Tax Regulations Templates

Documents:

480

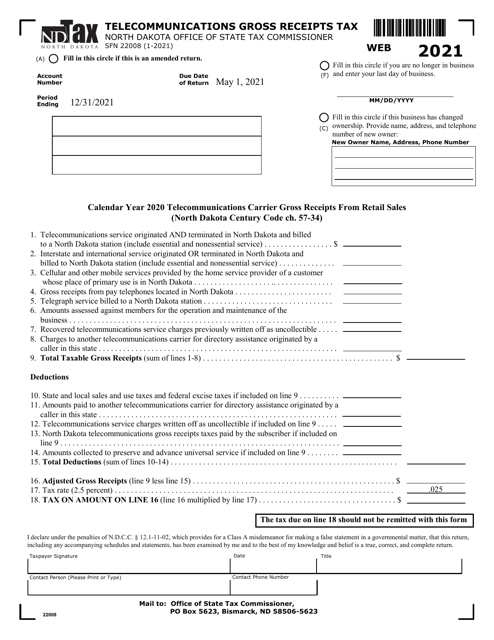

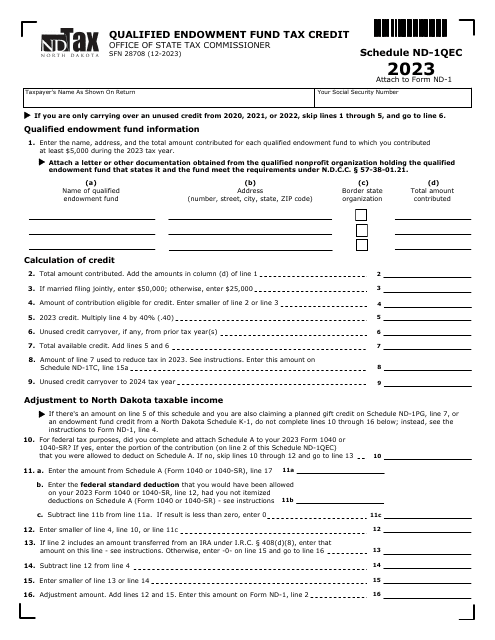

This form is used for calculating and reporting the telecommunications gross receipts tax in North Dakota.

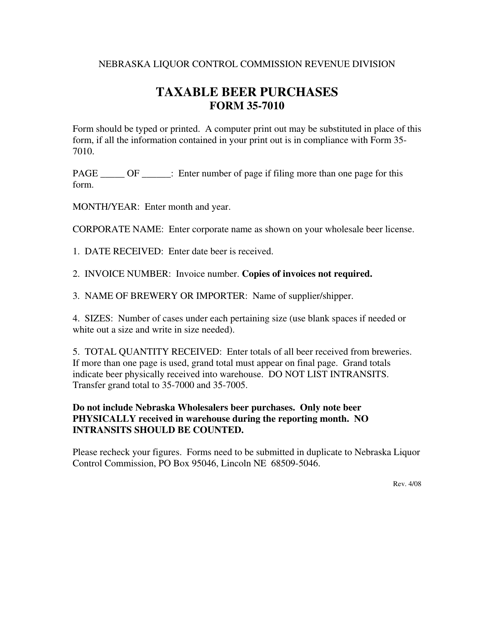

This Form is used for reporting taxable beer purchases in the state of Nebraska. It provides instructions on how to accurately fill out and submit the form to the appropriate tax authority.

