Tax Templates

Documents:

2882

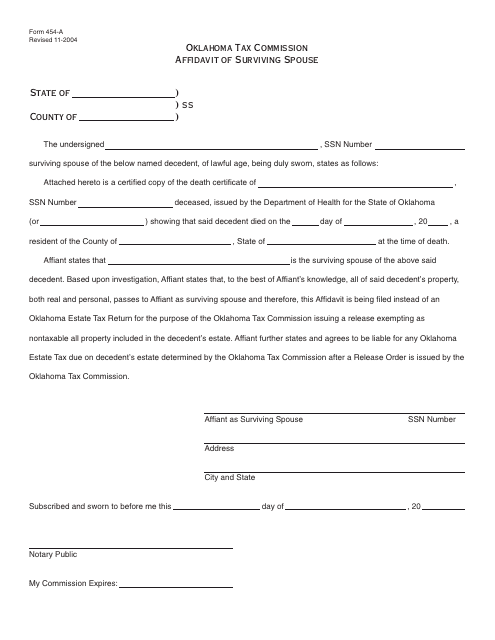

This form is used for a surviving spouse in Oklahoma to declare their status in order to claim certain benefits or rights.

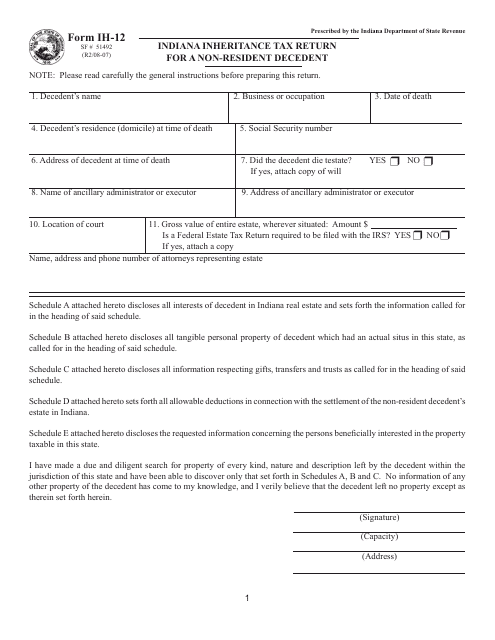

This form is used for filing an Indiana inheritance tax return for a non-resident decedent in Indiana.

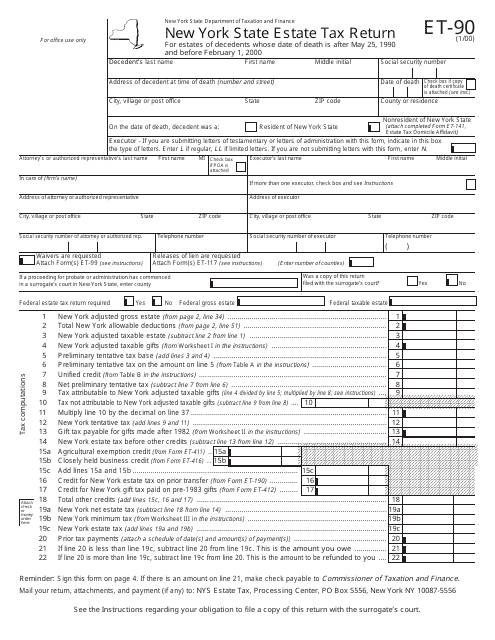

This form is used for reporting and paying estate taxes in the state of New York.

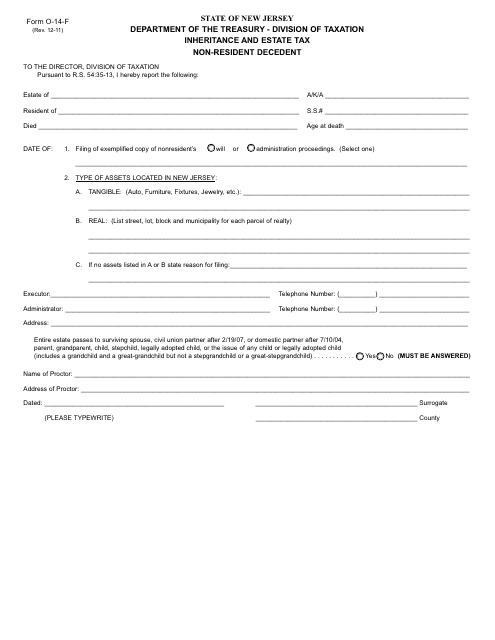

This form is used for reporting inheritance and estate taxes for non-resident decedents in the state of New Jersey.

