Tax Obligation Templates

Documents:

442

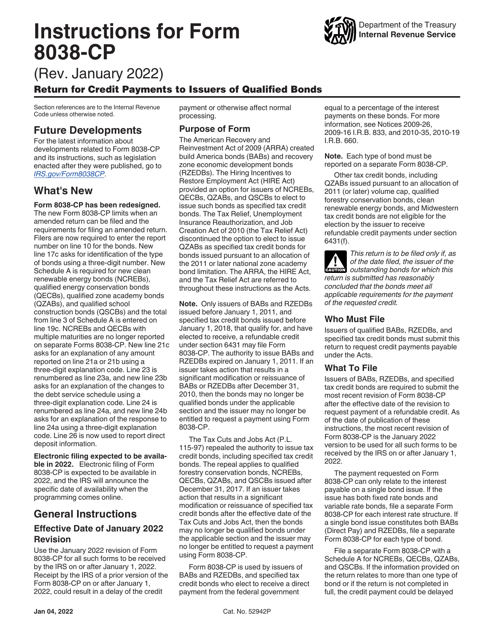

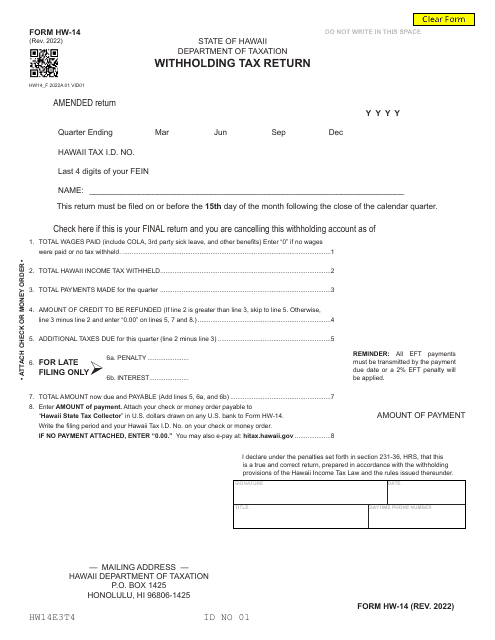

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

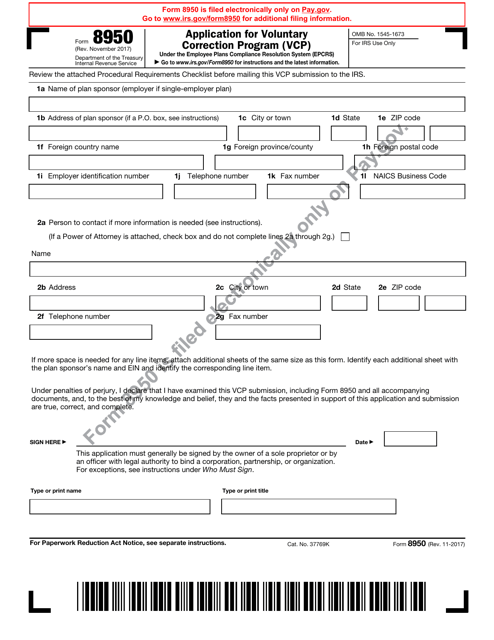

This form is used for applying to the IRS Voluntary Correction Program (VCP). The VCP allows employers to correct errors in their retirement plans and avoid penalties.

