Tax Regulations Templates

Documents:

480

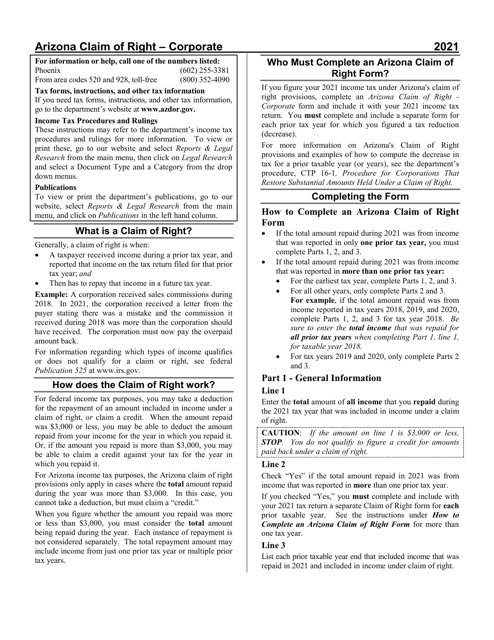

This document is used for filing a request to restore a substantial amount held under a claim of right for a corporate entity in the state of Arizona. It provides instructions on how to complete the form ADOR11289.

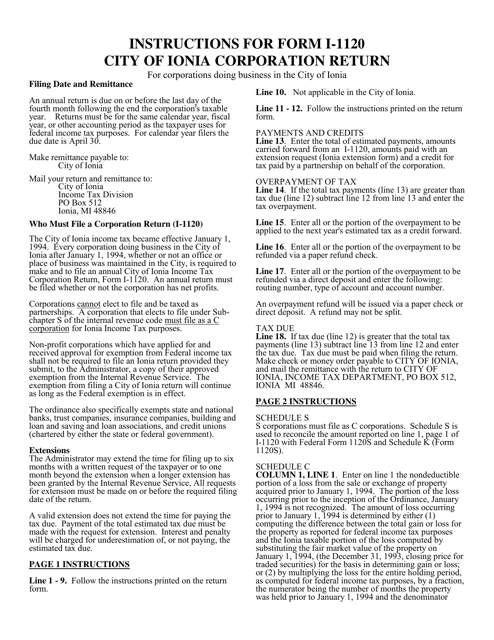

This Form is used for filing the Corporation Income Tax Return for businesses in the City of Ionia, Michigan. It includes instructions on how to accurately report income, deductions, and credits for the tax year.

This document provides instructions for filing the Corporation Income Tax Return specifically for businesses located in the City of Grand Rapids, Michigan. It explains how to report and calculate corporate income tax owed to the city.

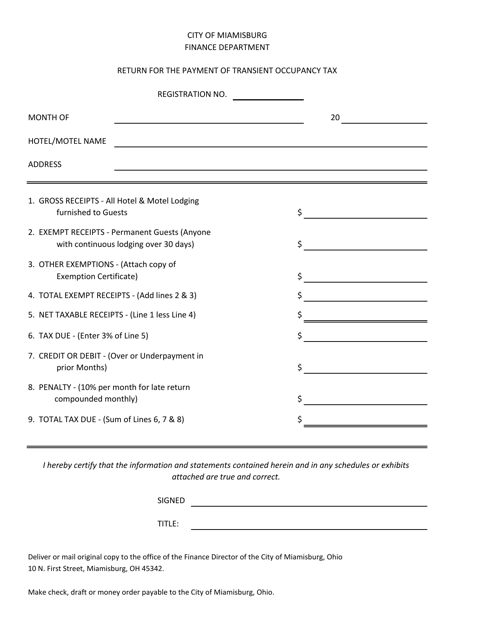

This form is used for reporting and submitting payment for the transient occupancy tax in the City of Miamisburg, Ohio.

