Tax Templates

Documents:

2882

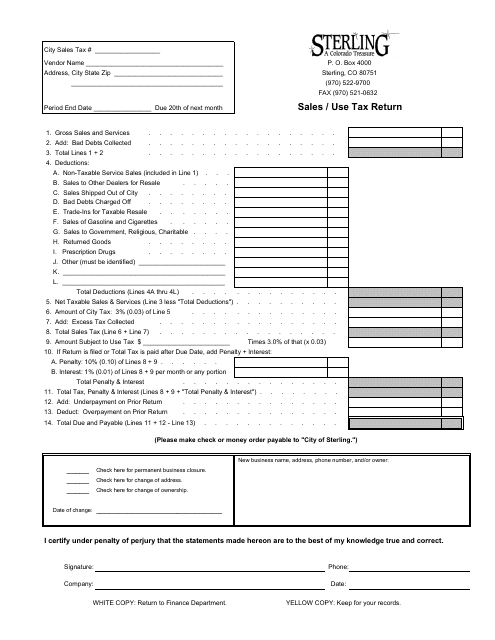

This form is used for reporting and remitting sales and use tax to the City of Sterling, Colorado. It is mandatory for businesses operating within the city limits to file this return on a regular basis.

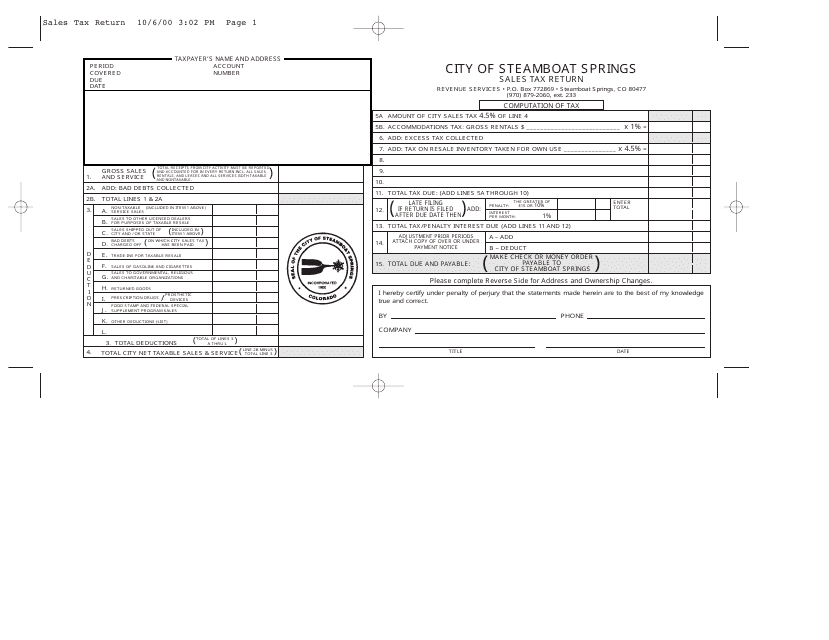

This document is used for filing sales tax returns with the City of Steamboat Springs, Colorado.

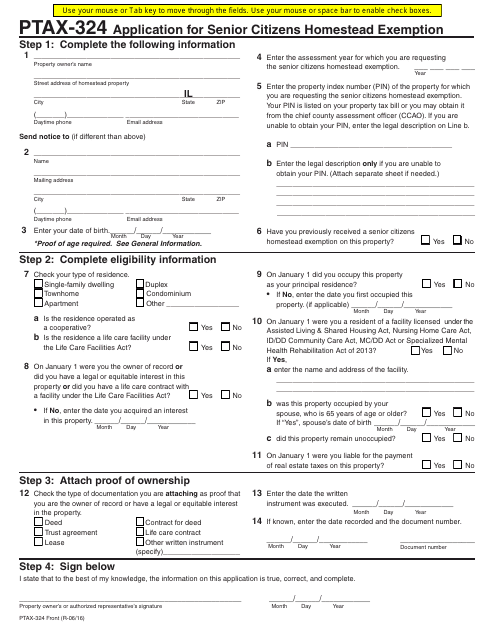

This form is used for applying for the Senior Citizens Homestead Exemption in Illinois.

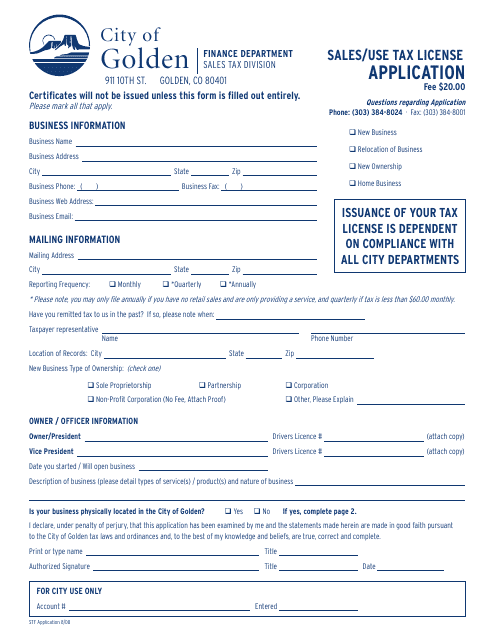

This form is used for applying for a sales/use tax license in the city of Golden, Colorado.

