Tax Templates

Documents:

2882

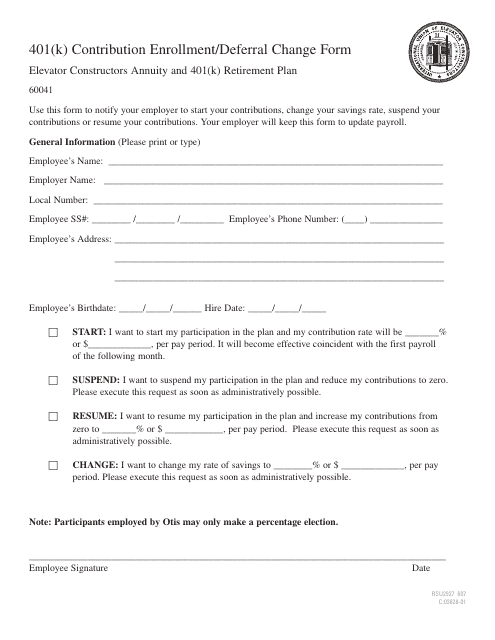

This type of document is used to make changes to your 401(K) contribution or deferral in the International Union of Elevator Constructors.

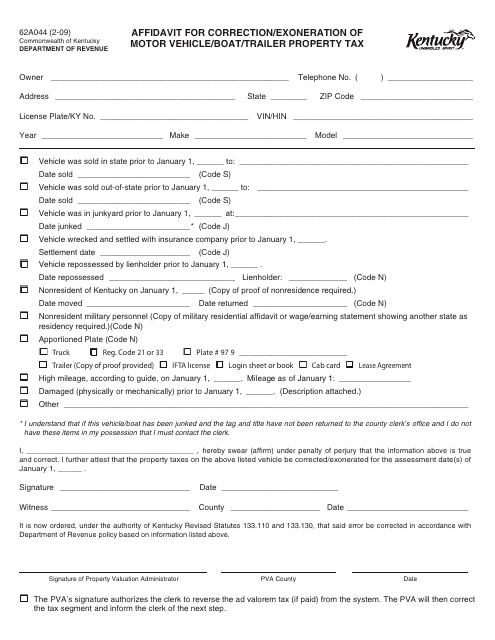

This form is used for correcting or requesting exemption from property tax for motor vehicles, boats, or trailers in Kentucky.

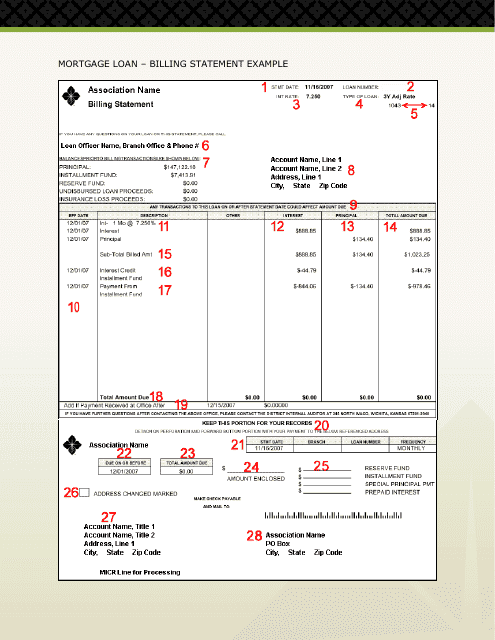

This document is a sample billing statement for a mortgage loan. It provides a breakdown of the amount due, including principal, interest, and any additional fees or charges.

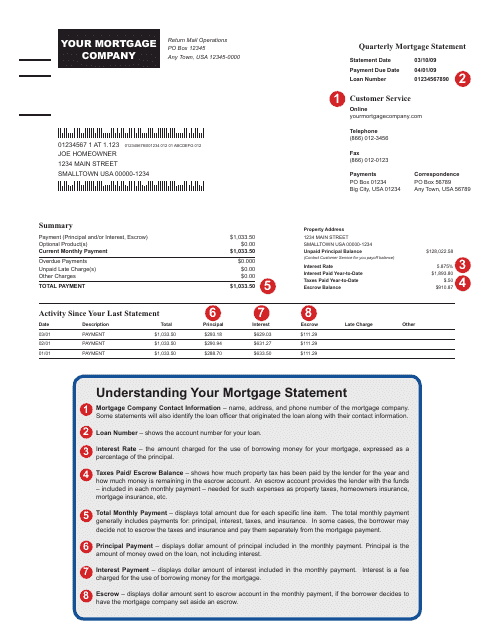

This document provides a summary of your mortgage account activity over a three-month period, including your loan balance, payments made, and any fees or charges applied. It helps you track your mortgage progress and better understand your financial obligations.

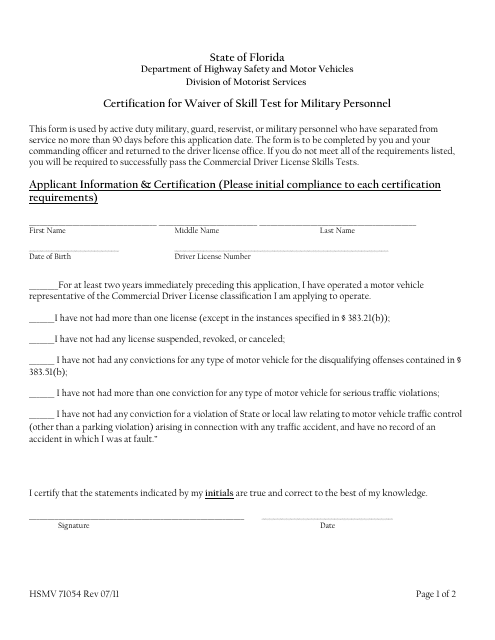

This form certifies the waiver of skill tests for military personnel in Florida. It is used to exempt qualified military personnel from taking certain skill tests when obtaining a driver's license.

