Tax Templates

Documents:

2882

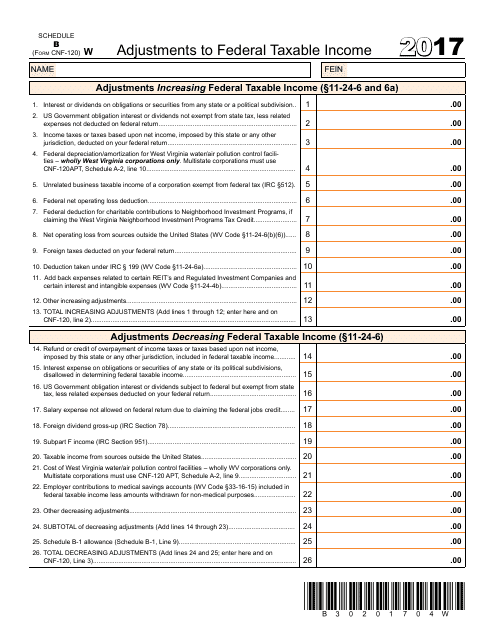

This form is used for reporting adjustments to federal taxable income for residents of West Virginia.

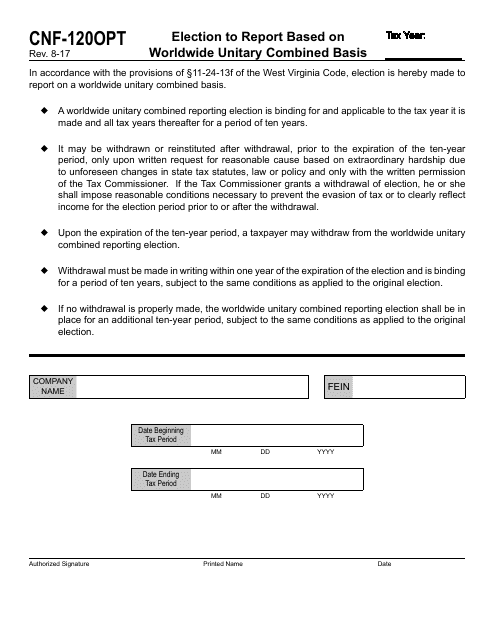

This form is used for filing an election to report taxes based on a worldwide unitary combined basis in the state of West Virginia.

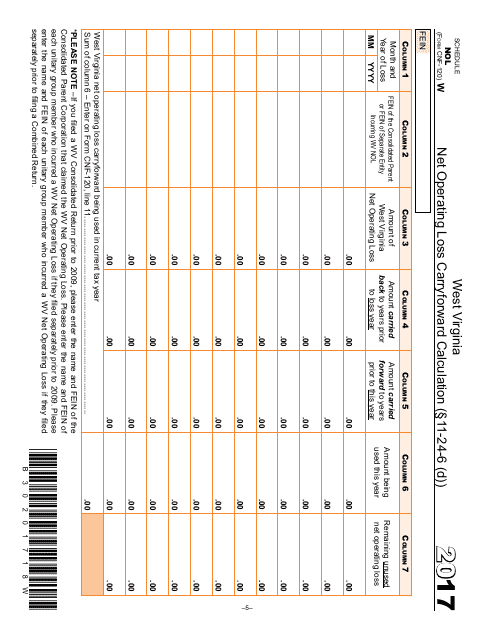

This form is used for calculating the Net Operating Loss (NOL) carryforward for individuals and businesses in West Virginia.

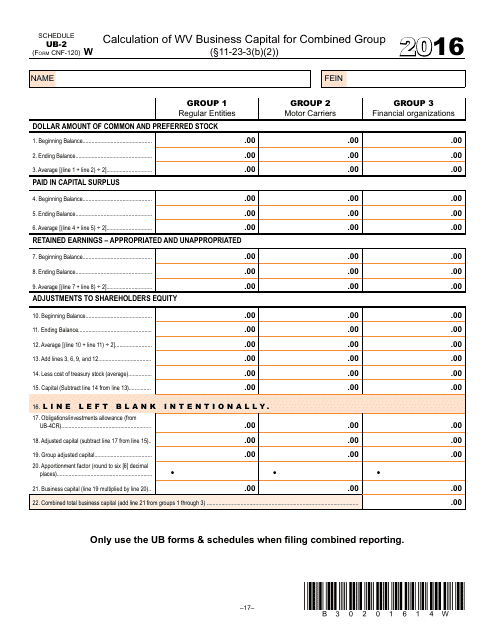

This form is used for calculating the business capital for a combined group in West Virginia.