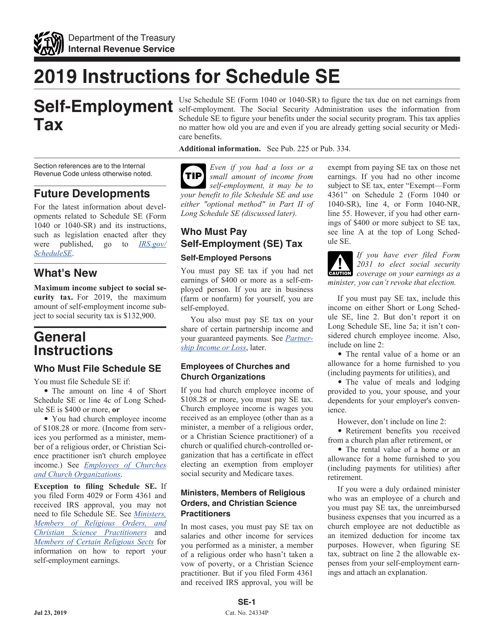

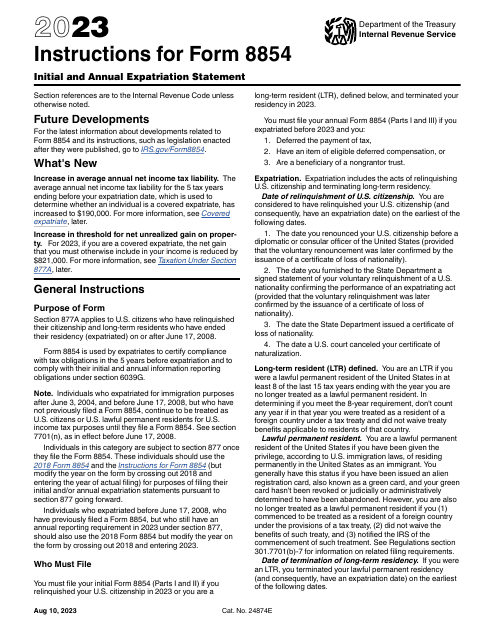

This document provides instructions for filling out and filing IRS Form 1040 and 1040-SR Schedule SE, which are used to calculate and report self-employment taxes. It includes step-by-step guidance on how to report income, deductions, and calculate the amount of self-employment tax owed.

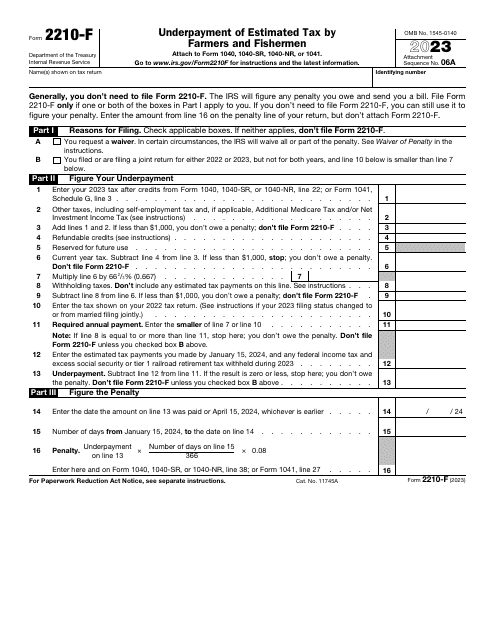

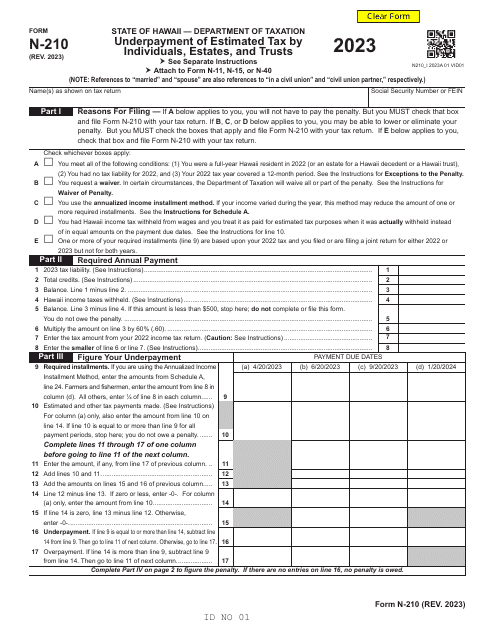

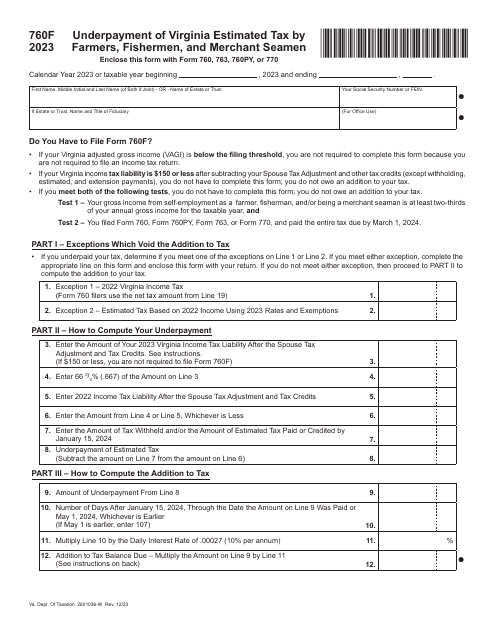

This is an IRS form completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations.