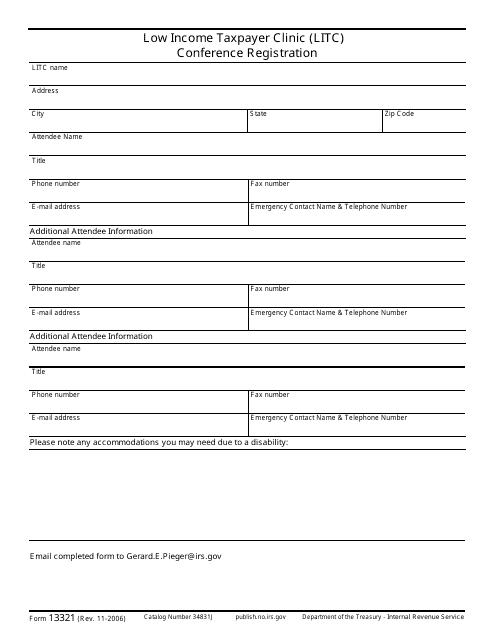

This form is used for registering for the Low Income Taxpayer Clinic (LITC) Conference organized by the IRS.

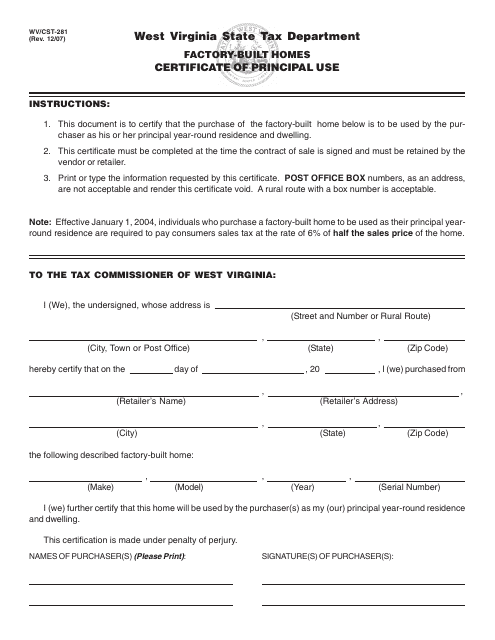

This form is used for obtaining a certificate of principal use for factory-built homes in West Virginia.

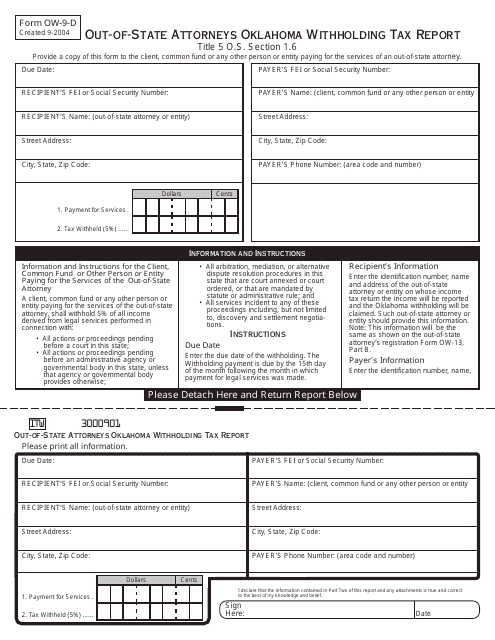

This form is used for Out-of-State Attorneys in Oklahoma to report Oklahoma withholding tax.

