Tax Templates

Documents:

2882

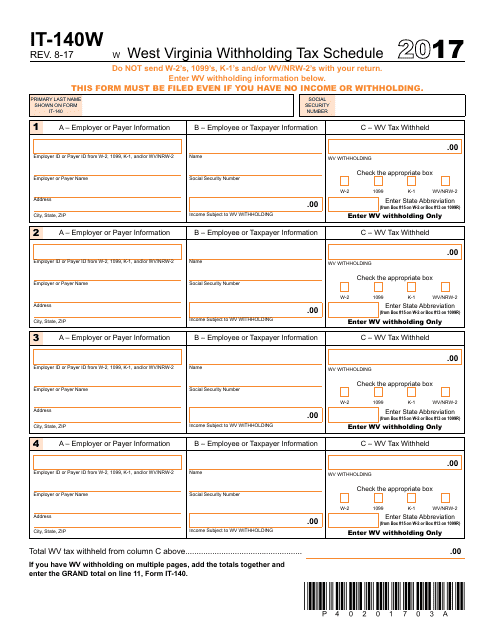

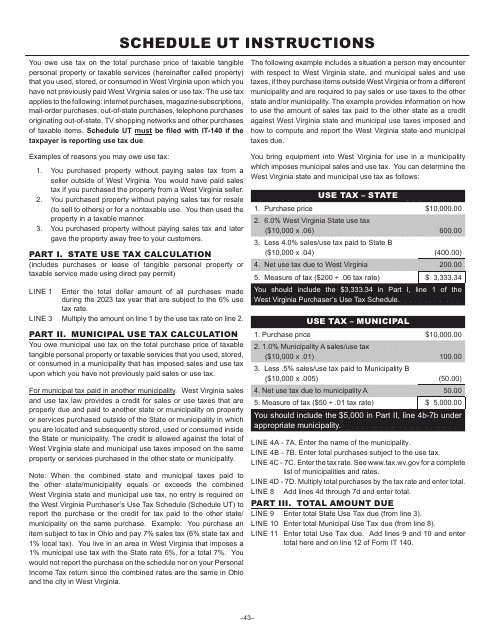

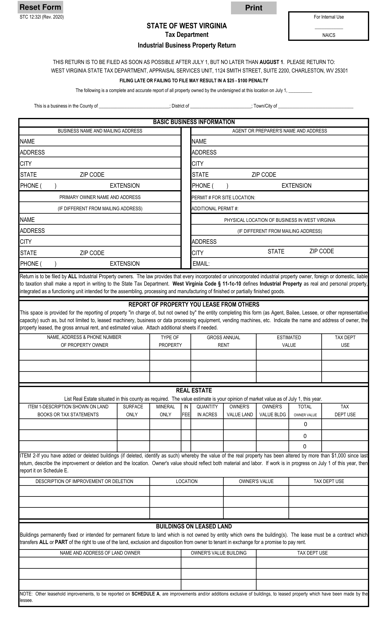

This Form is used for reporting and calculating withholding taxes in West Virginia.

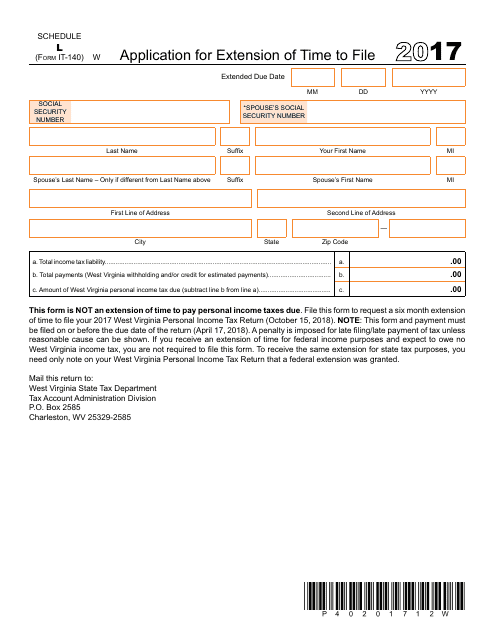

This form is used for applying for an extension of time to file your West Virginia state income tax return, Form IT-140.

