Tax Templates

Documents:

2882

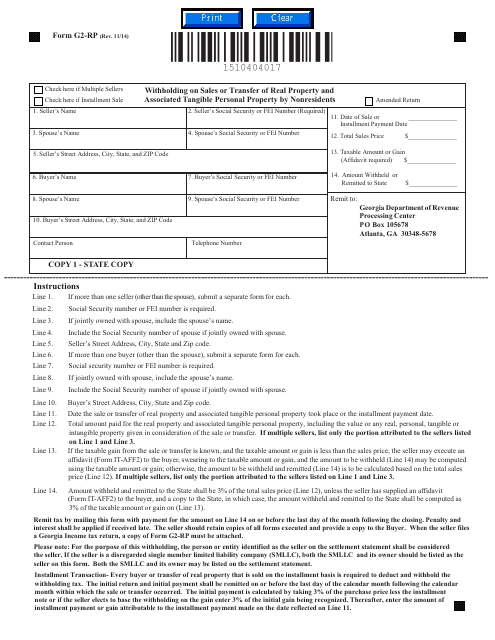

This form is used for reporting and withholding taxes on the sale or transfer of real property and associated tangible personal property by nonresidents in the state of Georgia, United States.

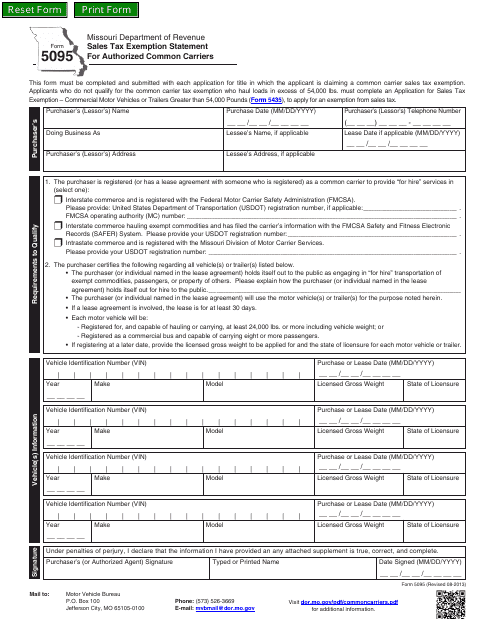

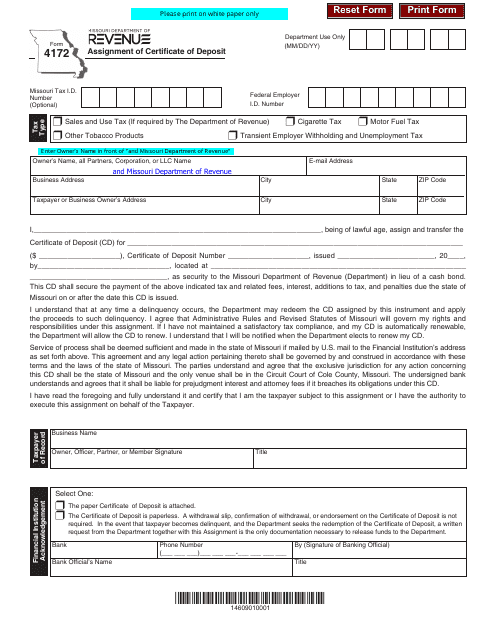

This form is used for authorized common carriers in Missouri to claim exemption from sales tax.

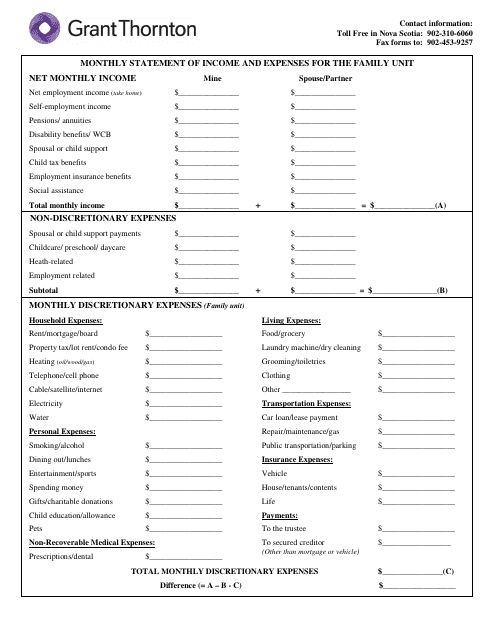

This document is a template provided by Grant Thornton for residents of Nova Scotia, Canada. It helps individuals or families track their monthly income and expenses.