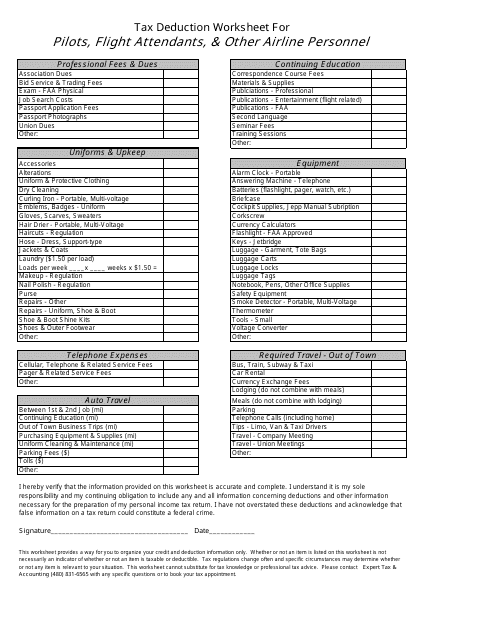

This form is used for calculating tax deductions specific to pilots, flight attendants, and other airline personnel. It helps ensure that eligible expenses related to work in the aviation industry are properly accounted for.

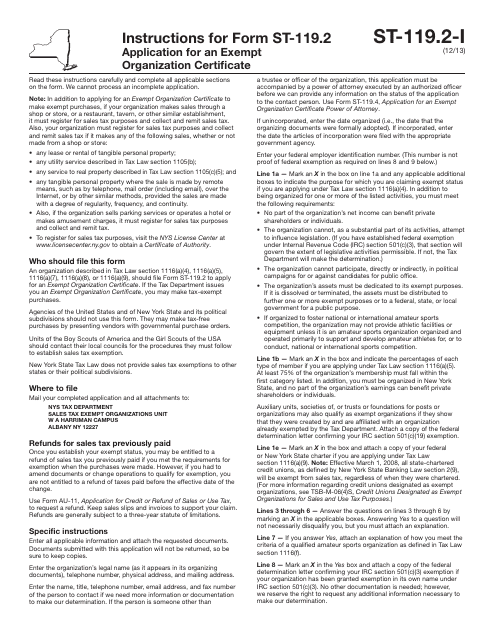

This document is used for applying for an Exempt Organization Certificate in New York.

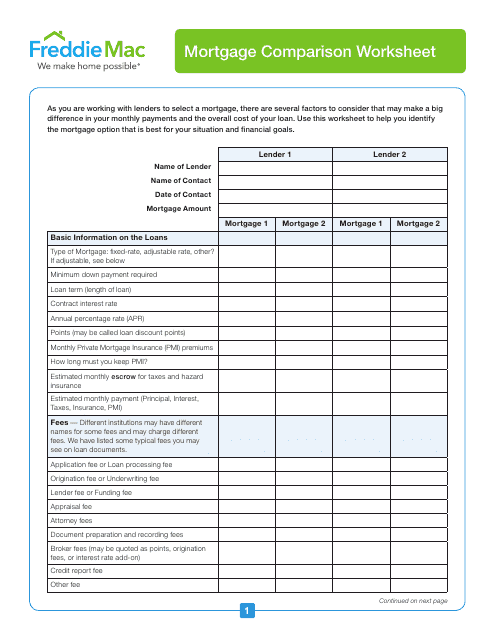

This type of document is a Mortgage Comparison Worksheet provided by Freddie Mac. It can be used to compare different mortgage options available to borrowers.

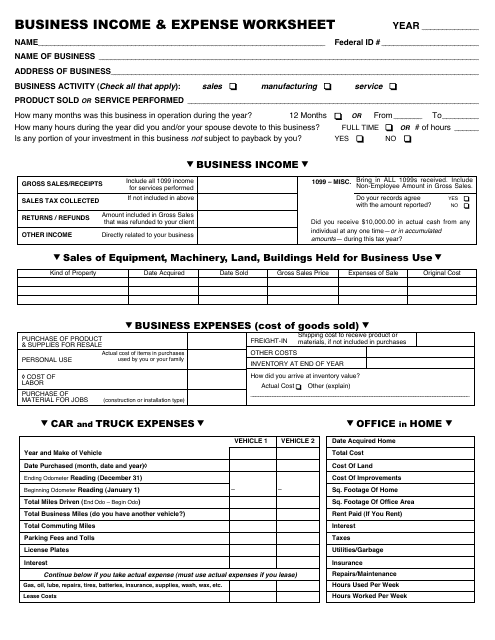

This type of document is used to track and organize income and expenses for a business. It helps businesses to analyze their financial situation and make informed decisions.

This Form is used for submitting quarterly occupational privilege tax return to the City and County of Denver, Texas.

