Tax Obligation Templates

Documents:

442

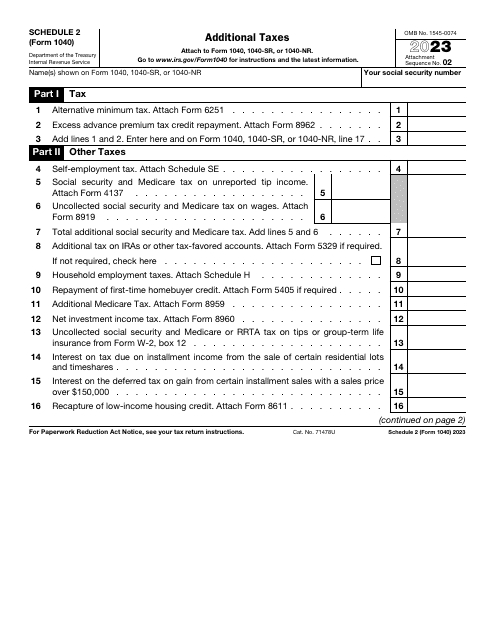

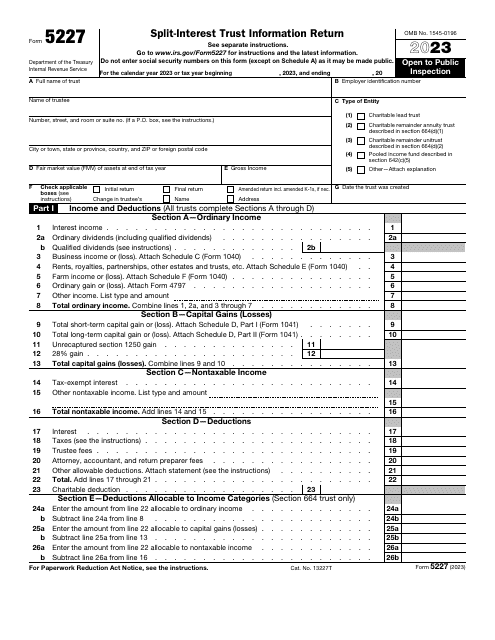

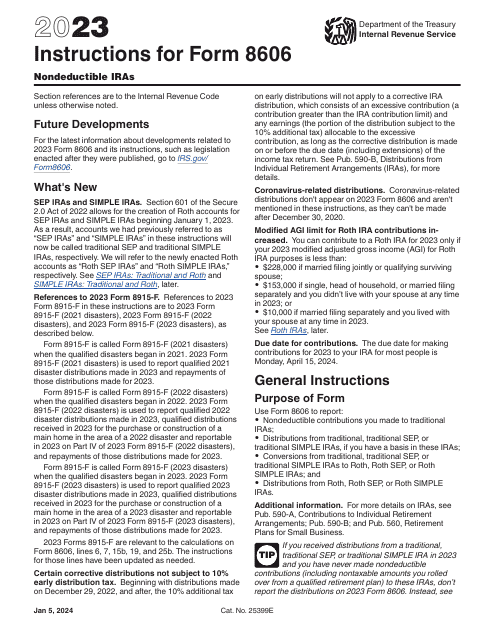

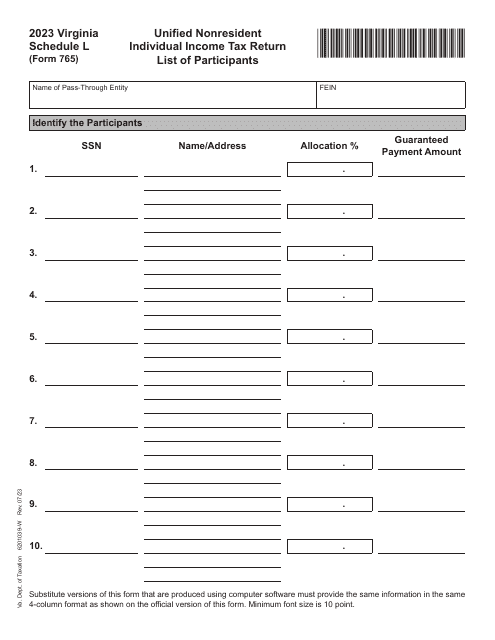

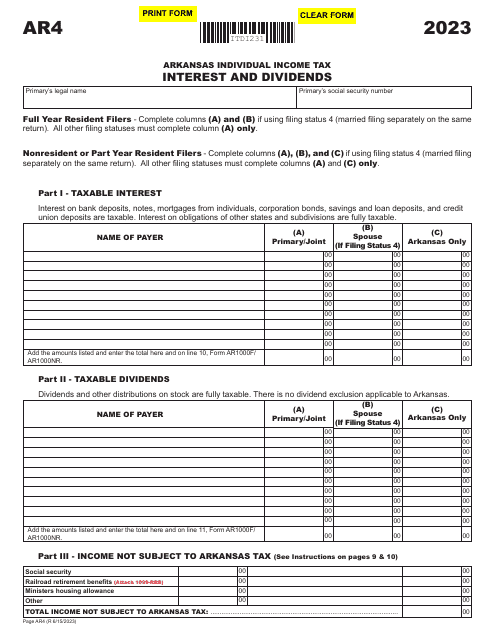

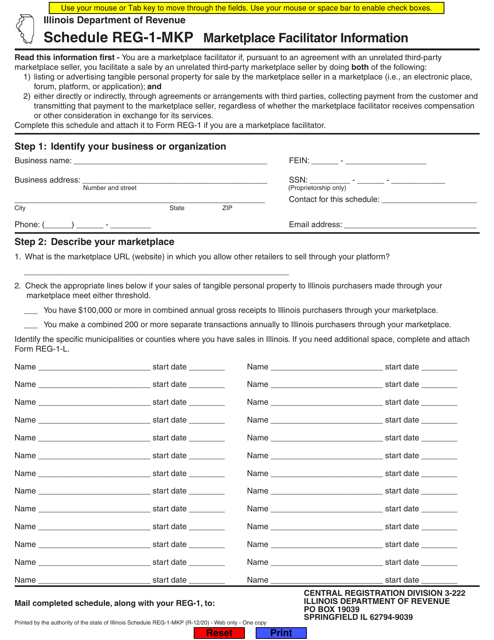

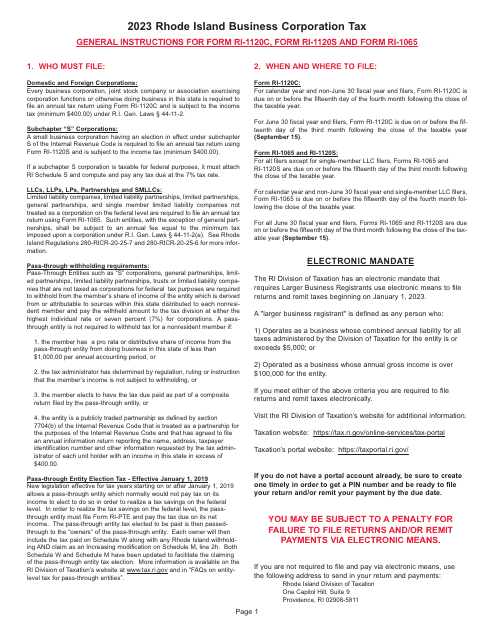

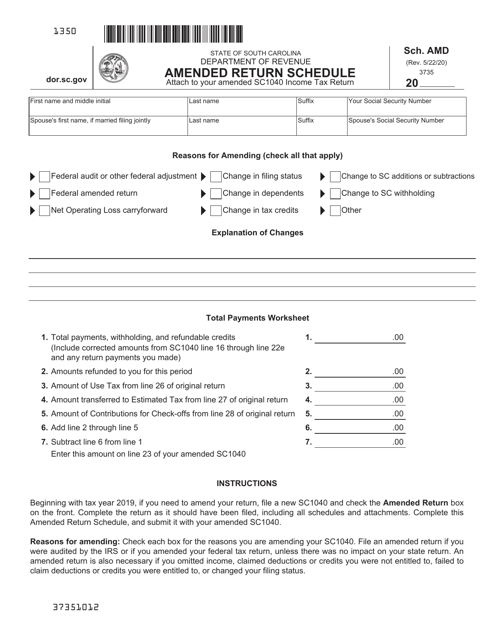

