Tax Templates

Documents:

2882

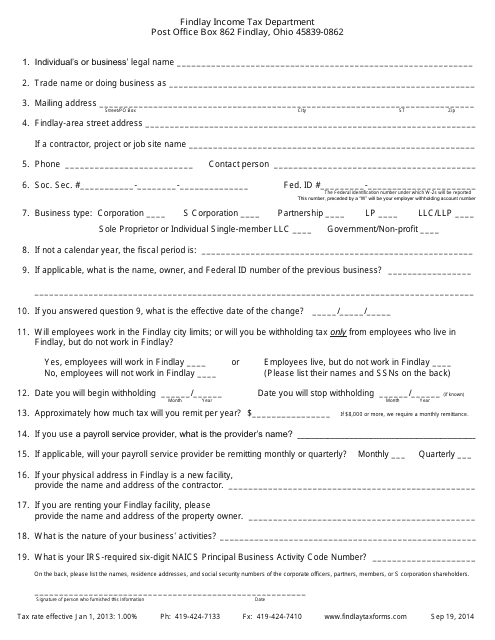

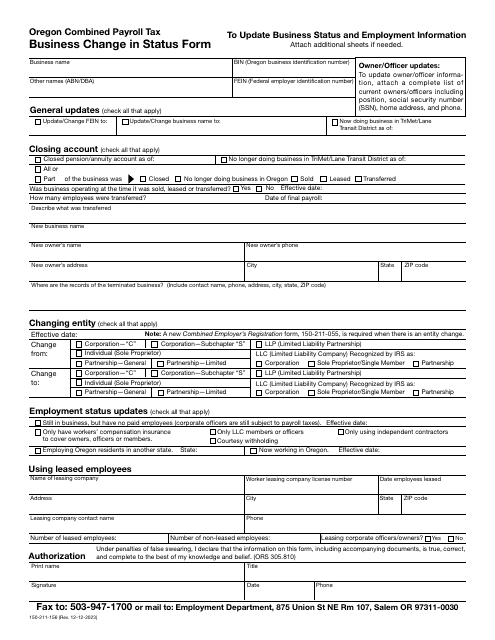

This type of document is a Business Questionnaire Form used by the City of Findlay, Ohio. It is used to collect information from businesses in the city for various purposes such as licensing, tax assessment, and community development.

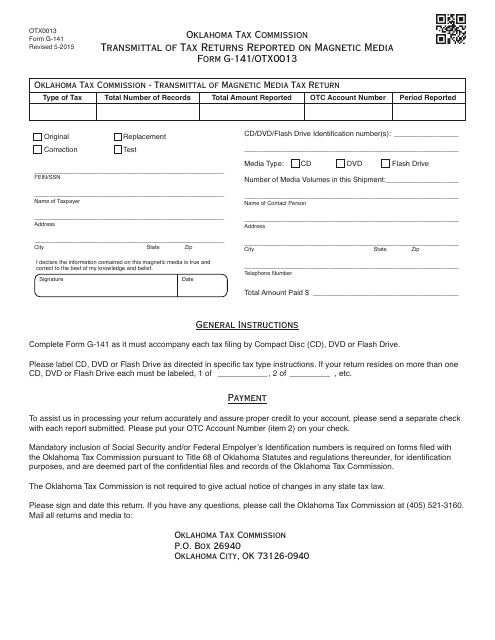

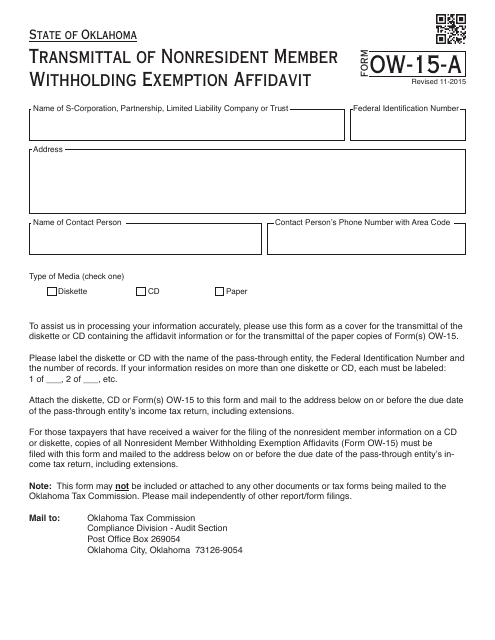

This document is used for transmitting tax returns reported on magnetic media to the Oklahoma Tax Commission (OTC).

