Tax Templates

Documents:

2882

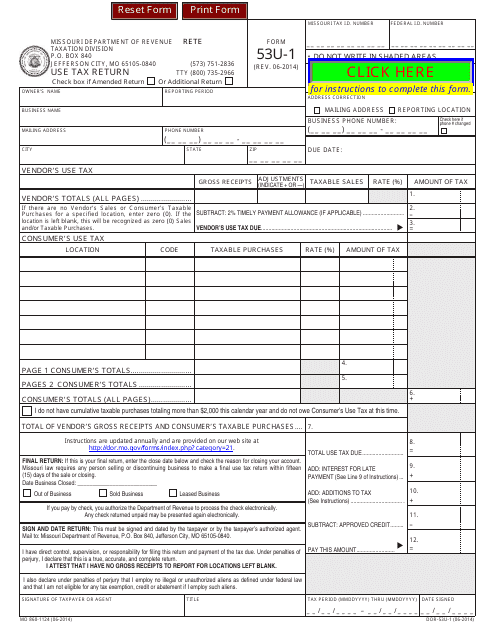

This Form is used for reporting and paying use tax in the state of Missouri. Use tax is owed on taxable items that were purchased tax-free and used in Missouri. The Form 53U-1 is used to calculate the use tax owed and submit it to the Missouri Department of Revenue.

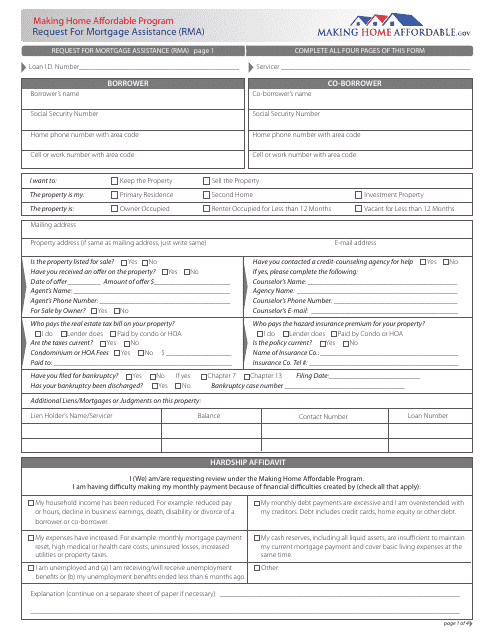

This form is used for requesting assistance with a mortgage. It contains important information and documentation that lenders require to evaluate eligibility for mortgage assistance programs.

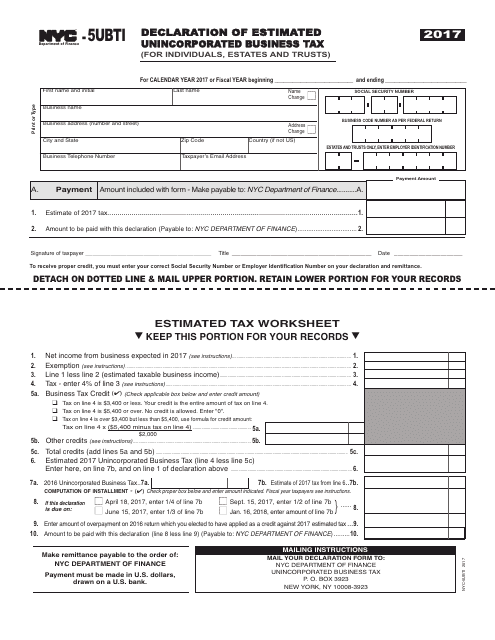

This Form is used for individuals, estates, and trusts in New York City to declare their estimated unincorporated business tax.

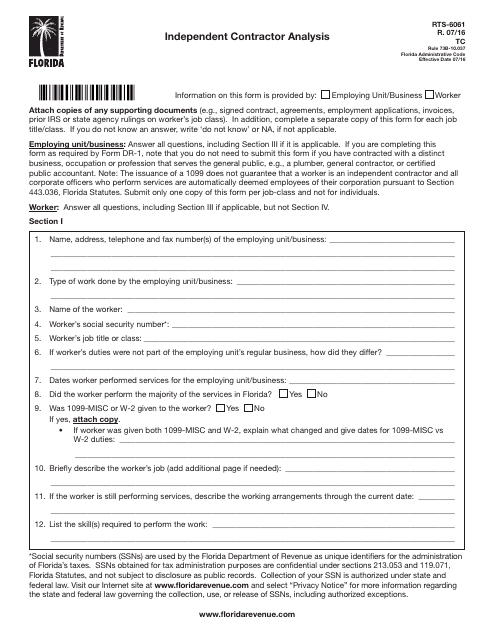

This form is used for conducting an independent contractor analysis in the state of Florida.