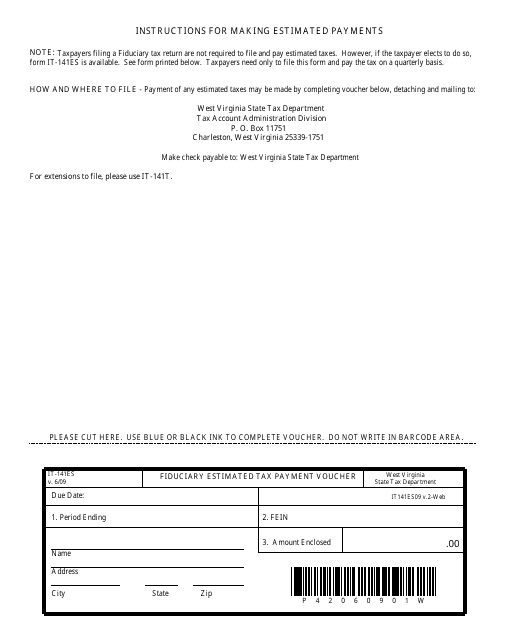

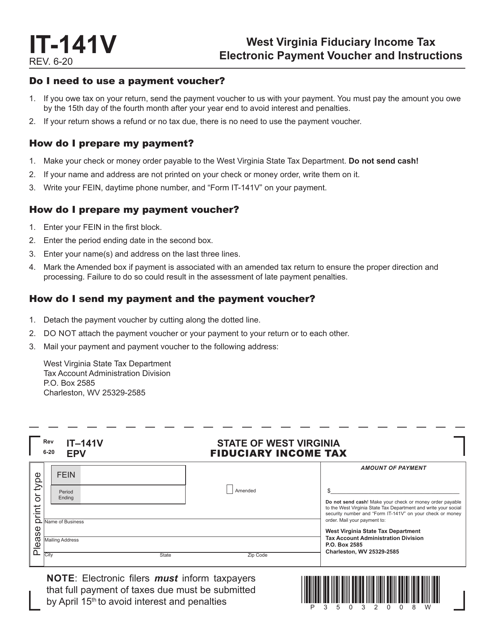

This form is used for making estimated tax payments for fiduciaries in West Virginia.

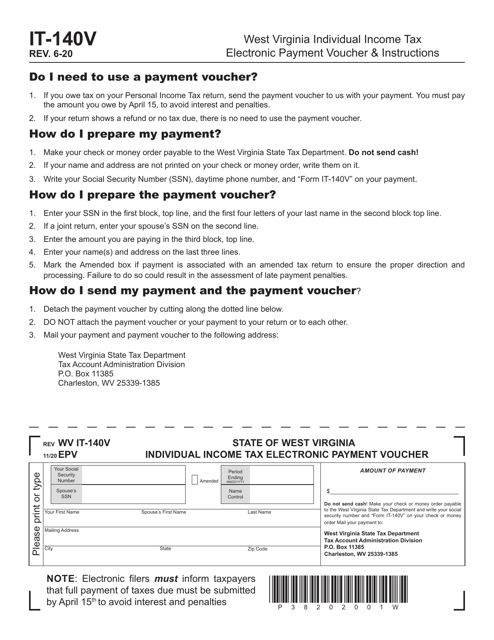

Form IT-140V State of West Virginia Individual Income Tax Electronic Payment Voucher - West Virginia

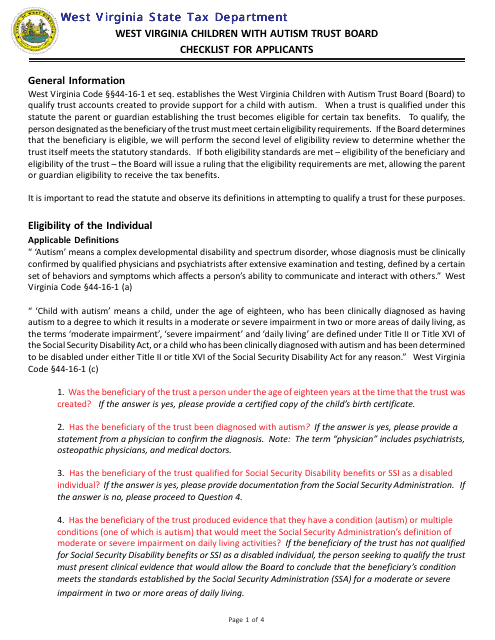

This form is used for applying for the approval of a qualified trust for children with autism in West Virginia. It is required by the West Virginia Children With Autism Trust Board.

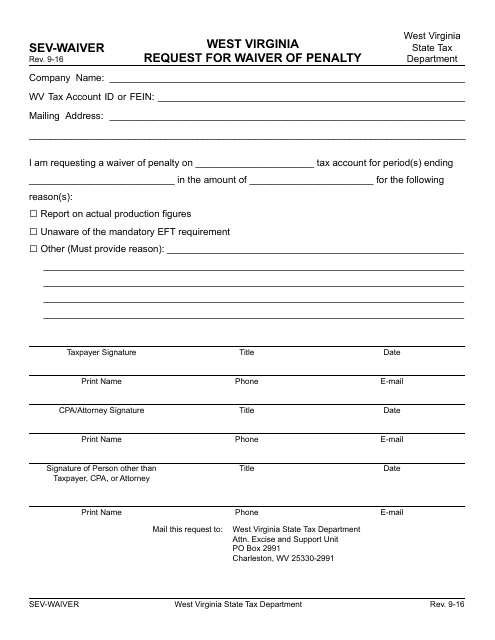

This form is used for requesting a waiver of penalty in the state of West Virginia.