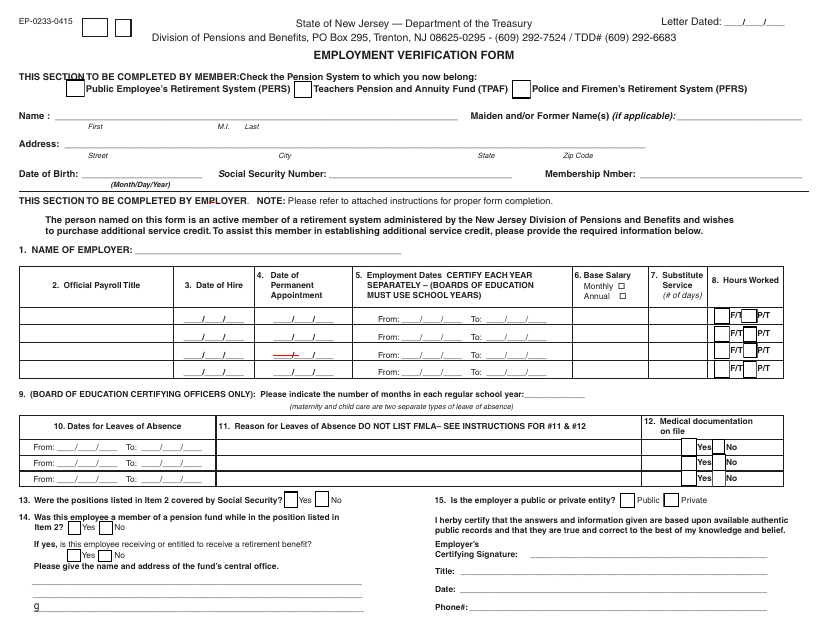

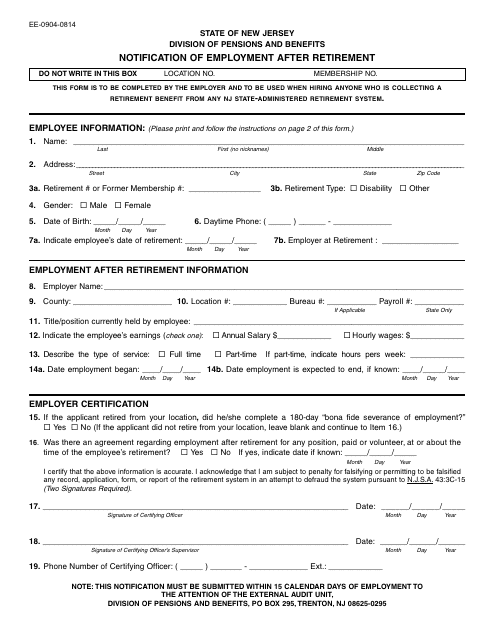

This form is used for verifying employment information in the state of New Jersey. It is used to ensure that the information provided by an employee is accurate and can be used for various purposes such as loan applications or background checks.

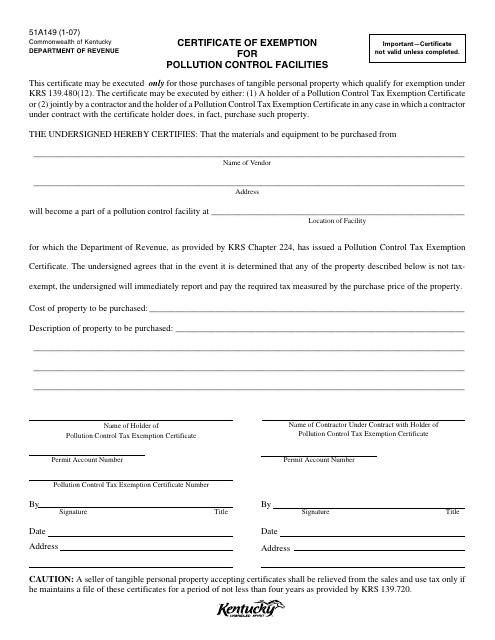

This document is a form used in Kentucky to apply for a certificate of exemption for pollution control facilities. It allows for an exemption from property tax for facilities that are used for pollution control purposes.

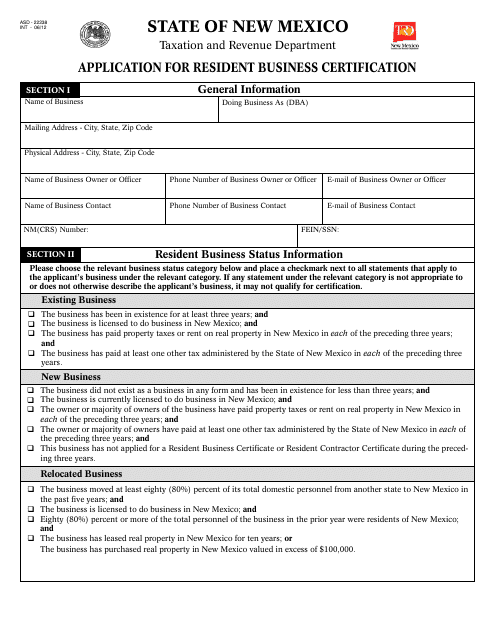

This form is used for applying for a resident business certification in the state of New Mexico. It is necessary for individuals or companies who want to establish a business residency in the state.

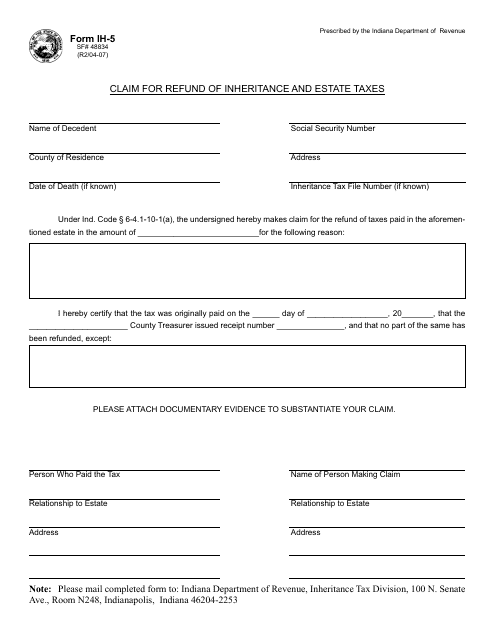

This form is used for claiming a refund of inheritance and estate taxes in the state of Indiana.

