Tax Obligation Templates

Documents:

442

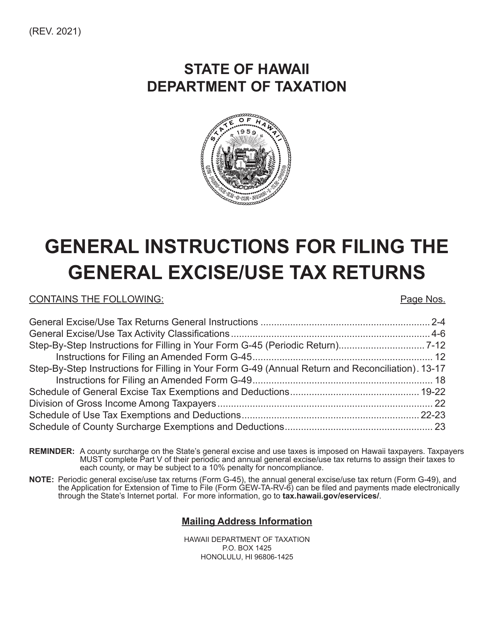

This Form is used for filing General Excise/Use Tax Returns in Hawaii. It provides instructions on how to properly fill out and submit the form.

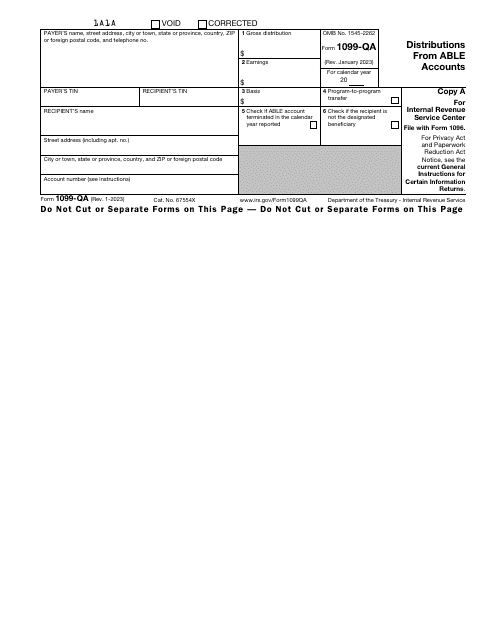

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

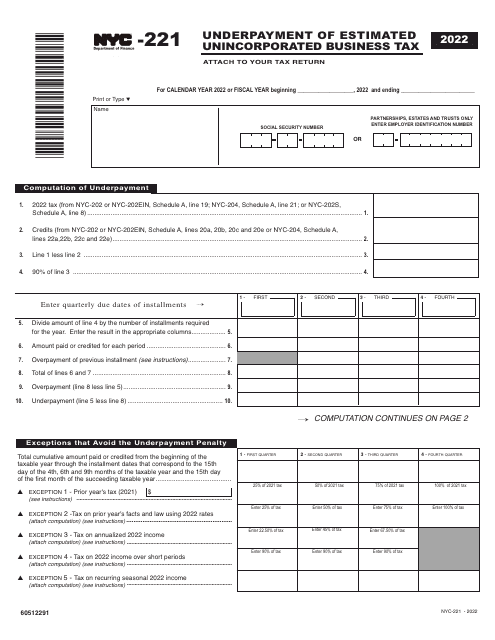

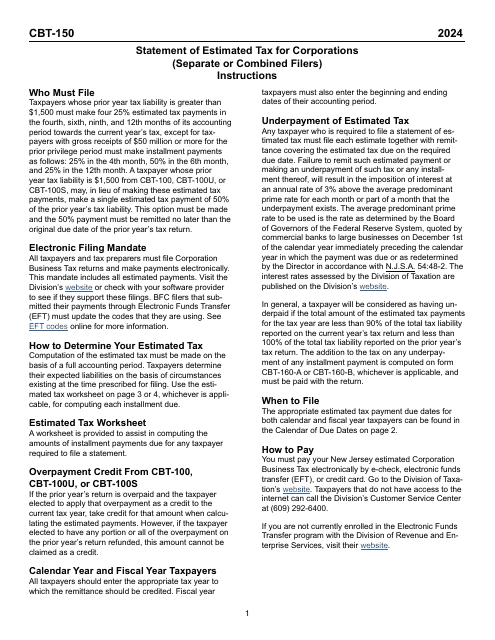

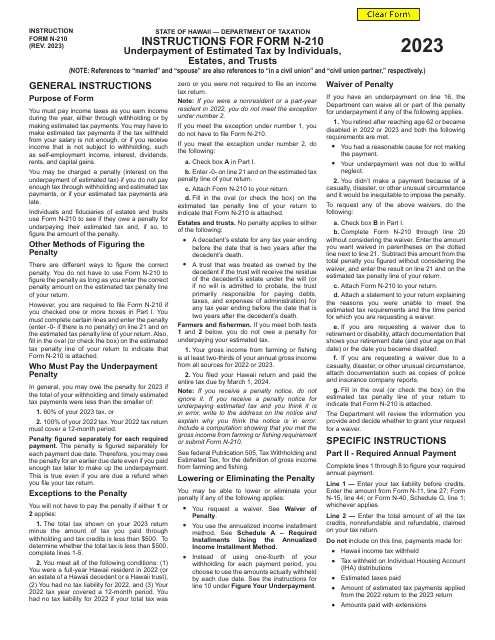

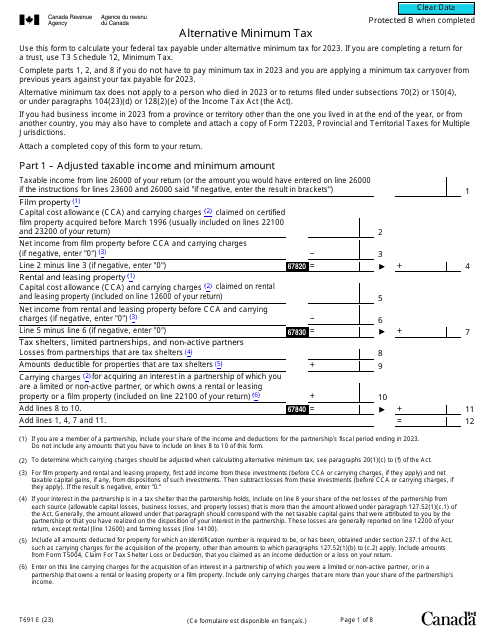

