Tax Templates

Documents:

2882

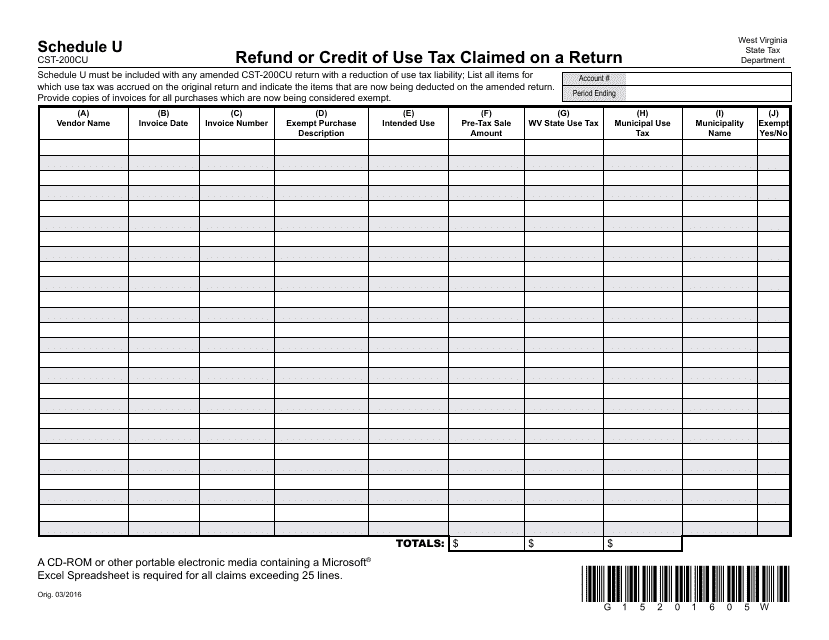

This form is used for claiming a refund or credit of use tax that was previously reported on a CST-200CU return in West Virginia.

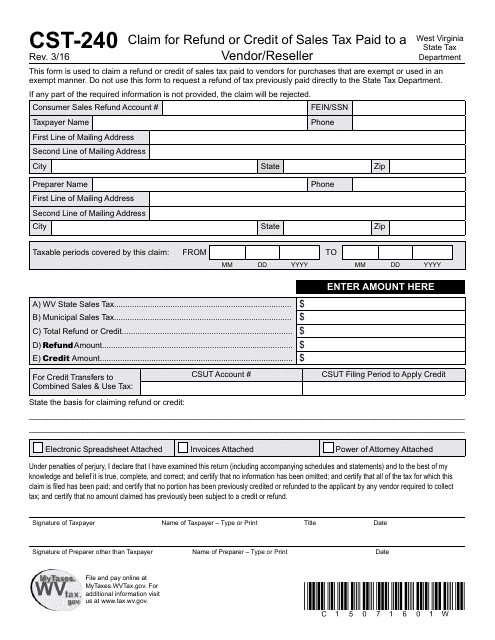

This Form is used for claiming a refund or credit for sales tax paid to a vendor or reseller in West Virginia.

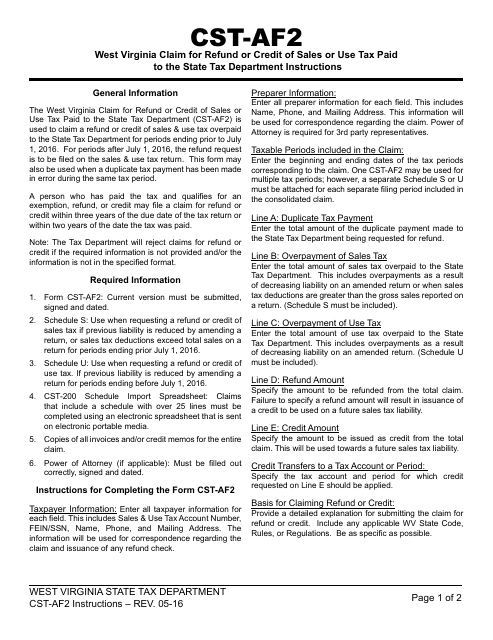

This Form is used for claiming a refund or credit for sales or use tax paid to the West Virginia State Tax Department.

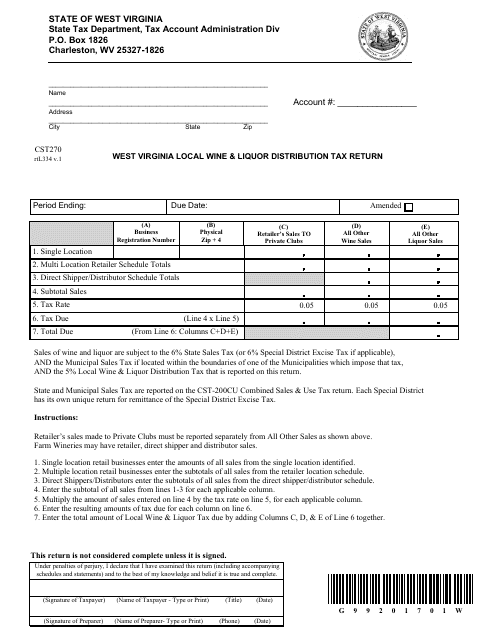

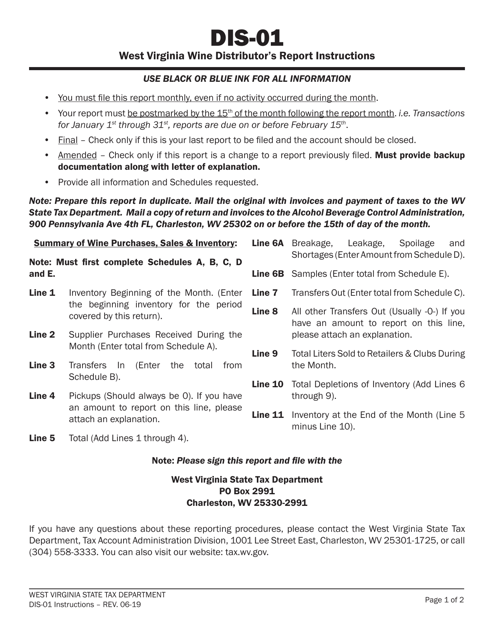

This Form is used for reporting and paying local wine and liquor distribution tax in West Virginia.