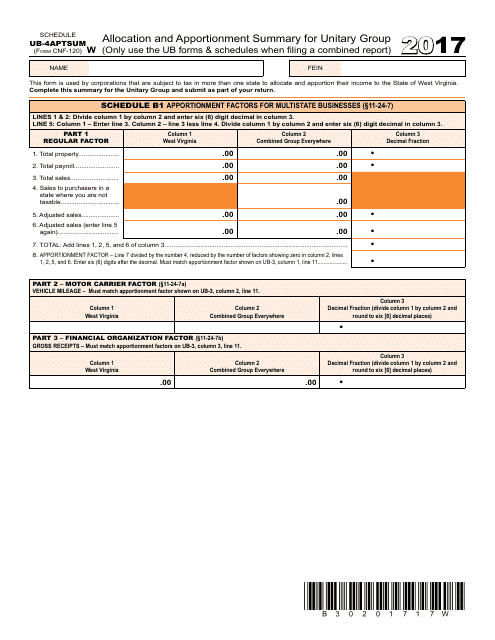

This form is used for allocating and apportioning income and expenses for a unitary group in West Virginia.

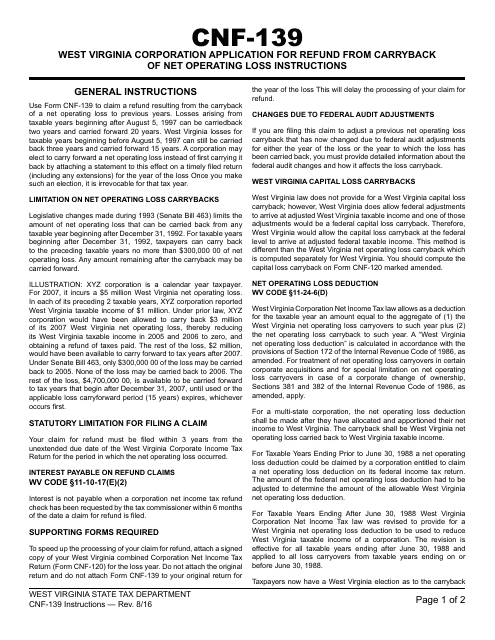

This Form is used for West Virginia corporations to apply for a refund from carryback of net operating losses. It provides instructions on how to complete the form and submit the application.

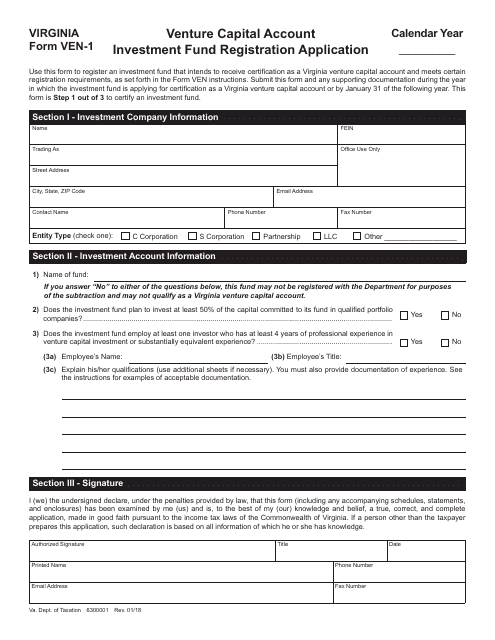

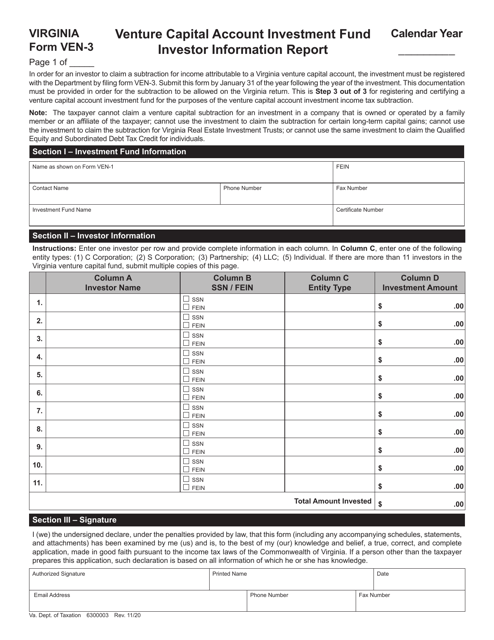

This form is used for registering a Venture Capital Account Investment Fund in the state of Virginia. It is necessary to complete this application in order to legally establish the fund in Virginia.