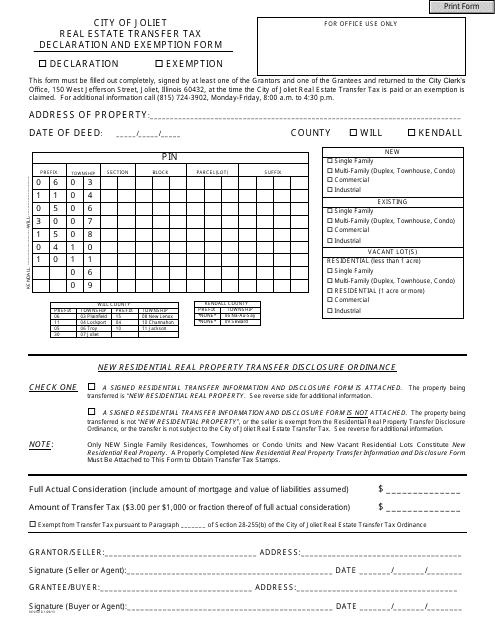

This document is used for declaring and seeking exemptions from real estate transfer taxes in the City of Joliet, Illinois.

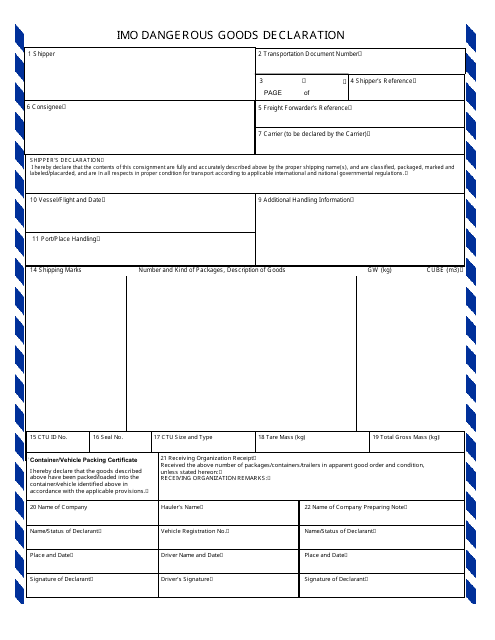

This form is used for declaring dangerous goods being transported internationally. It ensures compliance with international regulations for the safe handling and transportation of hazardous materials.

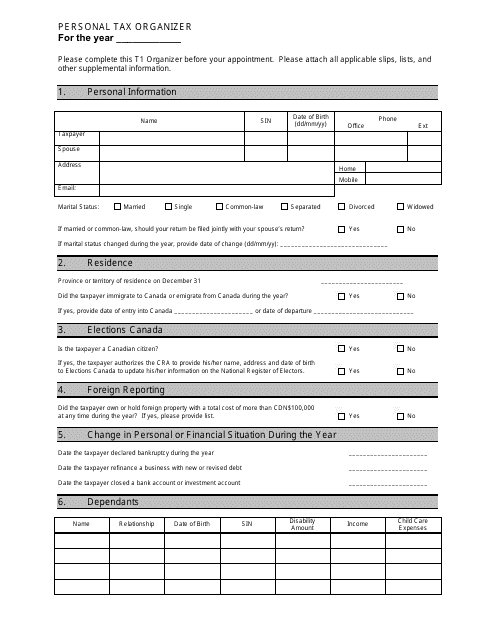

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

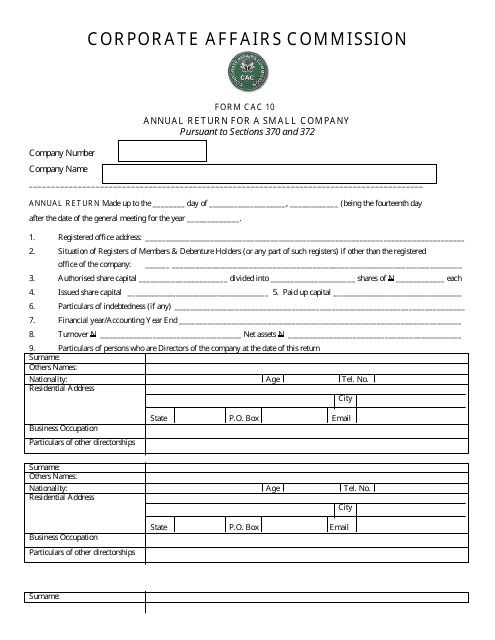

This form is used for filing the annual return for small companies in Nigeria. It provides information about the company's activities, financial statements, and shareholders.

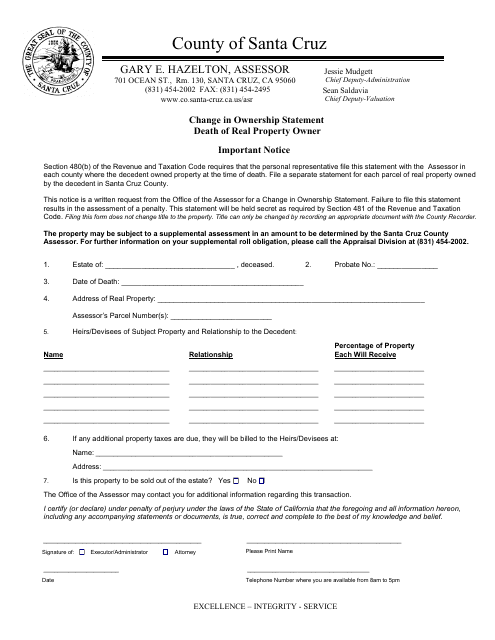

This document is used for notifying the county of Santa Cruz, California about a change in ownership of a real property due to the death of the owner.

