Tax Obligation Templates

Documents:

442

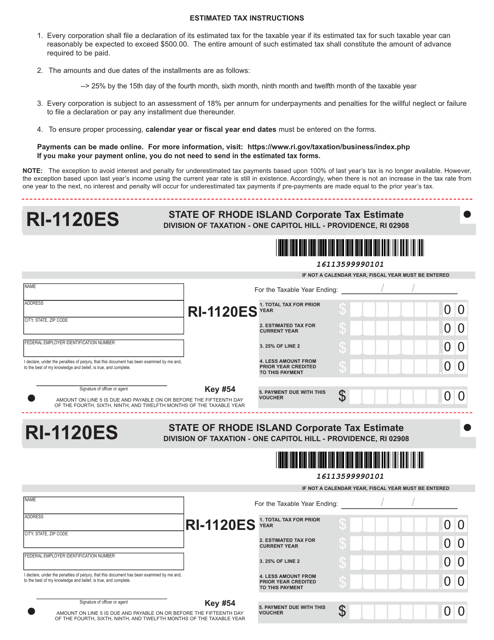

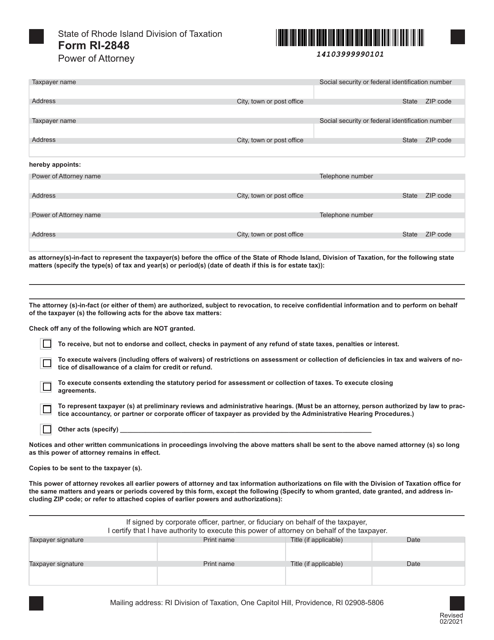

This Form is used for businesses in Rhode Island to estimate and pay their corporate taxes.

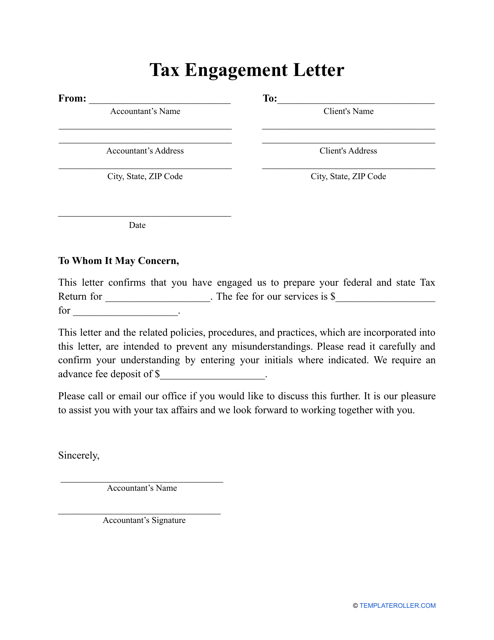

Complete this template to describe the work to be performed, the terms and conditions of performing that work, any limitations, and payment terms to the client.

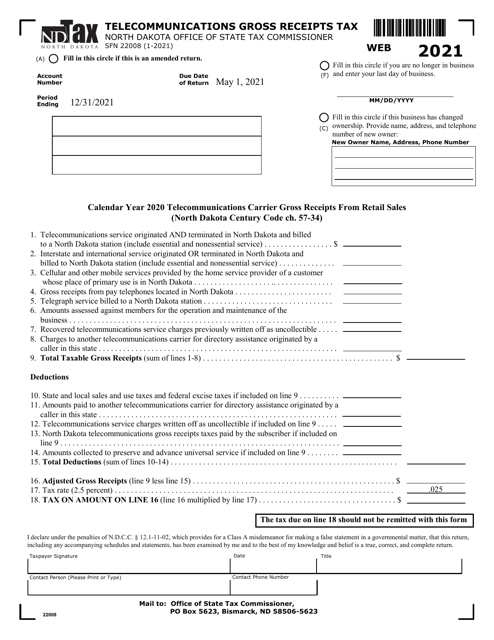

This form is used for calculating and reporting the telecommunications gross receipts tax in North Dakota.

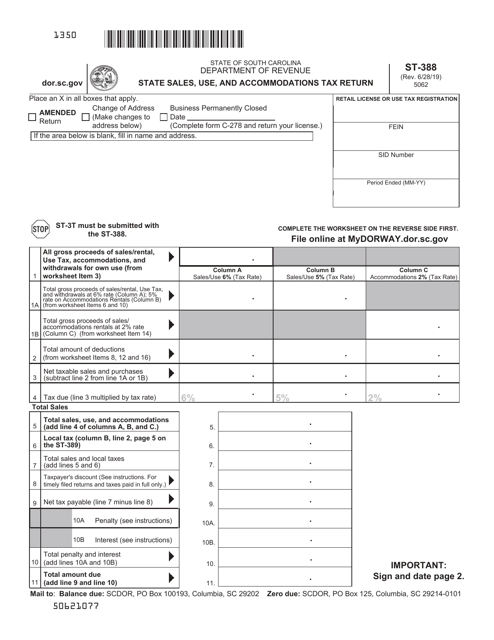

This form is used for reporting State Sales and Use and Accommodations Tax in South Carolina.