This Form is used for registering and certifying the Virginia Venture Capital Account Investment Fund. It provides instructions on how to complete the necessary forms.

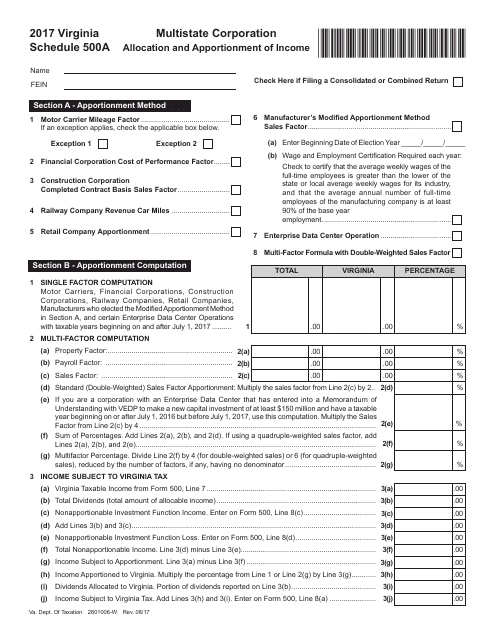

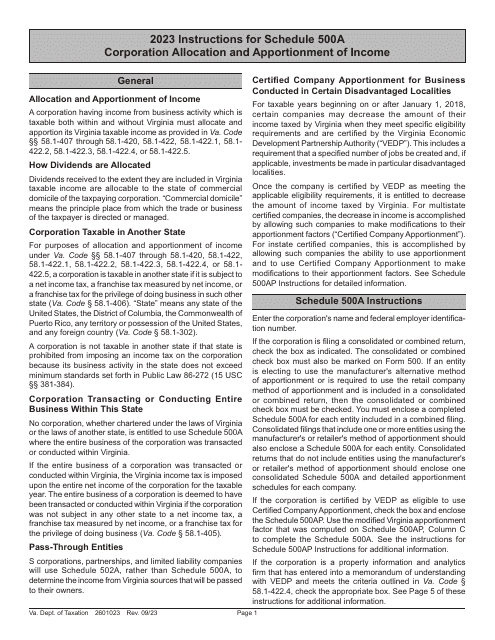

This form is used for the allocation and apportionment of income for a multistate corporation operating in Virginia. It is Schedule 500A of Form 2601006-W.

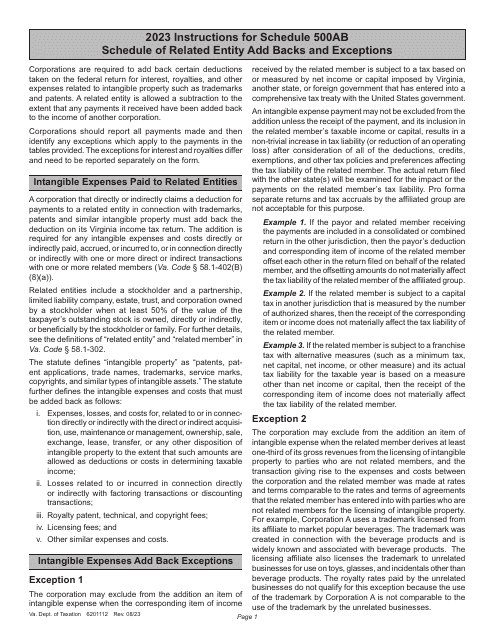

Instructions for Schedule 500AB Schedule of Related Entity Add Backs and Exceptions - Virginia, 2023