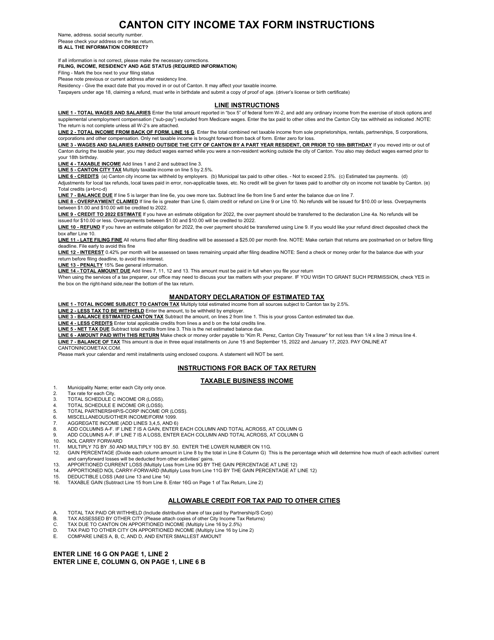

This Form is used for filing your Individual Income Tax Return with the City of Canton, Ohio. It provides step-by-step instructions for completing your tax return and ensures that you accurately report your income and claim any applicable deductions and credits.

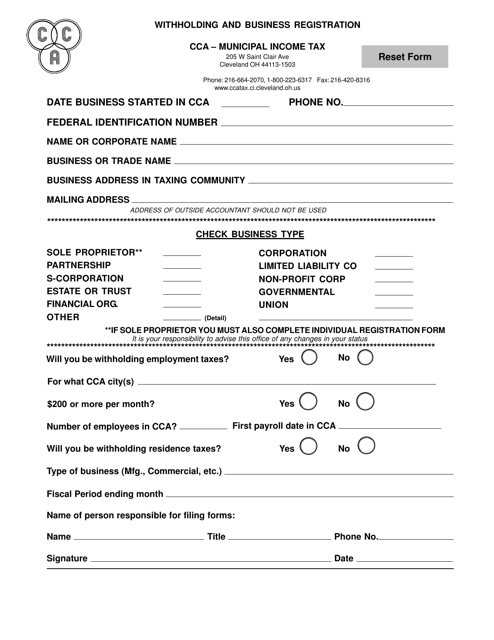

This document is for businesses in the city of Cleveland, Ohio who need to register for withholding taxes and obtain a business registration.

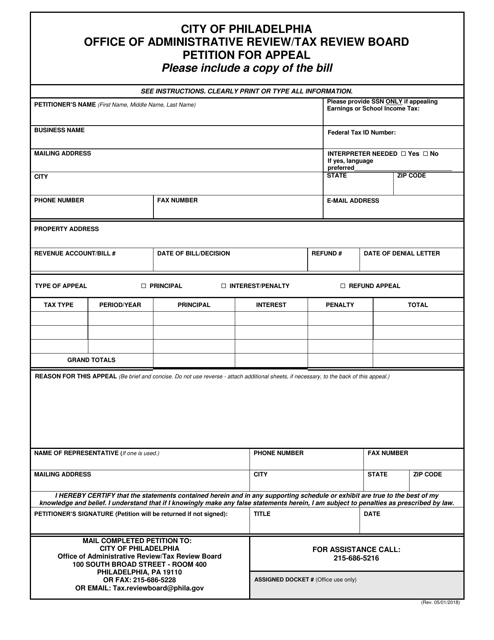

This Form is used for submitting a petition for appeal to the Tax Review Board in the City of Philadelphia, Pennsylvania.

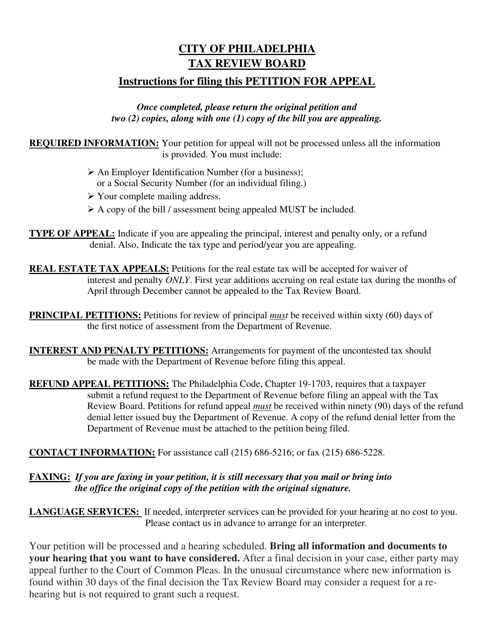

This document is for individuals in Philadelphia, Pennsylvania who wish to appeal a tax assessment made by the Tax Review Board. It provides instructions on how to complete a petition for appeal to challenge the assessment.