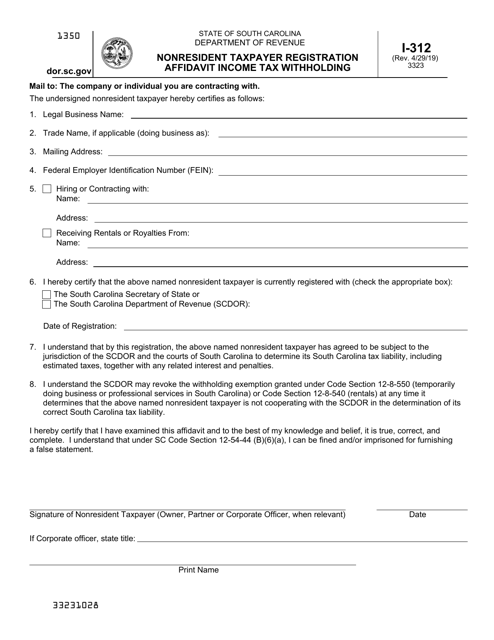

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

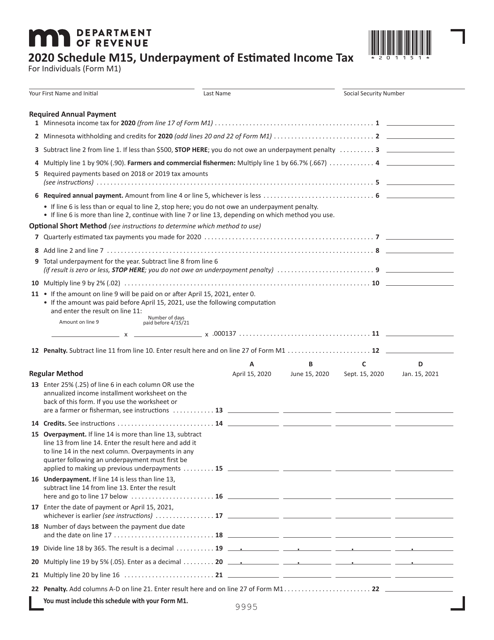

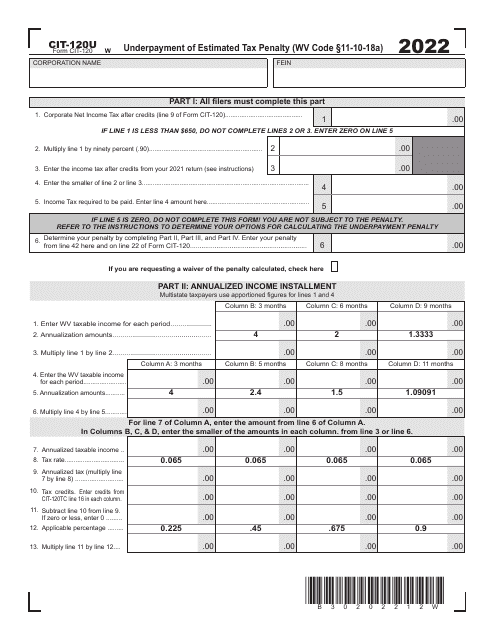

This form is used for calculating underpayment of estimated income tax in the state of Minnesota.

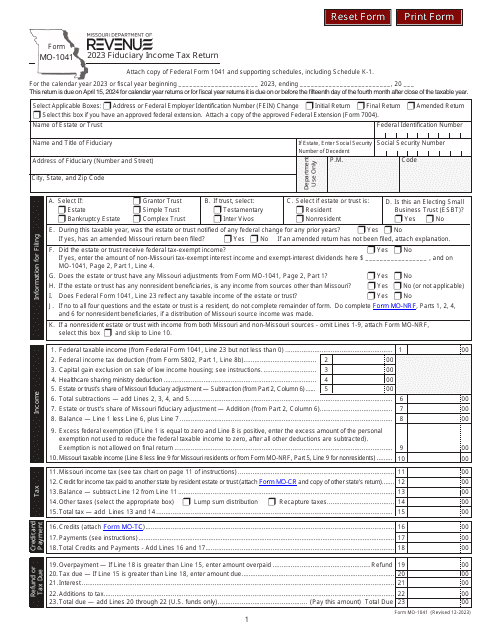

This form is used for reporting passive activity loss limitations in California.