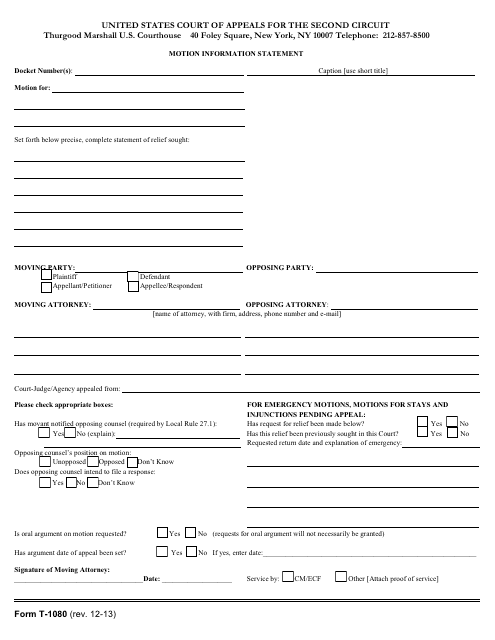

This form is used to provide information related to a motion filed in a legal case. It helps the court and parties involved understand the details and reasons behind the motion.

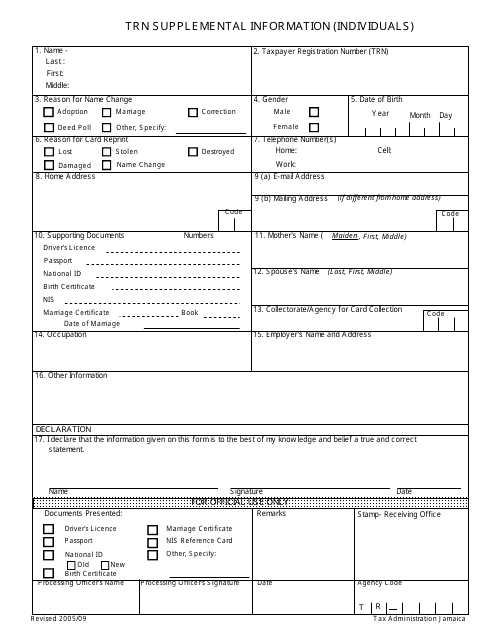

This document provides additional information for individuals applying for a TRN (Taxpayer Registration Number) in Jamaica. It includes supplemental details required for the TRN application process.

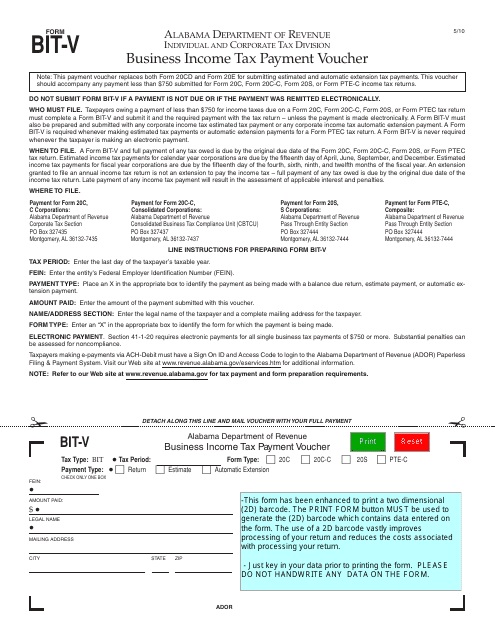

This Form is used for submitting business income tax payment in the state of Alabama.

