Tax Templates

Documents:

2882

This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service (IRS), which can send you this form in a paper format, if you wish.

This document is designed to inform the Internal Revenue Service (IRS) about the United States Virgin Islands salaries and the amount of taxes deducted from them. This document was issued by the IRS, which can send you this form in a paper format, if you wish.

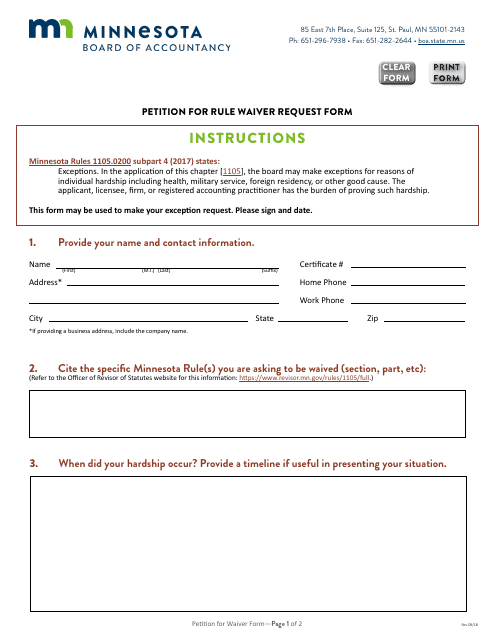

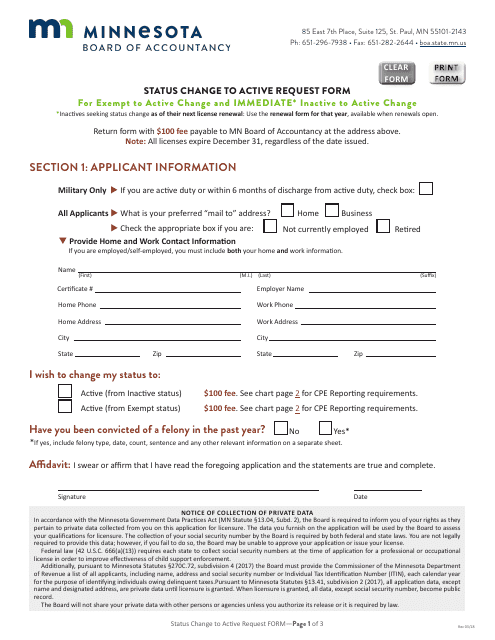

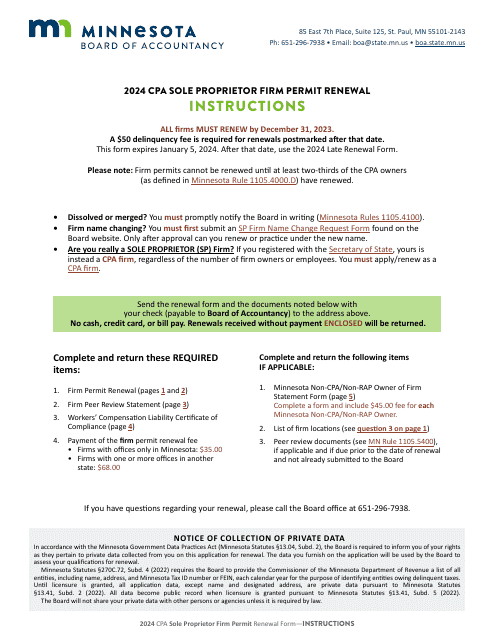