This type of document provides two templates for behavior bucks, a reward system often used to promote positive behavior in children.

This document is a template for a reward buck, commonly used in the United Kingdom. Reward bucks are a form of incentive or currency that can be given to individuals as a reward or recognition for good behavior or achievements.

This document is a template for creating reward bucks, which can be used to reward or incentivize individuals for their achievements or good behavior.

This document is a template for chore bucks, with 8 per page. Chore bucks are a reward system used for motivating children to complete household chores.

This document provides templates for creating one dollar bills and a chart that shows the equivalents of one dollar in cents.

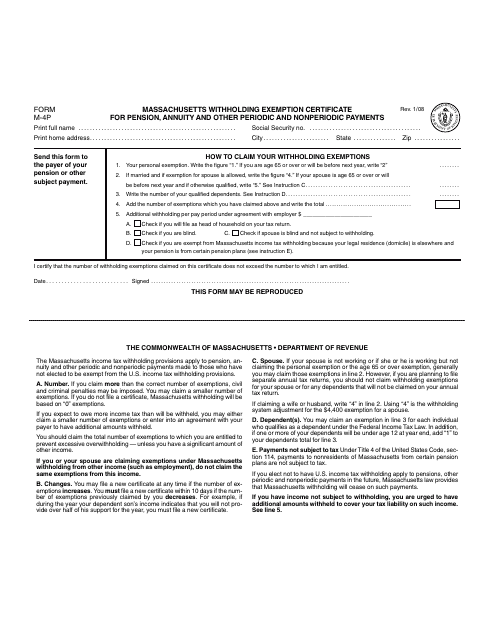

This Form is used for declaring withholding exemptions for pension, annuity, and other periodic and nonperiodic payments in Massachusetts.

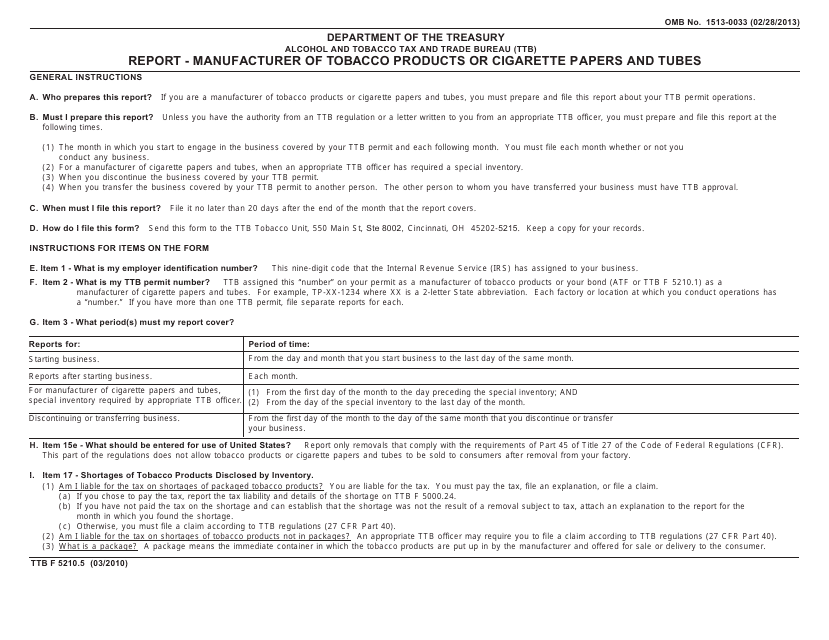

This document is used for reporting the information of manufacturers of tobacco products, cigarette papers, and tubes.

