Tax Obligation Templates

Documents:

442

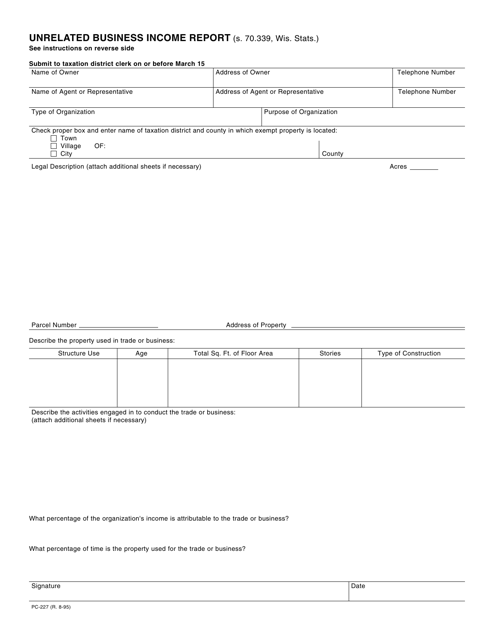

This Form is used for reporting unrelated business income in the state of Wisconsin.

This document is used for completing the IRS Form 965-E Consent Agreement under Section 965(I)(4)(D). It provides instructions on how to properly fill out the form and comply with the requirements.

