Tax Templates

Documents:

2882

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

This is a detailed form a partnership sends to every partner that participates in joint management of the entity to let the partner determine what to include in their personal tax returns.

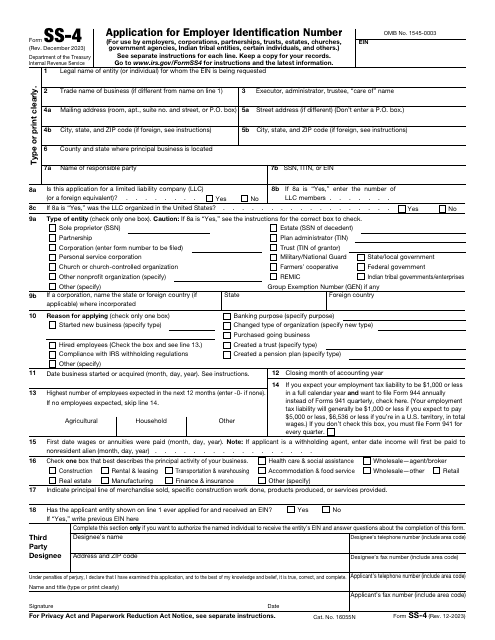

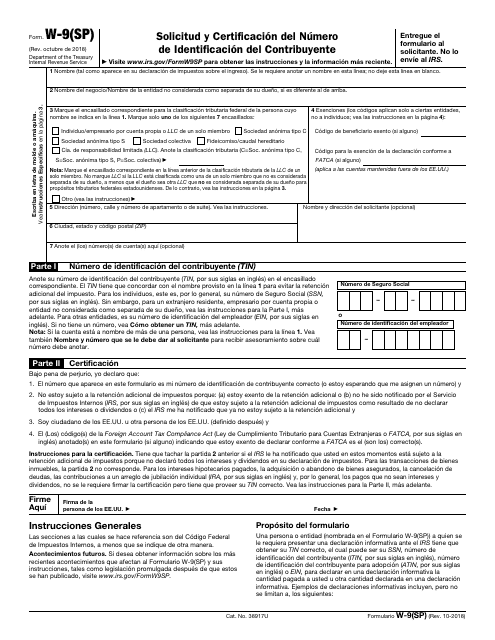

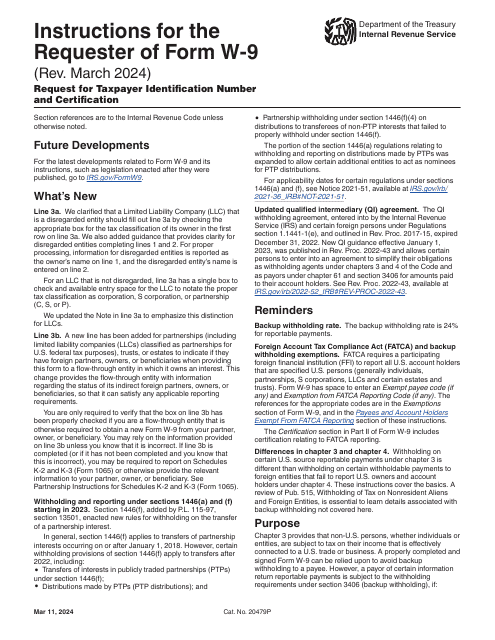

This is a fiscal document used by taxpayers - from sole proprietors to corporations - to ask tax organizations for a unique identification number.