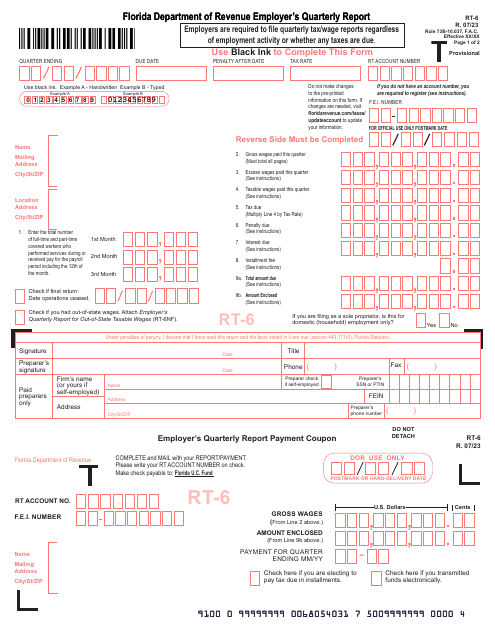

This is a legal document used to inform the Florida Department of Revenue (DOR) about the total number of all employees who performed services or received pay, their gross, excess, and taxable wages.

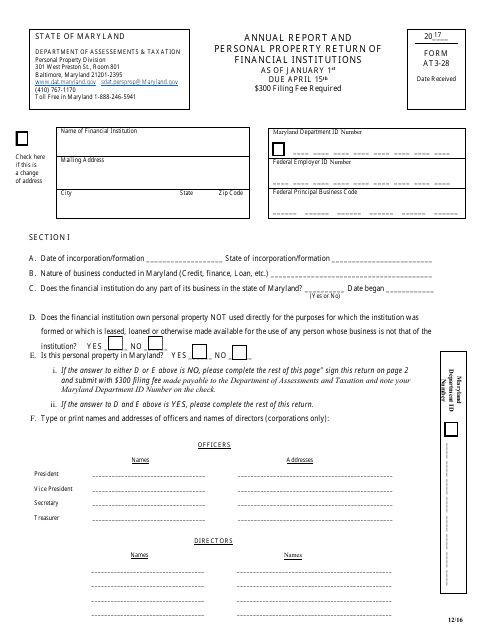

This Form is used for financial institutions in Maryland to file their annual report and personal property return.

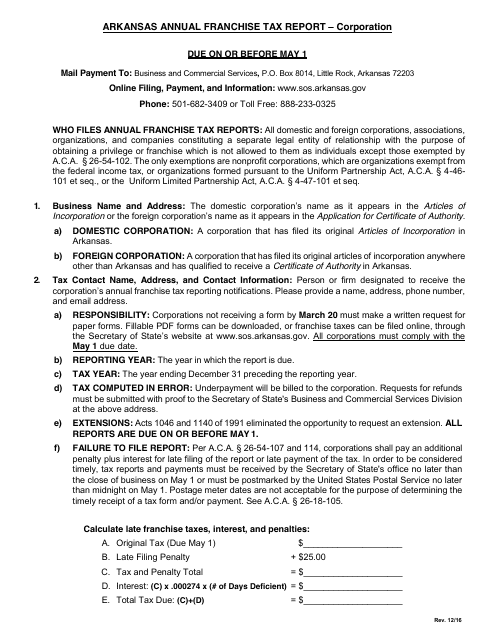

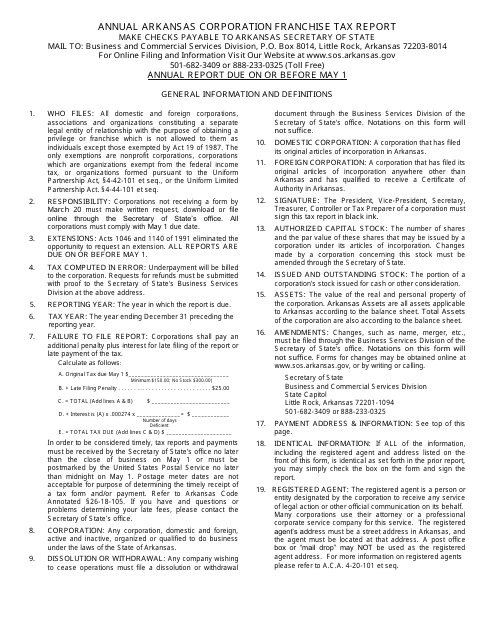

This document provides instructions for filling out the Annual Corporation Franchise Tax Report in Arkansas. It guides corporations on how to accurately report their taxes and includes step-by-step instructions for each section of the form.