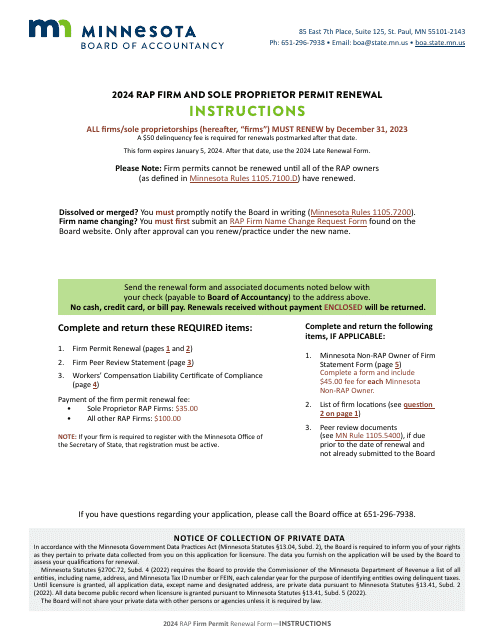

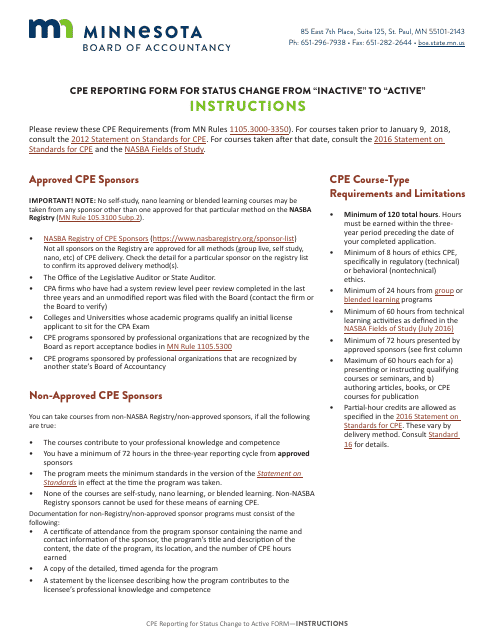

This form is used for requesting a status change from inactive to active in the state of Minnesota.

This document is for reporting a change in status from "inactive" to "active" for a CPE (Continuing Professional Education) in Minnesota.

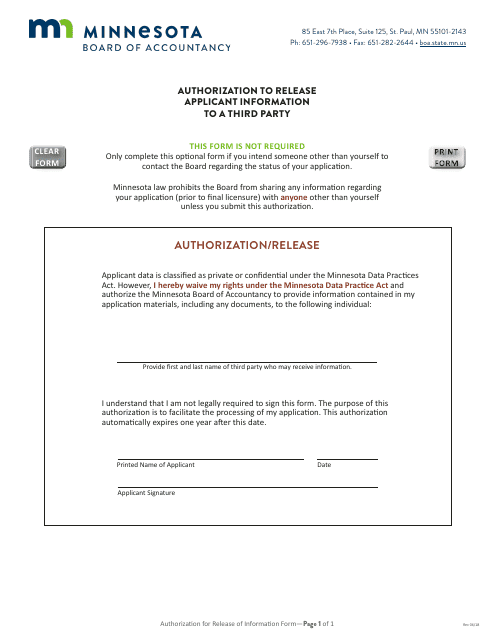

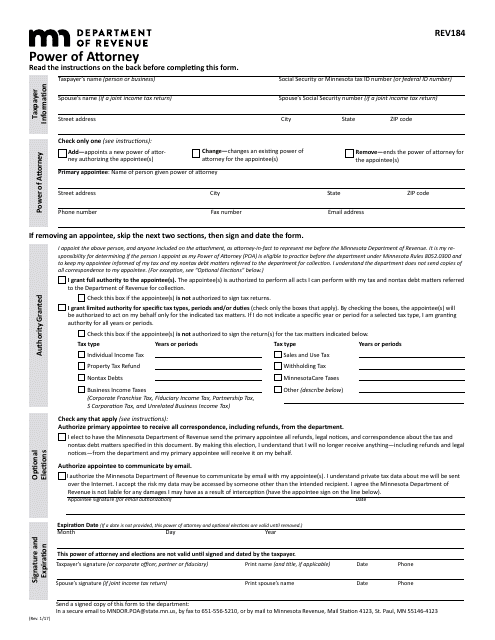

This Form is used for establishing a Power of Attorney in the state of Minnesota. It allows an individual to appoint someone to make important decisions on their behalf.