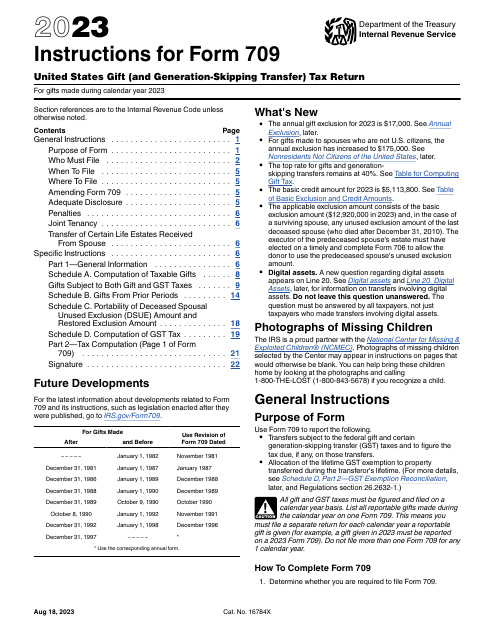

Instructions for IRS Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return, 2023

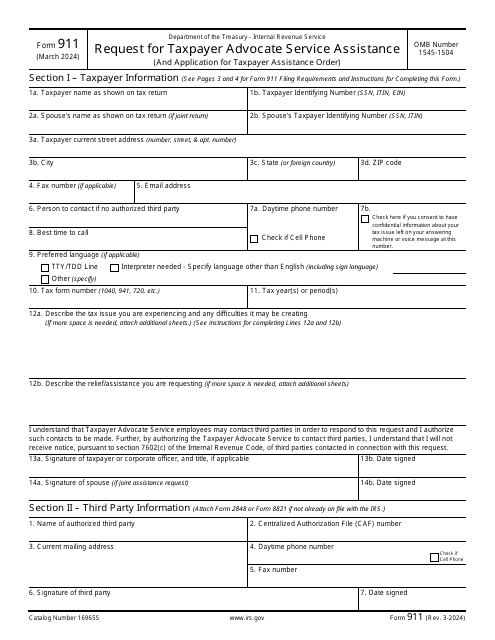

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

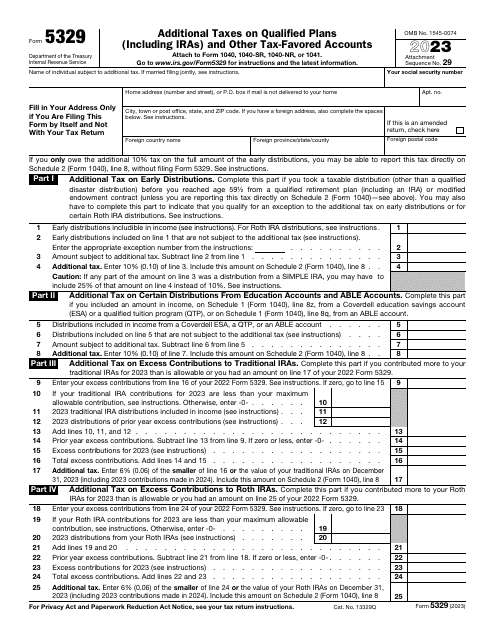

This is a fiscal document individual taxpayers need to prepare and file to demonstrate whether they need to pay the government penalties on education savings plans or retirement plans as well as a percentage of distributions they got throughout the tax year.

This is a formal statement filled out by the organization that manages certain retirement accounts to inform the recipient of the distribution about the income they generated and report the details to tax organizations.