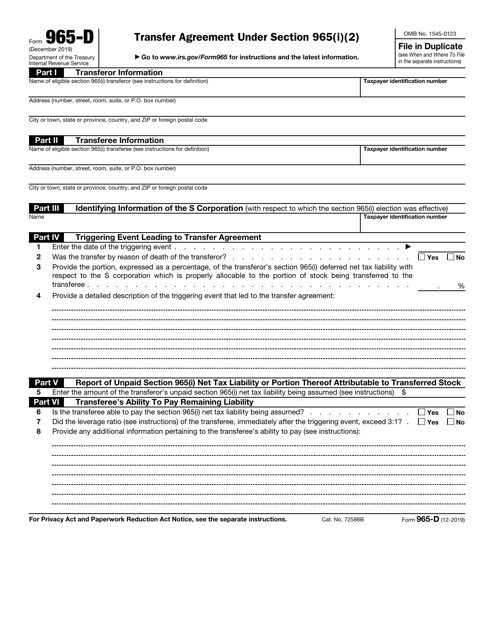

This form is used for transferring assets under Section 965(I)(2) of the IRS Code.

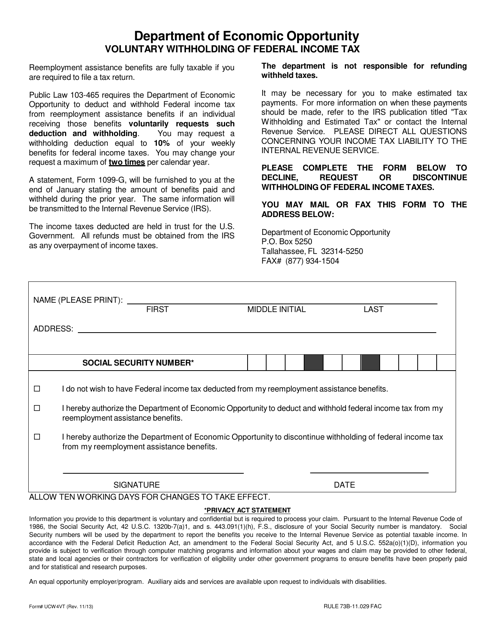

This form is used for voluntary withholding of federal income tax in the state of Florida.