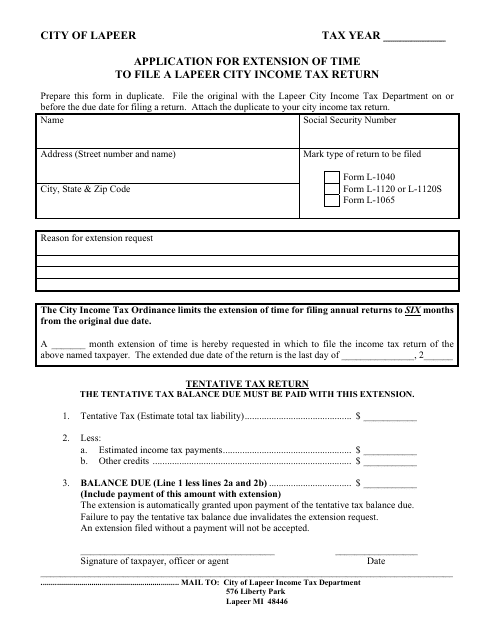

Application for Extension of Time to File a Lapeer City Income Tax Return - City of Lapeer, Michigan

This document is used for requesting an extension of time to file an income tax return for residents of Lapeer City, Michigan.

This form is used for notifying the state of New Jersey about your employment after retirement.

This Form is used for applying for a local business tax receipt in Osceola County, Florida.

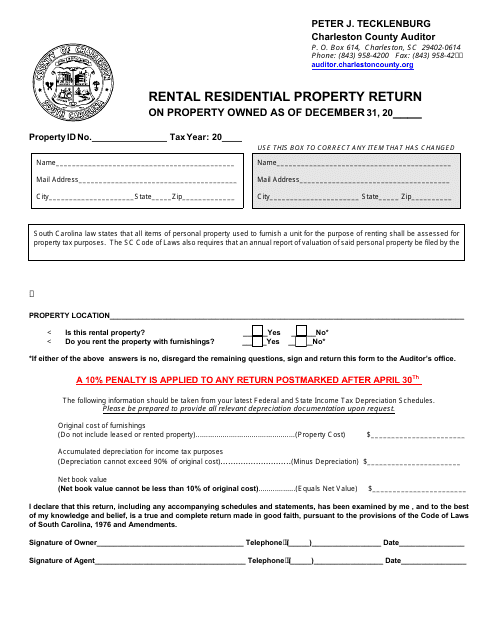

This Form is used for reporting rental residential property in Charleston, South Carolina.

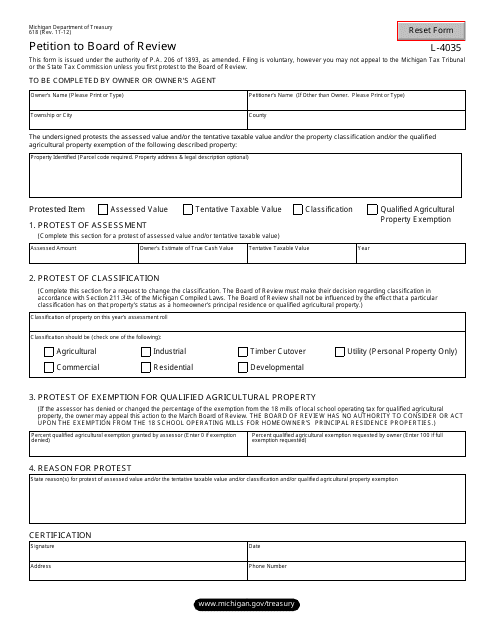

This form is used for filing a petition to the Board of Review in the state of Michigan.

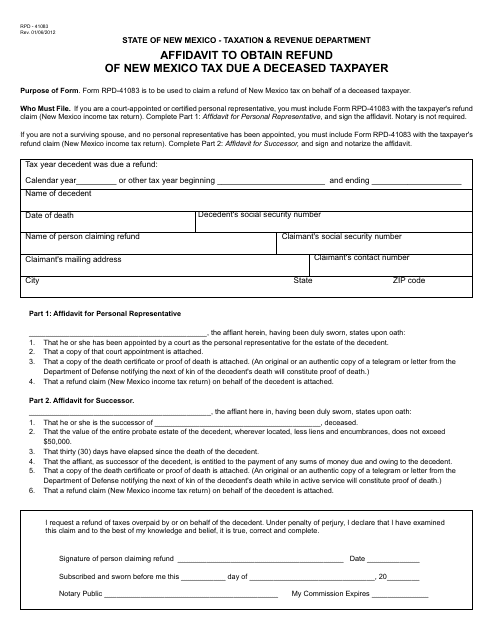

This form is used for obtaining a refund of New Mexico tax that is due to a deceased taxpayer in New Mexico.