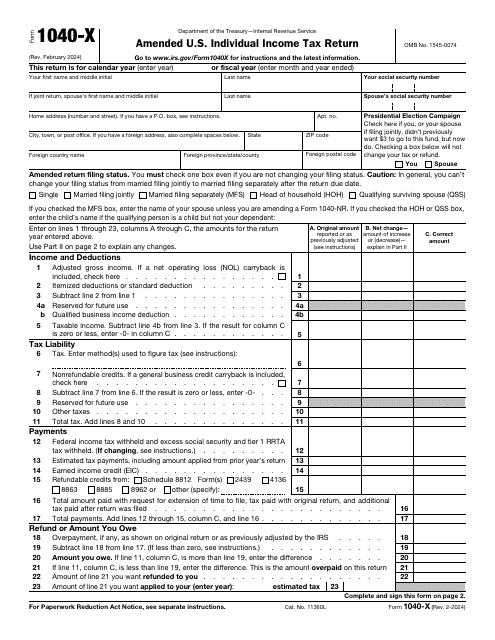

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

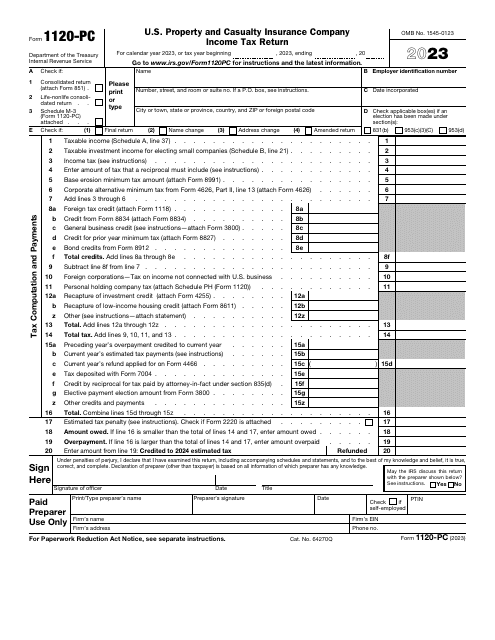

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

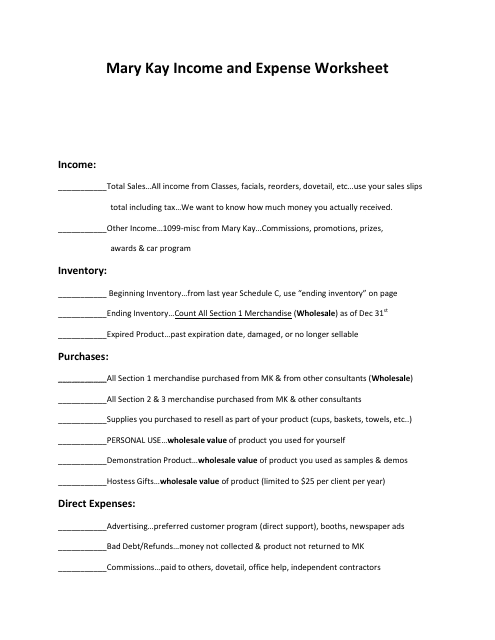

This type of document helps Mary Kay consultants track their income and expenses. It includes sections for recording sales, expenses, and calculating profit.

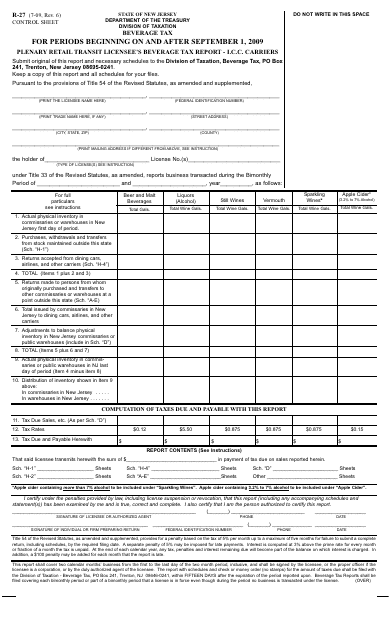

This form is used for New Jersey retailers to report and pay beverage taxes for the months of September and after.

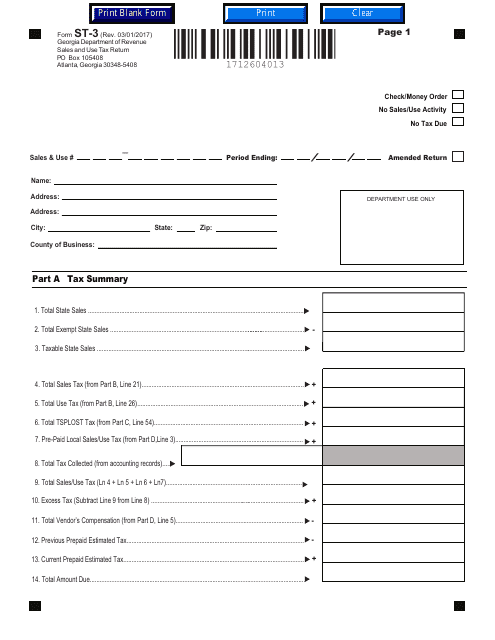

Georgia-registered organizations may use this form to report the sales and use tax they owe in the state of Georgia.