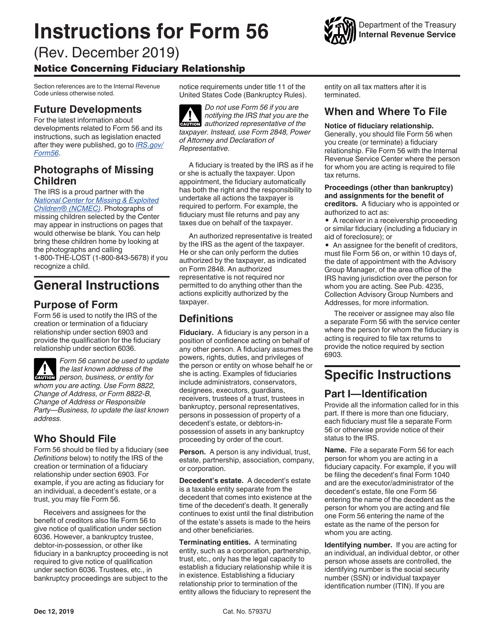

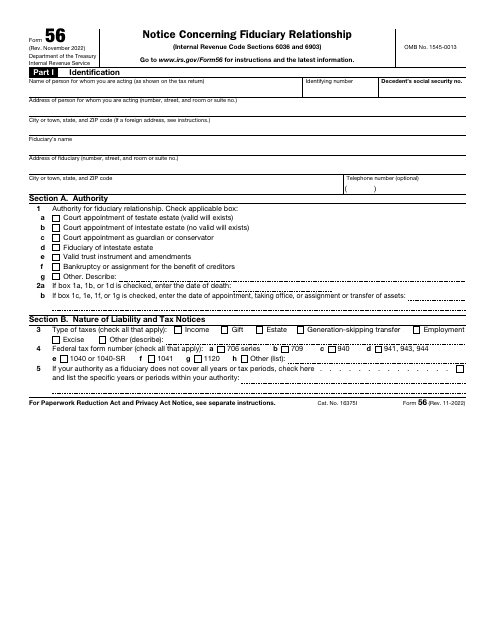

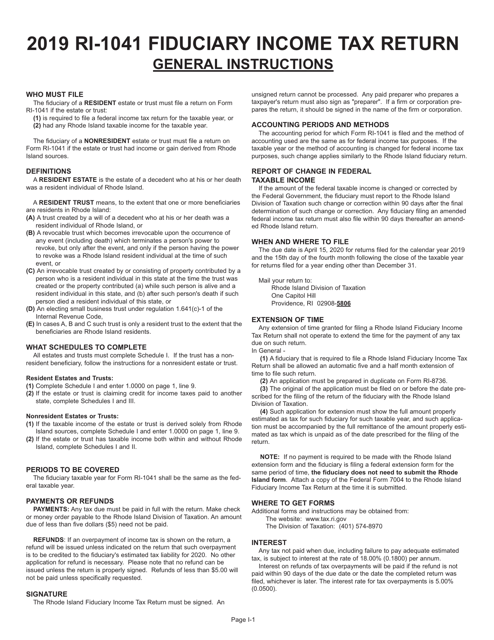

This is a fiscal statement prepared by a person or organization to tell the government about the fiduciary arrangement that was formed with them serving as a fiduciary.

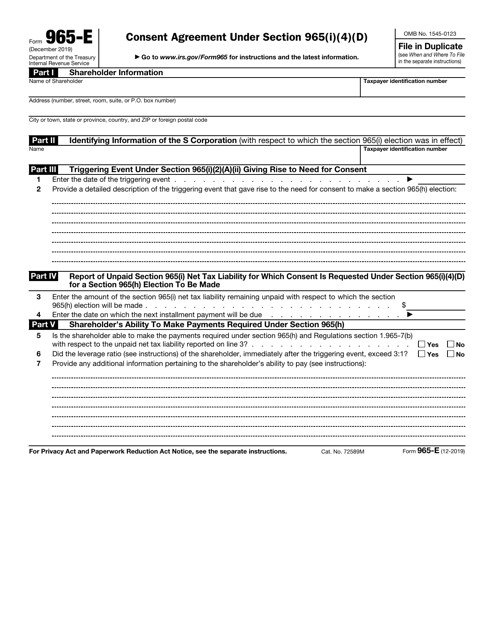

This form is used for entering into a consent agreement under Section 965(I)(4)(D) of the Internal Revenue Code.