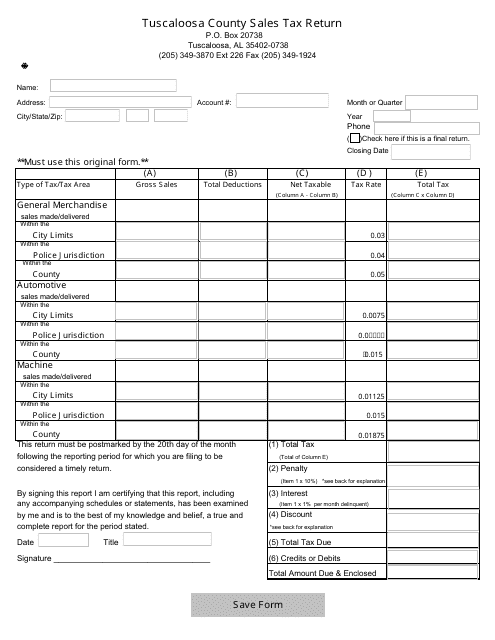

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

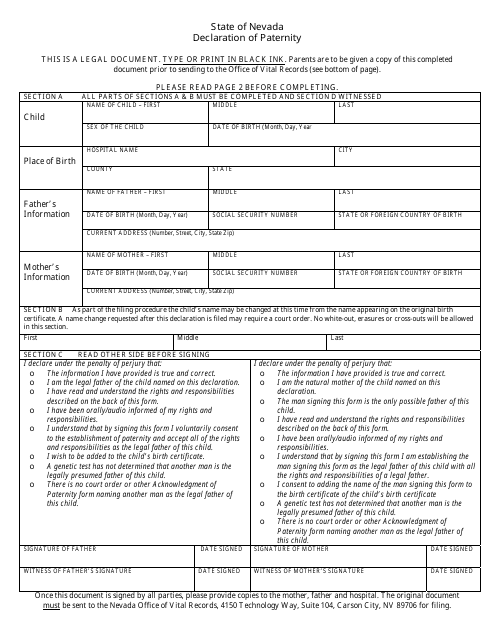

This document is used for establishing legal paternity in the state of Nevada. It is a form that allows a man to declare himself as the father of a child and establish his rights and responsibilities.

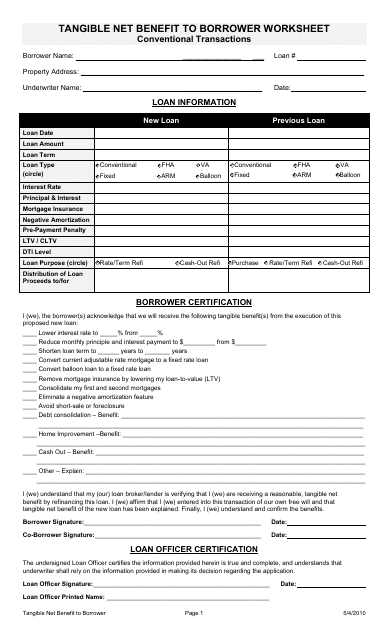

This document is used for calculating the tangible net benefit to the borrower when applying for a loan.

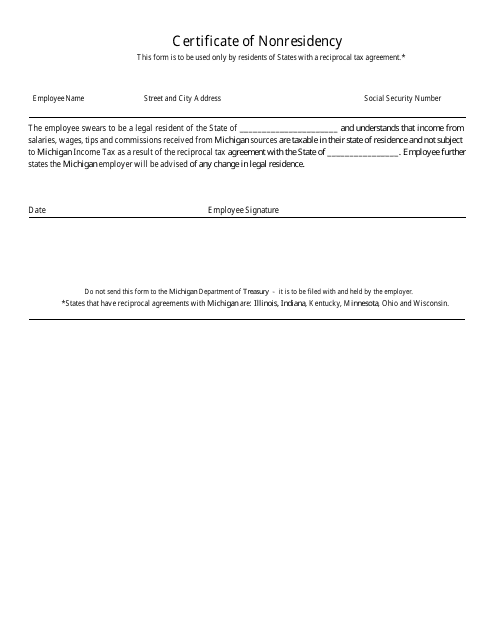

This document certifies that an individual does not reside in Michigan. It may be required for tax purposes or to show their nonresident status for certain benefits or privileges.

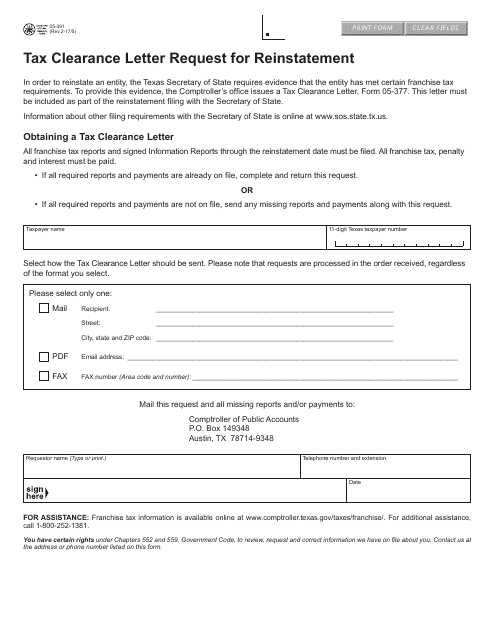

This form is used for requesting a tax clearance letter for reinstatement in the state of Texas.

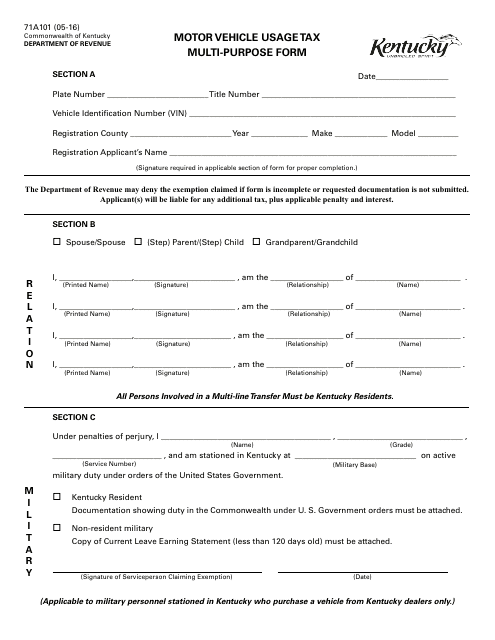

This form is used for reporting and paying motor vehicle usage tax in Kentucky. It is a multipurpose form that can be used for various purposes related to motor vehicle taxation.