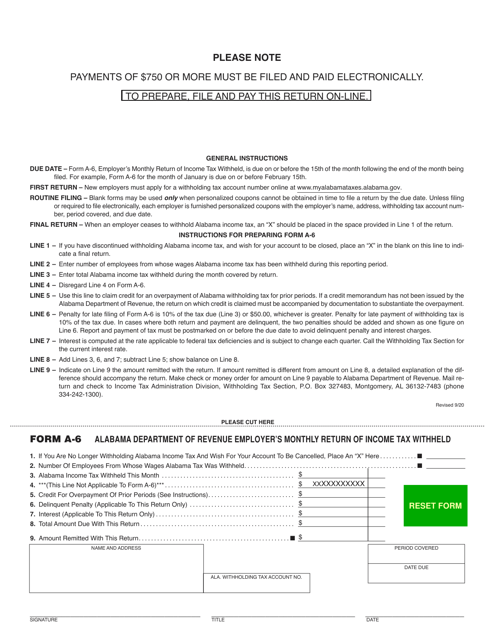

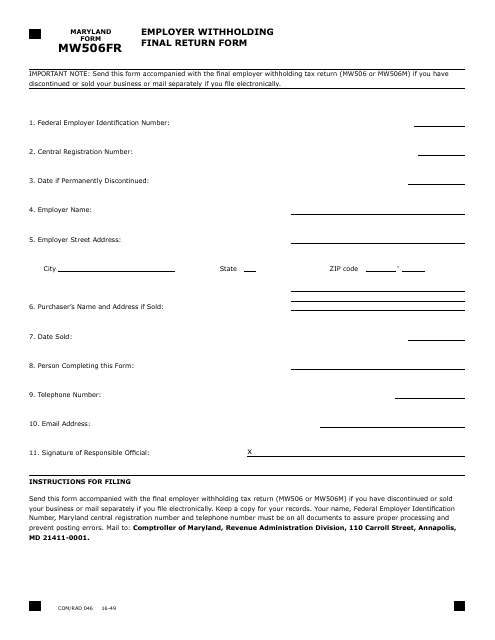

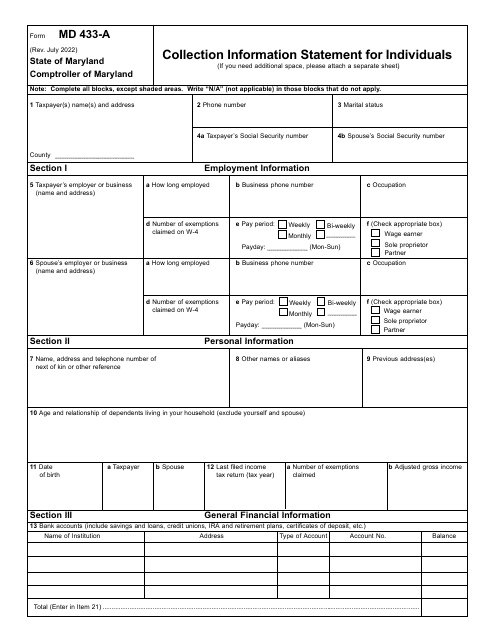

This form is used for filing the final employer withholding return for businesses in the state of Maryland. It is specifically for employers to report and remit any final withholdings from employee wages.

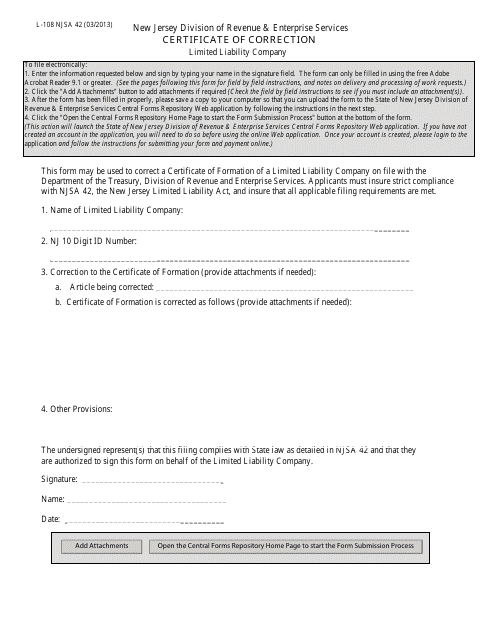

This form is used for correcting mistakes on legal documents in the state of New Jersey. It allows individuals to request a certificate of correction.