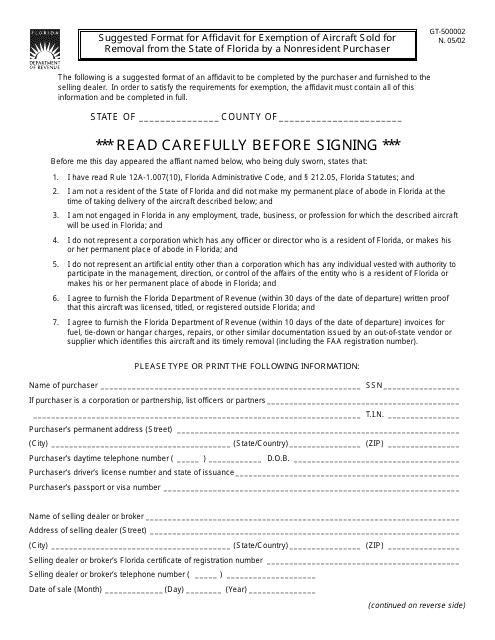

This form is used for creating an affidavit to claim exemption from aircraft sales tax for out-of-state buyers in Florida.

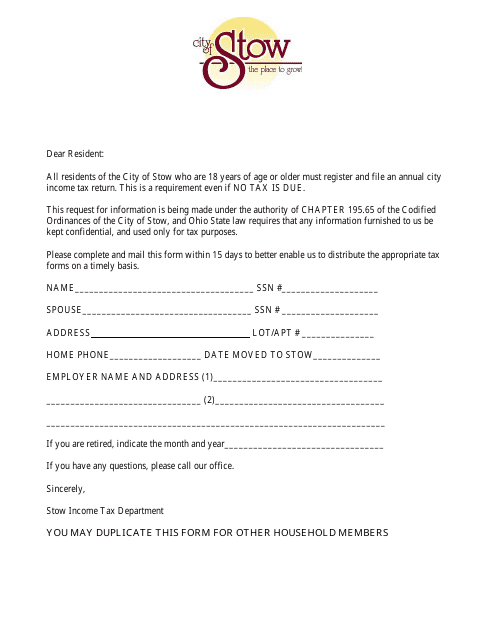

This Form is used for filing your income tax return in the City of Stow, Ohio.

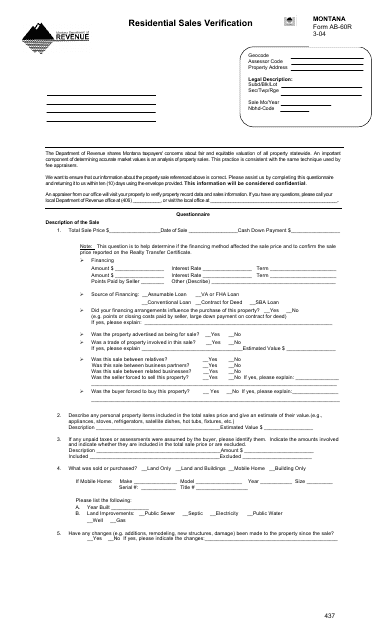

This Form is used for verifying residential sales in Montana.

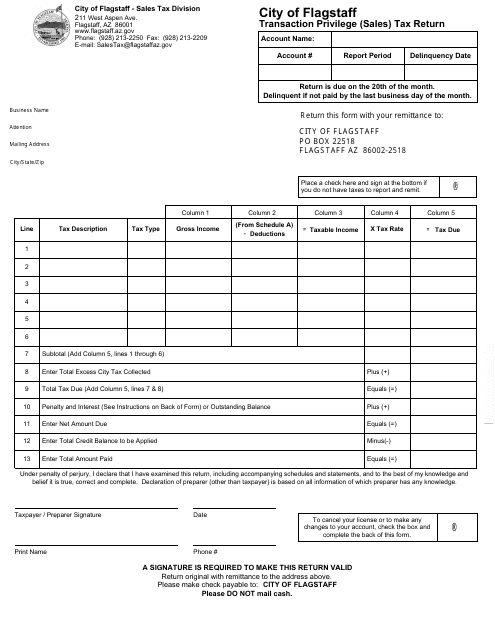

This document is used for filing sales tax returns with the City of Flagstaff, Arizona.

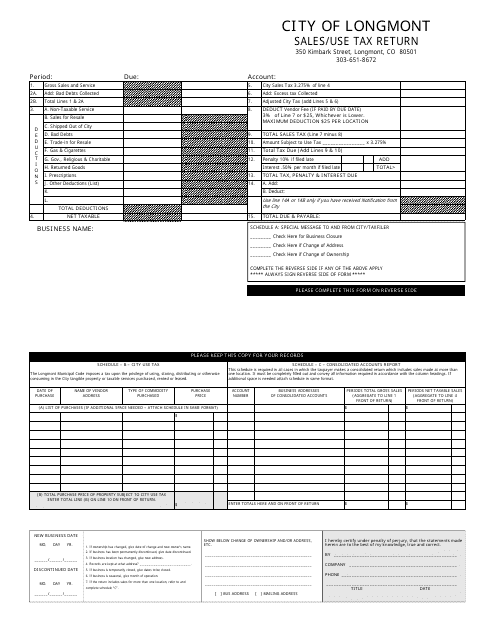

This Form is used for filing sales and use tax returns in LONGMONT, Colorado.