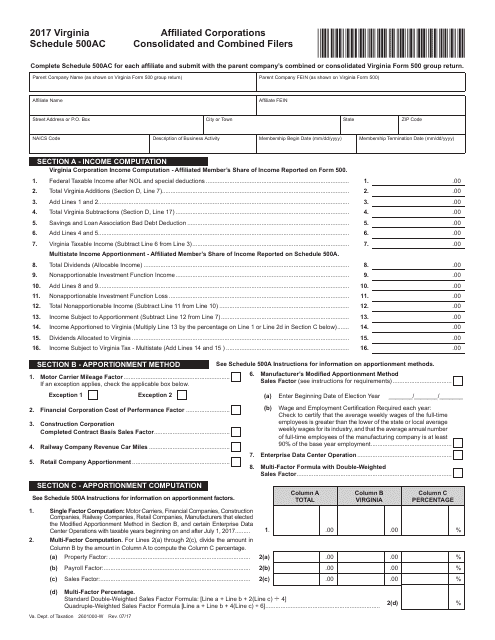

This form is used for consolidated and combined filing by affiliated corporations in Virginia. It is specifically for Schedule 500AC.

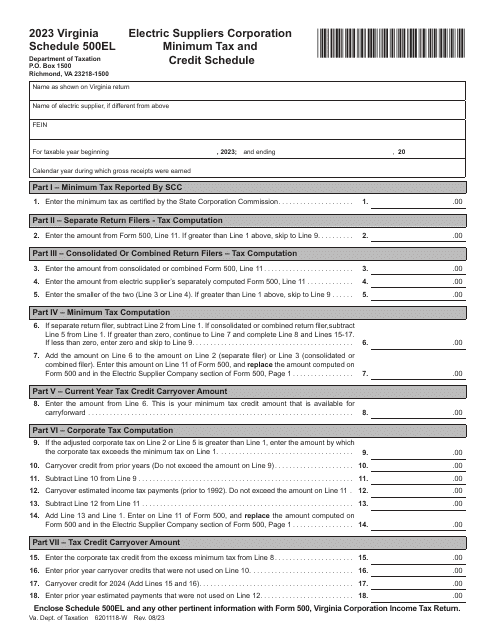

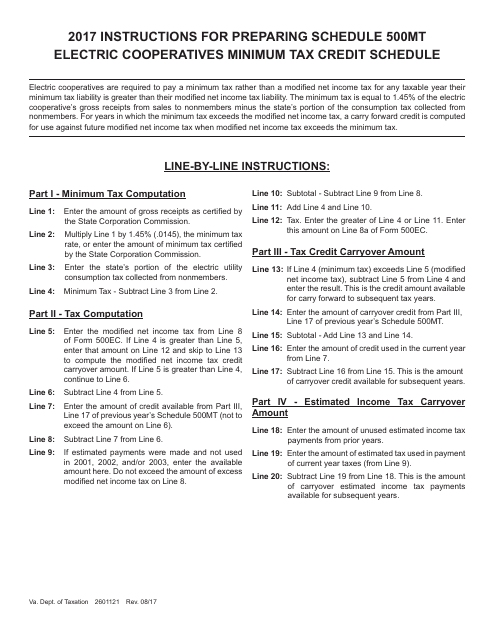

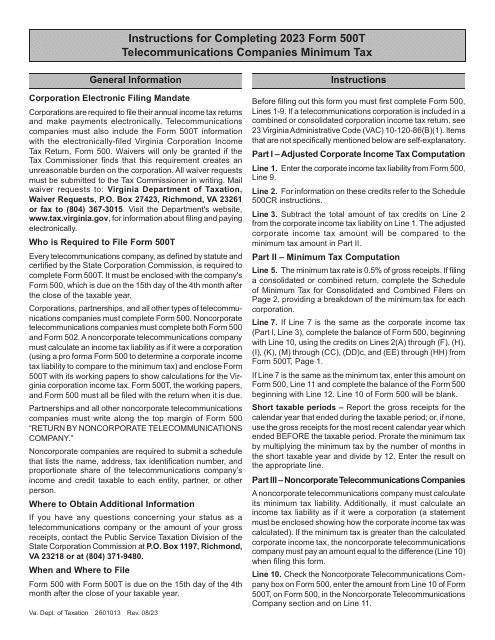

This Form is used for reporting the Minimum Tax Credit Schedule for Electric Cooperatives in Virginia.