This is a supplementary document designed to allow taxpayers to list taxes they do not outline on the main income statement they are supposed to file annually.

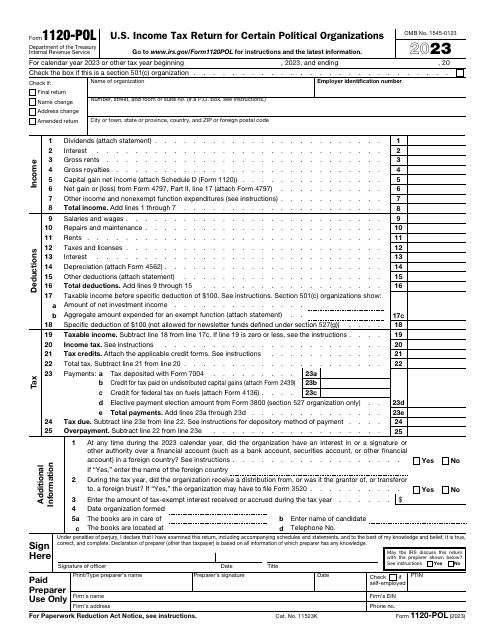

Use this form to inform the Internal Revenue Service (IRS) about the taxable income of your political organization, as well as about your tax liability according to Section 527.

