Tax Templates

Documents:

2882

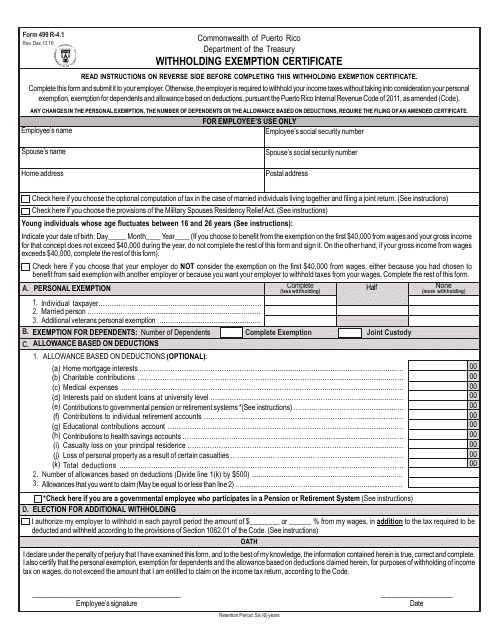

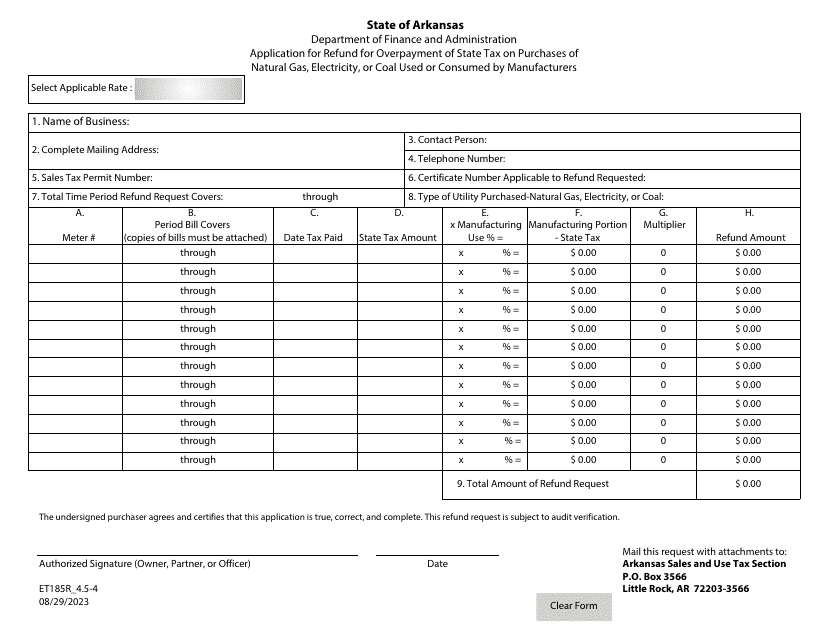

This document is used for claiming withholding tax exemption in Puerto Rico.

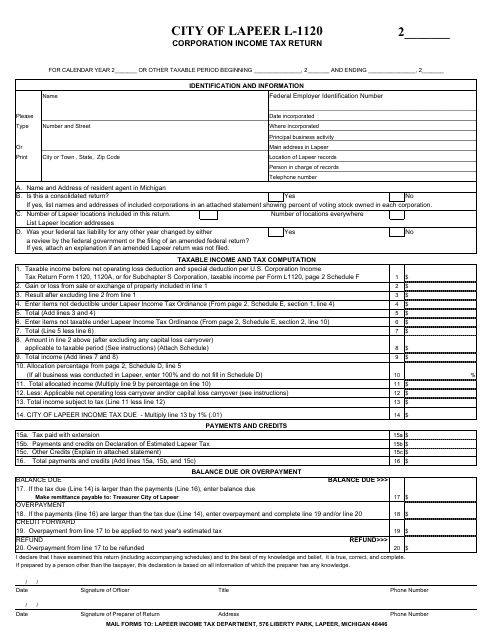

This form is used for filing corporation income tax return specifically for businesses located in the City of Lapeer, Michigan.

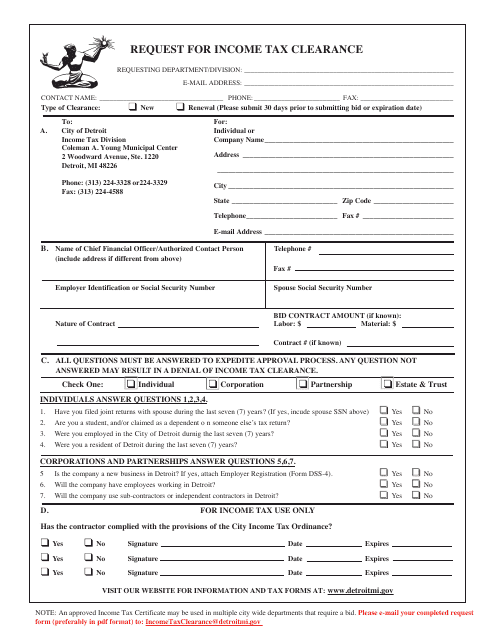

This form is used for requesting an income tax clearance in Detroit, Michigan. It is required to ensure all income taxes have been paid before certain transactions or activities can take place.

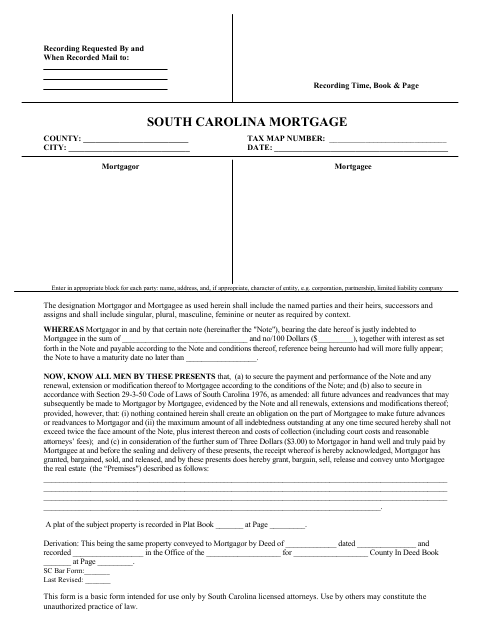

This document is used for applying for a mortgage loan in South Carolina. It contains the necessary forms and information required by lenders to approve a mortgage application.