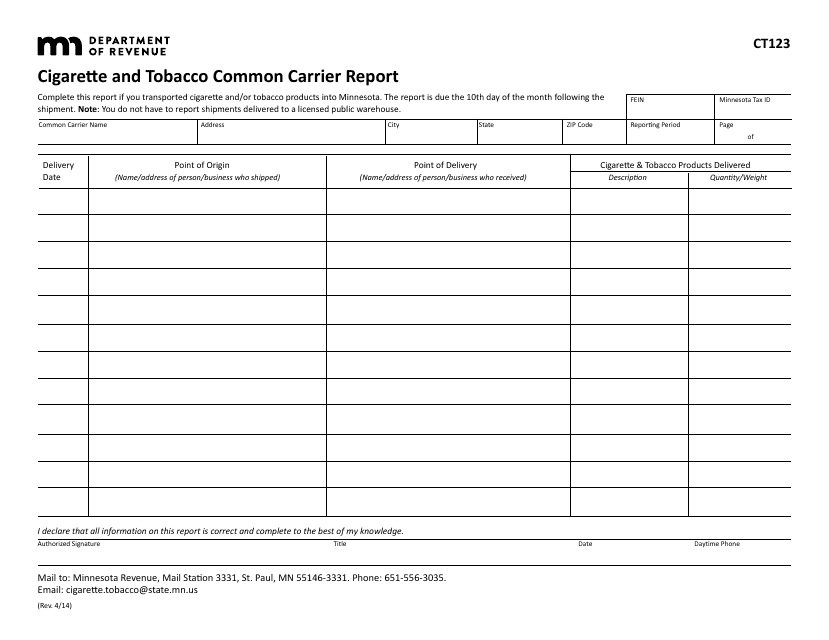

This form is used for reporting the transportation of cigarettes and tobacco products by common carriers in Minnesota.

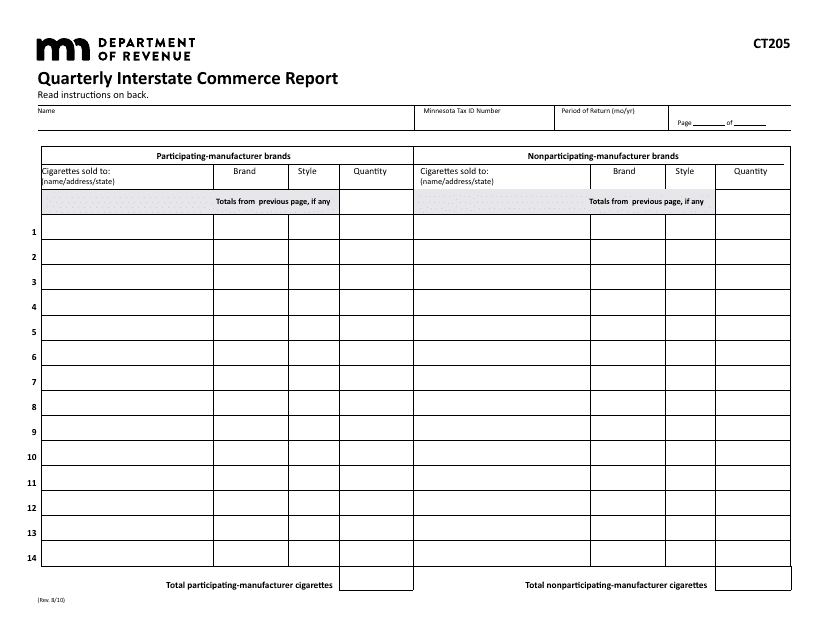

This form is used for reporting quarterly interstate commerce activities in the state of Minnesota.

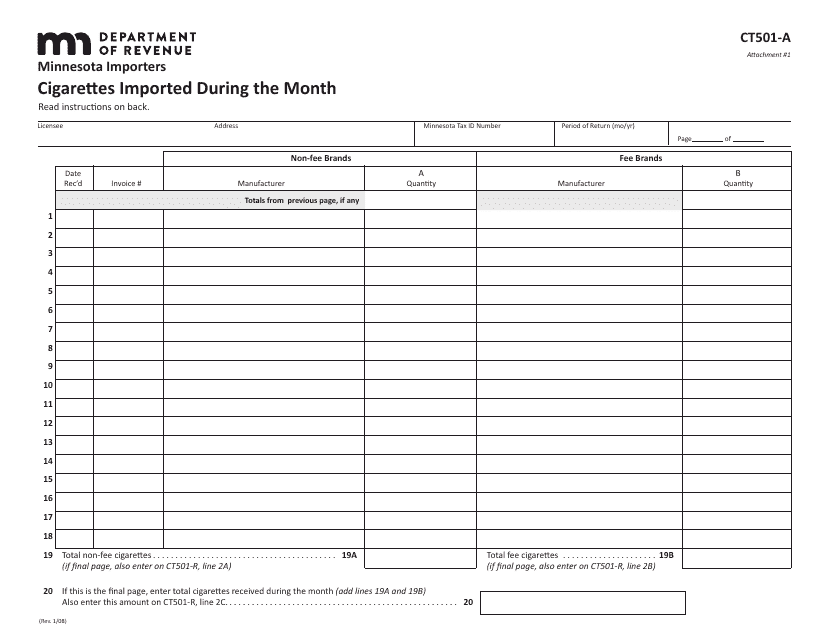

This form is used for reporting the schedule of imported cigarettes during the month for Minnesota importers in Minnesota.