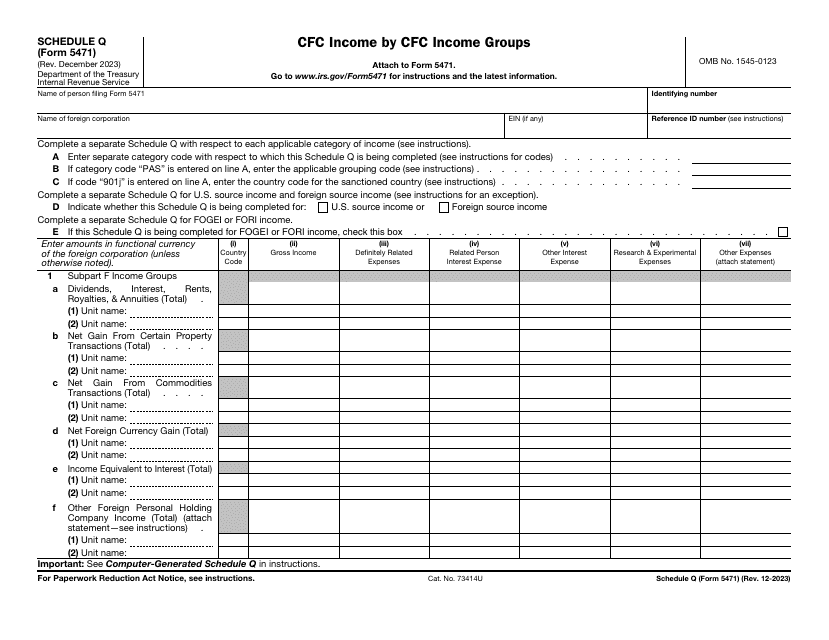

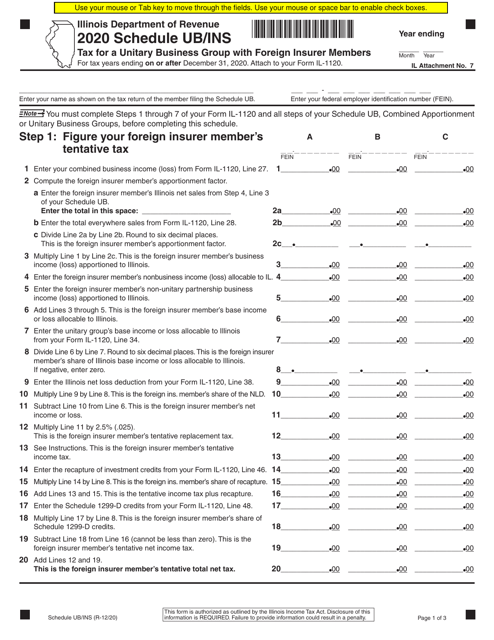

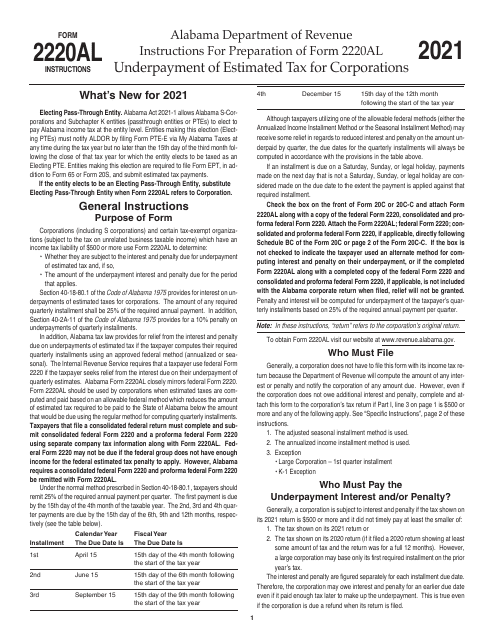

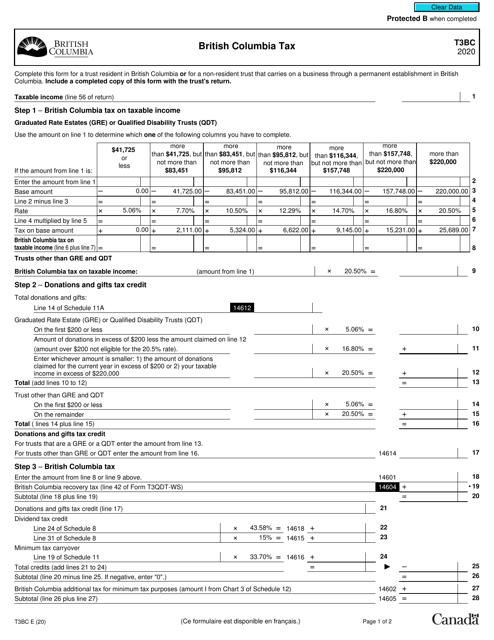

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

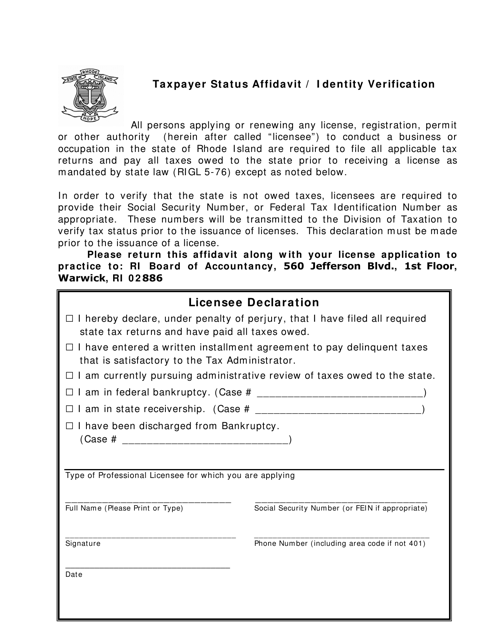

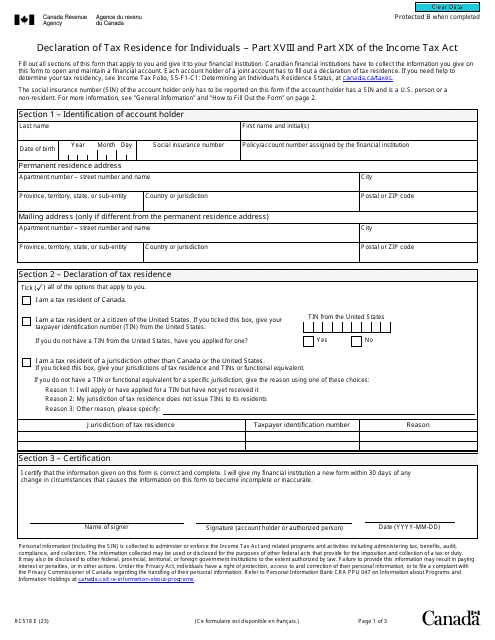