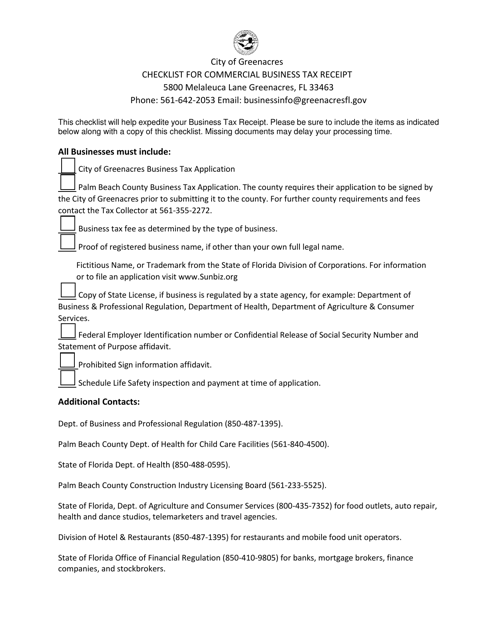

This document is a checklist for applying for a Commercial Business Tax Receipt in the City of Greenacres, Florida. It outlines the steps and requirements for obtaining a tax receipt for commercial businesses in the city.

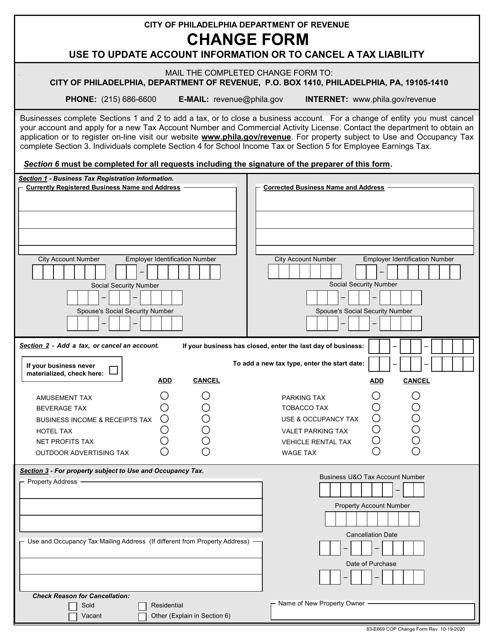

This form is used for changing your tax account information with the City of Philadelphia, Pennsylvania.

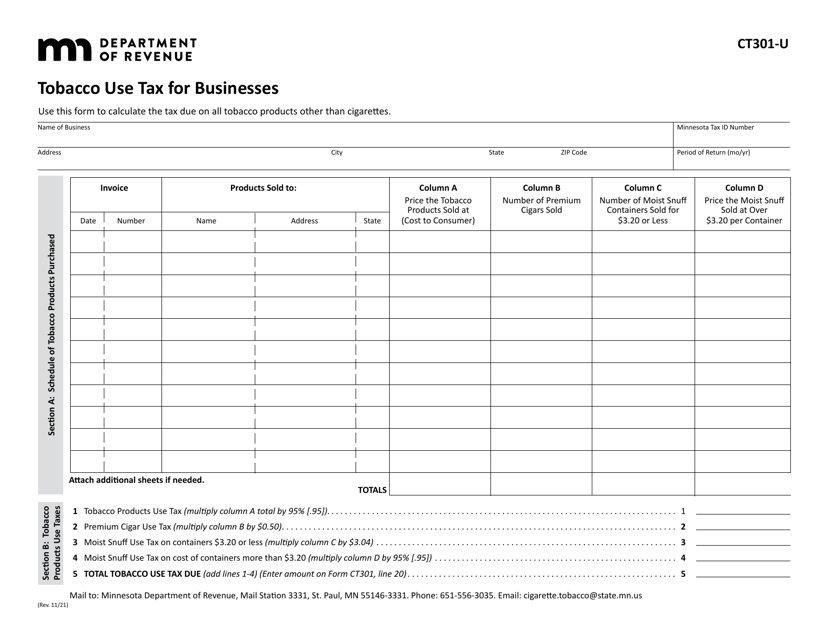

This form is used for businesses in Minnesota to report and pay tobacco use tax.