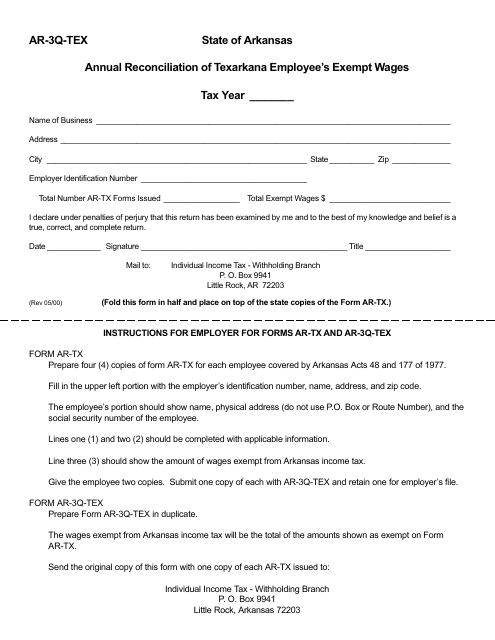

This Form is used for reporting quarterly sales and use tax information in the state of Arkansas. It provides instructions on how to fill out the AR-TX, AR-3Q-TEX form.

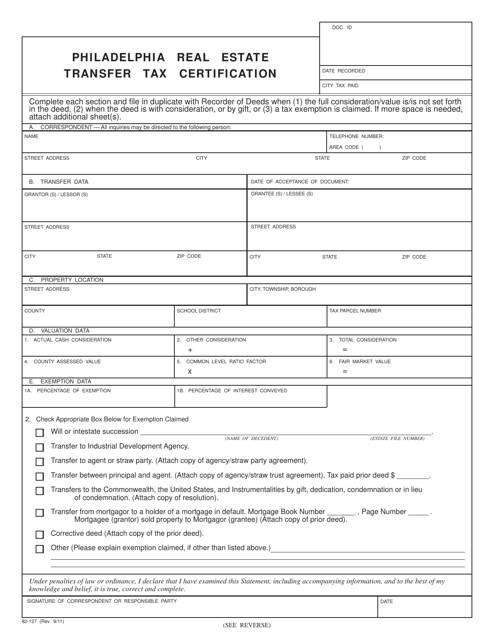

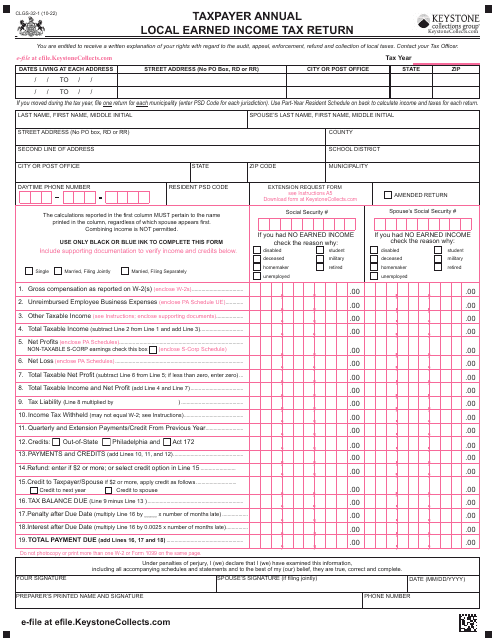

This is a legal document filled out by Pennsylvania residents with earned income, net profits, wages, dividends, and capital gains.

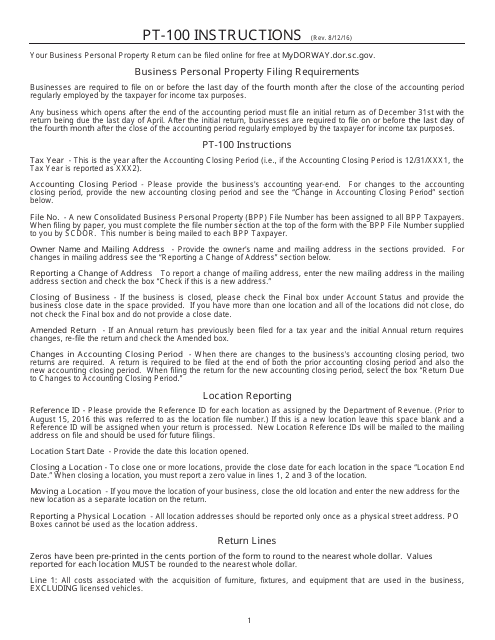

This Form is used for filing the Business Personal Property Return in South Carolina. It provides instructions on how to properly fill out and submit the form for reporting business personal property for taxation purposes.