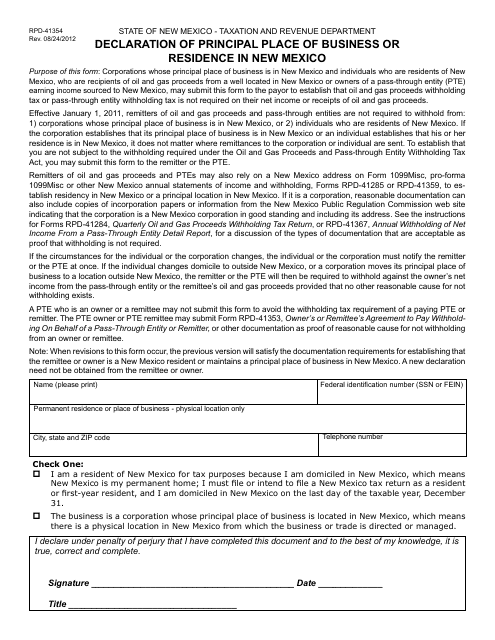

This Form is used for declaring the principal place of business or residence in New Mexico. It is required by the state of New Mexico.

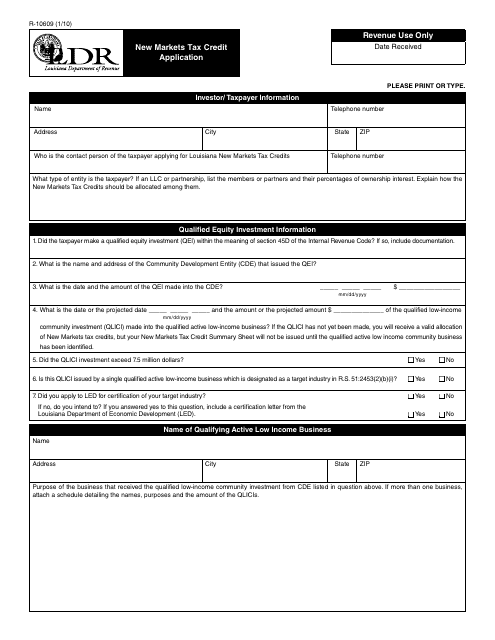

This form is used for applying for the New Markets Tax Credit program in Louisiana. It allows businesses to request tax credits for investments that benefit low-income communities in the state.

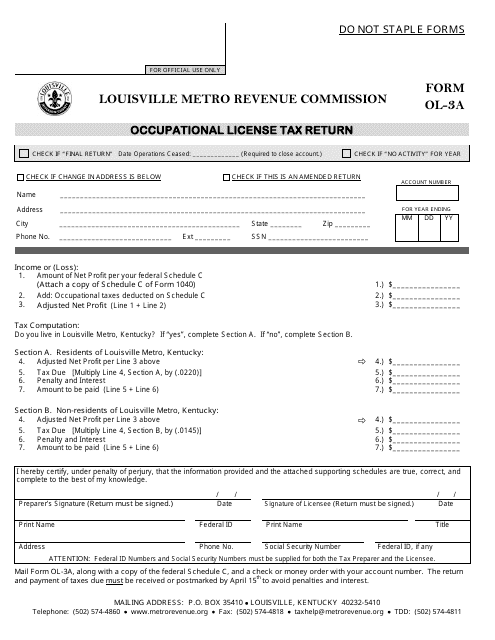

This form is used for filing the Occupational License Tax Return in Louisville, Kentucky.

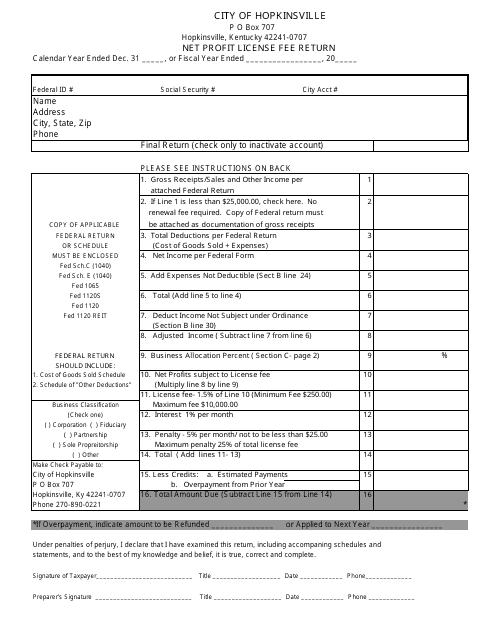

This Form is used for reporting and paying the net profit license fee in the City of Hopkinsville, Kentucky.

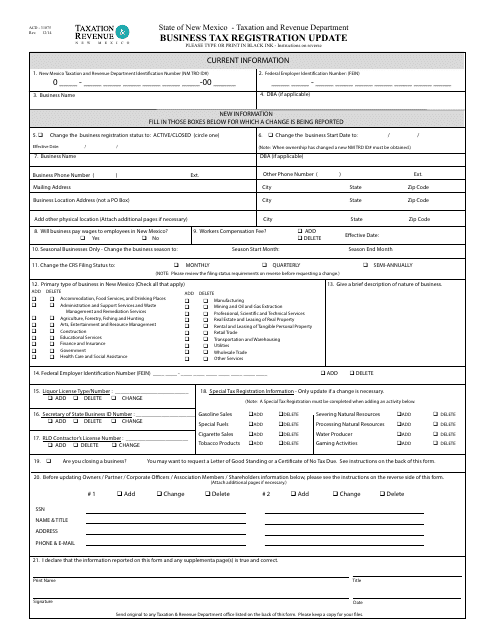

This form is used for updating the business tax registration in New Mexico.