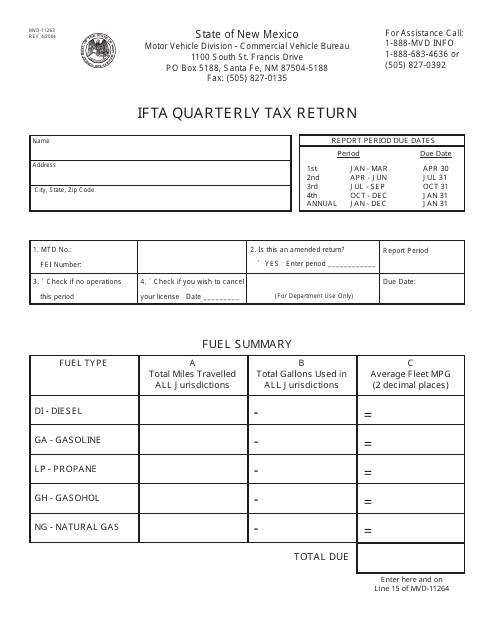

This form is used for filing the quarterly tax return for the International Fuel Tax Agreement (IFTA) in the state of New Mexico.

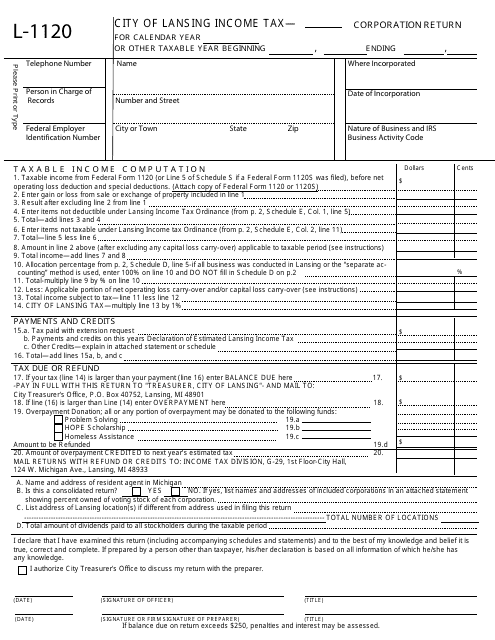

This form is used for filing the income tax corporation return specifically for businesses located in the City of Lansing, Michigan.

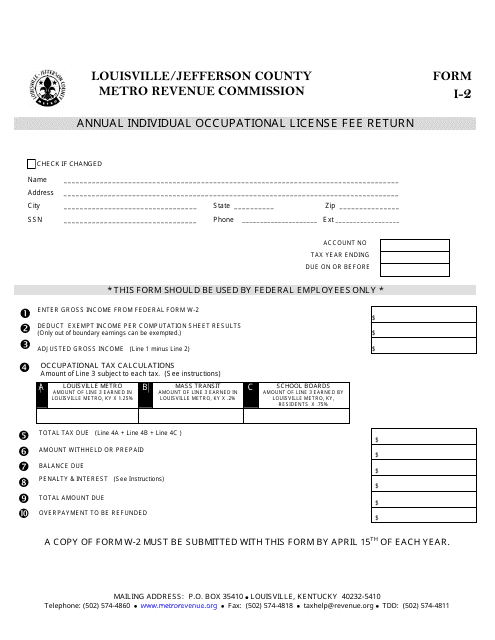

This form is used for reporting and paying the annual individual occupational license fee in Louisville/Jefferson County, Kentucky.

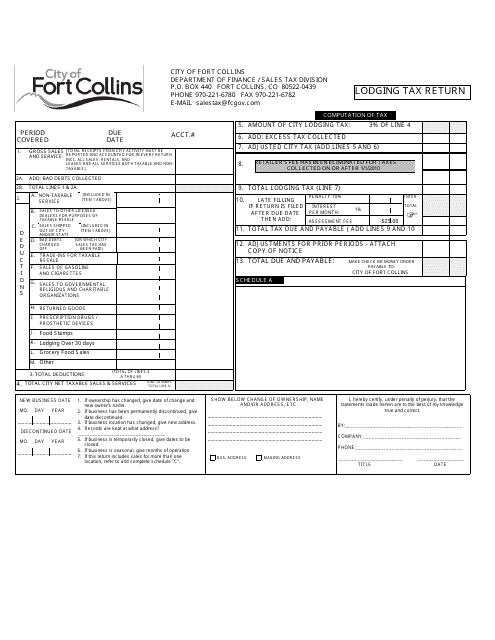

This document is used for filing a lodging tax return specifically for the city of Fort Collins, Colorado. It is required for individuals or businesses that provide lodging accommodations within the city and need to report and remit the applicable taxes.

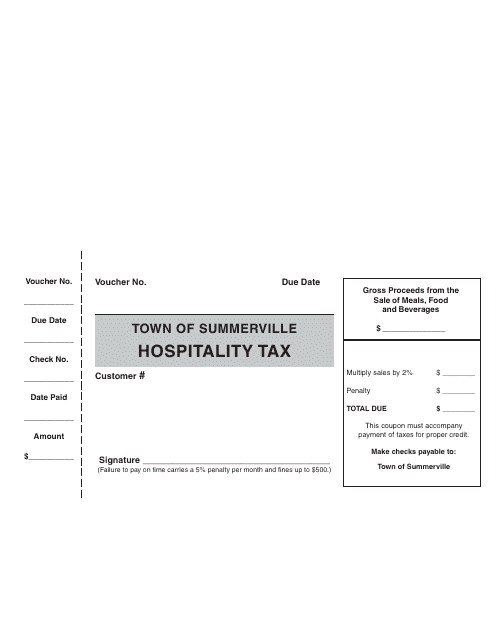

This form is used for reporting and remitting hospitality taxes to the Town of Summerville, South Carolina.