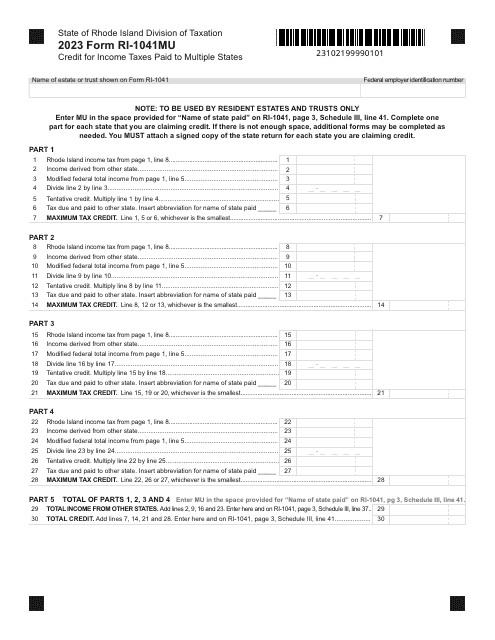

This document is used for affirming taxpayer status and verifying identity in the state of Rhode Island.

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

This form is filed to report American Samoa wages and withheld taxes. It is not used for reporting income taxes in the United States. IRS Form W-2, Wage and Tax Statement is used in these cases.

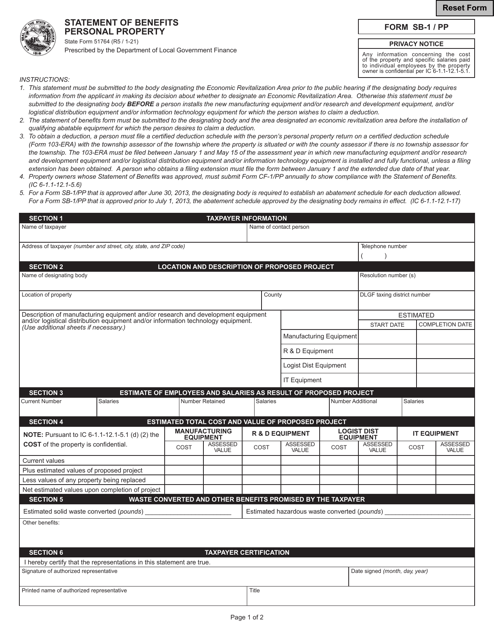

This Form is used for reporting personal property benefits in the state of Indiana.

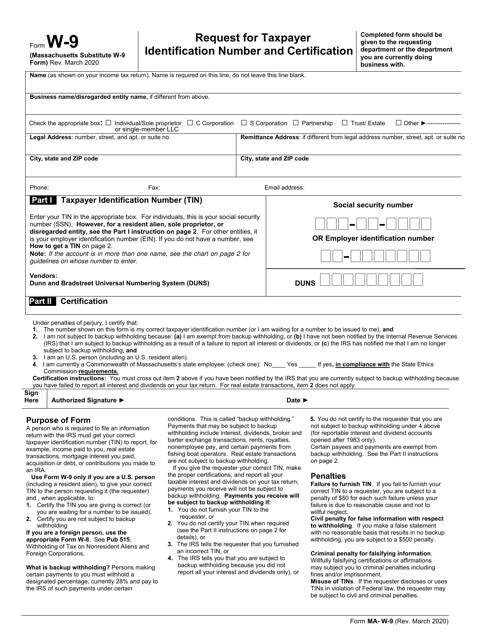

This form is used for requesting taxpayer identification number and certification in Massachusetts.