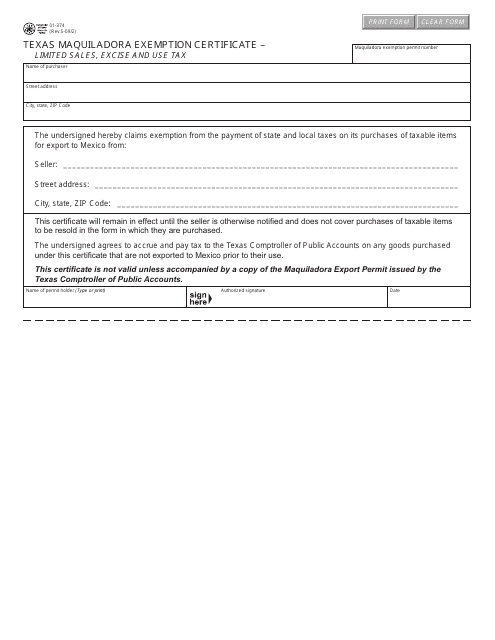

This form is used for businesses operating in Texas to claim exemption from certain taxes for goods produced in a maquiladora (manufacturing facility) in Mexico.

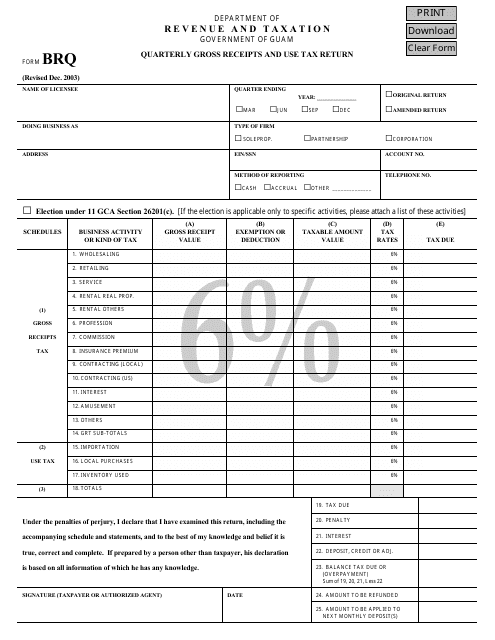

This form is used for reporting quarterly gross receipts and use tax in Guam.

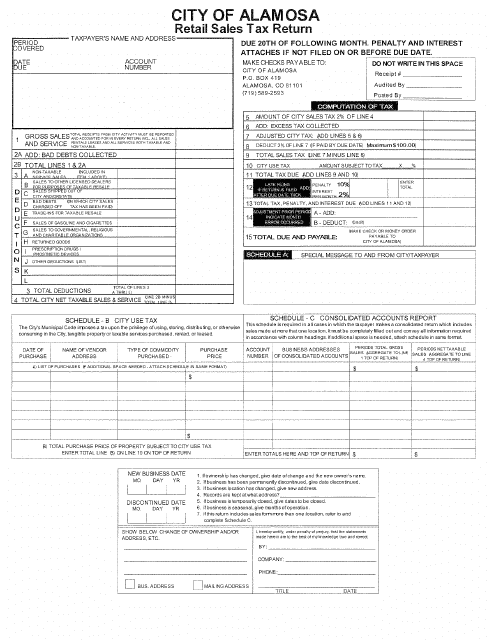

This Form is used for reporting and paying retail sales tax in the City of Alamosa, Colorado.

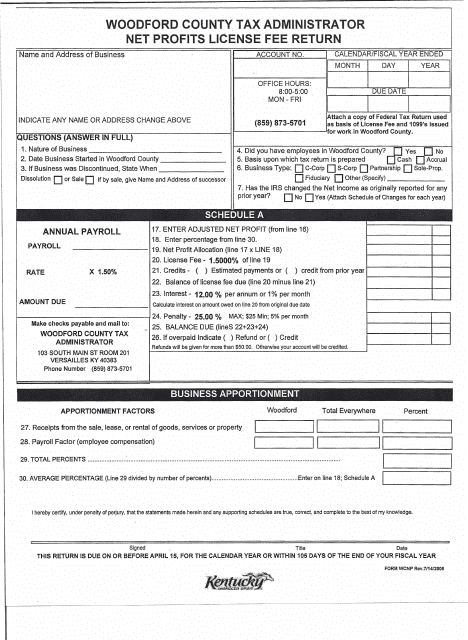

This form is used for reporting and paying the net profits license fee in Woodford County, Kentucky.

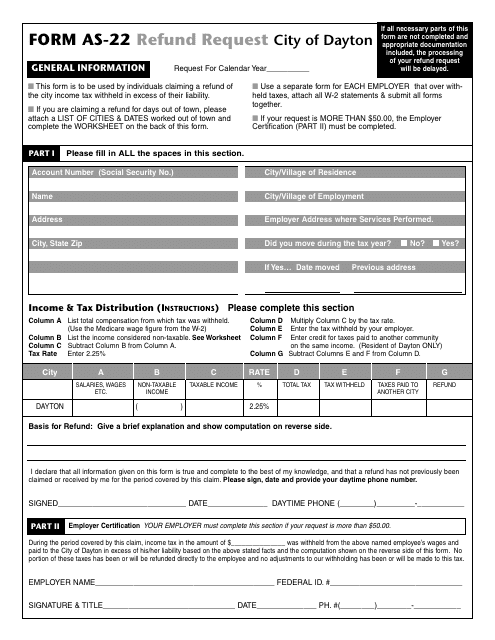

This form is used for requesting a refund from the City of Dayton, Ohio.