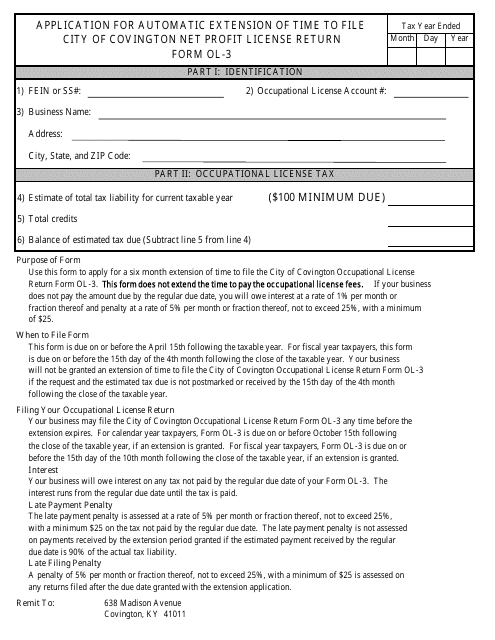

This form is used for requesting an automatic extension of time to file the Net Profit License Return form in the City of Covington, Kentucky.

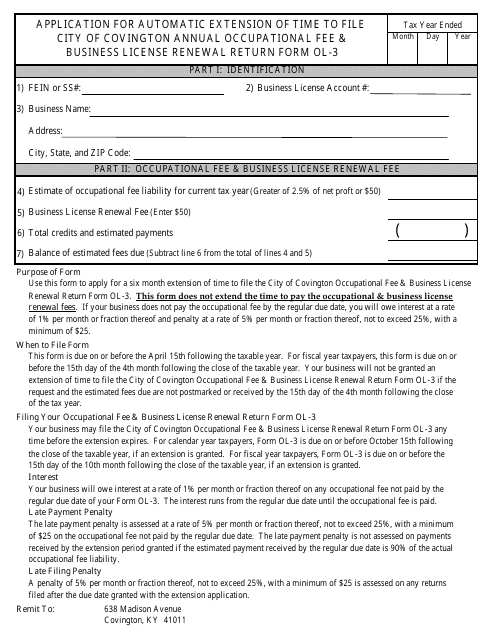

This form is used for requesting an automatic extension of time to file the City of Covington Annual Occupational Fee & Business License Renewal Return (Form Ol-3) in Covington, Kentucky.

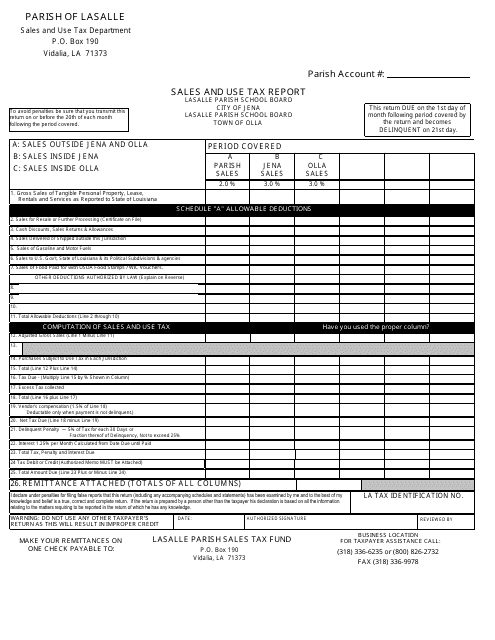

This document is used for reporting sales and use tax in LaSalle Parish, Louisiana.