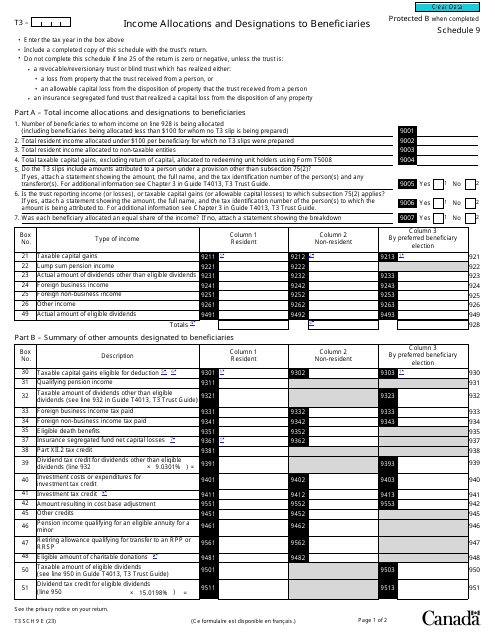

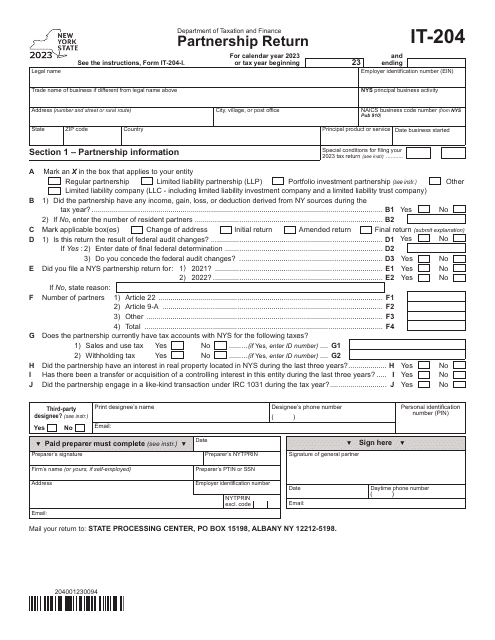

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

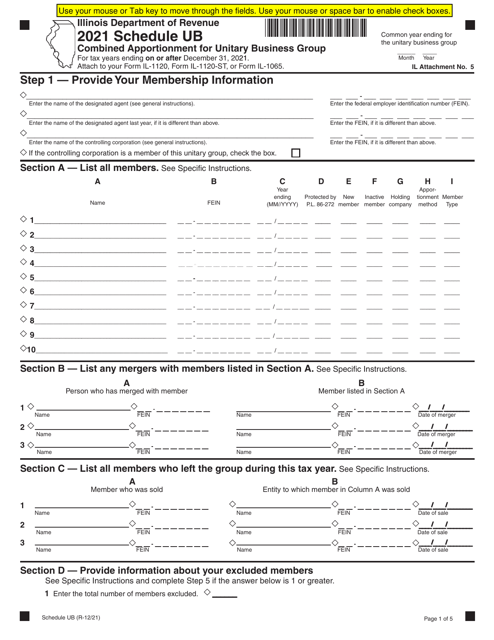

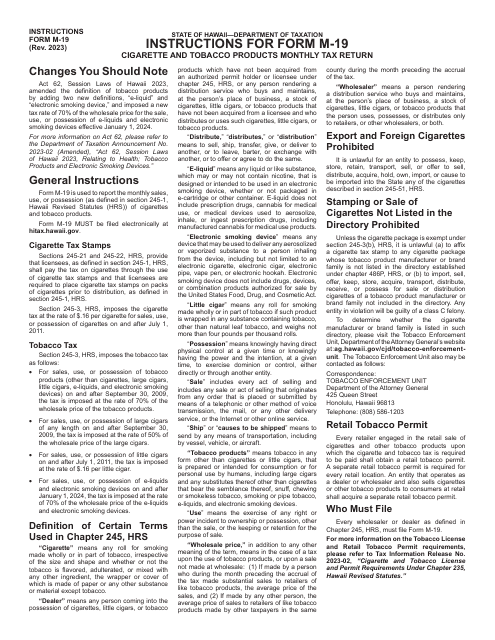

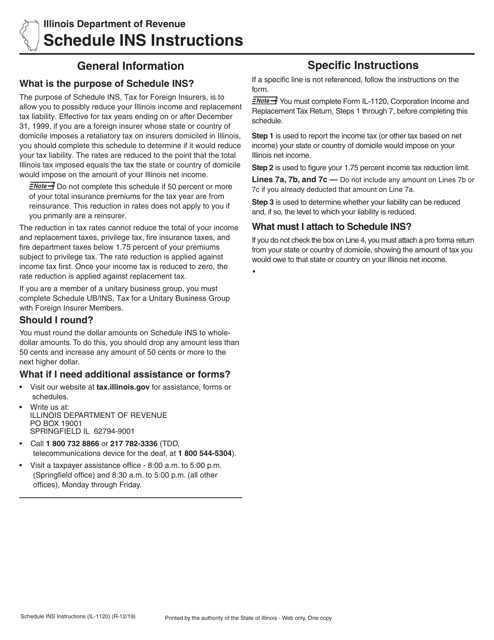

This Form is used for foreign insurers in Illinois to report and pay their tax obligations. It provides instructions for completing Schedule INS of Form IL-1120.

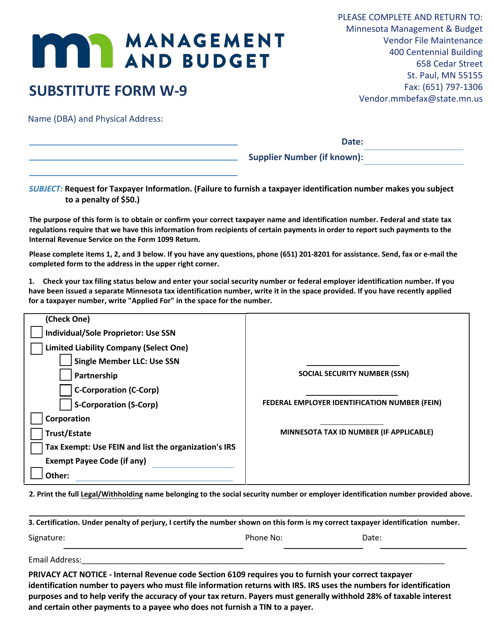

This Form is used for reporting taxpayer information for individuals or businesses in Minnesota. It is used to request the taxpayer identification number (TIN) and certification of the individual/business for tax purposes.