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

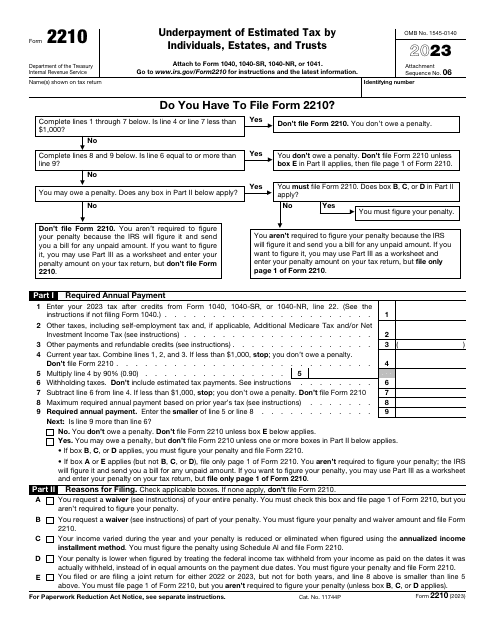

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

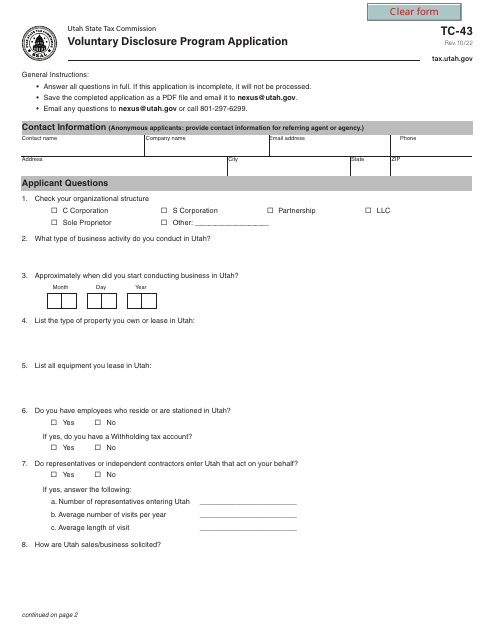

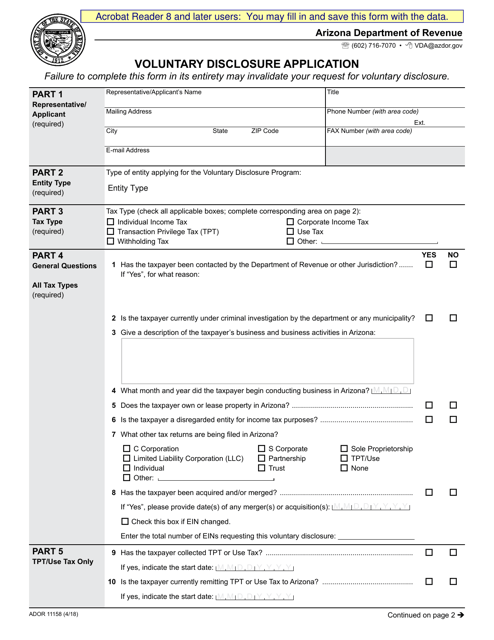

This form is used for submitting a voluntary disclosure application in the state of Arizona.

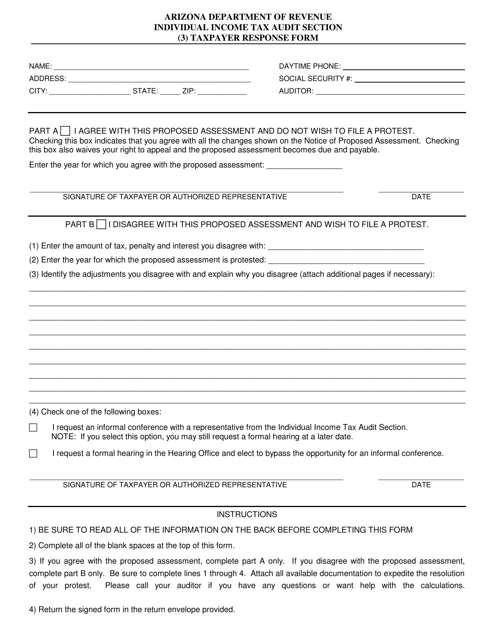

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

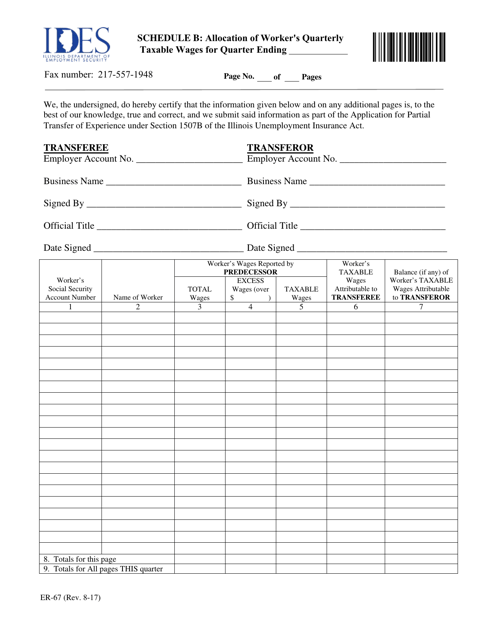

This Form is used for allocating worker's quarterly taxable wages in Illinois.