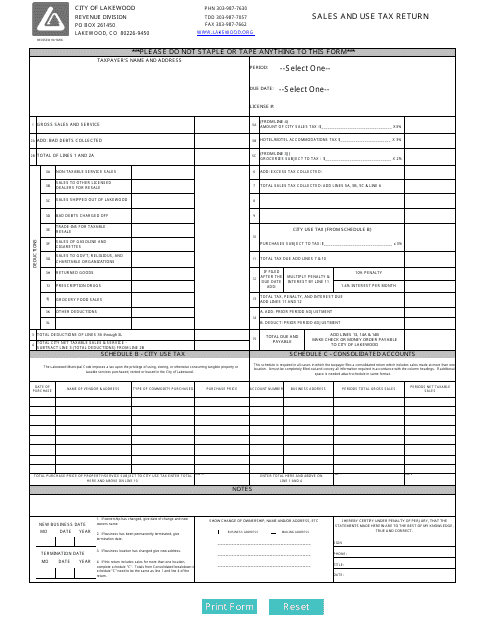

This Form is used for reporting and remitting sales and use tax to the City of Lakewood, Colorado.

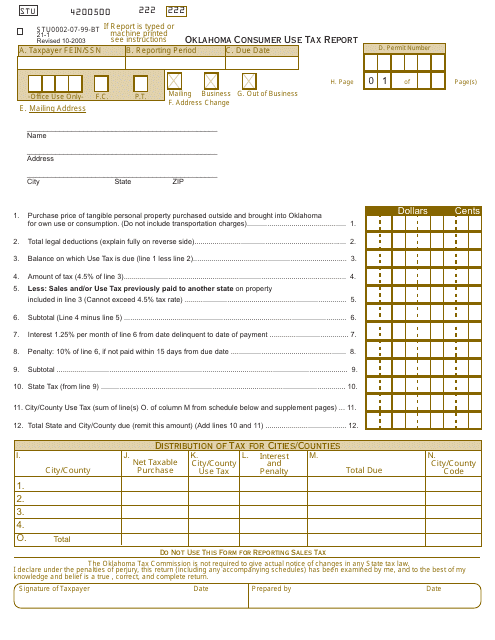

This document is used for reporting consumer use tax in Oklahoma.

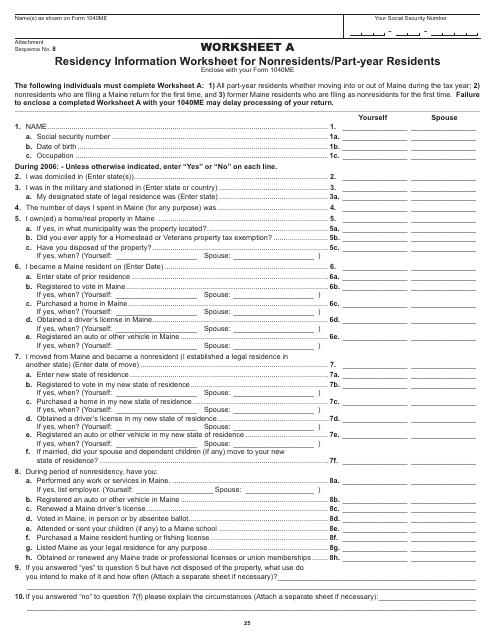

This document is a worksheet for nonresidents or part-year residents in Maine to provide information about their residency status. It helps determine their tax obligations.

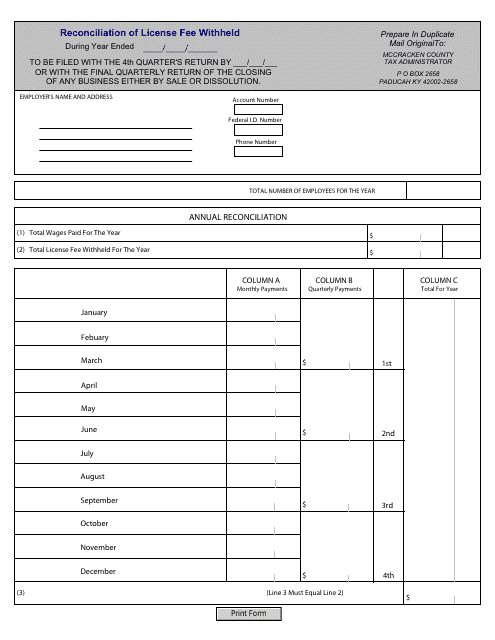

This type of document is used for reconciling license fees withheld in McCracken County, Kentucky.

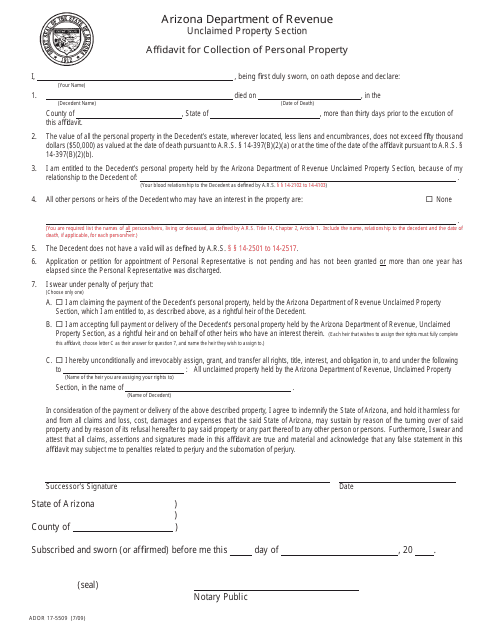

This form is used for the collection of personal property in Arizona. It allows individuals to make an affidavit for the collection of personal property.