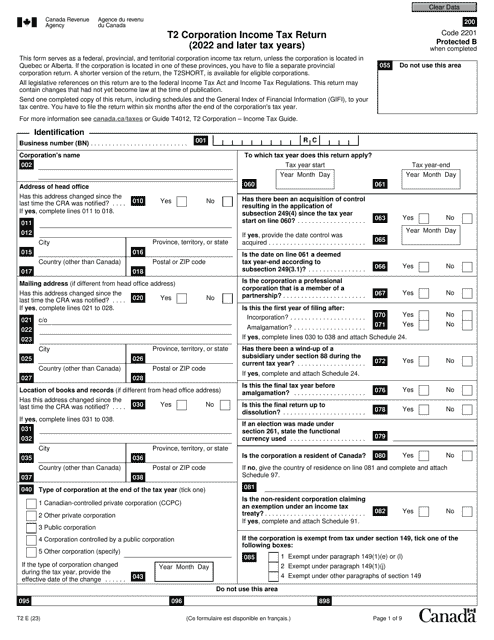

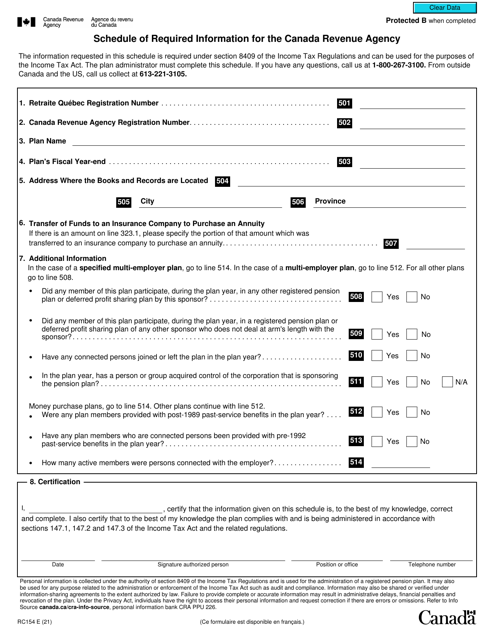

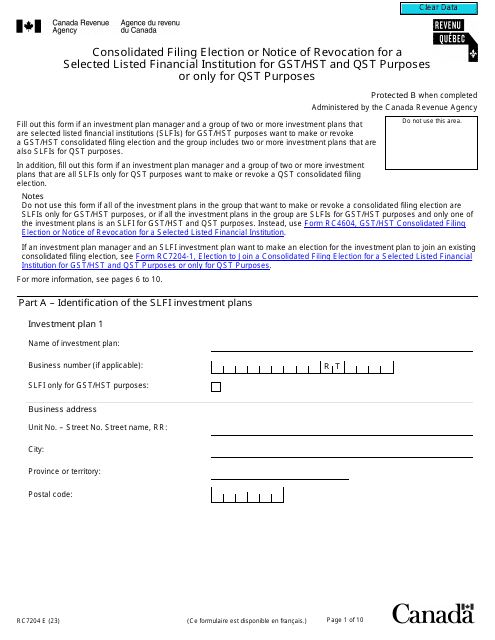

Canadian corporations must complete this main statement every year to report their income even if they eventually do not pay any tax.

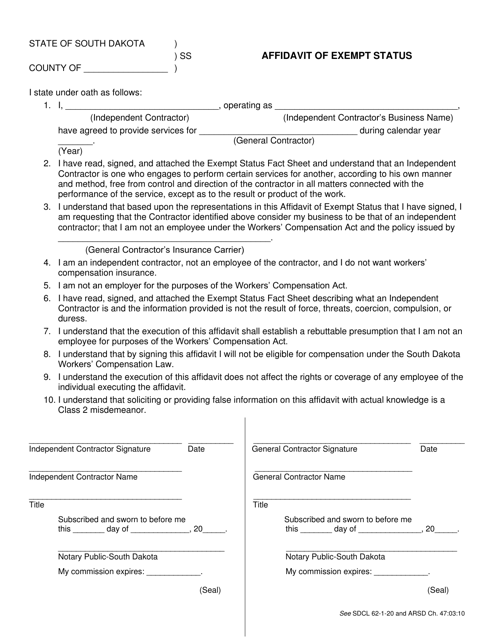

This form is used to declare exempt status for tax purposes in South Dakota.