This document is used for transmitting the Nonresident Member Withholding Exemption Affidavit in Oklahoma.

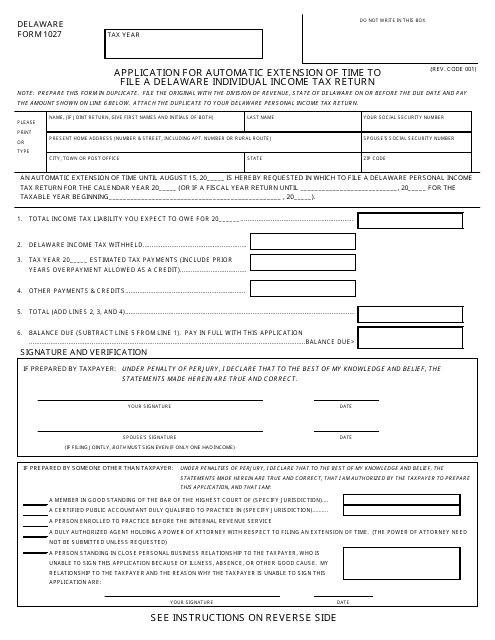

This Form is used for requesting an automatic extension of time to file a Delaware individual income tax return.

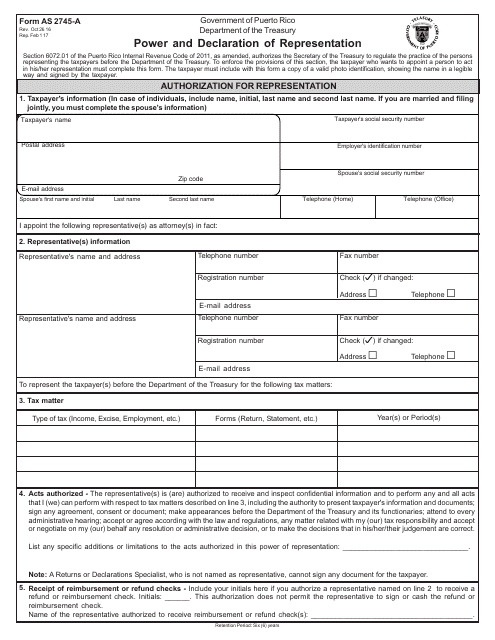

This Form is used for power and declaration of representation in Puerto Rico.

This type of document provides instructions on how to fill out the Annual Arkansas Corporation Franchise Tax Report for corporations in Arkansas. It explains the necessary steps and information required for completing the tax report accurately.

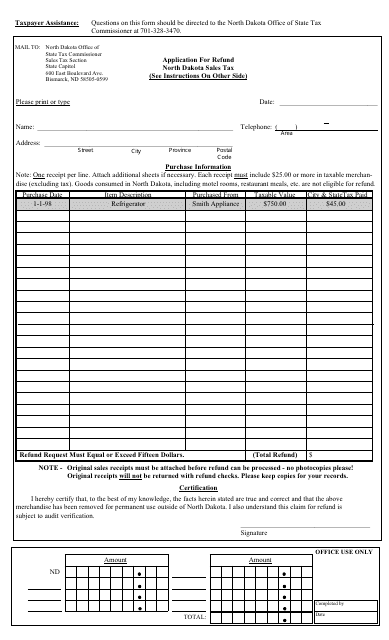

This Form is used for requesting a refund in the state of North Dakota.

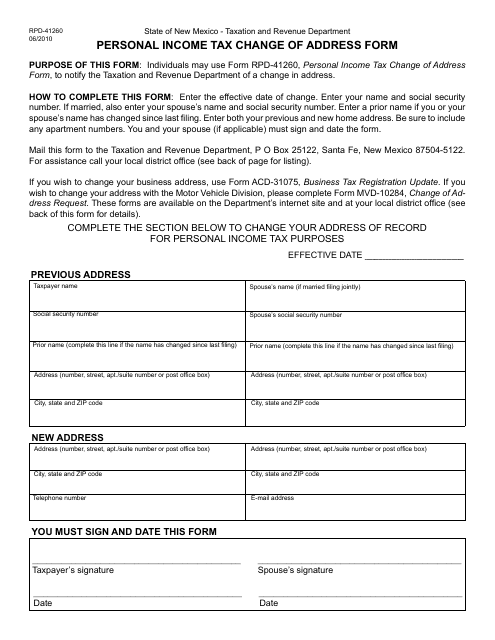

This Form is used for changing your address for personal income tax purposes in the state of New Mexico.