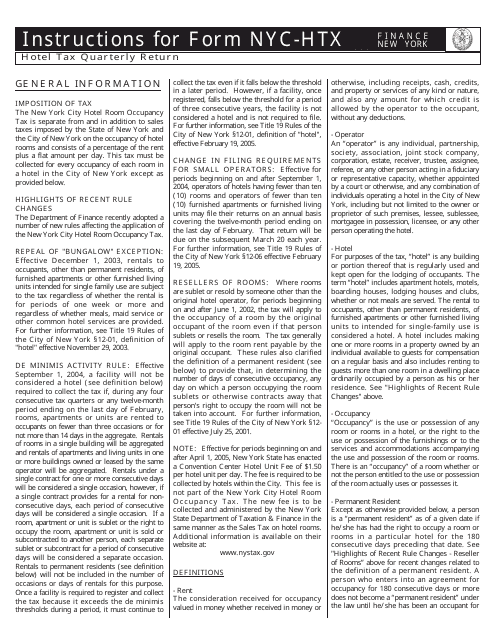

This form is used for reporting and paying hotel taxes on a quarterly basis in New York City. It provides instructions on how to complete the form and submit the necessary documentation.

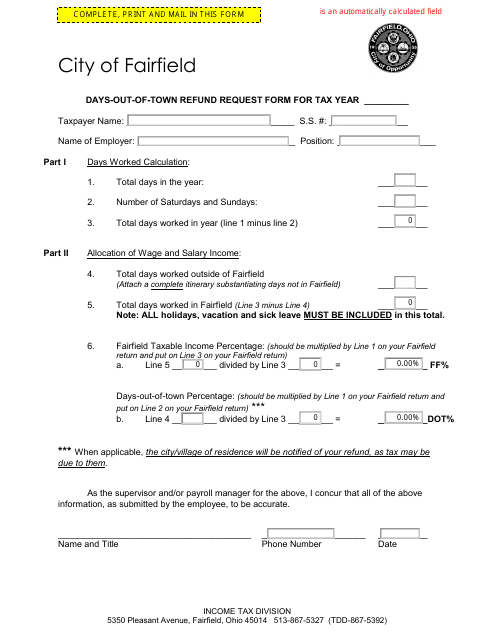

This Form is used for requesting a refund for days spent out of town in Fairfield, Ohio.

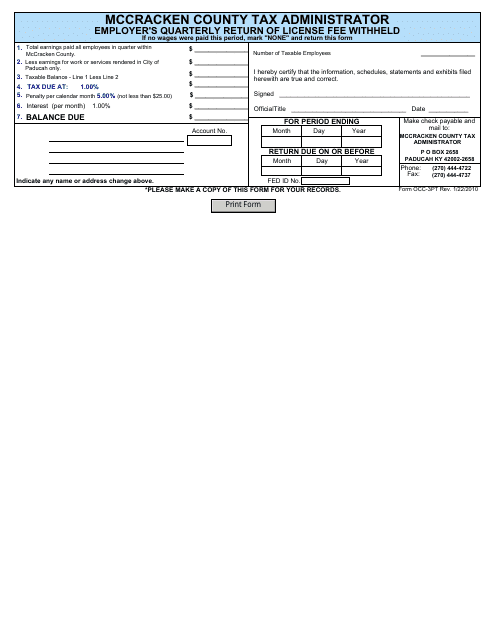

This form is used for employers in McCracken County, Kentucky to report and remit license fee withheld on a quarterly basis.

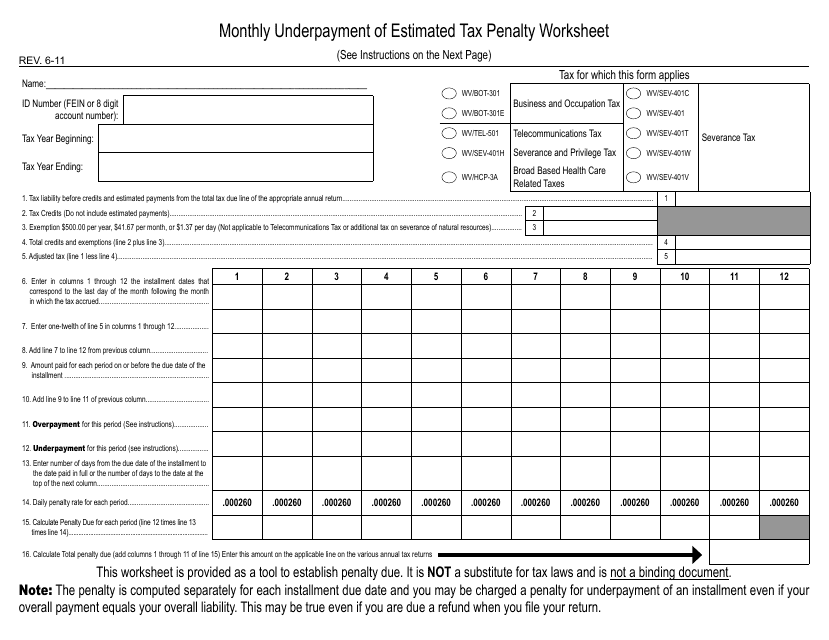

This form is used for calculating the penalty for underpayment of estimated taxes on a monthly basis for taxpayers in West Virginia.