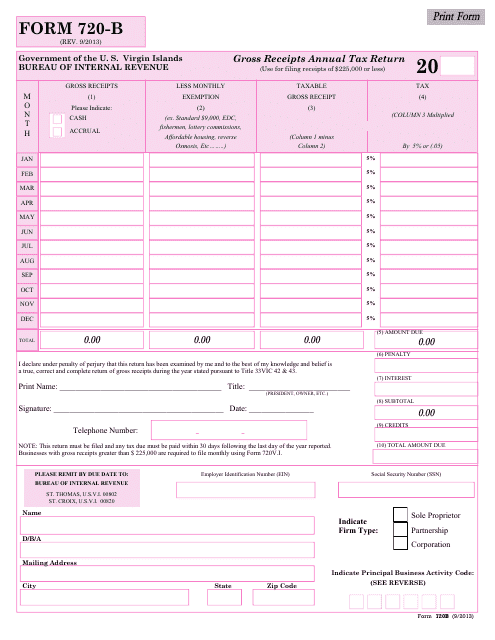

This Form is used for filing the Gross Receipts Annual Tax Return specifically for businesses operating in the Virgin Islands.

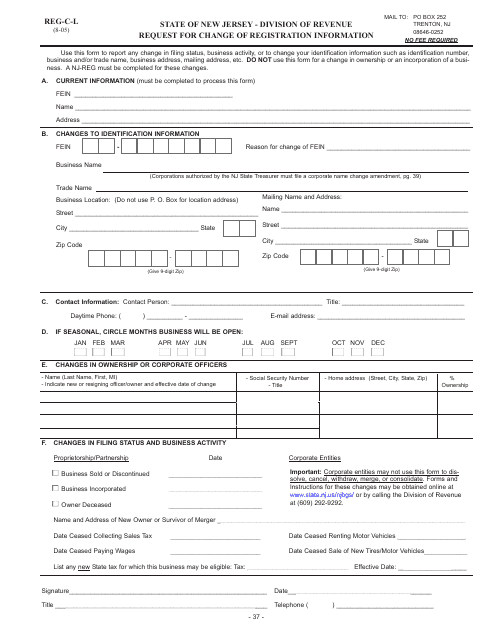

This form is used for requesting a change in registration information in the state of New Jersey. It is important to keep your registration information up to date.

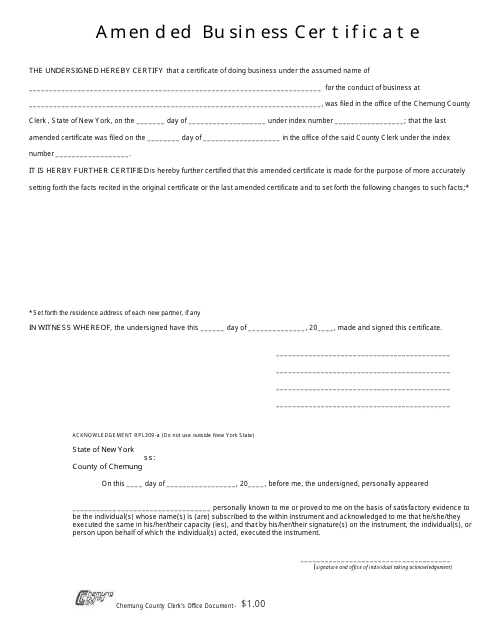

This form is used for making amendments to a business certificate in Chemung County, New York.

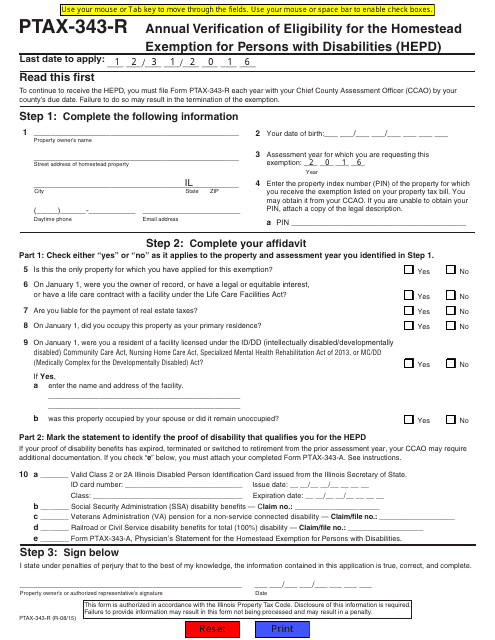

This form is used for annual verification of eligibility for the Homestead Exemption for Persons with Disabilities (HEPD) in Illinois.

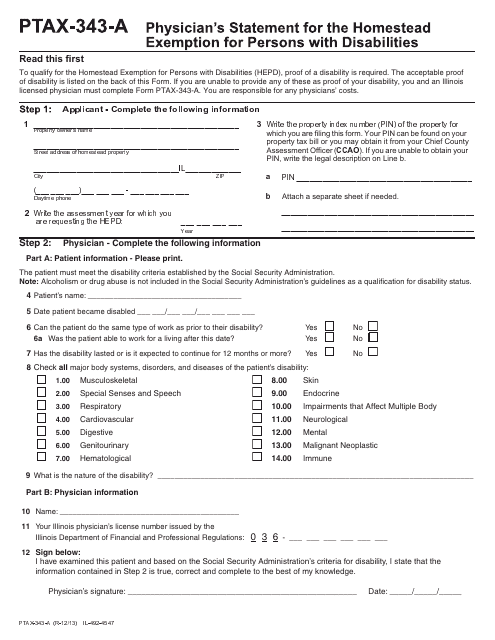

This form is used for applying for a tax exemption for persons with disabilities in the state of Illinois. Physicians need to complete this form to provide supporting medical information.