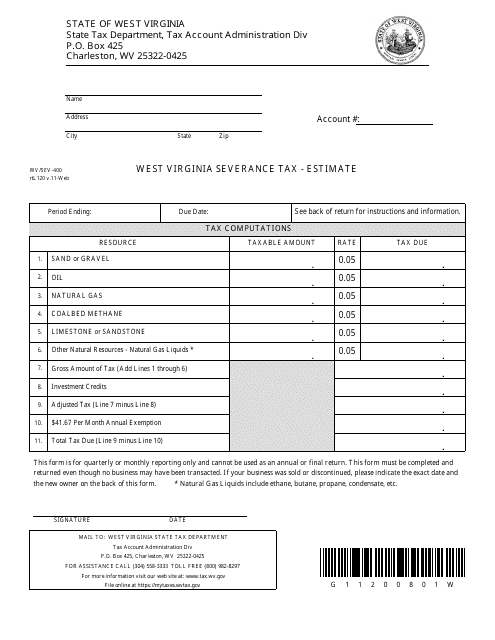

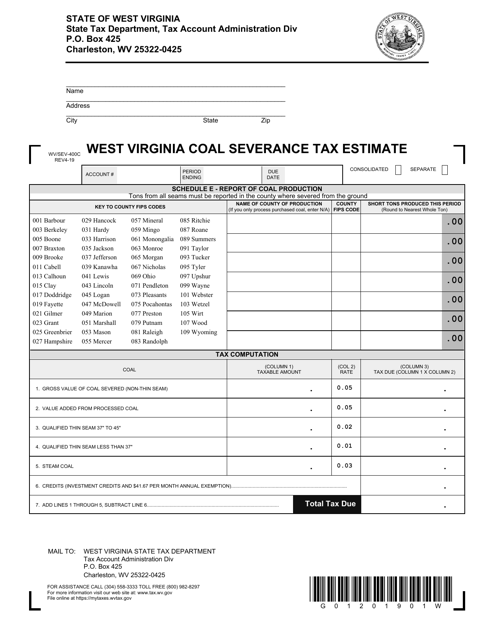

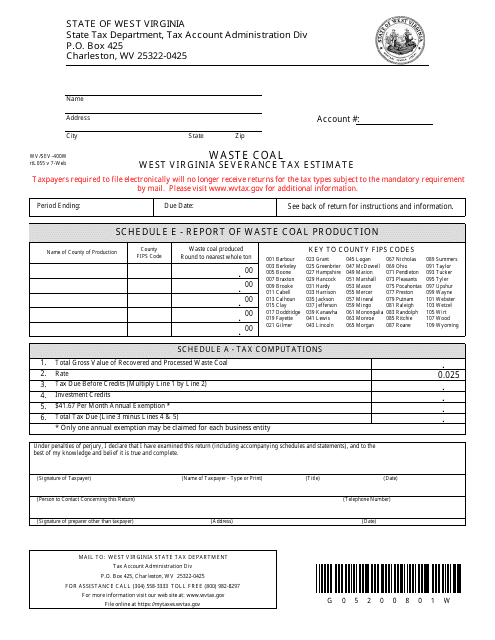

This Form is used for estimating the severance tax in the state of West Virginia. It is specifically designed for individuals or businesses involved in the extraction of natural resources.