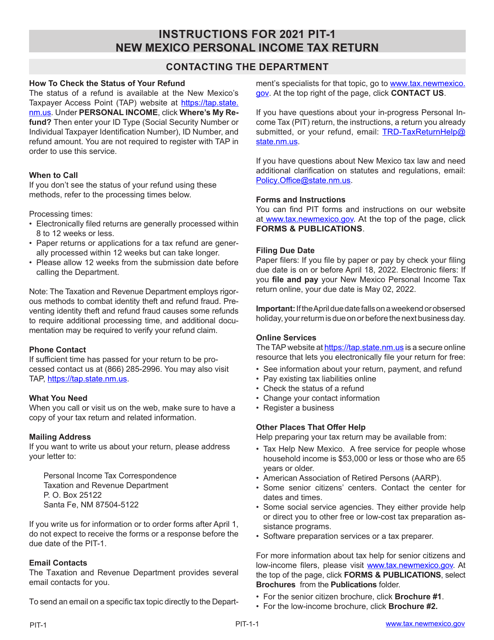

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.

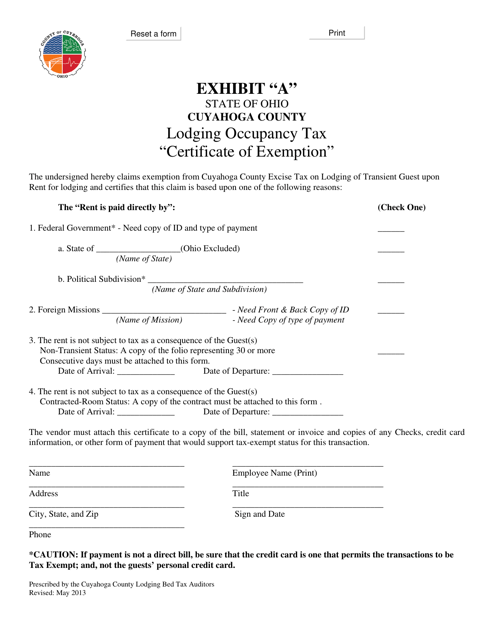

This document is a Lodging Occupancy Tax Certificate of Exemption specific to Cuyahoga County, Ohio. It is used for exempting certain types of lodging establishments from paying occupancy taxes in the county.

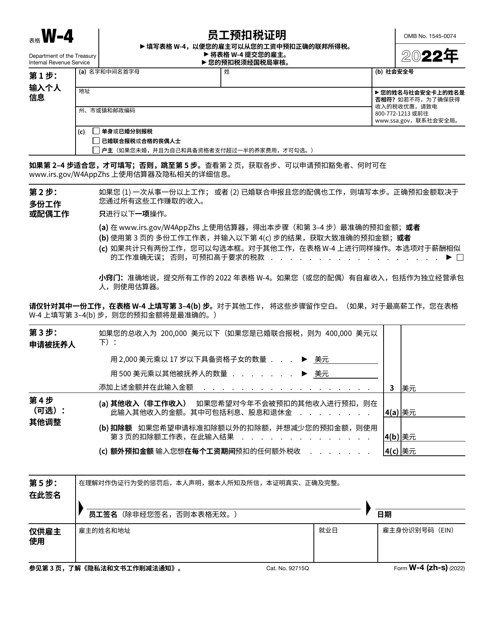

This Form is used for Chinese Simplified version of the IRS Form W-4 Employee's Withholding Certificate. It is used by employees to indicate their tax withholding preferences for income earned in the United States.