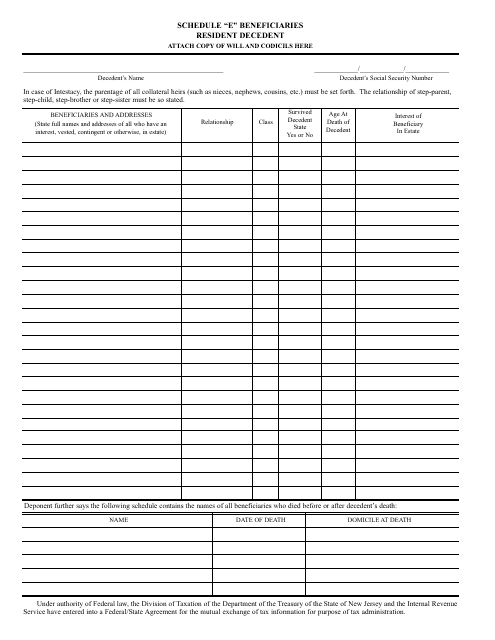

This form is used for reporting the beneficiaries of a deceased person's estate who are residents of New Jersey.

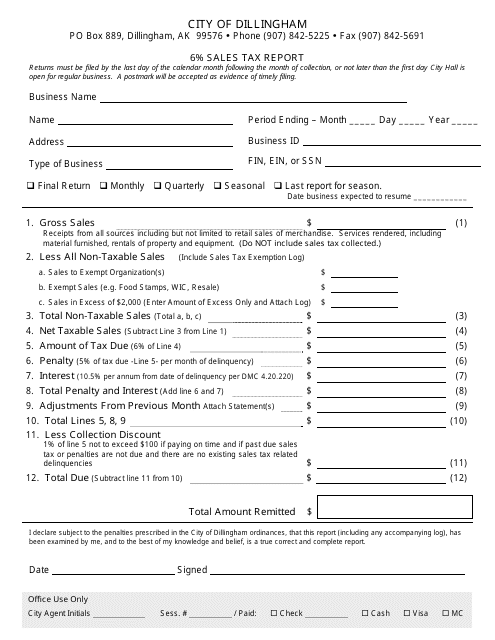

This form is used for reporting sales tax in Dillingham, Alaska. Businesses are required to fill out this form to show their sales tax amount, which is typically 6% of their total sales.

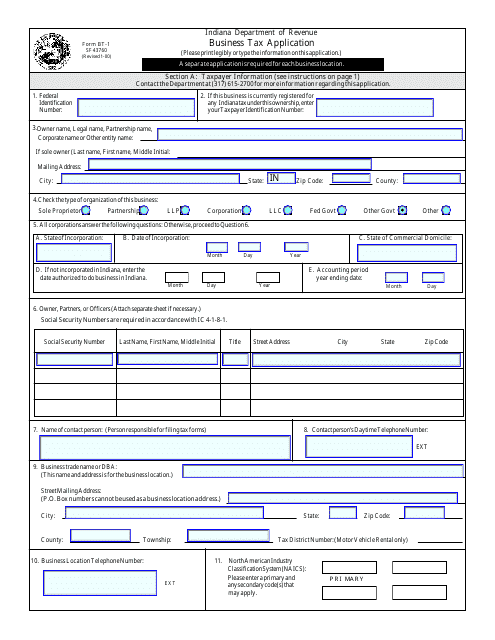

This form is used for businesses in Indiana to apply for a tax identification number. It is required for businesses to register with the state and pay their taxes.

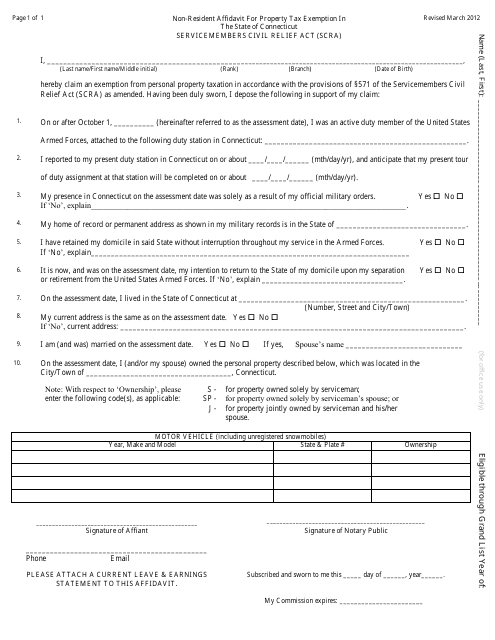

This document is a template for a non-resident affidavit that can be used to apply for property tax exemption in the state of Connecticut under the Service Members Civil Relief Act (SCRA).

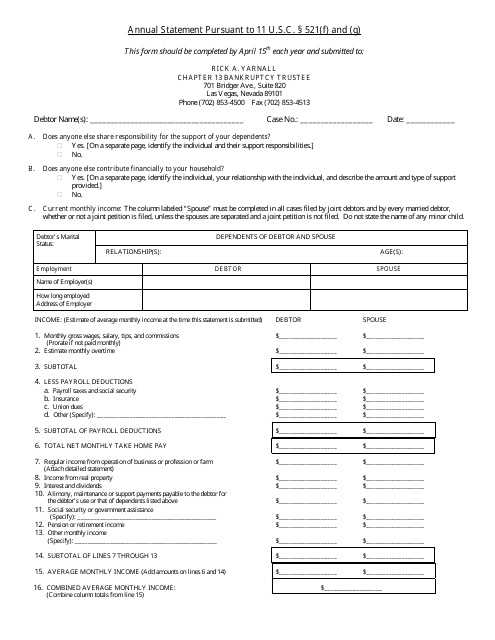

This document is an Annual Statement required by the United States Bankruptcy Code for residents of Nevada who have filed for bankruptcy. It is used to provide information regarding the debtor's current income and expenses.