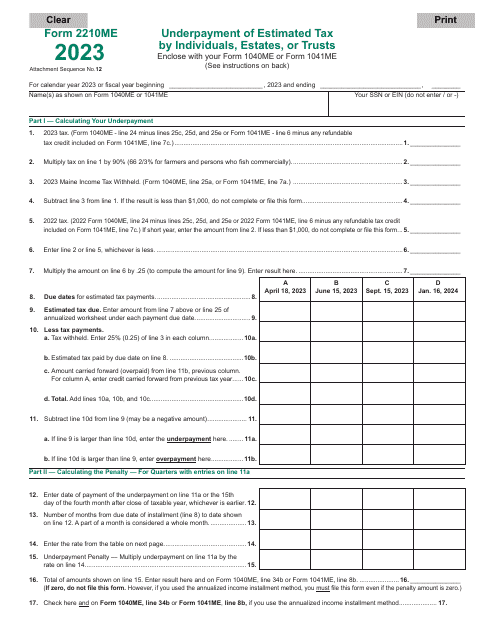

This is a supplementary form corporations were expected to fill out to compute the amount of estimated tax they owe to fiscal authorities.

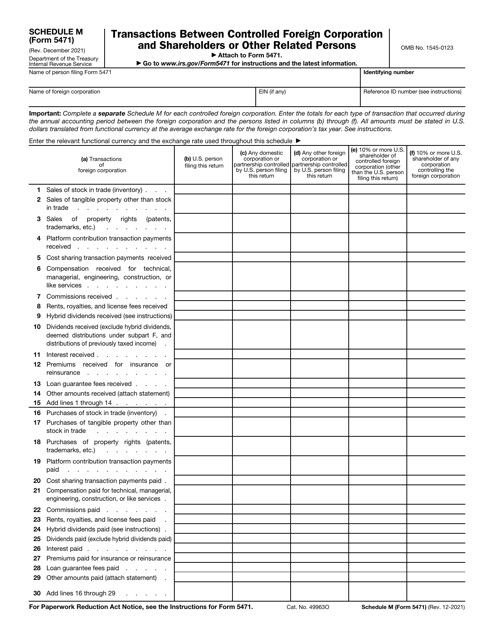

Fill in this document if you are a U.S. citizen that had control of a foreign corporation during the yearly accounting period of a foreign corporation

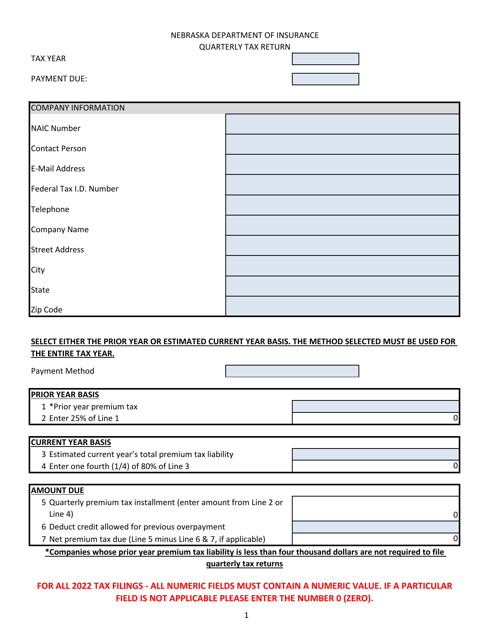

This form is used for reporting and paying quarterly premium taxes in the state of Nebraska.