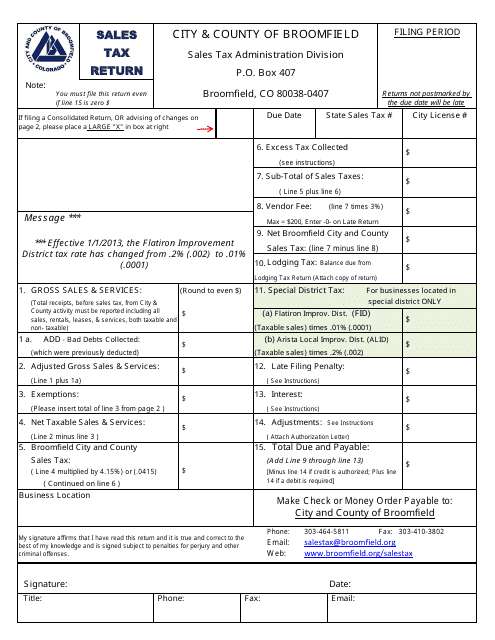

This form is used for filing sales tax returns for the City and County of Broomfield, Colorado.

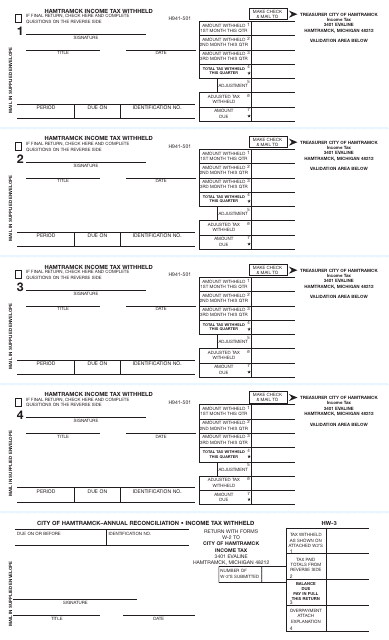

This Form is used for reporting income tax that has been withheld from wages in Hamtramck, Michigan.

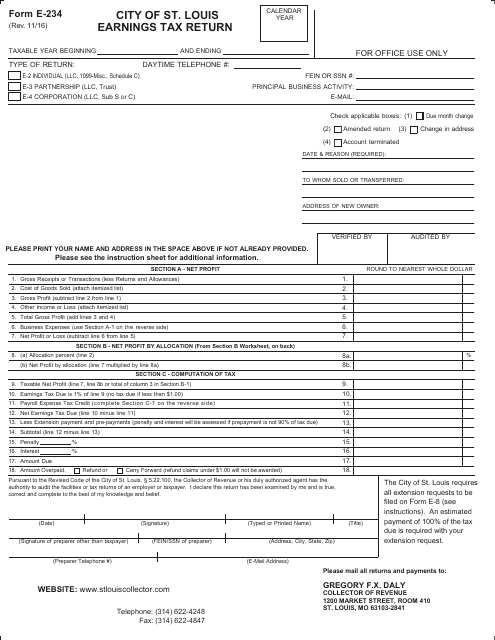

This form is used for filing the City of St. Louis earnings tax return in Missouri.

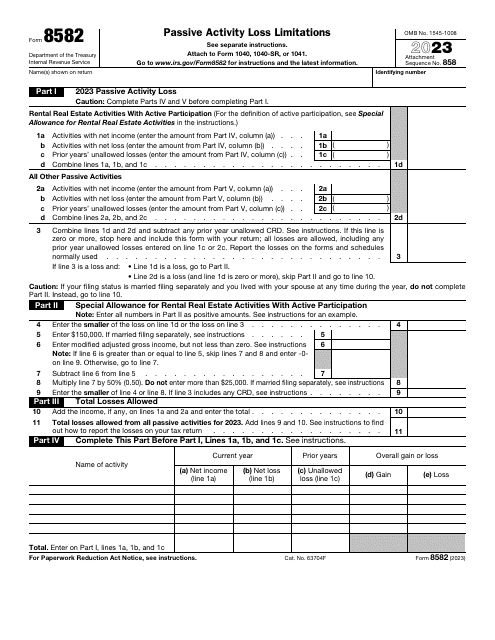

Download this form if you are a noncorporate taxpayer. The main purpose of this document is to help you calculate the amount of Passive Activity Loss (PAL). You can also use this form to claim for non allowed PALs for the past tax year.