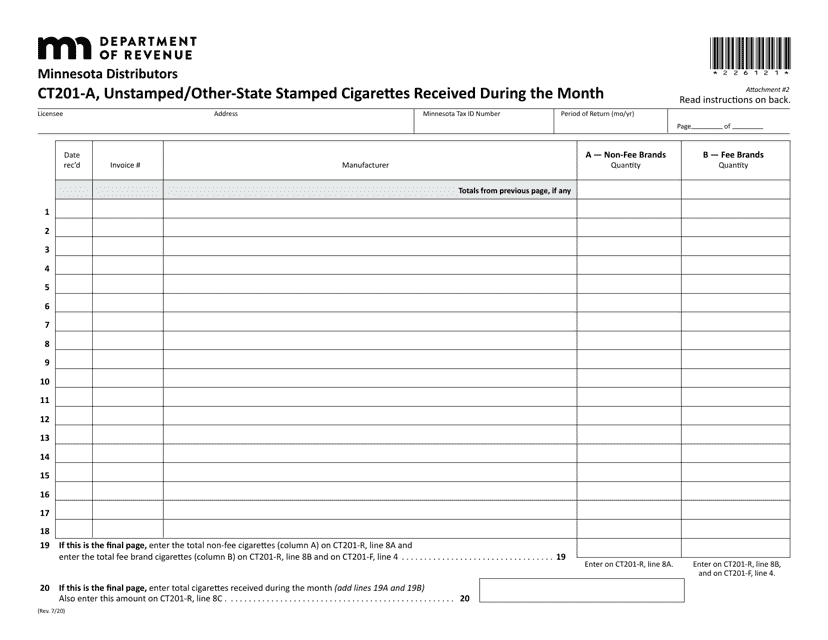

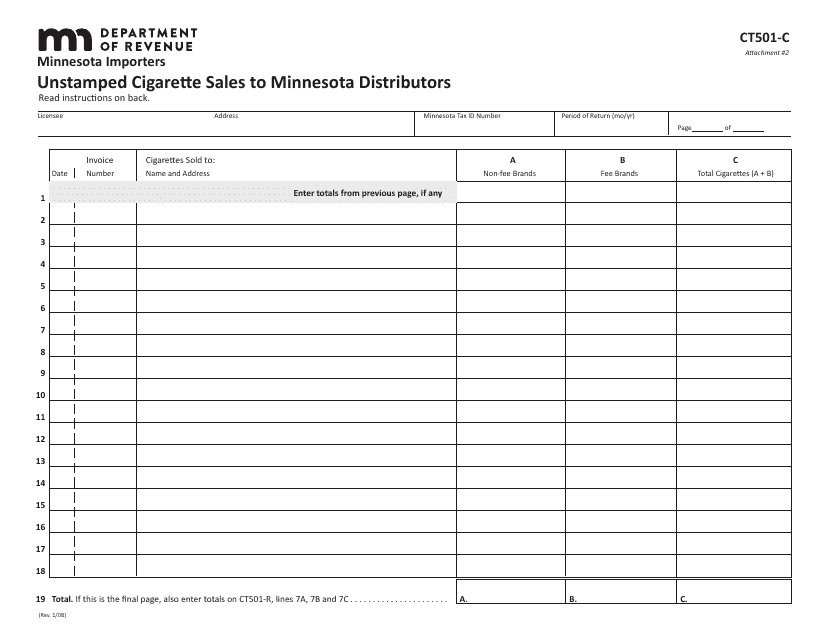

This form is used for reporting unstamped cigarette sales to distributors in Minnesota.