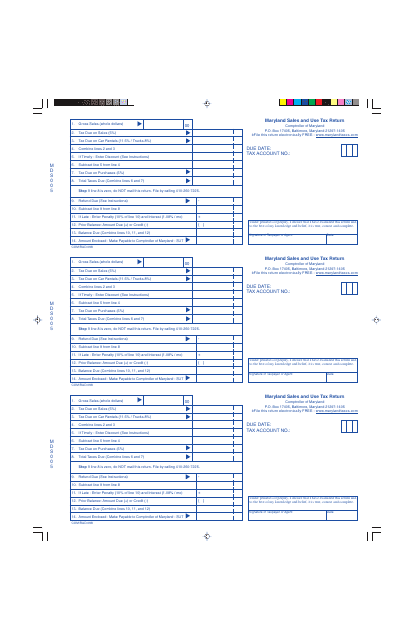

This document is used to report and remit sales and use tax in the state of Maryland. Businesses must submit this return to the Maryland Comptroller's Office to report the sales they have made and the corresponding sales tax collected.

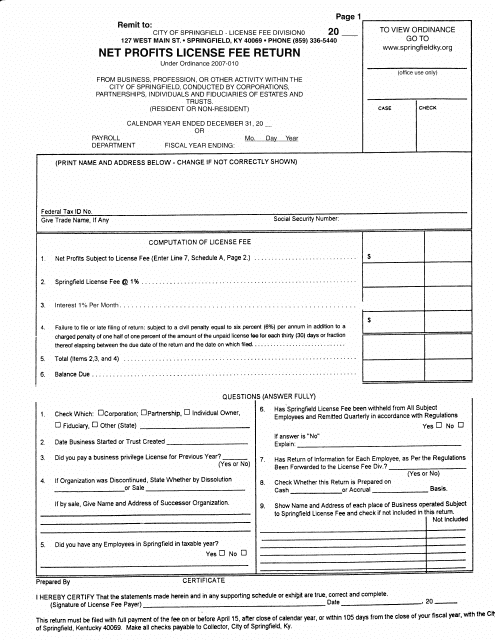

This form is used for reporting and paying the license fee on net profits in the City of Springfield, Kentucky.

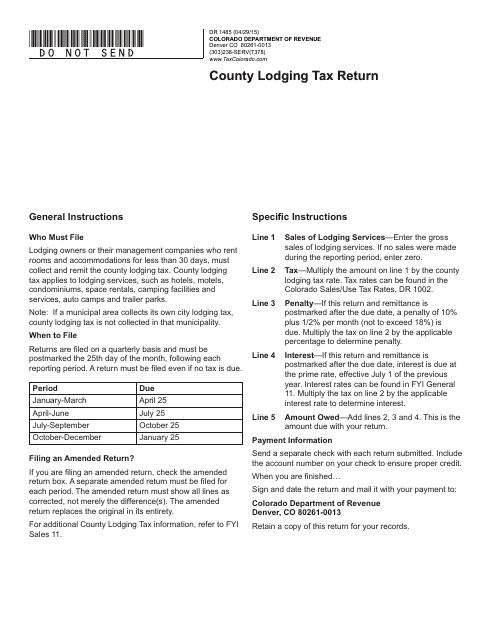

This Form is used for filing the County Lodging Tax Return in the state of Colorado. It provides instructions on how to report and pay the lodging taxes owed to the county.

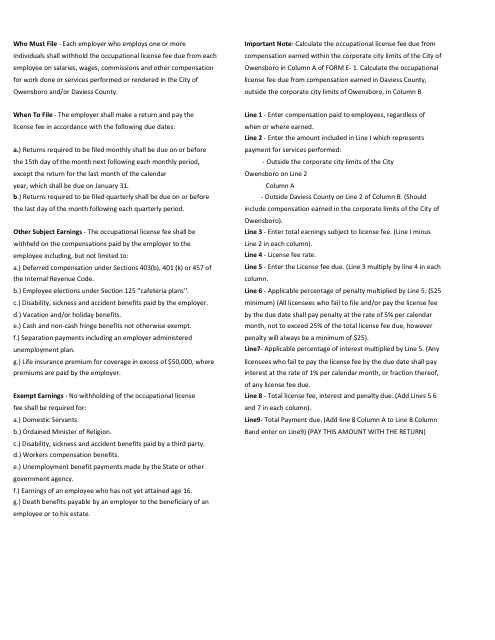

This Form is used for employers to report and remit the license fee withheld from employees in the City of Owensboro, Kentucky. It provides instructions for completing the return and ensuring compliance with local tax regulations.

