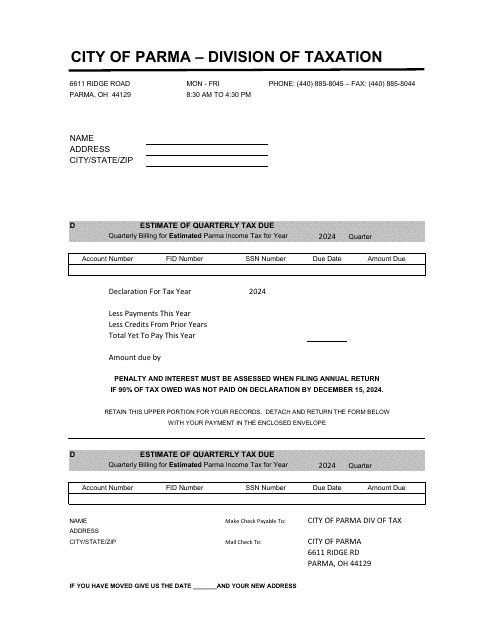

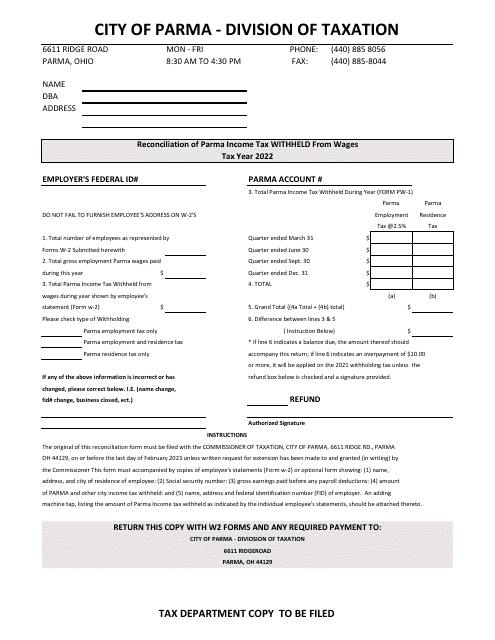

This form is used for reconciling the income tax withheld from wages in the City of Parma, Ohio.

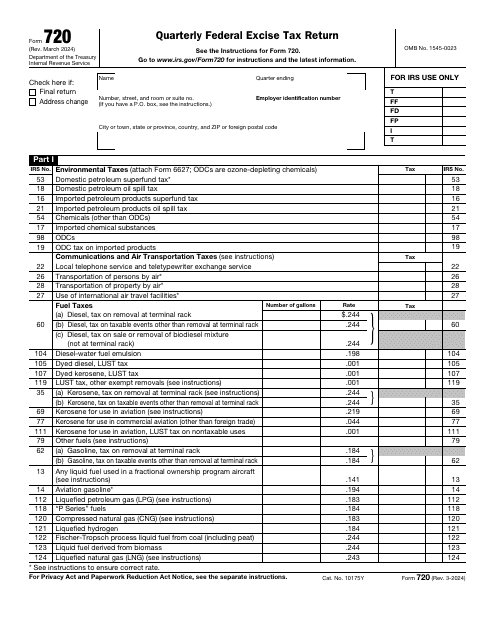

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.