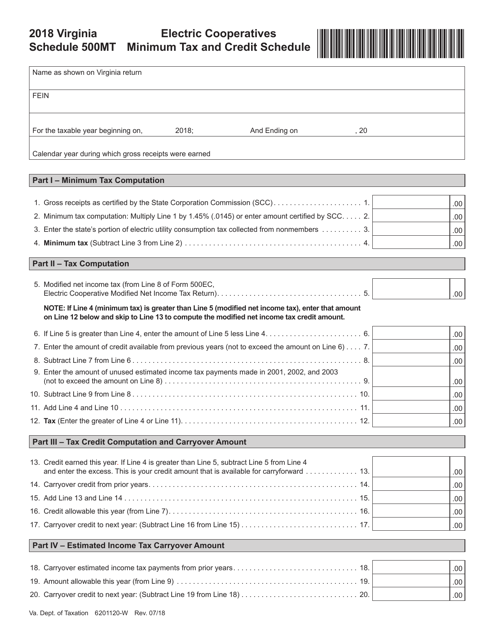

Form 6201120-W Schedule 500MT Electric Cooperatives Minimum Tax and Credit Schedule - Virginia, 2018

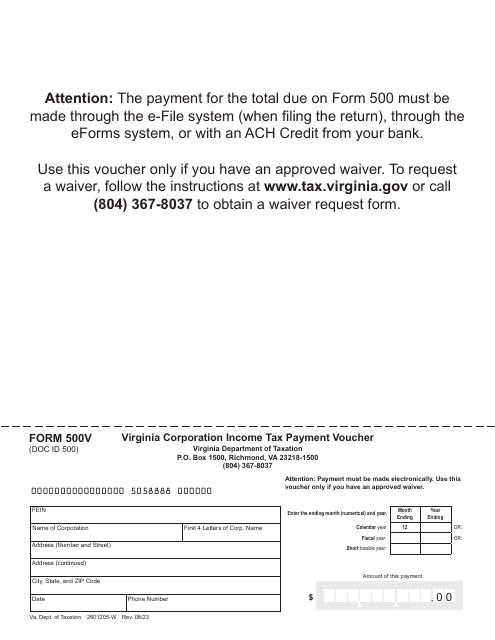

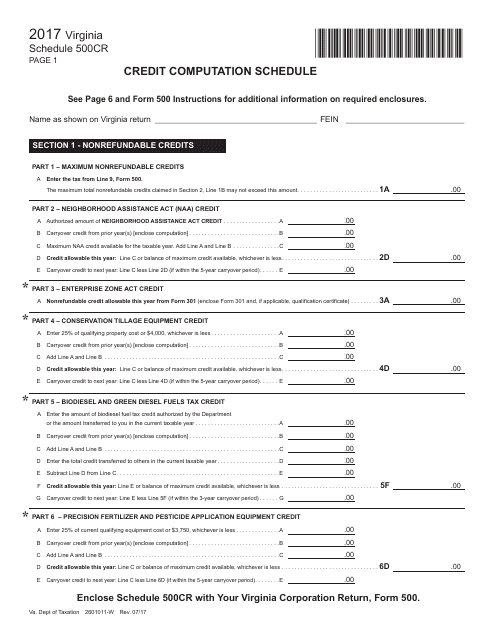

This Form is used for calculating the credit computation schedule for the state of Virginia.

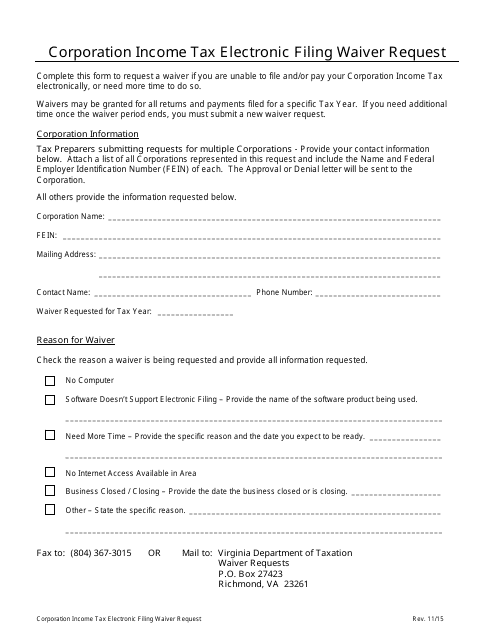

This document is used to request a waiver for electronic filing of corporation income tax in the state of Virginia.