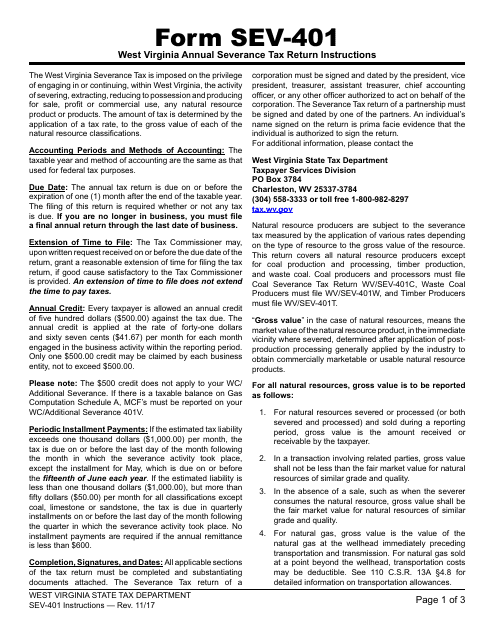

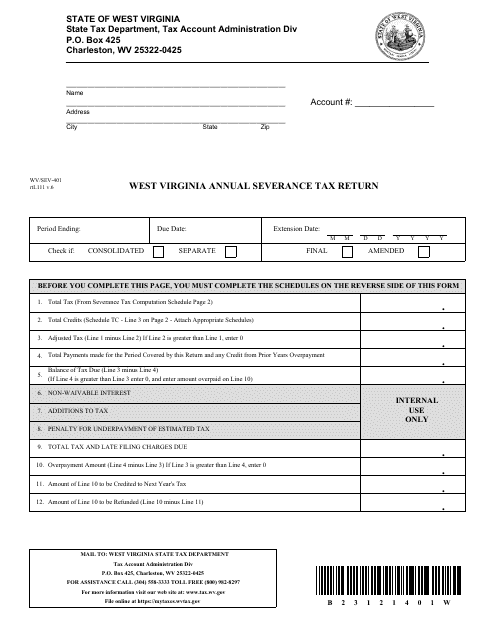

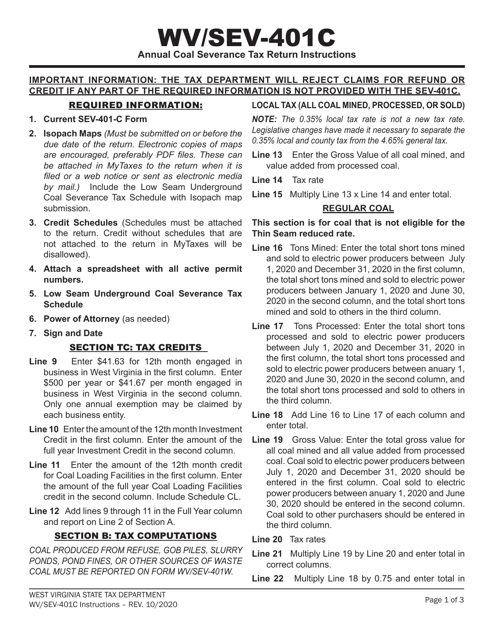

This document is used for filing the West Virginia Annual Severance Tax Return. It provides instructions on how to fill out the form correctly.

This form is used for filing the annual severance tax return in West Virginia.

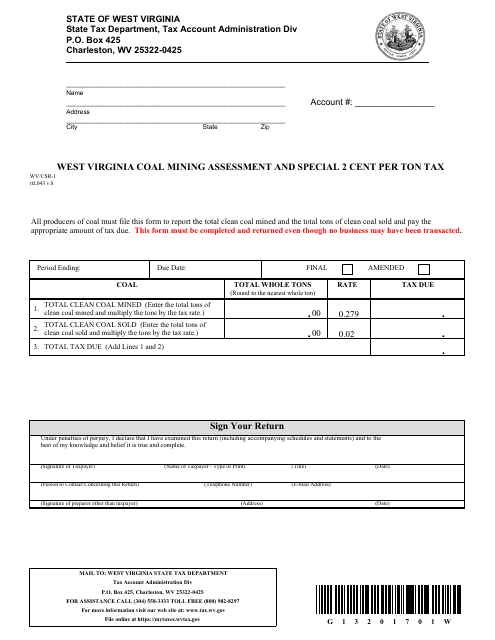

This form is used for the assessment and taxation of coal mining in West Virginia. It is specifically for the special 2 cent per ton tax on coal production in the state.

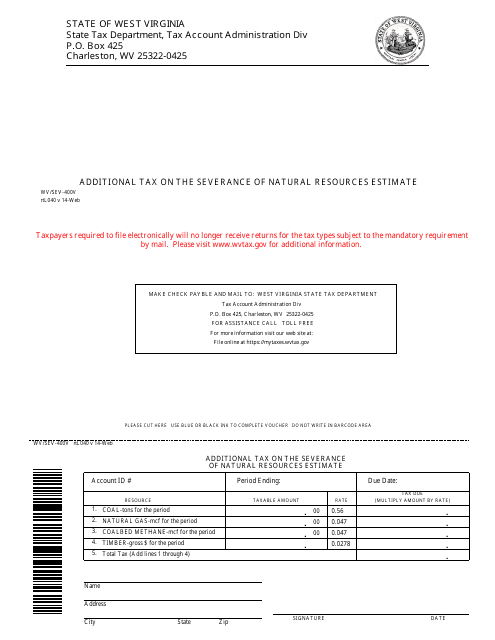

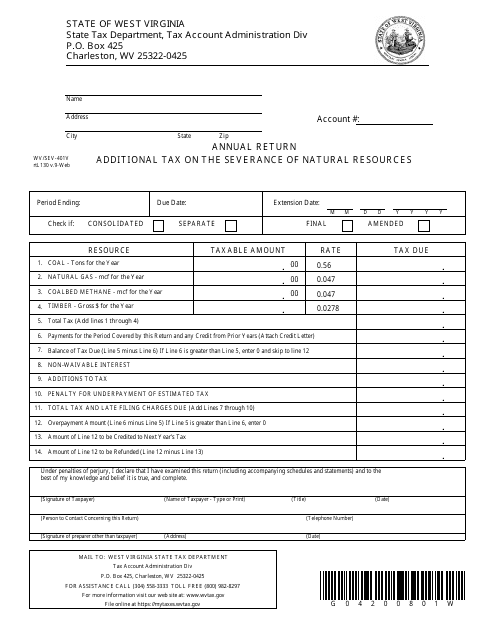

This Form is used for estimating the additional tax on the severance of natural resources in West Virginia.

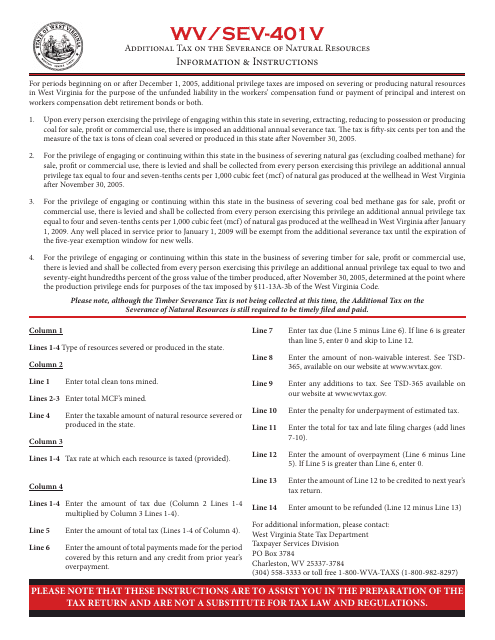

This Form is used for calculating and reporting additional tax on the severance of natural resources in the state of West Virginia. It provides instructions on how to properly fill out and file the form.