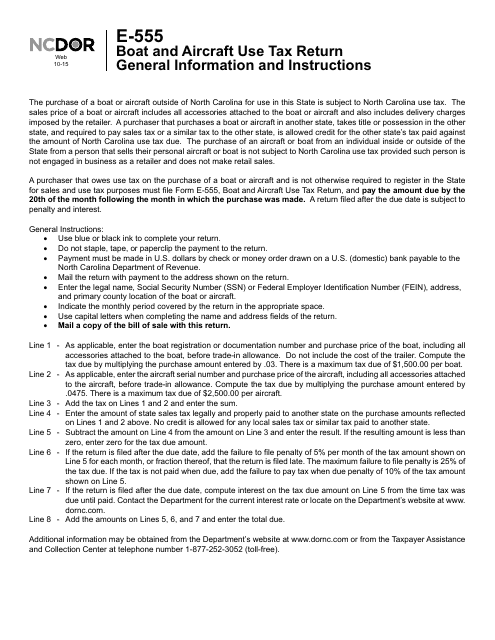

This Form is used for reporting and paying boat and aircraft use tax in North Carolina. It provides instructions on how to complete the tax return and ensure compliance with the state's tax laws for boats and aircraft.

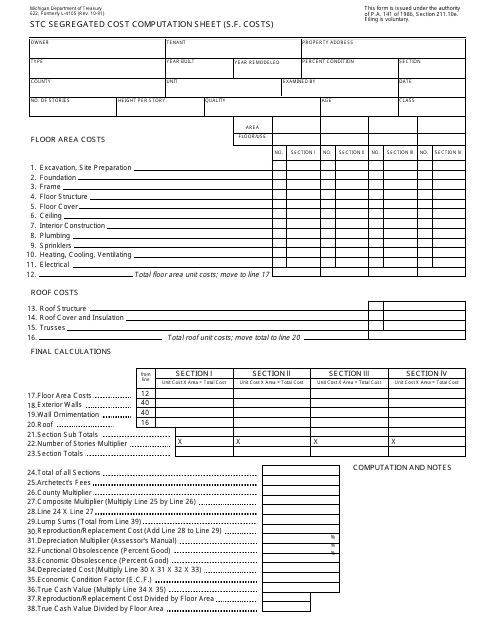

This document is used for calculating the segregated cost computation sheet for S.F. costs in the state of Michigan.