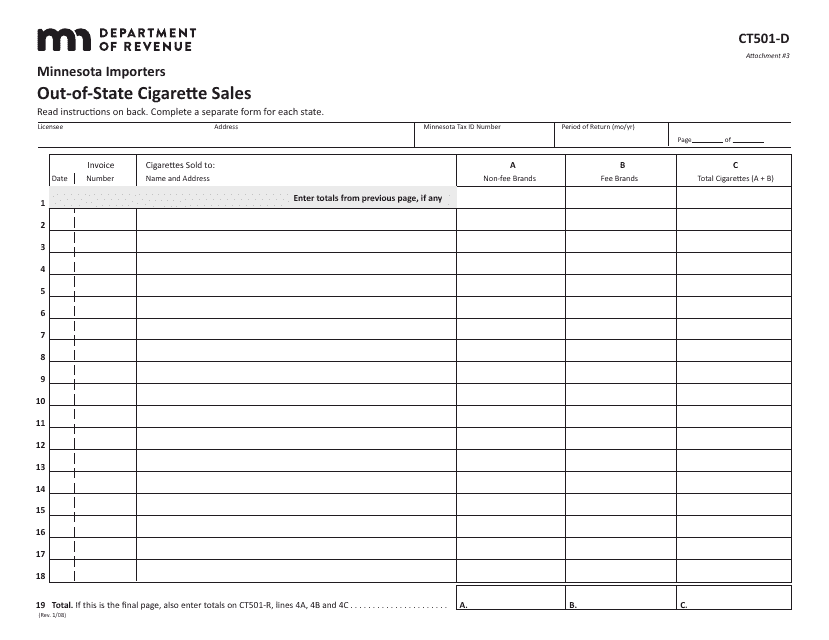

This Form is used for reporting out-of-state cigarette sales in Minnesota.

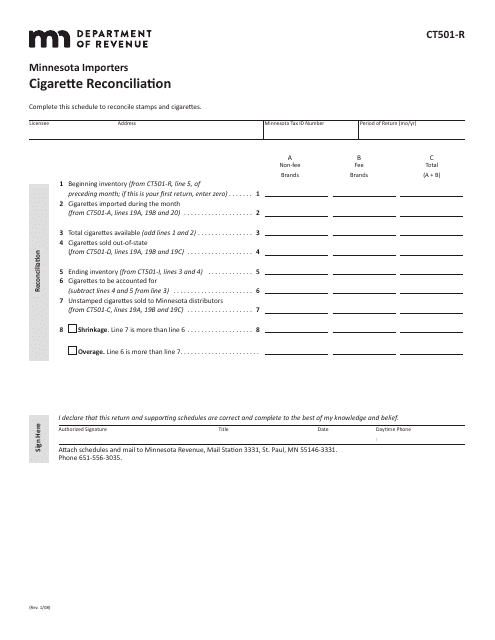

This form is used for cigarette importers in Minnesota to reconcile their cigarette inventory and tax liability. It helps ensure compliance with the state's regulations on cigarette imports.

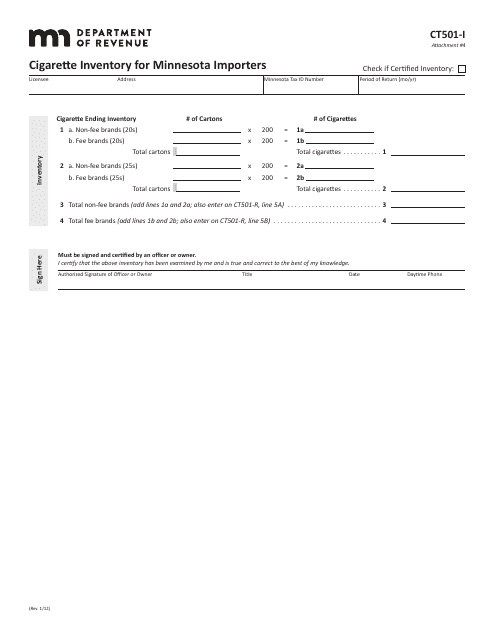

This form is used for Minnesota importers to report their cigarette inventory.