This Form is used for reporting and paying additional tax on the severance of natural resources in the state of West Virginia.

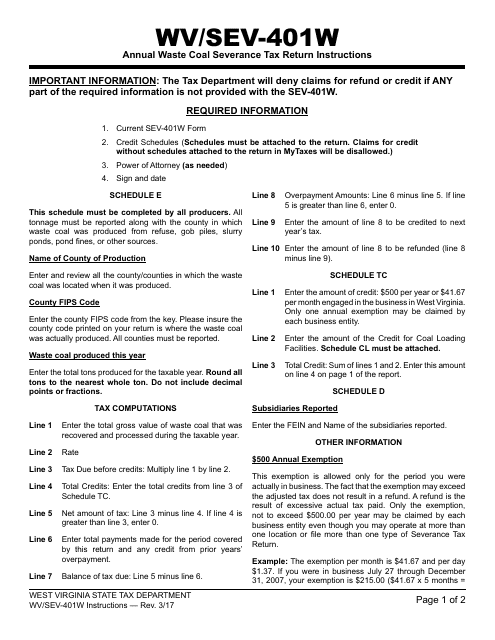

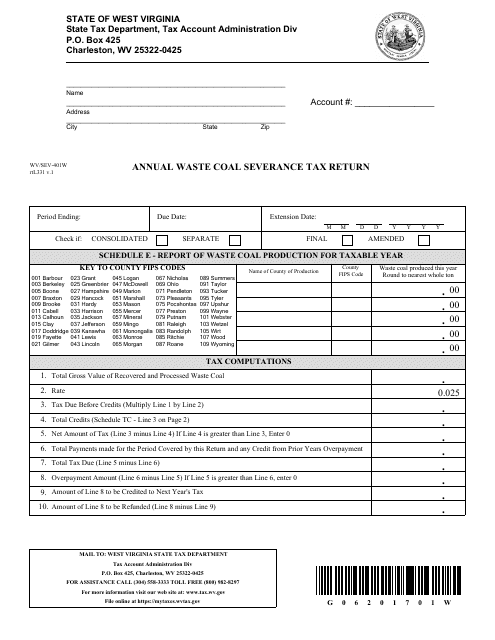

This form is used for filing the Annual Waste Coal Severance Tax Return in West Virginia. It provides instructions on how to properly complete and submit the form.

This form is used for filing the annual waste coal severance tax return in West Virginia.

This document is for estimating the severance tax on waste coal in West Virginia.

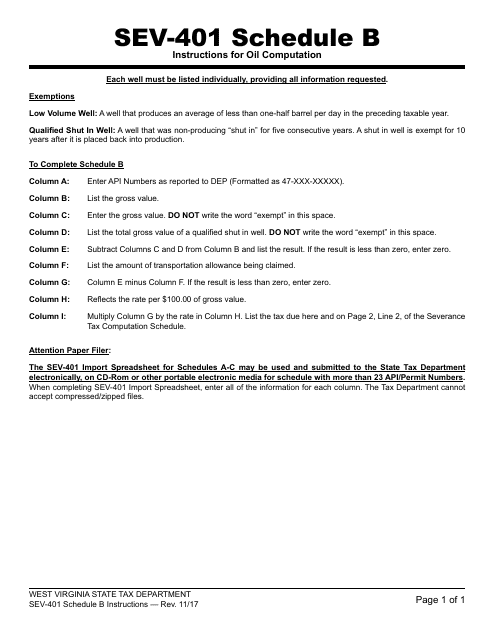

This Form is used for calculating oil production for tax purposes in the state of West Virginia.

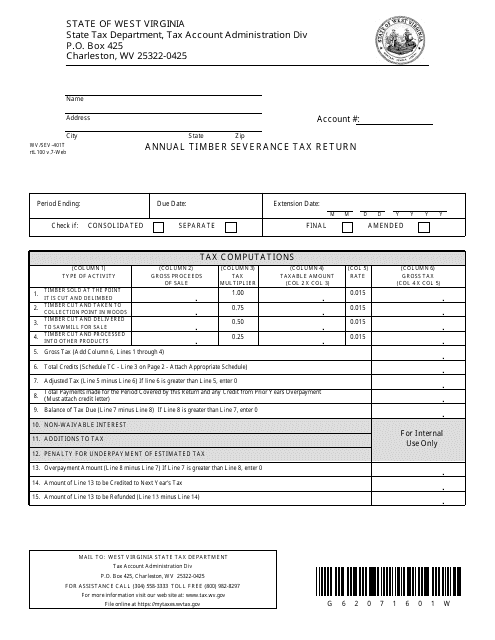

This form is used for reporting the annual timber severance tax in the state of West Virginia.