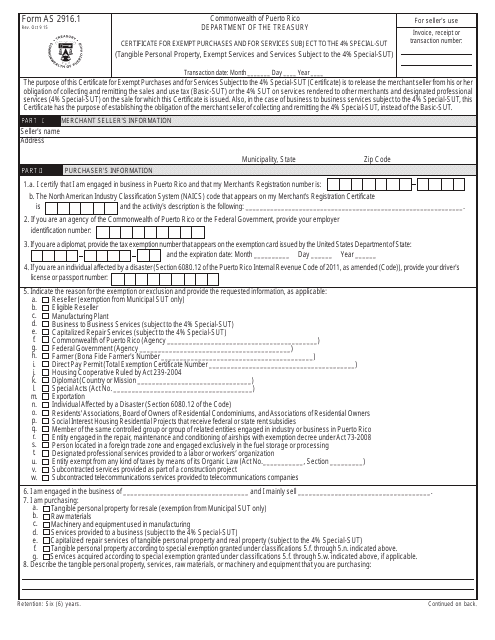

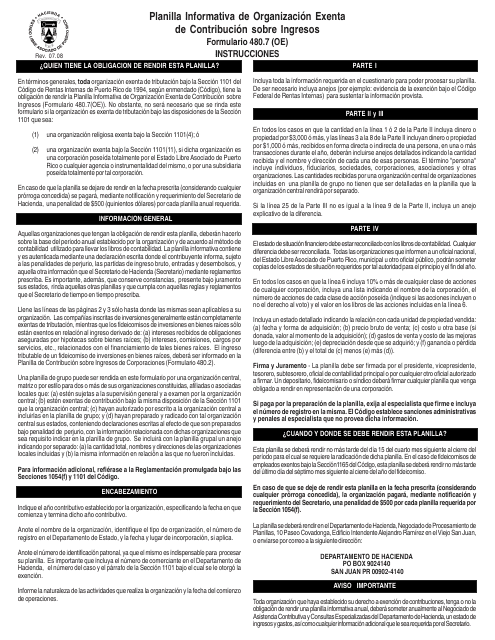

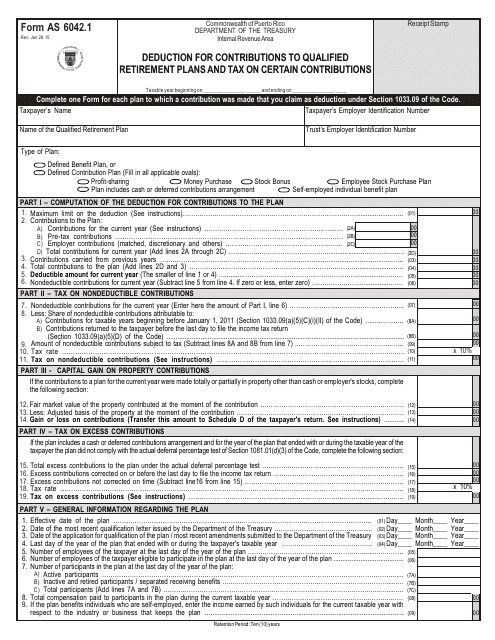

This form is used for claiming deductions for contributions to qualified retirement plans and calculating tax on certain contributions in Puerto Rico.

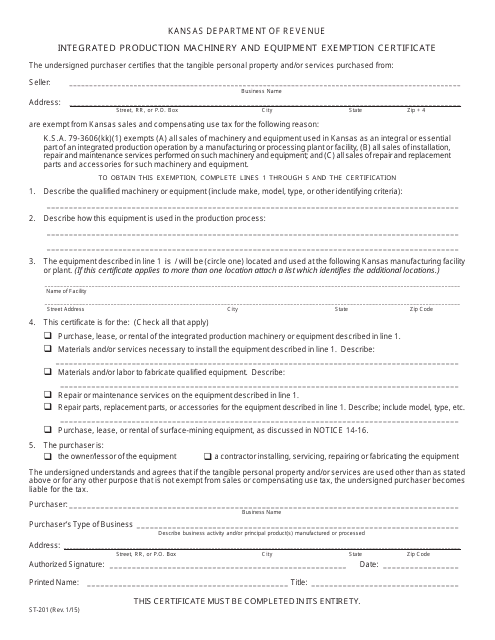

This form is used for claiming exemption from sales tax on machinery and equipment used in the production process in Kansas. It is specifically for businesses that are engaged in manufacturing, processing, or fabricating products.

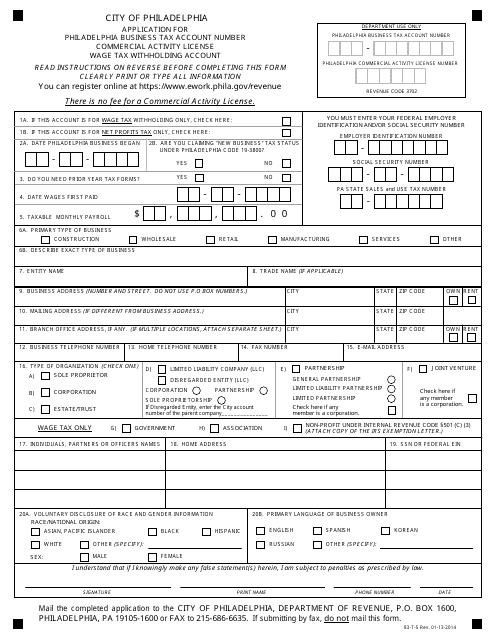

This form is used for applying for a business tax account number, commercial activity license, and wage tax withholding account in the City of Philadelphia, Pennsylvania.