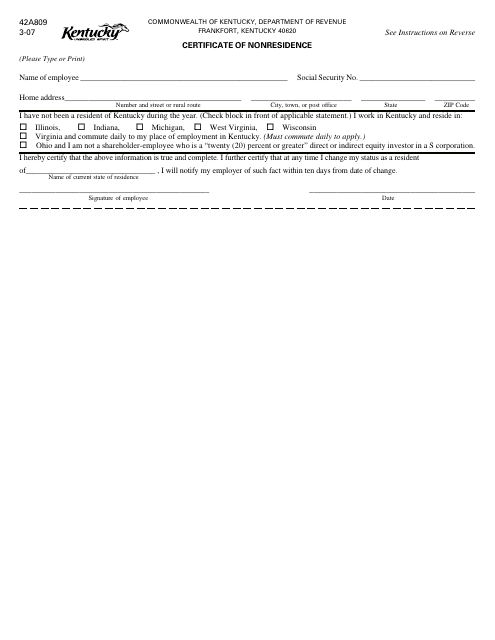

This document is used for obtaining a Certificate of Nonresidence in the state of Kentucky. It is typically required for individuals who are claiming nonresident status for tax or other purposes.

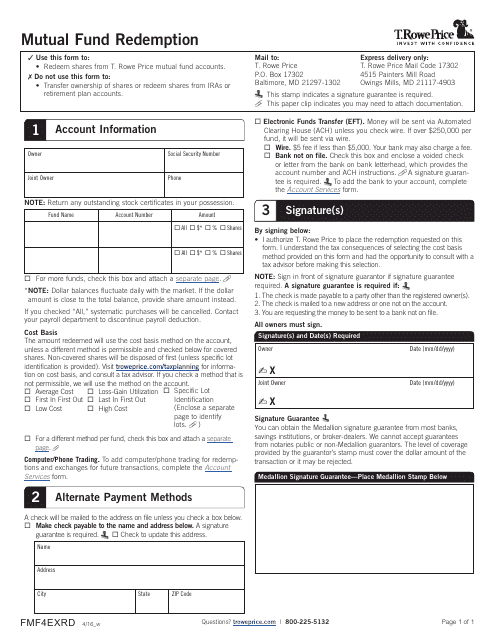

This form is used for redeeming mutual funds from T. Rowe Price, a financial services company based in Maryland. It allows investors to withdraw their investment from the mutual fund.

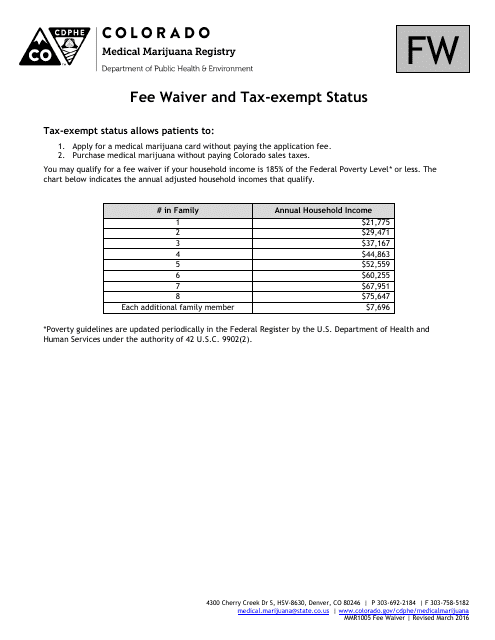

This document is used to request a fee waiver or tax-exempt status in the state of Colorado.

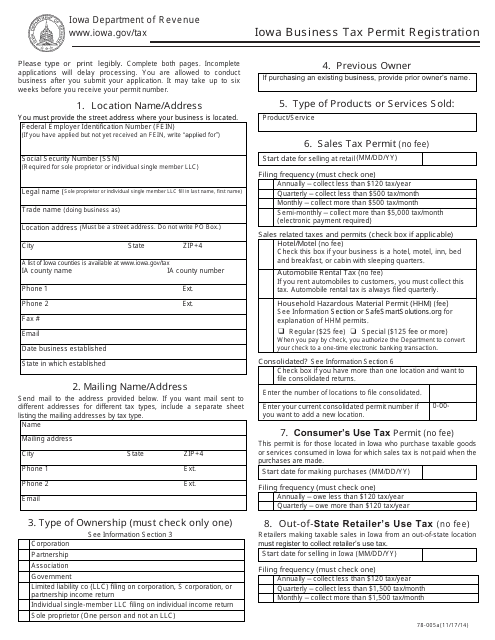

This form is used for business owners in Iowa to register for a tax permit.