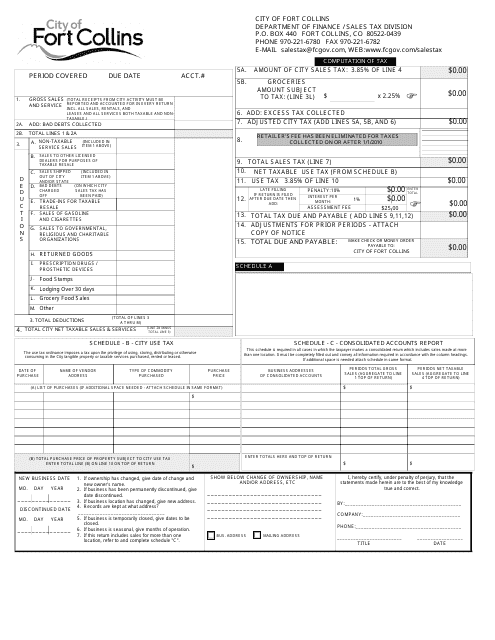

This form is used for reporting sales and use tax to the City of Fort Collins, Colorado. Businesses in the city are required to fill out this form to remit their tax obligations.

This is a fiscal IRS document designed for taxpayers that received different types of interest income.

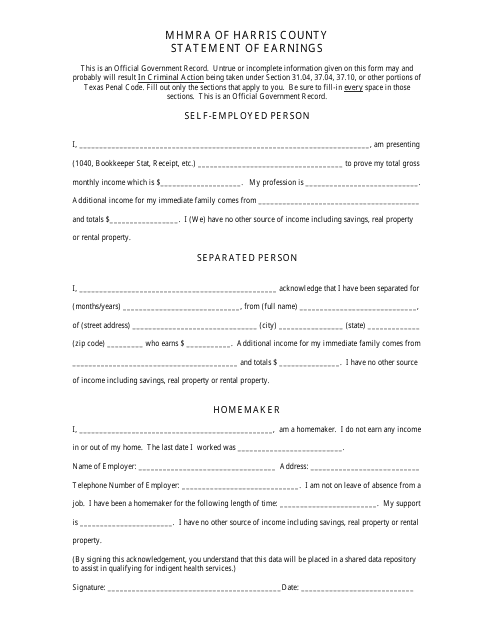

This form is used in Texas to provide a statement of earnings. It is used to report and document an individual's income and earnings.

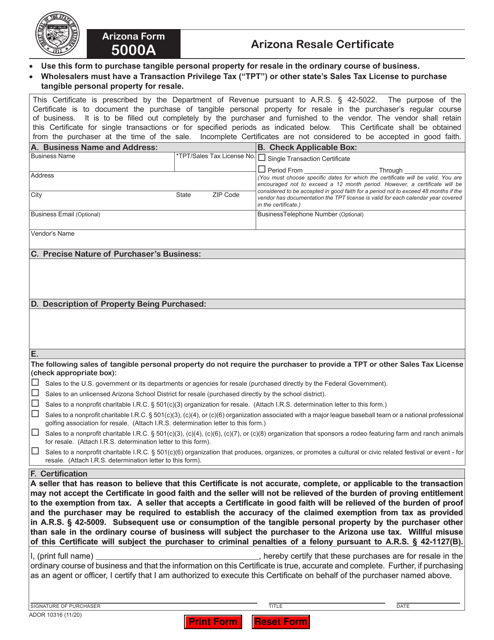

This form is released by Arizona's Department of Revenue and is supposed to be completely filled out and signed by a purchaser, and provided to a seller in order to document the purchase of a physical piece of personal property for resale.