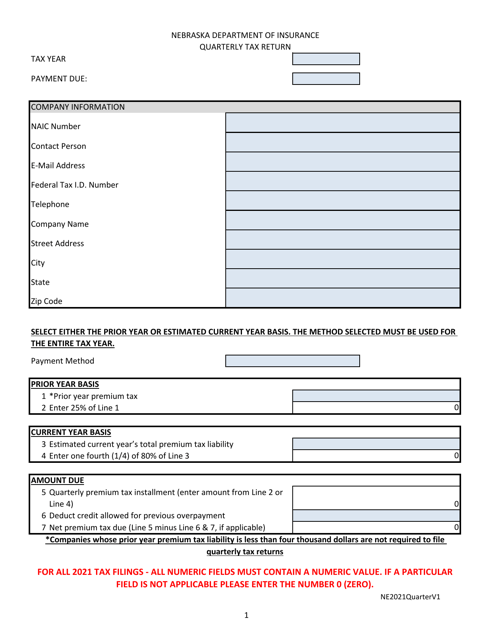

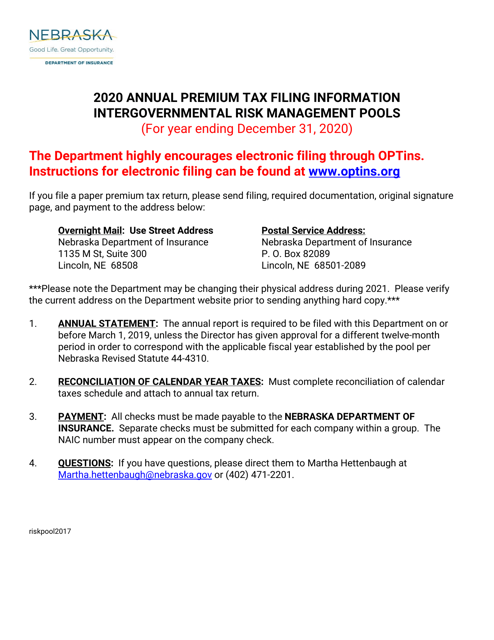

This document is used for reconciling calendar year taxes in Nebraska. It helps taxpayers ensure that their tax payments and credits are accurately recorded for the previous year.