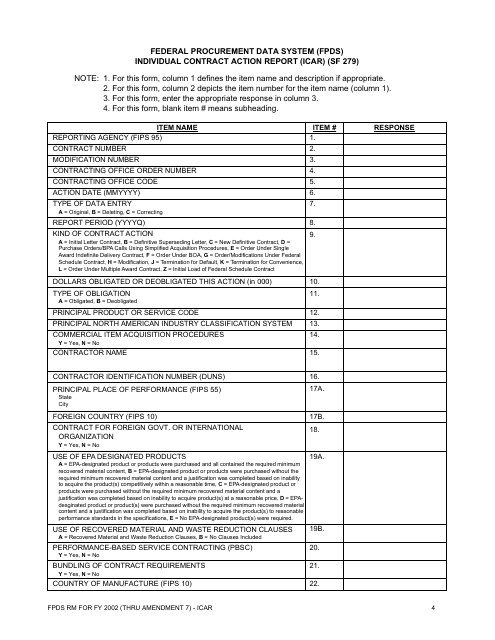

This form is used for reporting individual contract actions in the Federal Procurement Data System (FPDS). It provides detailed information about the contracts awarded by the federal government.

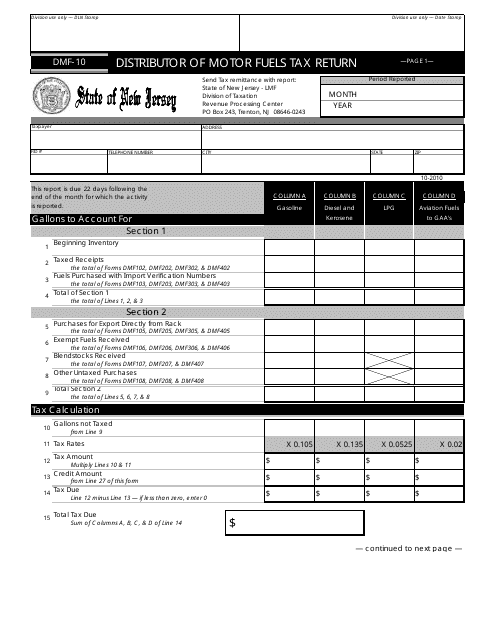

This form is used for filing the Motor Fuels Tax Return for distributors in the state of New Jersey.

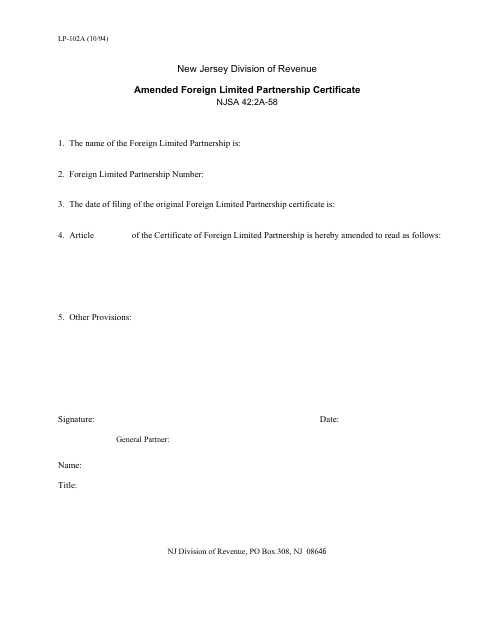

This form is used for filing an amended certificate for a foreign limited partnership in New Jersey.

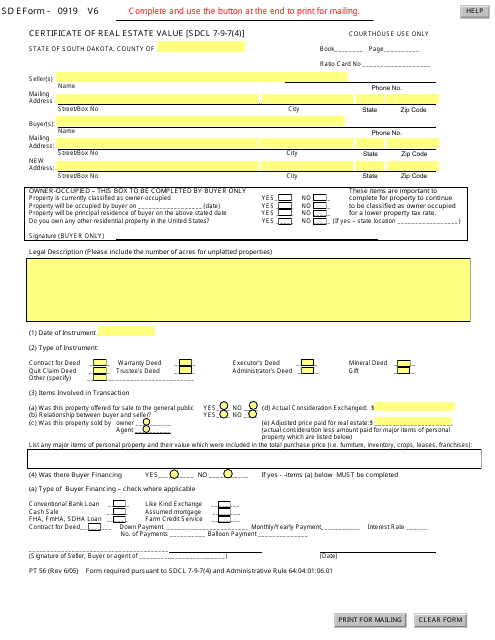

This form is used for reporting the value of real estate transactions in South Dakota. It is required for tax purposes and helps determine the assessment of property values.

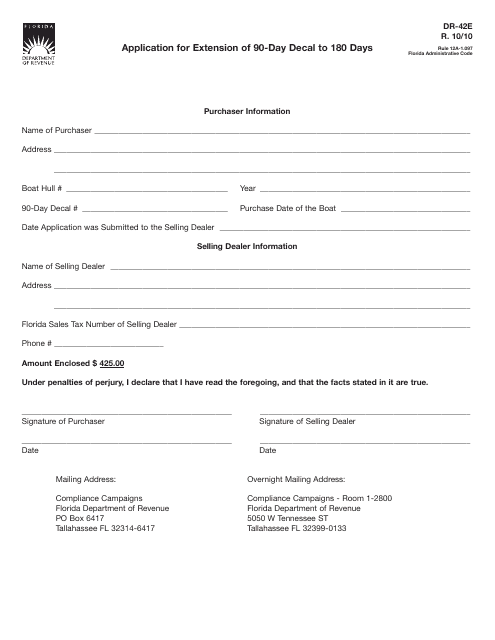

This form is used for applying for an extension of the 90-day decal in Florida, allowing it to be valid for 180 days.