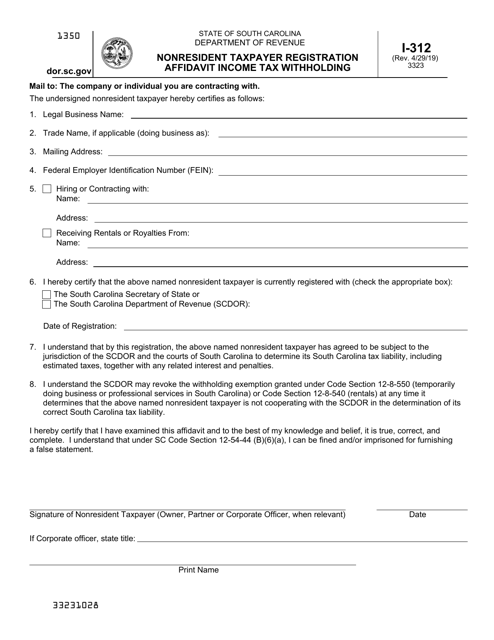

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

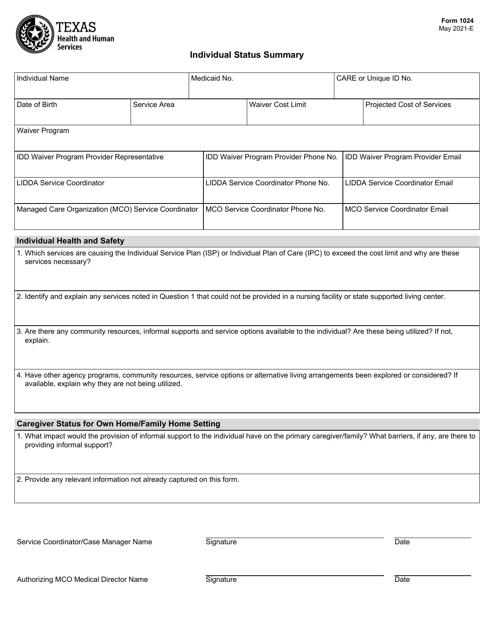

This form is used to provide a summary of an individual's tax status in the state of Texas.

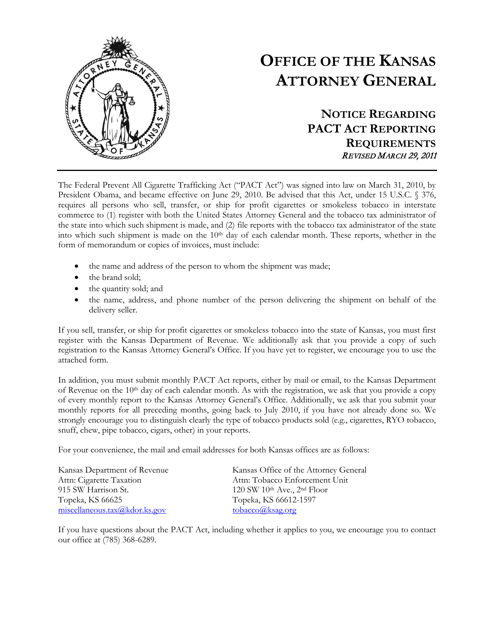

This Form is used for registering under the Federal Pact Act in the state of Kansas.

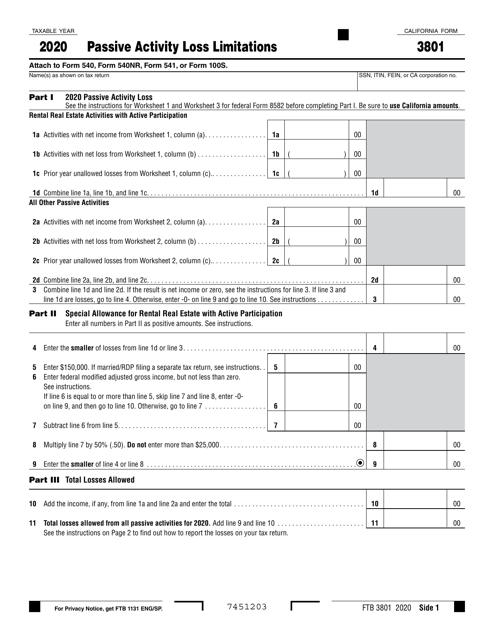

This form is used for reporting passive activity loss limitations in California.