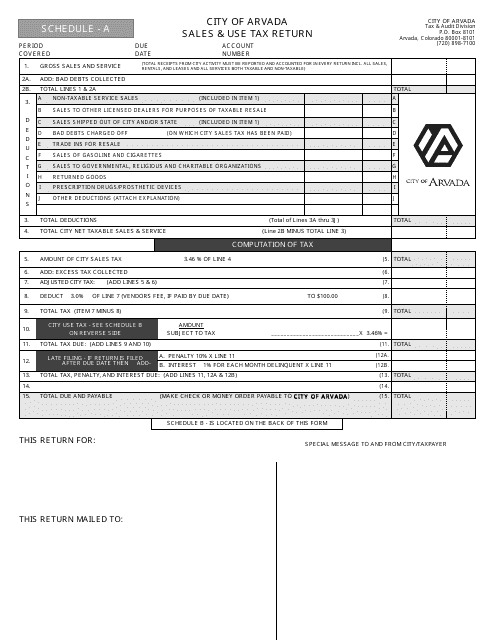

This document is used for filing Sales & Use Tax returns for businesses in the City of Arvada, Colorado.

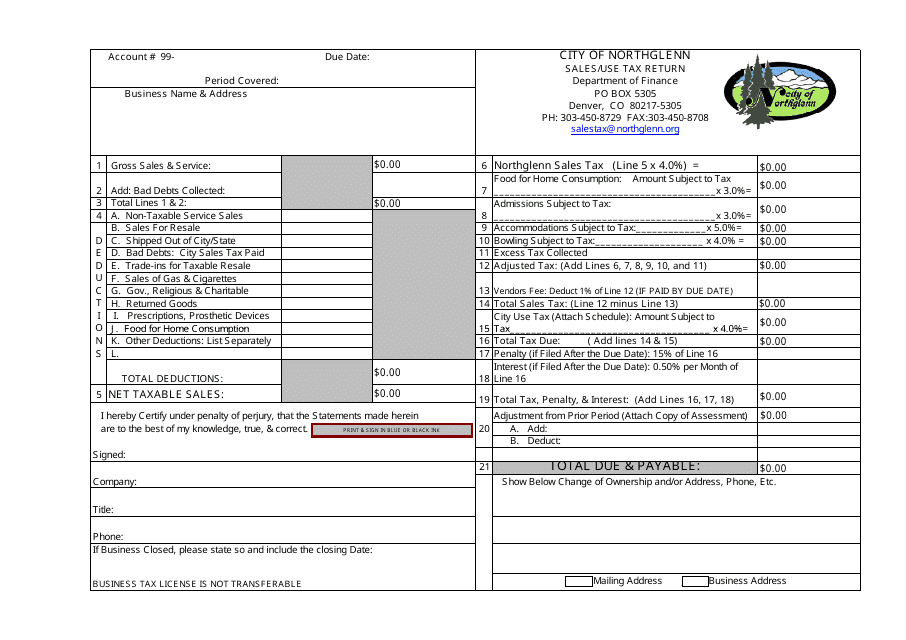

This form is used for reporting and remitting sales and use tax to the City of Northglenn, Colorado.

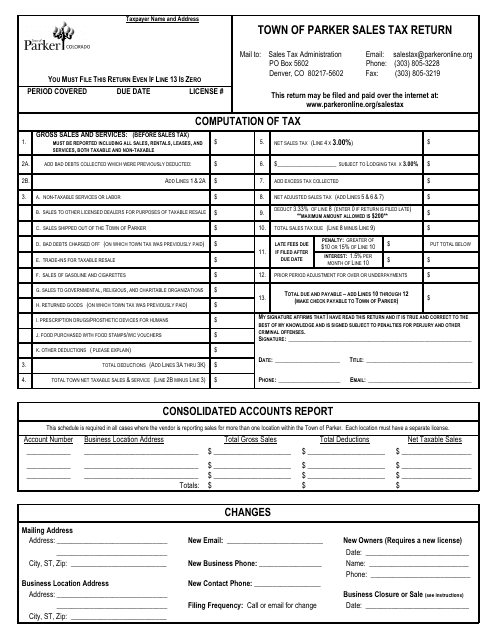

This form is used for filing sales tax returns in the Town of Parker, Colorado. It is used by businesses to report and remit the sales tax collected from their customers.