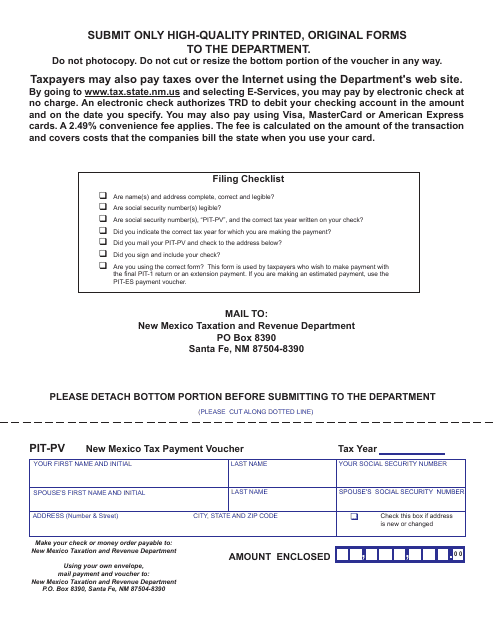

This form is used for making tax payment in New Mexico. It is called the PIT-PV (Personal Income Tax Payment Voucher) and is used to submit tax payments to the state.

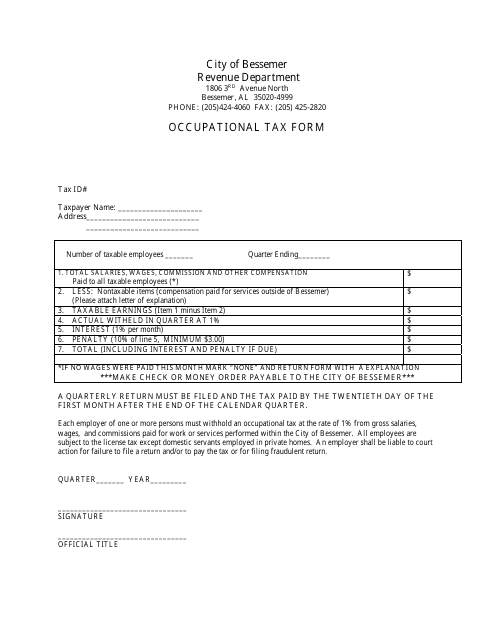

This Form is used for paying occupational taxes to the City of Bessemer, Alabama.

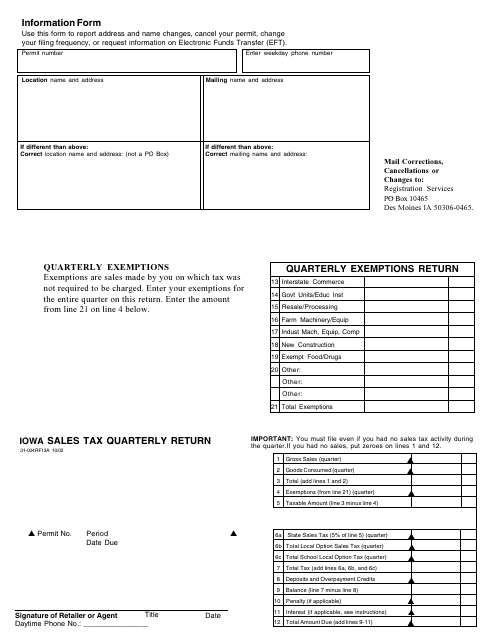

This Form is used for submitting Iowa sales tax quarterly return.

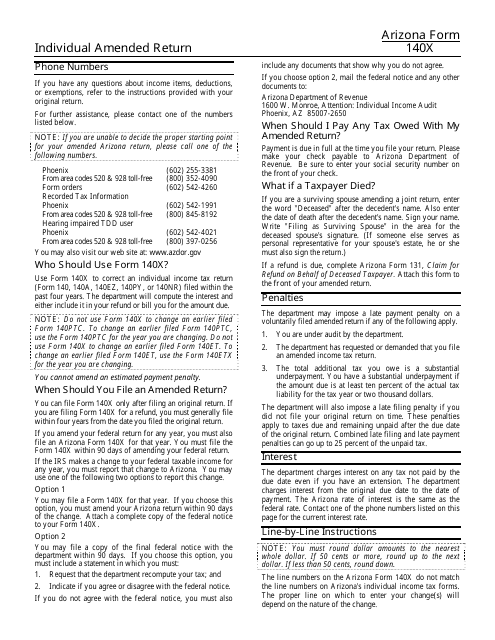

This Form is used for filing an amended individual tax return in the state of Arizona. It allows taxpayers to make corrections or updates to their previously filed Form 140.

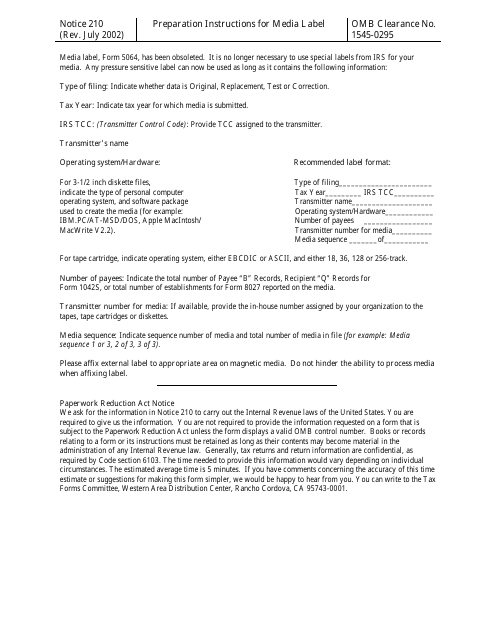

This document provides instructions for preparing media labels as required by the IRS for tax-related purposes.