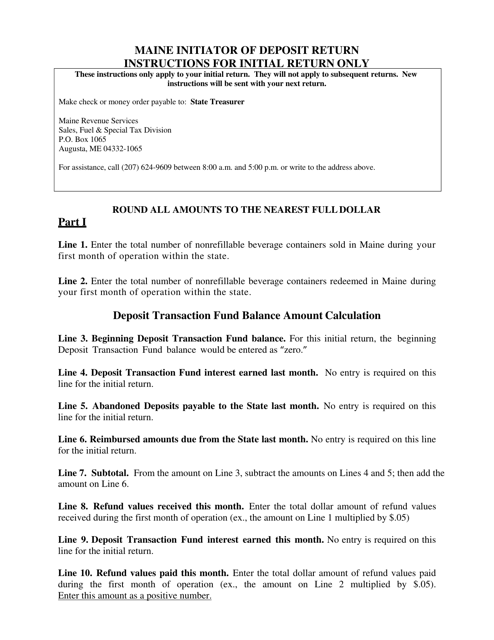

This document provides instructions for individuals in Maine who are initiating their initial deposit tax return. It outlines the requirements and steps for completing the return accurately.

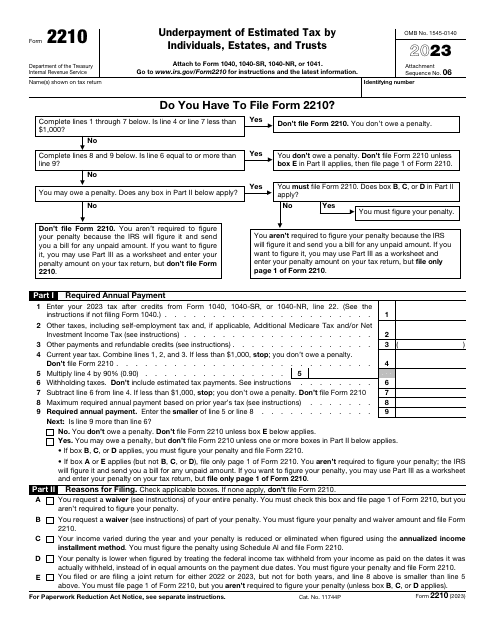

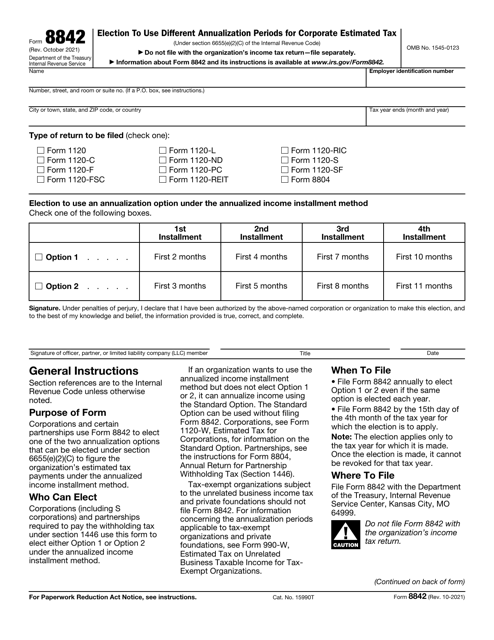

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

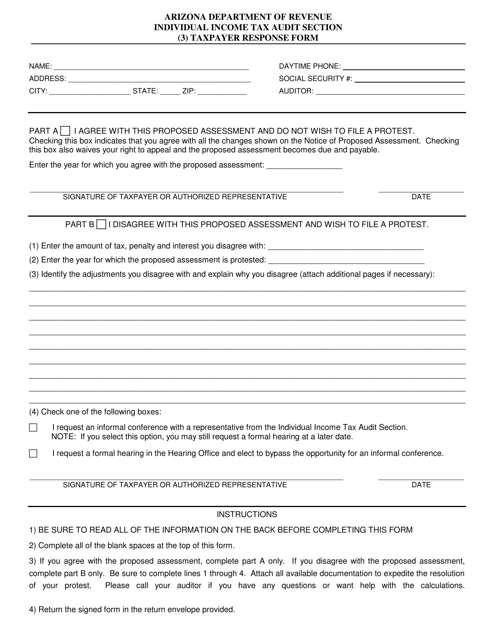

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.

This document is used for applying for the Annual Tax Credit under the Enhanced Enterprise Zone Tax Credit Program in Missouri.