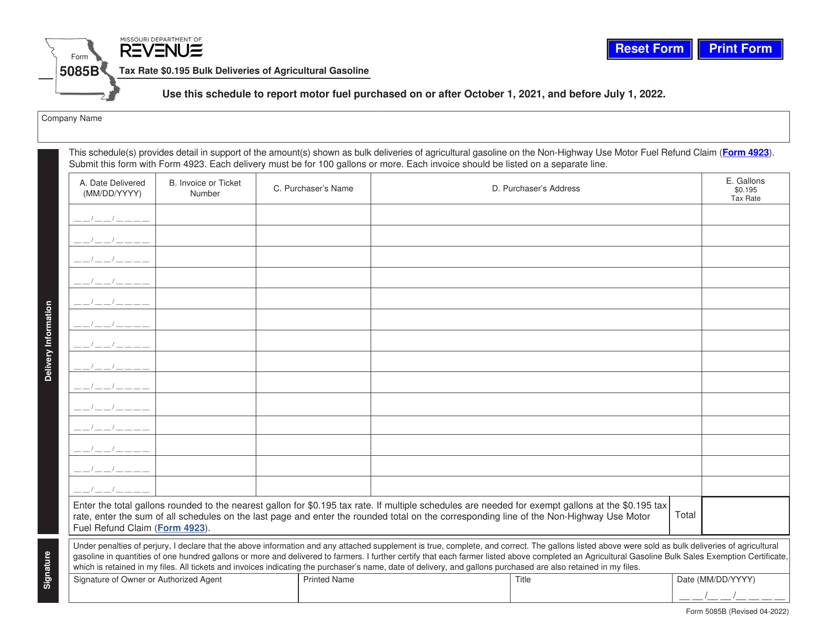

This form is used for reporting and paying a tax rate of $0.195 on bulk deliveries of agricultural gasoline in the state of Missouri.

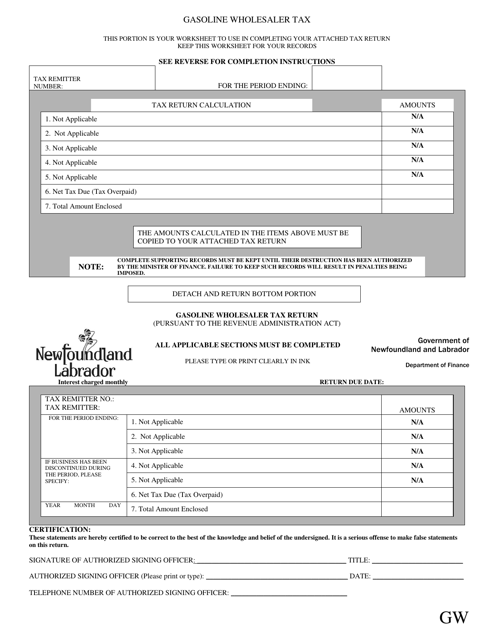

This document is for the Gasoline Wholesaler Tax in Newfoundland and Labrador, Canada. It explains the tax regulations for wholesalers who sell gasoline in the province.

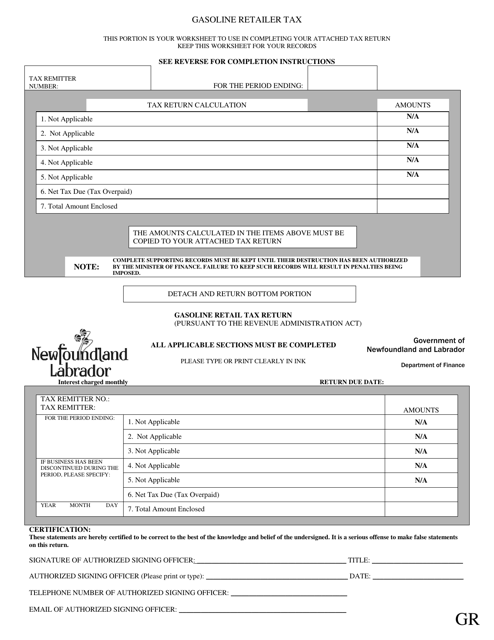

This document is used to schedule and pay the gasoline retailer tax in Newfoundland and Labrador, Canada.

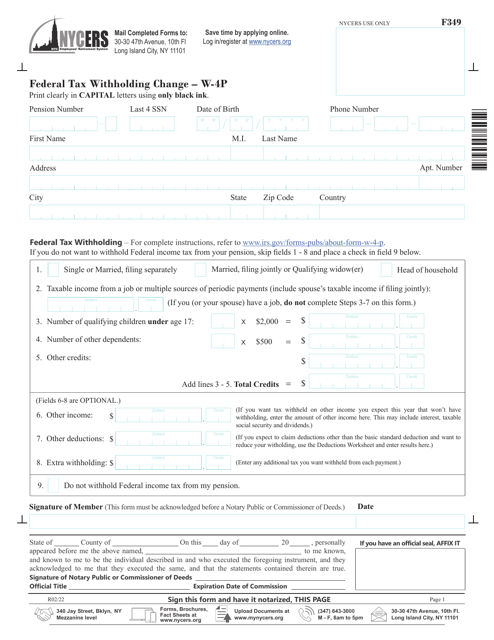

This form is used for making changes to federal tax withholding in New York City.