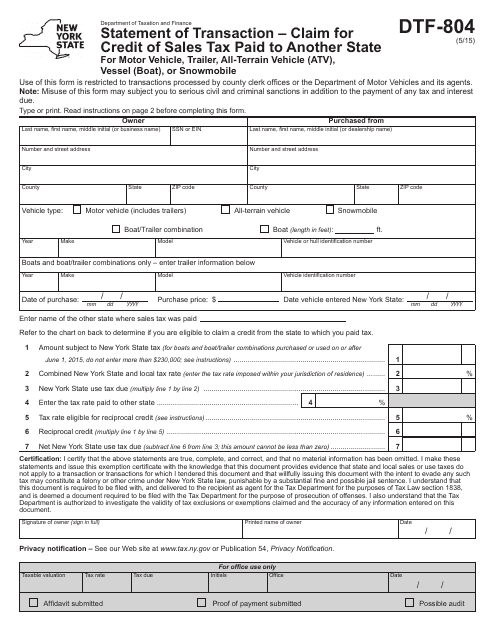

This Form is used for claiming credit of sales tax paid in another state for purchasing motor vehicles, trailers, all-terrain vehicles (ATV), vessels (boat), or snowmobiles in New York.

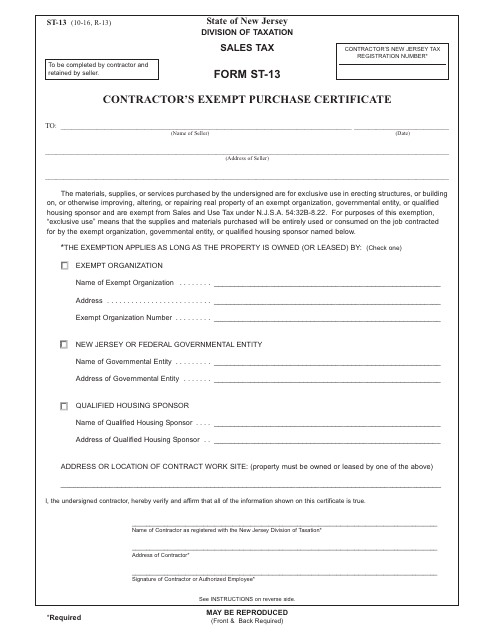

This Form is used for contractors in New Jersey to claim exemption on purchases made for construction projects.

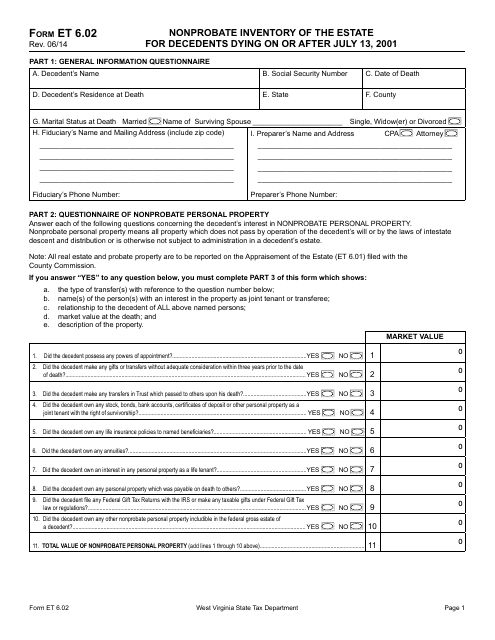

This Form is used for creating a Nonprobate Inventory of the Estate for Decedents Dying on or After July 13, 2001 in West Virginia.