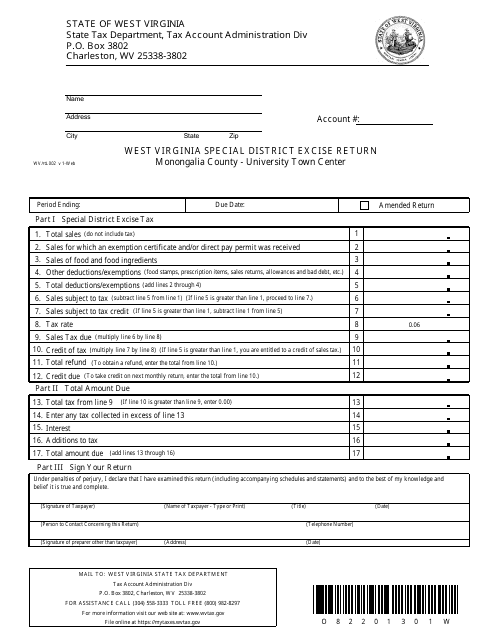

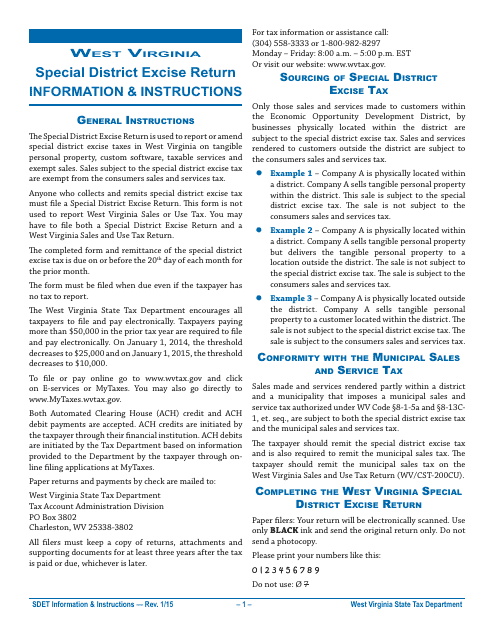

This Form is used for reporting and paying excise taxes in Monongalia County, West Virginia for special districts.

This form is used for reporting and paying excise taxes for special districts in West Virginia. The instructions provide guidance on how to complete and submit the return form accurately and in compliance with state regulations.

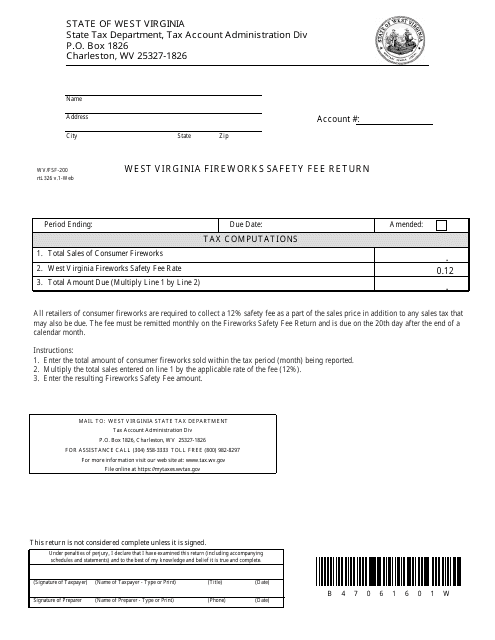

This Form is used for filing the West Virginia Fireworks Safety Fee Return in West Virginia.

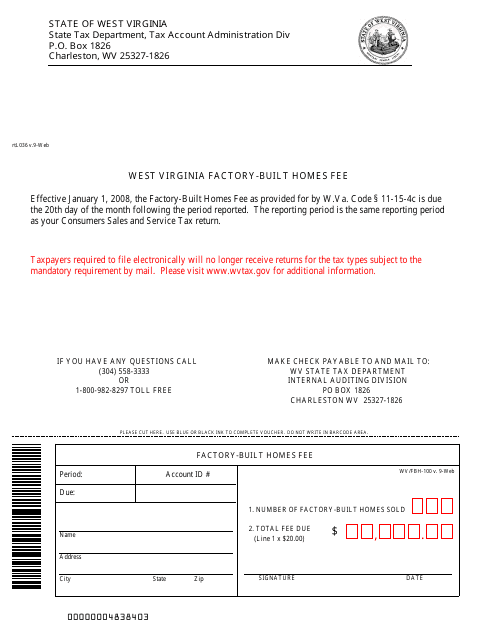

This form is used for filing a fee related to factory-built homes in West Virginia.