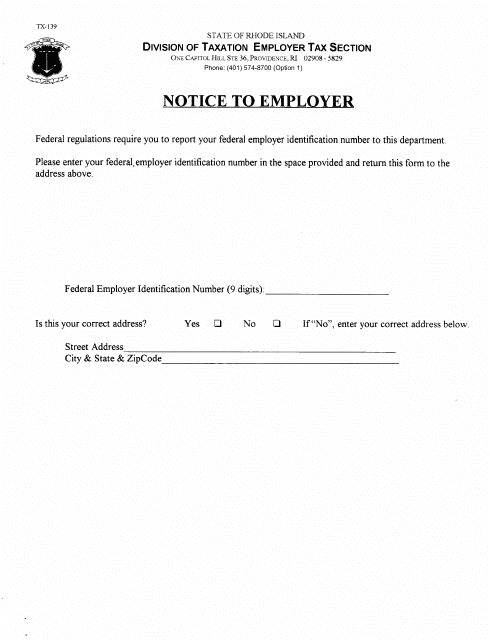

This document notifies an employer in Rhode Island of certain information or actions that they need to know or take.

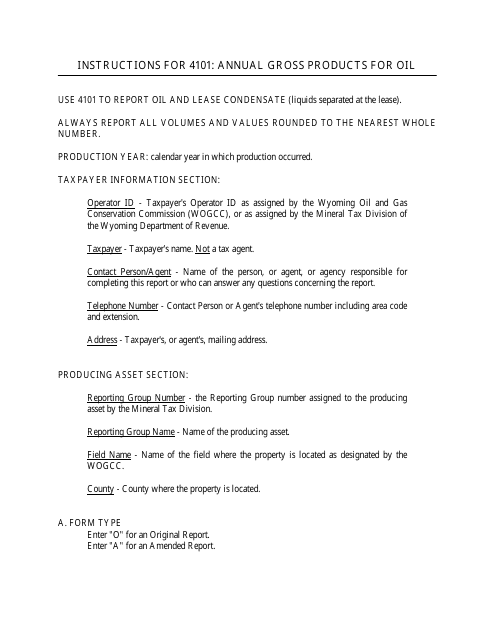

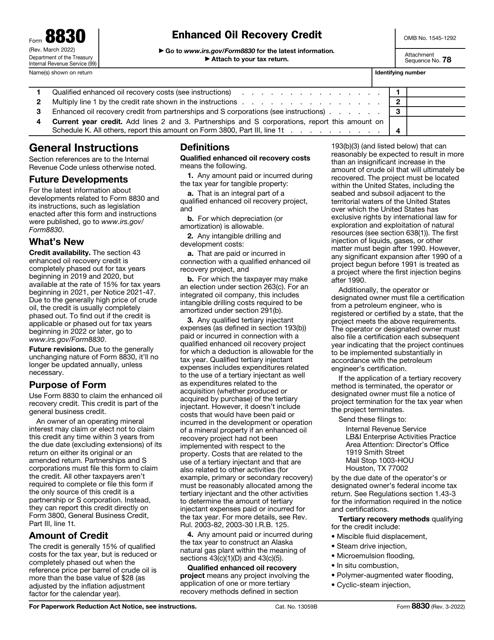

This Form is used for reporting the annual gross products for oil in the state of Wyoming. It provides instructions on how to properly fill out and submit the form.

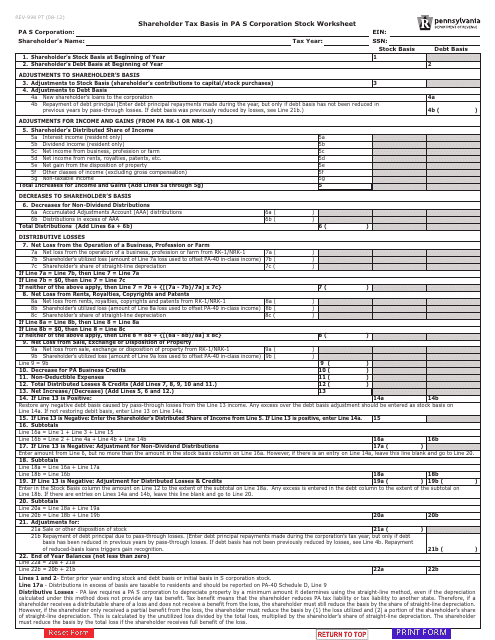

This form is used for calculating the tax basis in Pennsylvania S Corporation stock for shareholders.

