Tax Regulations Templates

Documents:

480

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

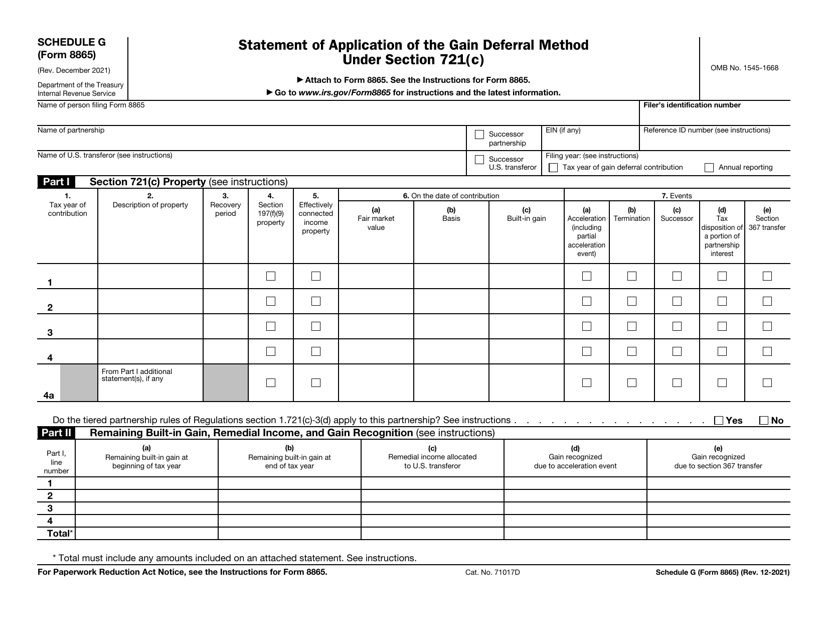

This form is used for reporting the application of the gain deferral method under Section 721(c) for certain contributions of property to a partnership.

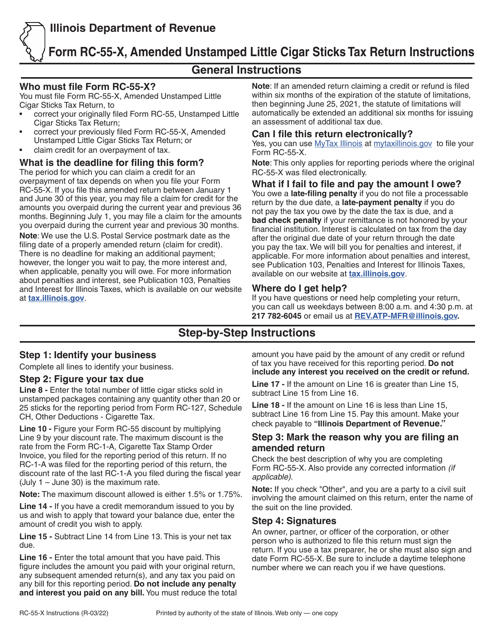

This Form is used for filing an amended tax return for the 94B Amended Unstamped Little Cigar Sticks Tax in the state of Illinois. It provides instructions on how to accurately report and pay the required tax.

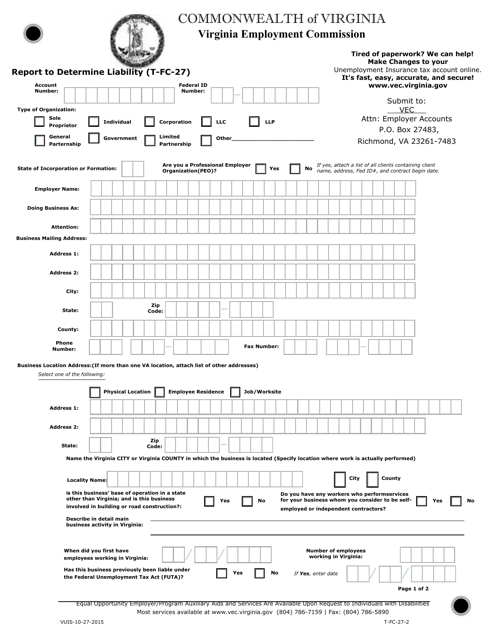

This form is used for reporting and determining liability in the state of Virginia. It is specifically for tax purposes and helps individuals or businesses report their financial obligations accurately.