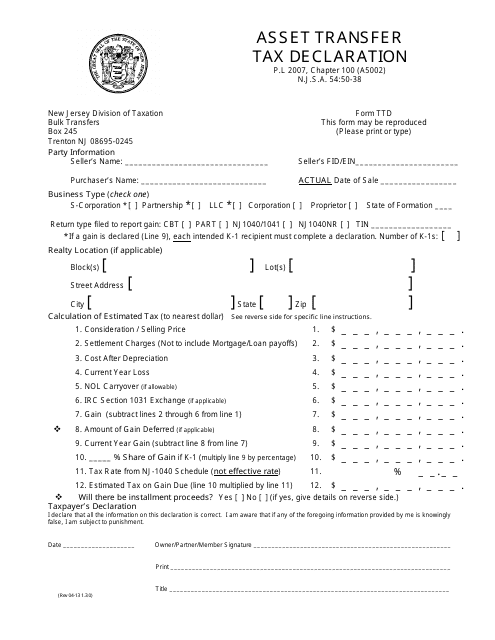

This form is used for declaring asset transfers for tax purposes in the state of New Jersey.

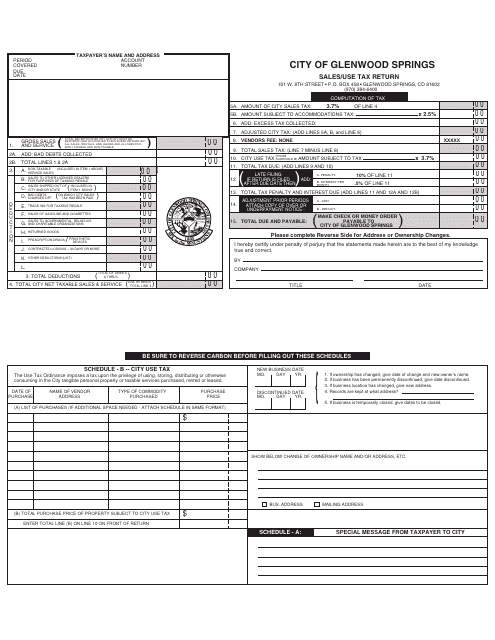

This Form is used for reporting and paying sales and use taxes to the City of Glenwood Springs, Colorado.

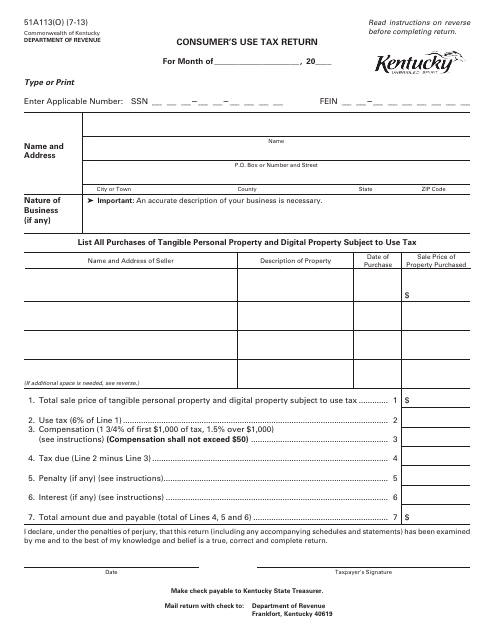

This Form is used for reporting and paying consumer's use tax in the state of Kentucky.

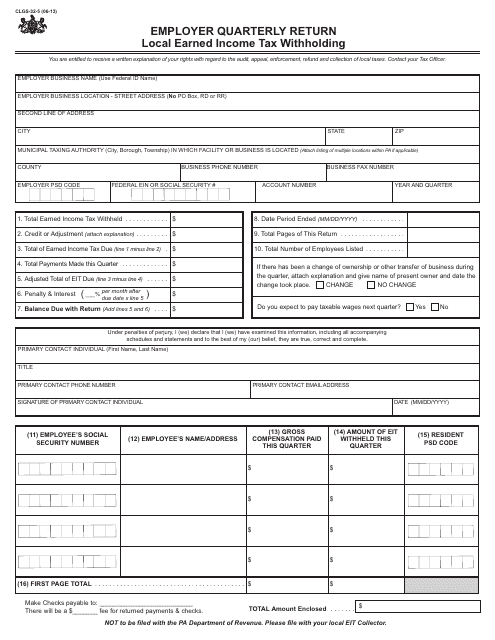

This Form is used for reporting and remitting local earned income tax withholding for employers in Pennsylvania on a quarterly basis.

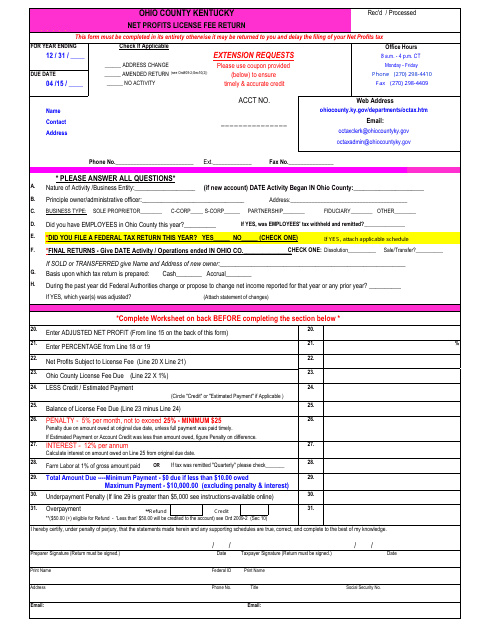

This Form is used for reporting and returning the license fee on net profits in Ohio County, Kentucky.