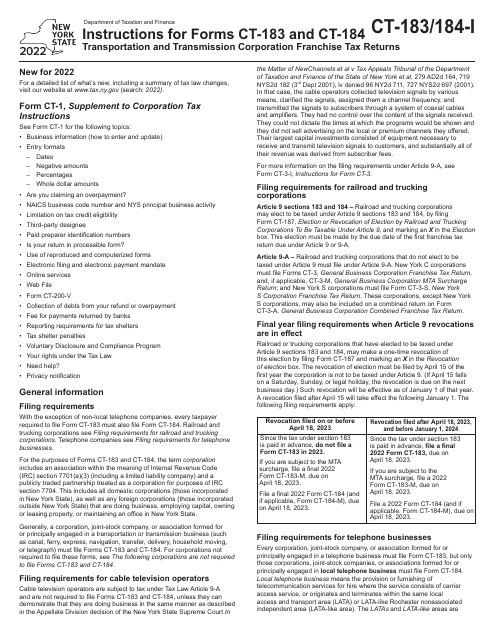

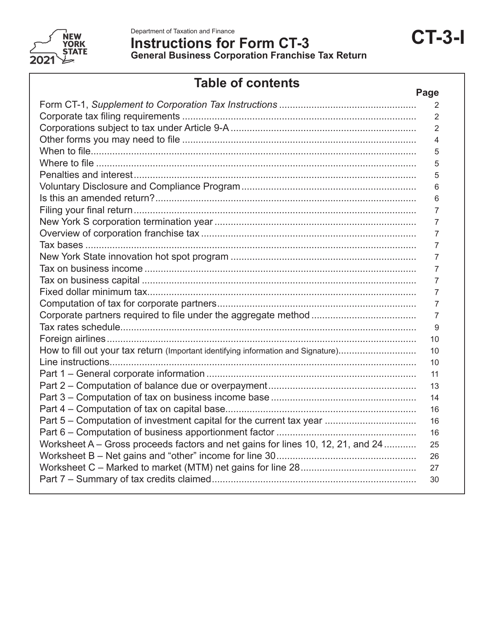

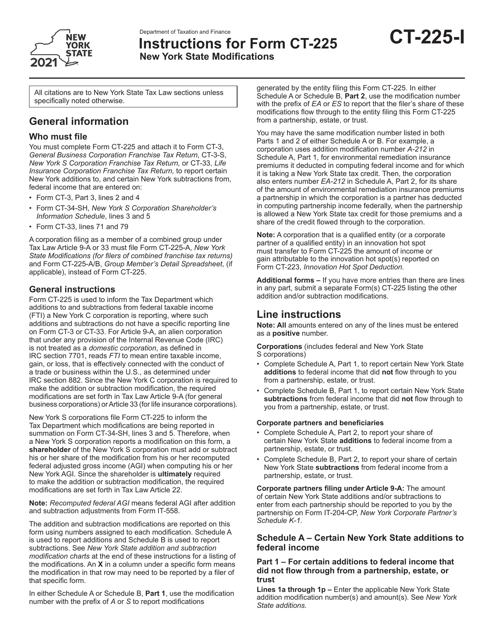

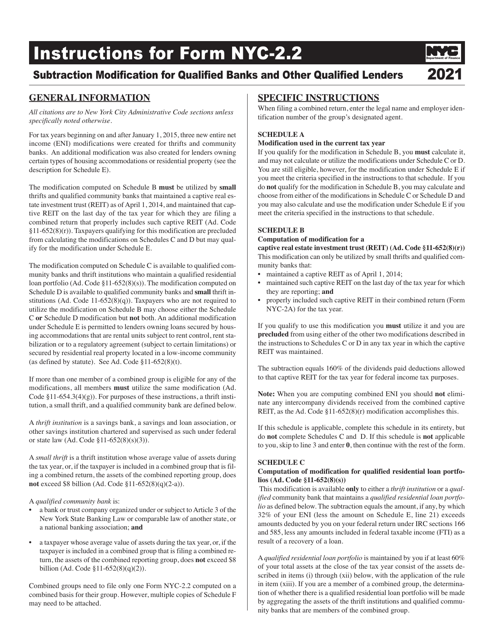

This form is used for filing the General Business Corporation Franchise Tax Return in the state of New York. It provides instructions on how to correctly complete and submit the form.

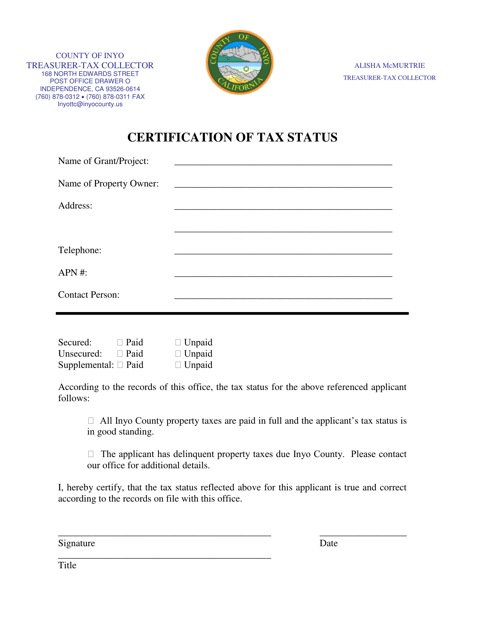