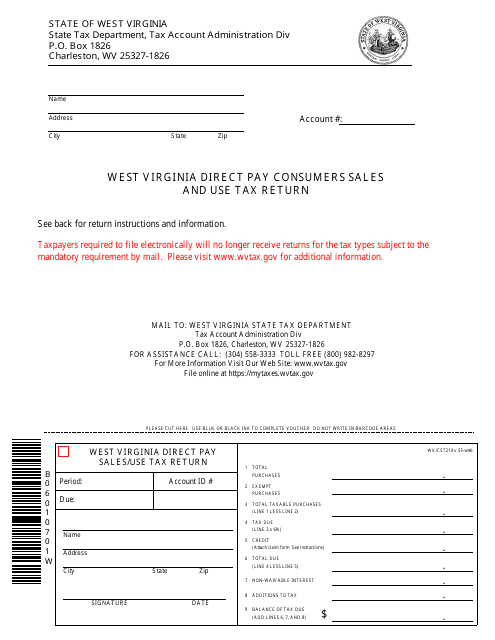

This document is used for filing the West Virginia Direct Pay Consumer Sales and Use Tax Return in the state of West Virginia. It is a form for individuals or businesses who have been granted direct payment authority to report and remit sales and use tax directly to the state. It allows for the reporting of taxable purchases and the calculation of tax due.

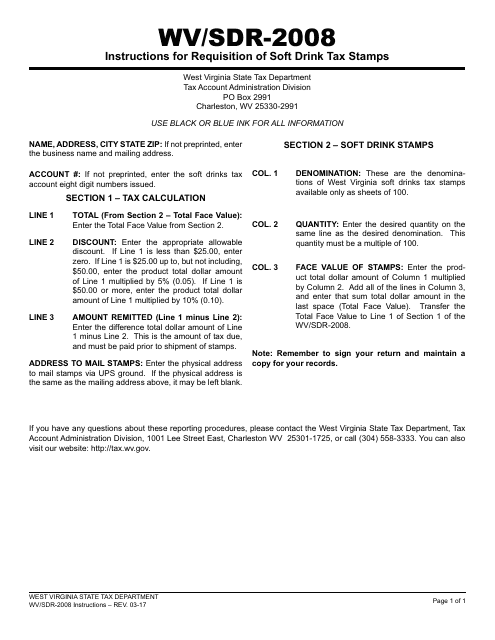

This type of document provides instructions for completing Form WV/SDR-2008, which is used for requisitioning soft drink tax stamps in West Virginia.

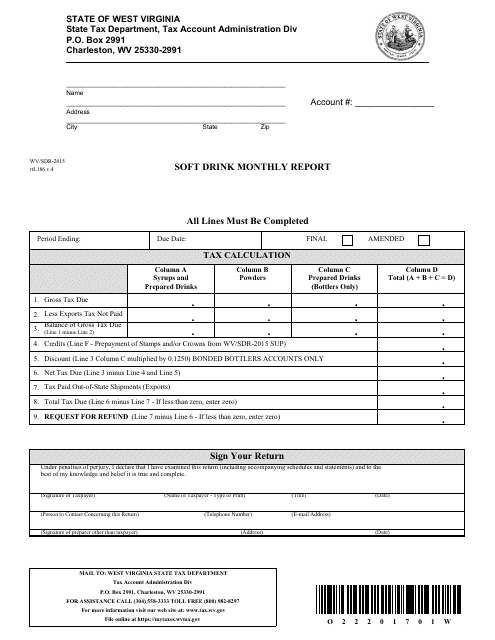

This form is used for submitting a monthly report on soft drink sales in West Virginia.

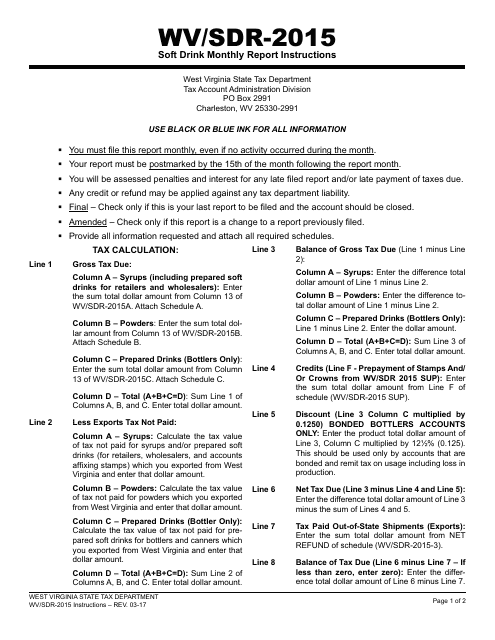

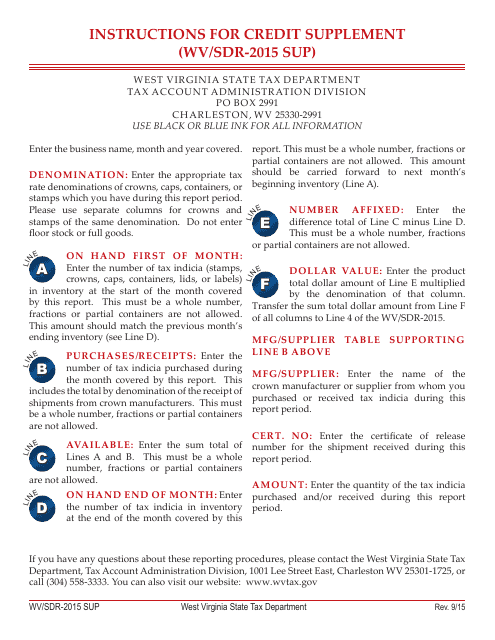

This document provides instructions for completing the WV/SDR-2015 Soft Drink Monthly Report in West Virginia. It guides businesses on how to report their monthly sales and distribution data for soft drinks in the state.

This Form is used for applying for the West Virginia Credit Supplement. It provides instructions on how to properly complete the form.