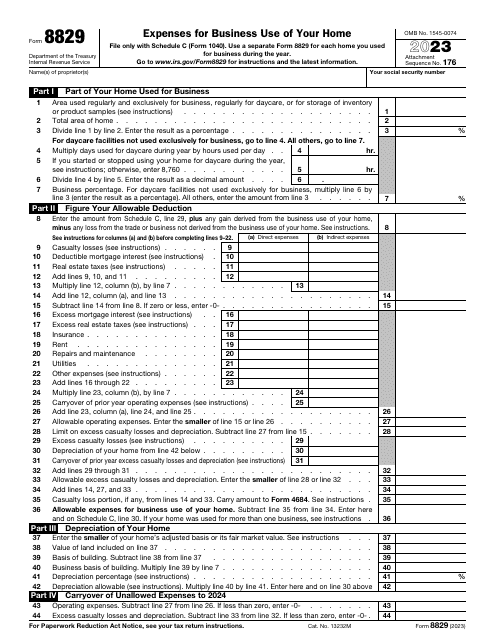

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

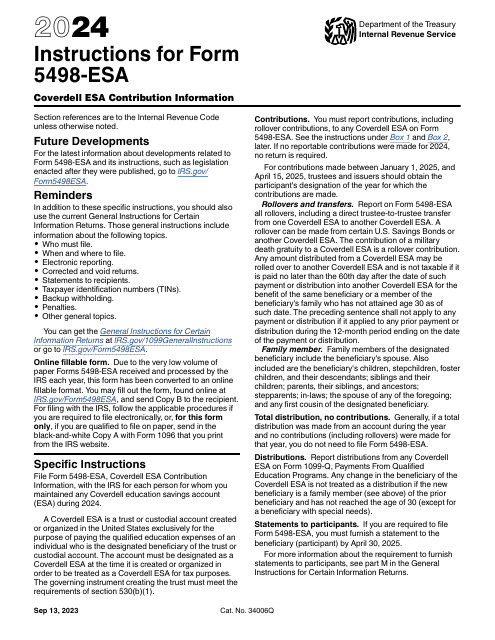

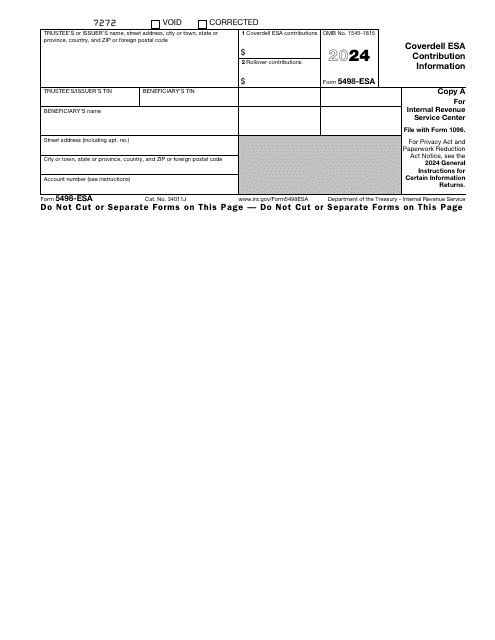

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

This is an IRS form that includes the details of an installment sale.

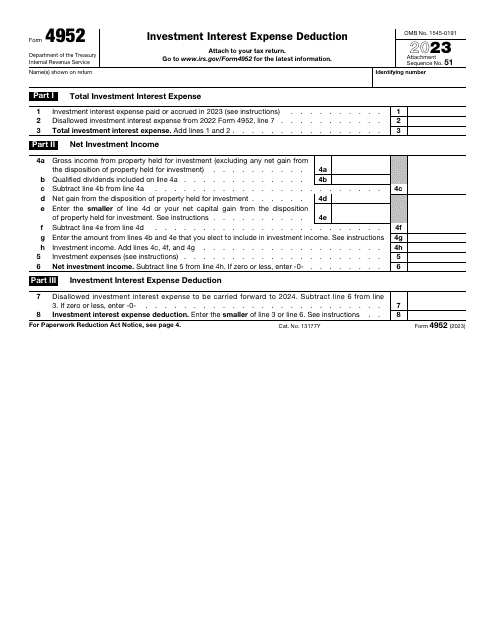

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

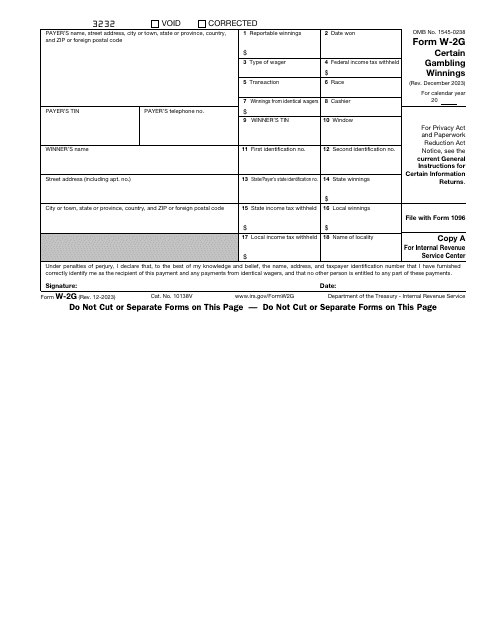

This is a formal report filed by gambling facilities to outline the winnings of their clients and certify they deducted taxes from the sum of money won.