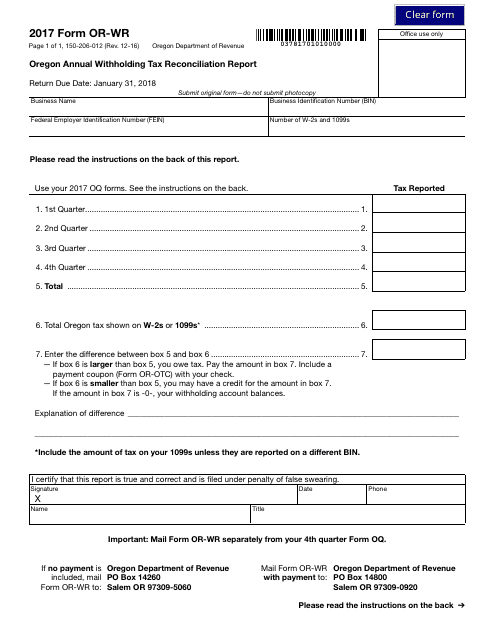

This Form is used for reporting annual withholding tax in Oregon.

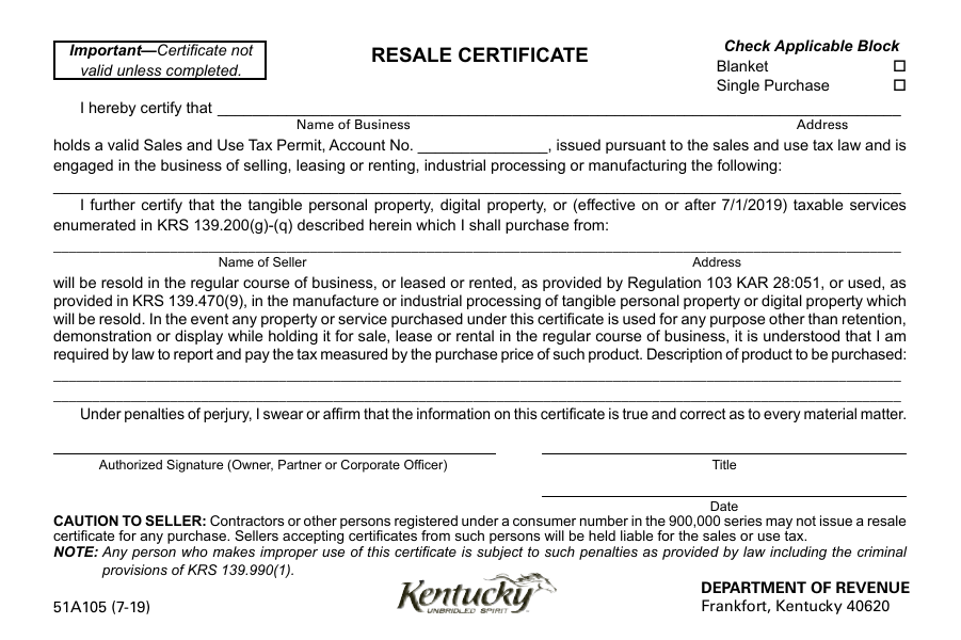

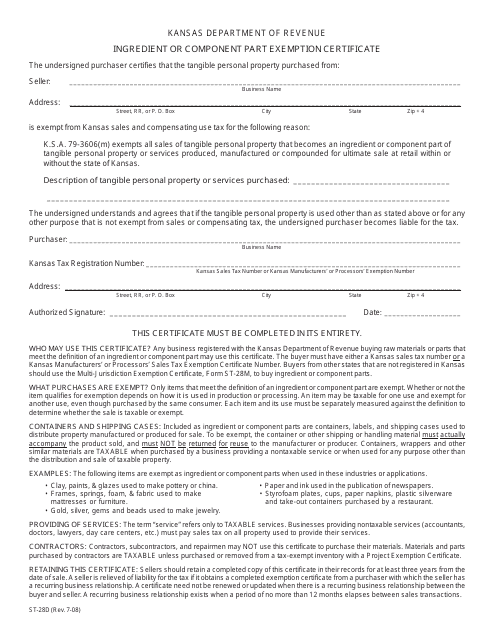

This document is used for claiming an exemption on certain ingredients or component parts in Kansas.