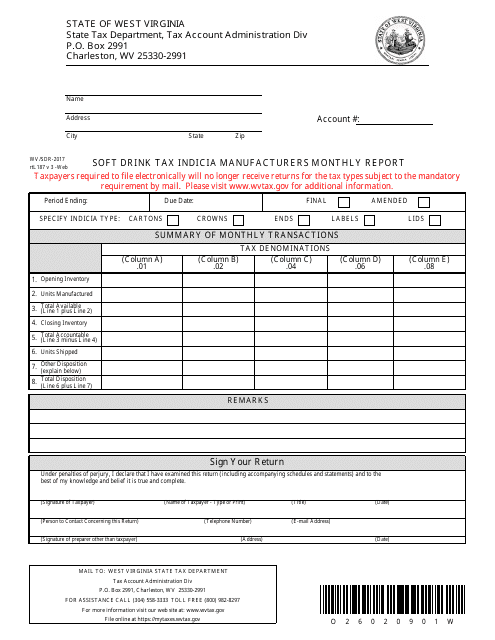

This Form is used for reporting monthly soft drink tax indicia sales by manufacturers in West Virginia.

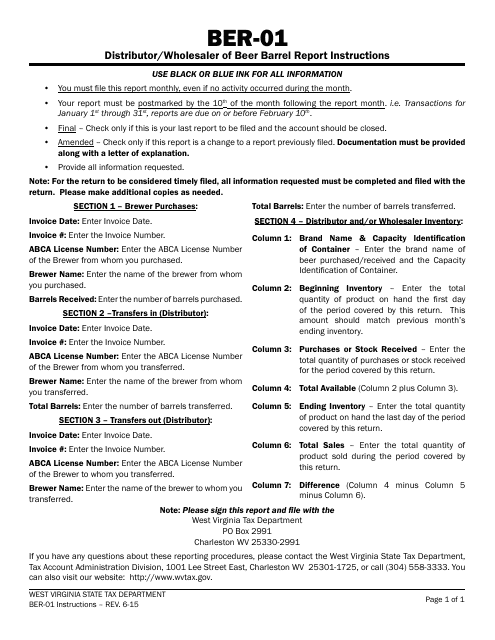

This document provides instructions for completing the Form WV/BER-01, which is used by distributors and wholesalers of beer in West Virginia to report beer barrel sales.

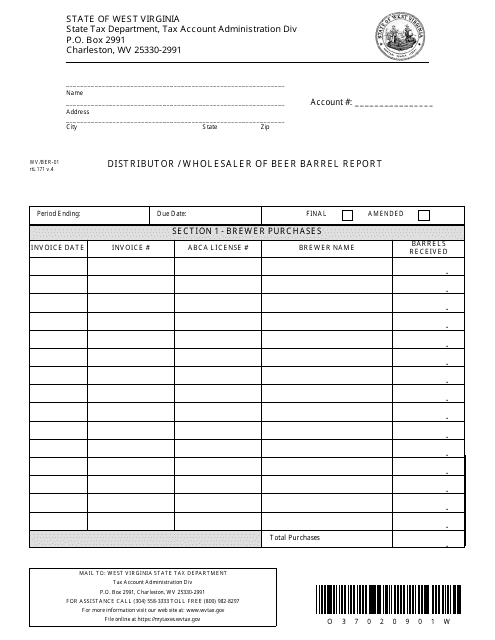

This form is used for reporting the distribution and wholesale activities of beer barrels in West Virginia.

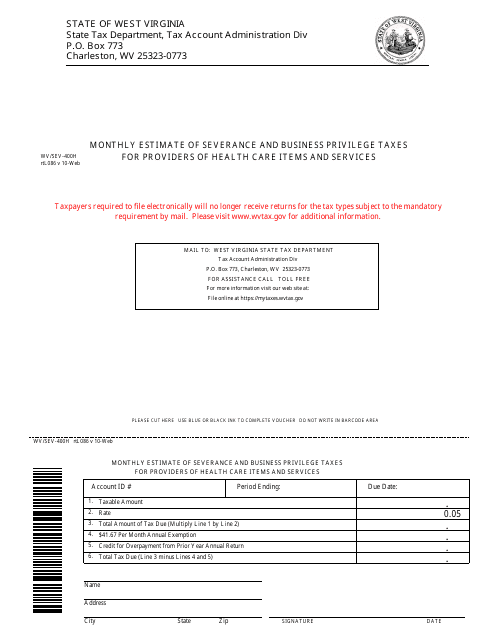

This form is used for monthly estimate of severance and business privilege taxes for providers of health care items and services in West Virginia.

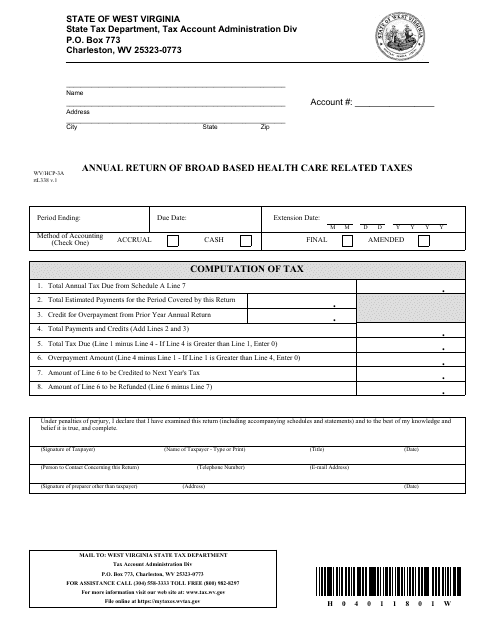

This form is used for the annual return of broad-based health care related taxes in West Virginia.