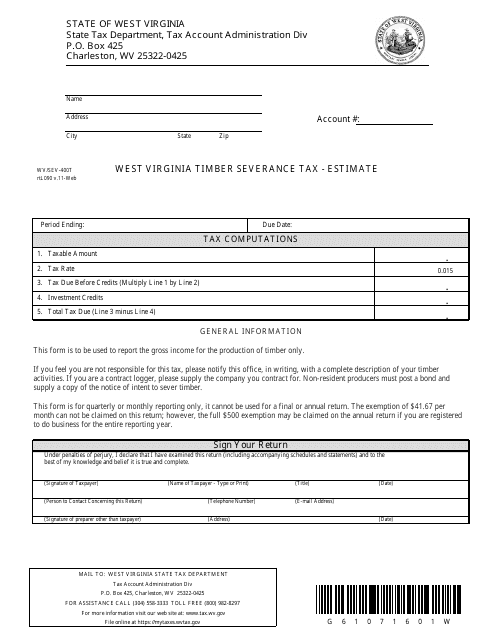

This Form is used for estimating the timber severance tax in West Virginia.

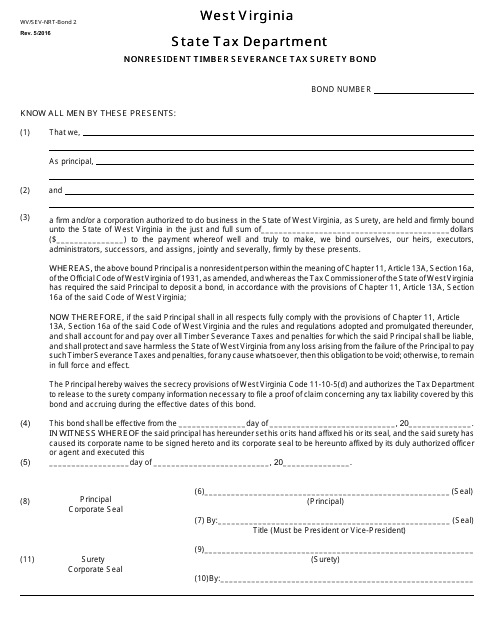

This form is used for obtaining a surety bond for nonresident timber severance tax in West Virginia.

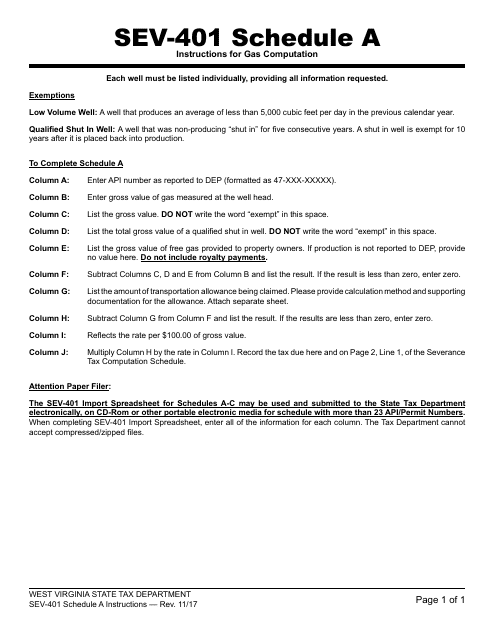

This document provides instructions for completing Schedule A Gas Computation for taxpayers in West Virginia. It guides taxpayers on how to calculate their gas consumption and report it accurately on their tax form.

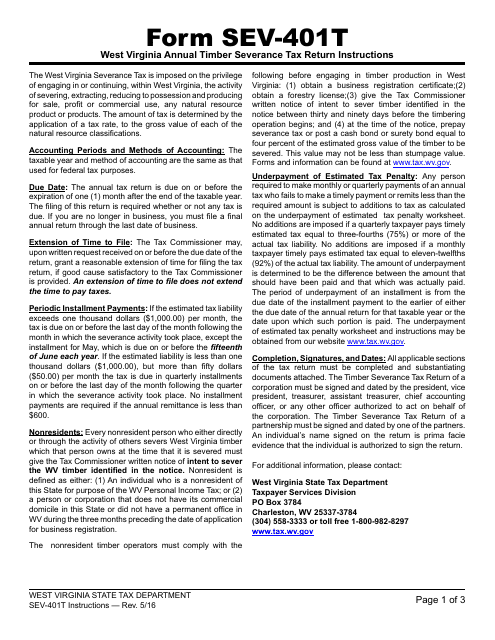

This document is for individuals or businesses in West Virginia who need to file an annual timber severance tax return. It provides instructions on how to complete and submit the form WV/SEV-401T.