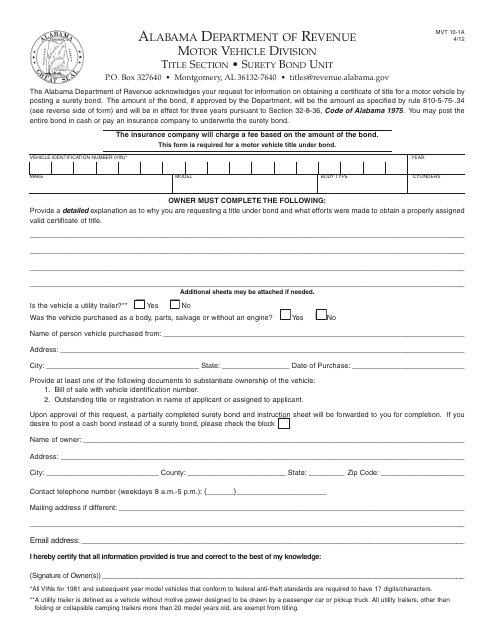

This form is used for requesting a surety bond in Alabama.

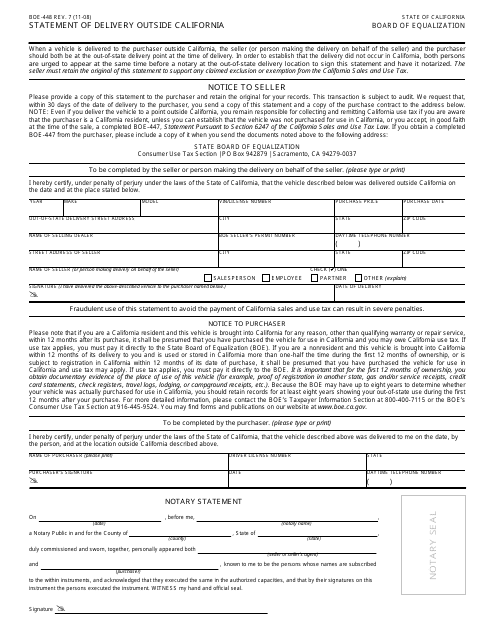

This form is used for reporting deliveries made outside of California for businesses based in California.

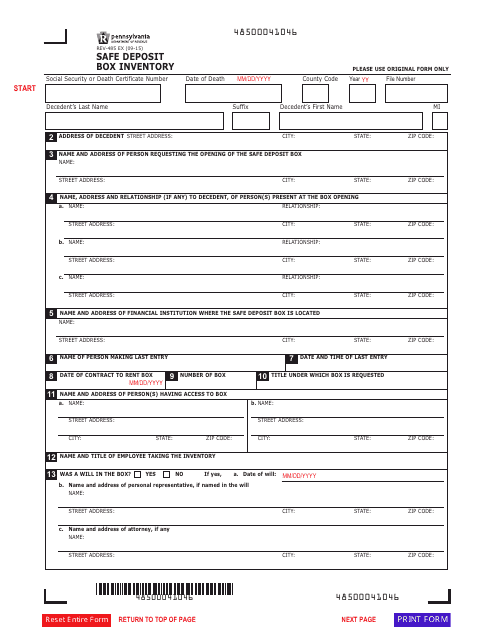

This Form is used for creating an inventory of items stored in a safe deposit box in Pennsylvania. It helps the owner keep track of their belongings and provides security.

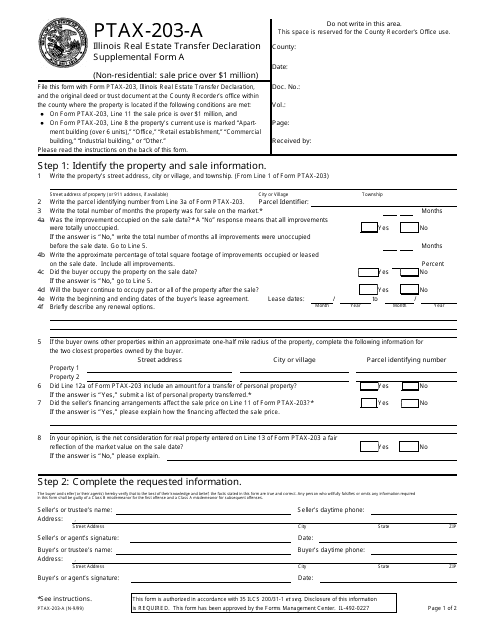

This Form is used for providing additional information for the Real Estate Transfer Declaration in Illinois.

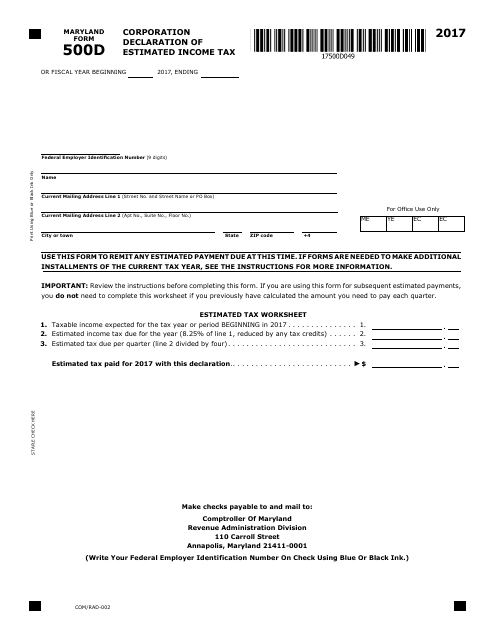

This form is used for Maryland corporations to declare their estimated income tax for the year.