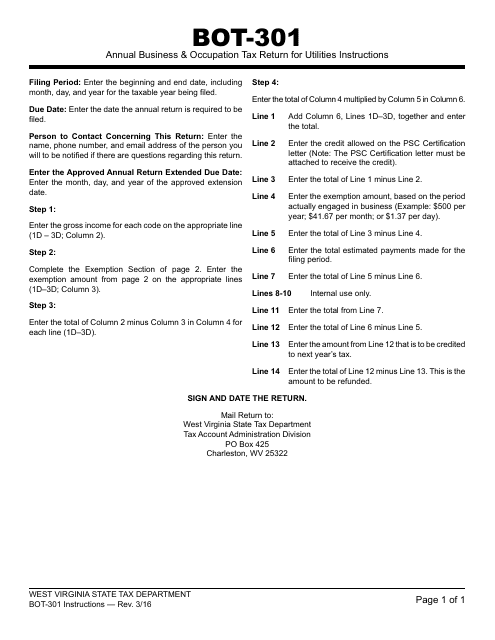

This document is for filing the annual business and occupation tax return for utilities in West Virginia. It provides instructions on how to complete the form WV/BOT-301. Use this document to ensure accurate filing and payment of taxes required for utility companies in West Virginia.

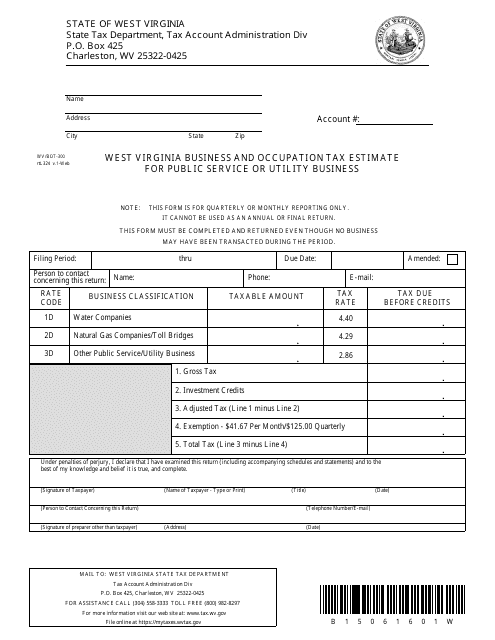

This form is used for estimating the Business and Occupation Tax for public service or utility businesses in West Virginia.

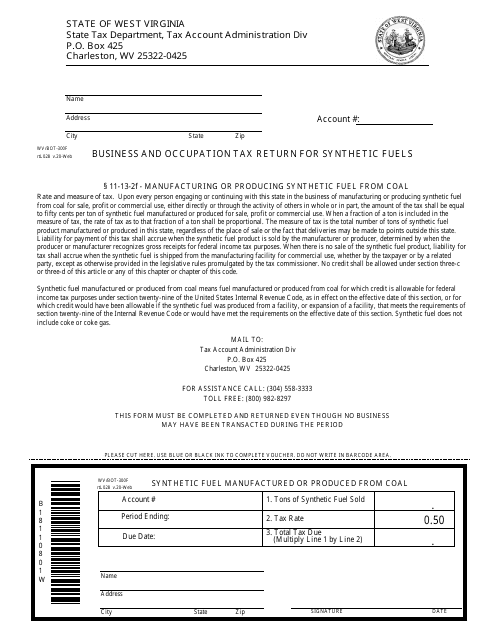

This form is used for filing the Business and Occupation Tax Return for Synthetic Fuels in the state of West Virginia.

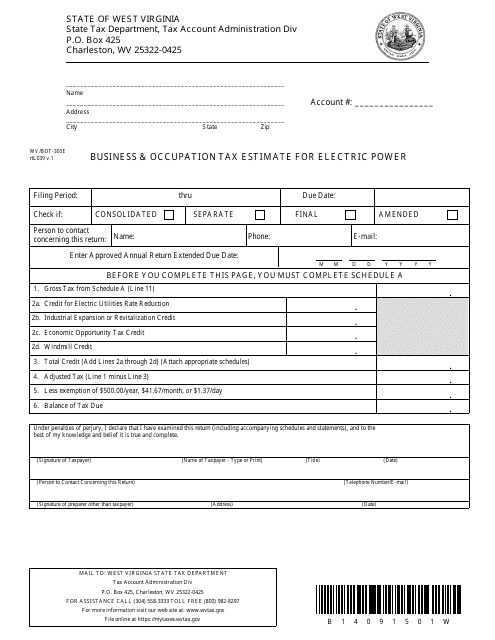

This form is used for estimating the business and occupation tax for electric power in West Virginia.

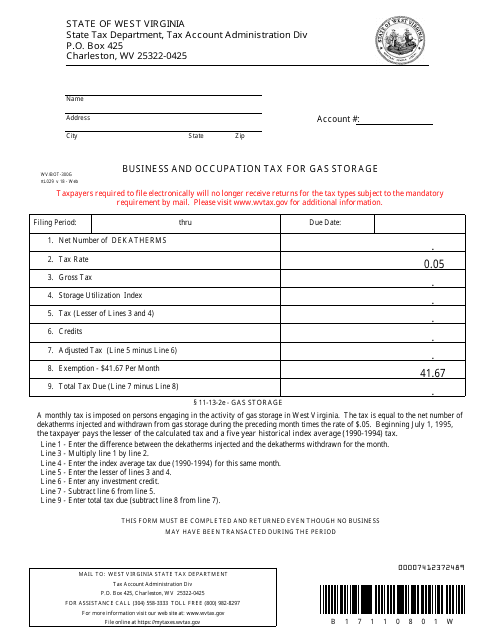

This Form is used for paying Business and Occupation Tax related to gas storage in West Virginia.