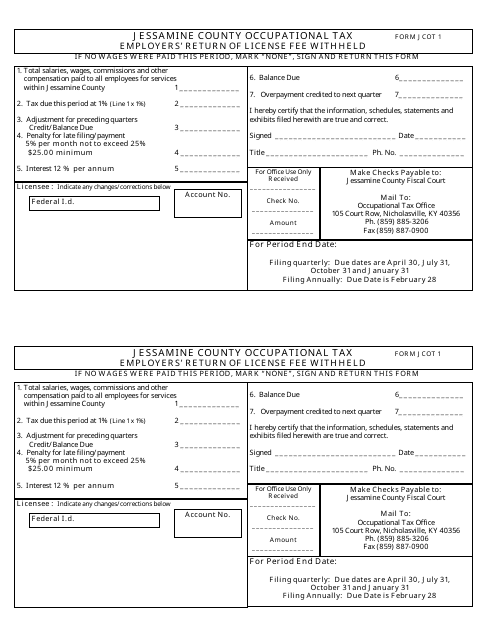

This form is used for employers in Jessamine County, Kentucky to report and remit the occupational tax withheld from their employees' license fees.

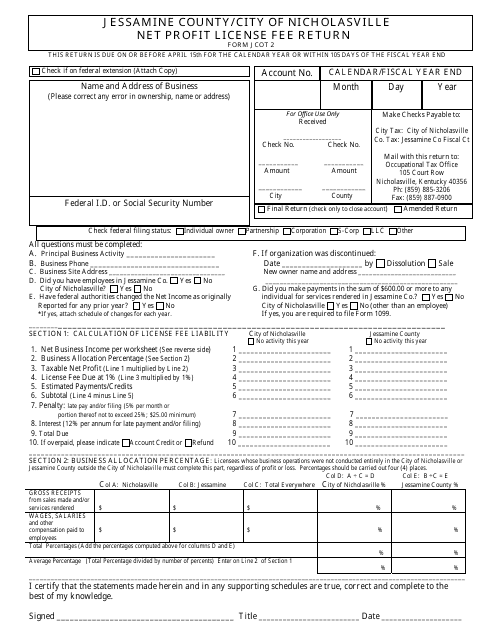

This form is used for filing the Net Profit License Fee Return in the City of Nicholasville, Kentucky.

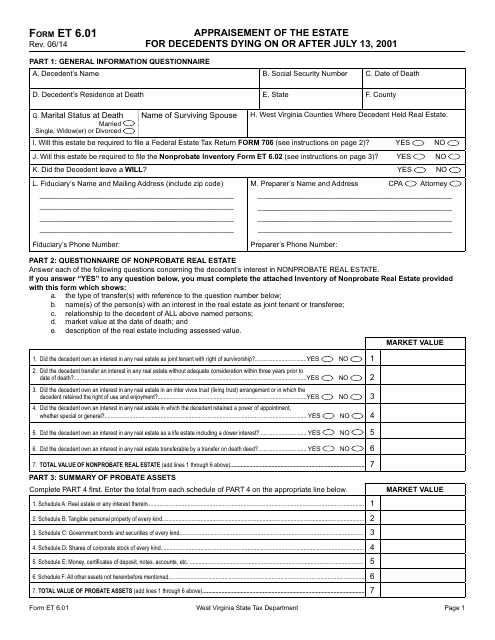

Form ET6.01 Appraisement of the Estate for Decedents Dying on or After July 13, 2001 - West Virginia

This form is used for appraising the estate of individuals who have passed away in West Virginia on or after July 13, 2001.

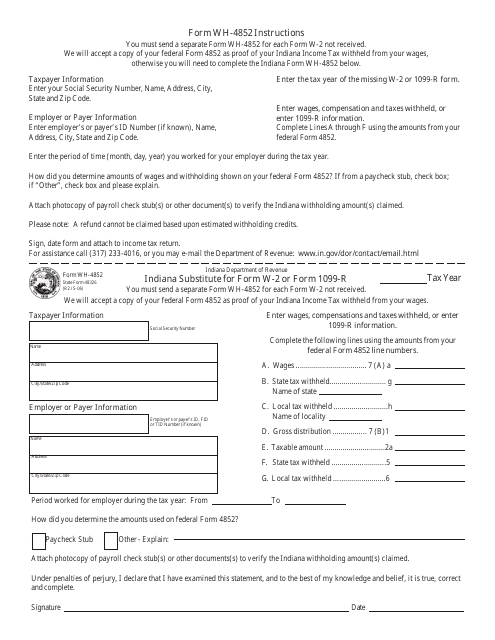

This document is used as a substitute for Form W-2 or Form 1099-R in the state of Indiana. It is used when an individual does not receive their W-2 or 1099-R and needs to report their income for tax purposes.

This Form is used for applying for the Volunteer Firefighters / Ambulance Workers Exemption in Westchester County, New York.

![Form RP-466-D [WESTCHESTER] Application Form for Volunteer Firefighters / Ambulance Workers Exemption (For Use in Westchester County Only) - New York](https://data.templateroller.com/pdf_docs_html/359/3598/359812/form-rp-466-d-westchester-application-form-volunteer-firefighters-ambulance-workers-exemption-use-in-westchester-county-only-new-york_big.png)