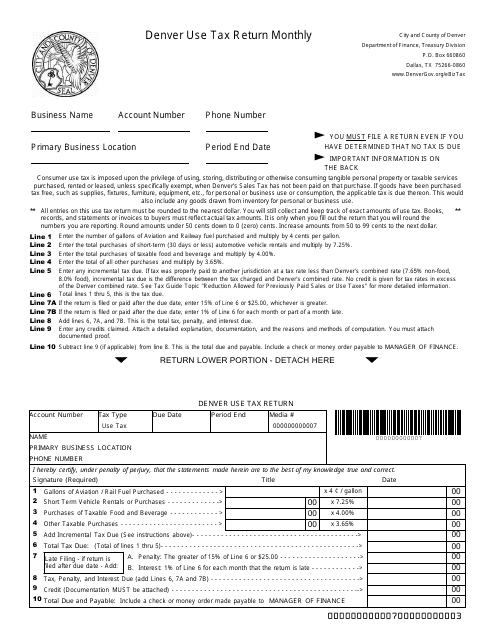

This Form is used for reporting and paying monthly use tax to the City and County of Denver, Texas.

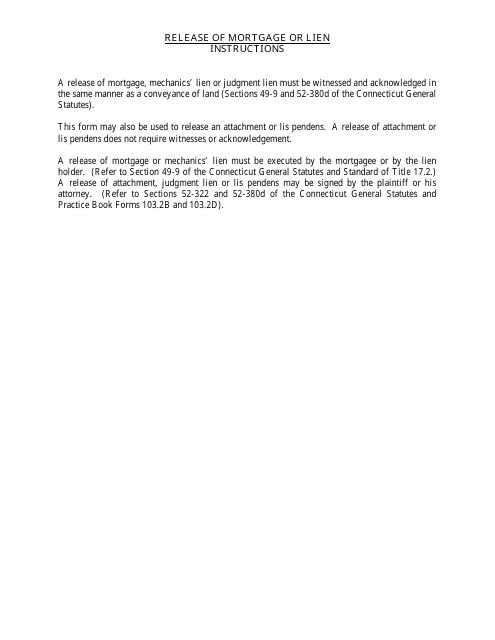

This Form is used for releasing a mortgage or lien on a property in Connecticut. It provides a legal way to officially remove the mortgage or lien from the property records.

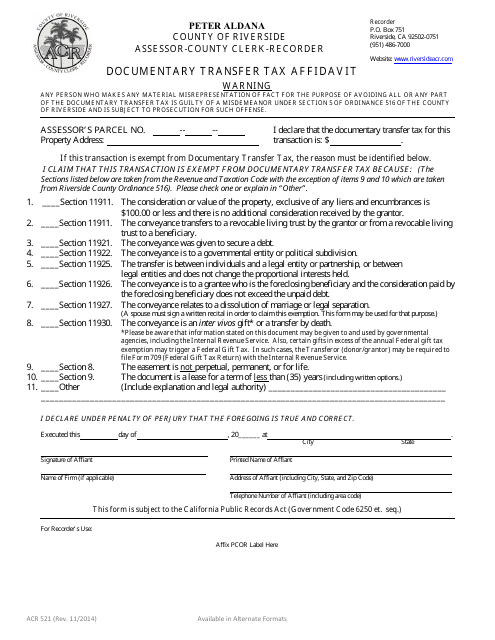

This Form is used for filing a Documentary Transfer Tax Affidavit in Riverside County, California. It is required when transferring real property and helps the county assess the appropriate transfer tax.

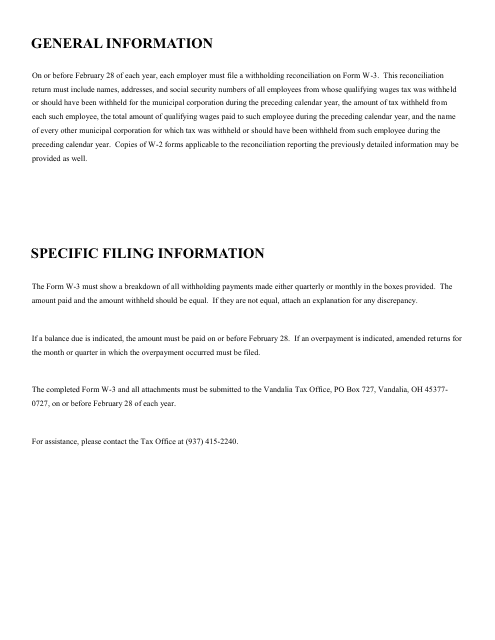

This Form is used for reconciling withholding taxes for the City of Vandalia, Ohio.