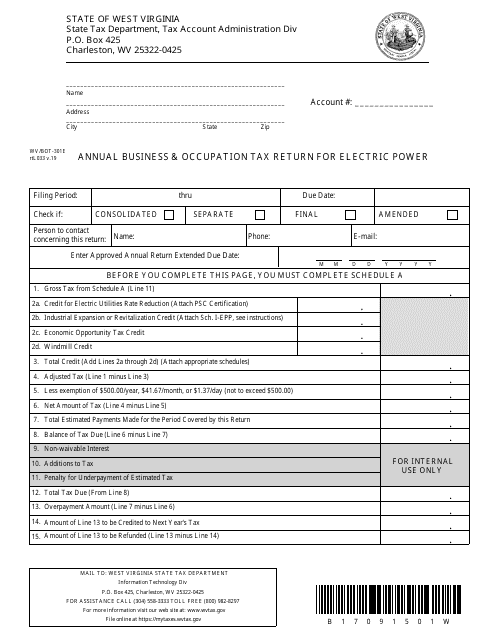

This form is used for filing the annual business and occupation tax return specifically for electric power companies operating in West Virginia.

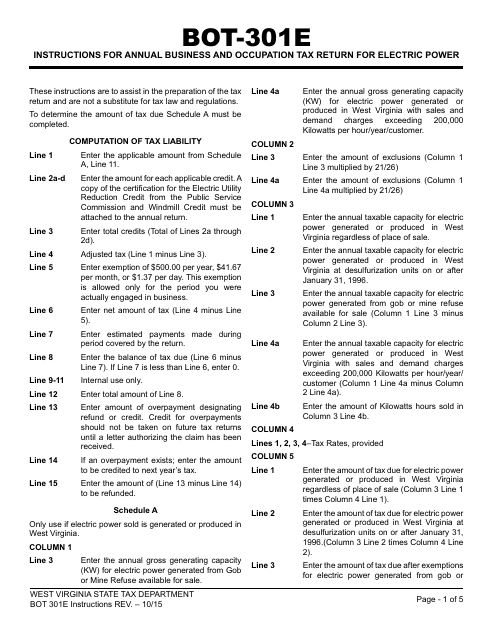

This Form is used for filing the Annual Business and Occupation Tax Return specifically for Electric Power companies in West Virginia. It provides instructions for completing the necessary tax paperwork.

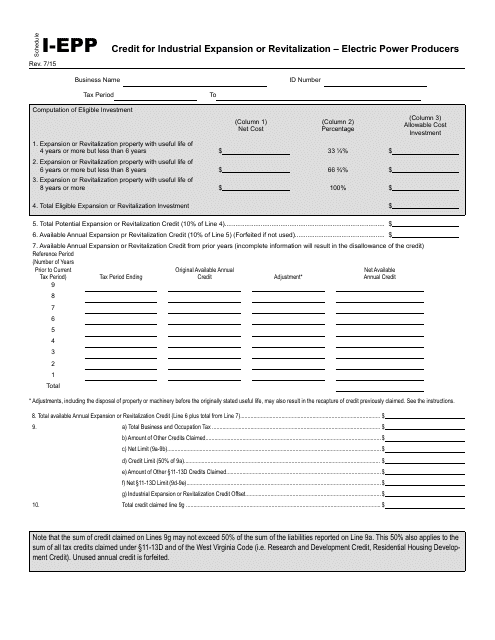

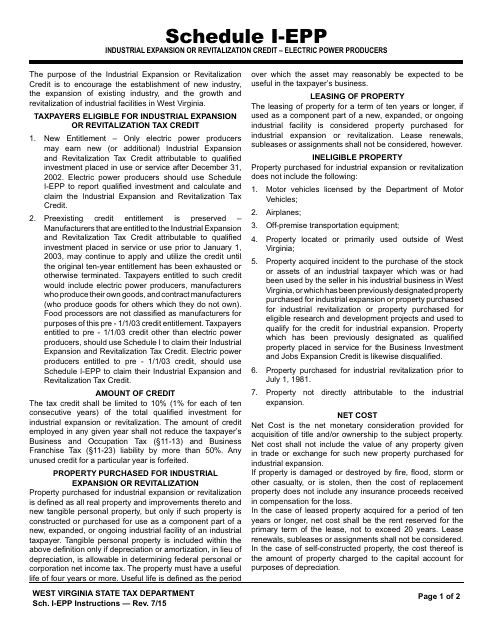

This form is used for applying for the Schedule I-EPP Credit in West Virginia for industrial expansion or revitalization by electric power producers.

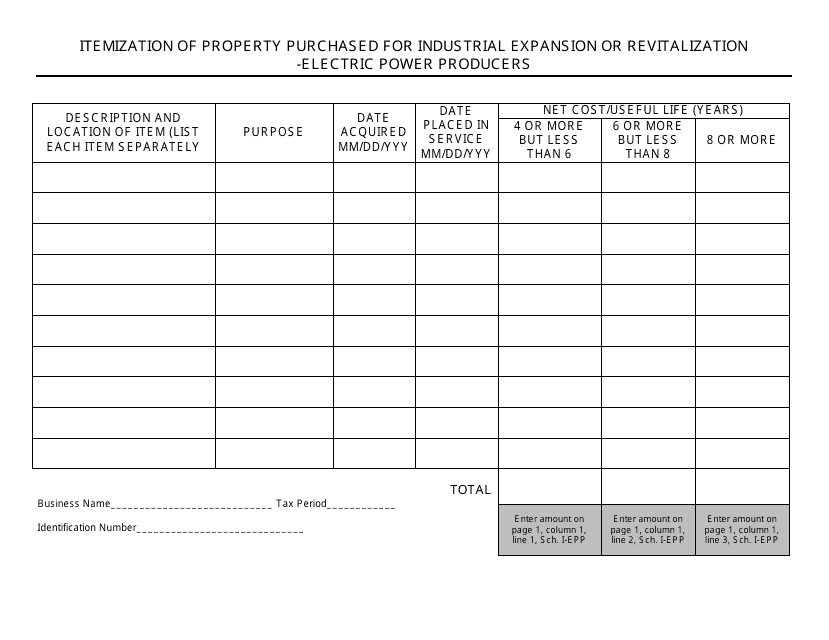

This document is used for itemizing the property purchased by electric power producers in West Virginia for industrial expansion or revitalization purposes.