This document is used for certifying the tax status of individuals or entities in Inyo County, California. It verifies whether a person or organization is up to date with their tax obligations in the county.

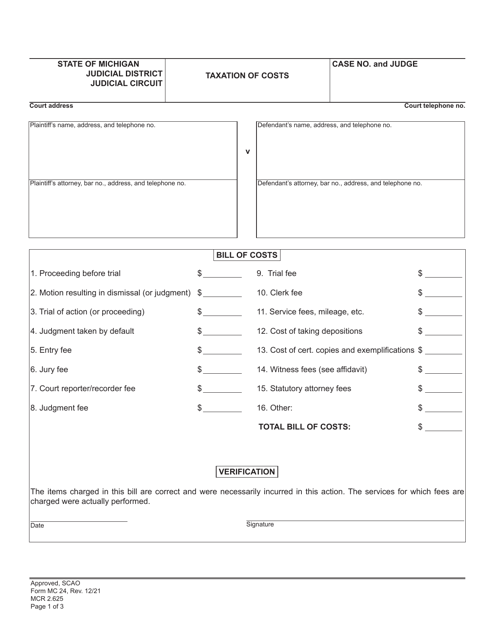

This form is used for determining the taxation of costs in Michigan. It provides a detailed breakdown of the costs that can be taxed in a legal case.