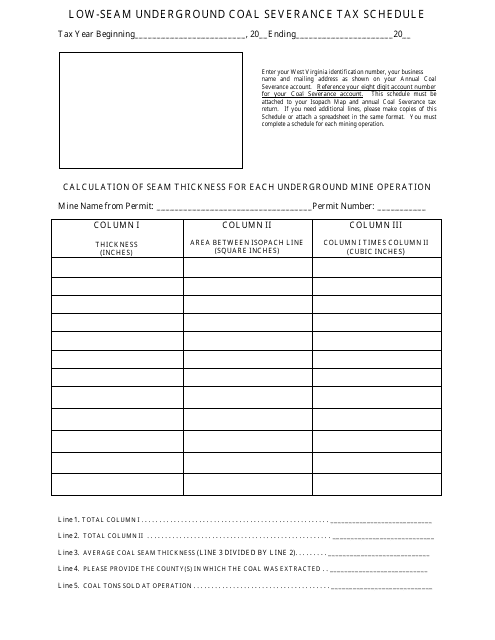

This document outlines the tax schedule for extracting coal from low-seam underground mines in West Virginia.

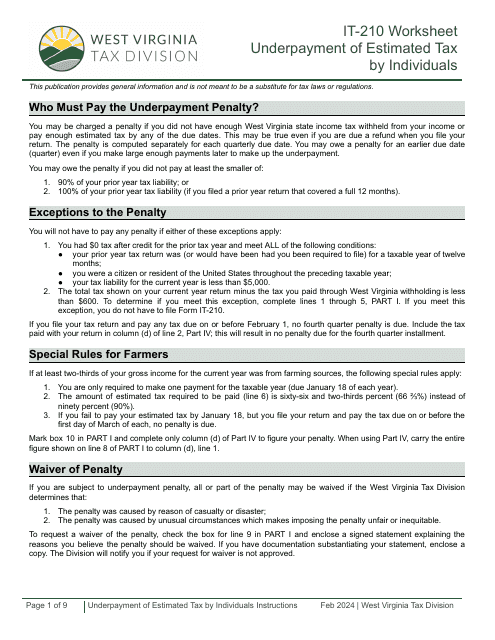

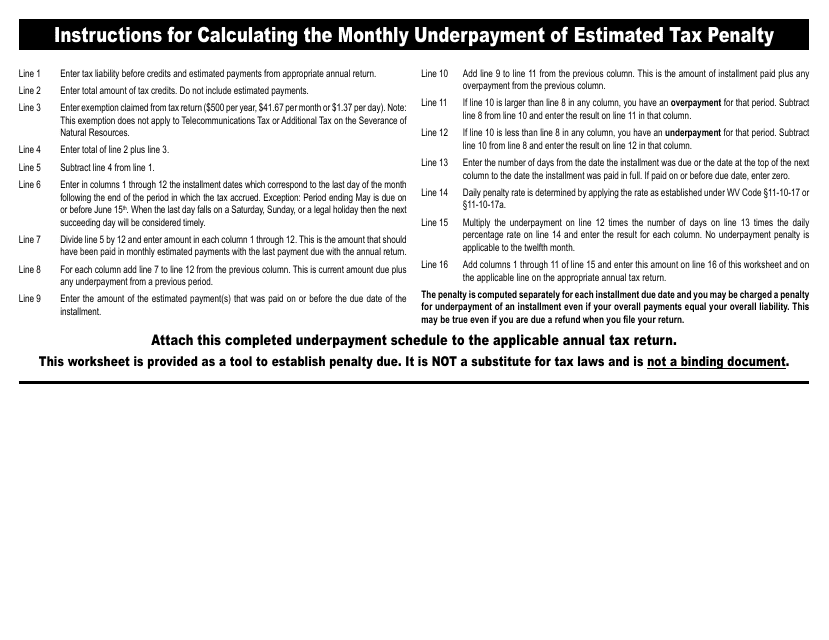

This document provides instructions for calculating the monthly underpayment of estimated tax penalty in West Virginia. It explains how to determine if you owe this penalty and how to calculate the correct amount.

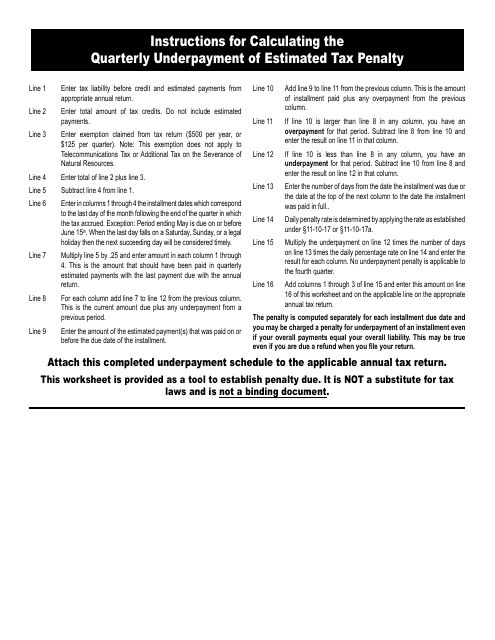

This Form is used for calculating the quarterly underpayment of estimated tax penalty in West Virginia. It provides instructions on how to accurately calculate and pay the penalty to avoid any additional charges or penalties.