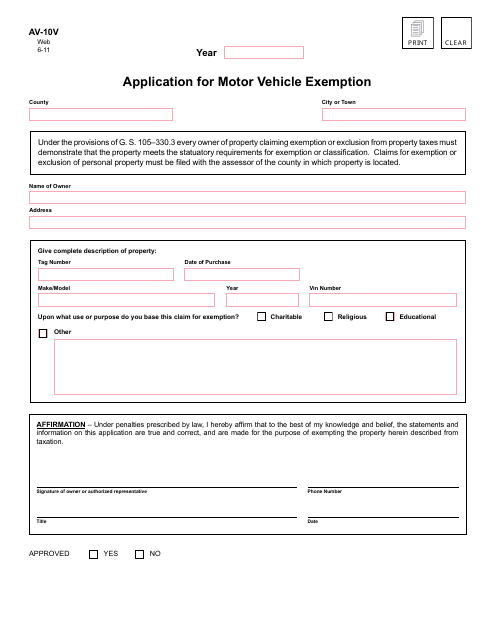

This Form is used for applying for motor vehicle exemption in North Carolina.

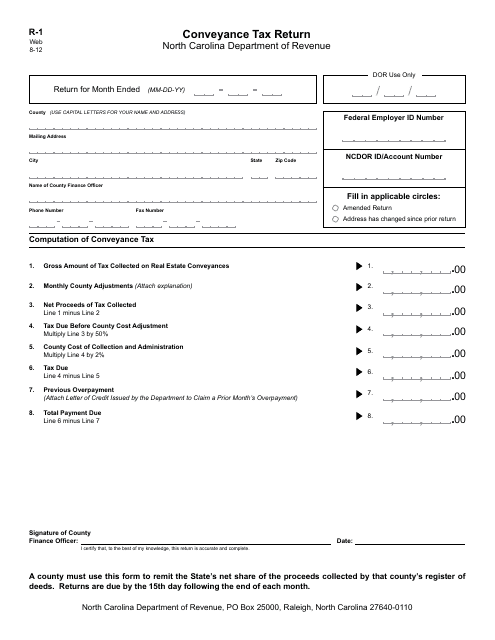

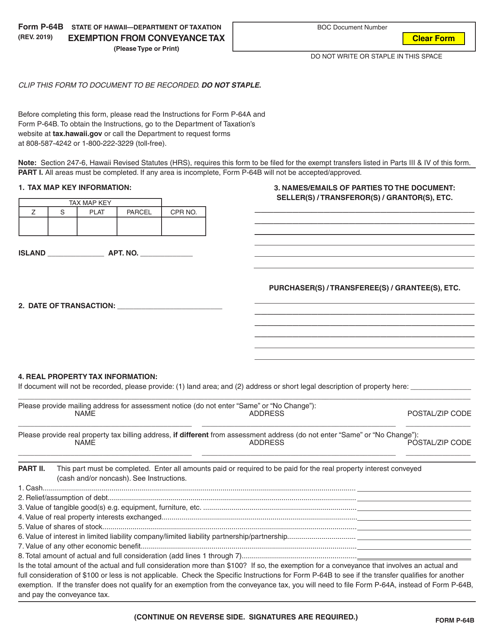

This Form is used for filing a Conveyance Tax Return in North Carolina.

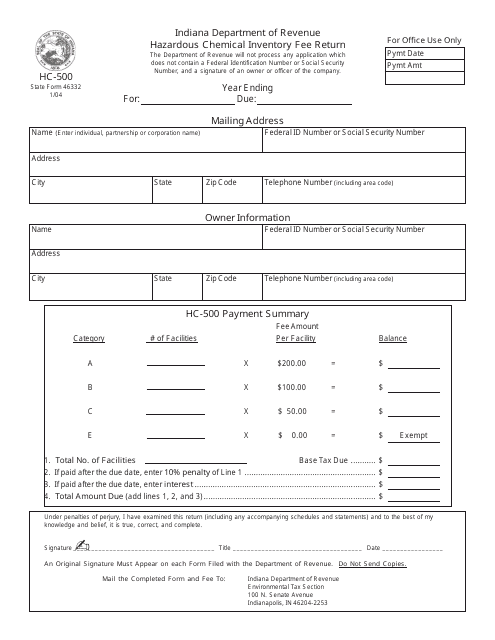

This Form is used for reporting and paying hazardous chemical inventory fees in the state of Indiana.

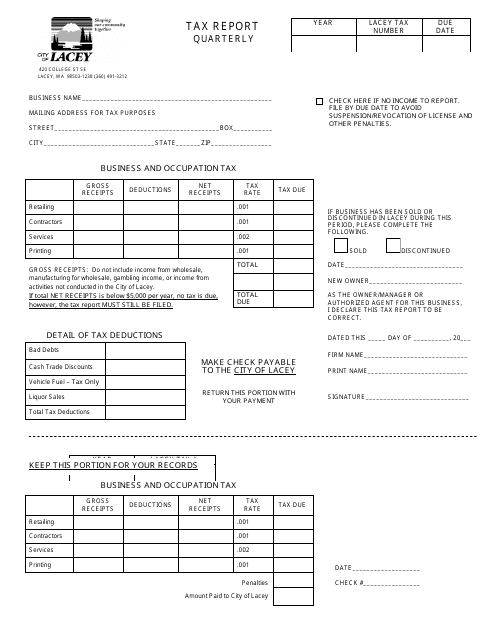

This document is a tax report for the City of Lacey, Washington on a quarterly basis. It is used to report and pay taxes owed to the city.