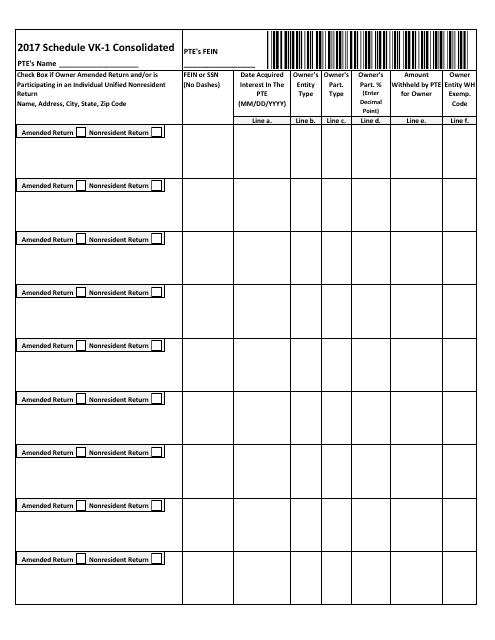

This document is used for reporting consolidated income and expenses in the state of Virginia.

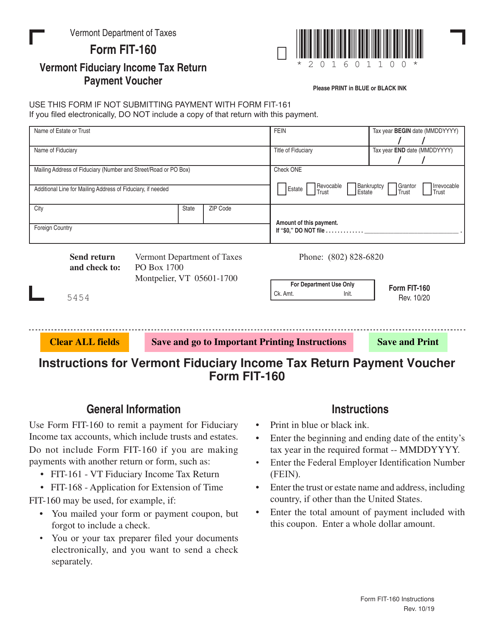

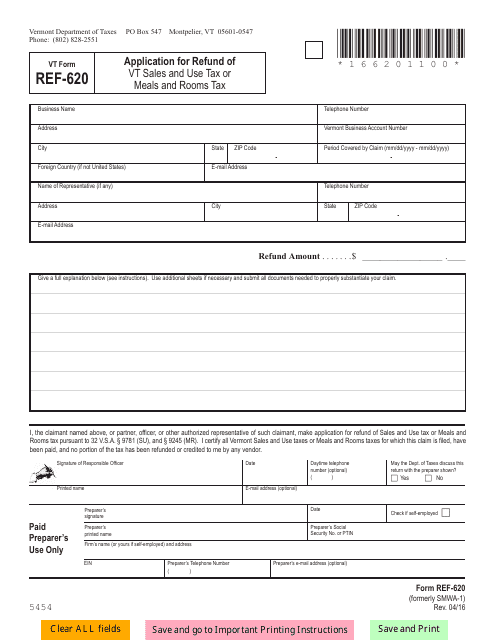

This Form is used for applying for a refund of Vermont Sales and Use Tax or Meals and Rooms Tax in Vermont.

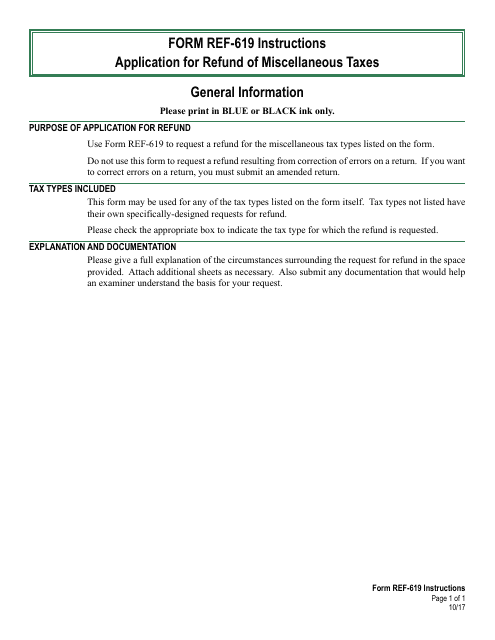

This Form is used for applying for a refund of miscellaneous taxes paid in the state of Vermont.