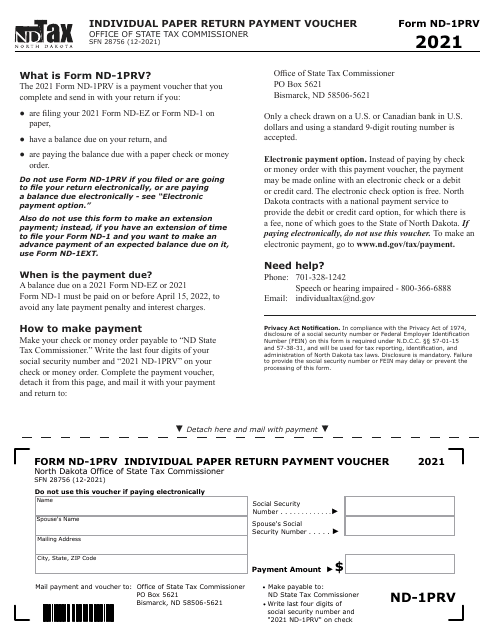

This form is used for making a payment for the North Dakota Individual Paper Return.

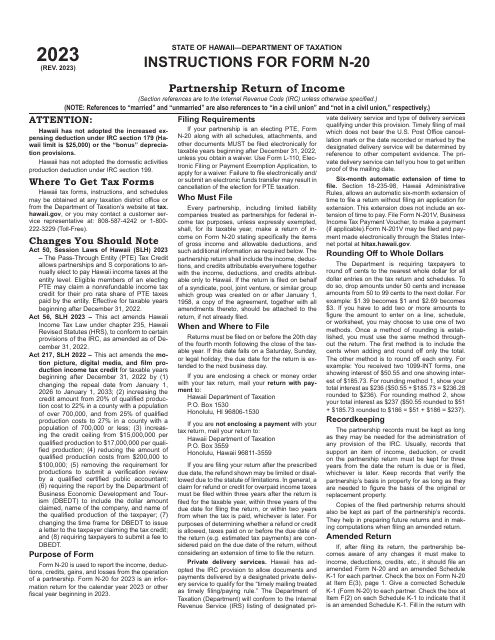

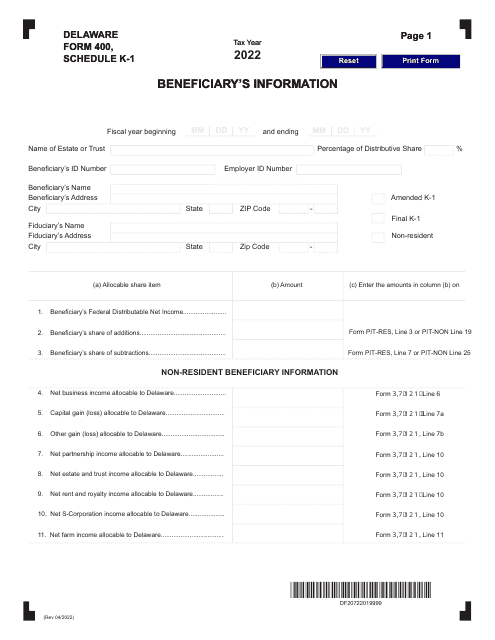

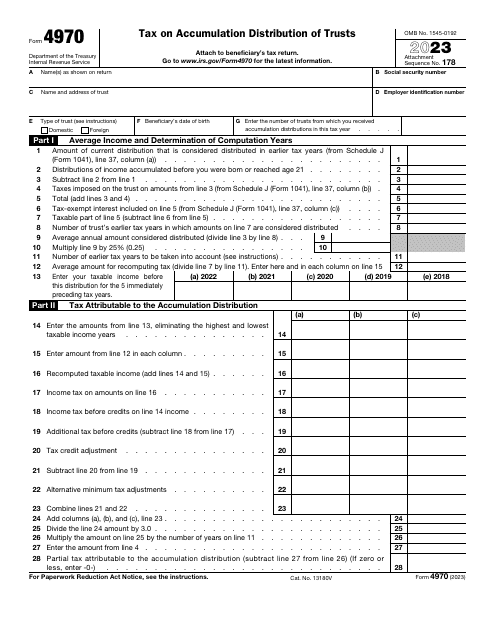

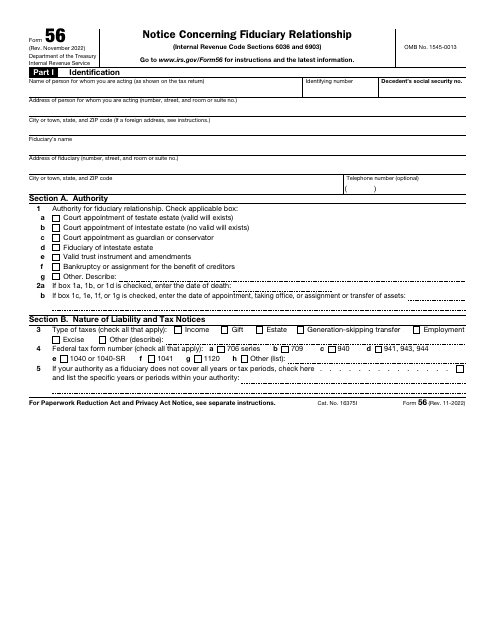

This is a fiscal statement prepared by a person or organization to tell the government about the fiduciary arrangement that was formed with them serving as a fiduciary.