This type of document is a full-color template for creating a customized million-dollar bill design.

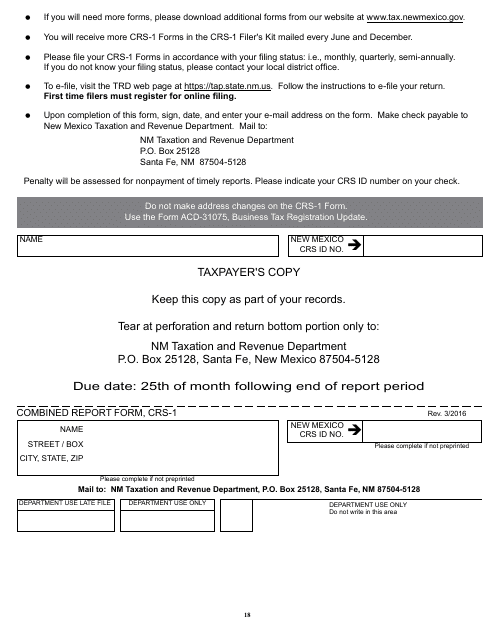

This form is used for submitting a combined report in the state of New Mexico. It allows businesses to report their financial information and activities to the appropriate authorities.

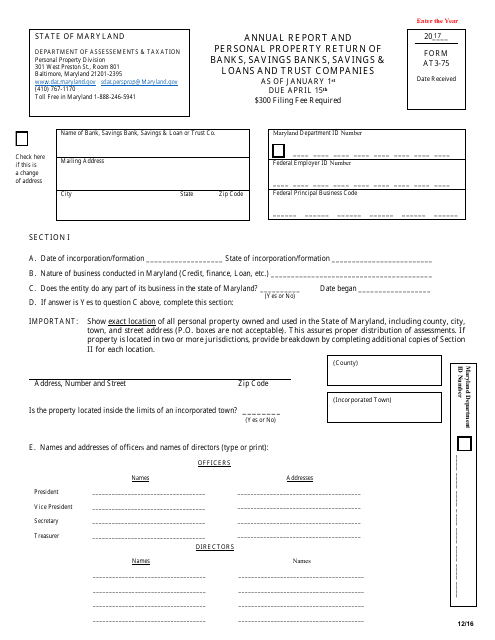

This Form is used for banks, savings banks, savings & loans and trust companies in Maryland to file their annual report and personal property return.

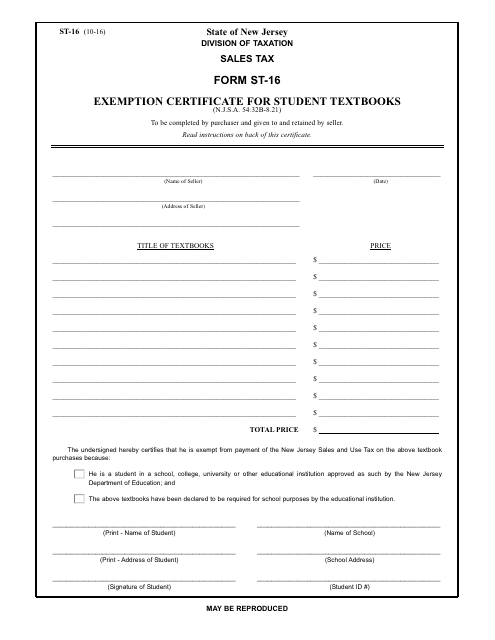

This form is used for requesting an exemption from sales tax on student textbooks in New Jersey.