This is a fiscal IRS document designed to outline the tax deducted from the income of various foreign persons.

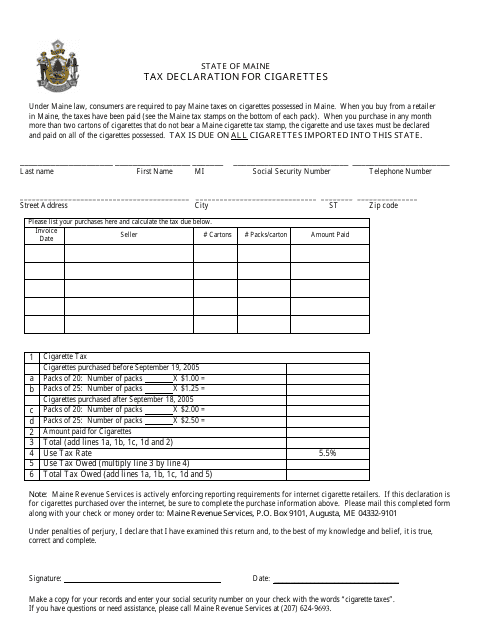

This form is used for declaring taxes on cigarettes in the state of Maine.

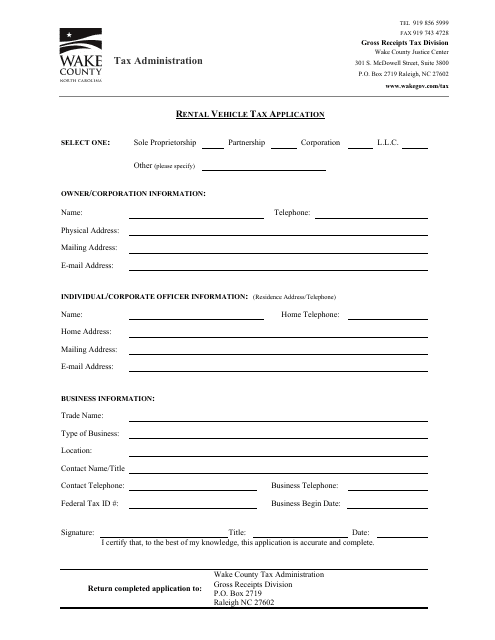

This document is for applying for rental vehicle tax in Wake County, North Carolina. It is used to report and pay taxes related to renting vehicles in the county.

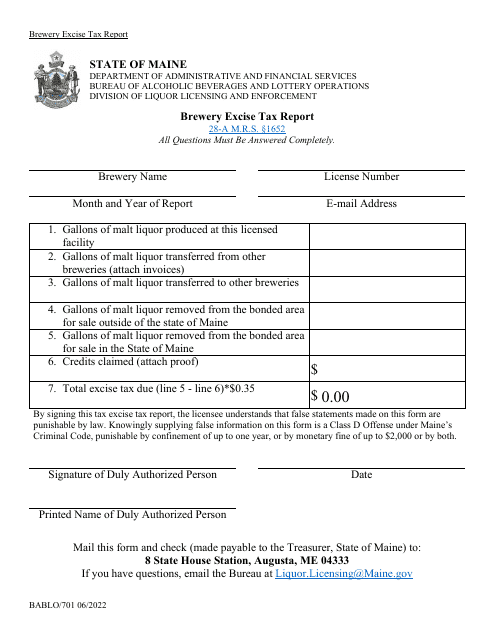

This Form is used for reporting brewery excise taxes in the state of Maine. It is required for breweries to accurately report and pay their excise tax obligations.