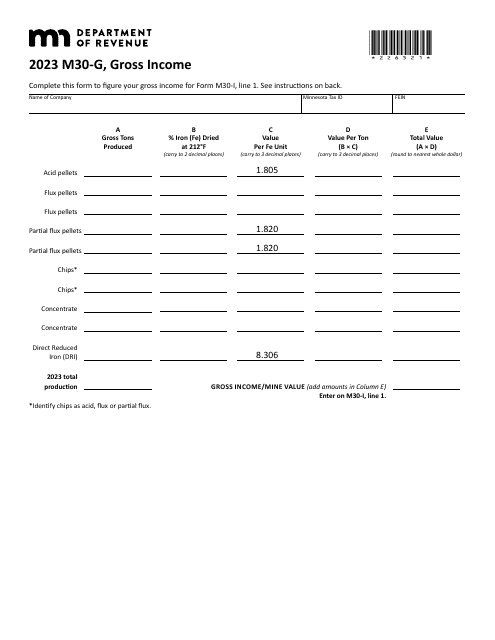

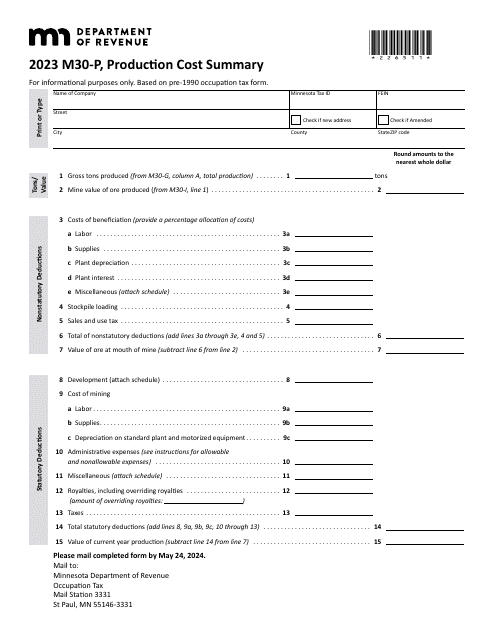

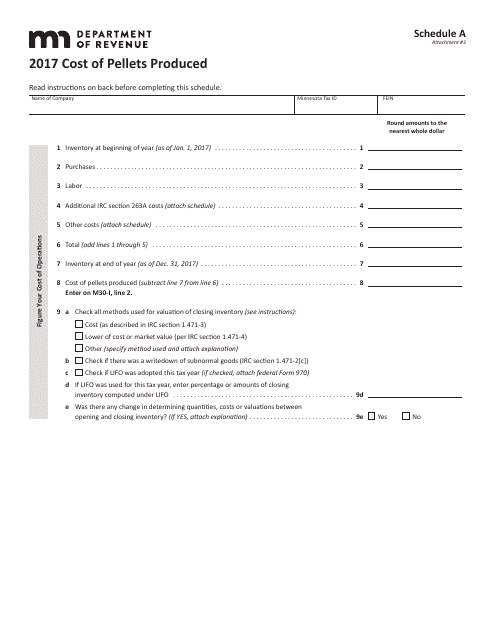

This document provides information about the cost of pellets produced in Minnesota. It includes details on the production process and factors that impact the cost.

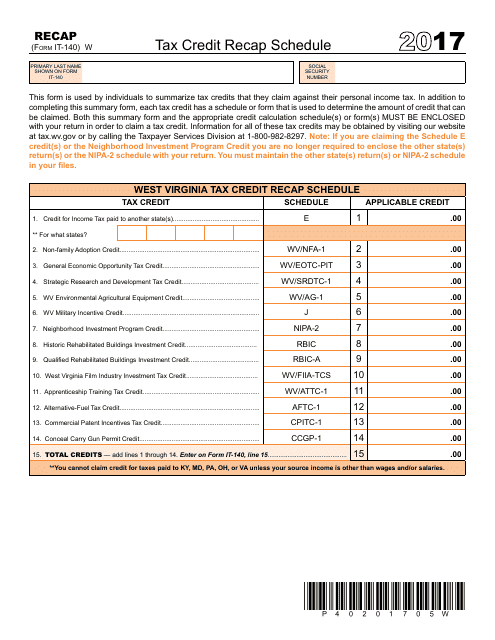

This form is used for recapping tax credits in West Virginia.

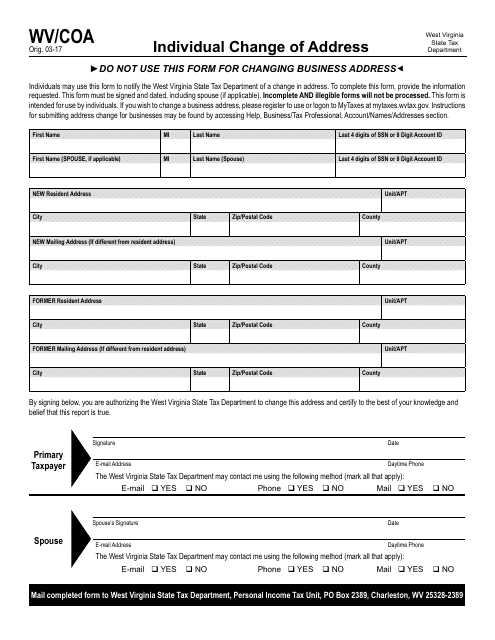

This form is used for changing your address as an individual in the state of West Virginia. It is important to update your address with the appropriate state agencies to ensure that you receive important mail and documents.