This document provides instructions for completing Schedule I-EPP for claiming the Industrial Expansion or Revitalization Credit for electric power producers in West Virginia.

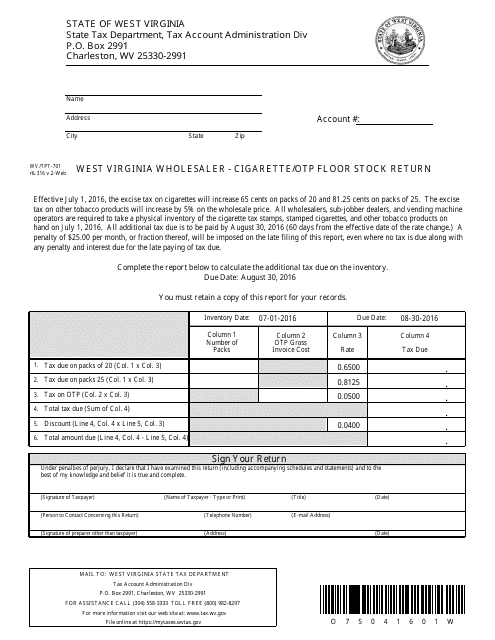

This Form is used for West Virginia wholesalers to report the return of cigarette and OTP floor stock.

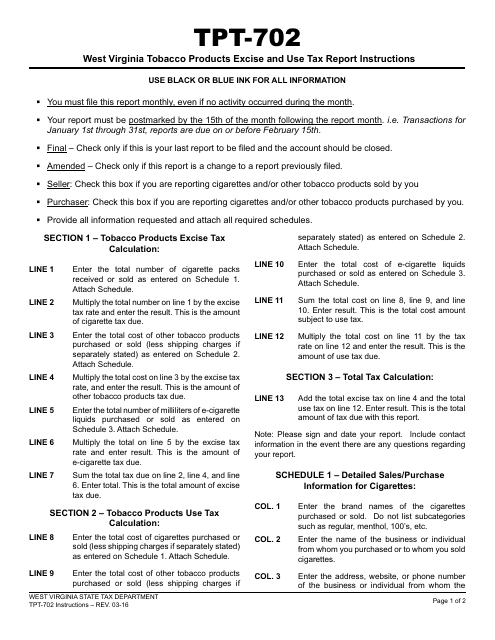

This document is used for reporting and paying tobacco products excise and use tax in West Virginia. It provides instructions on how to fill out Form WV/TPT-702. The form is used by businesses that sell tobacco products in the state.

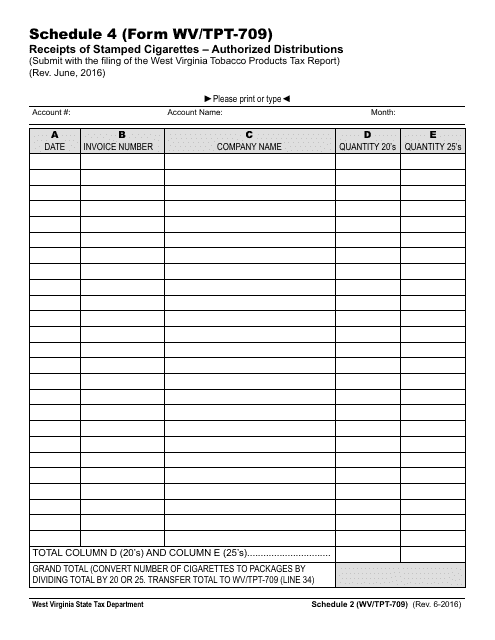

Form WV/TPT-709 Schedule 4 Receipts of Stamped Cigarettes - Authorized Distributions - West Virginia

This form is used for reporting the authorized distributions of stamped cigarettes in West Virginia.

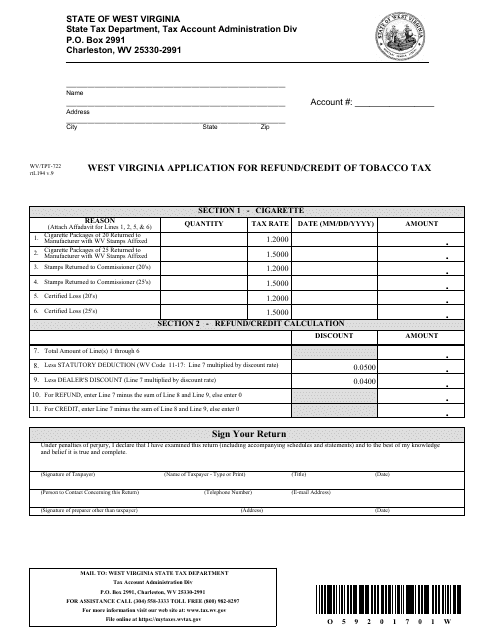

This Form is used for applying for a refund or credit of tobacco tax in the state of West Virginia.