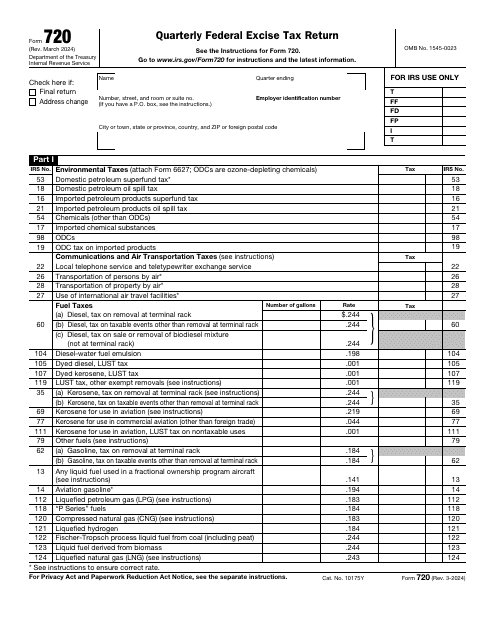

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

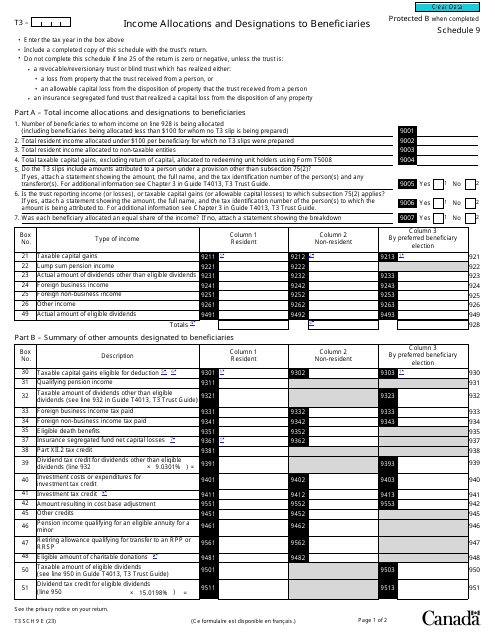

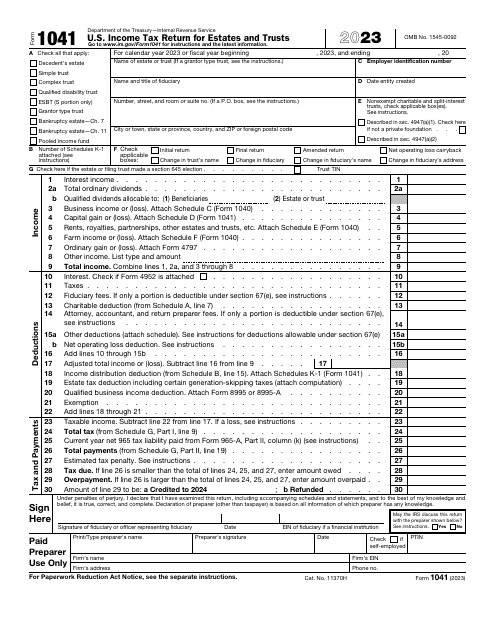

File this document, also known as the Estates and Trusts Tax Return, as an income tax return to the Internal Revenue Service (IRS) if you are a fiduciary of a bankruptcy estate, domestic decedent's estate, or a trust.