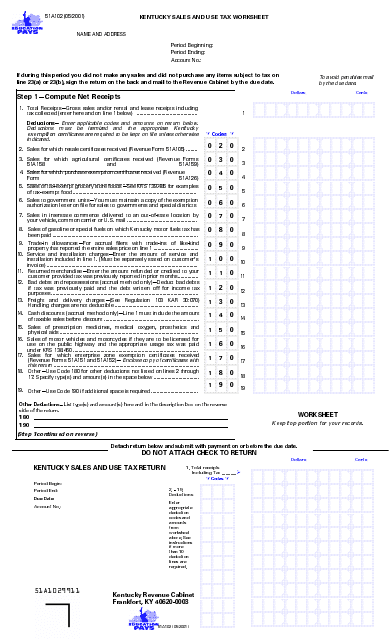

This Form is used for calculating sales and use tax in the state of Kentucky. It helps individuals and businesses determine the amount of tax owed based on their sales and use of taxable items.

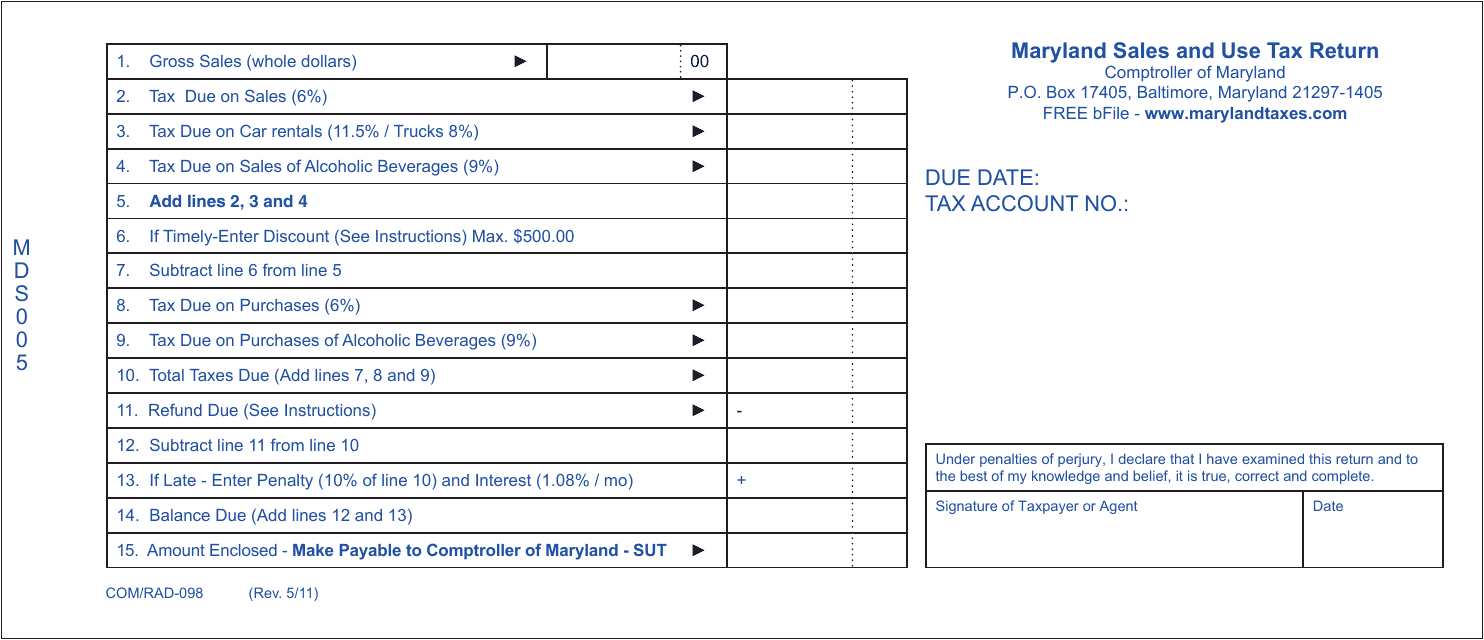

This form is used for reporting sales and use tax in the state of Maryland. It is used by businesses to calculate and pay their tax obligations related to sales of goods and services.

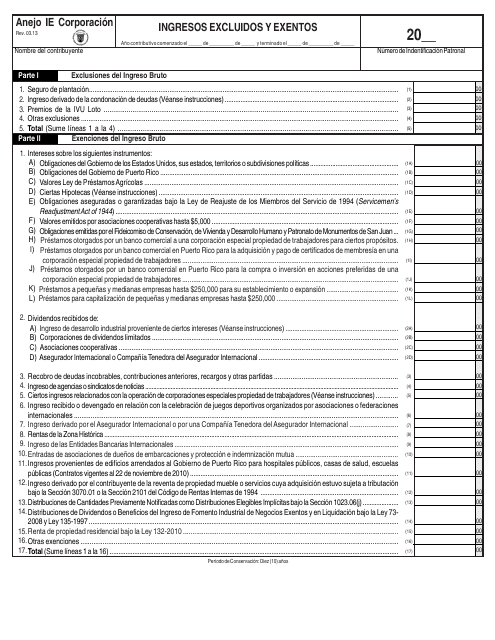

This document is for the inclusion and exemption of excluded and exempted income for corporations in Puerto Rico.

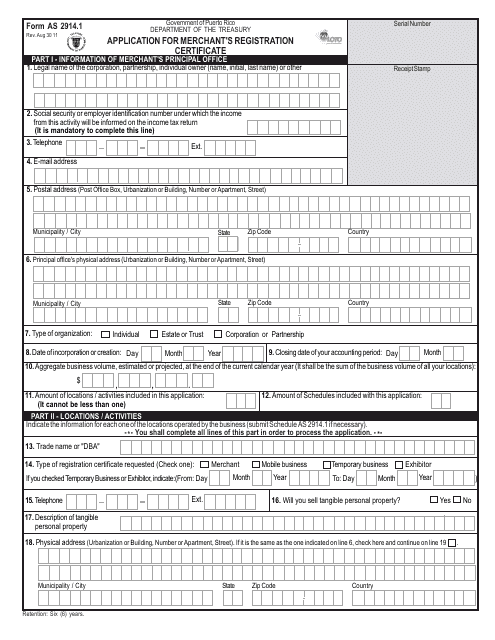

This form is used for applying for a Merchant's Registration Certificate in Puerto Rico. It is required for individuals or businesses engaging in commercial activities on the island.