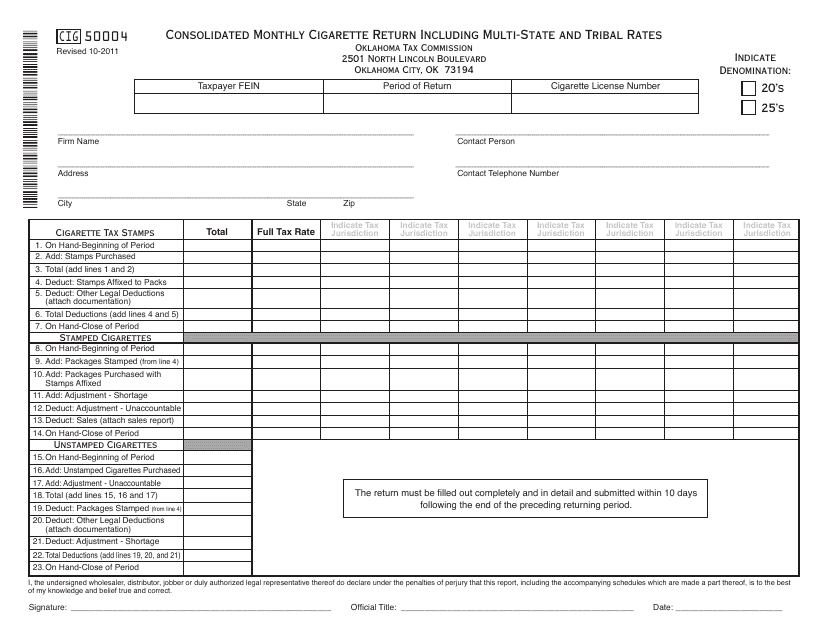

This form is used for submitting the consolidated monthly cigarette return including multi-state and tribal rates in the state of Oklahoma.

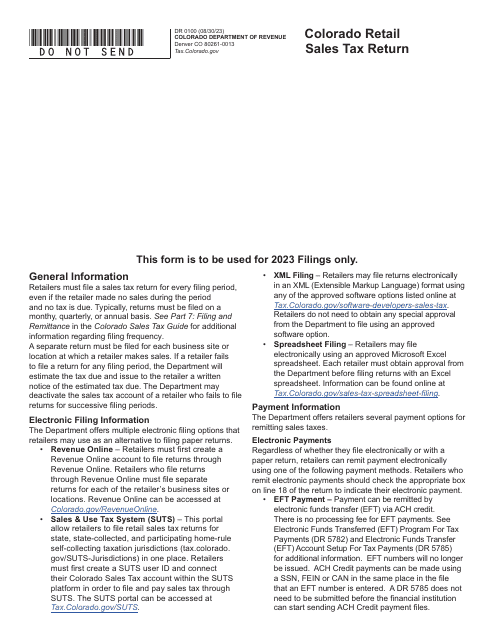

This form is required for any retail establishment within the state of Colorado and must be filed every quarter, even if no tax has been collected or no tax is due.

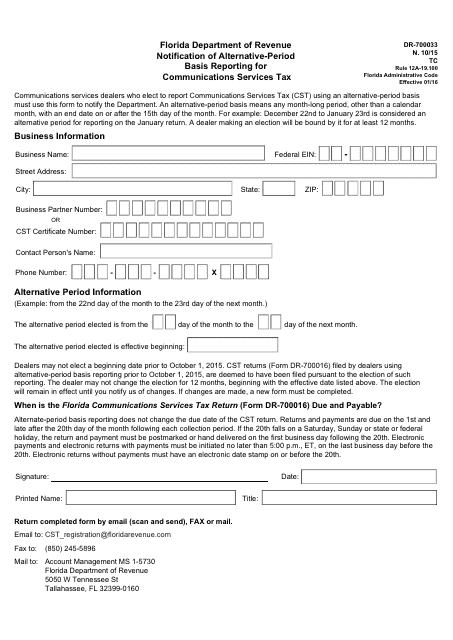

This form is used for notifying the Florida Department of Revenue about alternative-period basis reporting for communications services tax.