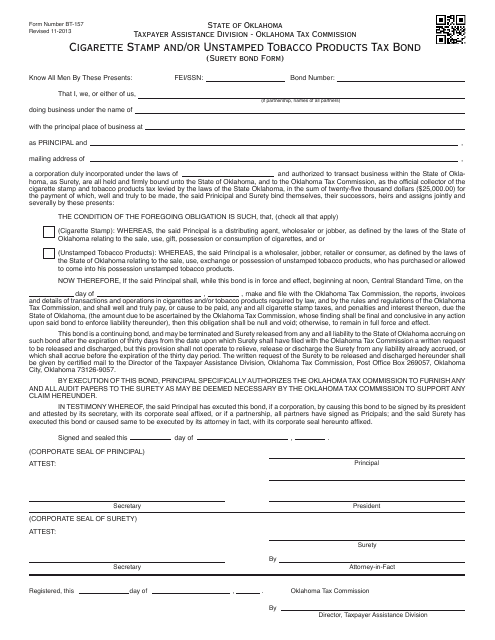

This form is used for a Cigarette Stamp and/or Unstamped Tobacco Products Tax Bond in Oklahoma. It is a surety bond form required for certain businesses selling cigarettes or tobacco products in the state.

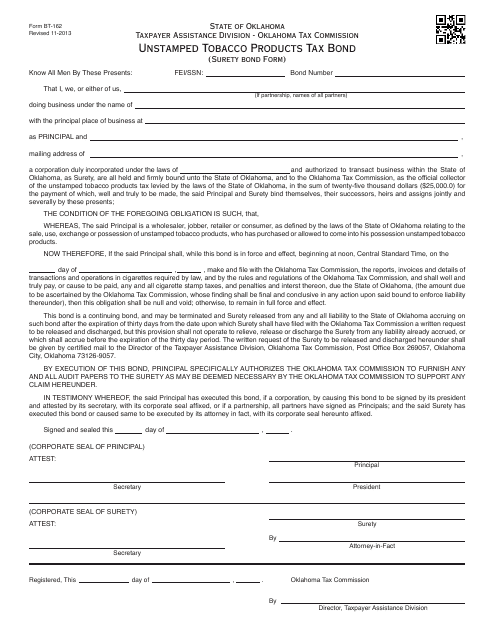

This document is used for obtaining an unstamped tobacco products tax bond in Oklahoma.

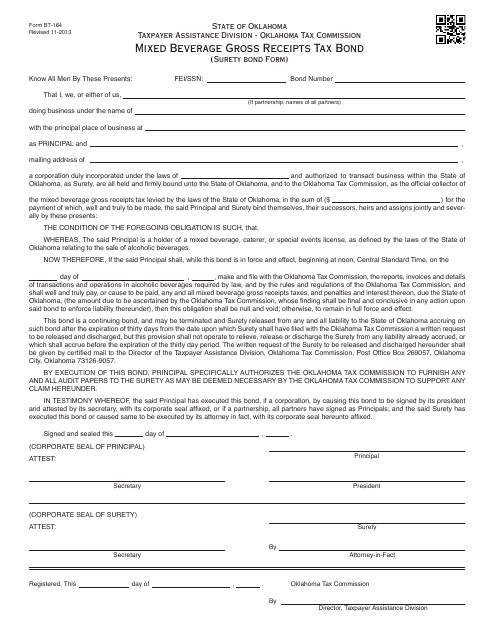

This document is used for obtaining a surety bond for the Mixed Beverage Gross Receipts Tax in Oklahoma. It is known as Form BT-164 and is used for compliance with tax regulations.