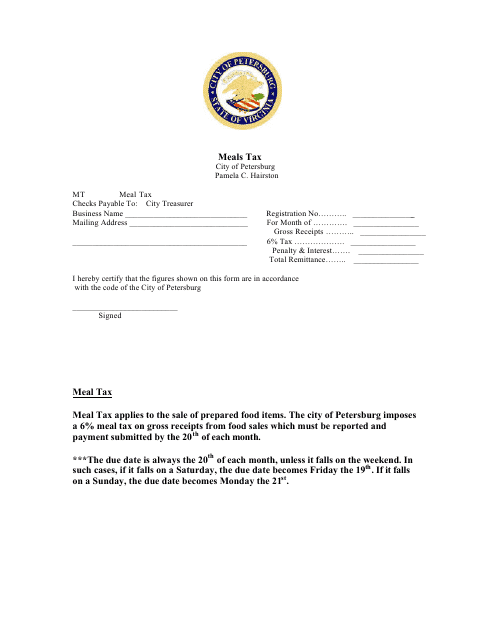

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

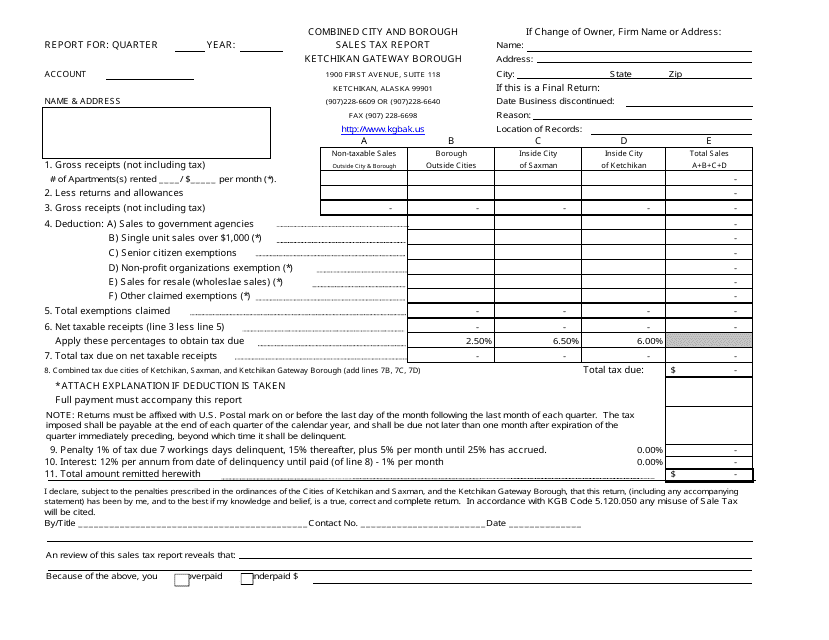

This document is a combined sales tax report for the Ketchikan Gateway Borough in Alaska. It includes information on the sales tax collected from both the city and borough within the area.

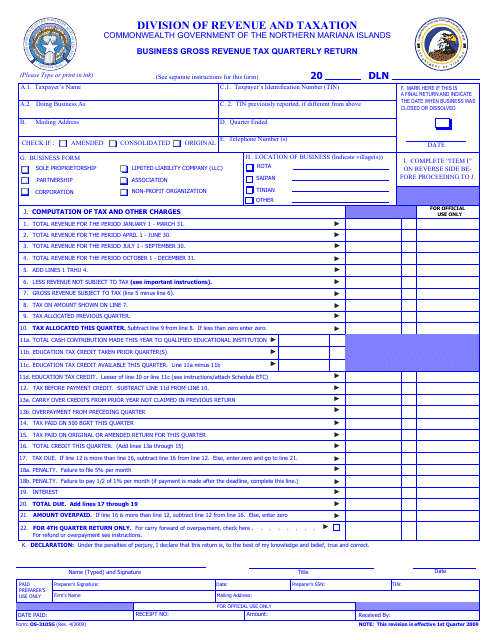

This form is used for filing the Business Gross Revenue Tax Quarterly Return in the Northern Mariana Islands.

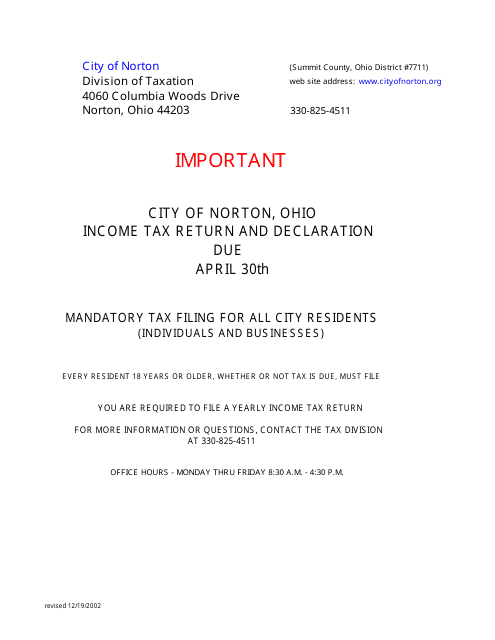

This Form is used for filing tax returns and declaring income to the City of Norton, Ohio.

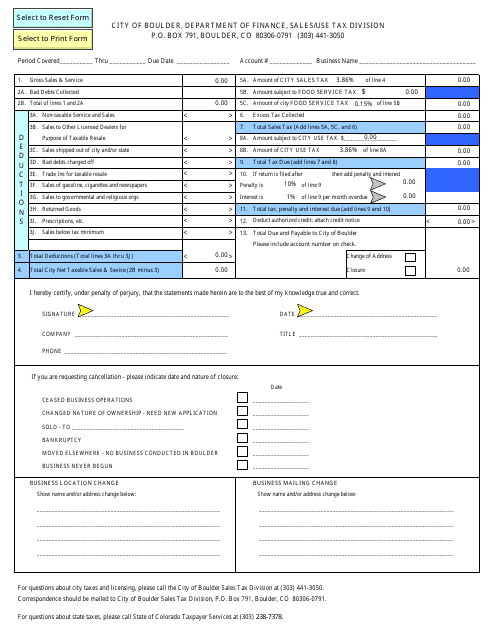

This form is used for reporting and remitting sales and use taxes to the City of Boulder, Colorado.