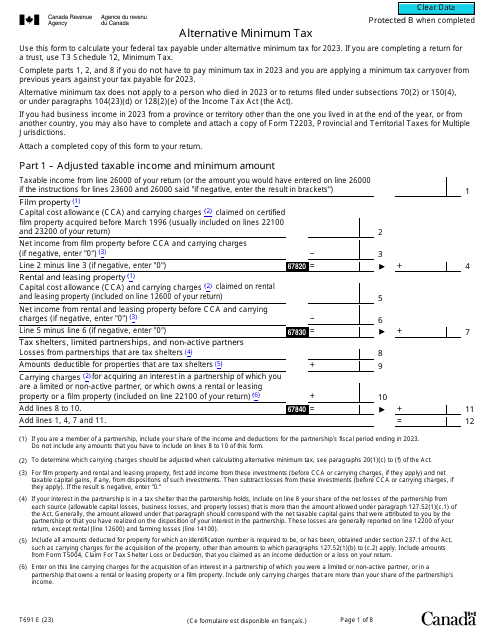

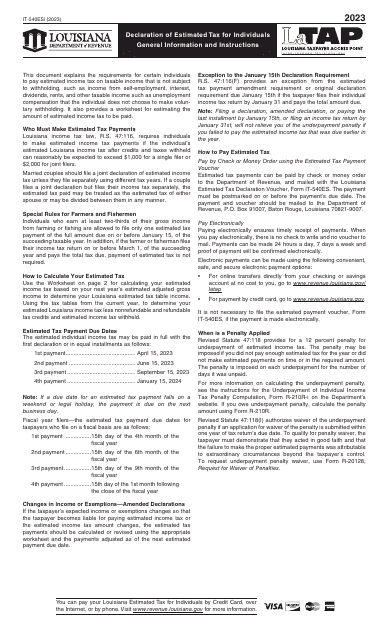

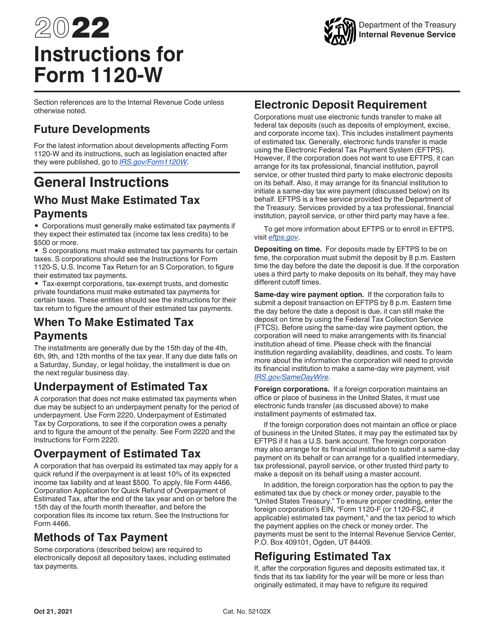

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

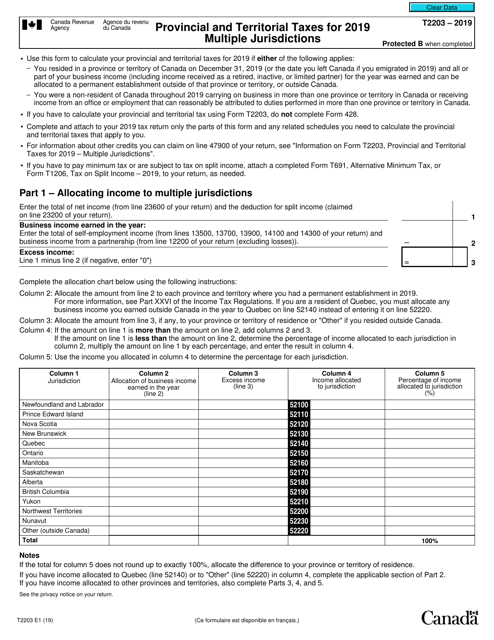

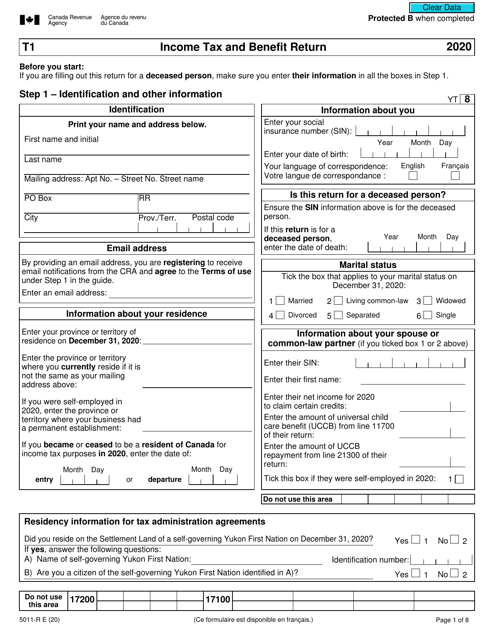

This form is used for calculating and reporting provincial and territorial taxes for multiple jurisdictions in Canada. It is used by individuals who have income or are residents in more than one province or territory.

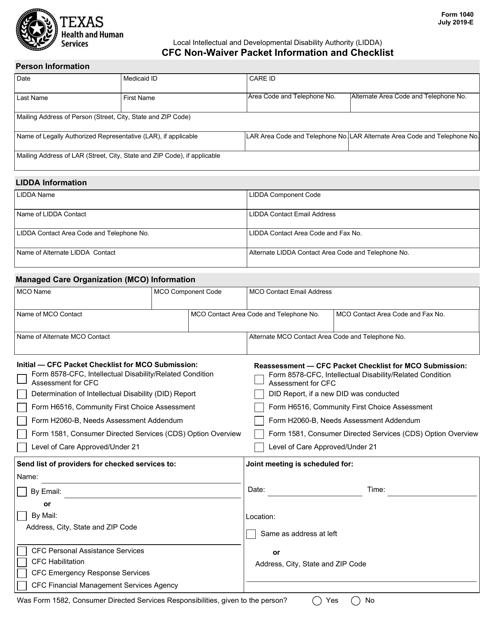

This Form is used for providing information and checklist for filing Form 1040 CFC Non-waiver Packet in Texas.

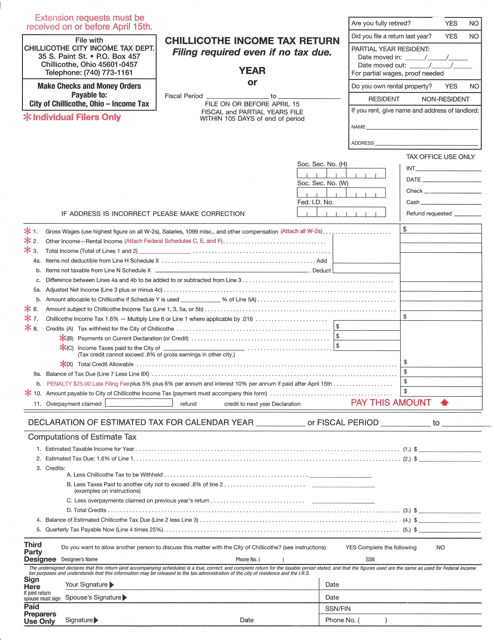

This document is used for filing your income tax return with the City of Chillicothe, Ohio.