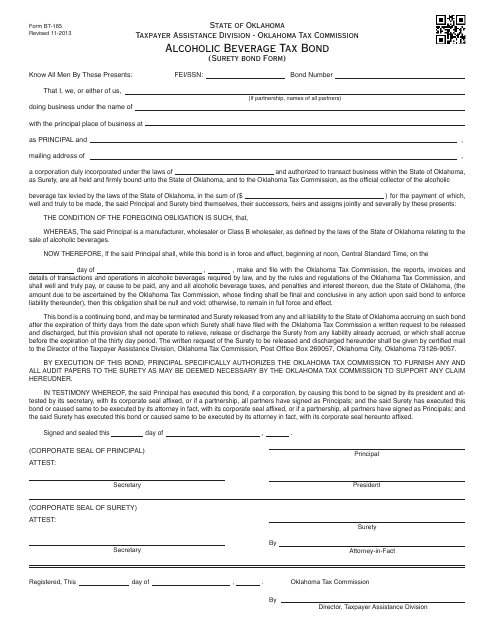

This Form is used for obtaining an Alcoholic Beverage Tax Bond (Surety Bond) in Oklahoma.

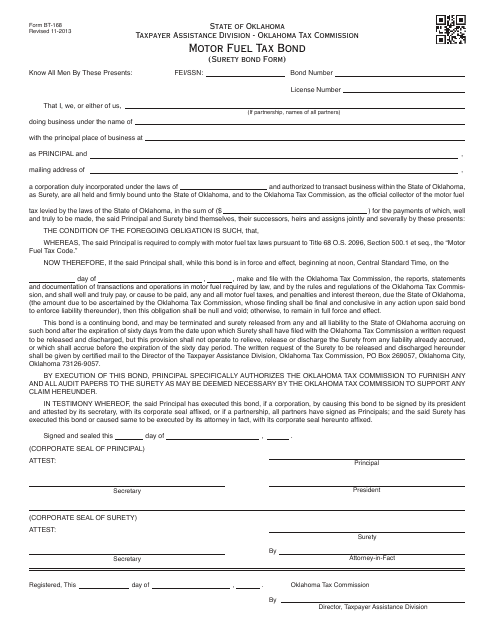

This Form is used for obtaining a Motor Fuel Tax Bond (Surety Bond) in Oklahoma for businesses that sell motor fuel over-the-counter. This bond ensures that the business complies with state laws and regulations regarding motor fuel taxes.

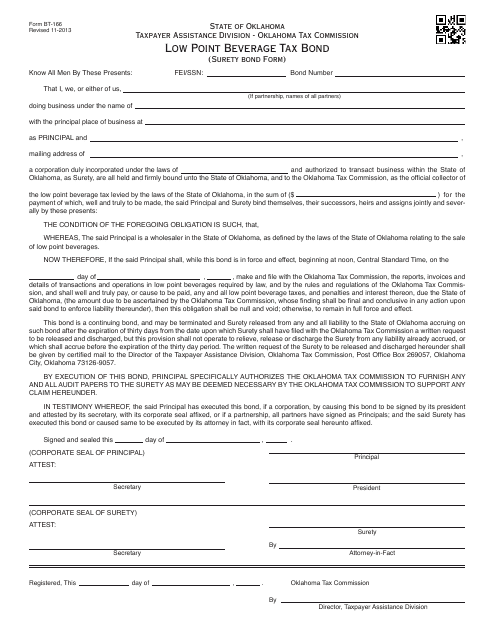

This document is for obtaining a surety bond for the Low Point Beverage Tax in Oklahoma.