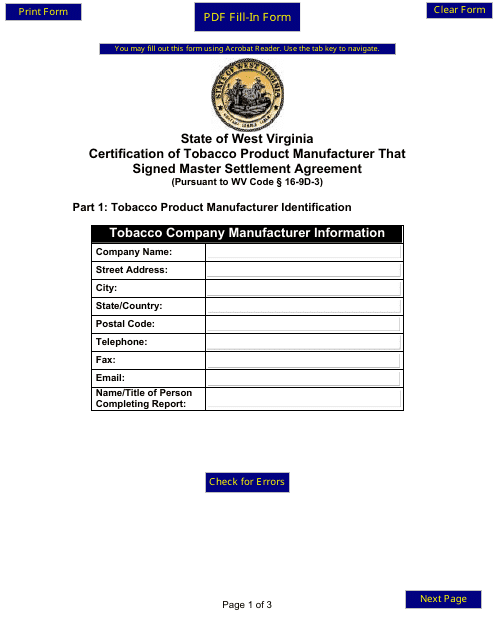

This Form is used for certifying that a tobacco product manufacturer in West Virginia has signed the Master Settlement Agreement.

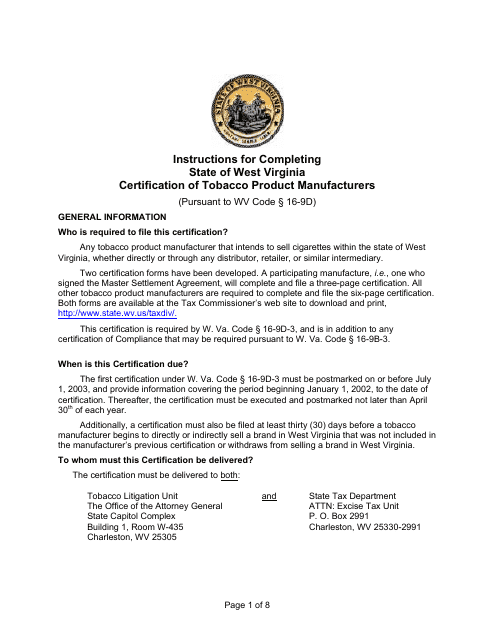

This form is used for the certification of tobacco product manufacturers in the state of West Virginia. It provides instructions on how manufacturers can comply with the certification requirements set by the state.

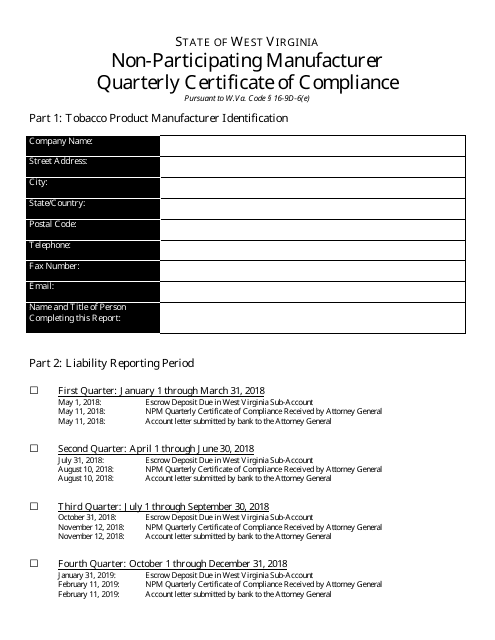

This form is used for non-participating manufacturers in West Virginia to provide a quarterly certificate of compliance.

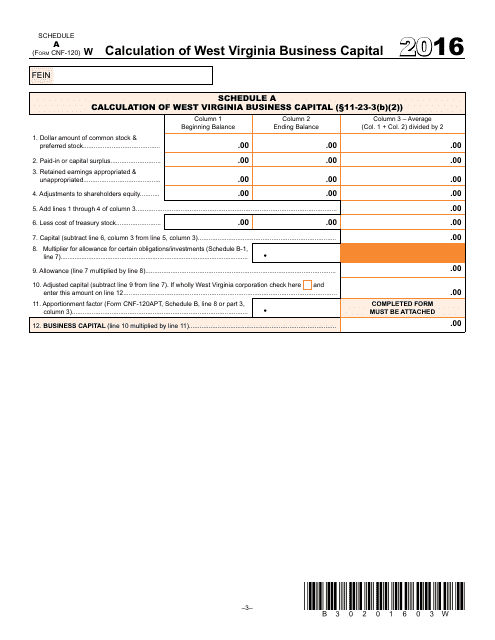

This form is used for calculating West Virginia business capital for tax purposes in the state of West Virginia.

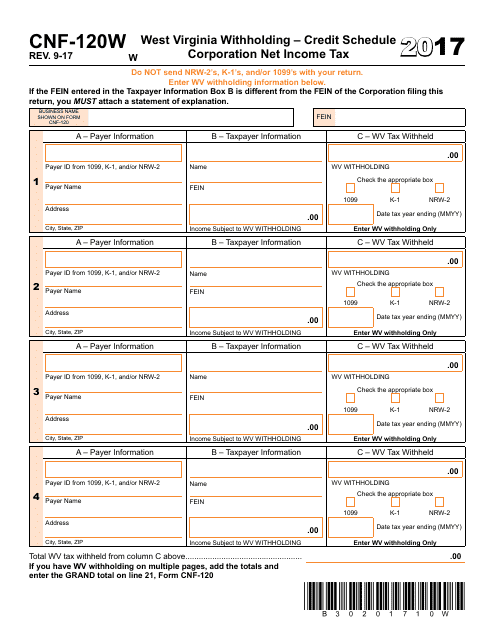

This form is used for reporting and calculating the credit schedule for corporation net income tax in West Virginia. The form is specifically for corporations that are withholding taxes in West Virginia.