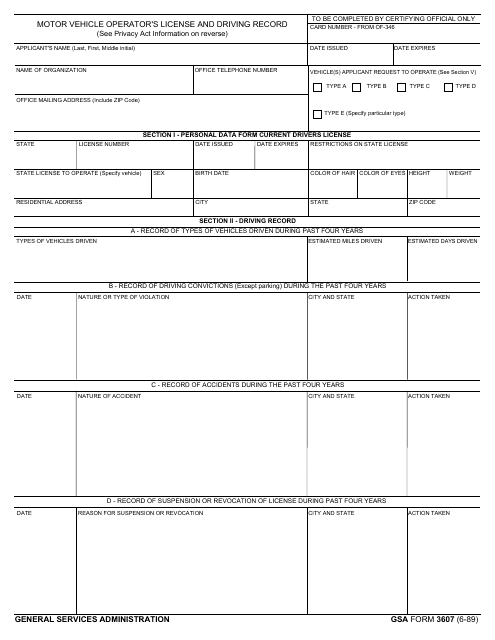

This form is used for obtaining a motor vehicle operator's license and driving record. It is typically required for individuals who need to operate a vehicle as part of their job duties. The form collects information about the applicant's driving history and verifies their eligibility to drive.

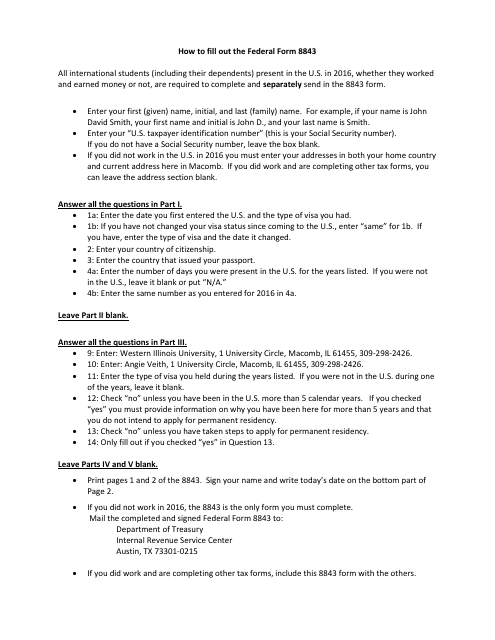

This document is used for filing Form 8843 with the IRS. It is specifically for individuals who are exempt from certain taxes or have a medical condition. The form requires certain information and must be submitted by the specified deadline.

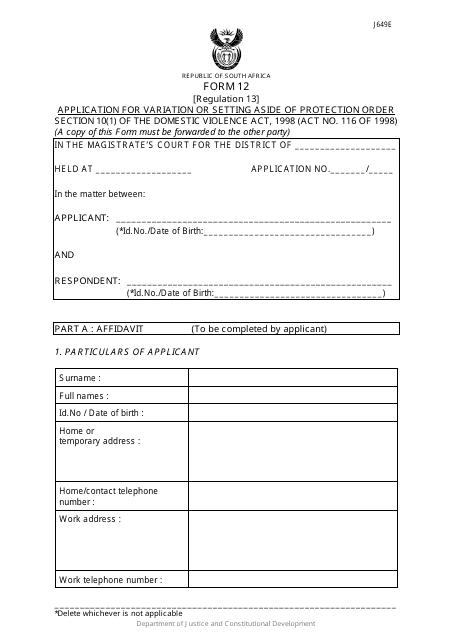

This form is used for applying to vary, set aside, or obtain a protection order in South Africa.

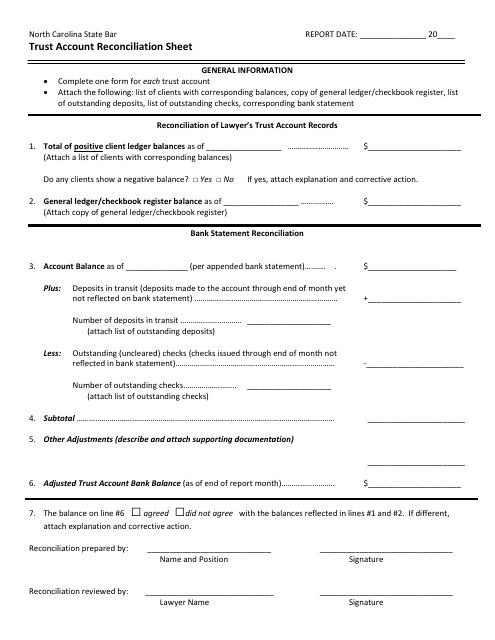

This document is used for reconciling trust accounts in North Carolina. It helps ensure accuracy and transparency in financial transactions.