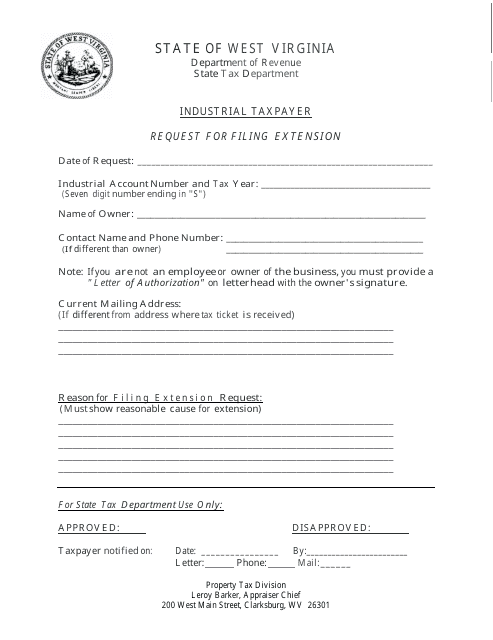

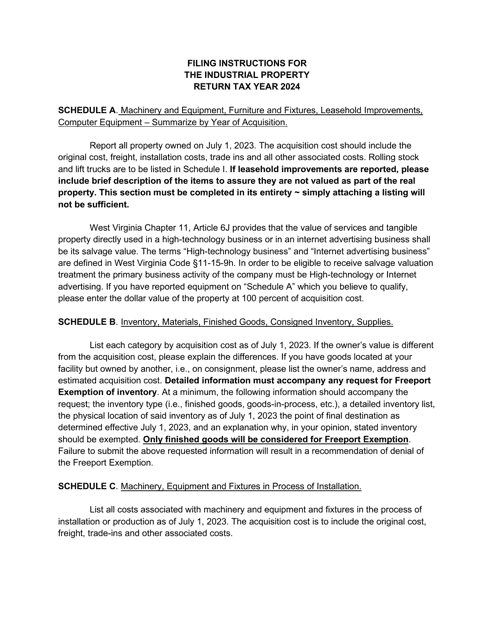

This document is used by industrial taxpayers in West Virginia to request an extension for filing their tax returns.

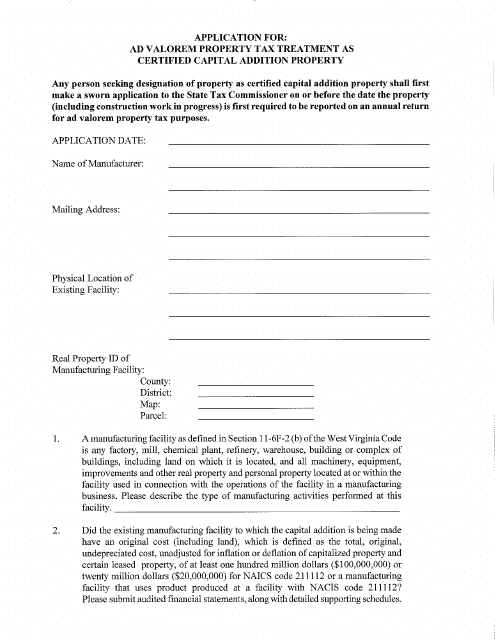

This Form is used for applying for Ad Valorem Property Tax Treatment as Certified Capital Addition Property in West Virginia.

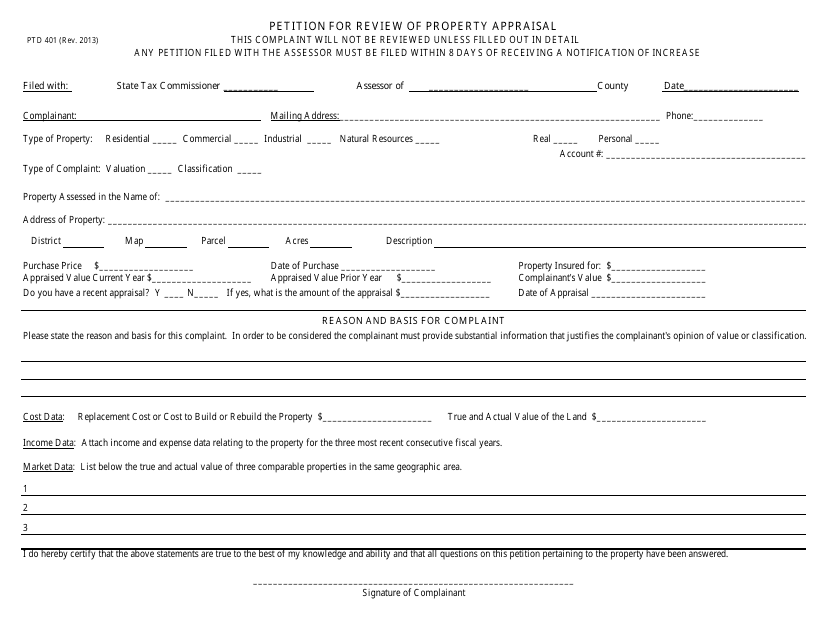

This form is used for petitioning a review of property appraisal in West Virginia.