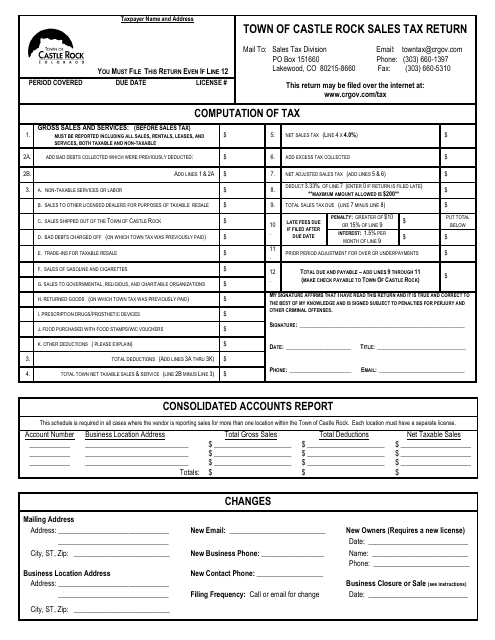

This document is used for reporting and remitting sales tax in the Town of Castle Rock, Colorado. Businesses must submit this form to the town's tax department on a regular basis to comply with local tax regulations.

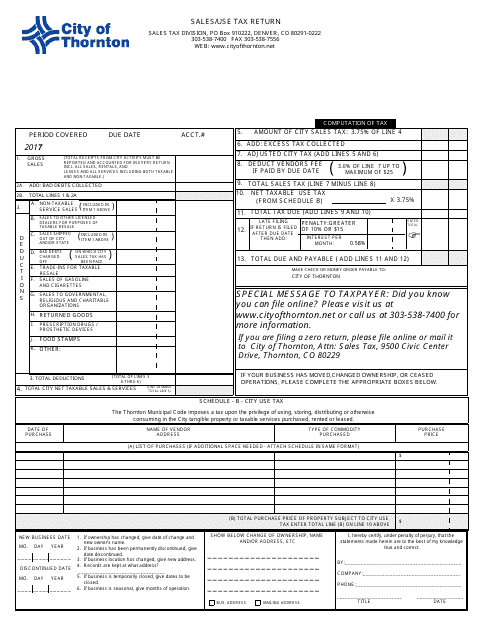

This form is used for reporting and remitting sales or use tax to the City of Thornton, Colorado.

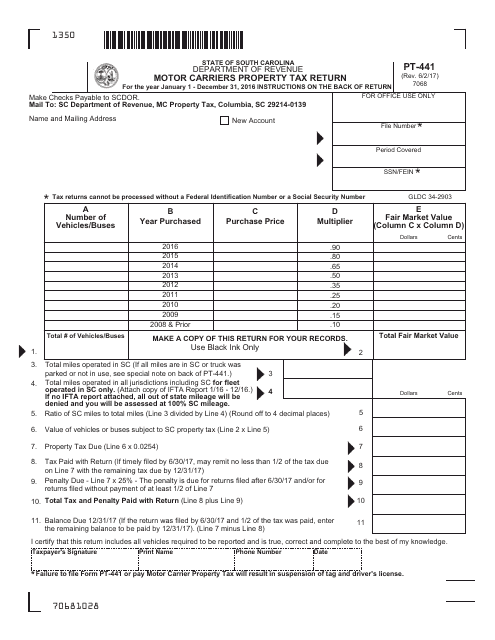

This form is used for South Carolina motor carriers to report and pay property taxes related to their operations.

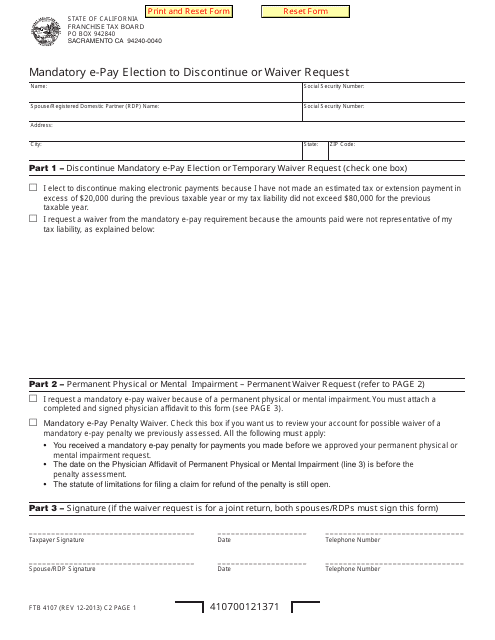

This form is used for making a mandatory electronic payment election and requesting to discontinue or waive the requirement in California.

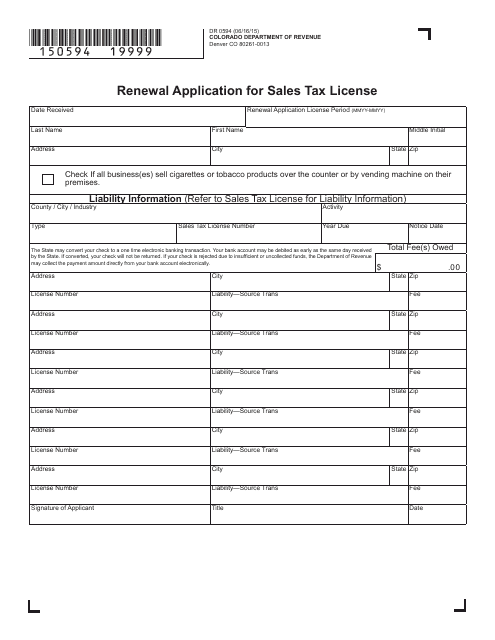

This form is used for renewing a sales tax license in Colorado.