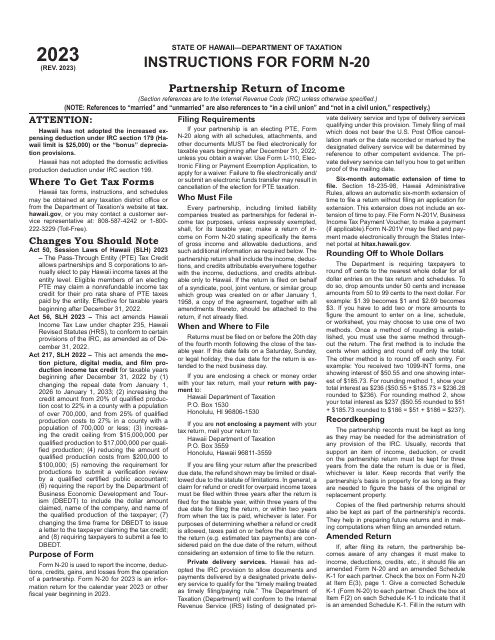

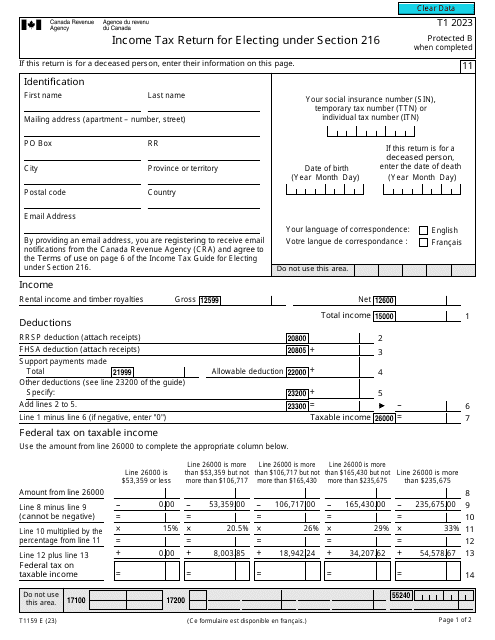

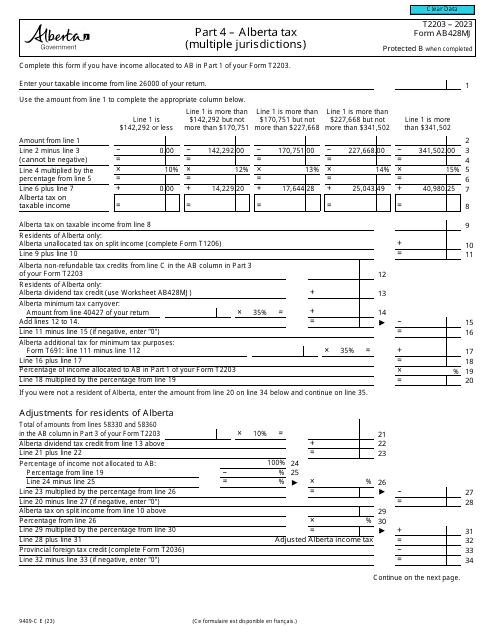

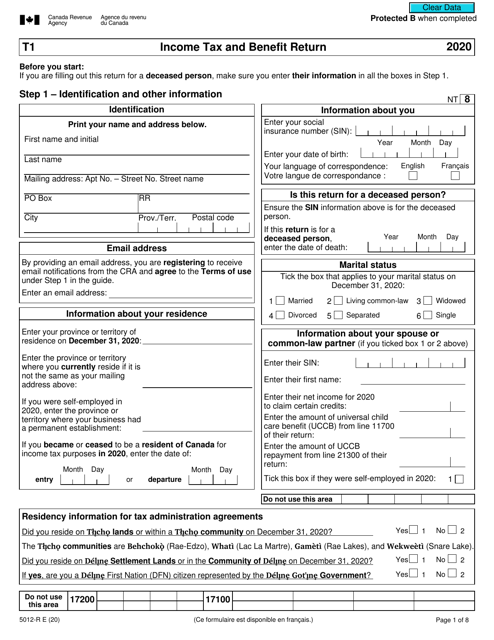

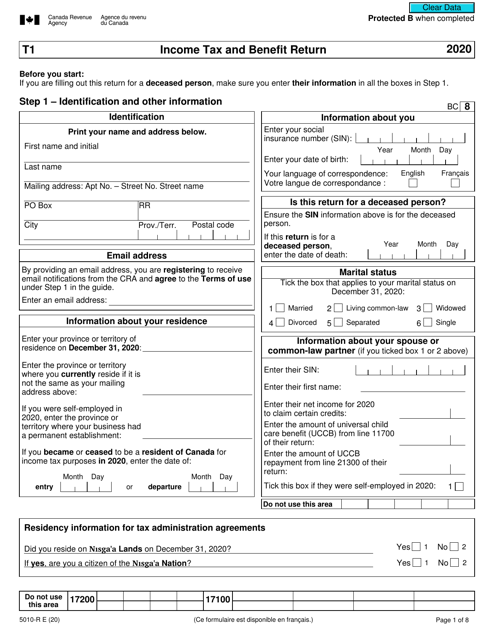

This form is used to report income, deductions, and tax credits for individuals in Canada filing their income tax and benefit return.