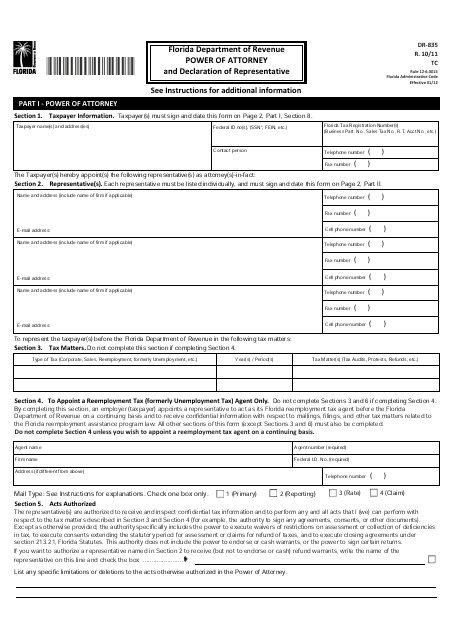

This form is used for appointing a representative to act on your behalf for tax matters in the state of Florida.

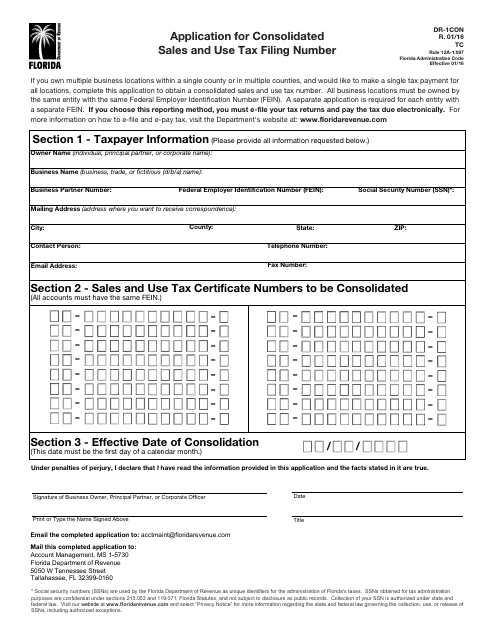

This Form is used for applying for a Consolidated Sales and Use Tax Filing Number in the state of Florida.

This is an IRS form used by taxpayers to calculate the amount of alternative minimum tax they owe to the government.

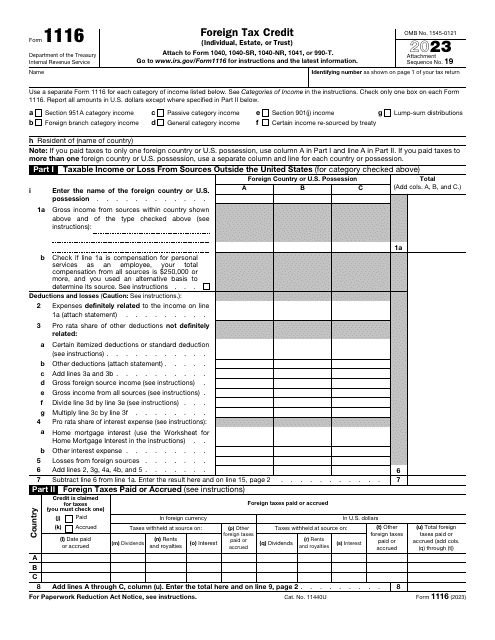

This is a formal document that allows American taxpayers that reside, work, and manage businesses overseas to lower the amount of tax they owe to the U.S. government.