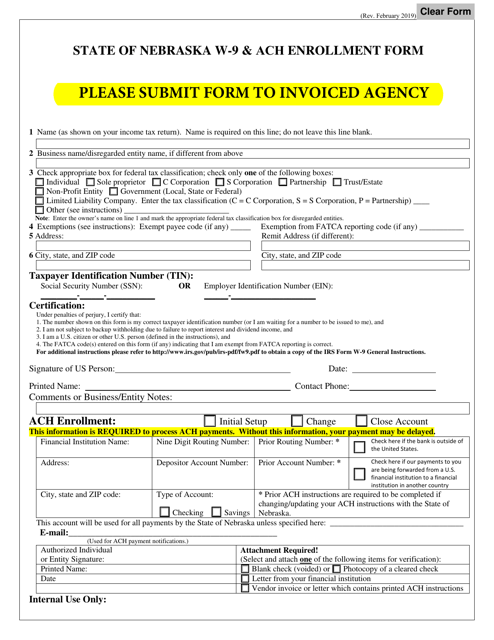

This form is used for the state of Nebraska to receive W-9 information and enroll in ACH (Automated Clearing House) payment.

This form is a fiscal instrument used by creditors to inform their debtors about the debts they canceled over the course of the calendar year.

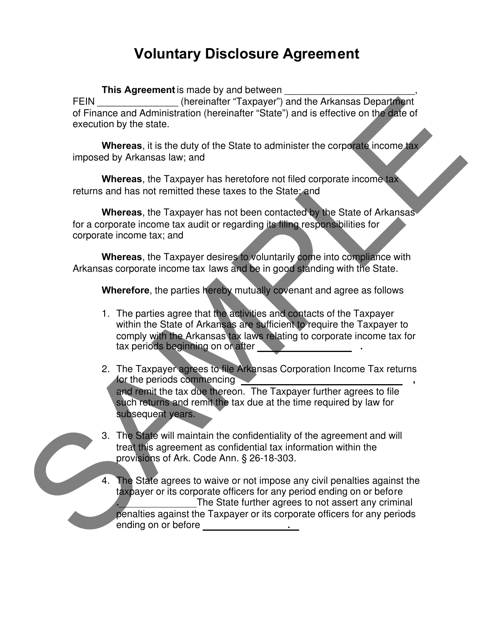

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

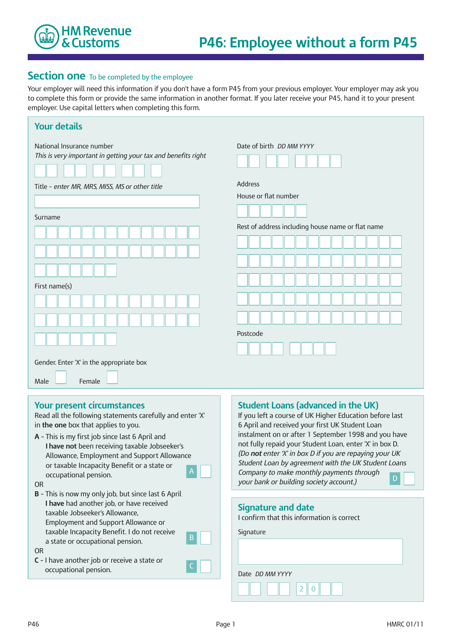

This is an outdated document that was completed for new employees to find out the correct amount of income tax to withhold.

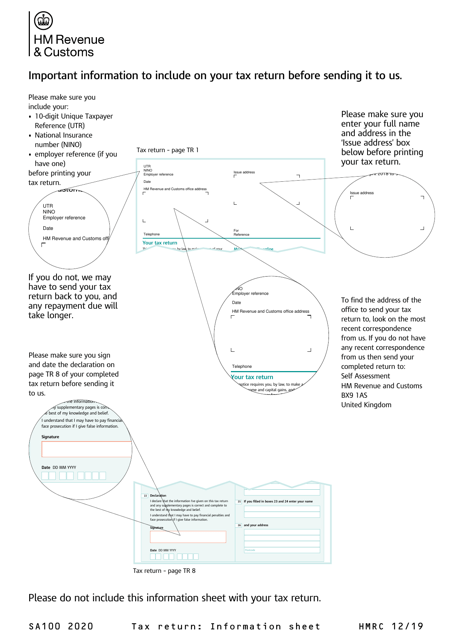

This form is used for reporting income, loan repayments, pensions, annuities, charitable contributions, and tax allowances.