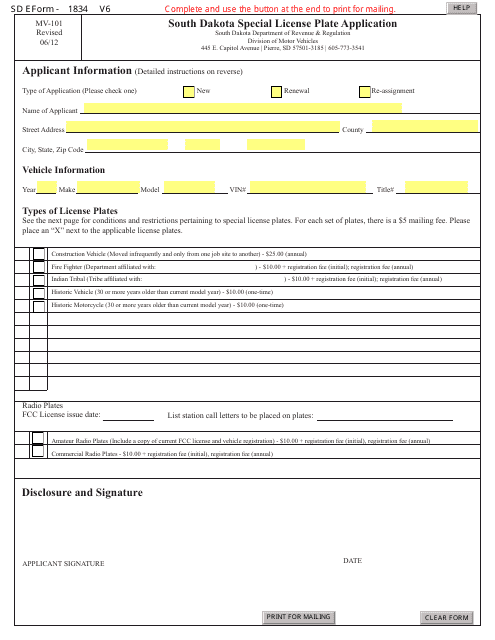

This Form is used for applying for special license plates in South Dakota.

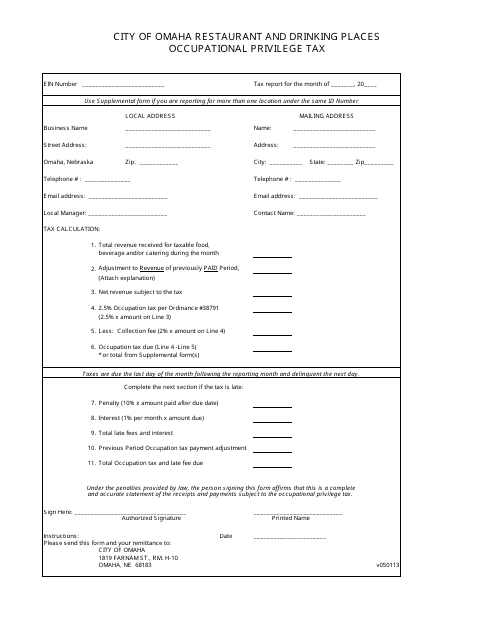

This form is used for filing the Occupational Privilege Tax for restaurants and drinking places located in Omaha, Nebraska.

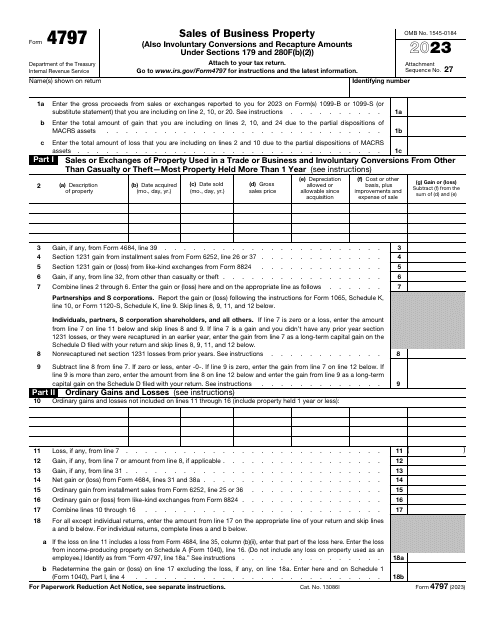

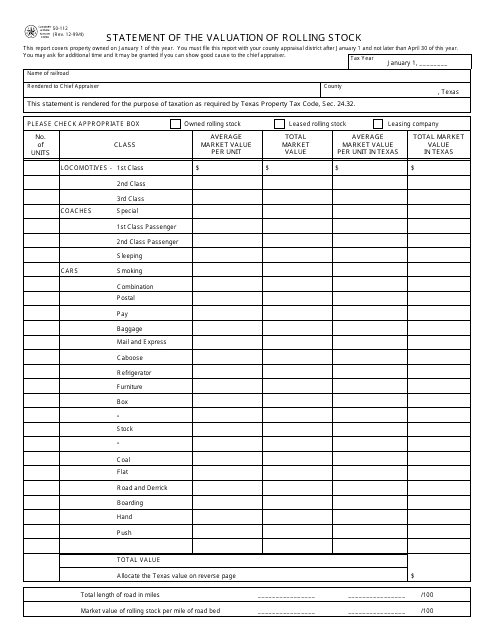

This form is used for reporting the valuation of rolling stock, such as locomotives and freight cars, in the state of Texas.