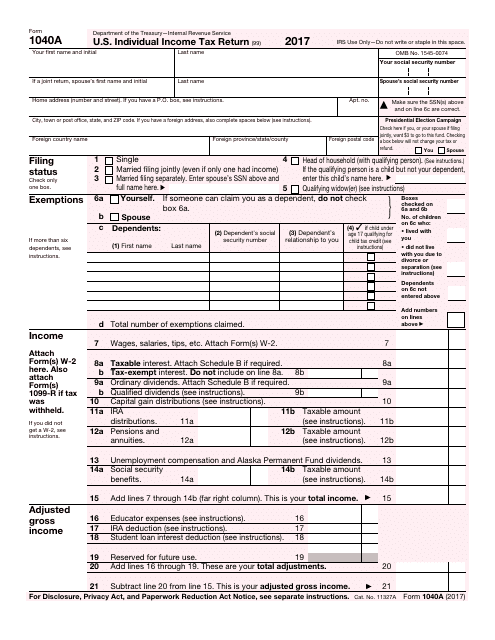

This Form is used for filing a simplified version of the U.S. Individual Income Tax Return. It is intended for taxpayers who have limited income and deductions.

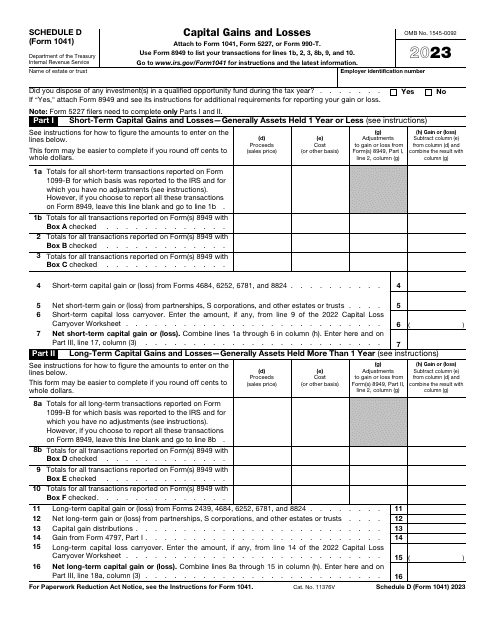

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

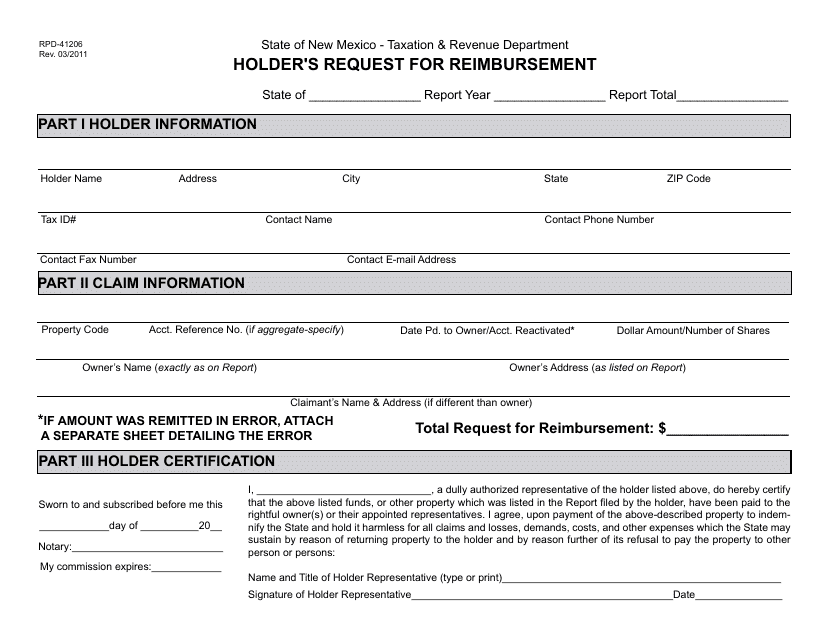

This Form is used for New Mexico residents to request reimbursement as a holder.